Launch your

in months, not years

Get a reliable tech launchpad with a source code license to boost operational efficiency, modernize your tech stack, and accelerate your FinTech journey.

One Platform, for multiple purposes

The Platform is designed to cater to the distinct needs of businesses across a wide range of cases.

Banks &

financial institutions

Core banking for digital-first banks

Digital wallets

Payment processing

Merchant services

P2P payment app

Payout solutions

Bulk & recurring payments (VRPs)

Instant A2A payments & transfers

PSD2-compliant Open Banking solutions

Settlement and reconciliation

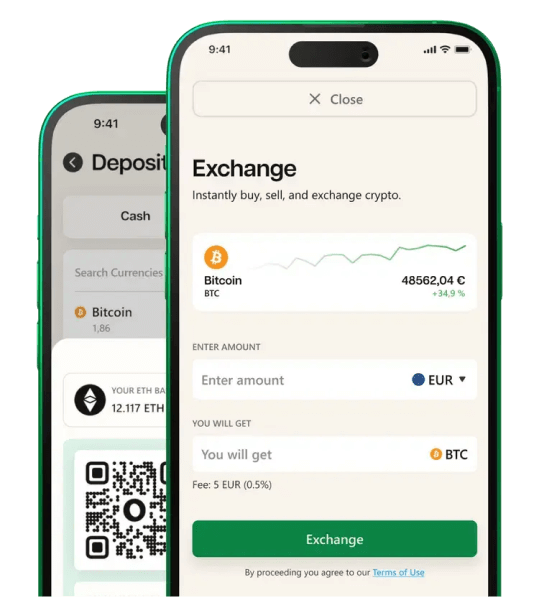

Crypto-to-fiat operations

Enterprises expanding

into FinTech

Closed-loop wallets

Closed-loop cards & gift cards

Loyalty and rewards

In-game currencies

Virtual & digital currencies

Super app

Embedded finance

Marketplace payment engine

Payroll management

General ledger

Corporate FinOps

Treasury orchestration

Out-of-the-box functionality to accelerate your time-to-launch

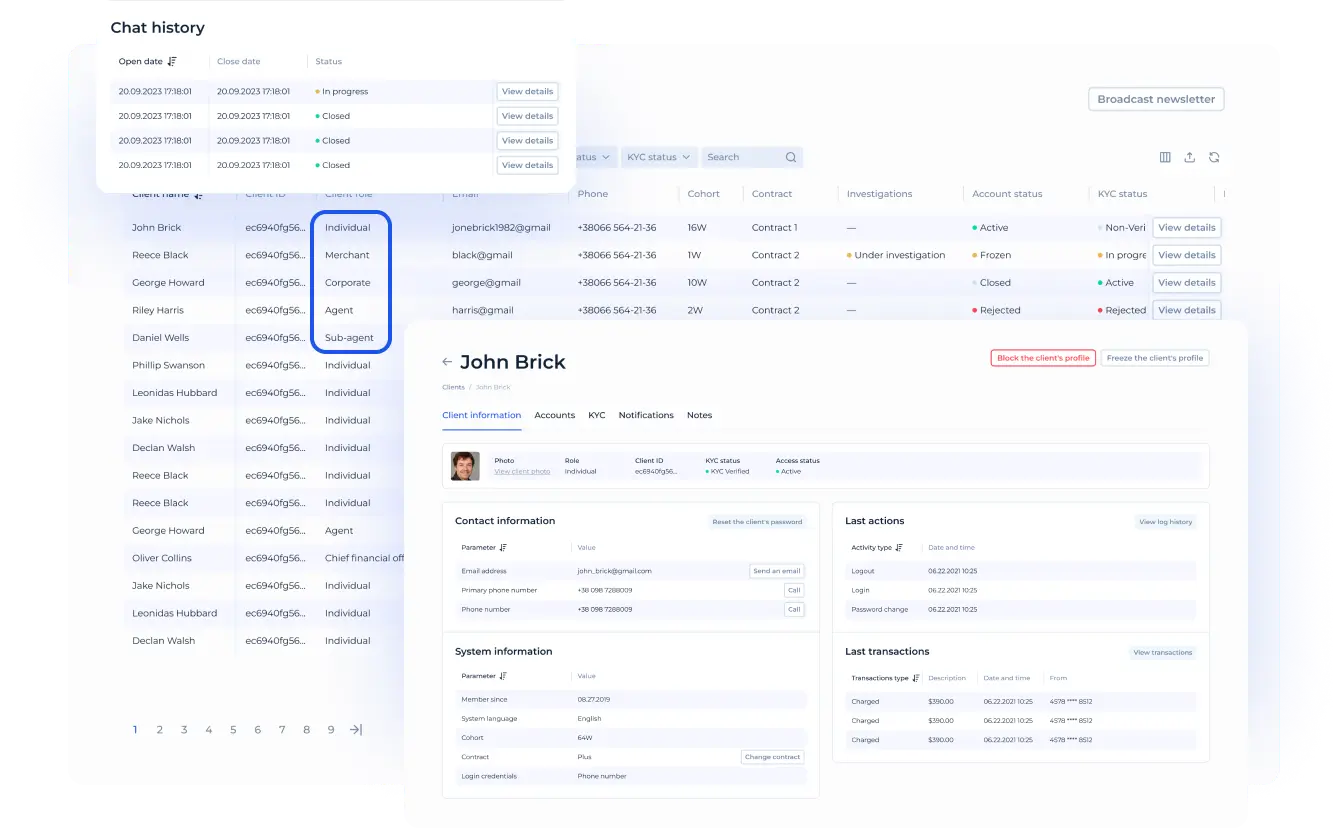

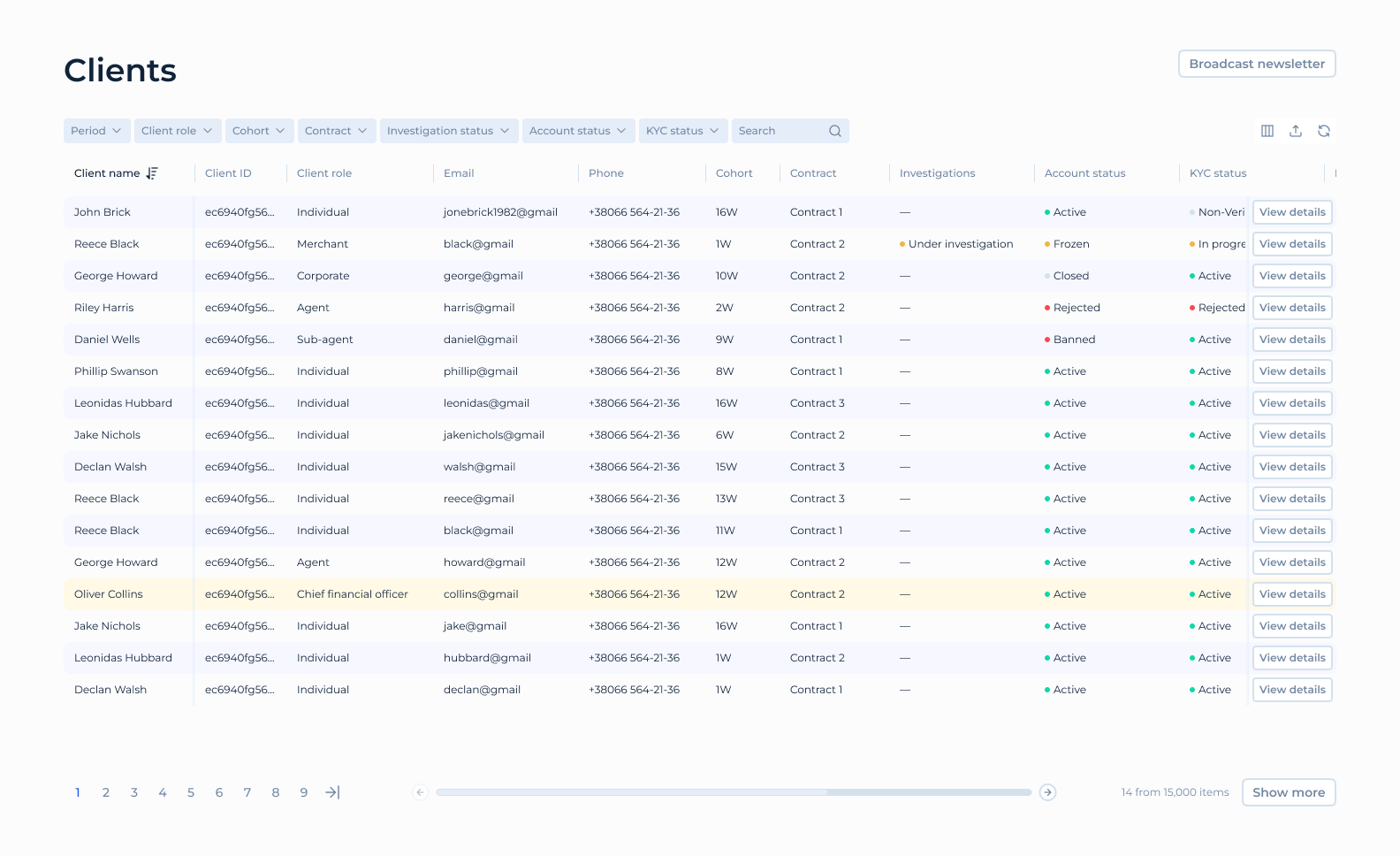

For individual & corporate clients

- Onboarding & 2FA (two-factor authentication)

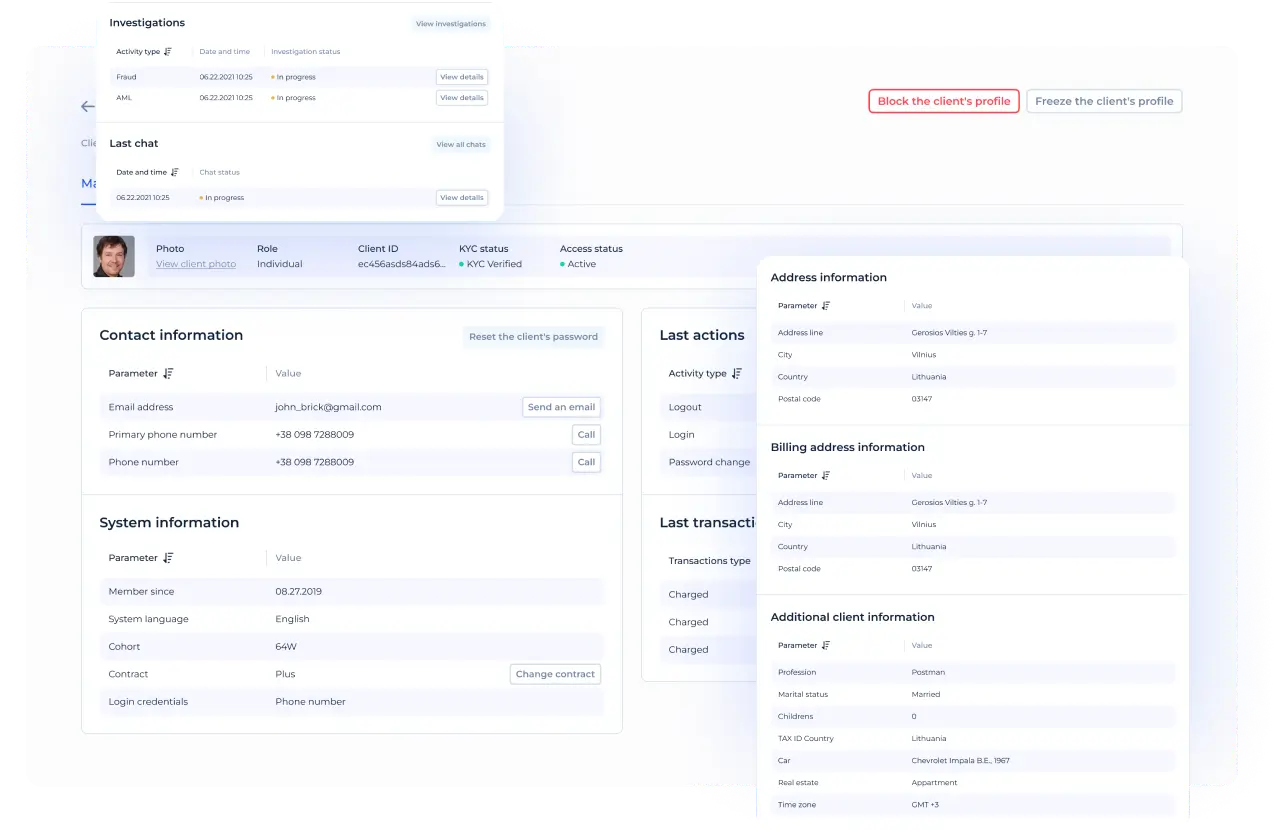

- Customer profile & settings

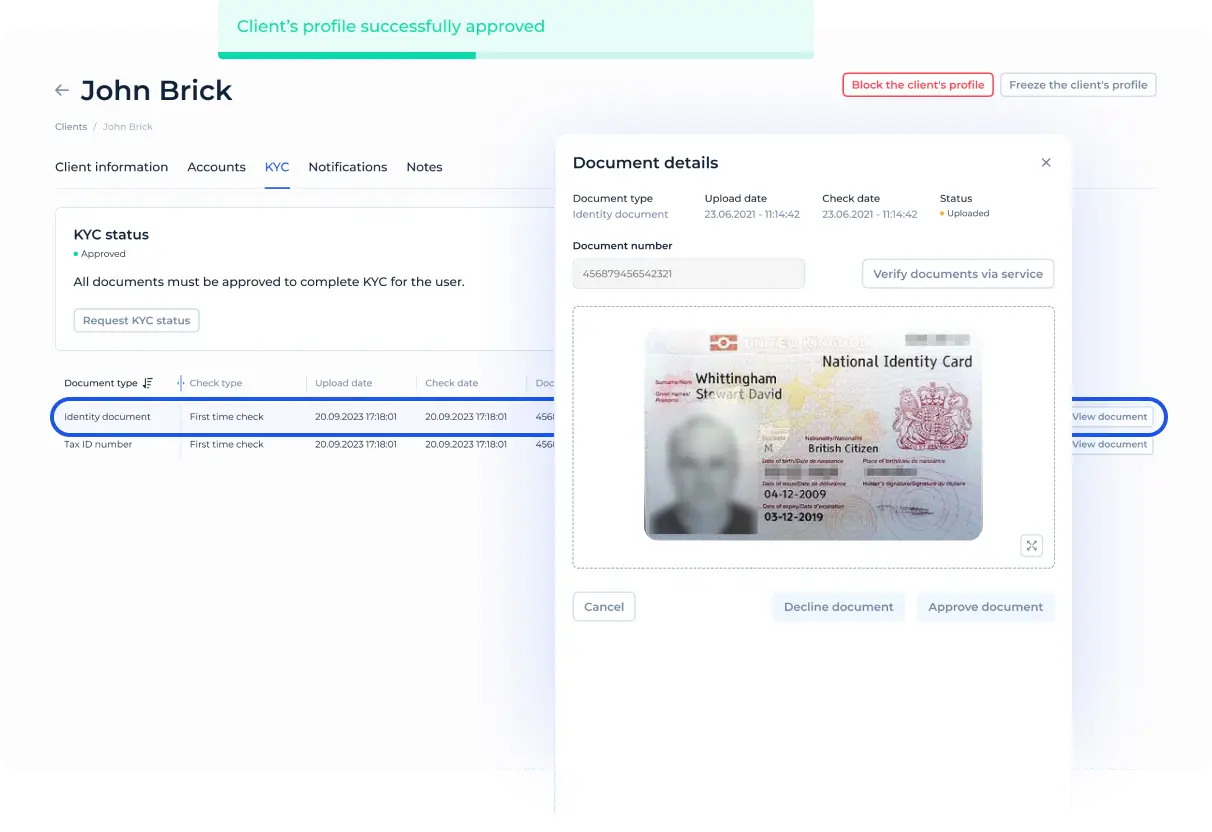

- Ongoing KYC/KYB with a trusted vendor

- Accounts in any currencies, crypto, points

- Cards & IBAN linked to accounts

- Real-time currency exchange

- Send, request, or exchange funds

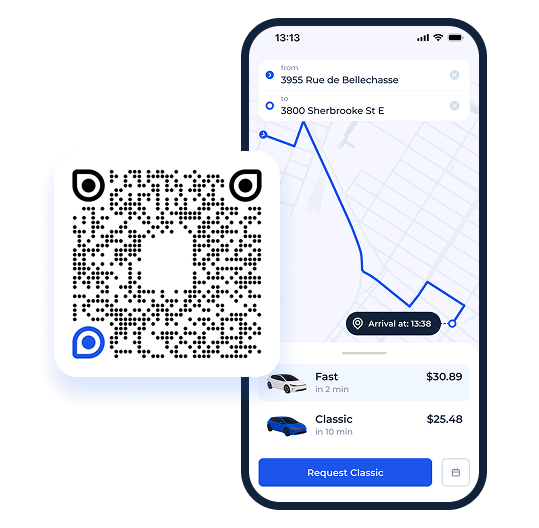

- Payment links & QR code payments

- Operations with cash for clients (Cash points)

For merchants

- Payment acceptance offline (POS, QR codes)

- Payment acceptance online (gateway)

- Checkout page experience

- Dispute resolution: refunds & chargebacks

- Reports

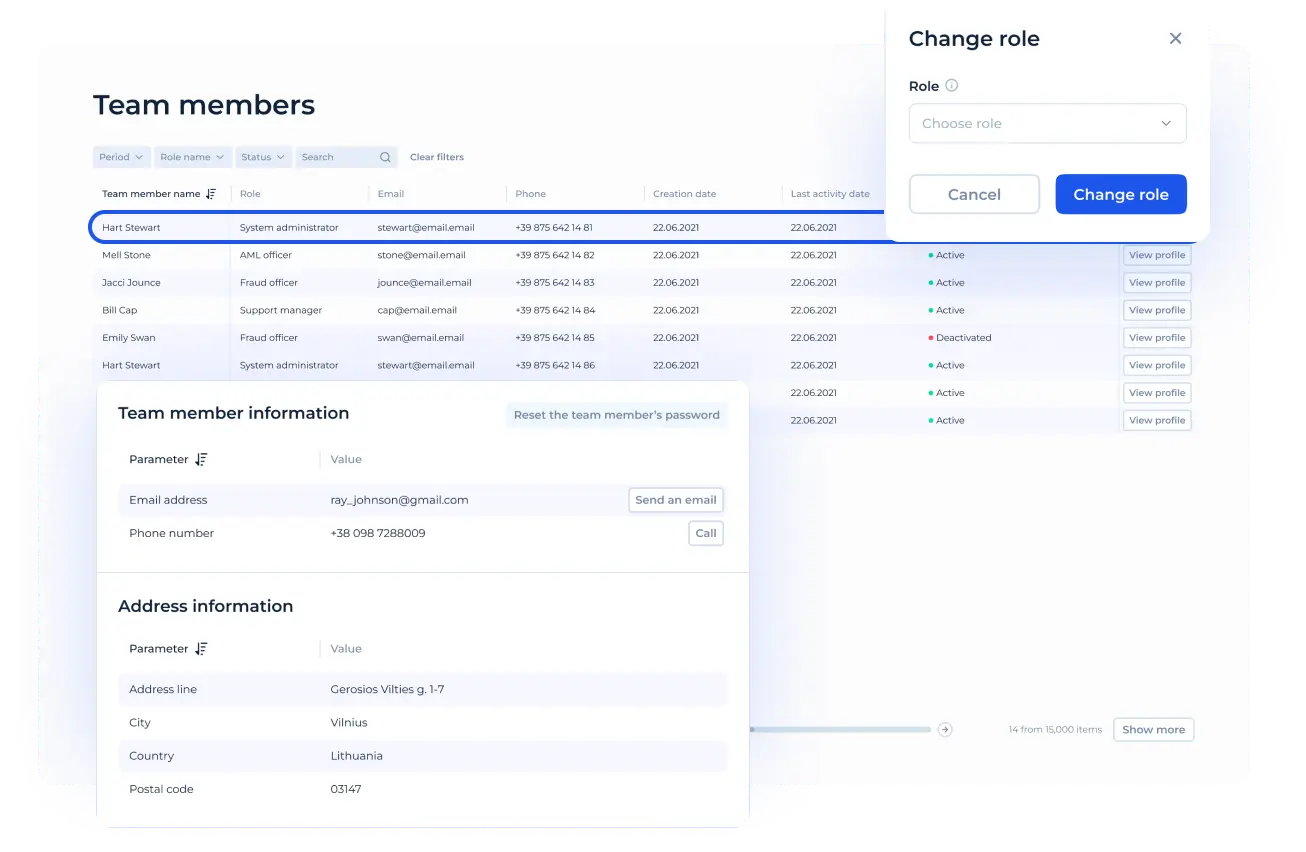

System management

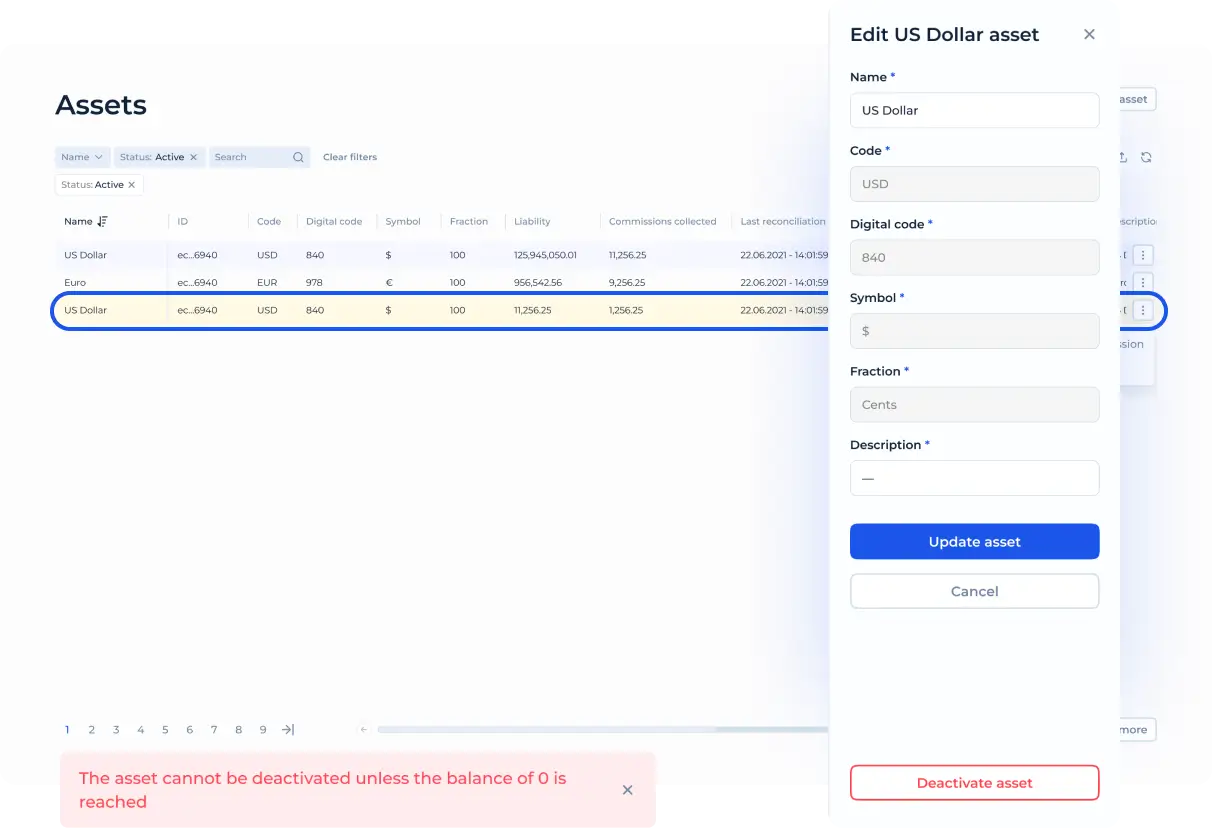

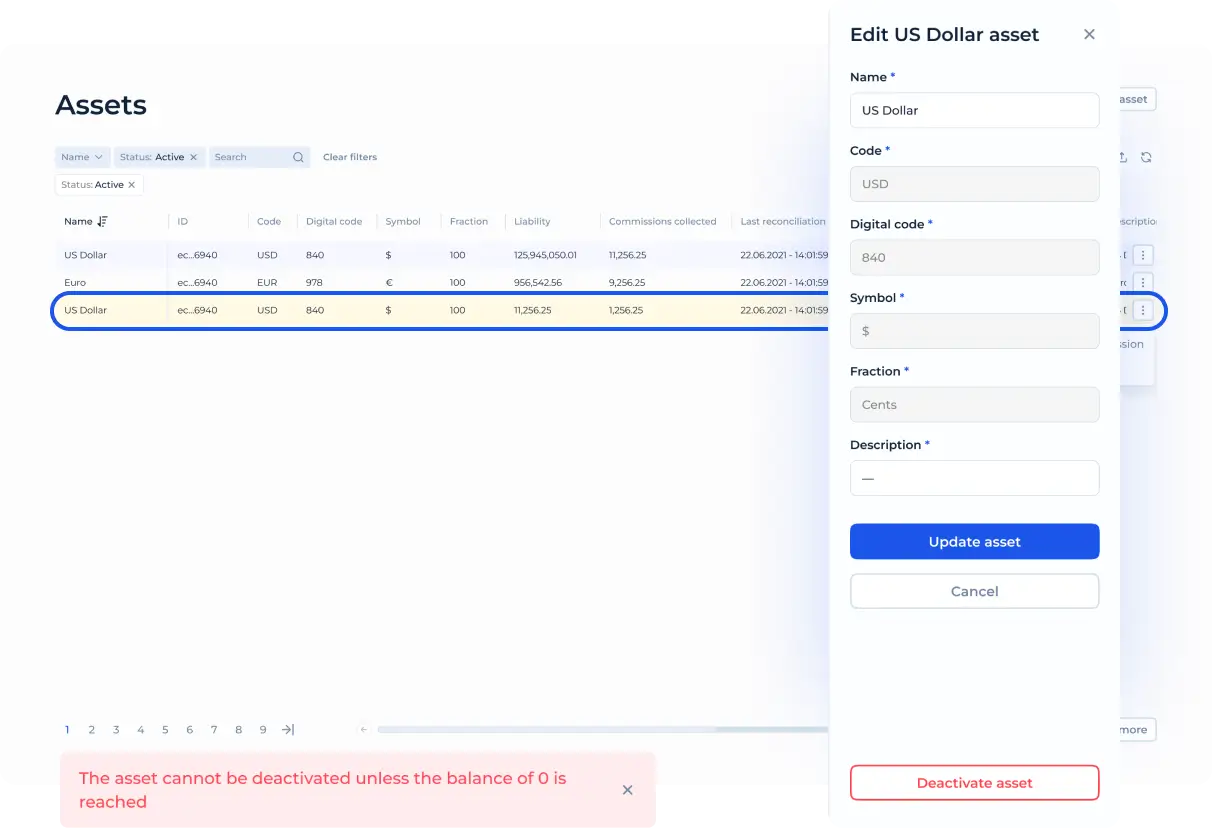

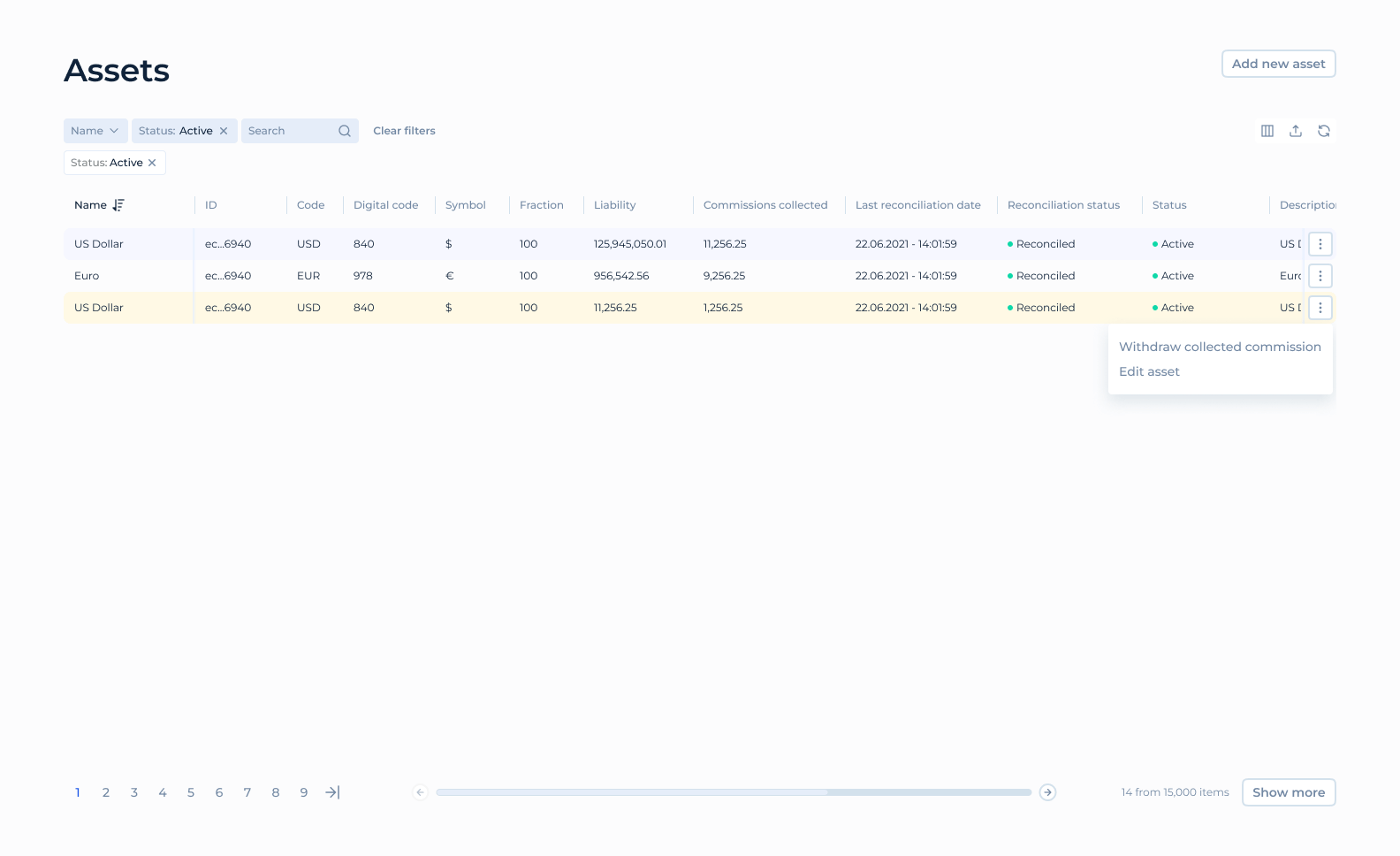

- Currency & assets creation engine

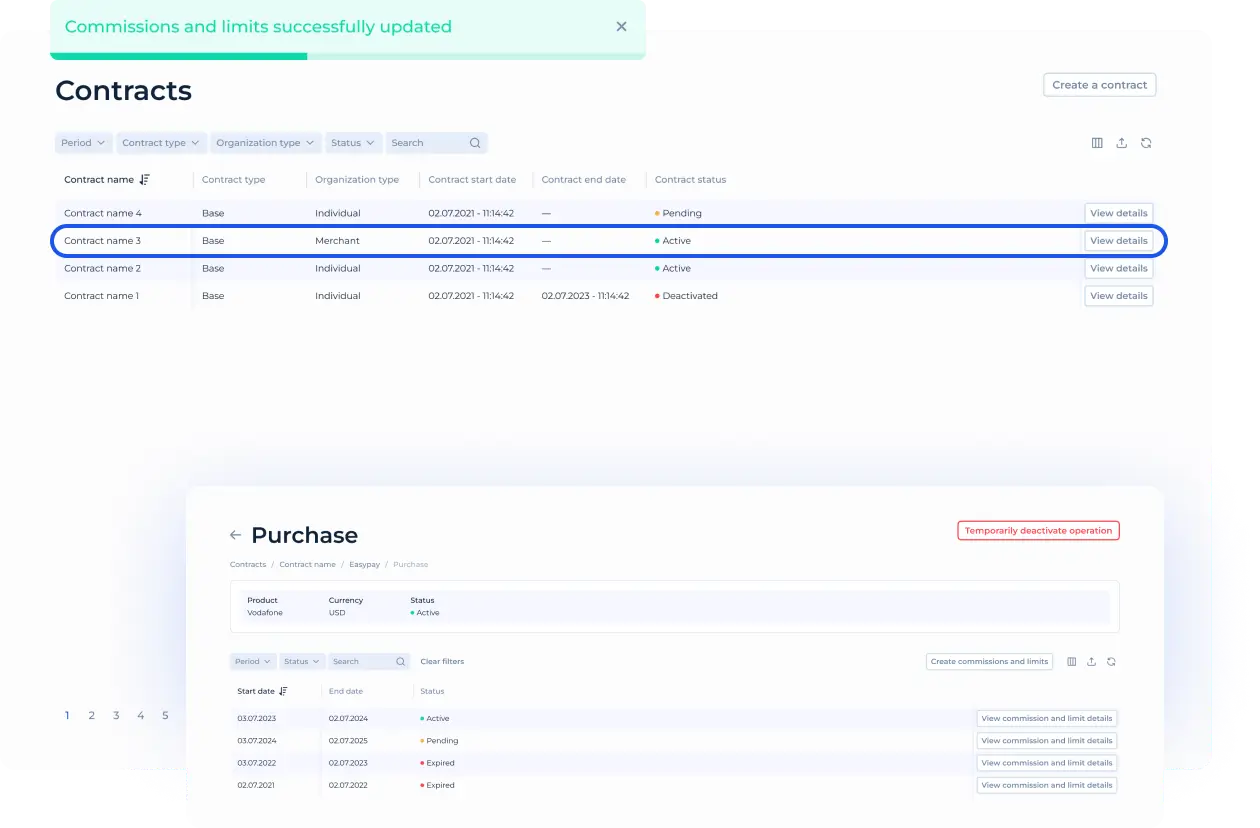

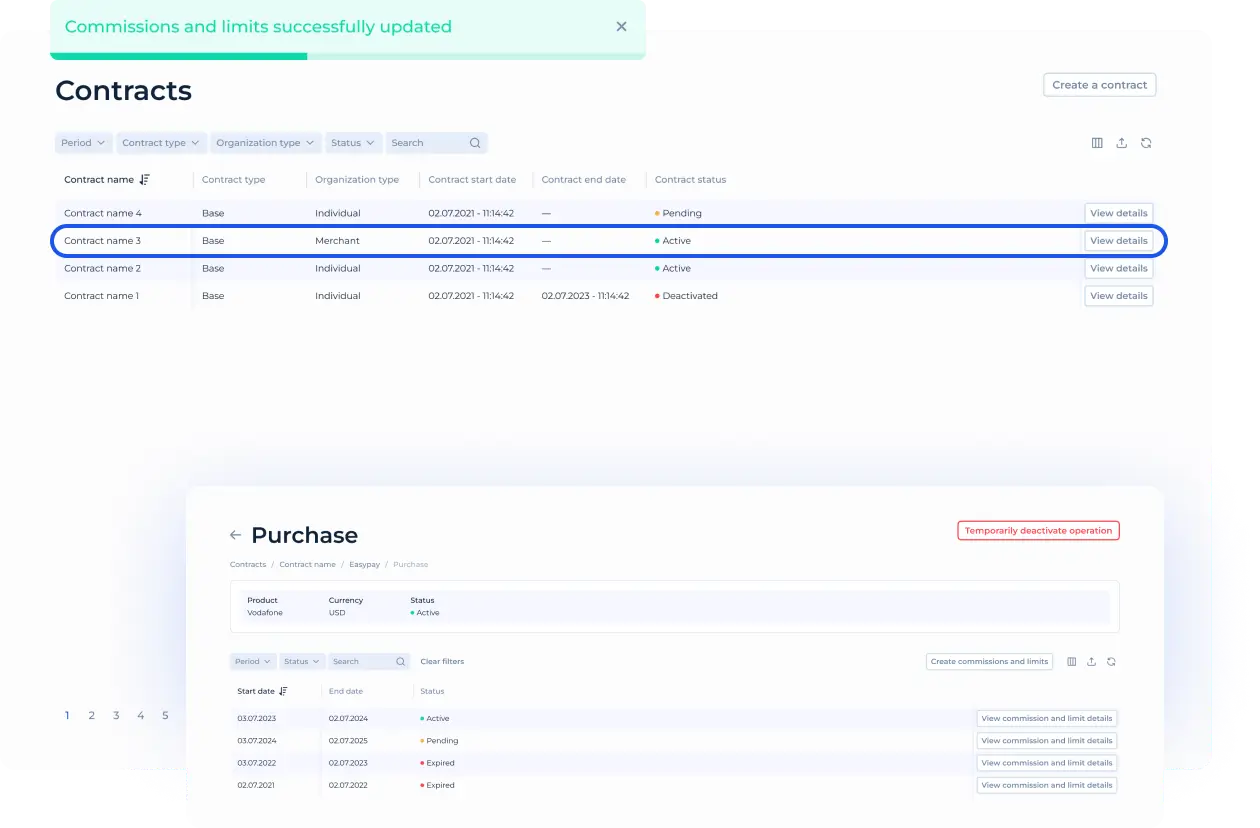

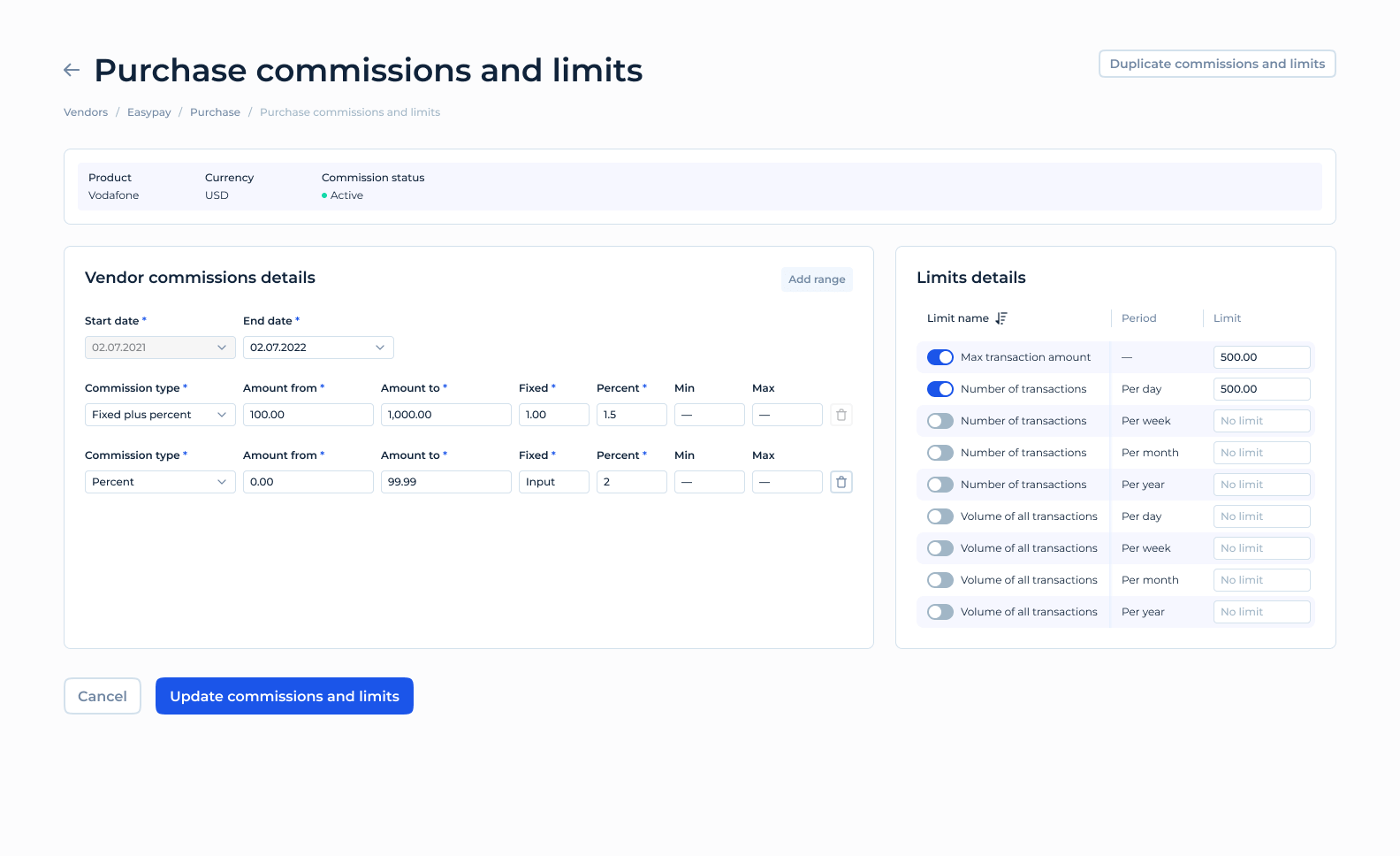

- Flexible fees & limits engine

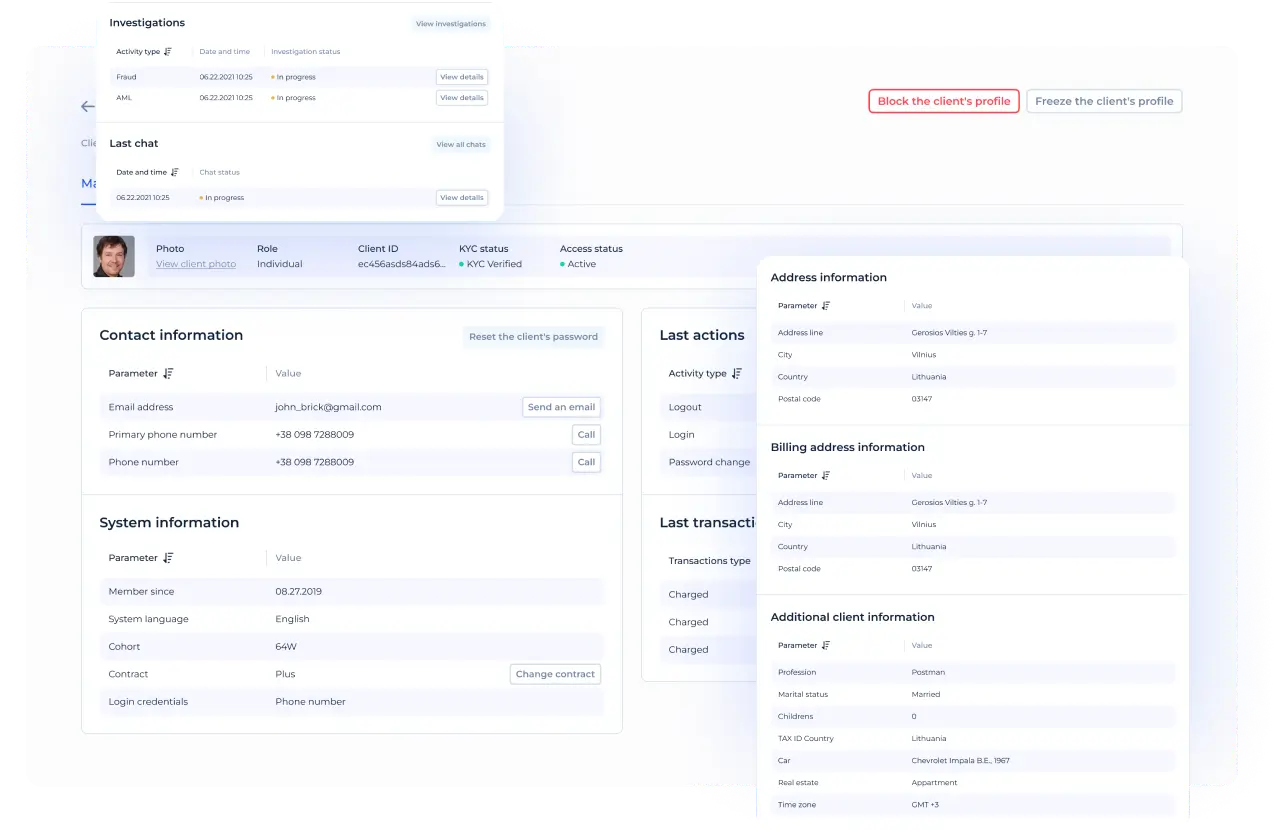

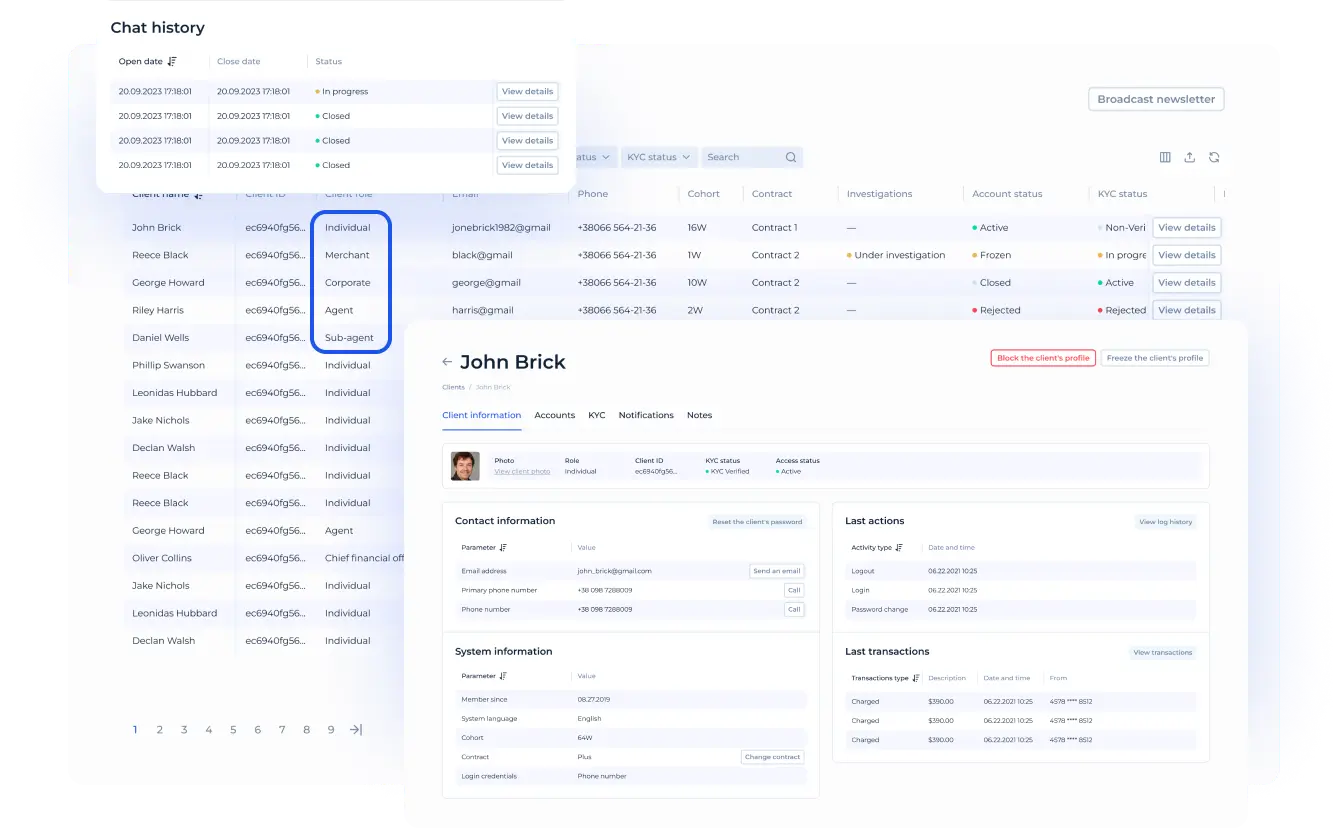

- In-system CRM & chat with clients

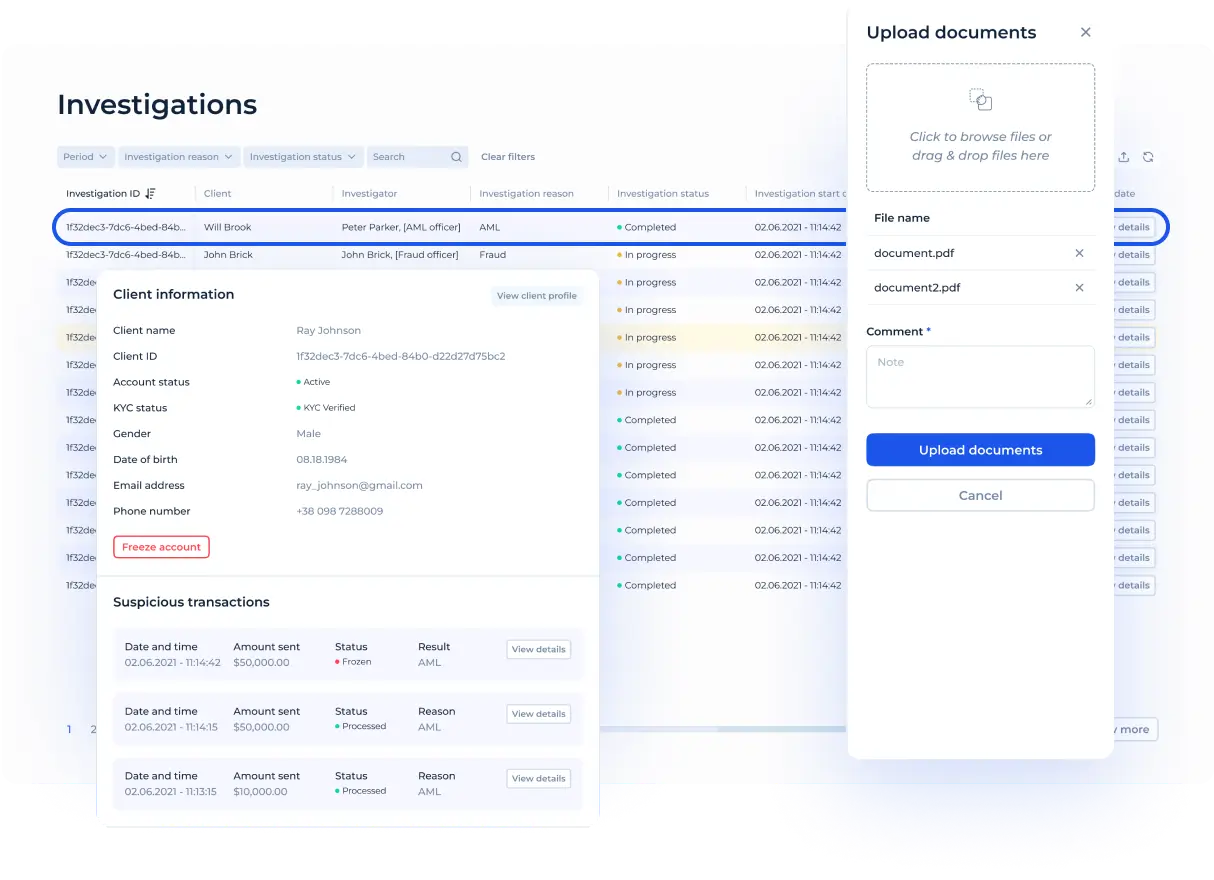

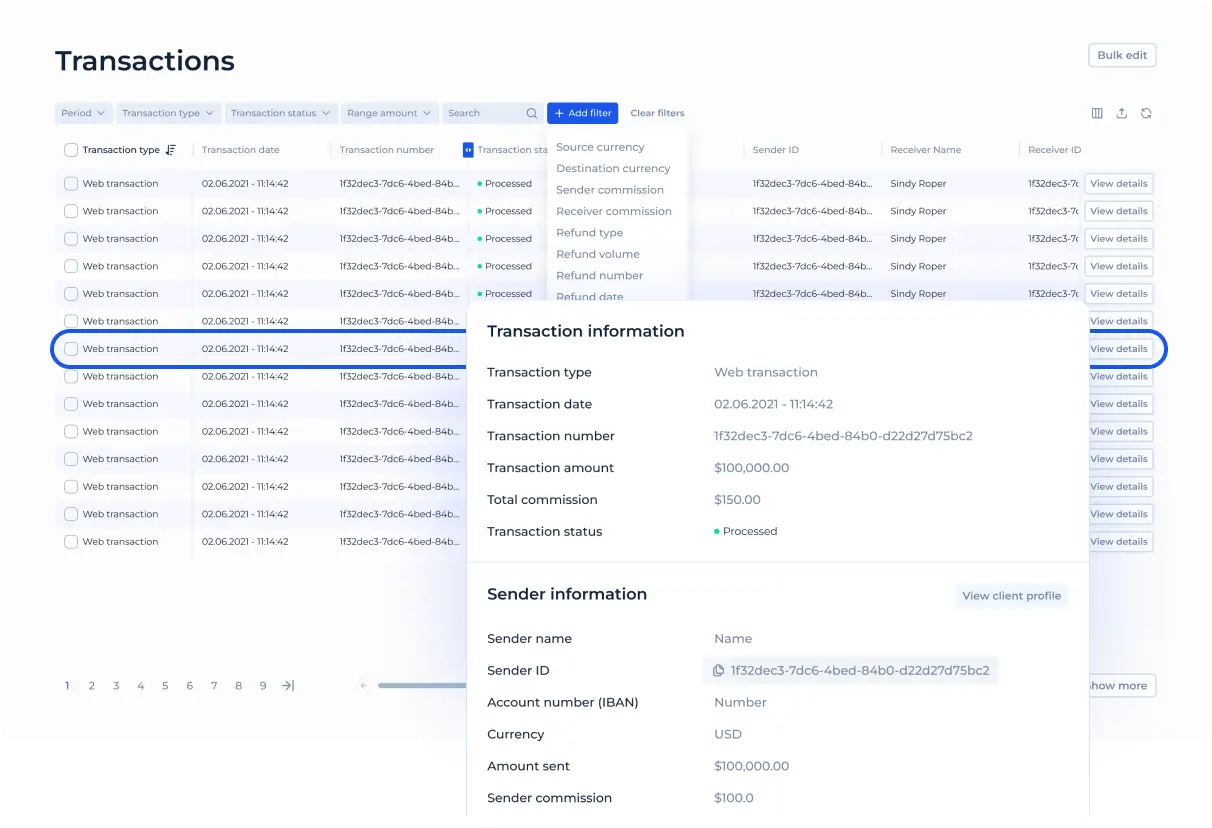

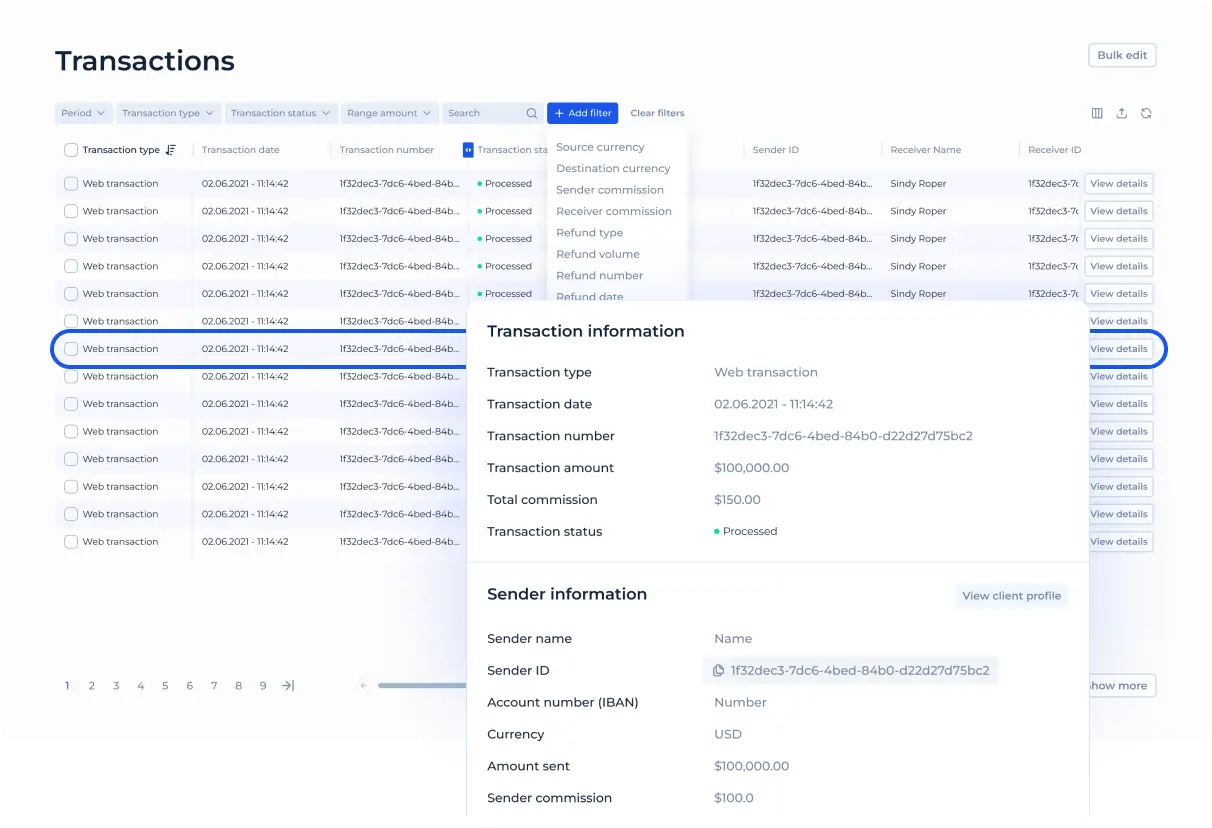

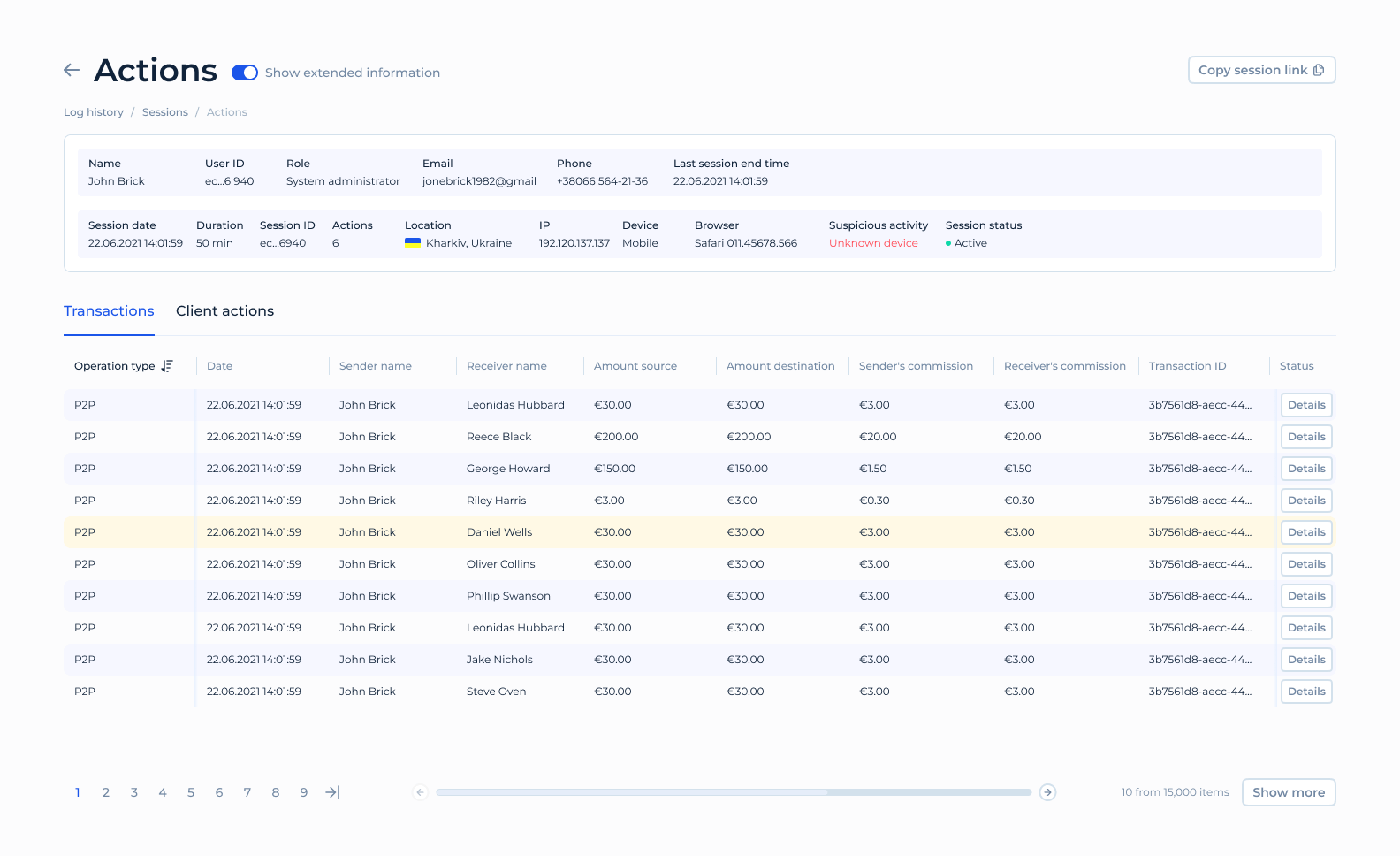

- Detailed transaction monitoring

- Flexible reporting

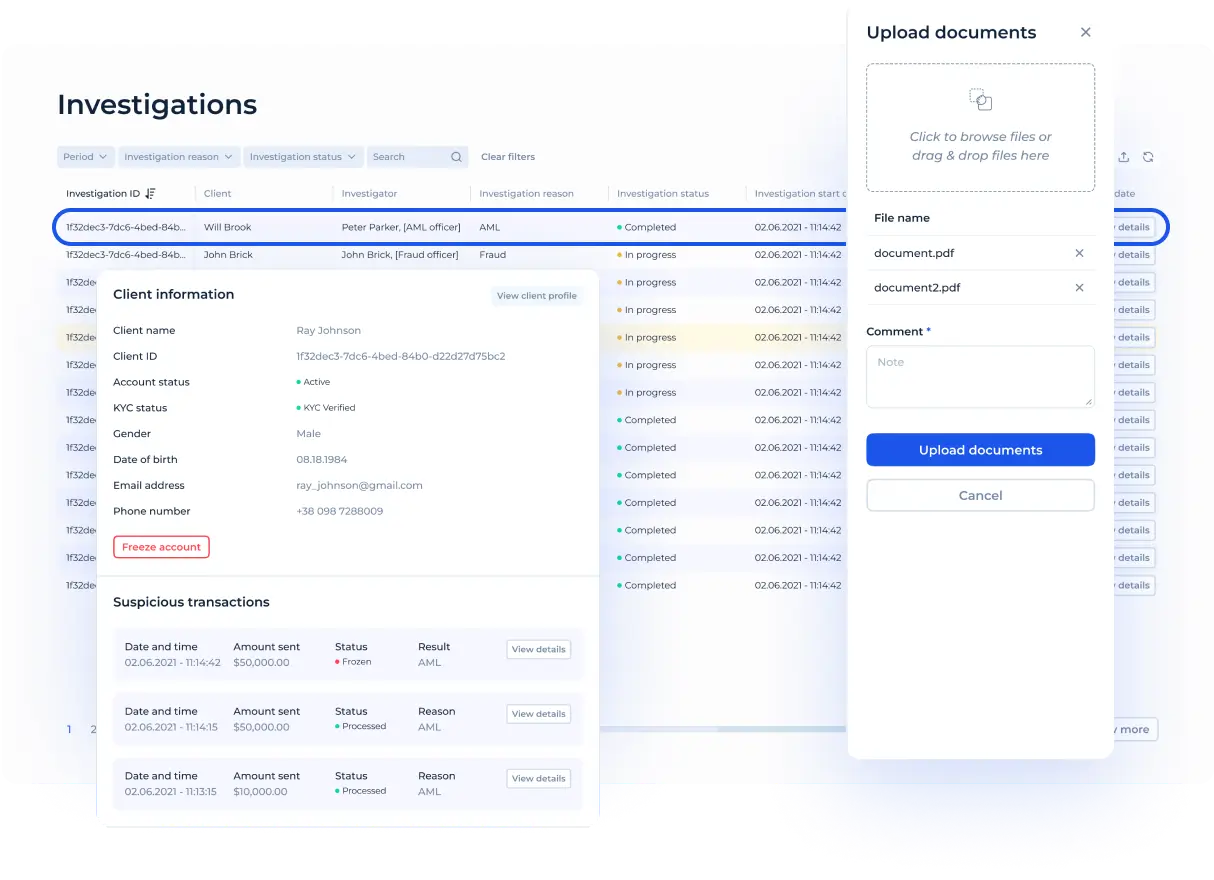

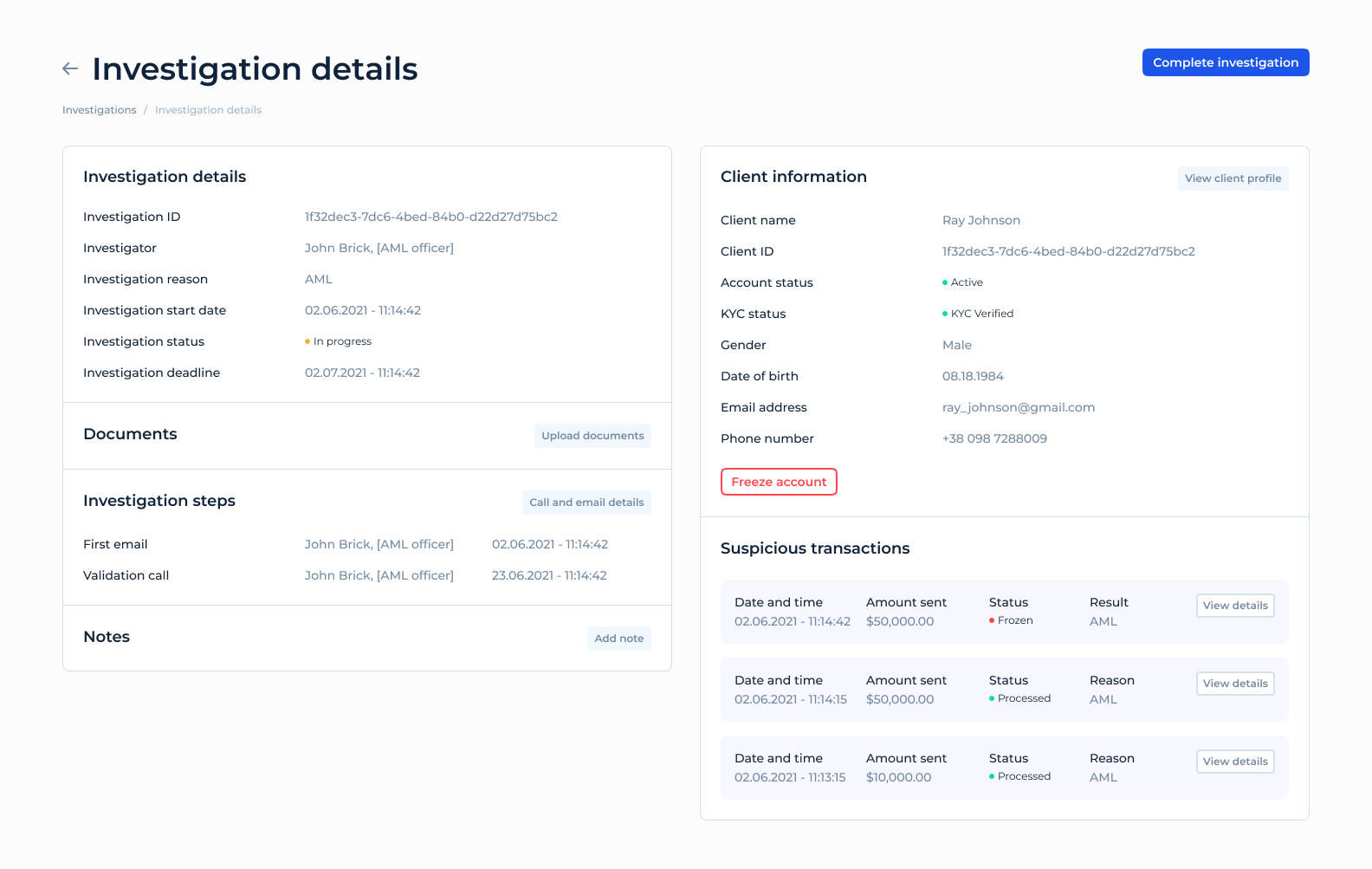

- AML/Anti-fraud officers’ workspace

- User action history

- Reconciliation & settlement section

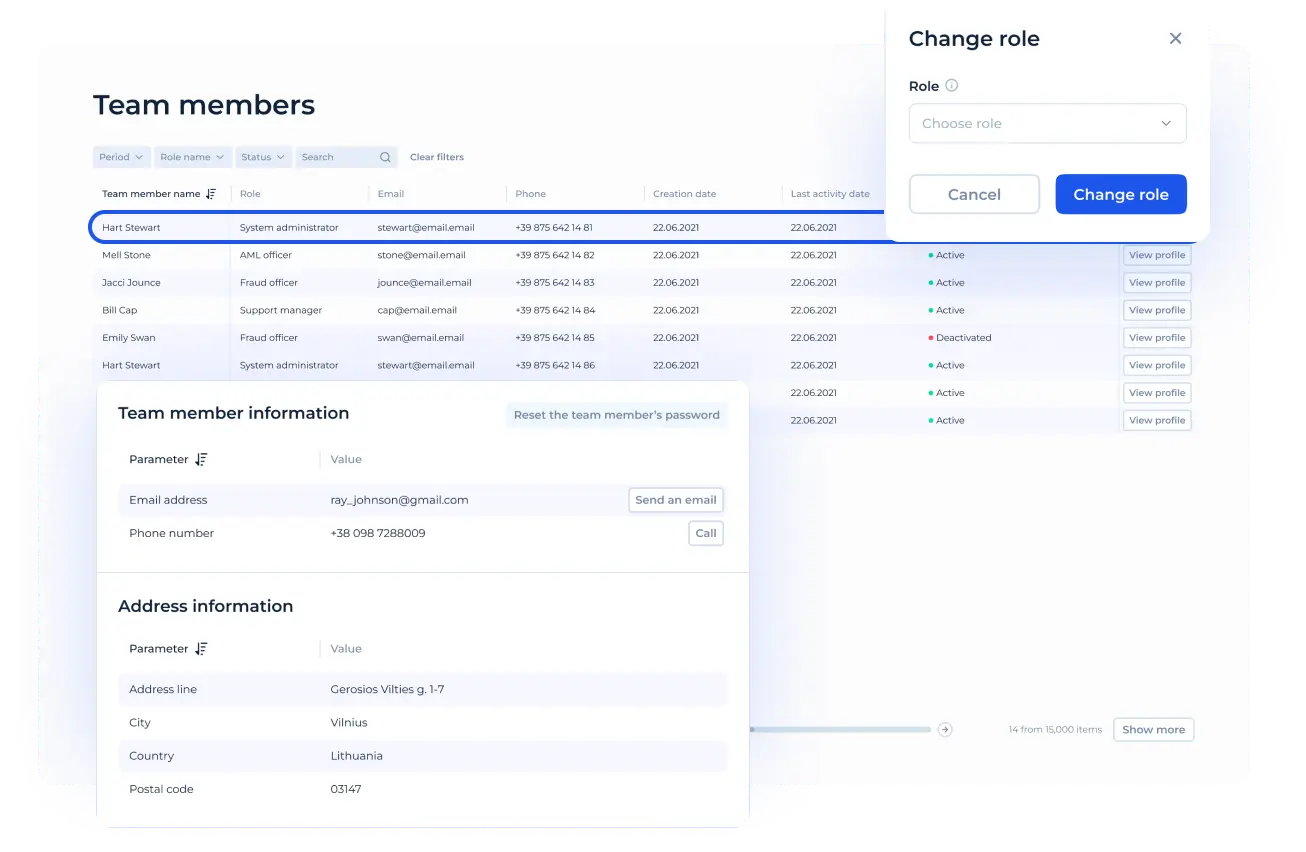

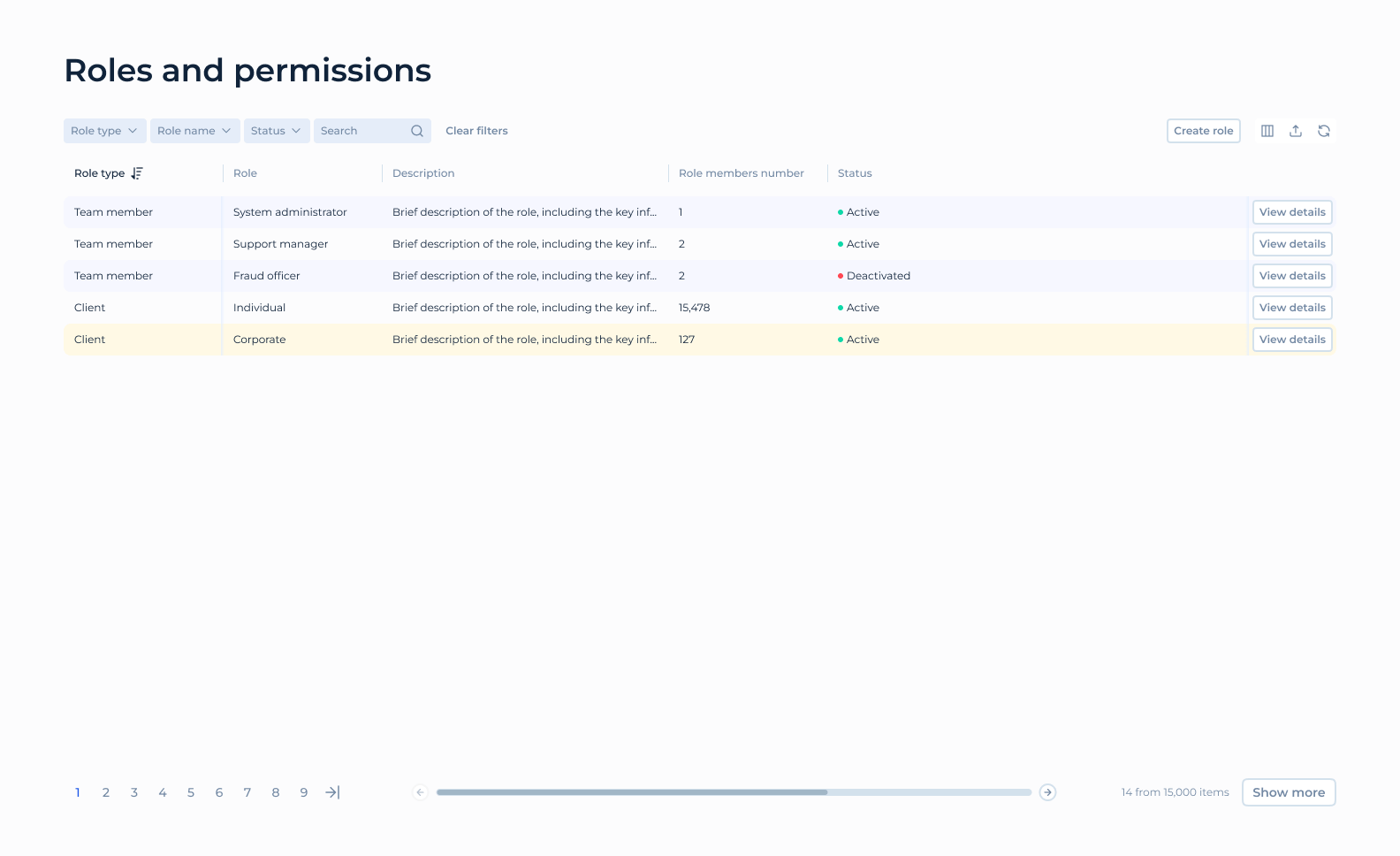

- Roles & permissions

Source code license for

Enterprises

Full source code access

Complete freedom to modify and customize at your pace.

Warranty protection

Coverage for bug fixes and security updates

Comprehensive support

We empower your team with in-depth training, guidance, and ongoing support.

Meet your deadlines

Operate with your internal team to meet deadlines, bypassing vendor delays.

Minimized development risks

Avoid the bottlenecks of building from scratch

Consistent updates

Leverage regular Platform updates and enhancements for peak performance.

Progressive technology, built by experts

Flexible infrastructure options

High code quality

Security certifications

Proven expertise, backing your venture

Modern tech stack

APIs

Backend

Data management

Backoffice

Mobile app

Version control and CI/CD

Scalable infrastructure to fuel your growth, starting from:

transactions per second

transactions per day

transactions per month

transactions per year

The World of Digital Payments

by Pavlo Sidelov, Ph.D.,SDK.finance Co-founder, CTO & Payment Expert

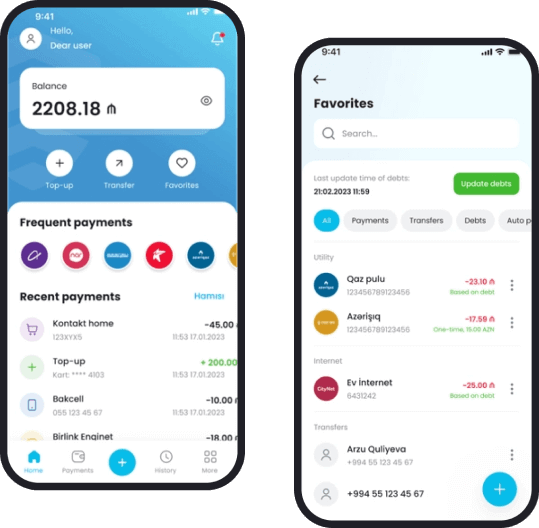

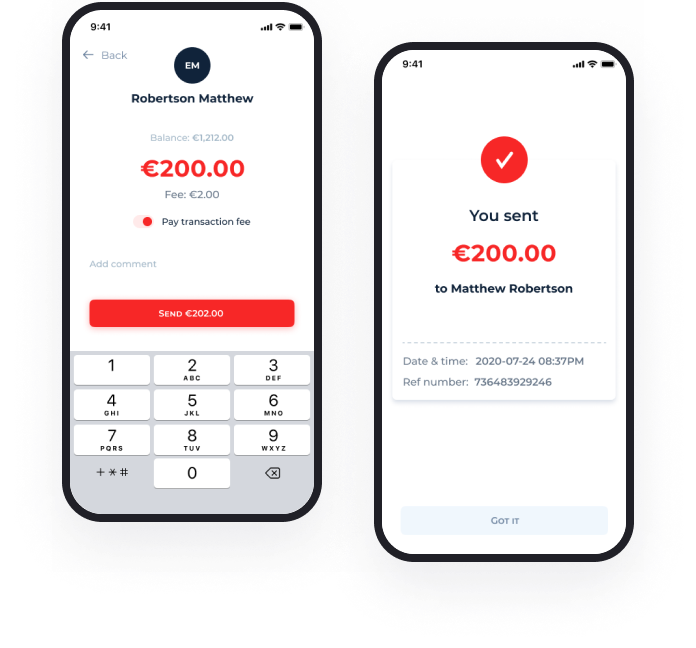

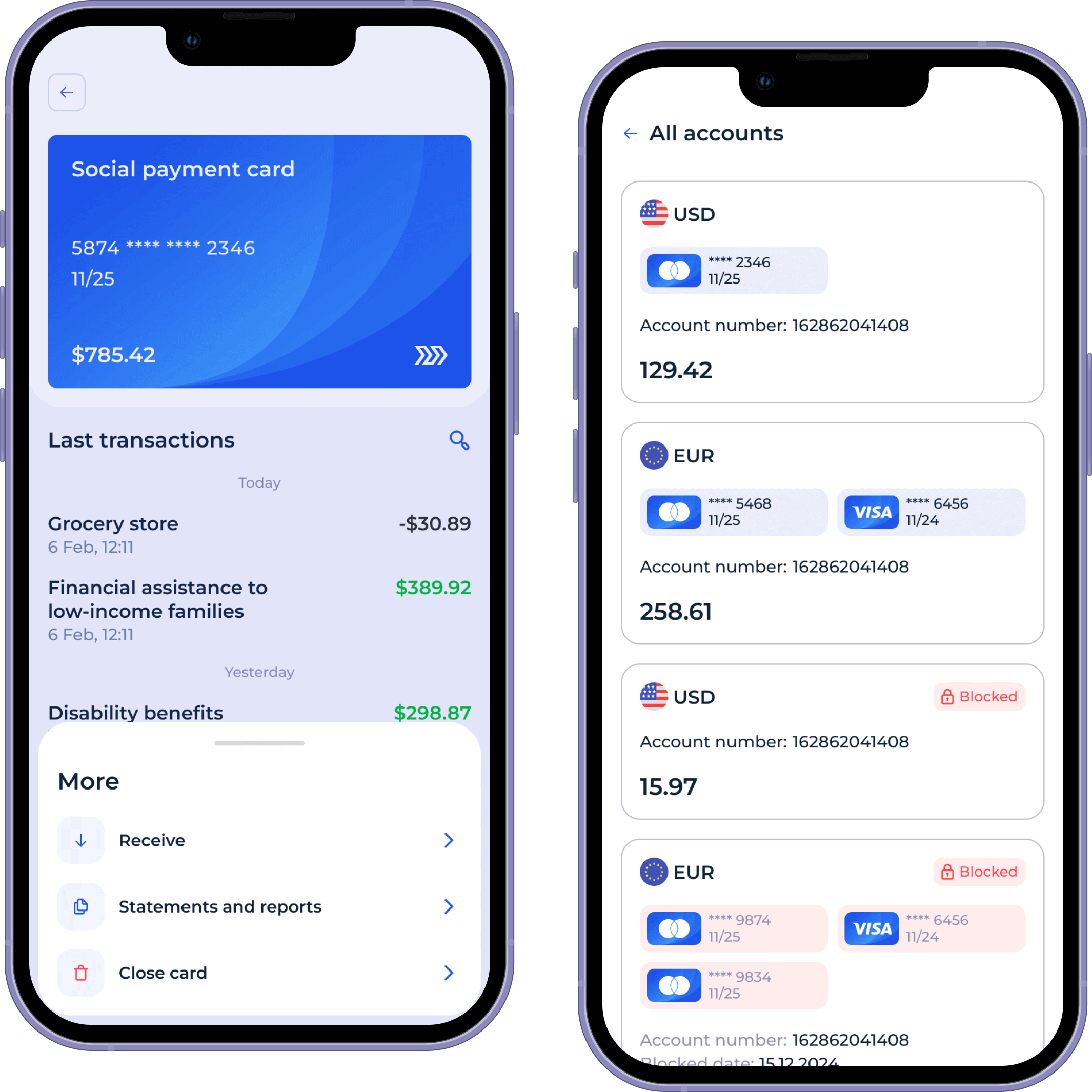

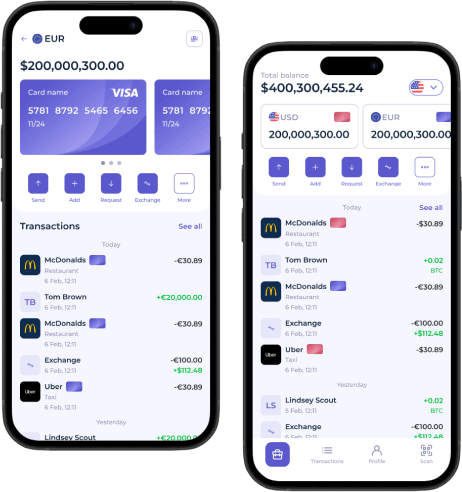

iOS/Android mobile app for first-rate customers’ experience

FinTech platform designed for rapid deployment as a neobank or e-wallet, this iOS/Android mobile app enables a swift market launch. Enjoy full flexibility to modify, brand, and customize to fit your unique vision.

Watch demo

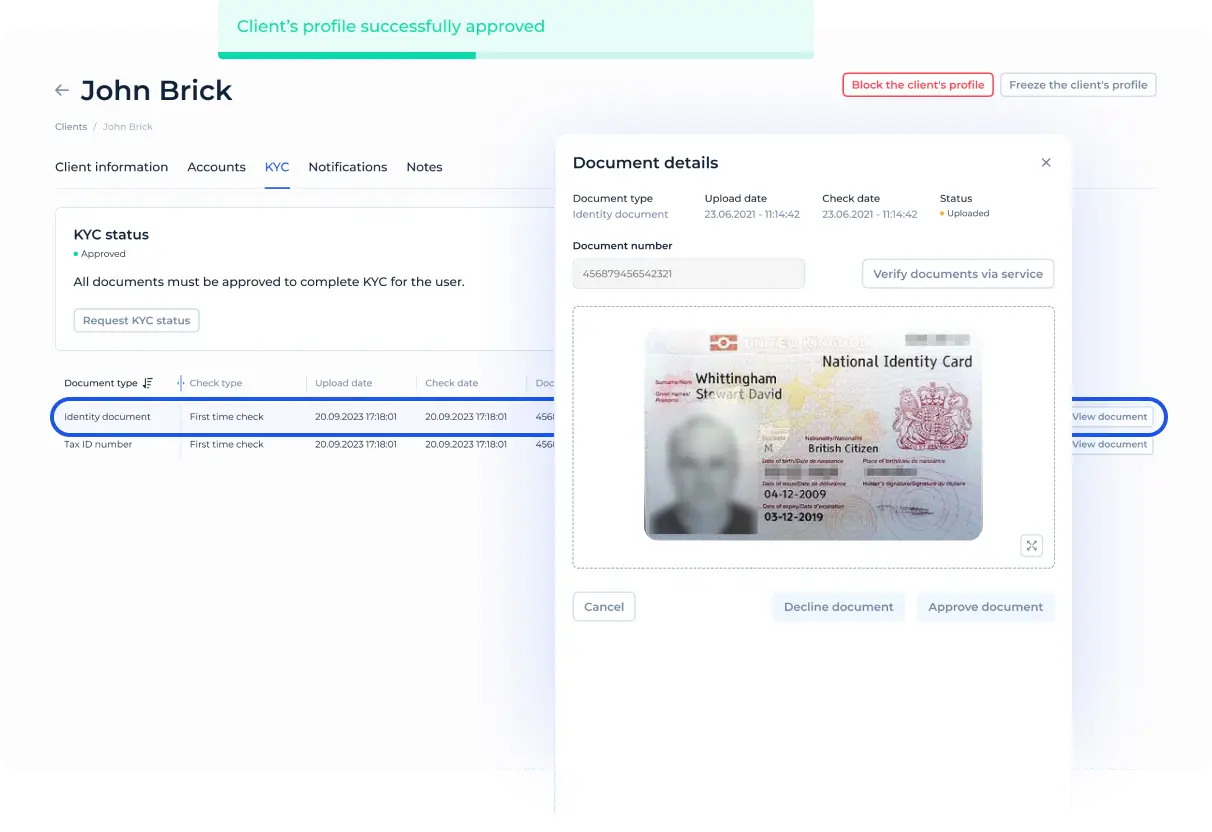

Backoffice workspace for key team-roles

Customer support team

- Сustomer success specialist

Compliance & fraud prevention team

- KYC/KYB specialist

- AML specialist

- Anti-fraud specialist

Finance

- CFO (Chief Financial Officer)

- Financial specialist / accountant

- Cashier

Revenue management

- CRO (Chief Revenue Officer) & Revenue specialist

Administrative

- Roles & Permissions administrator

CEO

- Full access

What our customers say

Nebeus sought a Platform with ready-made solutions to save on development time and SDK.finance stood out for its competitive pricing, 24/7 support, responsive professional team, and flexibility for customization. The implementation process was smooth since we built our solution from scratch after partnering. Overall, we saved lots of time and money so I would recommend SDK.finance to those seeking a swift and affordable start.

The core for creating financial products

SDK.finance FinTech Platform

AvailableA powerful, modular financial software with full source code access that helps enterprise businesses build, modernize or scale their financial services and payment solutions.

View product pageWhite-Label Digital Bank Solution

AvailableLaunch your digital retail bank faster with pre-built interfaces and a ready-made core. No need to start from scratch.

View product pageGlobal experience

Canada

United Kingdom

Lithuania

France

Spain

Poland

Switzerland

Luxembourg

Ukraine

Cyprus

Saudi Arabia

Egypt

Azerbaijan

Israel

Ghana

Algeria

Kenya

Morocco