Payment fraud is one of the most common forms of identity theft in the world. In 2020, the total amount of losses incurred by businesses due to financial fraud rose to a record $56 billion, with over 2,800,000 cases of credit card fraud being reported in the UK alone.

A large portion of these losses was borne by banks and payment processing service providers. These institutions are often responsible for covering chargeback costs. In the case of money laundering, they may also be subjected to million dollar fines from government authorities. Not to mention the costs of dealing with the PR nightmare that seems to always follow suit.

With more and more consumers taking their spending habits online, investing into better fraud prevention systems is one of the best decisions a financial institution can make. It will help your business avoid hefty penalties. It will safeguard your clients from unnecessary stress and headaches. And it will help you maintain a stellar reputation.

Market-ready payment Platform

Launch your Revolut-like bank based on our core banking software

Learn moreIn this article, you will find out what payment fraud is, its main types and forms, as well as the most effective payment fraud detection tools available.

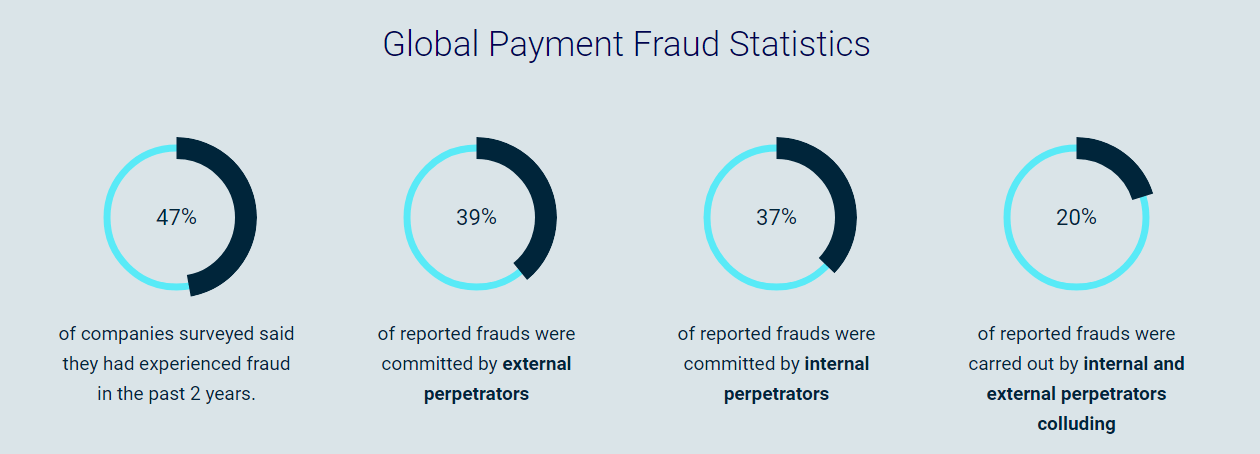

Source: PwC. 2020 Global Economic Crime and Fraud Survey.

Table of contents

What Is Payment Fraud?

Payment fraud is an umbrella term for illegal financial transactions. The European Union Agency for Law Enforcement Cooperation (Europol) categorizes payment fraud as a low-risk, high-profit criminal activity.

The combination of low stakes and high rewards makes this type of fraud very popular with criminal outfits of all sizes.

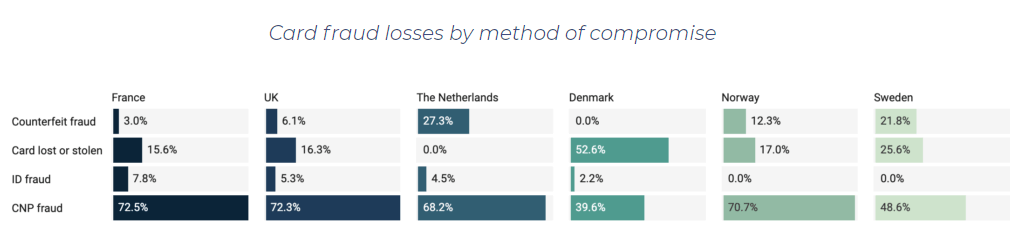

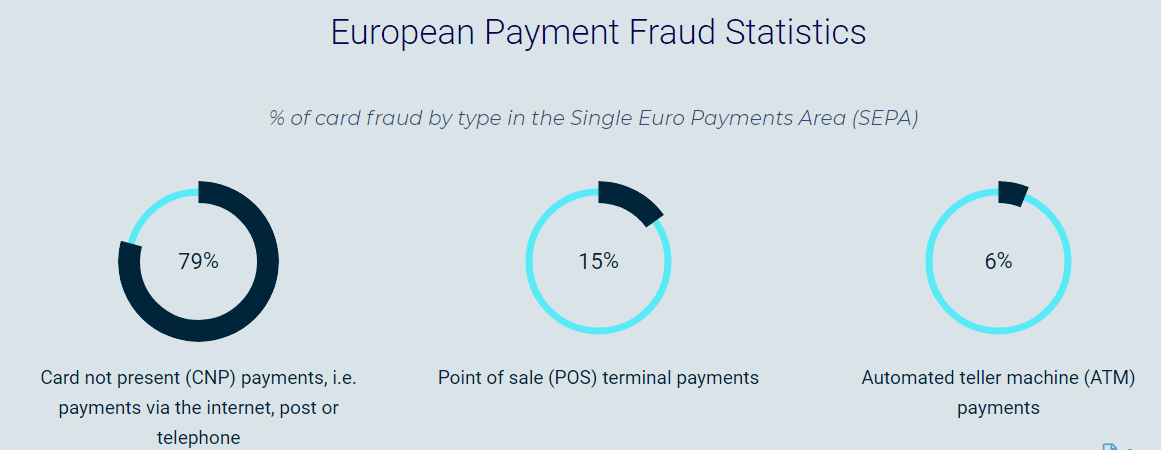

Source: European Fraud Report – Payments Industry Challenges. Date: 2019

What Are the Main Types of Payment Fraud?

Financial Identity Theft

When most people hear the word payment fraud, they think of financial identity theft. Simply put, this is the purchasing of goods using stolen payment information. Financial identity theft can be divided into two types, card-present fraud and card-not-present fraud.

Card-Present Fraud

As the name implies, this first type of credit card fraud involves the criminals having direct access to a copy of the victim’s physical card.

Fraudsters create these copies with the use of card skimming devices. After the victim inserts their card into a skimmer, the device reads and copies the authentication information exchanged between the credit card and the bank. This can happen, for example, at a compromised ATM or when the victim hands their credit card to an unscrupulous restaurant waiter. Check this article to get more information about credit card fraud detection.

The criminals then use the credit card to make fraudulent purchases until the victim notices the transactions and blocks their card.

Source: European Central Bank Sixth Report on Card Fraud Date: 2020

Card-Not-Present Fraud

Unlike the method we just discussed, card-not-present fraud does not require any direct contact with the victim or the purchase of expensive skimming and card creation equipment. All the criminals need are the victim’s payment details.

Multi-purpose cloud-based digital wallet software

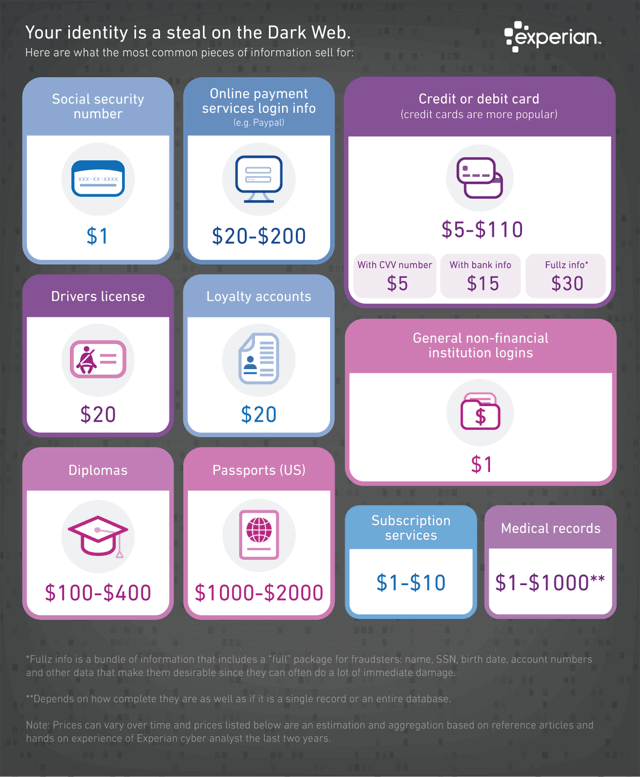

More detailsCriminals can gain this data in several ways, ranging from phishing attacks and social engineering to database breaches. Alternatively, they may simply purchase a database of already-stolen credit card information from the dark web.

Due to its low barrier to entry, card-not-present is by far the most common type of credit card fraud today.

Traditionally, this type of fraud was very difficult to deal with. However, modern software can help banks and payment processors successfully deal with most cases of card-not-present fraud instantly. Usually, it is trained on a database of billions of both legitimate and fraudulent transactions. So it’s like having a team of experienced employees instantly review every single payment.

Source: Experian

Money Laundering

There are many ways in which criminals can use credit card transactions for money laundering. Modern security software made old-fashioned schemes of using money mules to make deposits at dozens of different bank branches per day obsolete. So criminals have devised new ways to launder their ill-gotten money.

Merchant Identity Fraud

One of these ways is merchant identity fraud. The criminals register a business and create a legitimate-looking website for it. They then set up a merchant account and make payments to that account using stolen credit cards or the cards of their mules.

These fake businesses can pretend to sell anything from digital marketing services and personal coaching to foreign language courses. It actually does not matter what they do. It’s just a facade. No actual services are provided.

By the time most AML teams discover the fraud, the fake company is already nowhere to be found.

The best ways to protect yourself from digital fraud in banking is by investing in state-of-the-art Know Your Customer (KYC) and Anti-Money Laundering software.

Additional tools, such as anomaly detection, can act as an additional layer of security by highlighting which of your clients show signs of engaging in fraudulent activities and which credit card may have been stolen or is being used by money mules.

Modern Payment Fraud Prevention Tools

When it comes to combating payment fraud effectively, having good software on your side is a must. Bad actors are constantly figuring out new ways to outsmart payment providers and banks. By investing into the best credit card and retail banking fraud detection tools you can afford, you ensure that your business stays several steps ahead of them.

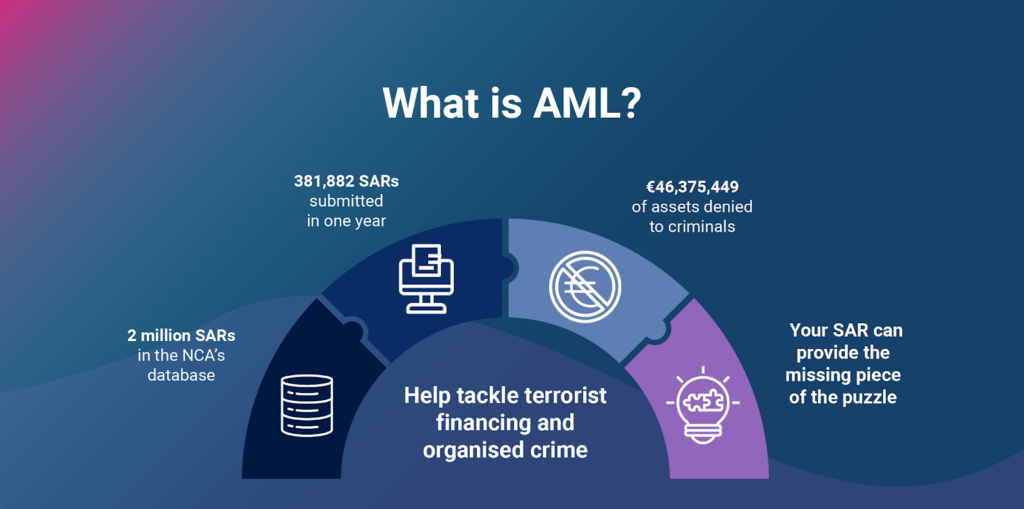

AML Fraud Prevention Tools

There are hundreds of AML fraud prevention tools on the market. Anti-Money Laundering software ranges from solutions that help your in-house team collect and process AML documents more efficiently to automated checkers that assign a reliability score to each client. There are also software suites that offer all-in-one packages.

Here are a few popular AML options:

- ComplyAdvantage

- NorthRow

- Sumsub

- Folio Digital Identity

- AML Manager

None of these solutions is universally better than the rest. Whether a particular piece of software is the right choice for you depends on the unique needs and wants of your business, as well as the AML requirements of the regulators you work with.

Source: Getid.ee

Fraud Protection with KYC Systems

Investing in a good Know Your Customer solution allows you to block bad actors before they have a chance to use your platform. Modern KYC solutions can instantly check your new clients against a list of persons and businesses under financial sanctions and known bad actors. They can also flag new or recently bought companies that aren’t in those lists but are of potentially high risk.

KYC solutions are often found bundled in AML software packages, but stand-alone options also exist.

Many KYC tools are tailored to meet the specific Know Your Customer requirements of government regulators. This helps ensure that your KYC procedure meets all the necessary guidelines.

Here are a few options that are popular with specialists across the globe:

- Mitek

- Comply Advantage

- Identity Mind Global

- Trulioo

- Fenergo

- Equiniti KYC Solutions

- Accuity

- Opus

- Simple KYC

Source: ShuftiPro

Anomaly Detection Systems for Payment Fraud Prevention

AI-driven anomaly detection tools are the latest development in digital banking fraud prevention that can be used for payment processors as well. With the help of big data, tools for anomaly detection in finance can easily handle cyclical, seasonal, and even idiosyncratic payment pattern variations while still being effective at filtering out fraudulent payments.

Why is this important? Because it provides great protection for you and your clients while not introducing any sales friction into the process. Your clients can enjoy a seamless payment process while the anomaly detection software does all the heavy lifting in the background.

Users whose transactions fall into this category are asked to complete an additional verification procedure. This helps you separate criminals from genuine customers who are making a highly unexpected purchase.

Wrapping up

Digital banking and payment fraud is a serious problem that no player in the financial services market can afford to ignore.

In 2020, the losses incurred by businesses due to illicit transactions rose to a record $56 billion. With more and more inexperienced customers taking their shopping online, it is very likely that this figure will continue to grow year after year.

The best way for banks and payment processors to safeguard themselves and their clients from payment fraud is by investing into high-quality Know Your Customer (KYC), Anti-Money Laundering (AML), and anomaly detection software.

FAQ

What is payment fraud?

The European Union Agency for Law Enforcement Cooperation (Europol) categorizes payment fraud as a low-risk, high-profit criminal activity.

What are the main types of payment fraud?

When most people hear the word payment fraud, they think of financial identity theft. Simply put, this is the purchasing of goods using stolen payment information. Financial identity theft can be divided into two types, card-present fraud and card-not-present fraud.

What are modern payment fraud prevention tools?

The best way for banks and payment processors to safeguard themselves and their clients from payment fraud is by investing into high-quality Know Your Customer (KYC), Anti-Money Laundering (AML), and anomaly detection software.