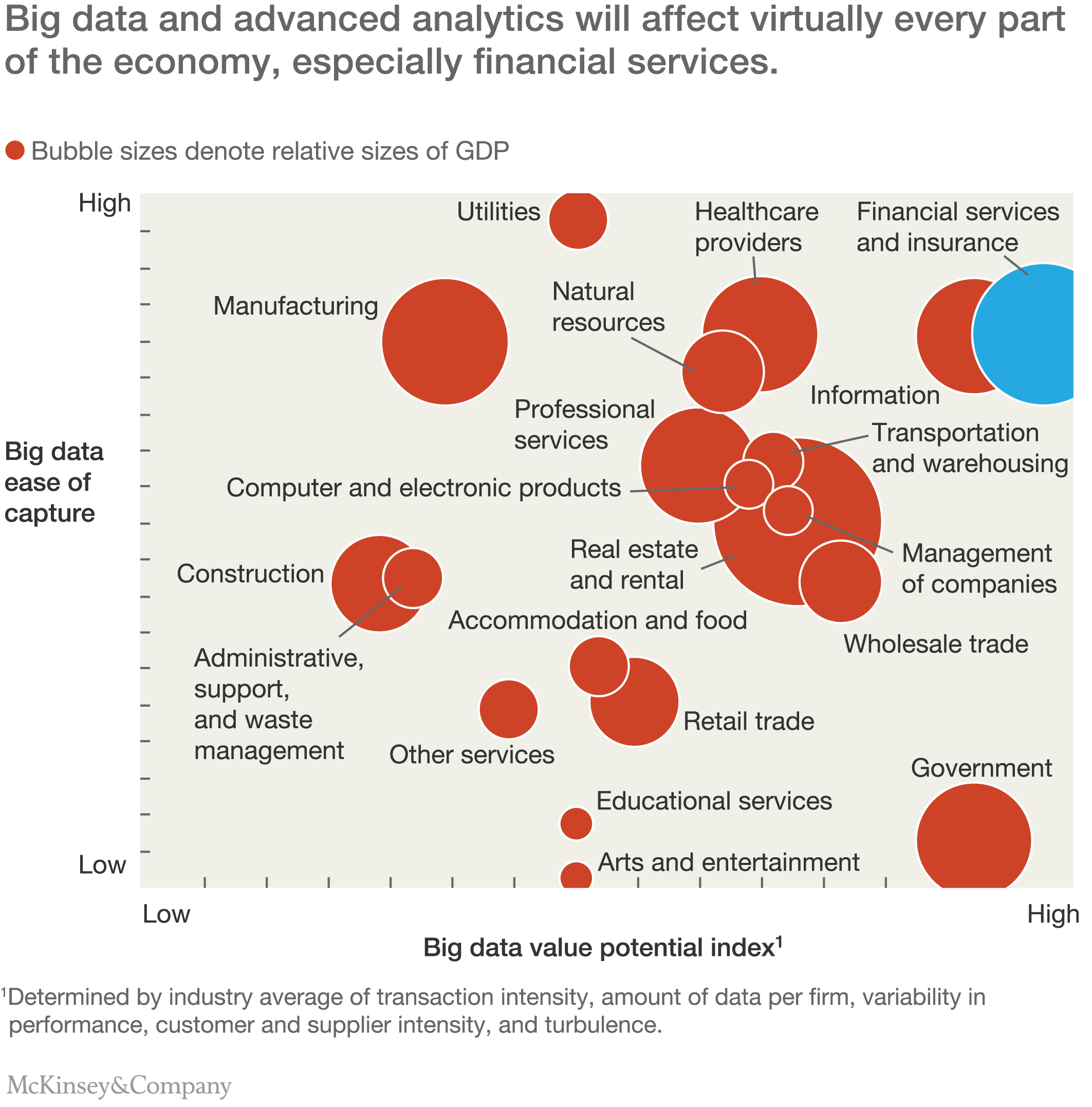

Machine learning use cases in banking are propelling the financial services industry forward. New innovative tools enable financial institutions to transform the endless stream of data they continuously generate into actionable insights for everyone, from C-suite and operations to marketing and business development.

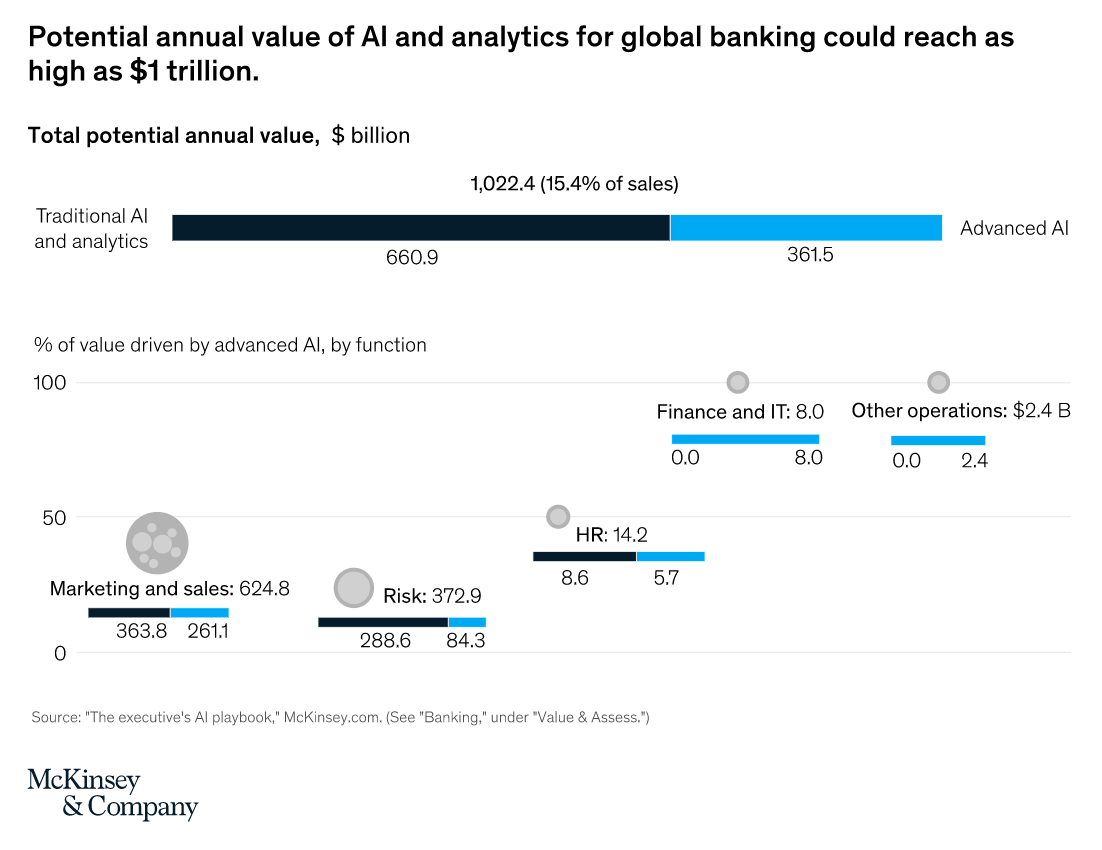

Companies are turning to machine learning use cases in finance for stronger security, slicker user experience, faster support, and nearly instant gapless processing. The benefits add up so much so that the potential annual value of AI and analytics for global banking could reach as high as $1 trillion, according to McKinsey.

High regulatory and compliance barriers often dampen the adoption of new technologies in the financial services industry, as security is paramount. This article explores why machine learning is different and how the world’s leading financial institutions are leveraging it with great success today.

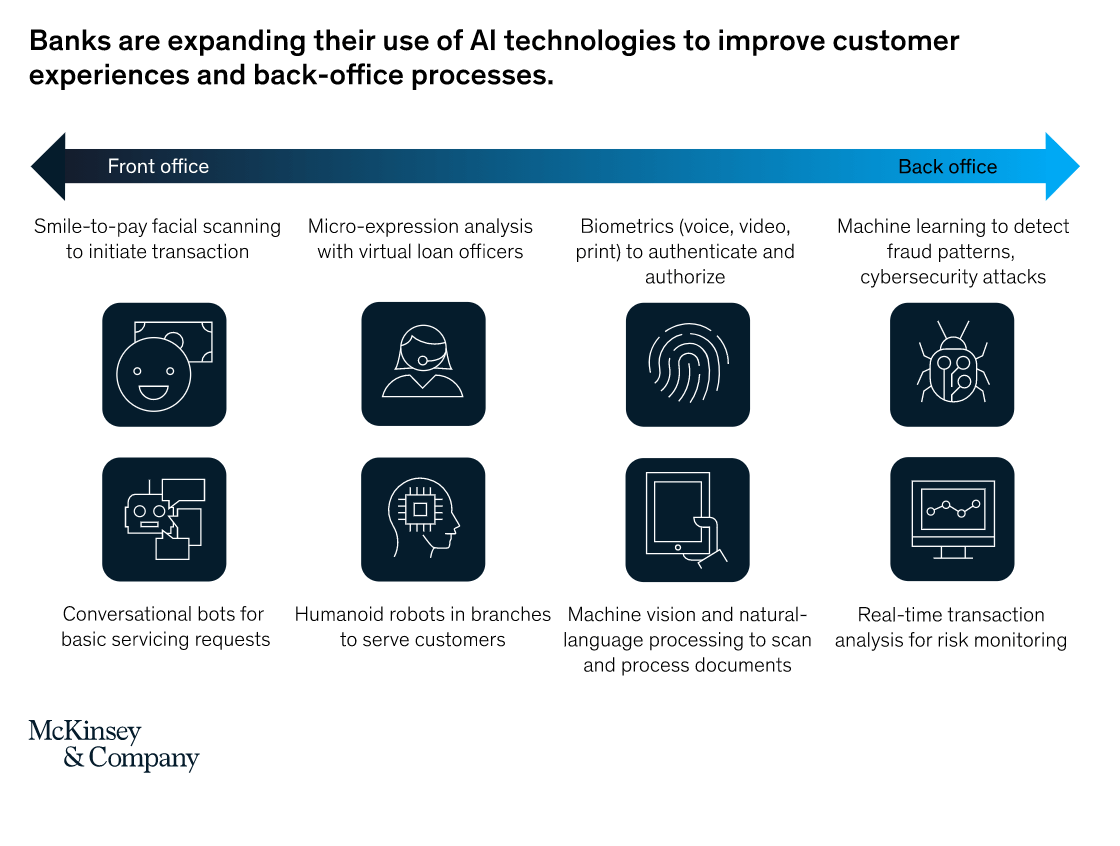

Source: McKinsey

Table of contents

Machine learning fraud prevention

Financial fraud costs customers and businesses billions every year. In 2020 alone, businesses lost a record $56 billion. Banks with outdated technology and lax security measures oppose sophisticated cyber attacks and exploits. Companies need to ensure that they know how to prevent fraud to stay at least a step ahead of the fraudsters.

Machine learning fraud prevention is among the most effective applications of technology to date. Dedicated innovative algorithms analyze millions of data points, transaction parameters, and consumer behavior patterns in real-time to detect security threats and potential fraud cases. Unlike traditional static rule-based systems that apply the same logic to most consumers, machine learning fraud prevention is personalized on a customer-by-customer basis.

Ready-to-go ewallet software

Build a loyalty program, or integrate into your product for gift cards, bonuses, vouchers etc.

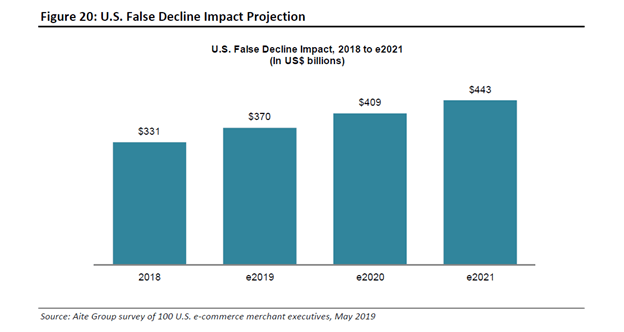

Learn moreAs a result, machine learning enables financial companies to detect fraudulent operations quickly and precisely to prevent any unnecessary losses. As a recent fraud detection case study pointed out, machine learning can be the key to solving the problem of false positives. The net revenue lost from merchants incorrectly identifying legitimate transactions as fraudulent, the so-called false positives, is estimated to reach $443 billion in 2021.

Source: Aite Group

Manual fraud prevention with a human monitoring a dashboard with a few KPIs is not scalable to millions of transactions consumers make every day and millions more metrics associated with them. Machine learning fraud prevention takes the guesswork out of the equation with a constant cycle of monitoring, detecting, and learning that makes better predictions with every new piece of data.

Machine learning in anomaly detection

Since the first applications of machine learning anomaly detection in financial services in the 1990s, the technology has matured to simultaneously track and process transaction size, location, time, device, purchase data, consumer behavior, and many other variables. Modern anomaly detection is successfully applied to anti money laundering (AML) and know your client (KYC) processes as well as financial fraud because it provides clear binary answers to complex inputs.

In 2020, regulators fined financial institutions a record-breaking $10.4 billion for AML and KYC violations, an increase of 81% from the year before. As governments continue to crack down on fraud, financial institutions need to ensure they are compliant with the strict regulations to prevent significant losses.

Machine learning in anti money laundering enables banks to accurately find the very subtle and usually hidden events and correlations in user behavior that may signal fraud. By automating the complex anomaly detection process, financial institutions can process much more data much faster than human rule-based systems.

Source: Fenergo report

The machine learning KYC process relies on anomaly detection to automatically find irregularities in documents customers submit for verification at the early stages of onboarding, saving companies from taking on unnecessary risk. It also helps to drastically improve user experience by reducing the number of verification steps that impede the consumer purchasing journey.

Real-time anomaly detection enables companies to immediately respond to deviations from the norm, potentially saving millions that would have been lost to fraudulent behavior otherwise. By eliminating the delay between spotting the problem and resolving it, payments and finance companies can maximize the efficiency of their anti-fraud strategies with machine learning.

Market-ready platform for neobanks

Speed up software development process with SDK.finance PLatform

Learn moreMachine learning in onboarding & document processing

The benefits of machine learning use cases in FinTech go beyond transactions and fraud detection. The technology can be applied to back-office tasks with great success as well. Document classification, for one, is a vital but traditionally labor-intensive process that requires considerable time and resources. Machine learning can significantly reduce the processing time for labeling, classifying, and organizing documents for later retrieval.

By first running documents through the Optical Character Recognition (OCR) process, machine learning algorithms can then digitize the text on scanned documents to read, process, and analyze their context. Using that information, the machine learning model can classify the document and index it for future search for ready access by company employees.

Machine learning powered document processing is as useful to traditional banks that still rely on paper forms to onboard customers as it is to neobanks that require customers to submit documents electronically. Whether it’s a photo of an invoice to prove the source of funds or a scan of an ID, machine learning is an efficient and highly scalable tool for onboarding.

As machine learning use cases in payments demonstrate, the algorithms play an important role in the design of the onboarding process. Machine learning can be used to determine what effect the smallest changes in the consumer’s decision journey will have on conversion rates. By crunching through millions of user actions, machine learning can enable financial companies to perfect how consumers interact with their systems.

When machine learning is a part of the onboarding and document recognition processes, customers can complete complex operations such as opening a new bank account in minutes from anywhere and on any device. All checks can be carried out in real-time while the business effectively captures the data consumer inputs into the system. Such use cases for machine learning help companies build long-lasting and valuable relationships with their customers.

To get more information about fintech software development challenges and solutions, read this article.

Machine Learning in credit scoring

Although most financial institutions collect valuable data with every transaction their customers make, most cannot use the information to its full potential. Machine learning in credit scoring can crunch through millions of data points, transaction details, and behavior patterns to determine hidden features about consumers. As a result, machine learning models can generate highly personalized offers that boost revenue by catering to more customers, such as those thought to be credit invisible.

Unlike human credit scorers, machine learning algorithms can evaluate borrowers without emotion or biases. According to Harvard Business Review, financial companies can make lending fairer by removing racial, gender, and other biases from the models when they are being built. Understanding the unbiased risks enables banks to make better decisions and serve a wider audience.

With the currently available computational capabilities, machine learning in the credit card industry and beyond can process vast amounts of customer data to generate accurate credit scores almost instantaneously and automatically. With processed data and comprehensive risk profiles, banks can enable their customers to customize their loans on their own and receive money in just a few clicks from the comfort of their homes.

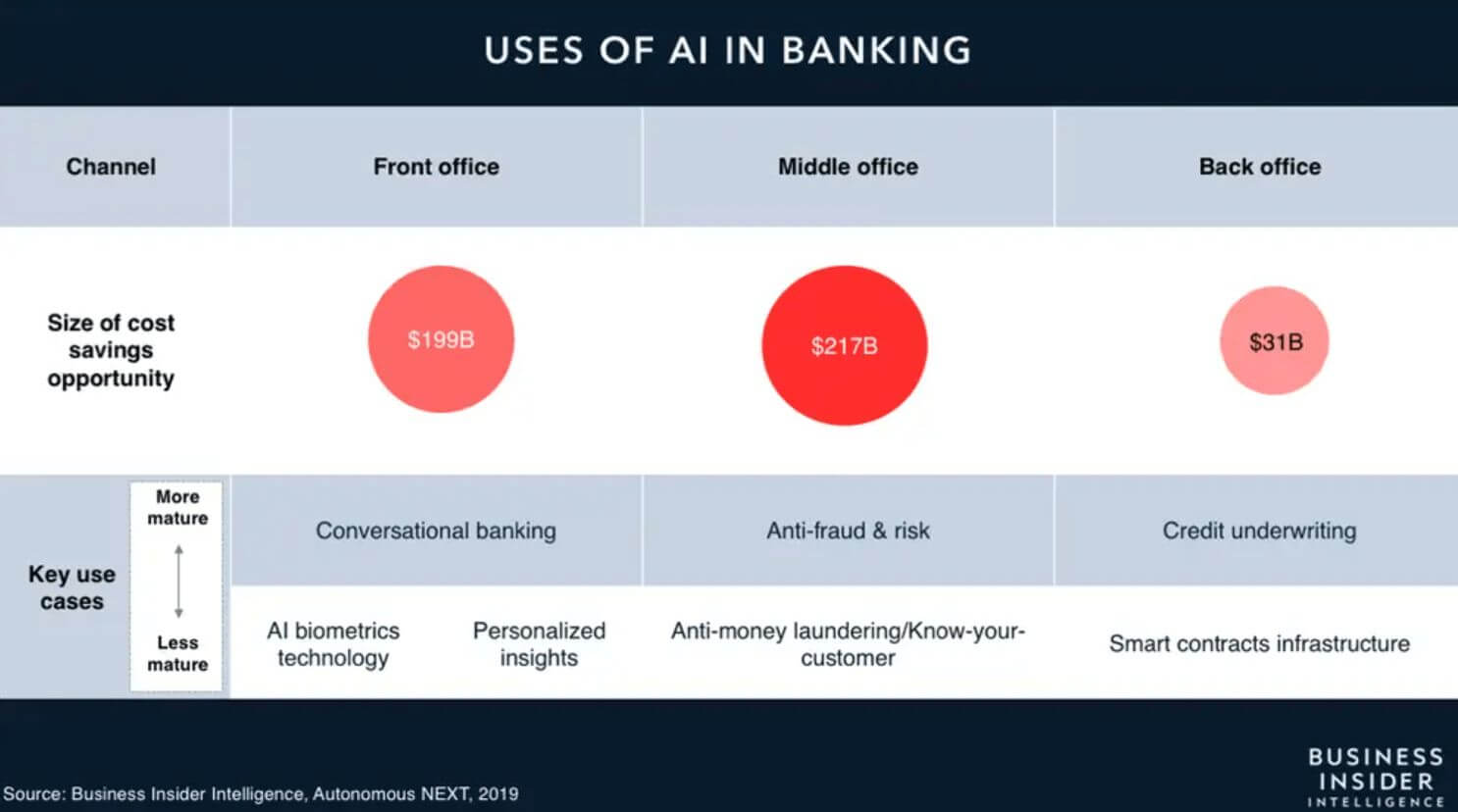

Source: Business Insider Intelligence

Machine learning in payments

The payments industry has a lot to gain from leveraging machine learning in payment processing. The technology enables payment providers to drive down transaction costs and attract more business when applied to costs, conversion, connectivity, billing, and payouts.

Machine learning can help PSPs optimize payment routing based on multiple parameters, such as performance, functionality, or pricing. By processing multiple data sources in real-time, machine learning algorithms can dynamically allocate traffic to the best performing combination of variables at any point in time. This unlocks a whole new level of service personalization as the provider can provide the best results for merchants based on their individual goals, whether it’s performance, pricing, or functionality.

FinTech Software Development Services

With a pre-developed software by SDK.finance and our dedicated team you can build your banking app faster

More detailsThe versatility of machine learning applications in finance allows companies to generate deep value by solving everyday challenges. For example, the recently enacted mandatory two-step verification measures like Verified by Visa or 3DSecure from Mastercard have led to a high decline rate in payments, resulting in many dissatisfied customers. By applying machine learning in payment processing, payment providers could determine if a transaction should be routed to a two-step verification page or if it will go through on its own.

Machine learning in process automation

Process automation is another successful application that resulted in many machine learning use cases in FinTech. From automating repetitive tasks through robotic process automation, such as document processing and employee training gamification to customer request tracking, finance companies can completely replace time-consuming manual work and generate more value in the process.

With every online action leaving a footprint, machine learning algorithms have a lot of data to work with that they can use to interpret behaviors and recognize patterns. This is especially useful for customer support systems that help classify, narrow down, and potentially solve client problems without any human input. Finance companies that use this to their advantage can improve their customer experience, reduce costs, and scale up their services efficiently.

Source: McKinsey

Given the amount of structurally diverse data businesses generate daily, and even more data available generated in the financial markets, processing it manually would barely scratch the surface of the insights that lie within. As machine learning use cases in finance demonstrate, integrating the technology to crunch through large volumes of data can produce valuable intelligence that improves business decision making, forecasting, and highlights profitable opportunities.

Machine learning in investing

Much like machine learning use cases in banking are applied to solving current problems, the technology has also been used to optimize how investment companies operate. For example, algorithmic trading that makes automatic purchases based on predetermined parameters has been around since the 80s, but its recent fusion with machine learning elevated it to a whole new level.

Trading companies use machine learning powered algorithmic trading to closely monitor financial news, trade results, prices, and hundreds of other data sources simultaneously to detect patterns that move the prices of financial instruments. The algorithms can execute trades at the best possible prices using that information, eliminating fat finger errors that sometimes result in millions in losses.

Similarly, machine learning has increased the accessibility of financial markets with automated robo-advisors that make investment decisions automatically based on a customer’s risk profile and preferences. Robo-advisors create personalized portfolios to help consumers achieve their investment goals, be it everyday savings, retirement funds, or protection from inflation.

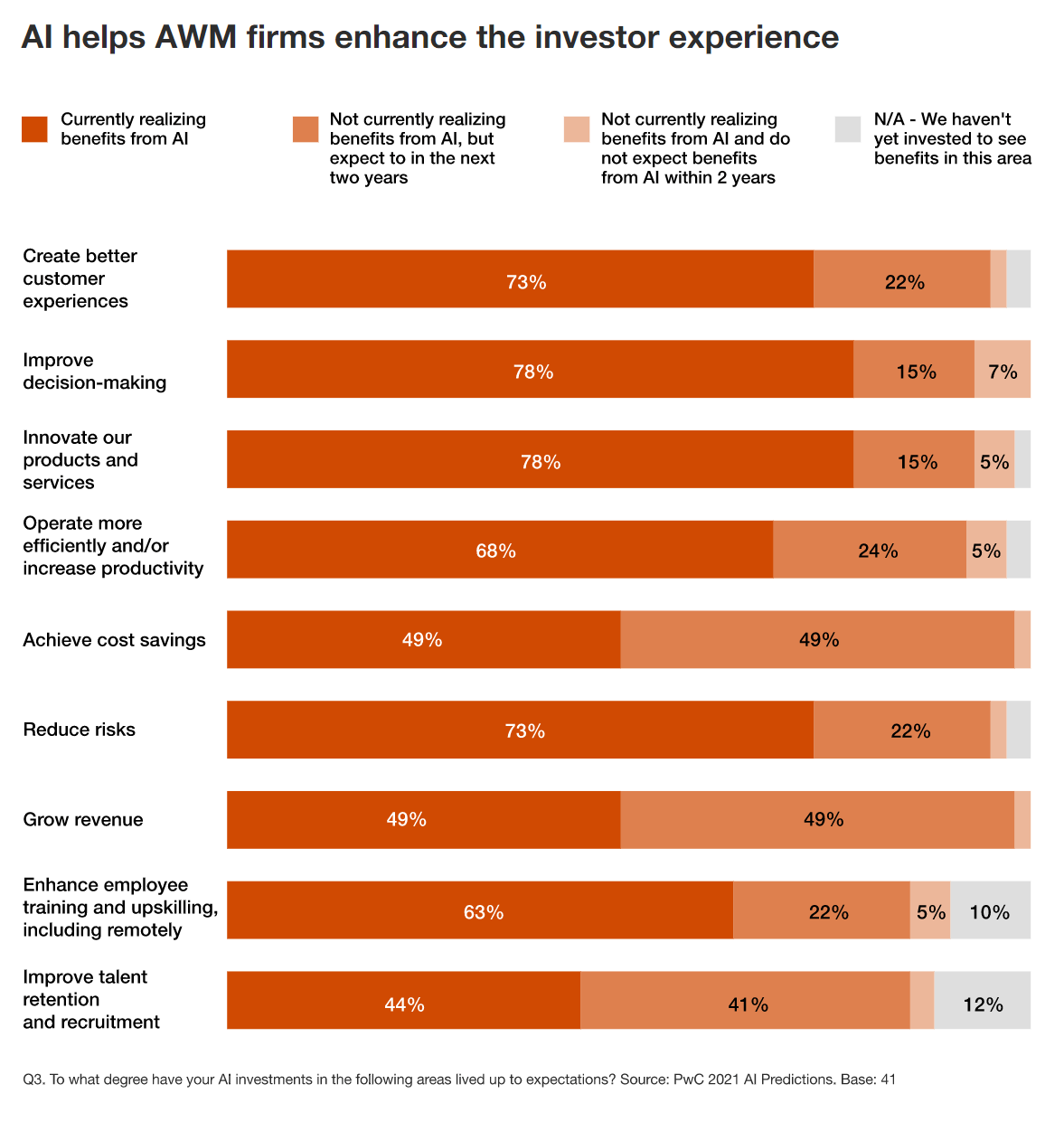

Source: PwC

Machine learning in customer retention

Quality customer support is a vital component of any successful financial business. Machine learning in the payment industry and financial services helps companies understand and cater to their customers’ needs with personalized services and offers. The technology enables businesses to extract nuanced insights from how their clients interact with their products and services. This intelligence can be used to determine areas for improvement and highlight opportunities for expansion with a huge scope of implementation that spans the whole marketing funnel.

Perhaps more importantly, the data can help companies monitor and forecast customer churn based on changes in behavior. As acquiring new customers is much more expensive than retaining existing ones, machine learning helps companies identify customers they are at risk of losing and act quickly to retain them. Whether it’s a customer who had a bad experience or someone who forgot about the service and stopped using it, machine learning can help build loyalty and keep customers interested longer.

Source: McKinsey

Machine learning in support & chatbots

Chatbots unlock new useful functions for customers much in the same way as machine learning use cases in payments do for companies. When connected to a payment system, machine learning powered chatbots let customers ask questions and receive insightful answers about their accounts and transactions. Sophisticated algorithms powering chatbots can solve many day-to-day queries that would otherwise be passed on to traditional customer support. Unlike most call centres, chatbots are available 24/7/365 and provide nearly instant responses.

If a chatbot cannot resolve an issue, it would have to pass it on to a human customer support representative. But before that happens, the algorithm would automatically classify the query and pull up all of the relevant details so that the human operator can resolve the issue much faster. Any conversation with a chatbot is an opportunity for companies to offer personalized offers, be it a lending product, a new subscription plan, or a special insurance offer.

Conclusion

Machine learning use cases in payments, finance, and banking challenge competition to develop faster, cheaper, and better propositions. Financial institutions must build loyalty with highly personalized, timely, and competitively priced products and services to remain competitive. The core technology and data infrastructure need to leverage the many advantages of machine learning in decisions across the customer life cycle to achieve this. For more and more financial companies, machine learning isn’t just the future. It’s the present.

FAQ

How is machine learning used in banking?

Machine learning use cases in banking are propelling the financial services industry forward. New innovative tools enable financial institutions to transform the endless stream of data they continuously generate into actionable insights for everyone, from C-suite and operations to marketing and business development.

Companies are turning to machine learning use cases in finance for stronger security, slicker user experience, faster support, and nearly instant gapless processing. The benefits add up so much so that the potential annual value of AI and analytics for global banking could reach as high as $1 trillion, according to McKinsey.

What are the use cases of machine learning in banking?

Machine learning solutions for fraud prevention, anomaly detection, credit scoring, anti-money laundering and kyc process, payment processing, onboarding & document processing, process automation are the main machine learning use cases for banking.