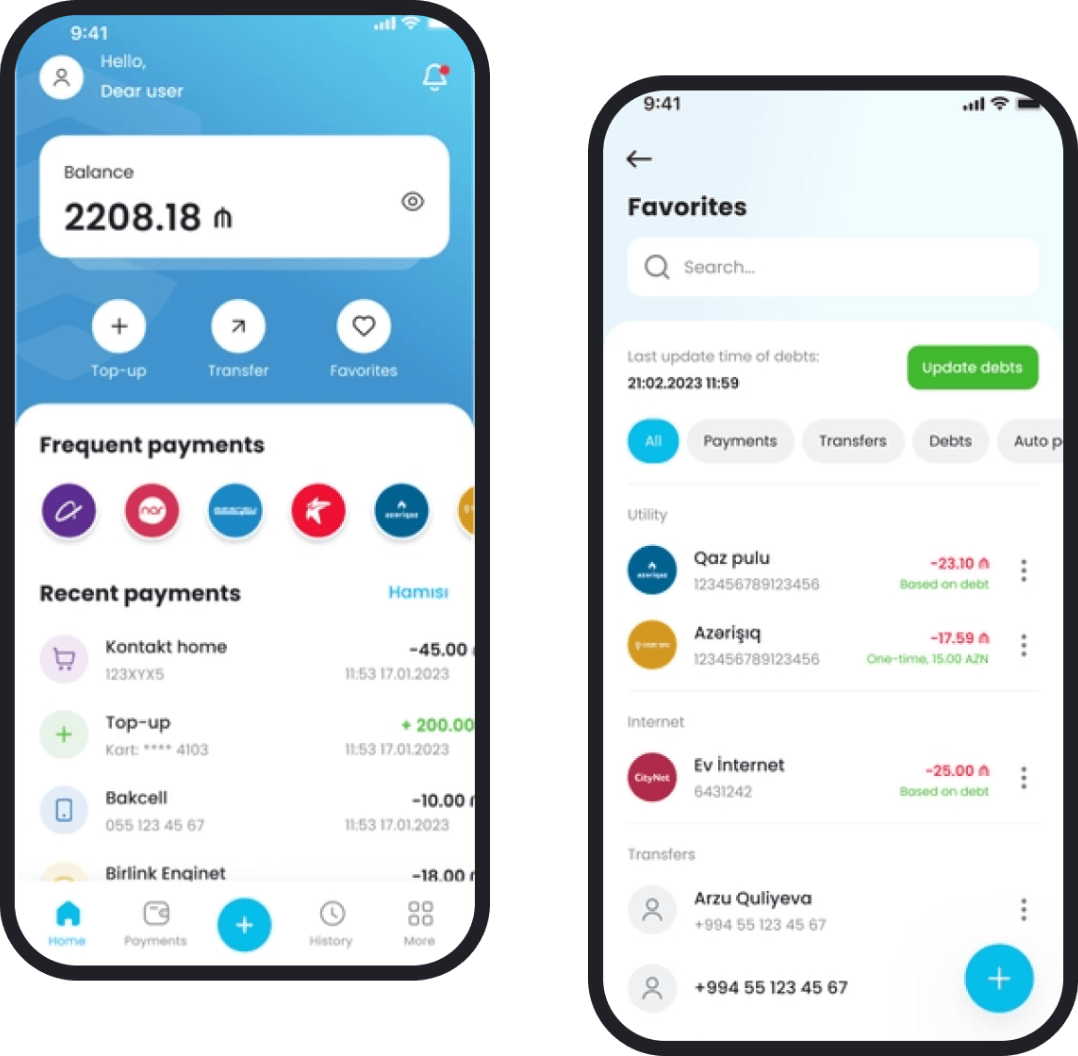

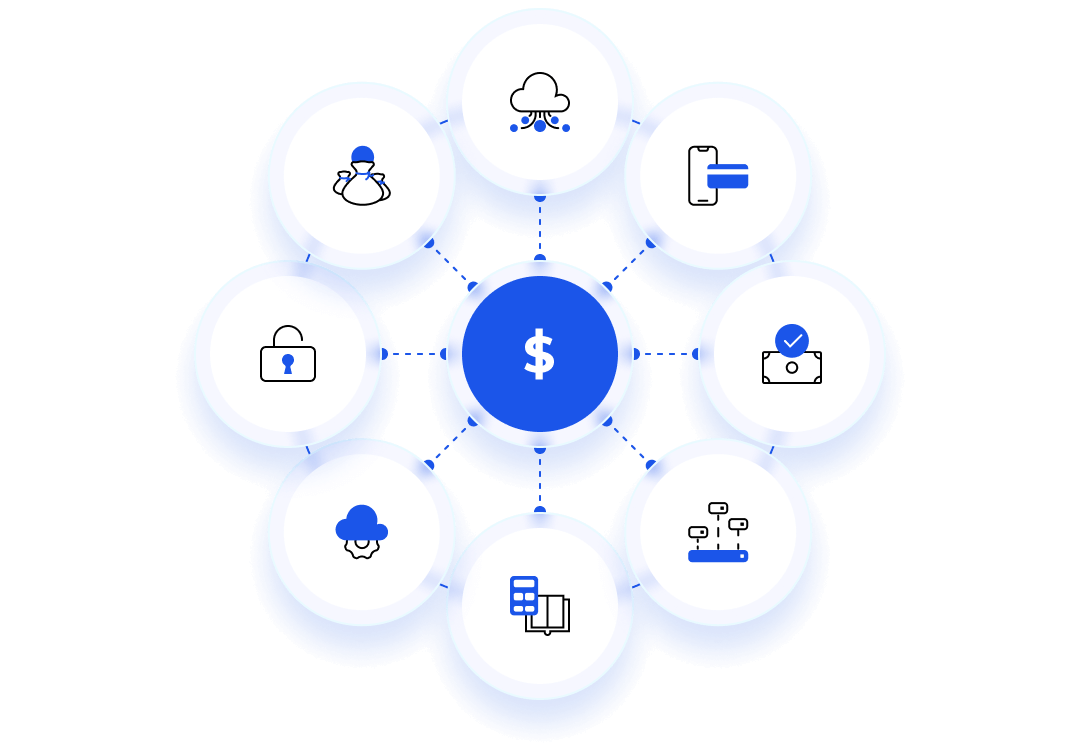

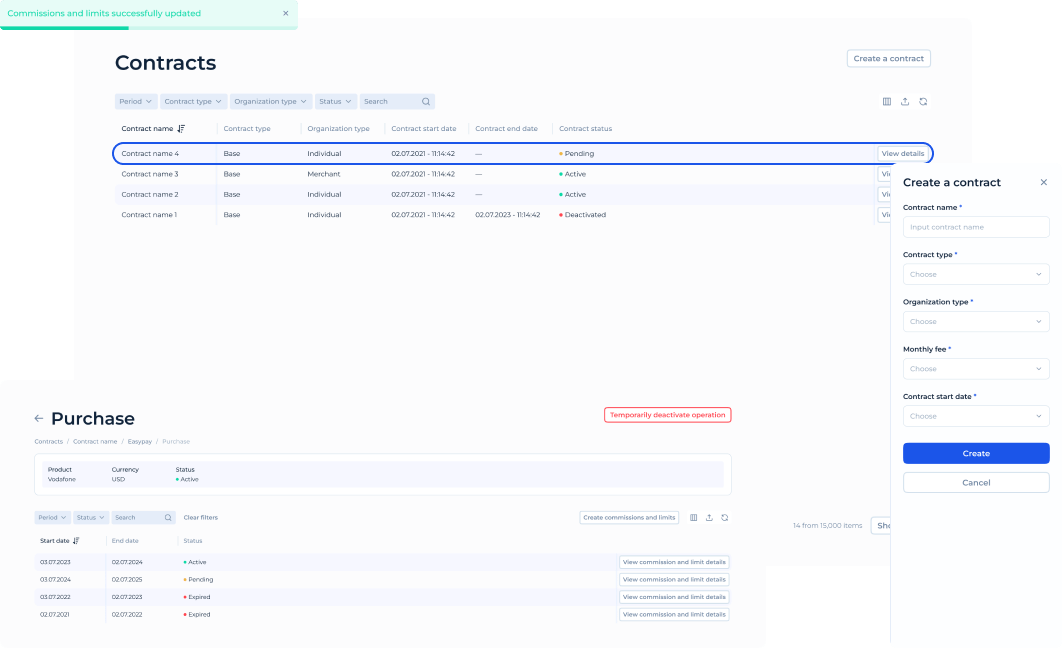

Individuals (ewallet, neobank, money remittance, currency exchange)

Merchants (payment acceptance via POS or online)

Corporate (neobank for corporate clients) (coming soon)

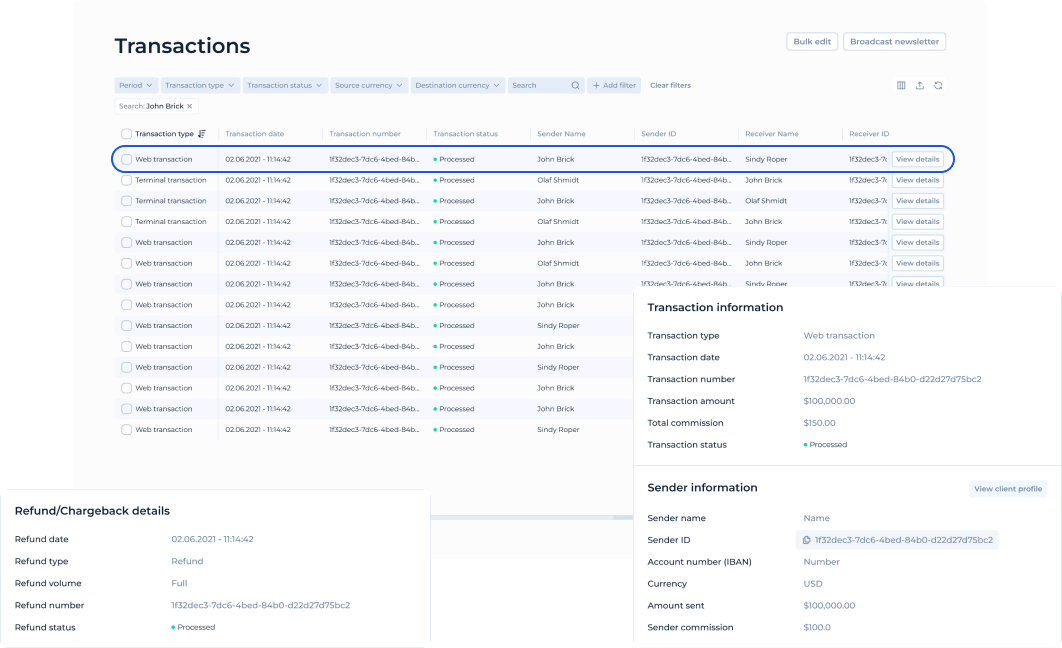

Self-registration via email or phone

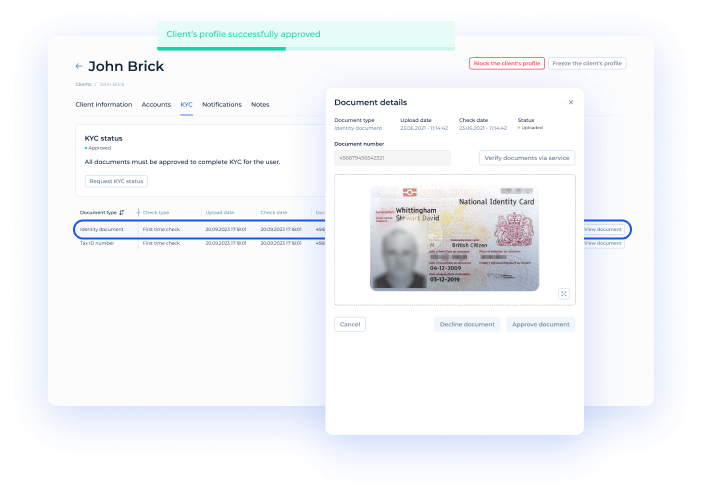

Flexible survey and document uploading (such as identity, utility bills, etc)

KYC

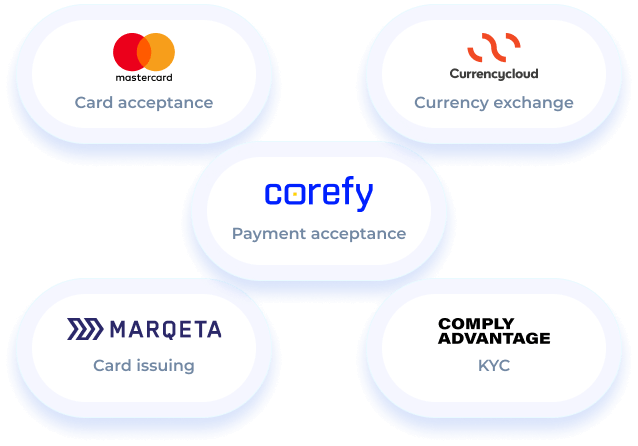

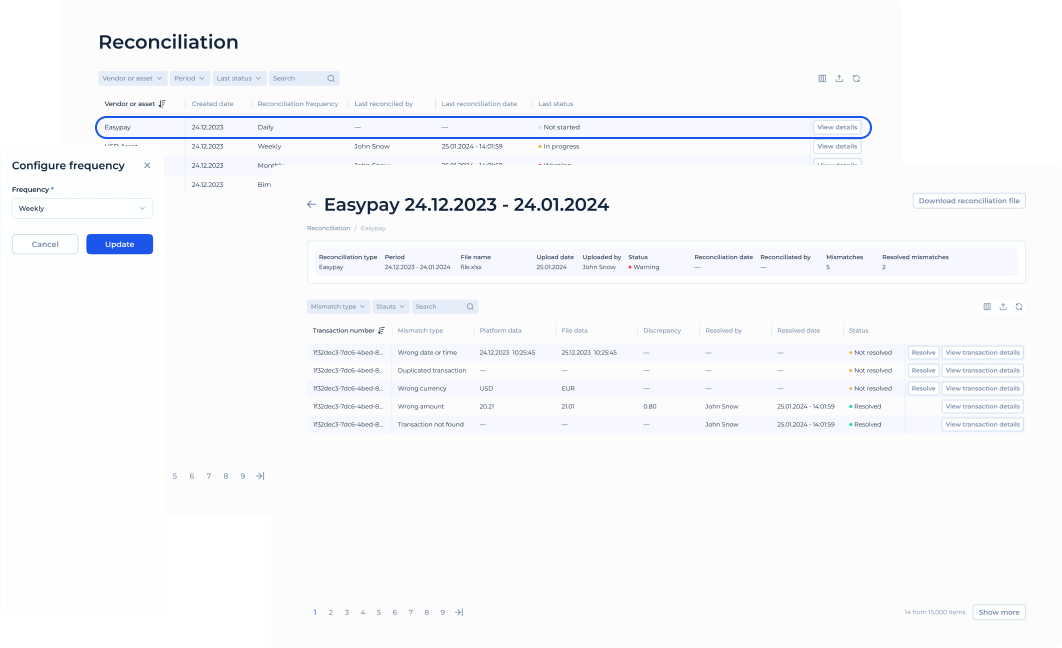

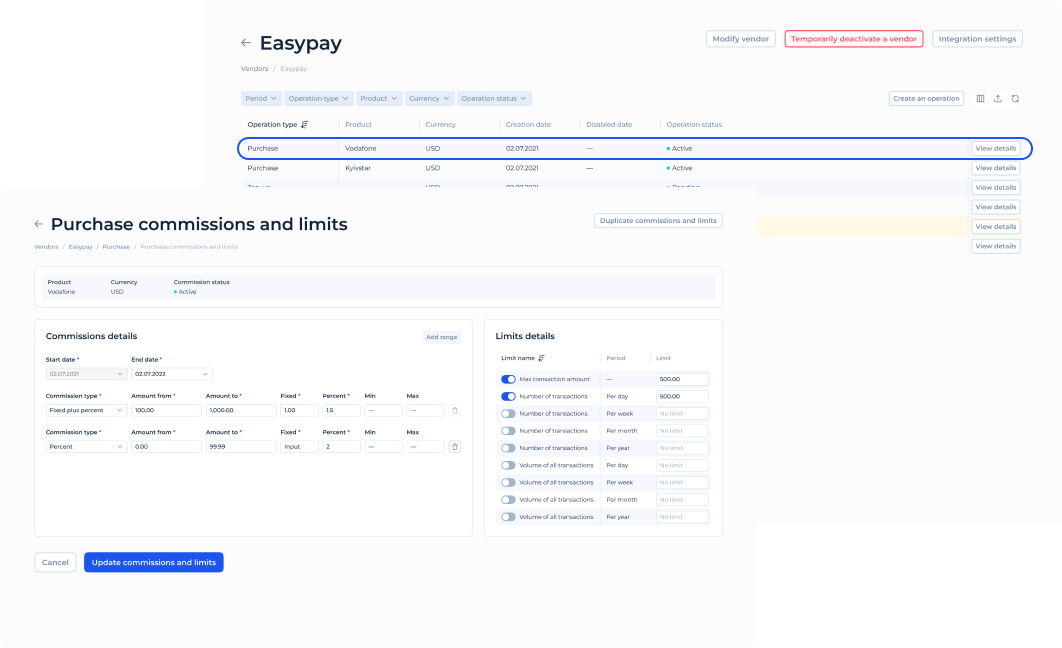

Automated (via pre-integrated vendors)

Manual (via back-office interface)

Two-factor authentication (2FA)

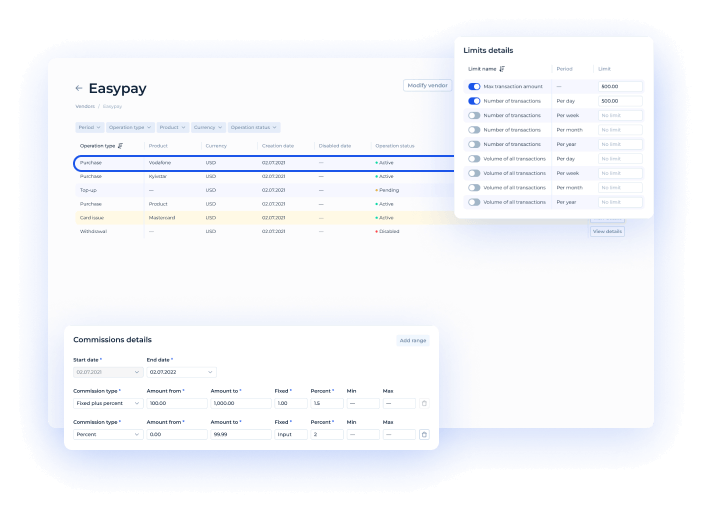

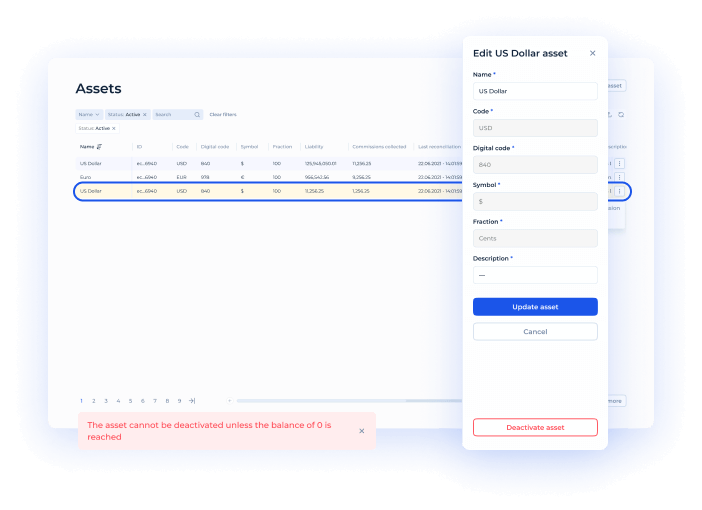

Accounts in any currency

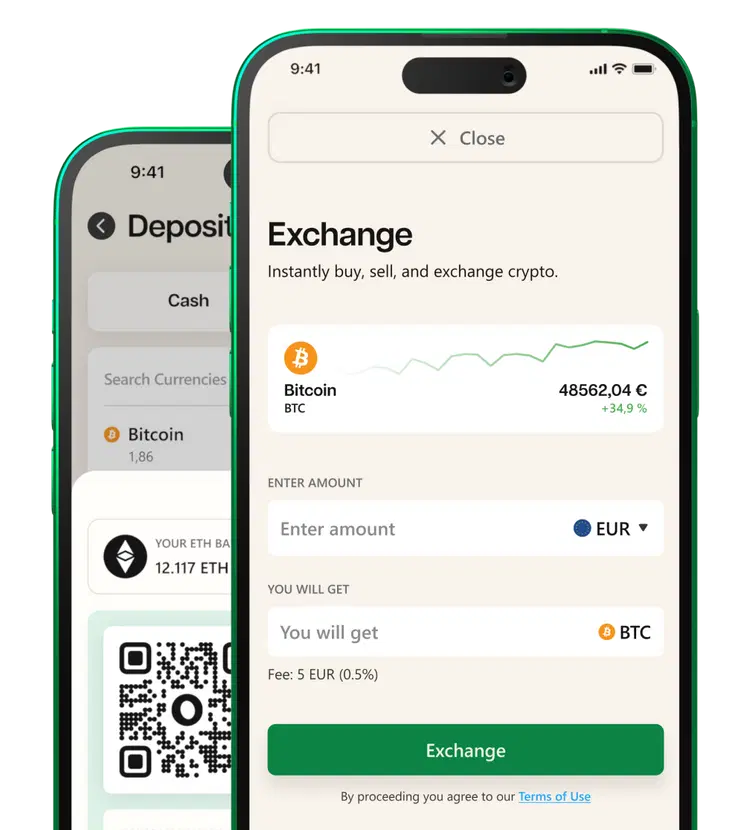

Any digital assets: crypto, points, bonuses, etc.

Ledger for accounting and reflection in the system of any currencies or digital assets

Card issuing (via pre-integrated vendor)

IBANs (via pre-integrated vendor)

ACH (via pre-integrated vendor, coming soon)

Top-ups and withdrawals

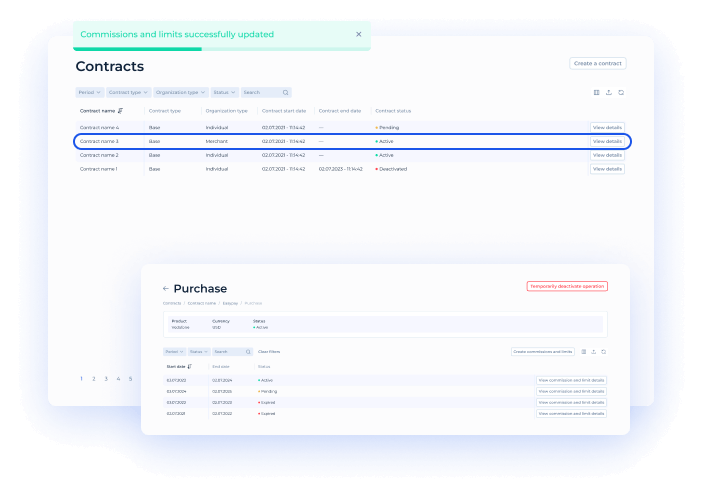

Payment gateway operations (via pre-integrated vendors)

In-system transfers or payments

In-system currency exchange

External currency exchange (via pre-integrated vendors)

Payment link

QR-payments (coming soon)

Refund and chargeback (coming soon)

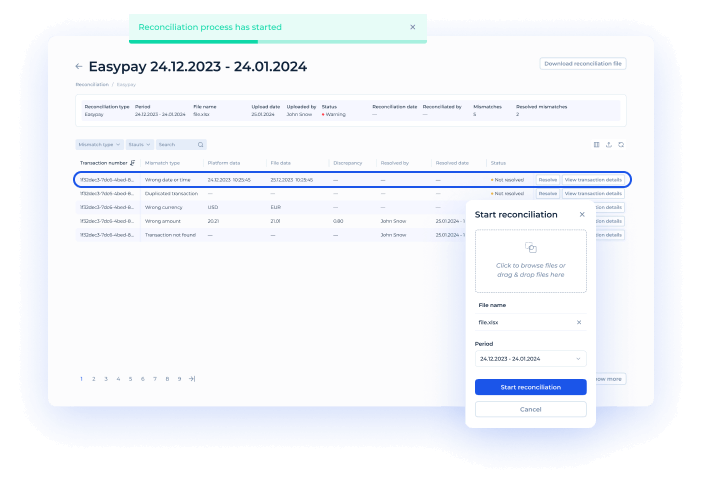

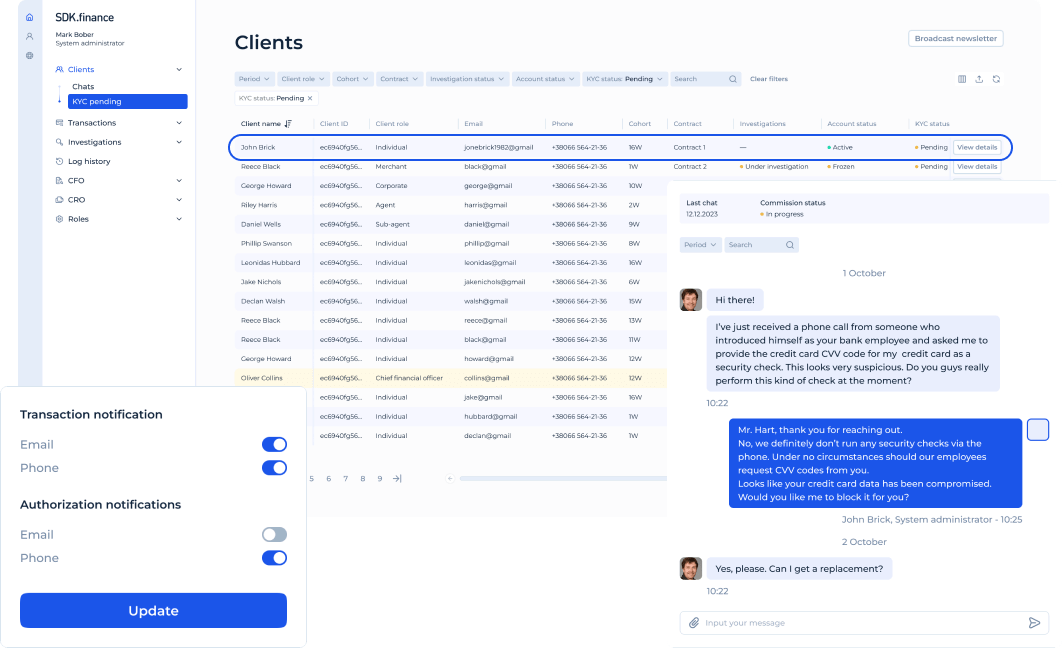

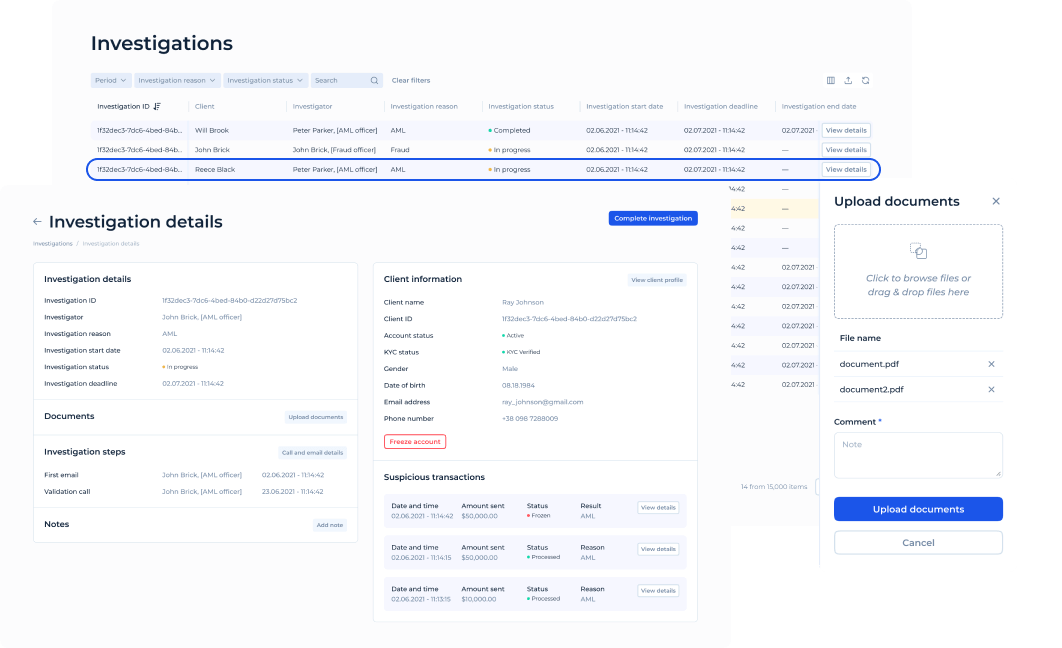

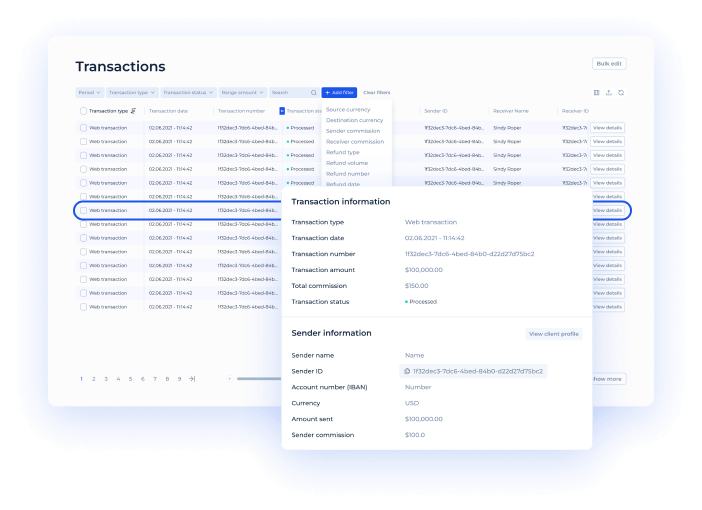

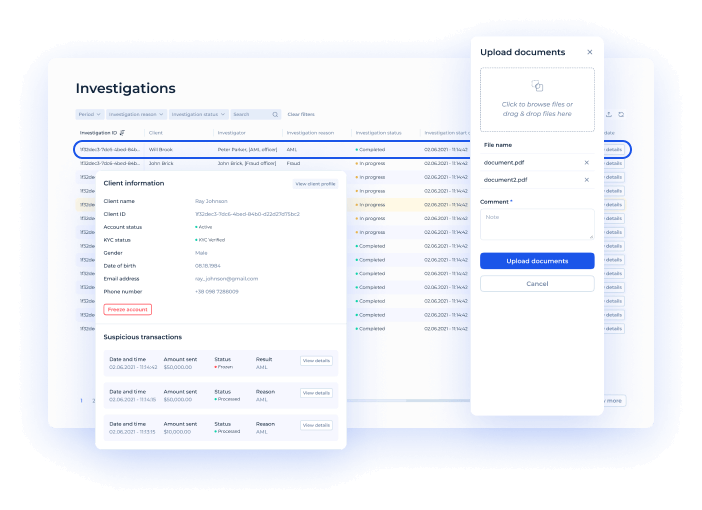

Identify suspicious transactions promptly

Obtain the client’s confirmation to exclude fraud

Get a proof of income from a client to be AML-compliant

Freeze/unfreeze customer accounts if necessary

Close the case

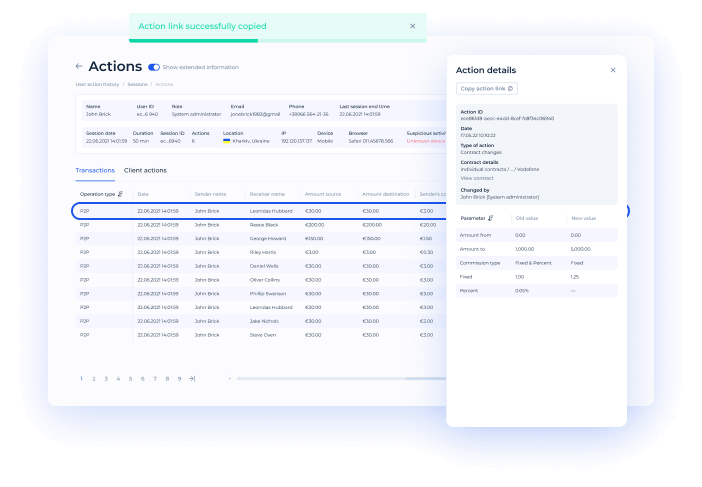

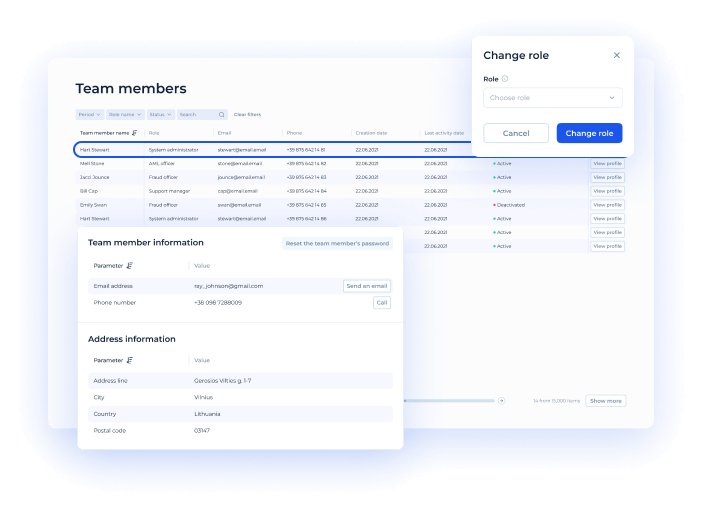

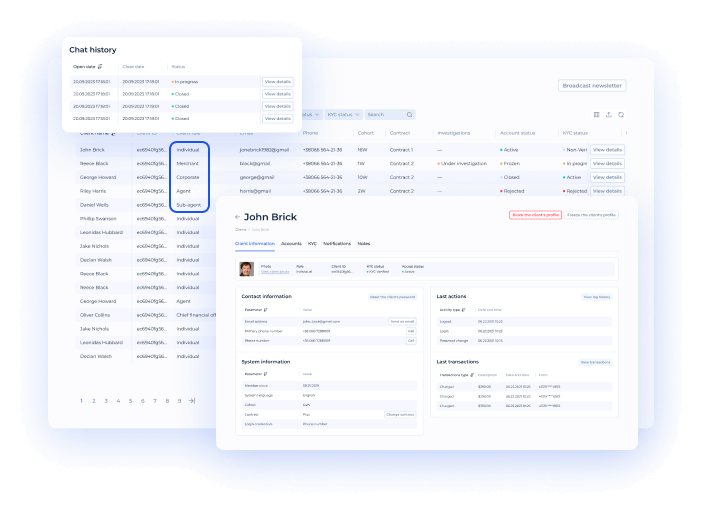

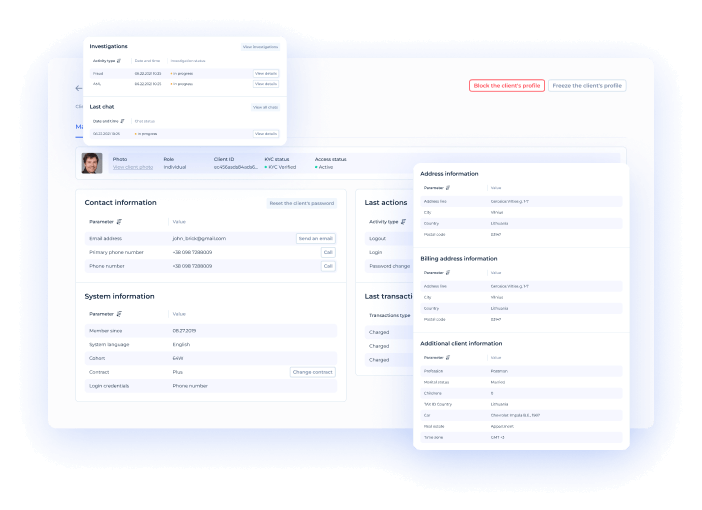

All customer details and activities in one place

Communication with clients and creating notes

Chats with customers via in-system messaging service

Notes about a customer for future

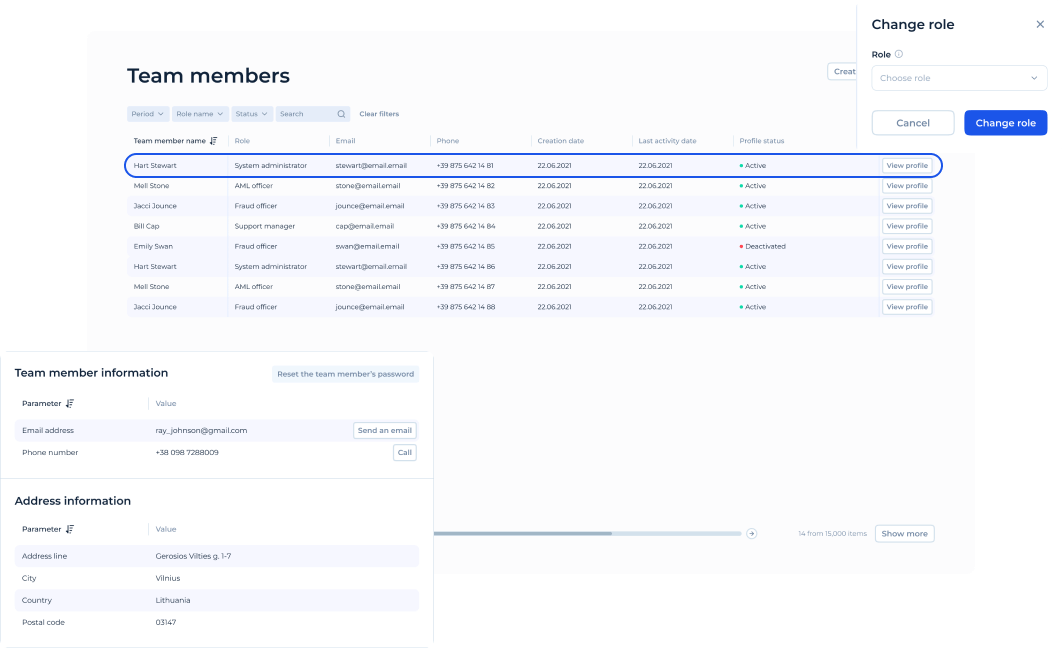

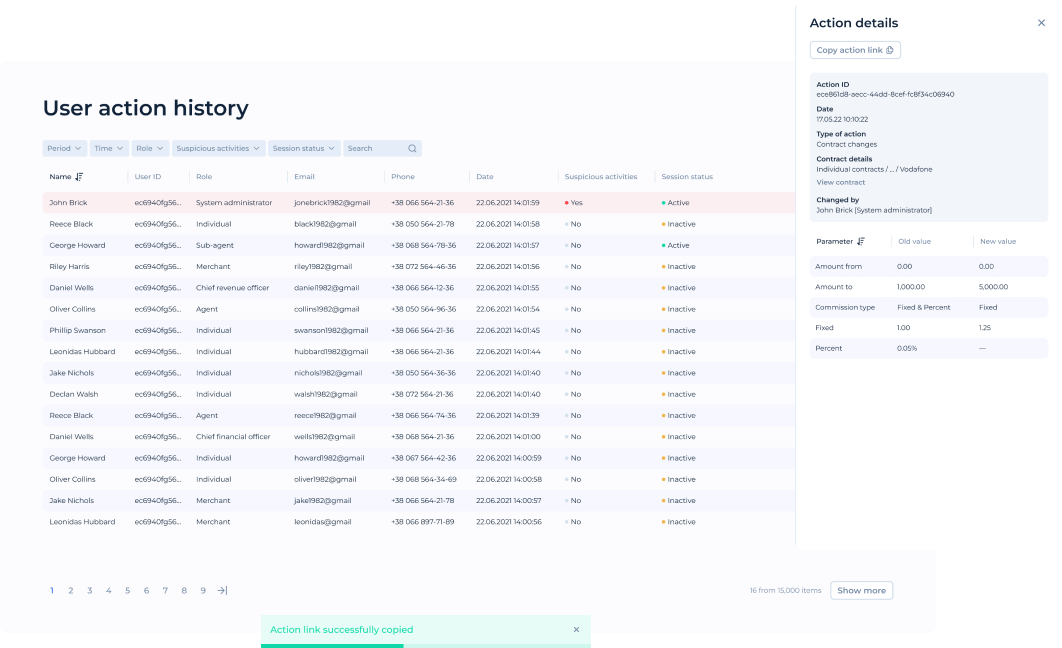

Log of system activities by clients and team members

Full details: logins, sessions, actions performed

Valuable for investigation purposes