The banking industry has evolved significantly over the years, and the introduction of technology has revolutionized the way banks operate. One of the most significant technological advancements in the banking industry is the use of banking software. Banking software has streamlined banking operations, made transactions faster, and enhanced customer experience. This article provides a comprehensive overview of the banking software market.

Table of contents

Global banking software market

The banking software market has witnessed significant growth over the years. According to a report by MarketsandMarkets, the global banking software market size is expected to grow from USD 25.37 billion in 2020 to USD 37.19 billion by 2025, at a CAGR of 7.9% during the forecast period. The increasing demand for customer-centric banking solutions, the adoption of cloud-based solutions, and the rising use of mobile banking applications are some of the factors driving the growth of the banking software market.

Banking software can be categorized into various types based on their functionalities. Some of the common types of banking software are core banking software, mobile banking software, internet banking software, payment processing software, and others. Core banking software is the most widely used banking software, and it helps banks manage their core operations such as deposit and loan management, transaction processing, and accounting.

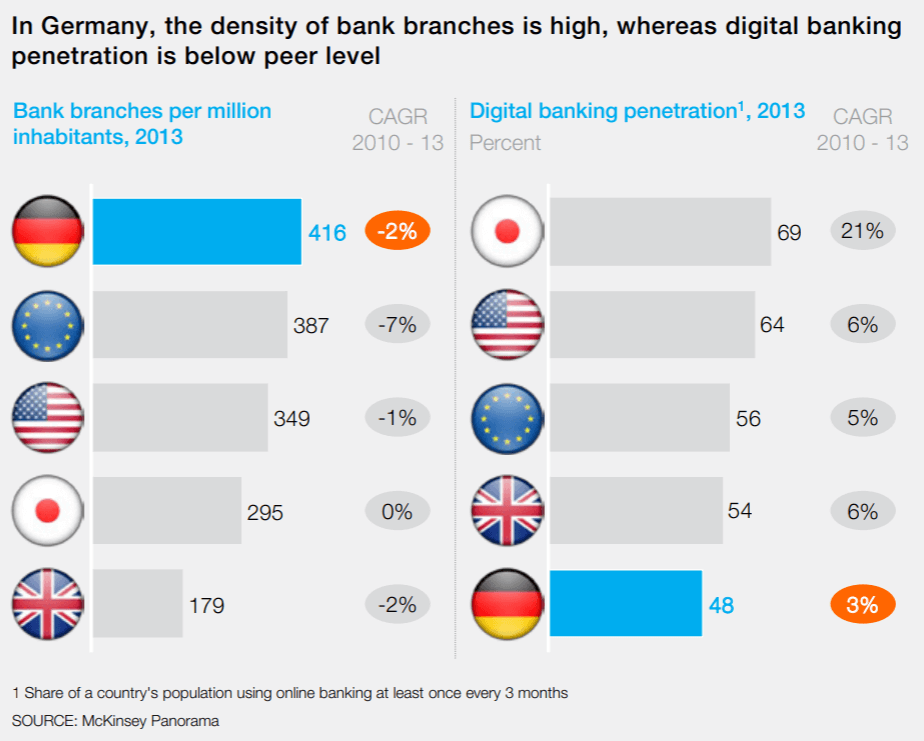

German banking software

The increase in the digitalization of banking services is likely to result in a key tech disruption of Germany’s competitive and overbanked market. Even though conservative client preferences and an aging population are holding back the transformation by protecting incumbent banks’ market share, a recent study shows that 40% of German adults are expected to have an online-only bank account by 2025.

Digital-only banks operating in Germany rely on banking software to offer state-of-the-art services. Check out our previous article to find what it takes to build a digital-only bank like N26, bunq, or Revolut here. Financial software in Germany lets challenger banks attract and retain clients with highly user-friendly applications and added levels of convenience.

With modern banking software, Deutsche customers can open an online account in less than 5 minutes whenever and wherever. Almost everything can be done online without the need to go to any branch, leading some to believe that branch banking is dying. As more people stay at home due to the coronavirus, the pandemic could even act as a catalyst for digital banking adoption.

While regulators have been slow to level the playing field for banks and FinTechs, new players are using the weaknesses of the German banking system and software they rely on to enter the market. Financial software used by Deutsche FinTechsand pure online banks is significantly ahead of their legacy competitors.

German bank software market is attractive for its great size and high wealth level not only to FinTechs but also to incumbent banks. Deutsche Bank has started its own digital bank to compete with the challengers in the corporate market. It’s called Fyrst and targets companies with fewer than ten employees. Over time, other german banks will need to adapt their outdated technology to compete with the growing number of fintech challengers or risk losing their market share.

Explore the banking app development cost in our latest article.

UAE banking software

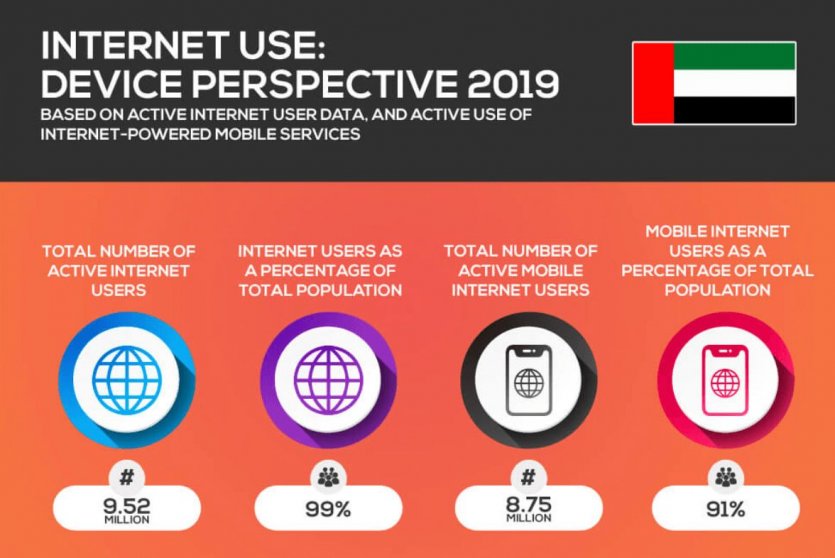

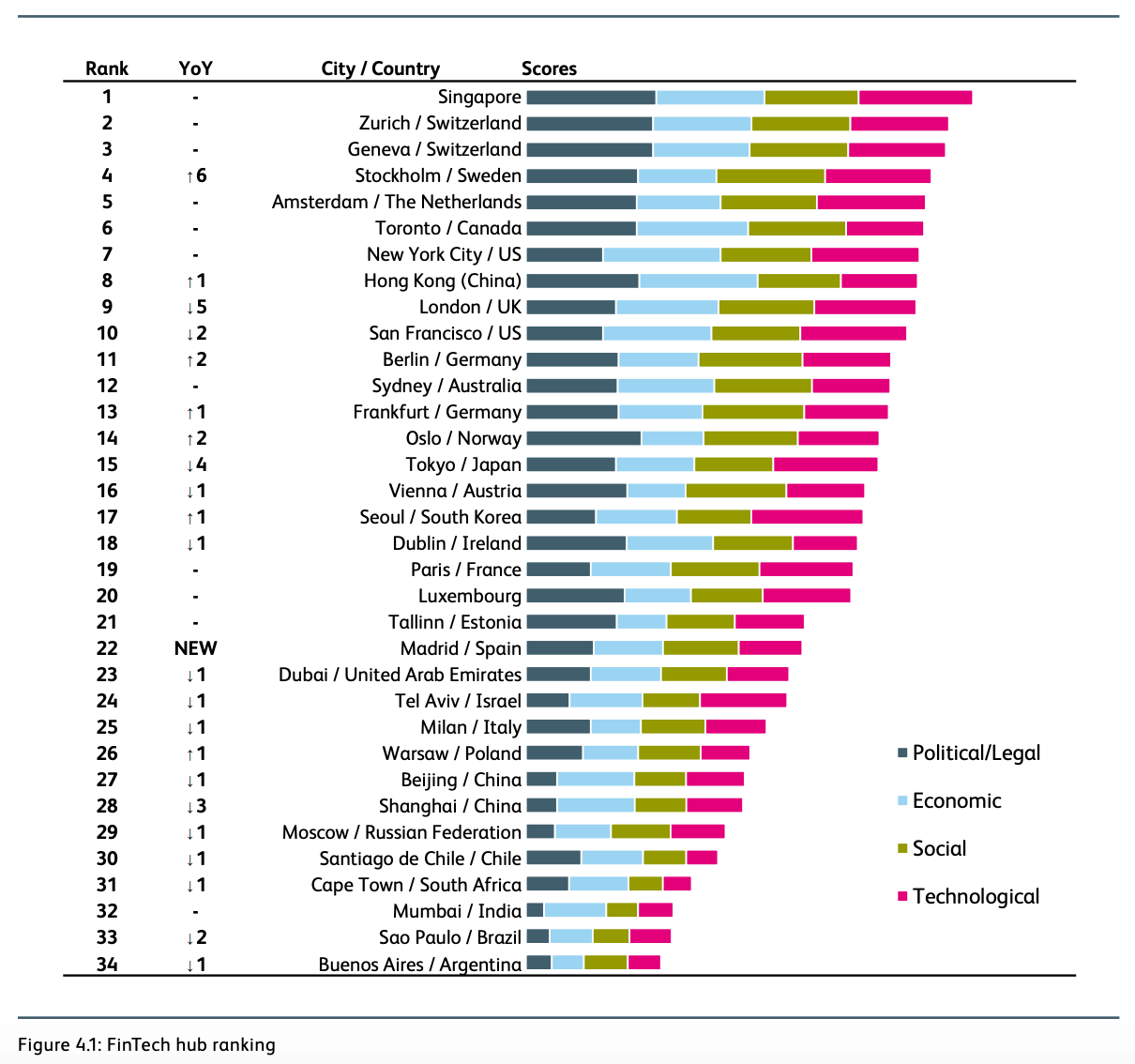

As the region’s largest FinTech hub, the UAE is attracting a wide range of groundbreaking banking software. The supply is met by UAE’s banks that are redeveloping their products and services to adapt to changing consumer expectations, rising competition, and new regulations.

Some companies with banking software in the Emirates have already expanded their digital capabilities with user-friendly, accessible, and convenient solutions. Banking software in UAE helped Emirates NBD to launch Liv, and Mashreq Bank to roll out Mashreq Neo, digital-only banks like Revolut. Abu Dhabi Islamic Bank partnered with Fidor to launch Moneysmart, the first community based digital bank in the Middle East.

These modern banking products aim to attract the growing digitally-native millennial generation while preserving the principles of Islamic Banking, which emphasizes the moral and ethical value in all dealings. But it isn’t just about the millennials. 99% of the UAE’s adult population use mobile devices, which makes mobile banking one of the best channels for attracting and retaining consumers.

Banks running on modern core banking software in UAE not only attract more customers for their added convenience and better functionality but also result in considerable cost savings. Through digital transformation, banking software in the Emirates can provide banks with better security using automatic fraud prevention checks and strong authentication methods.

In fact, within the next five years, almost 90% of UAE banks plan to have fingerprint scanning, and nearly 70% intend to implement face recognition. Developing these technologies from scratch requires a talented and dedicated team of software developers and a significant amount of time and resources. For this reason, most banks use external solutions from banking software companies in Dubai and UAE.

Switzerland banking software

Switzerland has a reputation for providing trustworthy, reliable, and innovative financial services. As one of the key drivers of Switzerland’s economy, the Swiss banking industry continues to face wide-ranging and well-known challenges. Rapidly evolving customer expectations and emerging digital-only bank competitors are changing the industry.

Leveraging robust but inflexible legacy banking software in Switzerland that worked well before no longer provides the same level and diversity of services for Swiss banks. Local and foreign fintechs are challenging the status quo.

In March 2020, Swiss authorities issued the first Swiss fintech banking license to a digital banking startup Yapeal. More licenses are set to follow as Switzerland’s fintech industry matures further and attracts new firms with great political stability and legal landscape.

Revolut’s client base in Switzerland, on the other hand, has surgedby over a third to 250 thousand customers in 2019. Digital challengers rely on modern banking software to provide better service to Swiss customers, more conveniently. Find out how digital banks like Revolut are created in our article here.

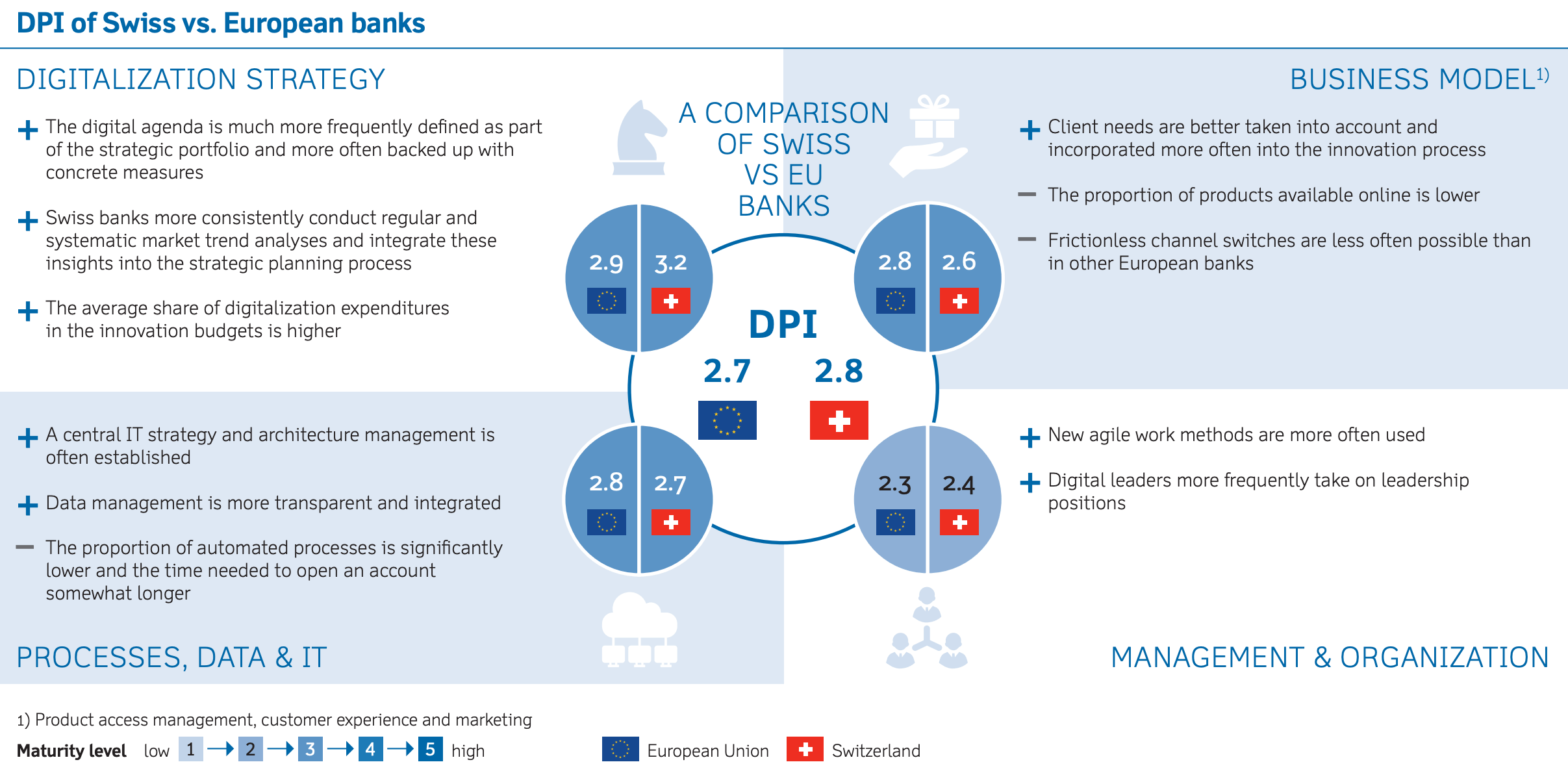

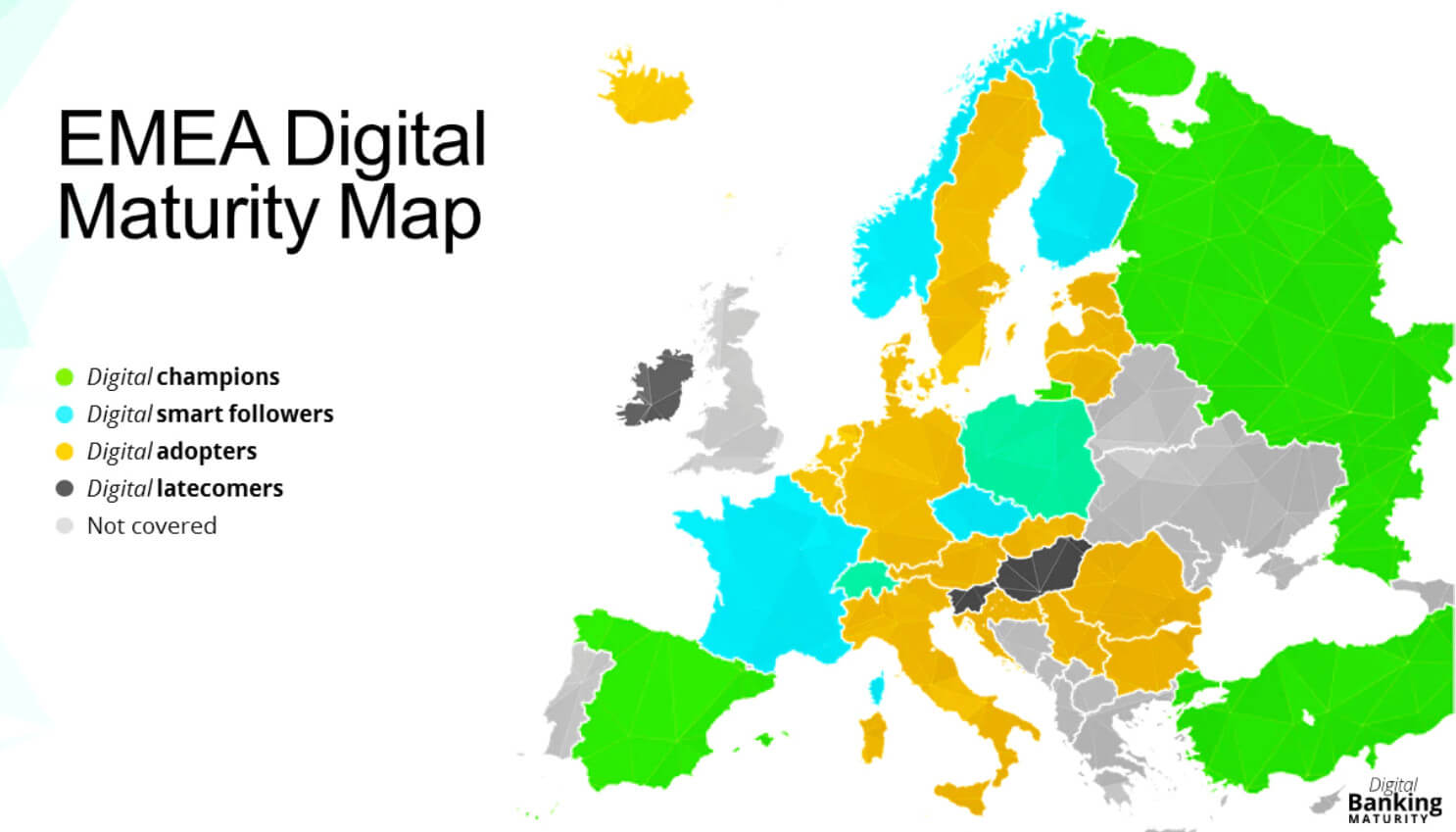

Even though Swiss banks have been successful in establishing modern digital strategies, the number of online banking products remains lower than the EU average. According to a Swiss Finance Institute report, incumbent banks are well-positioned in terms of knowledge but are lagging behind the rest of Europe in terms of implementing those insights into their banking software in Switzerland.

Comparison of digital performance of Swiss banks and the EU average. Source: Swiss Finance Institute

To keep up with the competition, KPMG outlines that Swiss banks should upgrade their legacy banking software, purchase or establish a digital bank. Collaboration between incumbents and specialized fintechs can address digitalization pressures and lead the way to the future of banking.

United Kingdom banking software

Although the impact of Brexit remains unclear, the UK’s financial sector will remain one of the most significant contributors to the UK economy. With over 1.1 million people working in the financial services, the sector generates £200 billion in revenues and £125 billion in GVA annually.

The UK financial services sector has consistently been the top country for foreign direct investment for the last twenty years. By promoting innovation in financial software, products, and services, the UK attracted the next generation of fintech leaders. The UK was the first nation to create a regulatory fintech sandbox in 2015, and the investment is paying off.

The number of digital-only bank accounts, relying on innovative banking software in the UK, has soared in the last five years. According to some estimates, almost one in four Brits has a digital-only account, and the adoption rate is expected to climb further.

Digital-only bank adoption in the UK is expected to increase.

Source: Finder.com

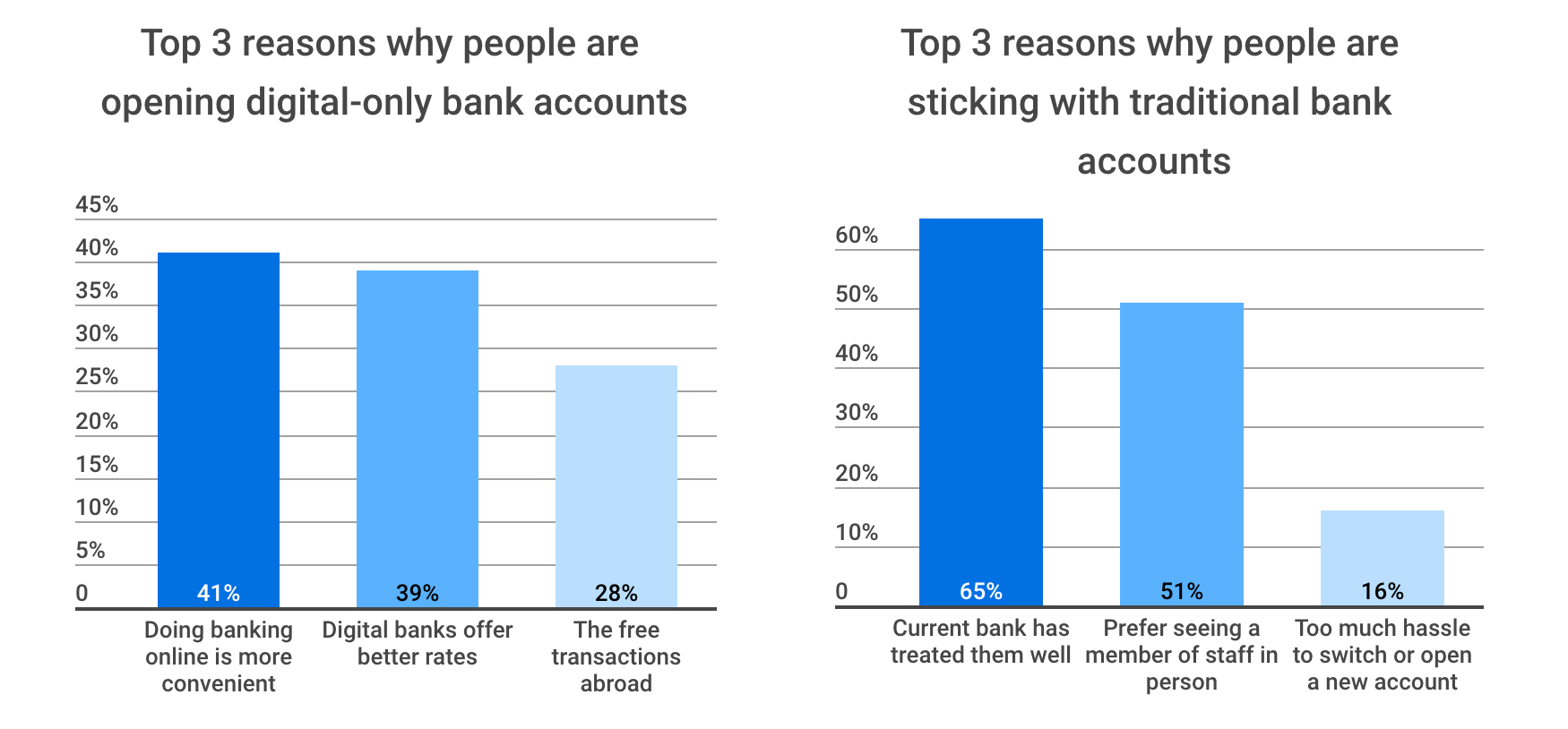

Over 40% of people switch to digital-only banks because they are more convenient than incumbents. Outdated banking software in the UK that traditional banks rely on is not only less functional but costlier as well. Compared with incumbents’ £170 cost per account, it costs neobanks far less (£20-£50) to serve their customers.

The functional and cost advantages of financial software used by neobanks let them offer better rates and cheaper transactions. Revolut, for example, offers free currency exchange at market rates. Read more about how to build a digital bank like Revolut in our previous article.

Why UK customers are switching and sticking to their bank. Source: Finder.com

With fintechs and neobanks putting significant competitive pressure on the UK’s financial sector, incumbent banks need to adapt or risk losing even more market share. Goldman Sachs has already rolled out their digital bank arcus that has attracted 300 thousand users since 2018. In response, industry giant JP Morgan is set to launch a UK digital bank in an attempt to acquire a share of the increasingly competitive market.

As entrants with stronger digital competencies continue to establish their brands in the UK, incumbents could be set for a shake-up as customer preferences evolve, and competition increases. Collaboration between incumbents and specialized fintechs can address these digitalization pressures and lead the way to the future of banking.

Luxembourg banking software

The Luxembourg internationalized banking sector offers an unparalleled range of services and world-class financial infrastructure. As a global financial hub, Luxembourg has remained resilient and competitive, even in an increasingly complex regulatory environment.

But with new compliance challenges stemming from PSD2, Luxembourg’s banks need to reflect on their banking software, business strategy, and how they will operate in a world of open banking. A combination of changing consumer preferences and competition from fintech startups creates market pressure on Luxembourg banks to develop their digital capabilities.

SDK.finance software solution

Global banking software providers like SDK.finance can help banks reach a broader market with modern solutions faster, cheaper, and more efficiently. We offer a comprehensive platform that serves as a foundation for building various financial applications, including e-wallets, neobanks, payment acceptance platforms and money transfer services.

The SDK.finance platform is designed to be flexible and customizable, allowing businesses to tailor it to their specific needs. It provides a set of core modules and APIs that enable developers to create and integrate different financial services seamlessly.

Advantages of software that is built on API-first architecture:

- The speed of releasing new features and functionality is much faster

- The cost of ownership is more economical

- Fewer bugs and more stable products exist

- Better flexibility, scalability, and features are just some of the advantages of the SDK.finance banking software.

SDK.finance provides technology and supports banks of all kinds at every stage of the digital transformation from market research to product launch and scaling. Banking customers can benefit from a modern and secure experience guaranteed by two-factor authentication, biometric checks, security notifications, and Strong Customer Authorization for payments. As a result, the payment software helps to simplify the development process for financial applications, allowing businesses to focus on their core offerings rather than building complex financial infrastructure from scratch.