High performance core for payments businesses

API-first approach (400+ REST APIs)

Databases 100% under your control

Isolated cloud infrastructure

Security by design

Flexible CI/CD

PCI DSS compliance (soon)

Tech stack and APIs

Backend

- System core: Java 17

- Frameworks: Spring, Spring Boot, Hibernate ORM

Databases

- Operational DB: PostgreSQL

- Transaction viewer DB: MongoDB

API layer

- 400+ Open API endpoints

- API architecture: REST, gRPC

- Documentation: Swagger

Front-end

- Technologies: VUE.JS, TypeScript

- Version control and CI/CD: GitLab

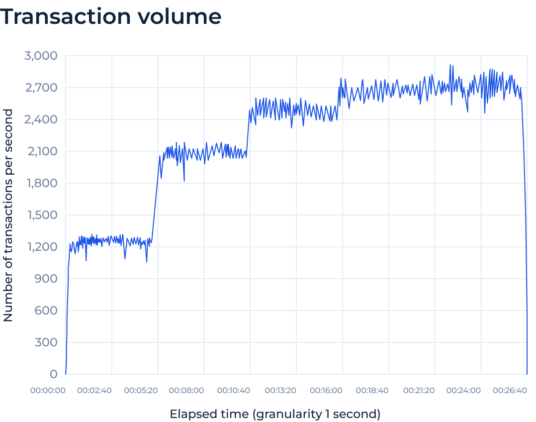

2,700 TPS* workload capacity

SDK.finance transaction processing capacity starts at 2,700 TPS* (business transactions per second) on a basic configuration, which translates to over 230 million daily business transactions to sustain your growth without a hiccup.

See performance testing details

*Internal transactions within the system.

Infrastructure and deployment

SDK.finance Platform is deployment agnostic and can operate effectively regardless of the underlying hardware or cloud infrastructure.

Cloud-based

Available on AWS, Azure, and GCP, allowing for global deployment that adheres to regional compliance and data sovereignty requirements.

On-premises

Deployed in private data centers to cater for specific control, security, or regulatory compliance needs.

Containerized and virtualized

Uses Kubernetes to ensure consistency and reliability across different environments.

Hardware requirements

Here are the minimum requirements of the instance for both Production and Test environments to run the system and ensure its stable performance.

Front end

CPU – 1

RAM – 2 GB

SSD – 40 GB

OS: Ubuntu 22.04 LTS

Software: NGINX 1.18.0

Application server

CPU – 4

RAM – 8 GB

SSD – 160 GB

OS: Ubuntu 22.04 LTS

Software: openJDK 17

Postgres DB

CPU – 4

RAM – 16 GB

SSD – 160 GB

OS: Ubuntu 22.04 LTS

DB: PostgreSQL – 14.4

Transaction Viewer DB

CPU – 2

RAM – 4 GB

SSD – 80 GB

OS: Ubuntu 22.04 LTS

DB: MongoDB – 6.02

Security

We’ve implemented a comprehensive, multi-layered security approach that protects financial information from unauthorized access, cyber threats, and human error.

System architecture security

- ISO 27001 compliance

- TLS encryption and hashing algorithms (SHA-256/512)

- Network & intrusion protection:

- IP filtering

- firewalls

- IDS and WAF

Code quality & security testing

- SonarQube

- OWASP

- unit/integration tests

- static code analysis

Client & staff access

- Multi-factor authentication:

- 2FA and OAuth for both user and staff logins.

- Back-office access controls:

- OTP, HMAC, and role-based access control (RBAC).