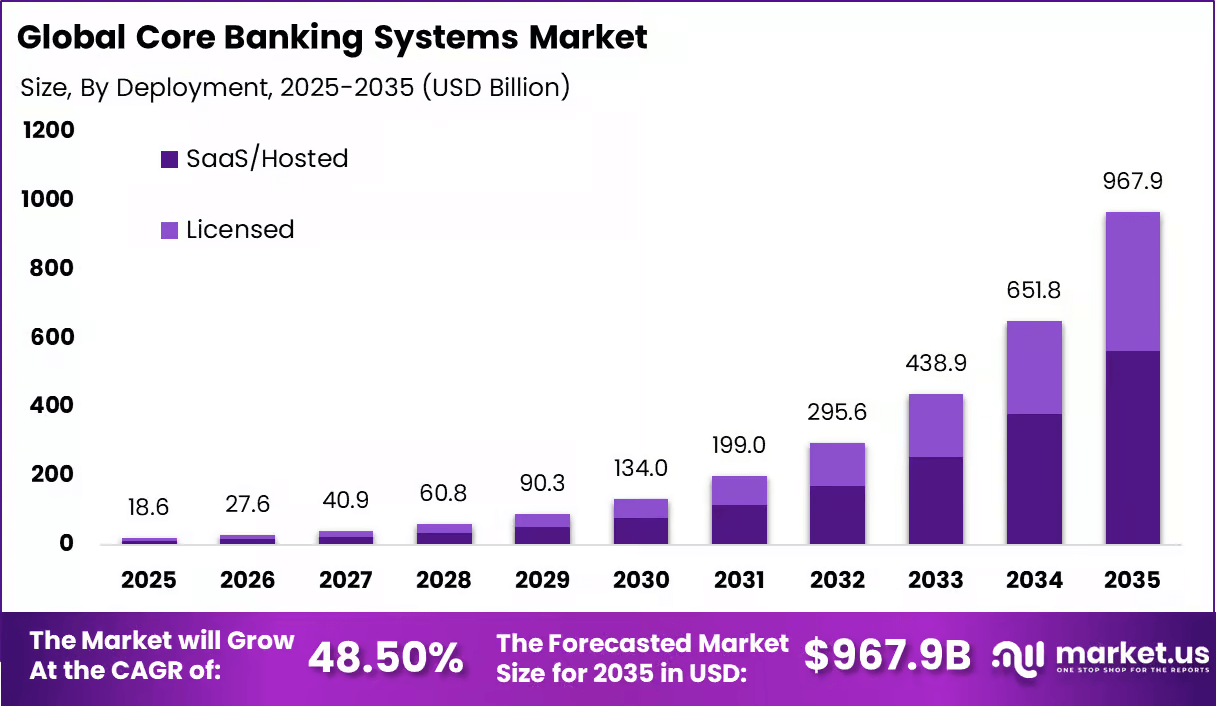

Every year, a small number of global market studies set the benchmark for how banking technology is evaluated by banks, regulators, investors, and large financial institutions. One of the most established among them is the Core Banking Systems Market report published by Market.us. The research is known for its structured methodology, broad regional coverage, and focus on platforms that operate in real production environments.

In the 2026 edition of the report, SDK.finance was recognised as a top core banking provider. This recognition reflects the Platform’s maturity, long-term reliability, and relevance for institutions building or modernising banking infrastructure today.

We are proud to see SDK.finance recognised again in independent market research. For our team, this is a confirmation that years of consistent engineering, real-world deployments, and close work with regulated institutions translate into tangible market validation.

The report highlights a group of established global core banking providers shaping the current market landscape. Alongside SDK.finance, the study references vendors such as EdgeVerve Systems Limited, Temenos Headquarters SA, Oracle Corporation, Fidelity National Information Services, Fiserv, Inc., Finastra International Limited, Mambu GmbH, 10x Banking Technology Limited, Backbase, nCino, Alkami Technology, Jack Henry & Associates, Securepaymentz, and Sopra Banking Software.

This positioning places SDK.finance among globally recognised core banking systems used by banks and financial institutions across different regions, regulatory models, and operating scales.

Key Market Highlights From the 2026 Core Banking Report

The Market.us overview makes it clear that core banking systems are no longer viewed as static back-office software. Instead, they have become the central layer connecting accounts, payments, cards, settlement, reporting, and increasingly, digital assets.

Key insights from the 2026 report include:

- The market is clearly moving toward cloud and hosted deployments. According to the report, around 58% of core banking systems are already running in SaaS or hosted environments, and this share continues to grow. For many banks, this is driven by operational simplicity and faster change cycles.

-

In real deployments, SaaS is often part of a broader setup, not a full replacement. While roughly 78% of banks use SaaS-based core solutions, this frequently applies to specific layers or environments rather than the entire core. Hybrid approaches remain common.

-

Licensed core banking software continues to play a major role, especially for regulated and operationally complex banks. Control over deployment, data location, upgrade timing, and access to source code remains a decisive factor in many core banking decisions.

-

Digital-only banks follow a different pattern. Nearly 89% of neobanks launch on fully cloud-based core infrastructure, which fits greenfield projects focused on speed and lower initial complexity. This model is far less typical for banks operating at scale.

-

North America remains the largest core banking market, accounting for close to 40% of global spending. The US market alone is valued at USD 6.36 billion, with most demand coming from modernisation of existing institutions rather than new bank launches.

-

Retail banking continues to drive core banking demand, representing about 38.7% of adoption. High transaction volumes, cards, and payment rails place sustained pressure on core performance and reliability.

-

Despite ongoing transformation programs, around 70% of bank technology budgets are still spent on maintaining legacy systems. This is a key reason why many institutions prefer modular, licensed core banking platforms that allow gradual modernisation instead of full system replacement.

Why SDK.finance Fits the 2026 Core Banking Market Direction

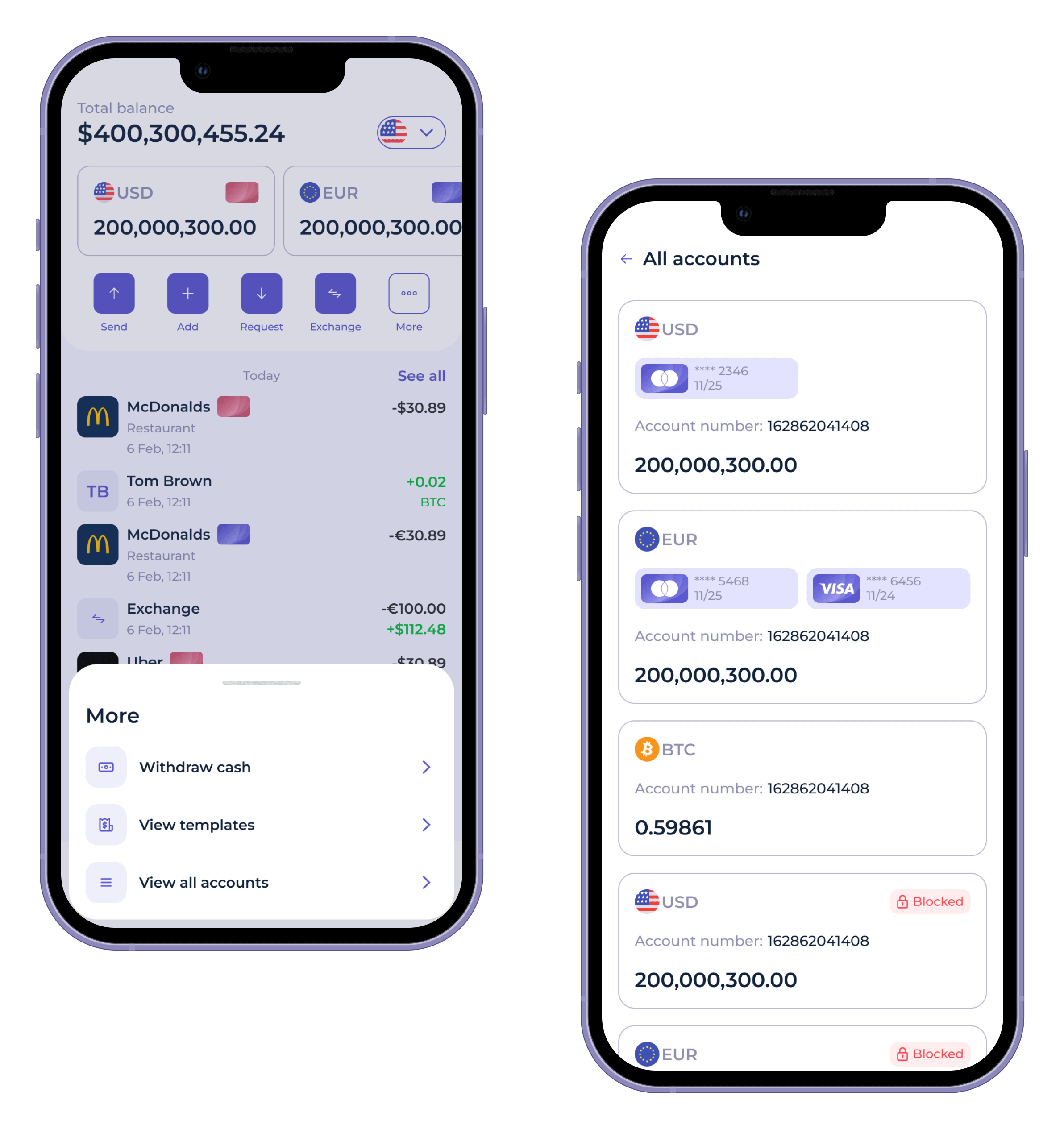

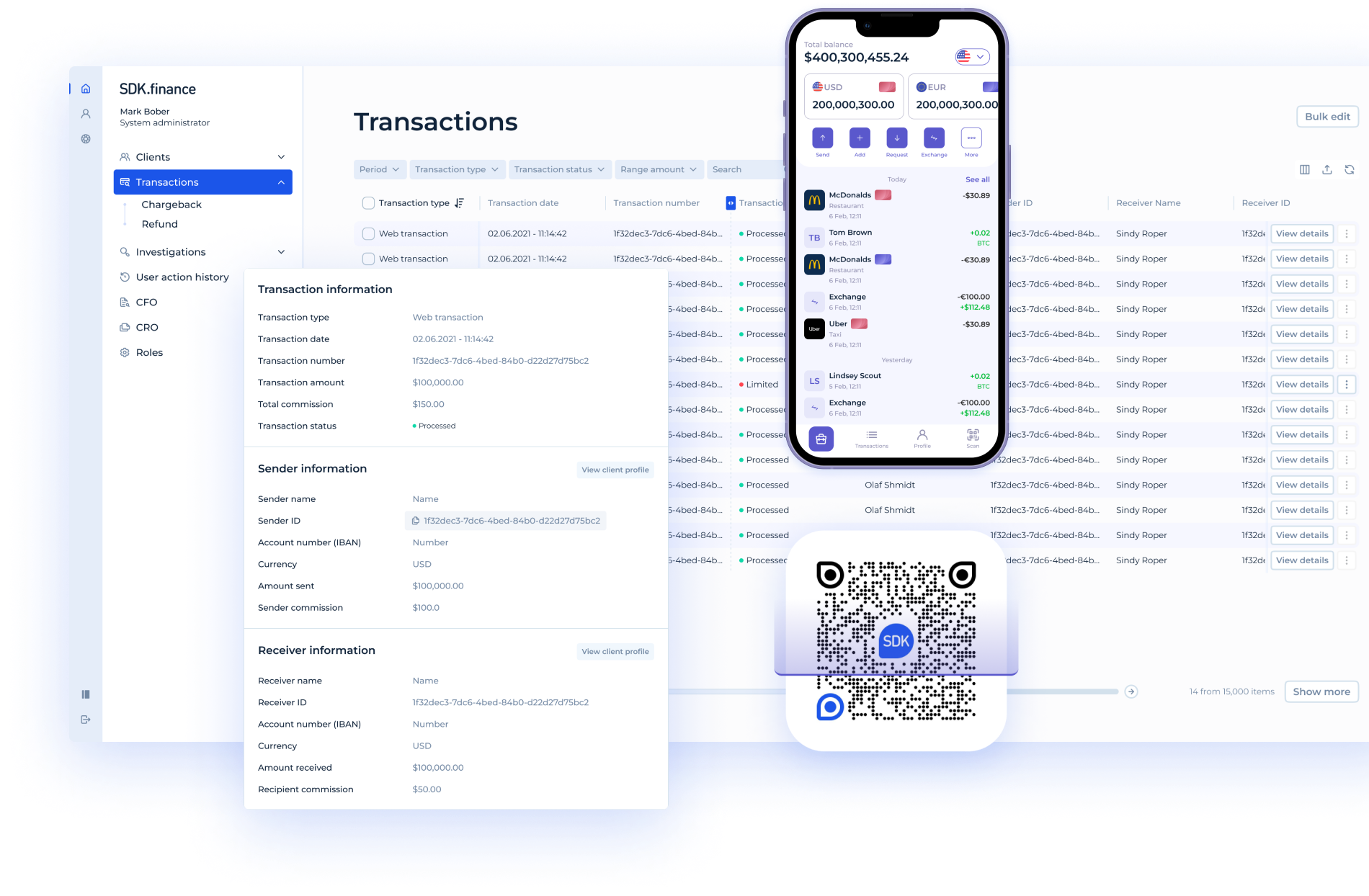

SDK.finance is a white-label core banking system designed to serve as the transactional, accounting, and operational backbone of a modern bank. It is built around a ledger-based engine that enables real-time transaction processing, consistent financial accounting, and operational control across products and regions.

The Platform is used by banks, FinTech companies, PSPs, EMIs, and enterprises launching regulated financial products across the US, Europe, and the MENA region. It supports both greenfield bank launches and the modernisation of existing financial infrastructure.

Core Banking Capabilities of SDK.finance

-

Ledger-based core banking engine supporting real-time transaction processing and accurate financial accounting.

-

More than 570 APIs covering accounts, wallets, payments, cards, onboarding, reporting, and integrations.

-

Multi-currency accounts and wallets, supporting both fiat and crypto assets within a single core.

-

IBAN account infrastructure, enabling local and cross-border bank transfers.

-

Payment rails support, including SEPA, SWIFT, and local transfer schemes, managed through a unified transaction engine.

-

Card issuing capabilities, supporting virtual and physical cards integrated with external card processors and networks.

-

Card transaction processing, including authorisations, settlements, fees, reversals, and reconciliation.

-

Crypto payment and exchange flows, handled within the same ledger and reporting logic as traditional banking transactions.

-

Operational backoffice for finance, compliance, and operations teams.

-

PCI DSS compliance and ISO 27001:2022 certification.

-

SaaS and full source code license delivery models.

-

White-label architecture, allowing institutions to launch under their own brand.

-

15 years on the market, with live deployments across multiple regulatory environments.

Crypto functionality is embedded directly into the core banking logic rather than delivered as a separate layer. This approach allows institutions to extend an existing bank with digital asset operations or to build crypto-focused banking models on the same core platform.

What It Means to Launch a Bank in 2026

One of the strongest messages in the Market.us report is that launching a bank in 2026 requires more than basic account management. A modern bank must support multiple payment rails, issue cards, manage settlement and reconciliation, and increasingly operate across both fiat and digital assets, all while remaining auditable and compliant.

SDK.finance brings these capabilities together within a single core banking platform. Its recognition as a top core banking provider in the 2026 market research reflects a broader industry shift toward platforms that are modular, API-driven, asset-agnostic, and proven in production.

For organisations planning to launch or modernise a bank in 2026, SDK.finance provides a practical core banking foundation that supports real operations from day one, without the need to build core infrastructure from scratch.