Global Payment Processing & Payouts Infrastructure

SDK.finance + Corefy

With SDK.finance you get a robust FinTech platform that seamlessly integrates with Corefy’s payment orchestration technology, enabling you to accept credit card payments and process payouts effortlessly across 200+ countries and 400+ payment providers.

A comprehensive payment ecosystem at your fingertips

SDK.finance offers a modular, API-first FinTech platform, allowing businesses to build, scale, and monetise financial services. With Corefy embedded, our clients gain instant access to:

Global payment acceptance

- Connect with 400+ payment providers and acquirers worldwide

- Accept credit card payments, e-wallets, crypto, and bank transfers

- Enable multi-currency transactions with dynamic conversion

- Offer frictionless checkout experiences for online & mobile payments

Payouts without borders

- Send money with cross-border payouts in 70+ currencies

- Process bank transfers, card withdrawals, and digital wallet payouts

- Optimise transaction routing for faster, cost-efficient disbursements

- Support freelancers, vendors, gig workers, and marketplace sellers seamlessly

Smart transaction routing for maximum efficiency

- Automatically select the best-performing payment provider per transaction

- Reduce costs with optimised payment routing and real-time failover mechanisms

- Improve approval rates with localised acquiring solutions

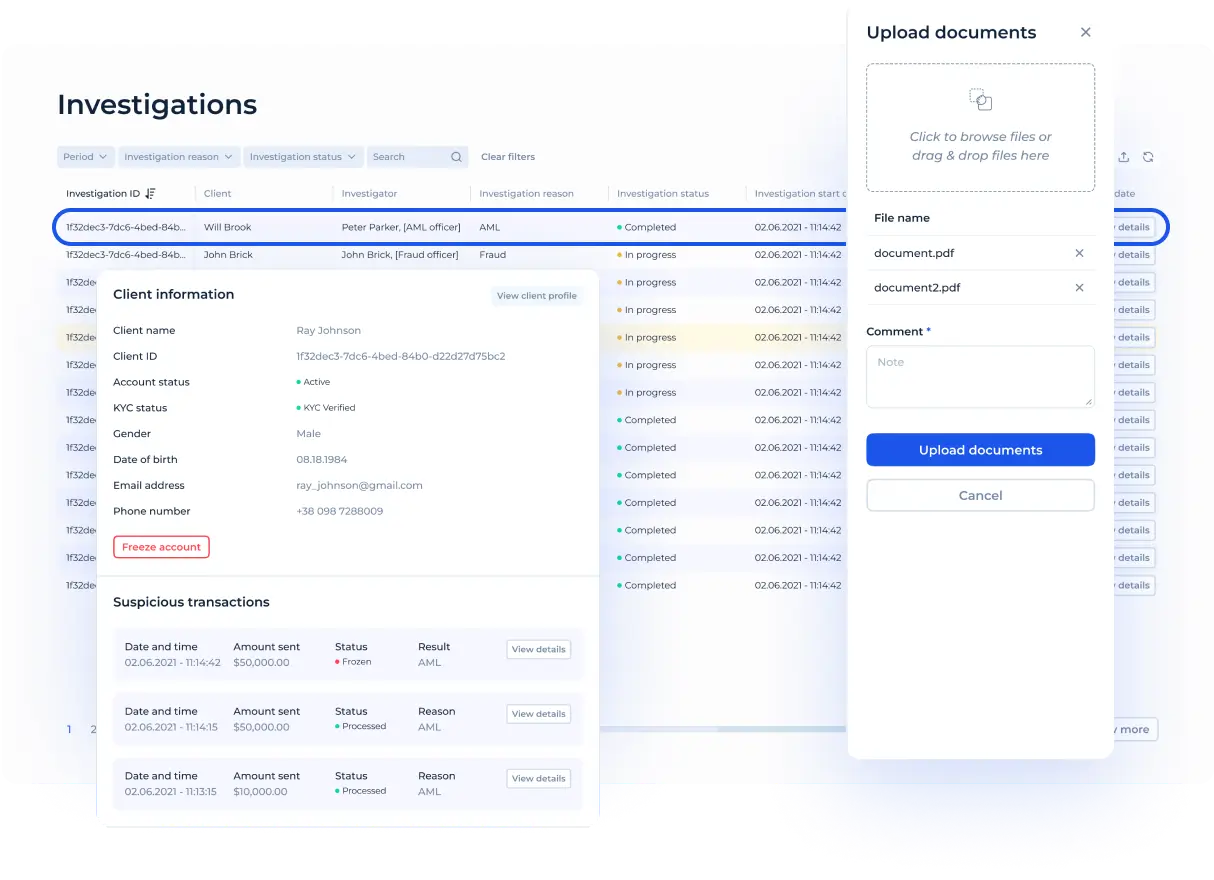

- Minimise risks with built-in fraud detection and compliance tools

Why choose SDK.finance for global payments processing?

Unmatched flexibility & scalability

SDK.finance provides a comprehensive FinTech platform, allowing you to launch and expand your payment services without the complexities of building from scratch. With Corefy’s global payments coverage seamlessly integrated, your business can process transactions at scale with maximum efficiency.

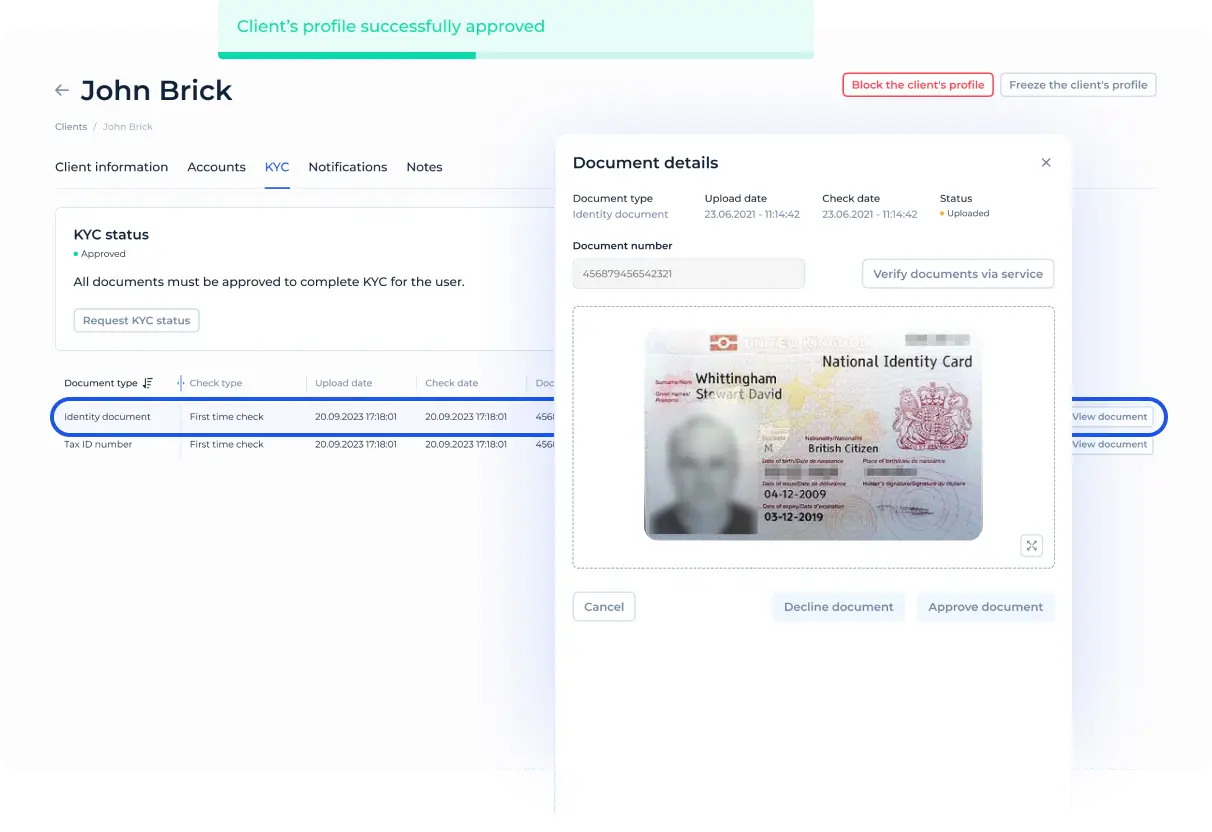

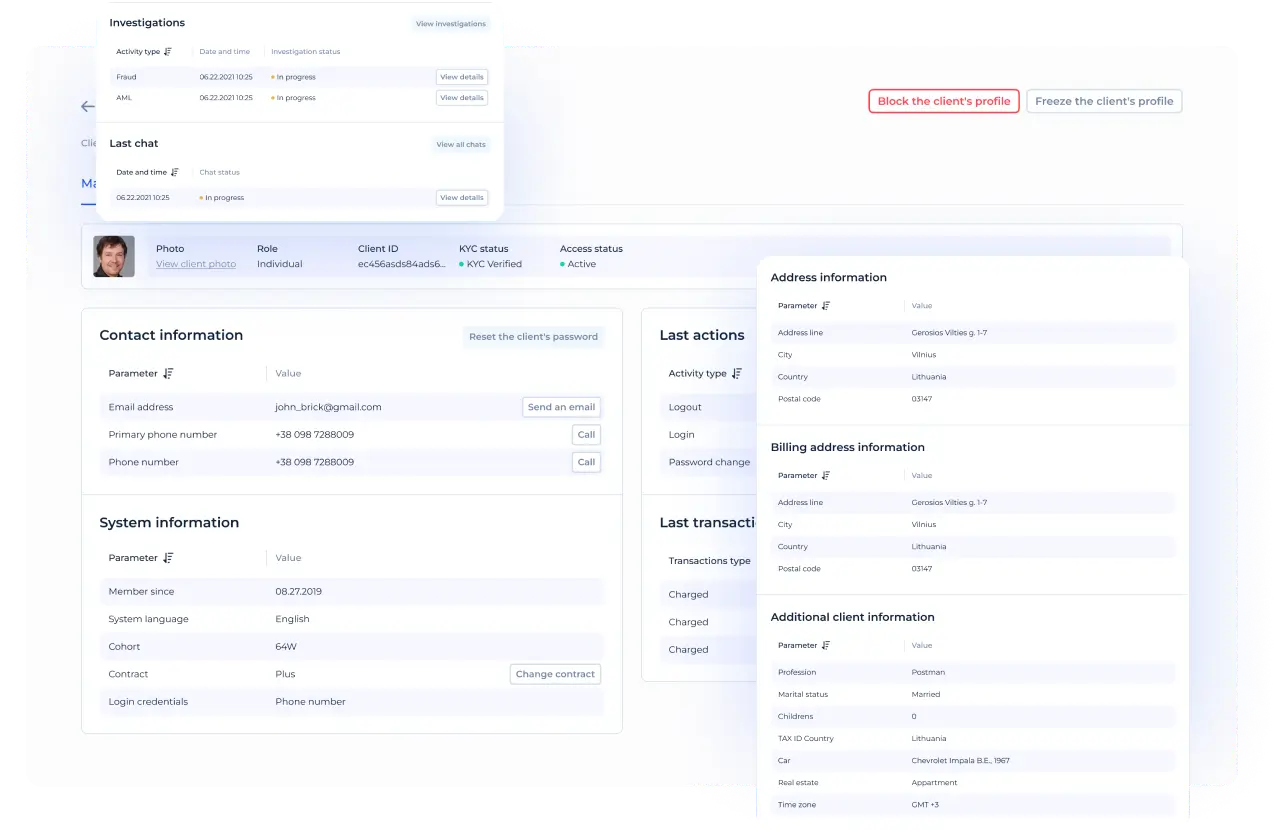

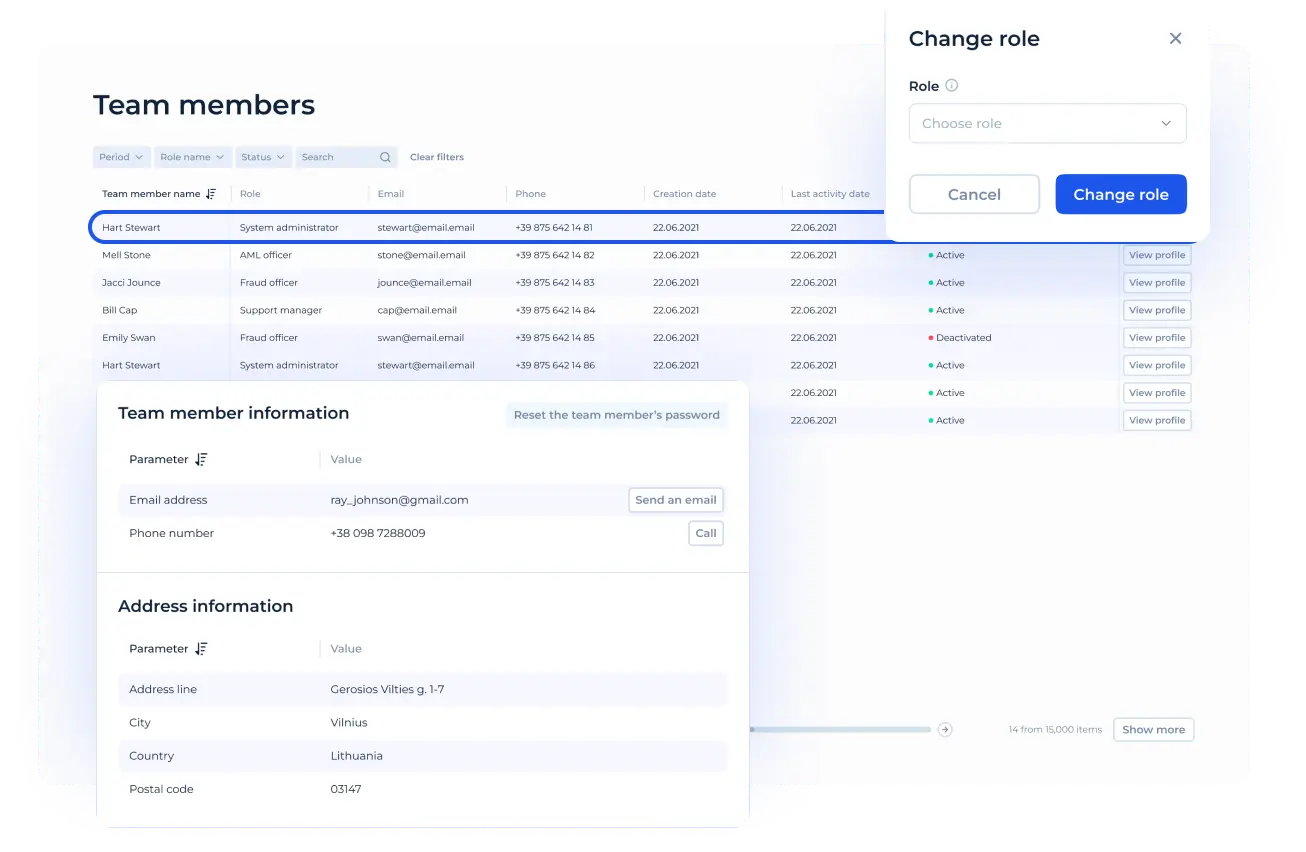

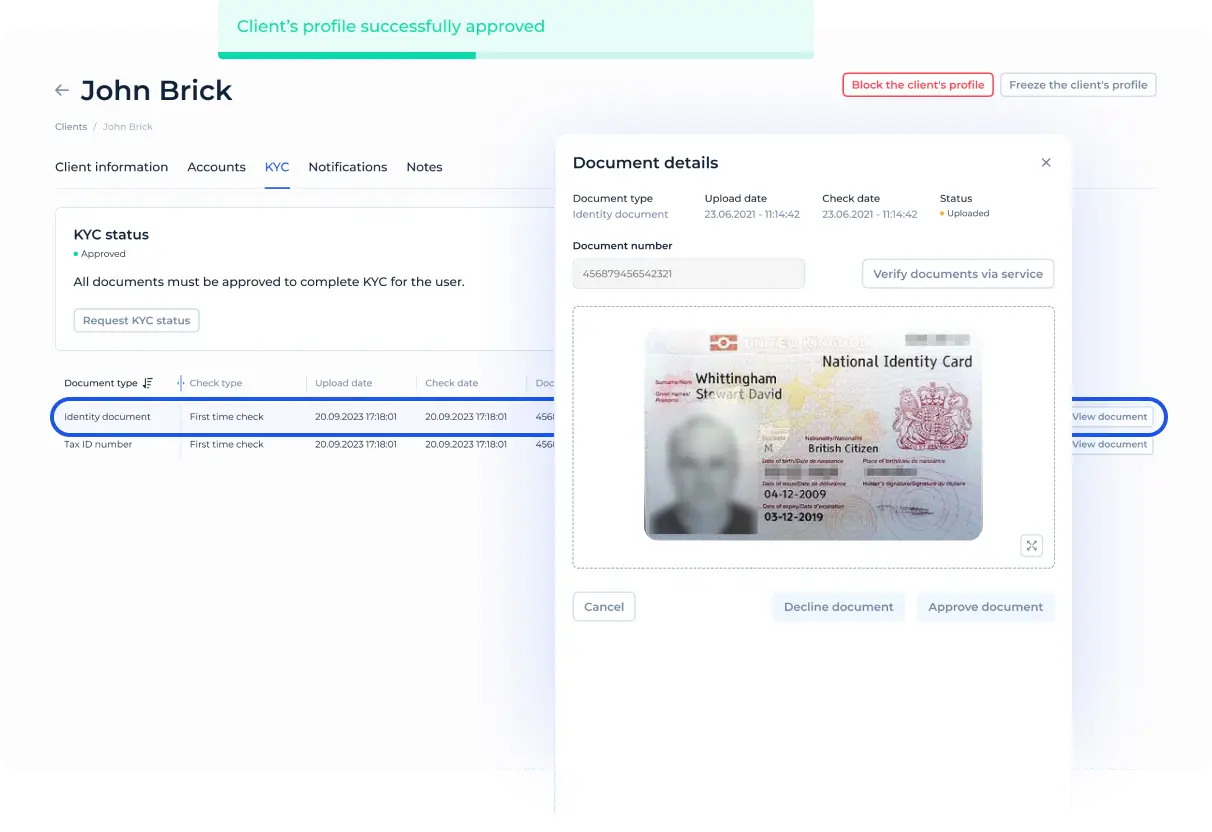

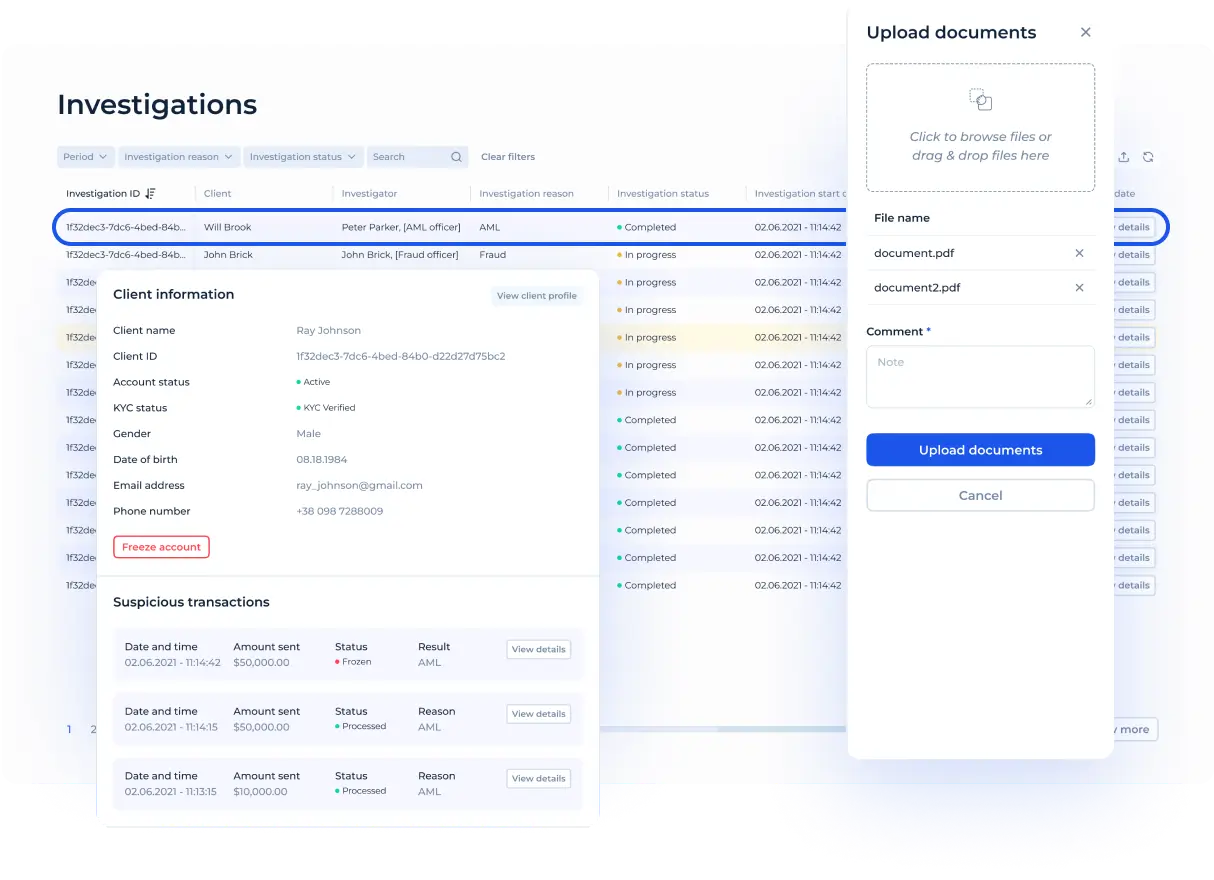

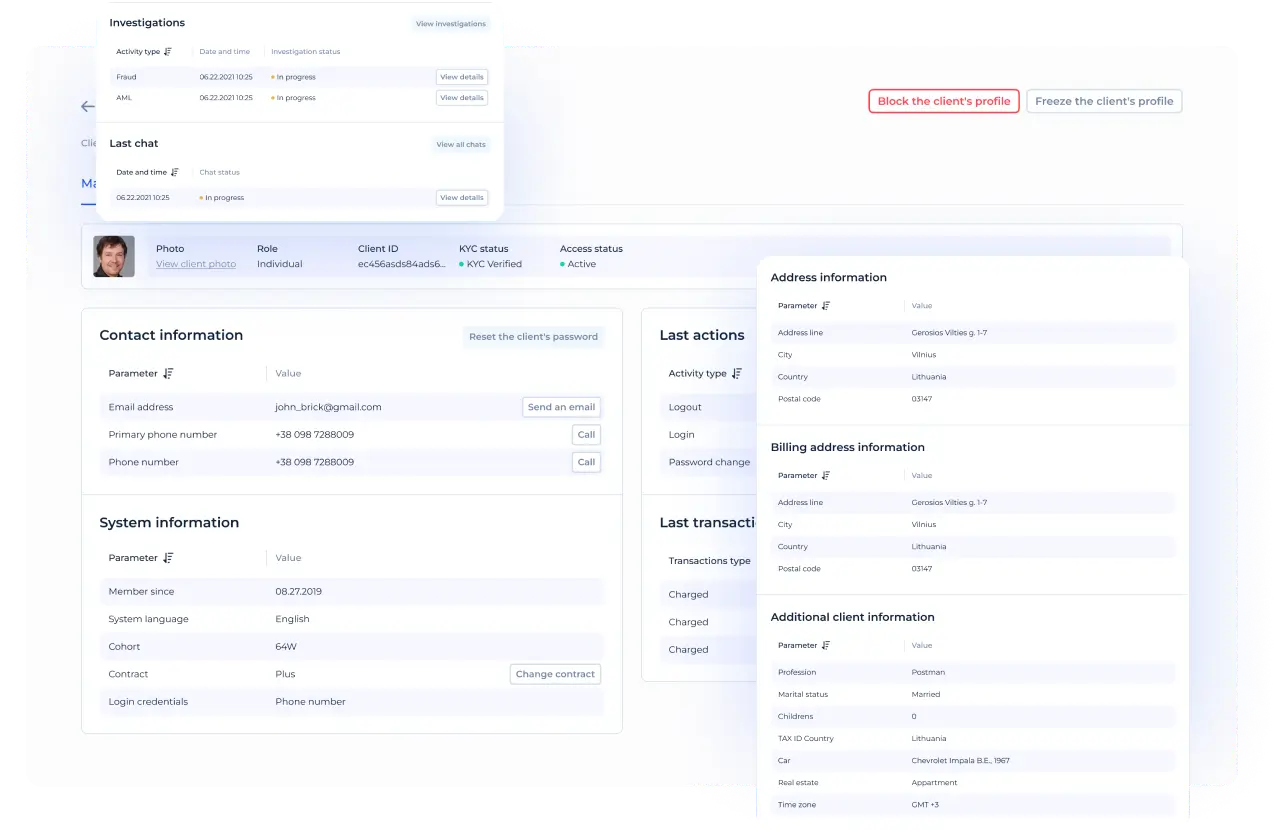

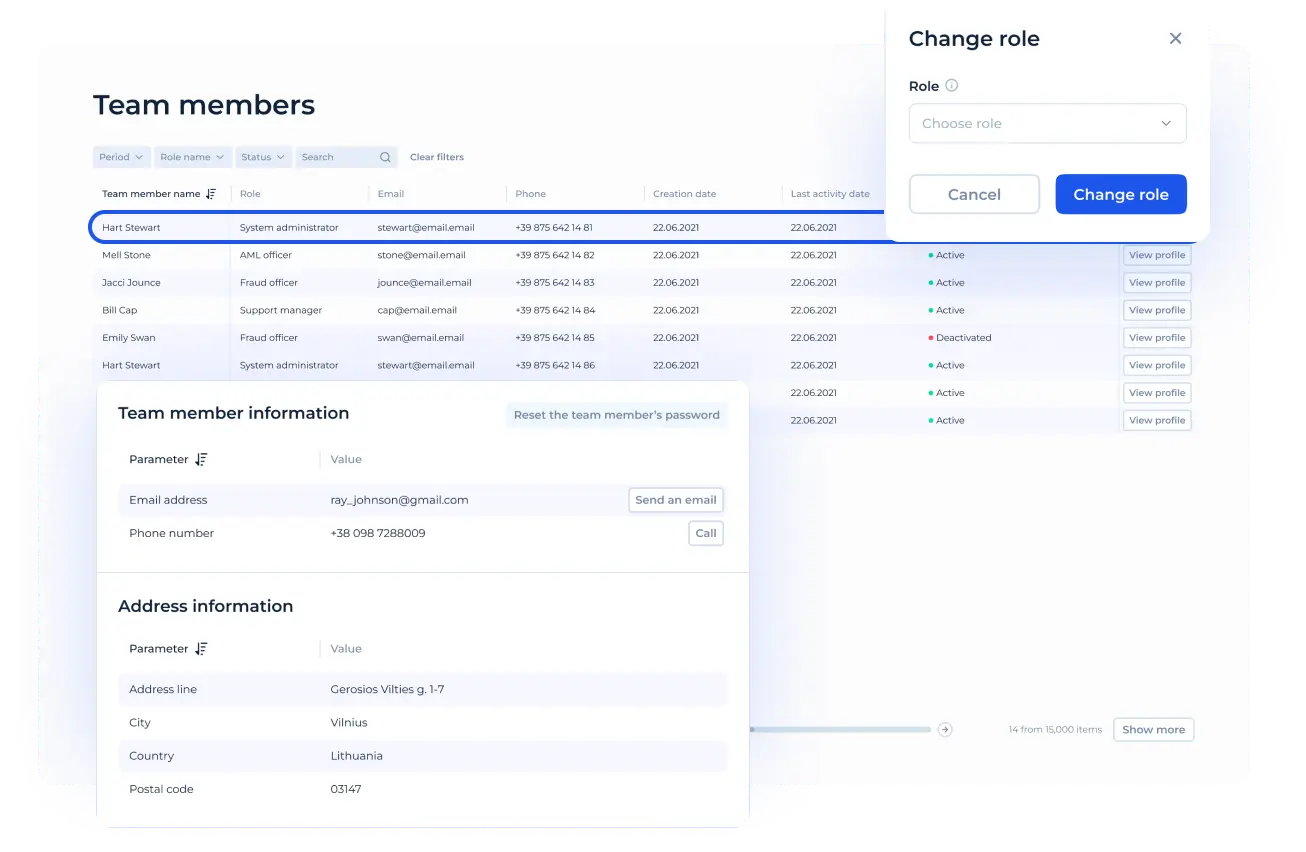

Pre-built KYC/AML & security features

Financial transactions demand the highest level of security. SDK.finance comes with AML, KYC, fraud prevention, and PCI DSS compliance tools, ensuring that all payments meet regulatory and security requirements across different regions.

A single integration for Endless payment possibilities

Instead of managing multiple payment provider contracts, integrations, and compliance requirements, SDK.finance with Corefy allows you to connect once and access 400+ payment options globally (PayPal, Stripe, Skrill and other top providers), reducing operational overhead while maximising coverage.

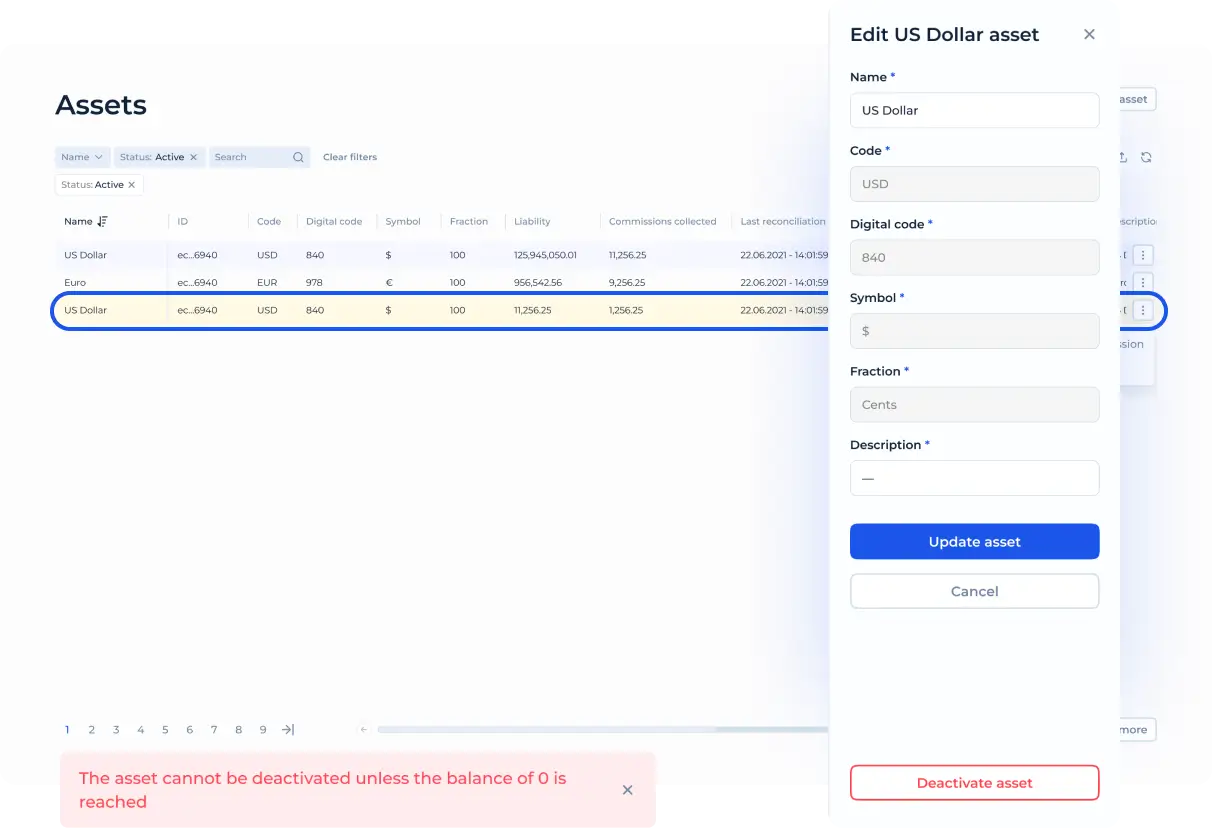

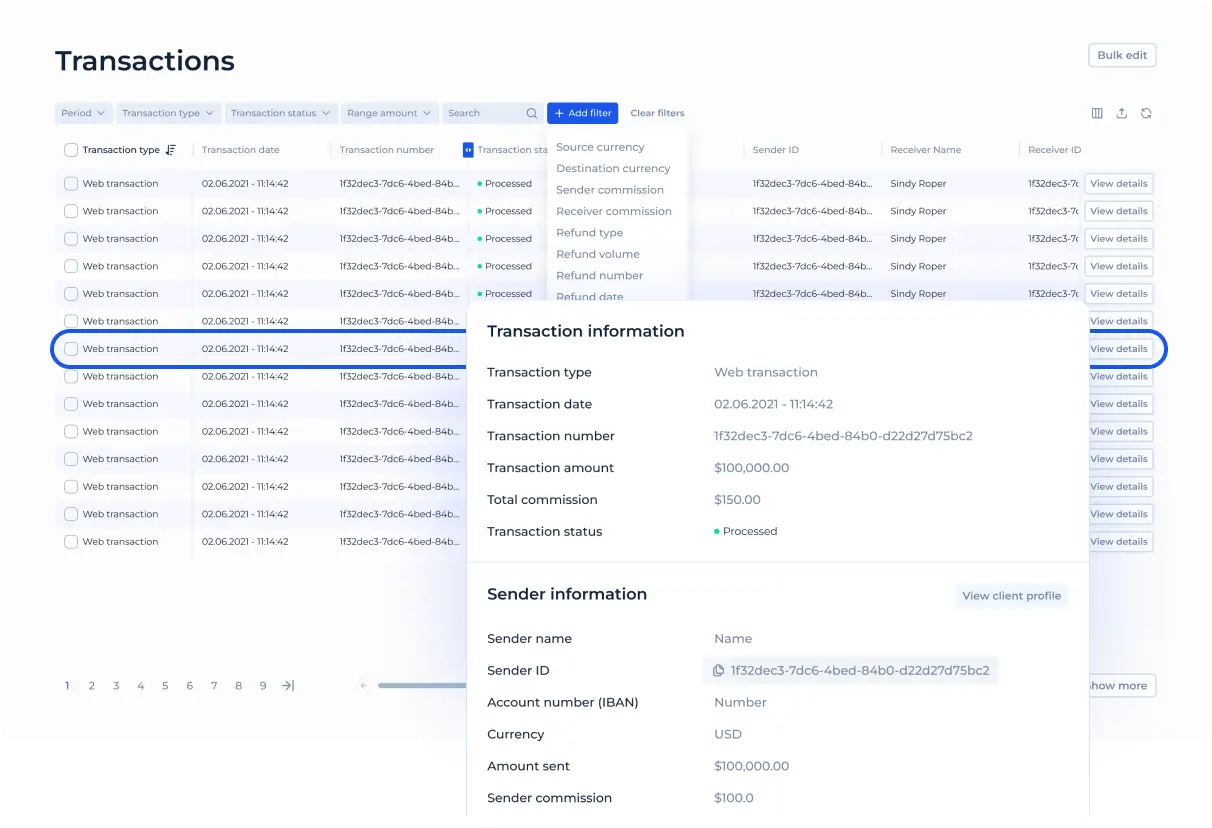

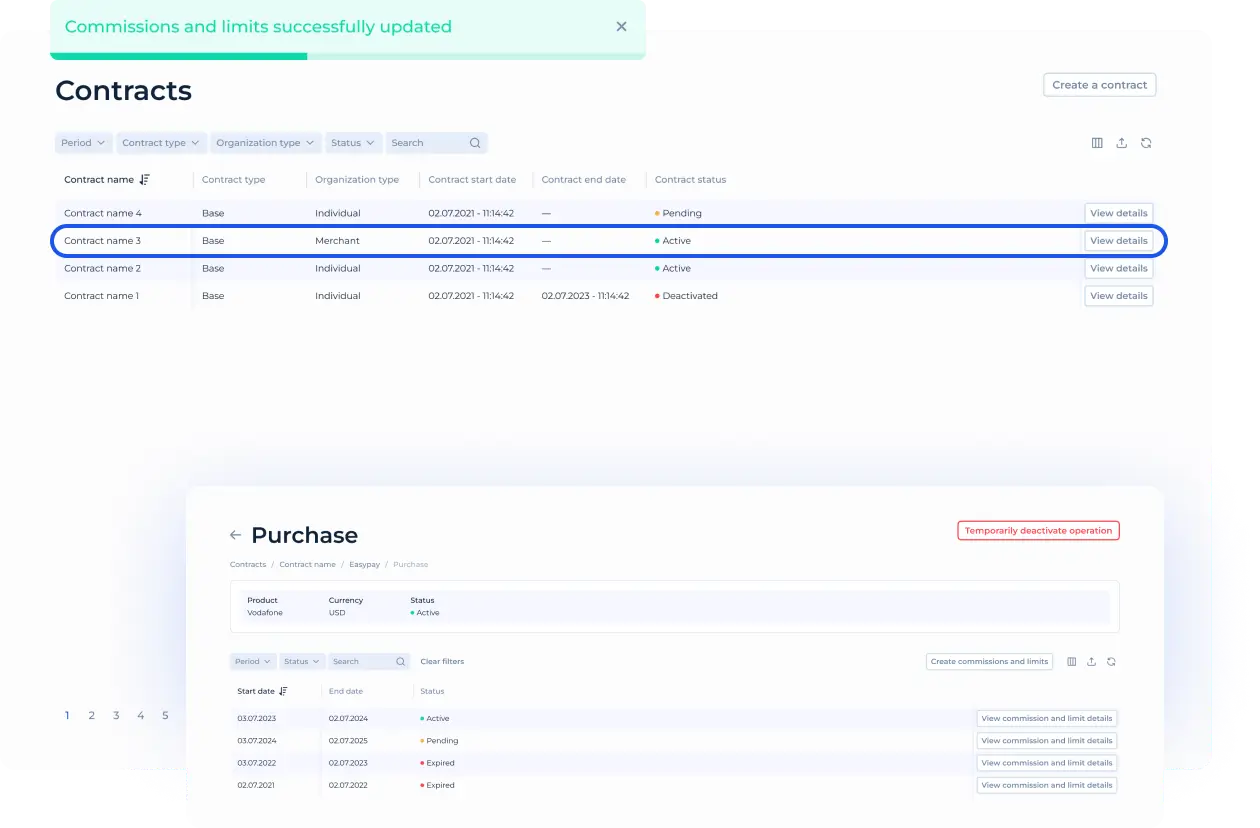

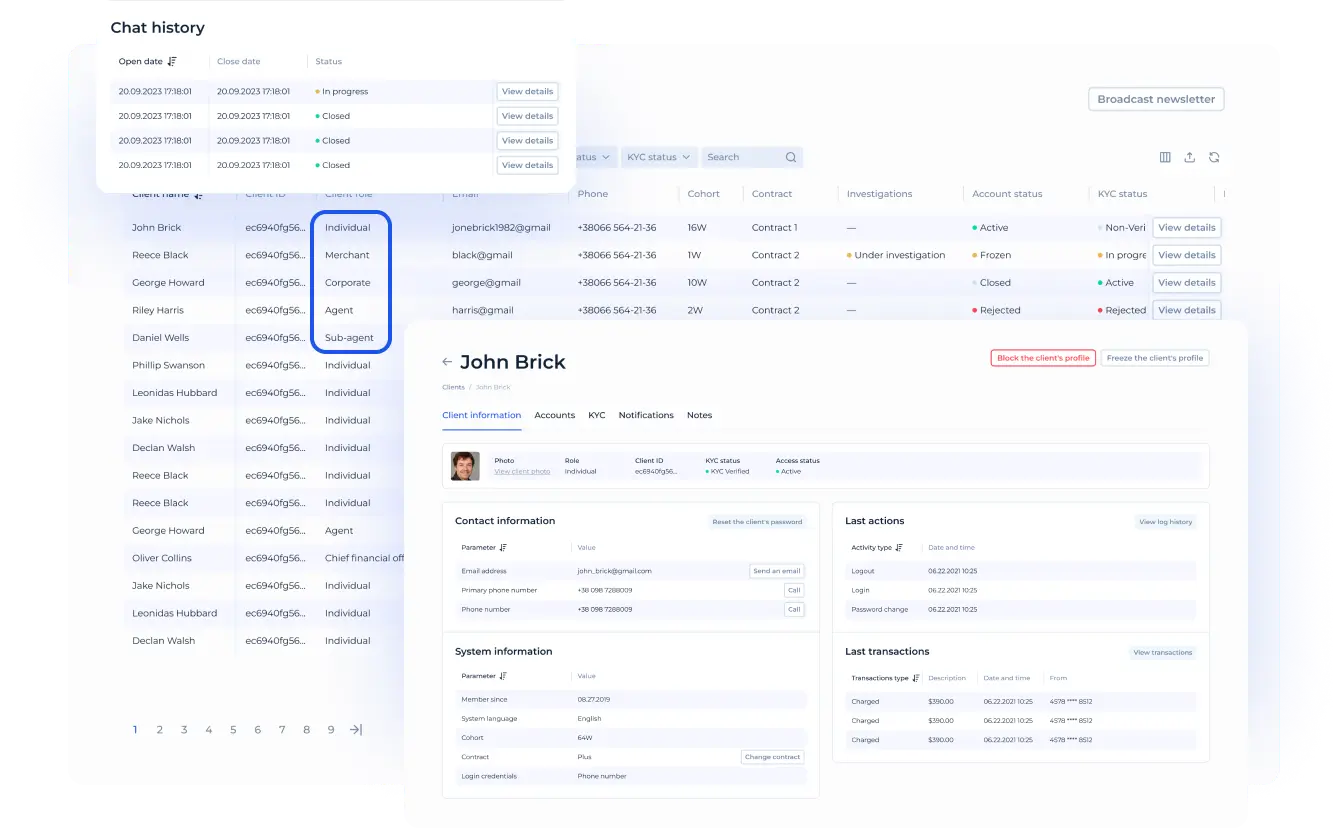

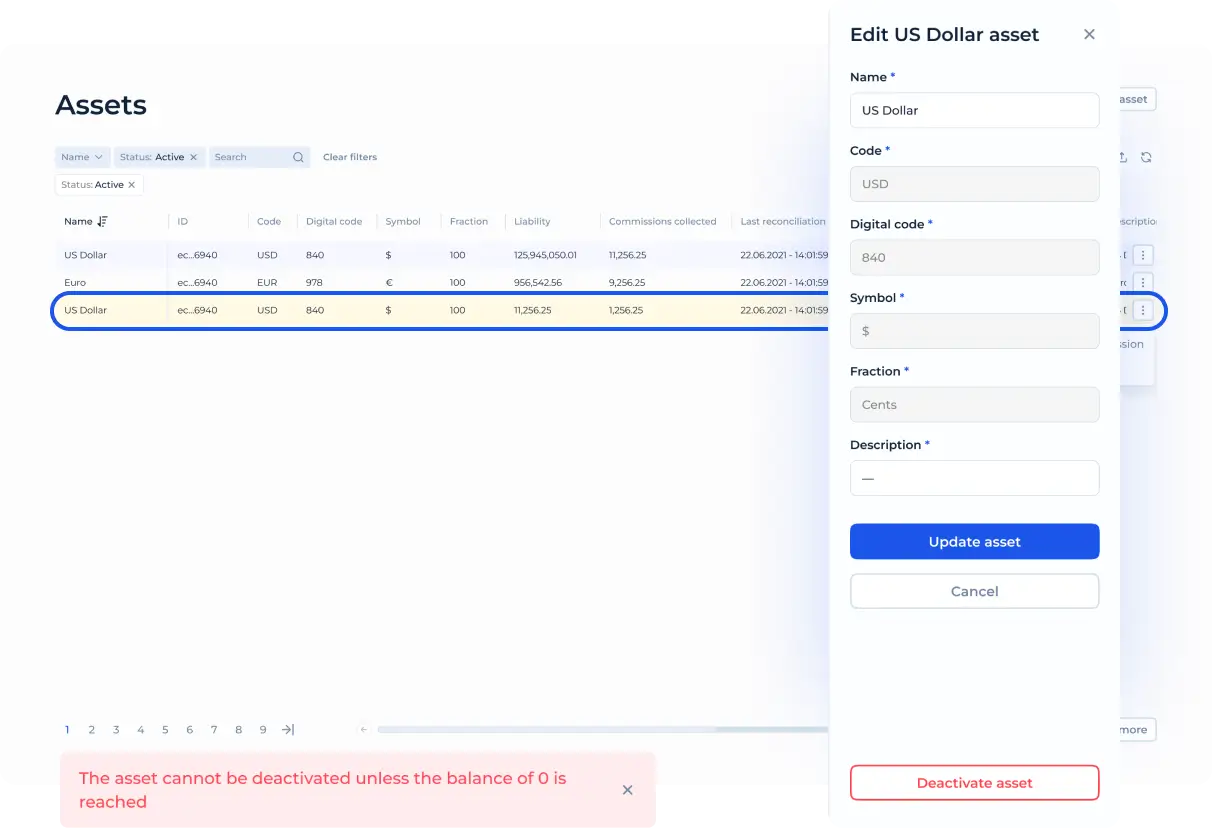

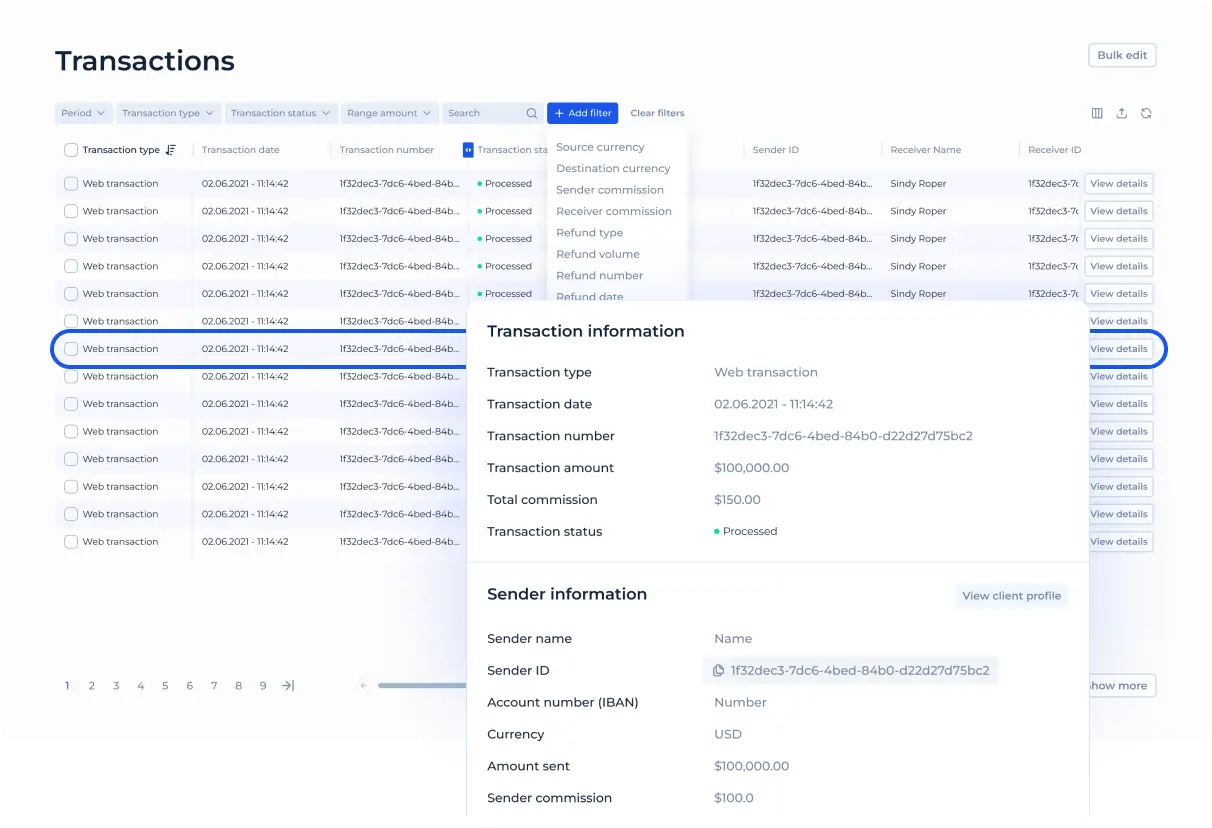

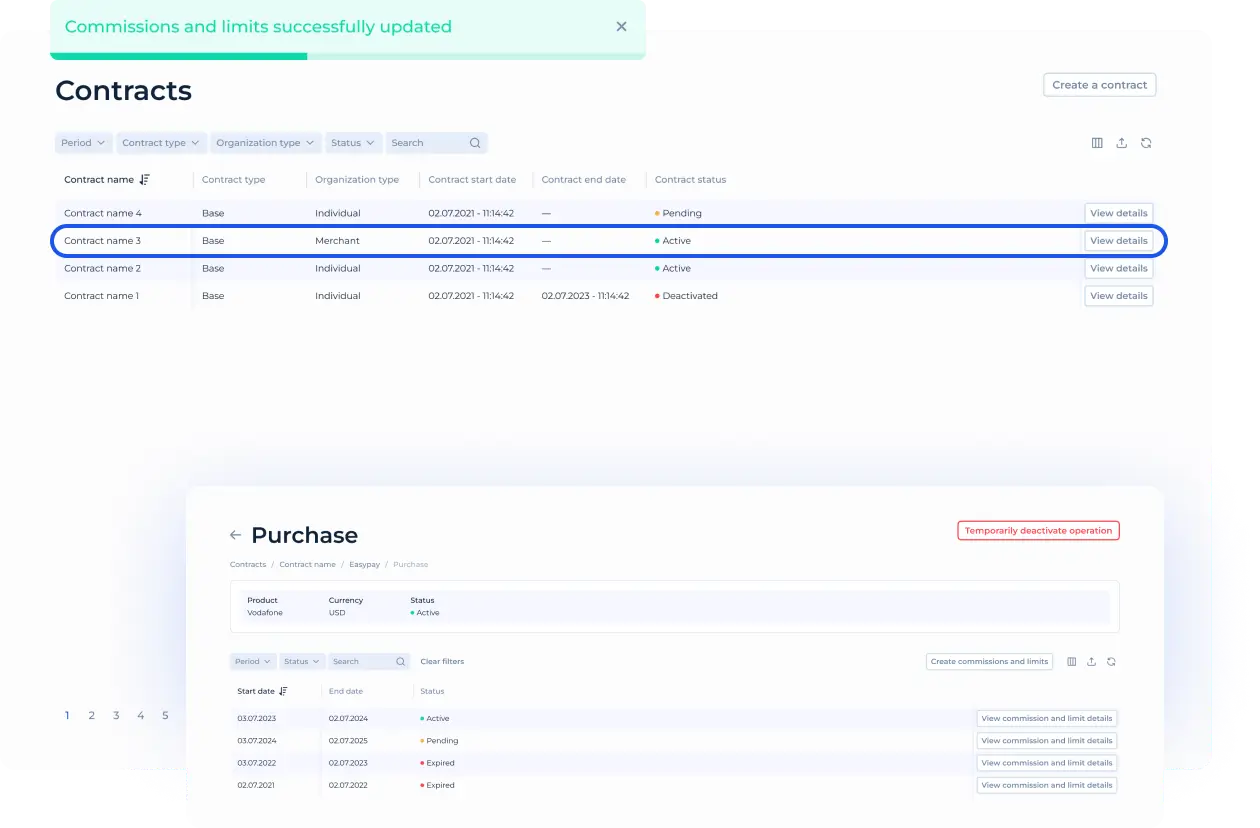

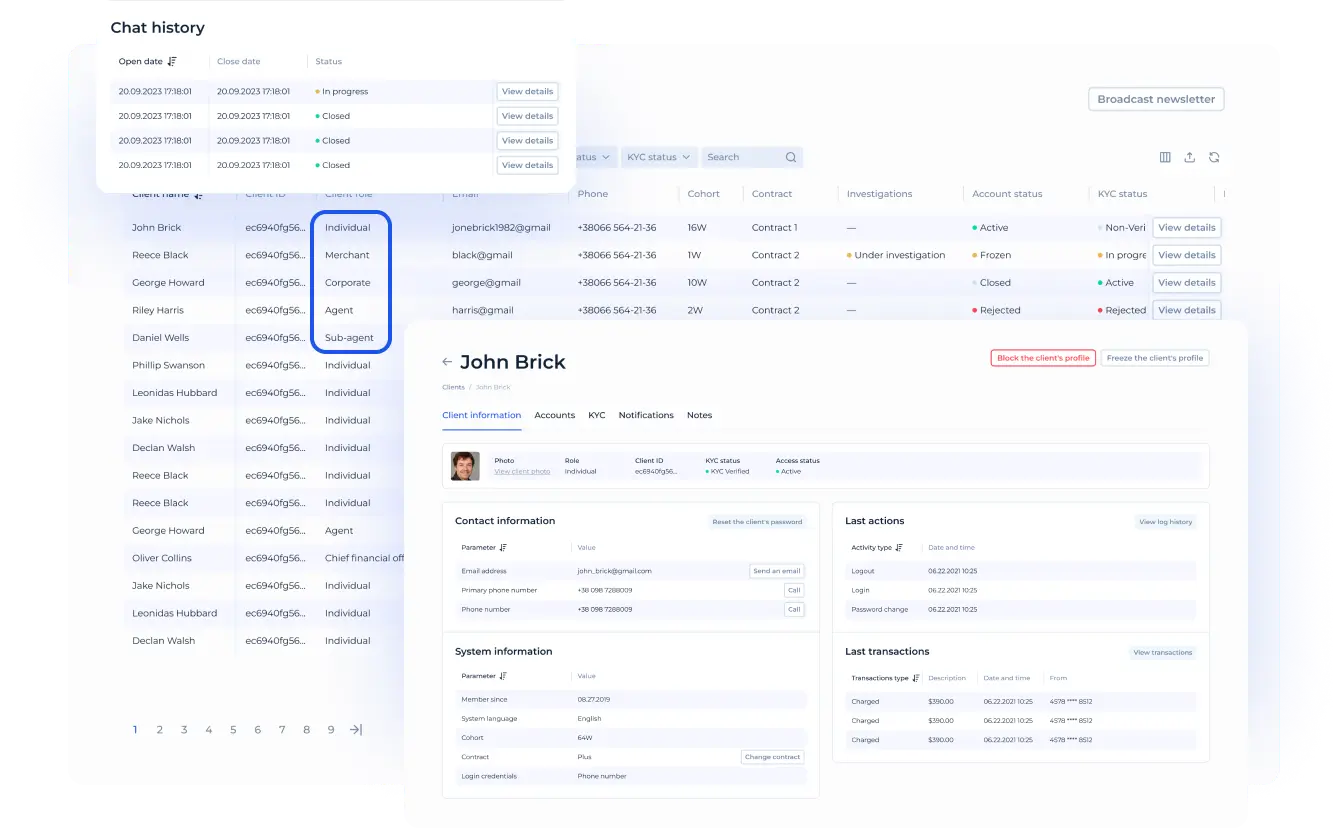

Full control & transparency over transactions

Centralised dashboard to manage incoming & outgoing payments. Real-time transaction tracking & reconciliation. Automated reporting, analytics, and settlement management. Seamless integration with your existing banking & financial operations.

Optimised for businesses of all types

The Power of SDK.finance + Corefy

SDK.finance provides the engine to build your financial services, while Corefy extends its capabilities with unparalleled payment connectivity worldwide.

Integrate once

And gain access to a truly global payment infrastructure

Reduce operational complexity

By managing everything from a single platform

Expand to new markets instantly

Without the need for multiple provider agreements

Stay compliant & secure

With built-in fraud protection and regulatory tools

Ready to power your business with a scalable payment solution?

Whether you’re launching a wallet, super app, neobank, or global marketplace, SDK.finance empowers you to process payments & payouts seamlessly—all while giving you the tools to scale effortlessly.

SDK.finance Global Payment Proesscing & Payouts FAQs

Global payment processing refers to the ability to accept and send payments across multiple countries and currencies using a unified infrastructure that connects businesses to various payment methods, acquirers, and financial networks worldwide.

Global payment processing works by connecting businesses to multiple payment providers, acquirers, and financial institutions worldwide. When a customer makes a payment, the transaction is routed through a payment gateway, verified for security and compliance, processed by an acquiring bank, and settled in the merchant’s account in the preferred currency.

SDK.finance’s global payment processing solution integrates with Corefy’s payment orchestration platform, enabling businesses to accept and process payments seamlessly across 200+ countries and 400+ payment providers. It provides a single API connection for credit card payments, e-wallets, bank transfers, and alternative payment methods, along with smart transaction routing, real-time monitoring, and built-in compliance tools.