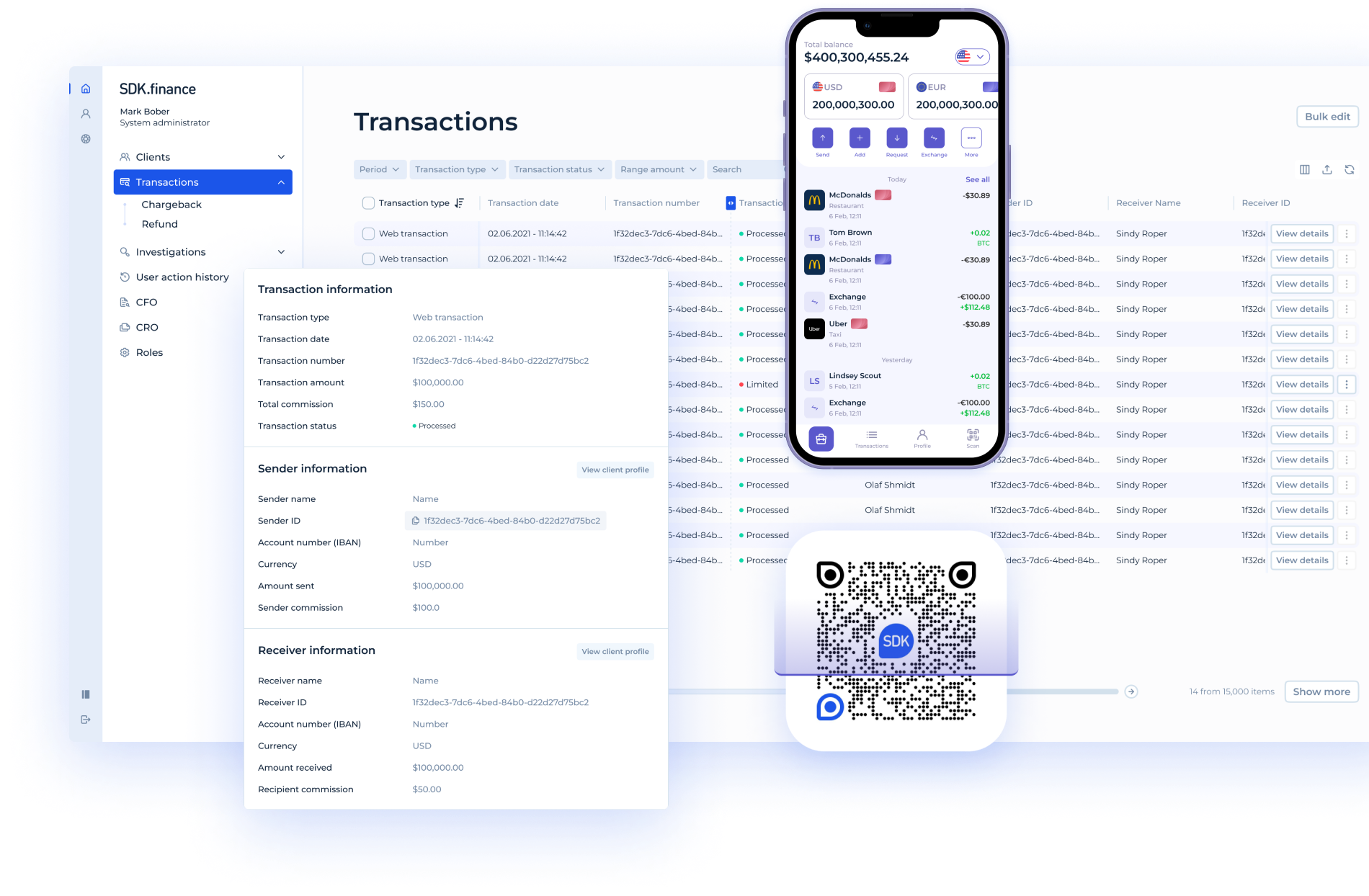

Banking Software for Banks and Financial Institutions

SDK.finance delivers banking software and financial software that helps banks, neobanks, and regulated financial institutions build, modernise, and operate digital banking services on a secure, ledger-based platform aligned with PCI DSS Level 1 and ISO 27001 standards.

Get in touchDesigned for Regulated Banks and Financial Institutions

SDK.finance banking software is designed for financial institutions that operate regulated financial products and need reliable control over accounts, transactions, and payment flows.

Regulated Banks

Retail, corporate, and universal banks use the Platform to launch new digital banking services and modernise existing systems without replacing their entire core infrastructure at once.

Neobanks and Digital Banks

Digital-first banks and challenger banks rely on SDK.finance as a core banking foundation to build accounts, payments, cards, and wallets with full API control and scalable transaction processing.

EMIs and Licensed Financial Institutions

EMIs and licensed payment institutions use the Platform to operate account-based products, manage client balances, and process transactions while maintaining clear accounting, and reporting.

The Core for Building Banking and Financial Products

Core Banking Software

AvailableA modular core banking software designed for banks and regulated financial institutions. The platform provides ledger-based accounting, account management, transaction processing, and API connectivity to modernise or extend existing core systems.

View product pageWhite-Label Digital Bank

AvailableWhite-label digital bank software that allows banks and financial institutions to launch branded digital banking applications using a ready-made core. Suitable for retail and SME banking use cases without building infrastructure from scratch.

View product pageNeobank Software

AvailableNeobank software built for digital-first banks and challenger banks. Enables the launch of account-based products, payments, cards, and wallets on top of a scalable banking and financial software foundation.

View product pagePSP and Payment Processing Software

AvailablePayment service provider software for banks and licensed institutions that operate payment acceptance, transaction processing, settlement, and reconciliation. Designed to integrate with card schemes, payment rails, and external acquirers.

View product pageWhy Banks Choose SDK.finance?

Source Code Licence and Full Control

Banks choose SDK.finance for access to the full source code, which allows them to adapt the banking software to internal architecture, regulatory requirements, and long-term product strategy. This model removes vendor lock-in and gives financial institutions full ownership over their financial software and infrastructure.

Faster Time-to-Market for Banking Products

SDK.finance provides pre-built banking software components that reduce development cycles for new digital banking services. Banks can launch accounts, payments, and transactional products faster without building core financial infrastructure from scratch.

High-Performance Transaction Processing Core

The Platform is built on a ledger-based transactional core designed for real-time processing and high transaction volumes. Banks use this financial software to maintain accurate balances, ensure consistency across accounts, and support scalable payment and transfer operations.

API-Driven Banking Architecture

SDK.finance is designed as API-first banking software, enabling seamless integration with existing core systems, payment rails, card processors, and third-party financial services. This approach allows banks to extend functionality, connect partners, and evolve their technology stack without disrupting operations.

Ready to get started?

Talk to our team