Software for Crypto and Digital Asset Companies

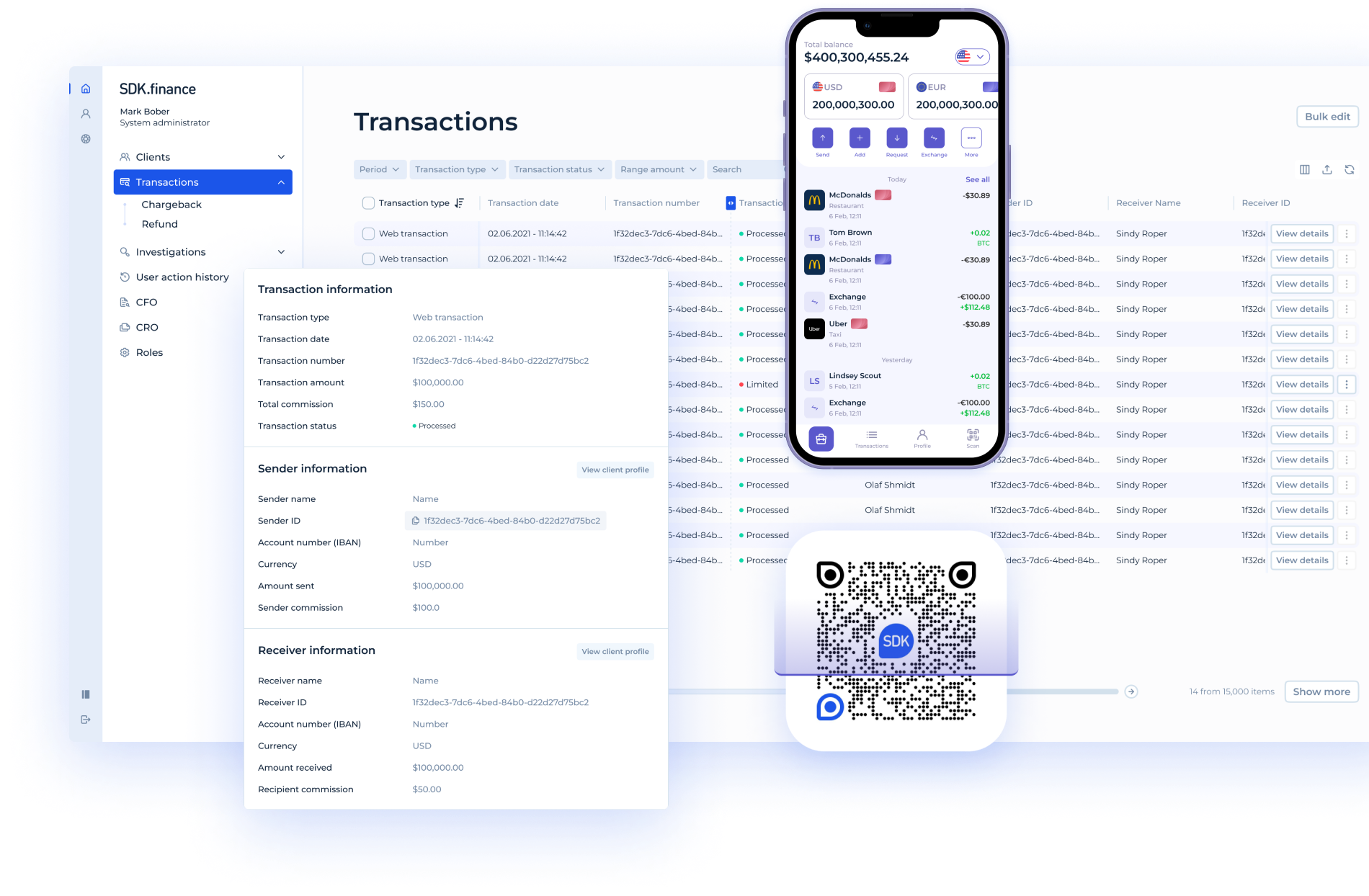

SDK.finance provides a core foundation for crypto and digital asset companies building wallets, crypto-to-fiat services, and account-based financial products without developing core infrastructure from scratch.

Get in touchDesigned for Crypto and Digital Asset Companies

SDK.finance is designed for crypto and digital asset companies that need a stable core software foundation to operate wallets, manage balances, and connect digital assets with fiat payment flows as their products and transaction volumes grow.

Crypto Wallet and Digital Asset Platforms

Crypto wallet providers and digital asset platforms use the Platform to manage user balances, internal transfers, and transaction history on top of a ledger-based core. SDK.finance provides a structured foundation for handling both digital assets and fiat-linked balances within a single system.

Crypto-to-Fiat and On-Ramp Services

Companies building crypto-to-fiat products rely on SDK.finance to connect digital assets with traditional payment infrastructure. The Platform supports account-based flows, transaction processing, and operational control required for on-ramp and off-ramp services.

Digital Asset Companies Scaling Operations

As crypto products scale, transaction volumes, reporting needs, and operational complexity increase. SDK.finance is built to support higher throughput, consistent transaction processing, and predictable system behaviour without rebuilding core infrastructure.

Products for Crypto and Digital Asset Companies

Crypto Banking Infrastructure

AvailableA core software foundation for building crypto banking products that combine digital assets with account-based financial services. Supports balance management, transactions, cards, and integration with fiat payment rails within a single system.

View product pageCrypto-to-Fiat and Fiat-to-Crypto Infrastructure

AvailableSoftware for operating on-ramp and off-ramp services that connect cryptocurrencies with traditional financial systems. Enables account-based flows, transaction processing, and operational control across crypto and fiat movements.

View product pageCrypto Wallet Software

AvailableA core wallet infrastructure for custodial crypto products. Supports digital asset balances, internal transfers, transaction history, and ledger-based accounting required to operate crypto wallets at scale.

View product pageCrypto Exchange Backend Infrastructure

AvailableSoftware foundation for running exchange-related operations, including user accounts, balances, internal transfers, and transaction accounting. Designed to support trading activity while maintaining clear separation between trading logic and core financial infrastructure.

View product pageWhy Crypto and Digital Asset Companies Choose SDK.finance

Core Foundation for Crypto and Fiat Operations

Crypto and digital asset companies choose SDK.finance to avoid building core financial infrastructure from scratch. The Platform provides a stable foundation for managing balances, transactions, and accounts across crypto and fiat products within a single system.

Faster Launch of Crypto Products

SDK.finance helps teams reduce time-to-market when launching crypto banking services, wallets, exchanges, or crypto-to-fiat products. The ready core allows companies to focus on product logic and integrations instead of low-level infrastructure development.

Ledger-Based Accounting Across Assets

The Platform uses a unified ledger model to manage crypto and fiat balances consistently. This ensures accurate accounting, predictable transaction flows, and clear visibility across wallets, accounts, and exchange-related operations.

API-First and Flexible Architecture

SDK.finance is built as API-first software, allowing crypto companies to integrate custody providers, liquidity sources, payment rails, and compliance services. The architecture supports gradual product evolution as regulatory and business requirements change.

Ready to get started?

Talk to our team