Software for FinTech Companies

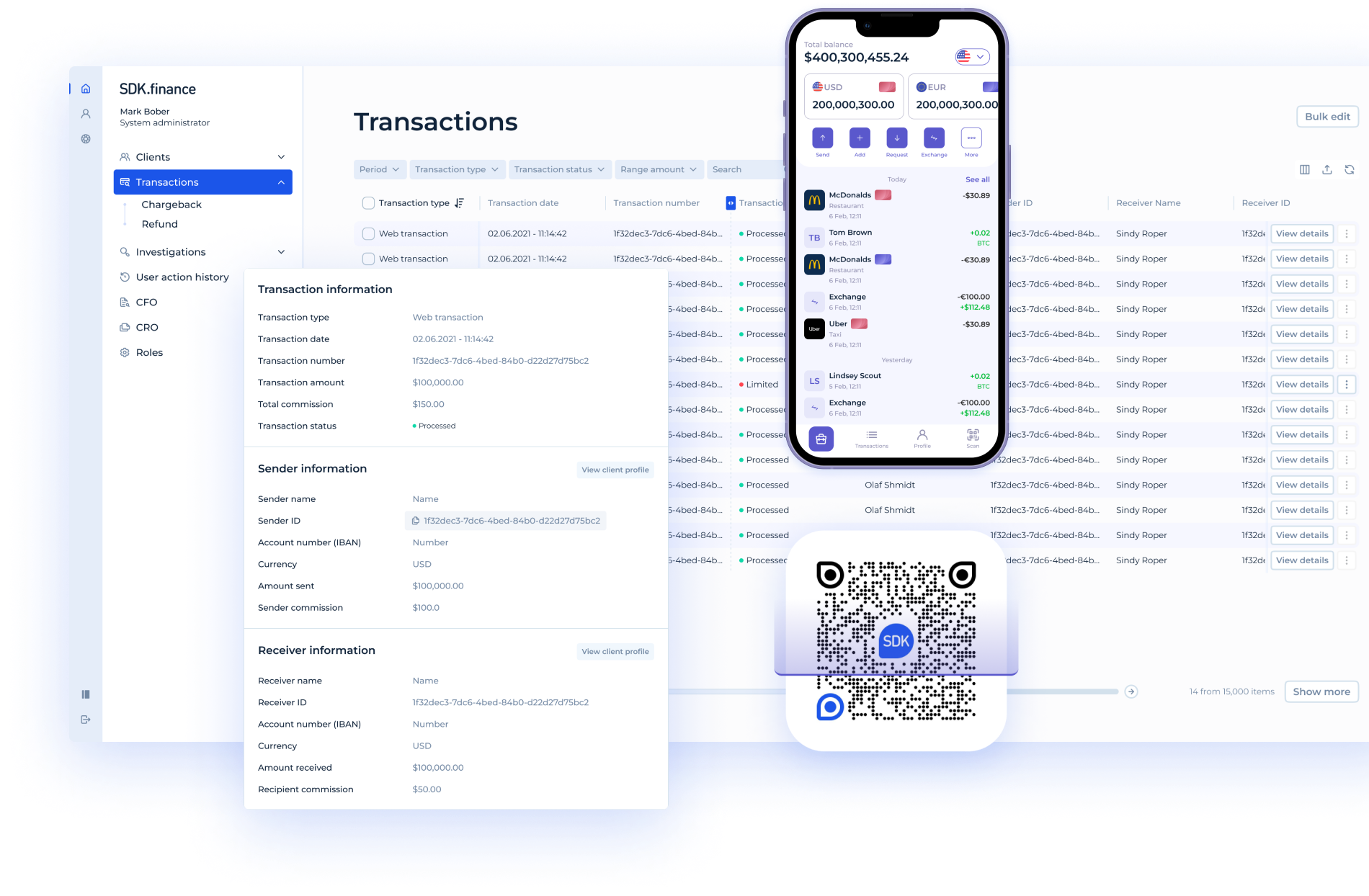

SDK.finance provides a ready-to-go FinTech software foundation that allows companies to launch digital financial products without building core infrastructure from scratch.

Get in touchDesigned for FinTech Teams Building Financial Products

SDK.finance is designed for FinTech companies that need a production-ready software foundation to launch, operate, and scale financial products efficiently, without investing time and resources into building and maintaining core infrastructure.

FinTech Startups Launching Their First Product

Early-stage FinTech companies use the Platform to go to market faster with a reliable core for transactions, balances, and operations. SDK.finance allows startups to validate business models and launch compliant financial products without assembling complex infrastructure from multiple vendors.

Growing FinTechs Scaling Transaction Volumes

As transaction volumes and user bases grow, FinTech companies rely on the Platform to handle higher loads, operational complexity, and reporting requirements. The ready-to-use foundation supports predictable scaling without re-architecting core systems.

Product-Focused FinTech Teams

SDK.finance is built for teams that want to focus on product design, user experience, and market differentiation. The Platform removes the need to maintain low-level financial infrastructure, reducing technical debt and long-term development costs.

The Core for Building FinTech Products

Digital Wallet Software

AvailableA ready-to-use wallet infrastructure for FinTech companies building multi-currency wallets, account balances, and internal transfers. The Platform provides ledger-based accounting, transaction tracking, and operational controls required to run wallet-based financial products at scale.

View product pageCard Issuing and Card Programme Software

AvailableSoftware for launching and managing card programmes, including virtual and physical cards. FinTech companies use this product to connect wallets and accounts to card schemes, handle authorisations, transactions, and card lifecycle management without developing card infrastructure internally.

View product pageNeobank Software

AvailableSoftware for FinTech companies launching account-based financial products, including neobank-style applications. Provides the backend foundation for accounts, balances, transfers, and operational workflows required to run regulated or semi-regulated financial services.

View product pagePayment Processing and PSP Software

AvailableA modular payment processing foundation for FinTech companies operating payment services or PSP models. Supports transaction processing, settlement, reconciliation, and integration with external acquirers and payment rails.

View product pageWhy FinTech Companies Choose SDK.finance

Ready-to-Go Foundation Instead of Building From Scratch

FinTech companies choose SDK.finance to avoid building and maintaining core financial infrastructure from the ground up. The Platform provides a production-ready foundation for transaction processing, ledger accounting, and operational workflows, allowing teams to start with a proven core rather than assembling complex systems piece by piece.

Faster Product Launch and Lower Development Costs

By using pre-built modules and a structured backend, FinTech teams significantly reduce time-to-market and engineering effort. SDK.finance helps companies launch MVPs and production systems faster, while keeping development and infrastructure costs predictable as the product evolves.

Focus on Product, Not Infrastructure

SDK.finance allows FinTech teams to concentrate on product logic, user experience, partnerships, and go-to-market strategy. The Platform removes the burden of maintaining low-level financial infrastructure, reducing technical debt and supporting long-term product development.

Reliable Core That Scales With the Business

As FinTech products grow, transaction volumes, user activity, and operational complexity increase. SDK.finance is designed to handle this growth on a stable, ledger-based core that supports real-time processing, accurate balances, and consistent system behaviour under load.

Ready to get started?

Talk to our team