Embedded Finance Software for Non-Financial Enterprises

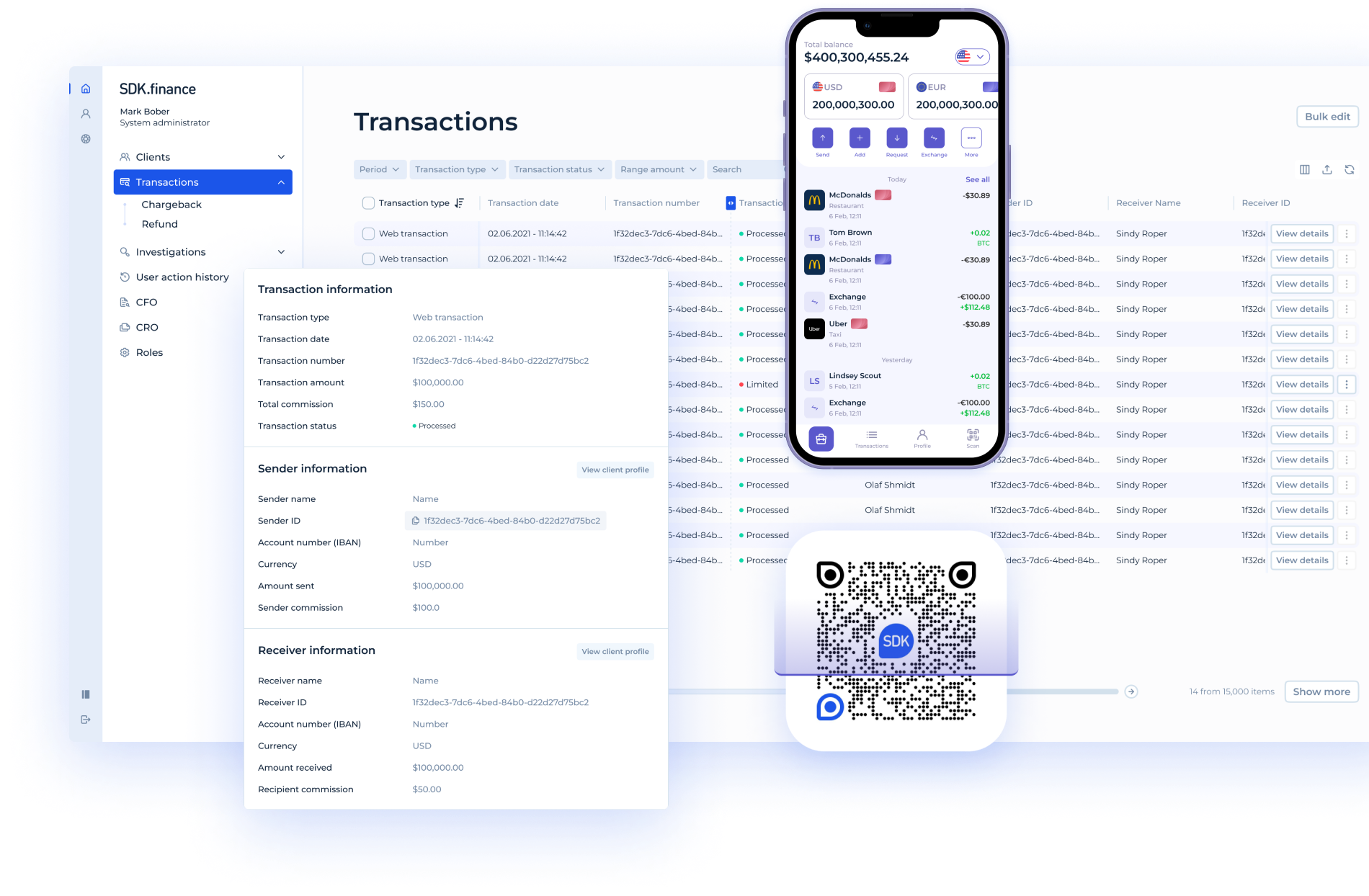

SDK.finance provides a core software foundation that allows non-financial enterprises to embed wallets, payments, and financial flows directly into their products and services.

Get in touchDesigned for Non-Financial Enterprises

SDK.finance is designed for non-financial enterprises that want to embed financial functionality such as wallets, payments, and account-based money flows into their products without becoming financial institutions.

Enterprises Adding Embedded Finance to Digital Products

Companies in retail, mobility, logistics, and digital services use SDK.finance to embed wallets and payments directly into their applications. This allows financial functionality to operate as part of the core user journey rather than as an external add-on.

Businesses Managing Internal Balances and Payments

Non-financial enterprises rely on internal wallets to manage customer balances, prepaid services, refunds, loyalty credits, and service-level payments. SDK.finance provides a structured foundation for balance management and transaction accounting.

Enterprises Scaling Embedded Financial Use Cases

As embedded finance use cases grow in volume and complexity, operational control becomes critical. SDK.finance supports predictable scaling, consistent accounting, and clear separation between financial logic and core business systems.

Solutions for Non-Financial Enterprises

E-Wallet Solutions

AvailableNon-financial enterprises use e-wallets to store customer funds, manage prepaid balances, handle refunds, and support internal payments. Wallets act as a financial layer embedded directly into digital products, without exposing users to external payment flows.

View product pageEmbedded Finance Infrastructure

AvailableSDK.finance enables enterprises to embed financial functionality such as accounts, payments, and money movement into non-financial products. Embedded finance operates inside existing user journeys, allowing companies to add financial use cases without becoming regulated financial institutions.

View product pagePayment Processing

AvailablePayment processing solutions support in-app payments, service charges, subscriptions, and transaction-based billing. SDK.finance provides a structured foundation for processing payments while maintaining clear accounting and operational control across embedded finance use cases.

View product pageInternal Balance and Transaction Management

AvailableEnterprises use internal balance management to handle loyalty credits, service-level balances, bonuses, and stored value. The Platform ensures consistent transaction tracking and ledger-based accounting as embedded financial activity grows.

View product pageWhy Non-Financial Enterprises Choose SDK.finance

Embed Finance Without Becoming a Financial Institution

Non-financial enterprises use SDK.finance to embed wallets, payments, and account-based money flows directly into their products. The Platform enables embedded finance use cases while keeping regulatory and financial complexity outside the core business.

Faster Launch and Lower Development Costs

SDK.finance provides a ready core foundation for embedded finance, allowing enterprises to avoid building financial infrastructure from scratch. This reduces time-to-market and long-term development and maintenance costs.

Operational Control Over Embedded Financial Flows

Enterprises maintain full visibility over balances, transactions, refunds, and service-level payments. SDK.finance ensures consistent accounting and clear separation between financial logic and core business operations.

Source Code Access and Vendor Independence

With a source code licence option, enterprises gain long-term independence from vendor constraints. Teams can adapt embedded finance functionality to internal systems, business models, and regional requirements without being locked into a fixed roadmap.

Ready to get started?

Talk to our team