Software for Payment Service Providers

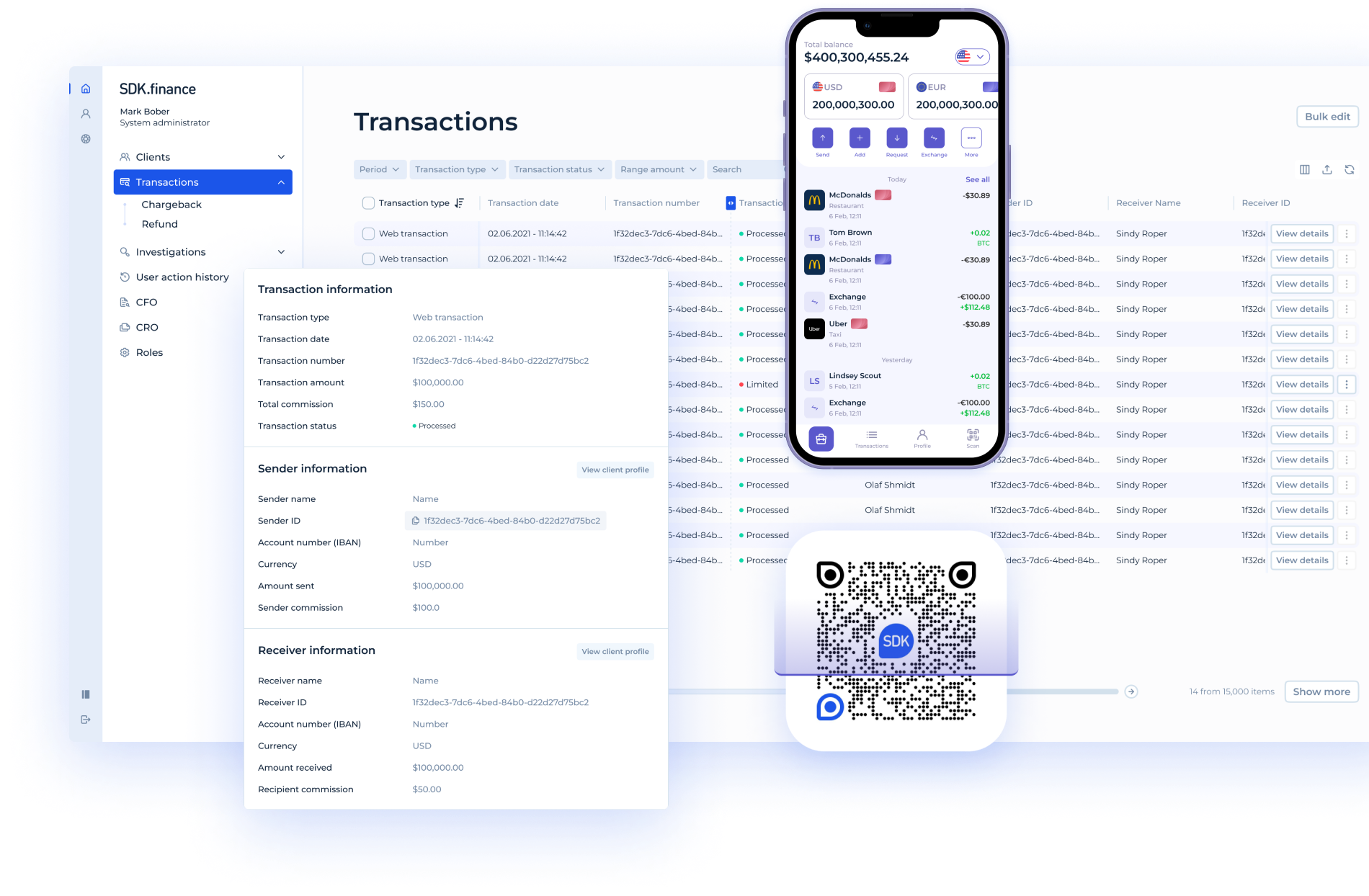

SDK.finance provides a ready-to-go software for Payment Service Providers (PSPs) that need to build, operate, and scale payment processing services without developing core infrastructure from scratch.

Get in touchDesigned for Payment Service Providers

SDK.finance is designed for Payment Service Providers that need a reliable, production-ready software foundation to operate payment services, manage transactions, and scale processing volumes without building and maintaining core payment infrastructure internally.

Licensed Payment Service Providers and Acquirers

Licensed PSPs and acquiring institutions use the Platform to run payment processing, settlement, and reconciliation on top of a ledger-based core. SDK.finance supports structured transaction flows, clear accounting, and operational visibility required for regulated payment services.

Payment Aggregators and PSP Startups

Payment aggregators and early-stage PSPs rely on SDK.finance to launch payment services faster with a ready-to-use backend. The Platform helps reduce development effort while providing the core components needed to onboard merchants, process payments, and manage transaction data from day one.

PSPs Scaling Transaction Volumes

As payment volumes grow, PSPs face increased operational complexity and reporting requirements. SDK.finance is built to support higher throughput, consistent transaction processing, and stable system behaviour, allowing PSPs to scale without re-architecting their payment core.

The Core for Building Payment Products

Payment Processing Software

AvailableA ready-to-use payment processing foundation for PSPs handling online and offline transactions. The Platform supports transaction authorisation flows, payment lifecycle management, and integration with external acquirers, card schemes, and payment rails.

View product pageMerchant and PSP Operations Management

AvailableOperational tools for onboarding merchants, managing accounts and balances, and monitoring transaction activity. Provides PSP teams with visibility and control over day-to-day payment operations and reporting.

View product pageTransaction Processing System

AvailableA core transaction processing system designed for high-volume payment environments. Provides real-time transaction handling, ledger-based accounting, fee calculation, and consistent state management across the full payment lifecycle.

View product pageGlobal Payment Processing

AvailableSoftware designed for PSPs operating across multiple markets and payment corridors. Supports cross-border payment flows, multi-currency processing, fee calculation, and settlement logic required for global payment operations.

View product pageWhy PSPs Choose SDK.finance

Ready-to-Use Payment Processing Core

PSPs choose SDK.finance to avoid building a payment processing core from scratch. The Platform provides a production-ready foundation for transaction processing, ledger-based accounting, and payment lifecycle management, allowing PSPs to launch and operate payment services faster.

Built for High-Volume Payment Environments

SDK.finance is designed to handle growing transaction volumes and complex payment flows. PSPs rely on the Platform to process payments consistently, maintain accurate balances, and ensure stable system behaviour as traffic and merchant activity increase.

Operational Control Over Payment Flows

PSPs use SDK.finance to gain visibility and control across the full payment lifecycle, from authorisation to settlement. The Platform supports fee calculation, reconciliation logic, and reporting workflows required for day-to-day payment operations.

Proven and Secure Infrastructure

SDK.finance operates in line with PCI DSS Level 1 requirements and follows ISO 27001-aligned processes. This provides PSPs with a reliable software foundation designed for secure payment processing and controlled access to sensitive transaction data.

Ready to get started?

Talk to our team