SDK.finance FinTech Platform Technology

Explore what’s behind the SDK.finance Platform and how it enables you to create scalable payment solutions on top of its open APIs and accelerate product launch, address regulatory compliance issues, reduce development costs, and fuel innovation.

Contact usSDK.finance tech stack and APIs

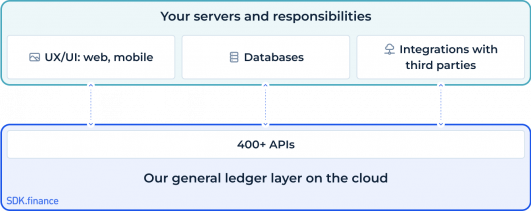

At SDK.finance, we utilize REST APIs to connect our ledger-based system with third-party solutions. To design, build, and document our flexible APIs, we rely on OpenAPI, a top-of-the-line framework. This framework enables us to automatically generate and maintain our interactive API documentation, ensuring our users always have the latest information. We have compiled a comprehensive list of over 400 APIs in the latest release.

Languages

- Operational DB – PostgreSQL 13

- Transaction Viewer DB – MongoDB 6

- System core – Java 17 LTS

Frameworks and environments

- Spring 5.3

- Spring Boot 2

- Hibernate ORM 5.6

- VUE.JS 2

Hybrid Cloud SaaS

The subscription-based SaaS version of SDK.finance software is available through the hybrid cloud delivery model designed primarily for startups or SMBs.

The backend app is hosted on our servers or via major public cloud platforms and maintained by our team.

The databases are stored on your servers and managed by your own team. This is in order to meet the cloud data management regulators’ requirements for any country and enable the usage of our Platform around the globe.

Front-end

Users of the SDK.finance Platform need to take care of the product front-end on their side. This includes the end-user design, as the back office UI comes out of the box.

The downloadable web front-office UI packs can be modified according to the customer’s vision. Alternatively, customers can develop their own front-office design from scratch.

Integrations

SDK.finance implements REST API architecture style to facilitate integration with third-party providers and services and assist in driving our customers’ product innovation.

SDK.finance’s out-of-the-box functionality lies in using its 400+ interactive API endpoints exposed as Open APIs.

Customers can build integrations with third-party services and providers leveraging SDK.finance API flows designed for specific use cases, which streamlines the process and makes it more time- and cost-efficient.

AWS Server infrastructure

SDK.finance solution is available on the AWS cloud infrastructure, which features top-notch resilience, security and meets the strictest regulatory requirements.

In addition, AWS services can be delivered regionally across the AWS 87 availability zones, per customer request, in order to meet the data management requirements of the regulator.

If necessary, a customer’s SDK.finance platform instance can also be made available from the other cloud providers like Oracle or Microsoft Azure.

Hardware requirements

Here are the minimum requirements of the instance for both Production and Test environments to run the system and ensure its stable performance.

Front end

CPU – 1

RAM – 2 GB

SSD – 40 GB

OS: Ubuntu 20.04 LTS

Software: NGINX 1.14.0

Application server

CPU – 4

RAM – 8 GB

SSD – 160 GB

OS: Ubuntu 20.04 LTS

Software: openJDK 16

Postgres DB

CPU – 4

RAM – 16 GB

SSD – 160 GB

OS: Ubuntu 20.04 LTS

DB: PostgreSQL – 13.3

Transaction Viewer DB

CPU – 2

RAM – 4 GB

SSD – 80 GB

OS: Ubuntu 20.04 LTS

DB: MongoDB – 6.02

Security

System architecture security

We follow the latest ISO standards in code development, meeting the requirements of the ISO 27001. The interaction between clients and server components in the system is protected by a variety of traffic encryption methods:

- -TLS with a 256 or 512 bit encryption

- -data hashing algorithms SHA-256 or SHA-512

- -data packets signature

- -checksums verification

- -IP filtering

- -brute force attacks protection.

We also implement firewalls, IDS (Intrusion Detection System), WAF (Web Application Firewalls) and load-balancing.

AWS infrastructure security

SDK.finance customers benefit from a secure environment offered by AWS cloud infrastructure. Apart from a range of physical security measures protecting the data centers, AWS infrastructure is compliant with numerous third-party assurance frameworks, like PCI-DSS, EU Data Protection Directive, FedRAMP, GDPR, etc.

Clients interface and staff back office security

- -OTP and HMAC authorization are used to secure the back office access for employees

- -Two-factor authorization and OAuth are used for end-users’ logins into their accounts.

- -Role-based access limits staff access to specific sections of the back office

- -A trusted domains list can be implemented.

Need more details? Get in touch!

SDK.finance SaaS Solution FAQs

Key technologies in FinTech include blockchain and distributed ledger technology, artificial intelligence and machine learning, robotic process automation, application programming interfaces, cloud computing, mobile technology and cyber security.

At SDK.finance, we use 400+APIs endpoints to connect our ledger-based system with third-party solutions. We use OpenAPI to automate the creation and maintenance of our interactive API documentation and ensure that our users always have access to the latest information.

SaaS, or Software as a Service, refers to a software distribution model in which applications are hosted by a third-party provider and made available to customers via the internet. SaaS-based FinTech solutions offer companies a cost-effective, scalable, flexible, secure, compliant and analytical way to accept and process digital payments.

The SDK.finance software’s SaaS version follows a hybrid cloud deployment model, wherein the backend app is hosted on the major public cloud platforms. To comply with cloud data management regulations in different countries and enable global platform usage, your team manages and stores the databases on your servers.