White-Label PSP Software for Payment Service Providers

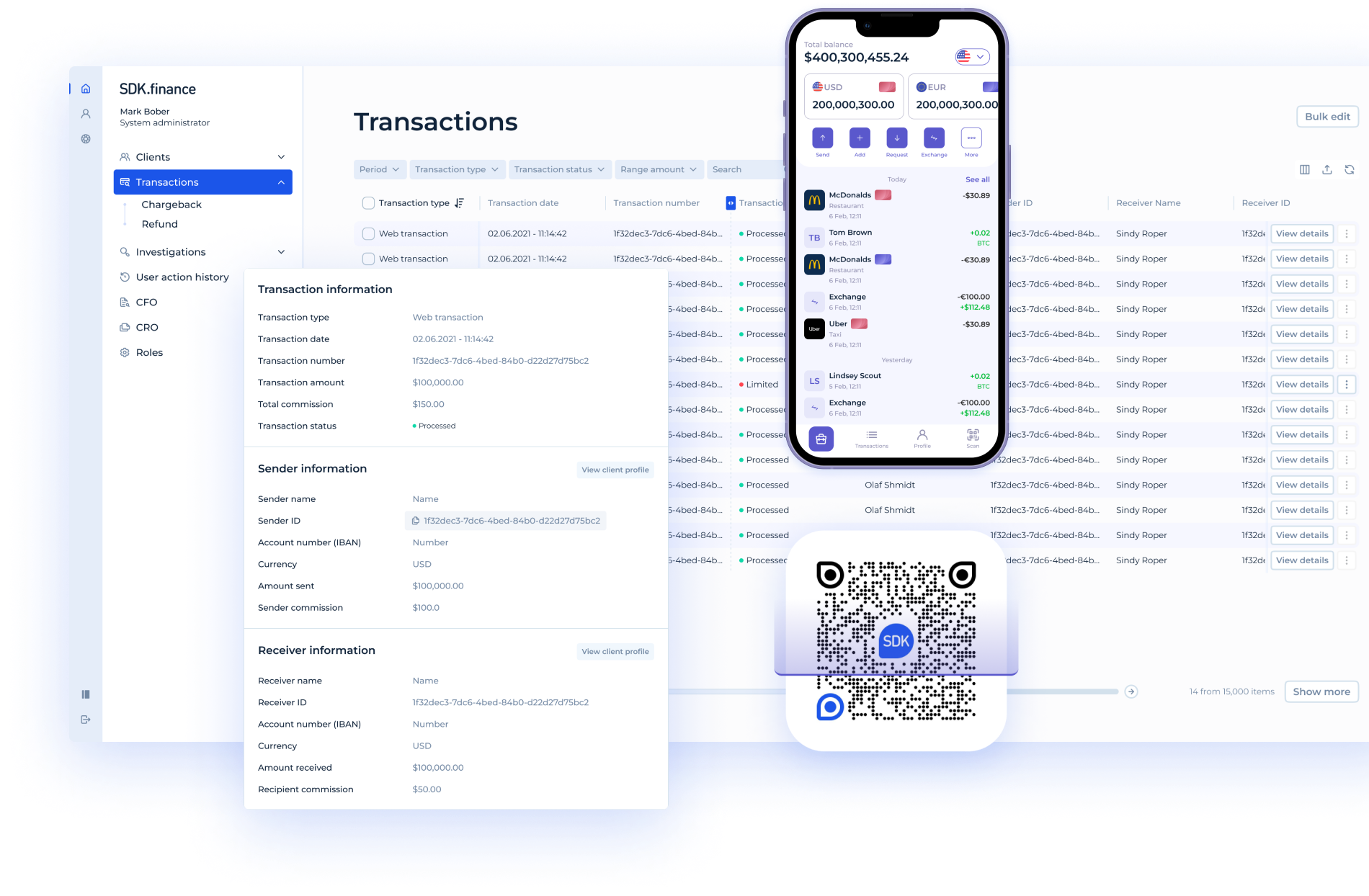

SDK.finance is a Software Payment Provider delivering payment software for PSPs that need to build or expand a payment gateway, manage merchants, and control settlements without developing core infrastructure in-house.

Request a demoAll-in-one white-label PSP software

Merchant and Payment Operations

-

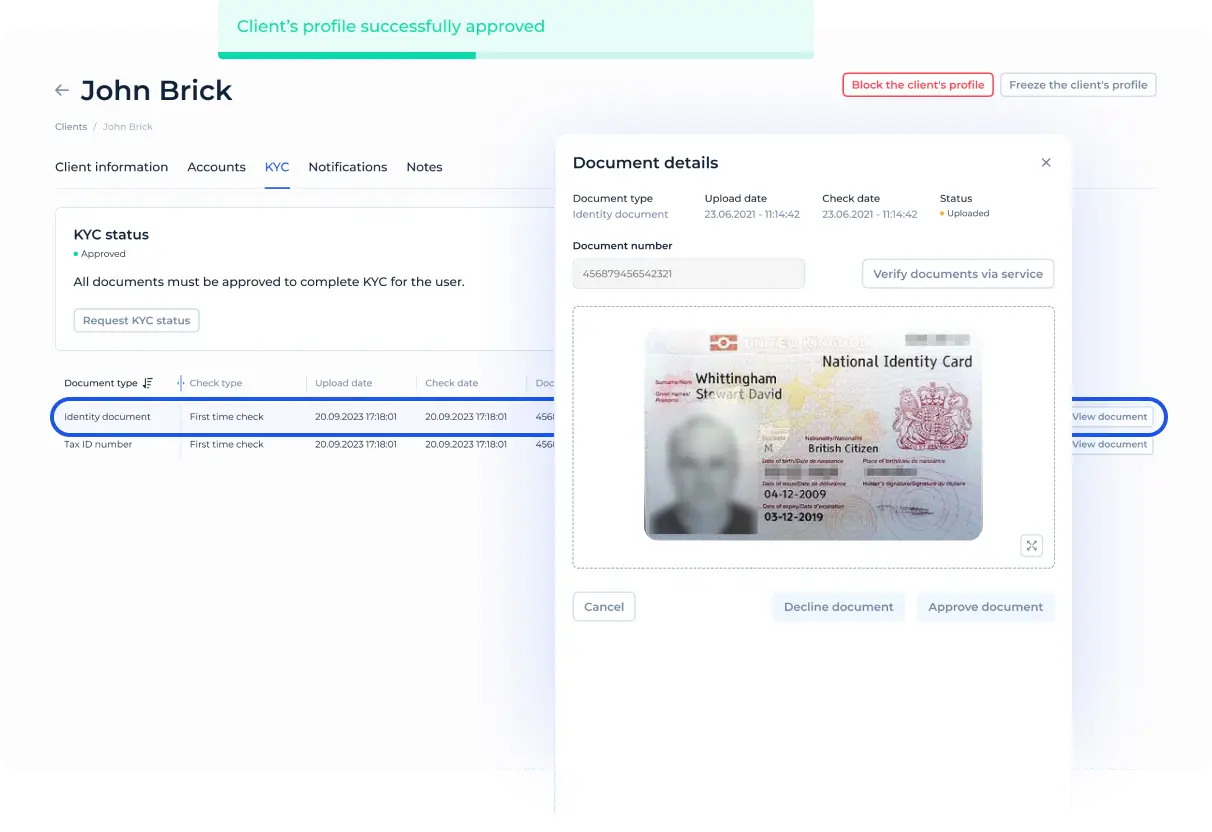

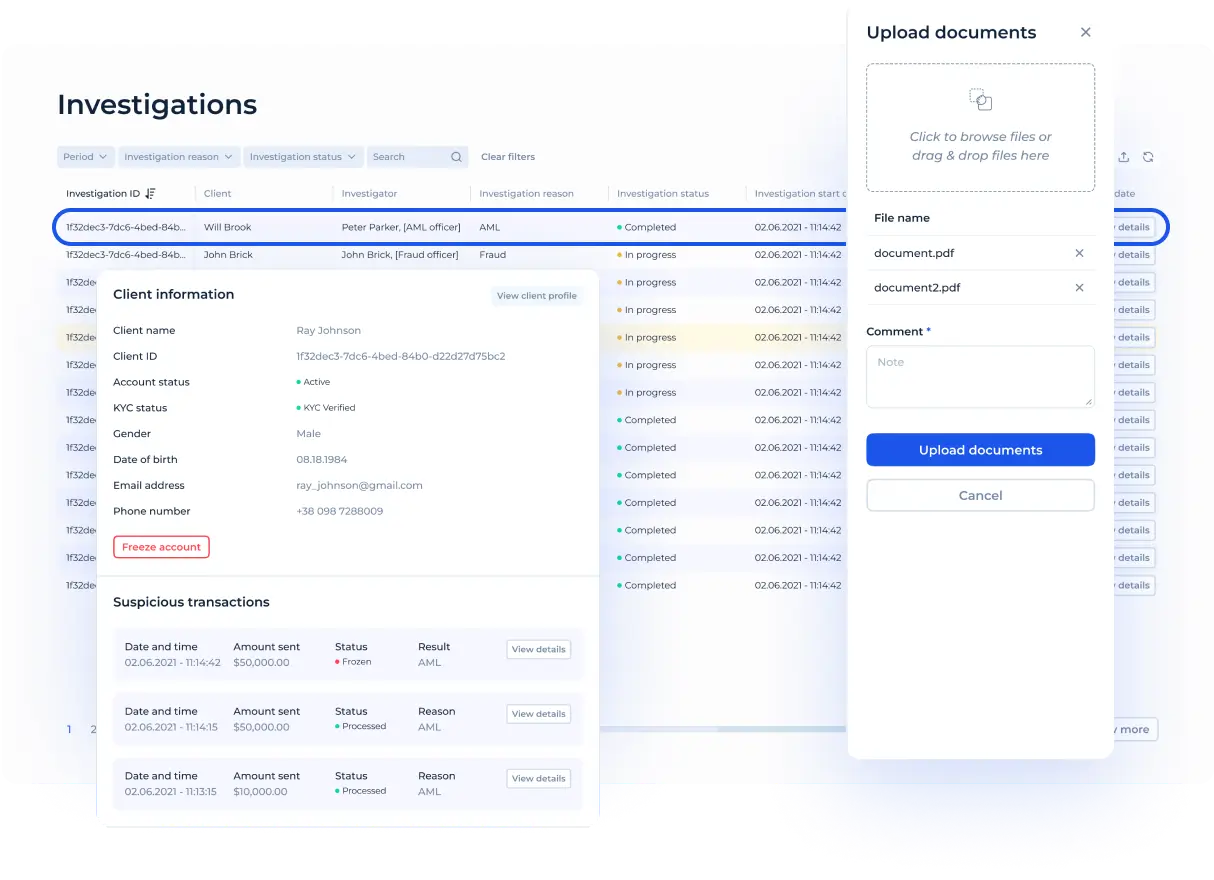

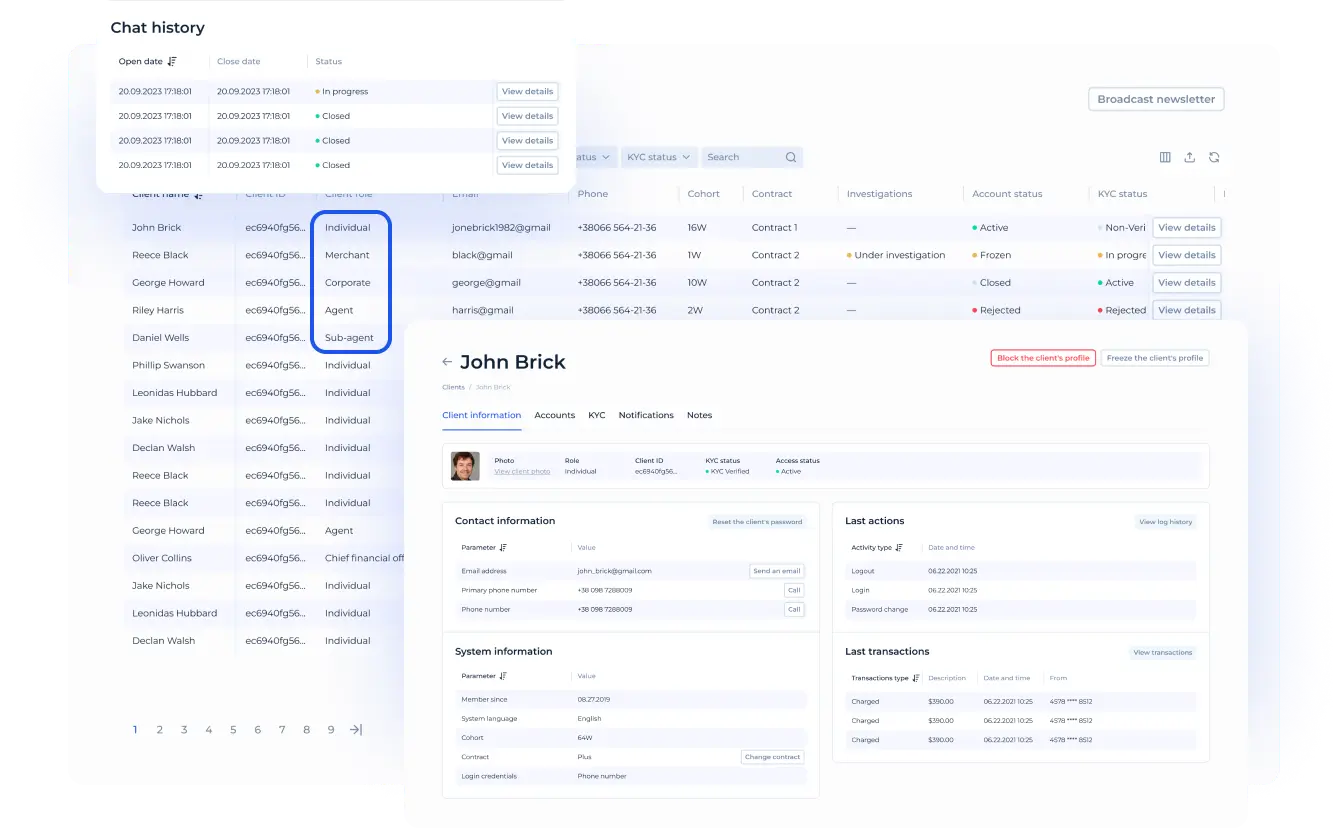

Merchant onboarding with document upload and approval flow

-

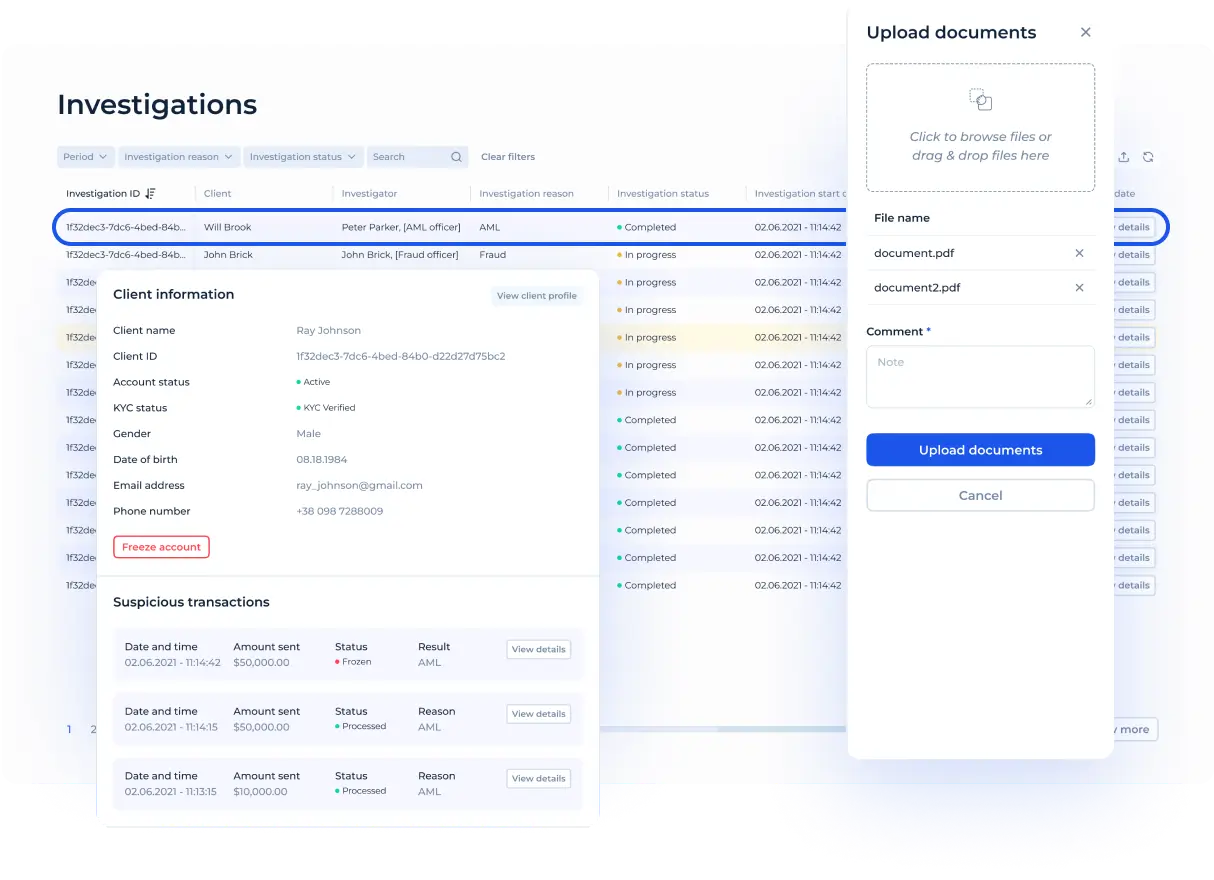

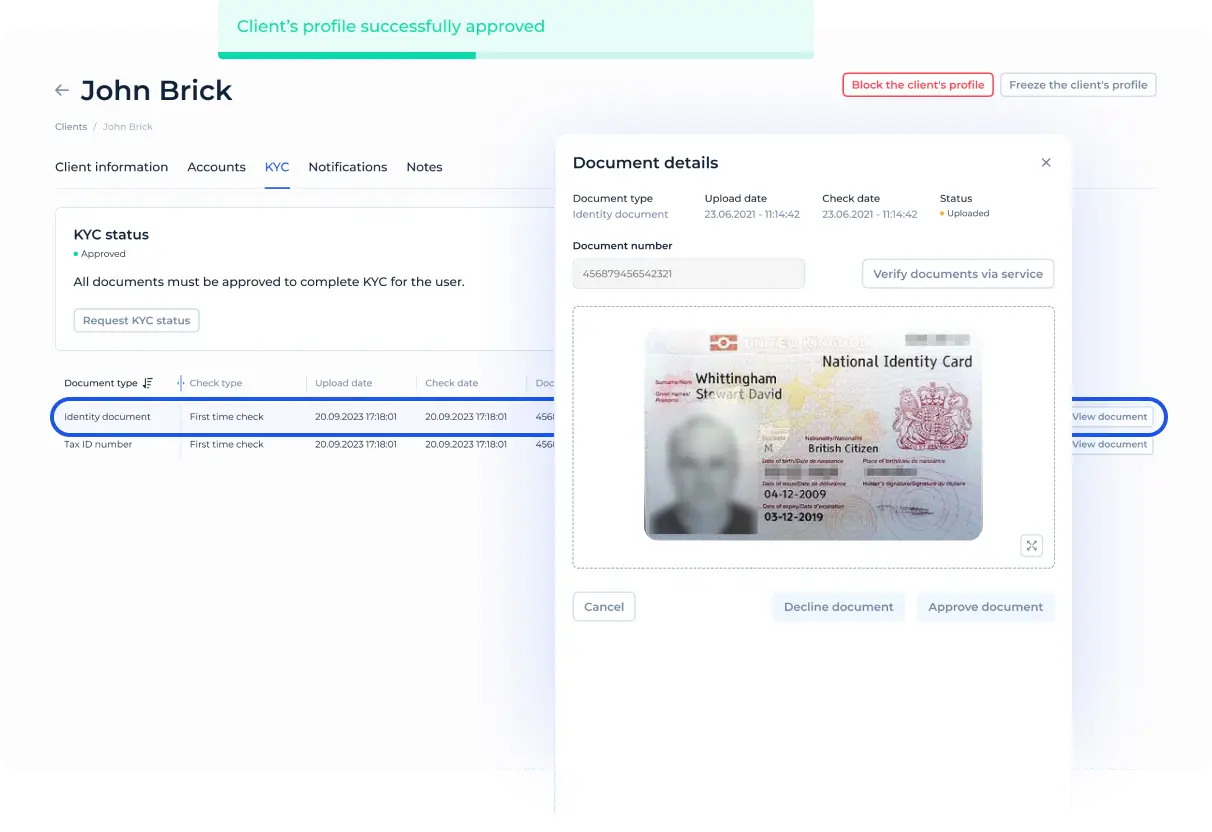

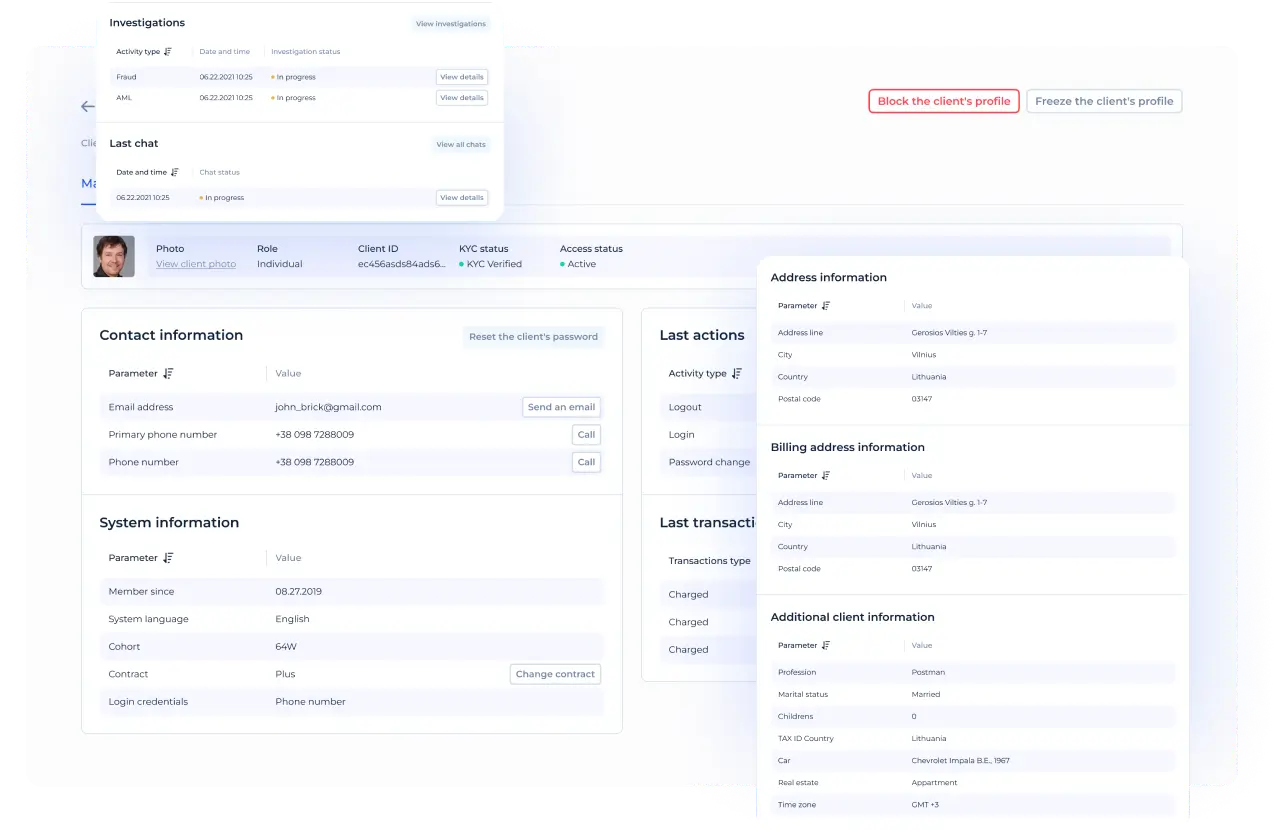

KYC/KYB verification and risk management

-

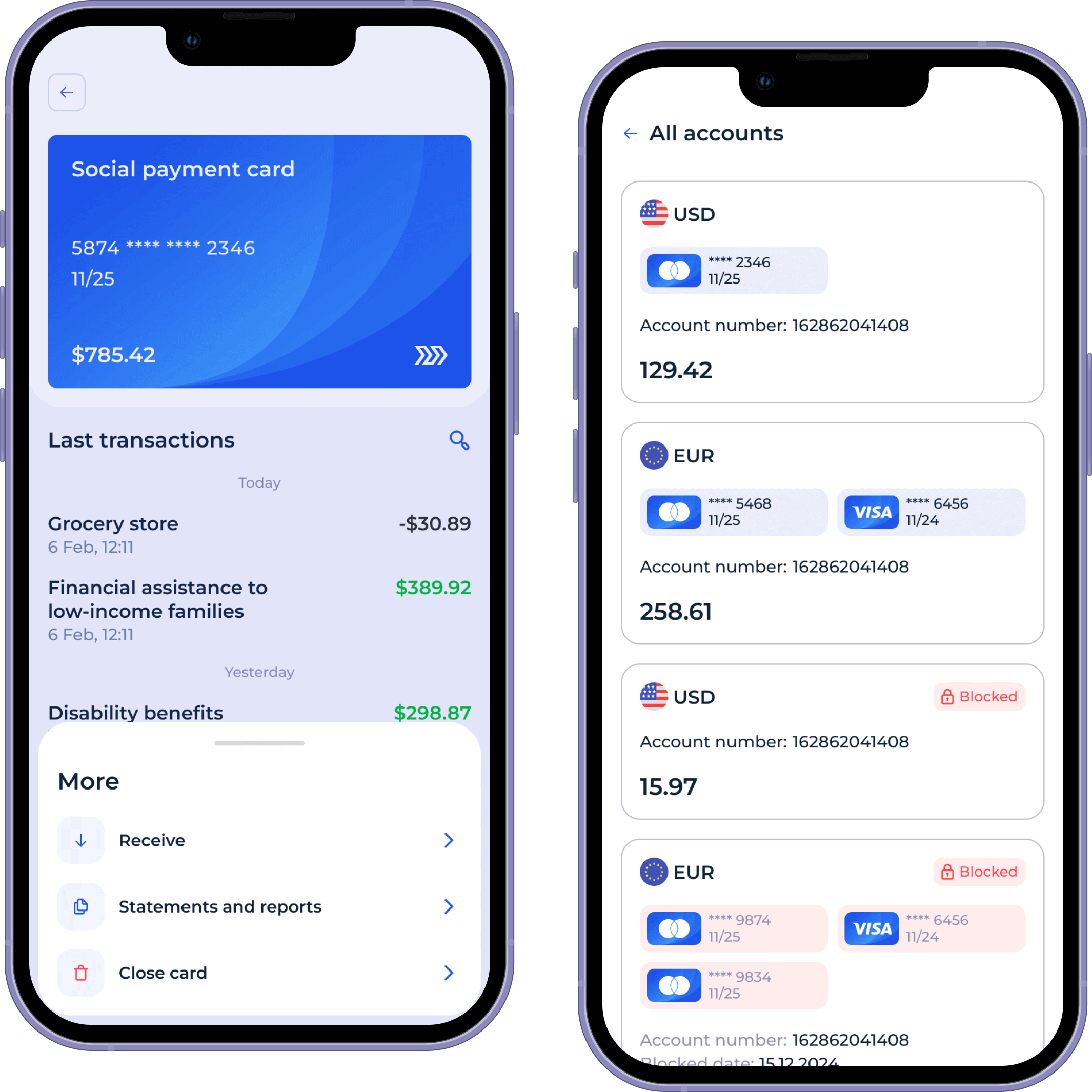

Merchant dashboard with transaction history and reports

-

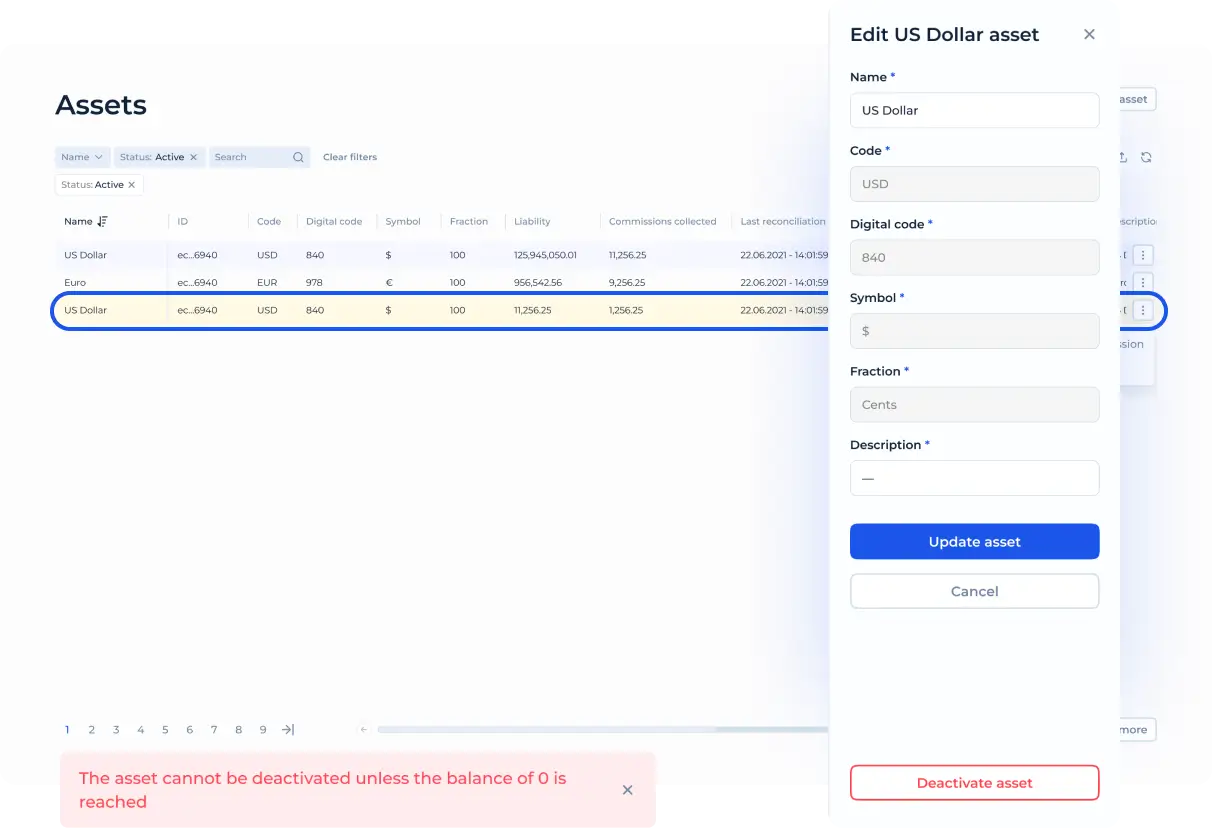

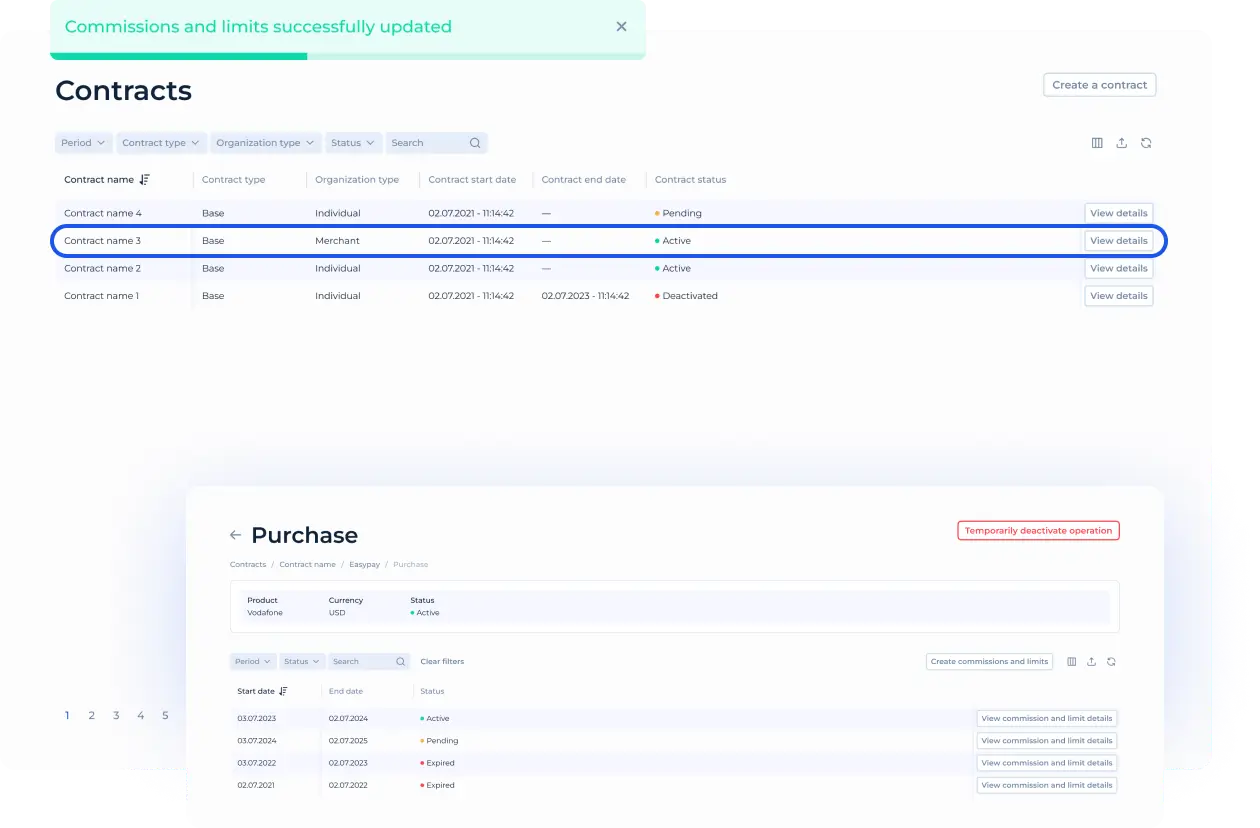

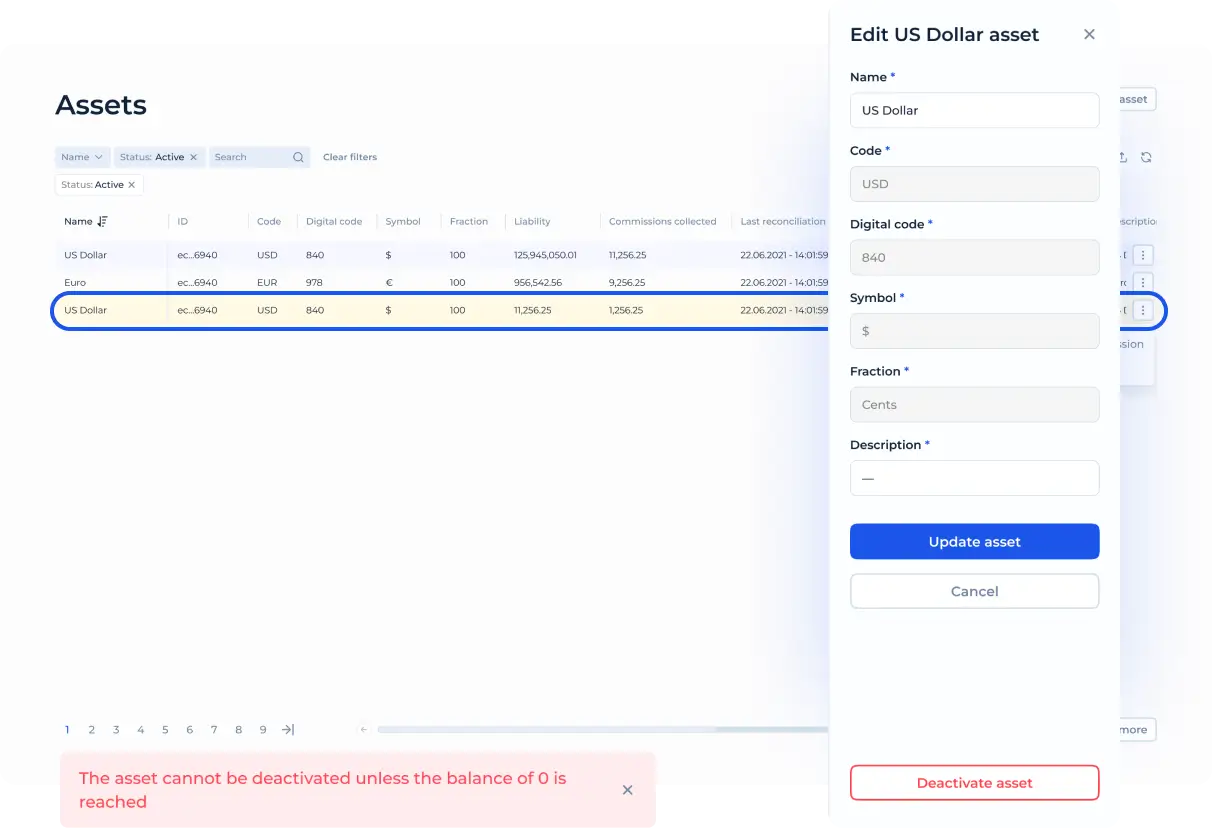

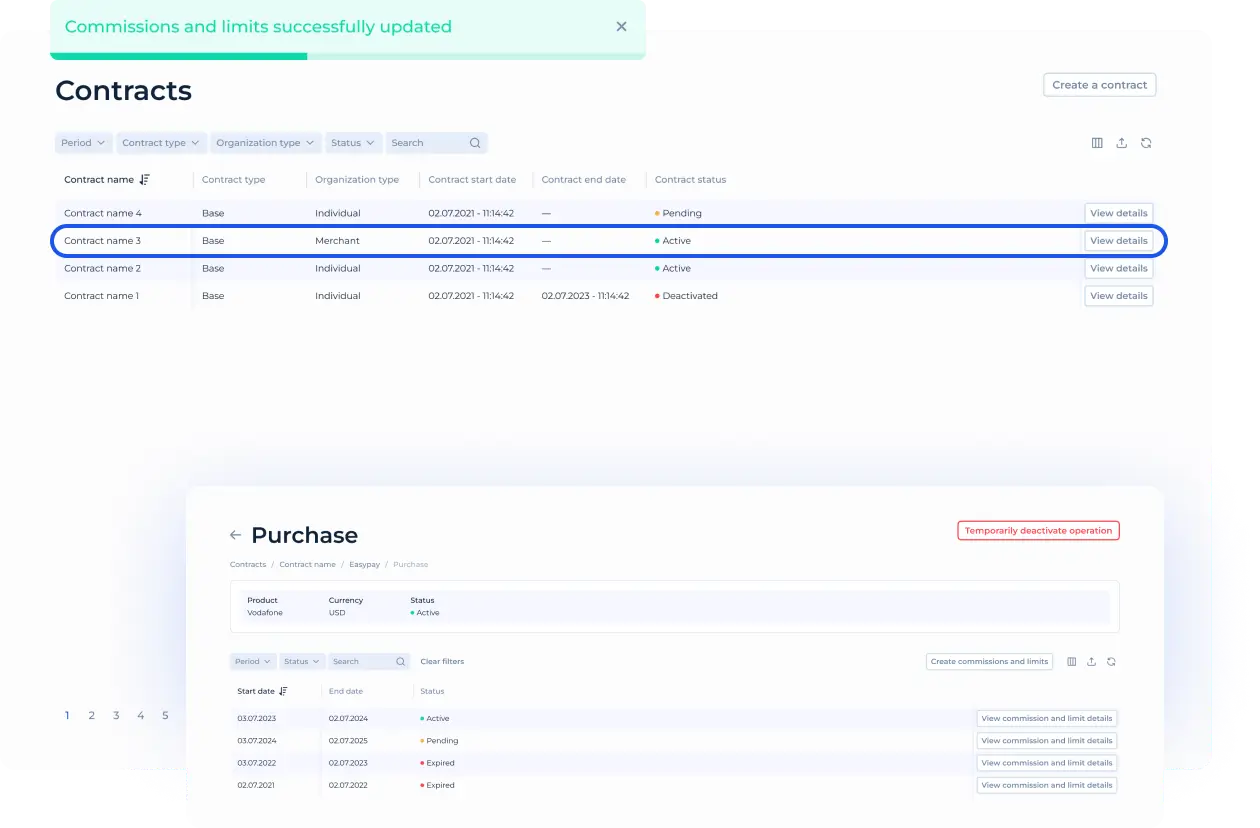

Configurable fees, commissions, and pricing tiers

-

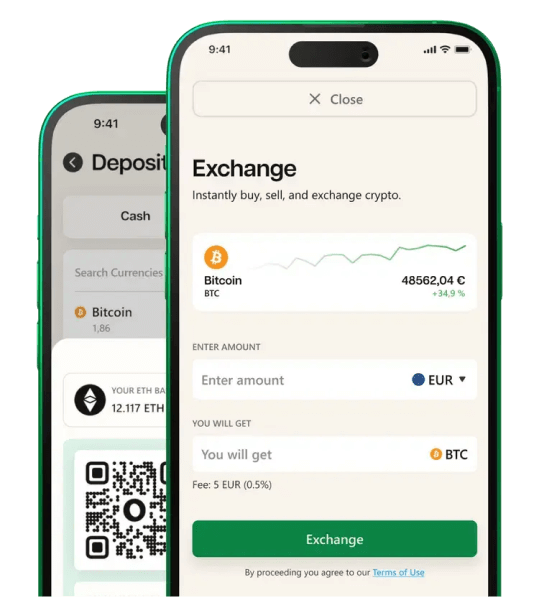

Multi-currency support for global operations

Payment Processing and Settlement

-

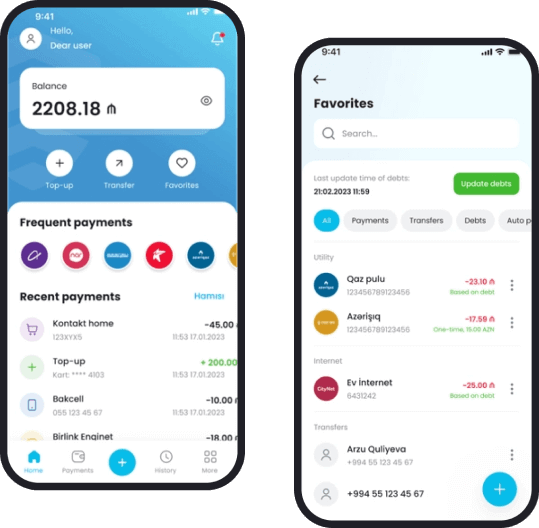

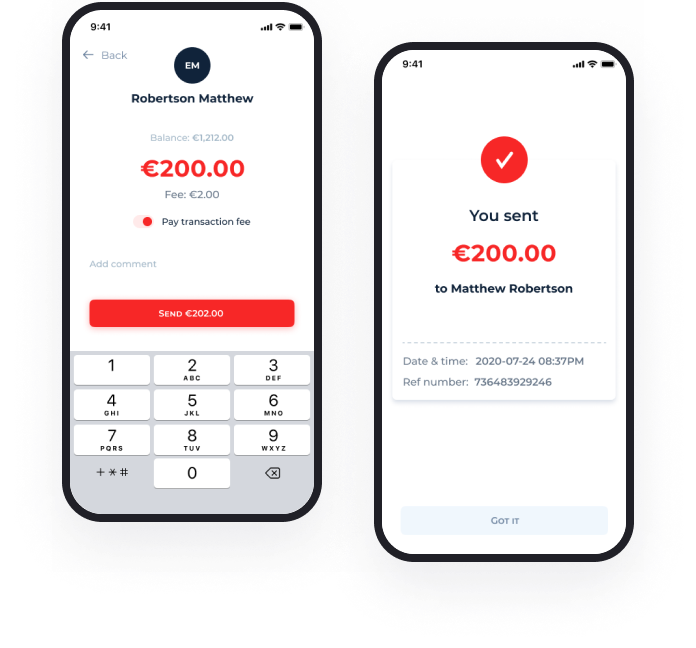

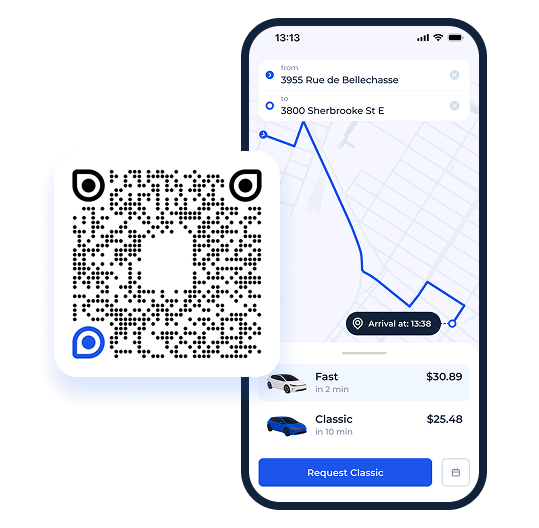

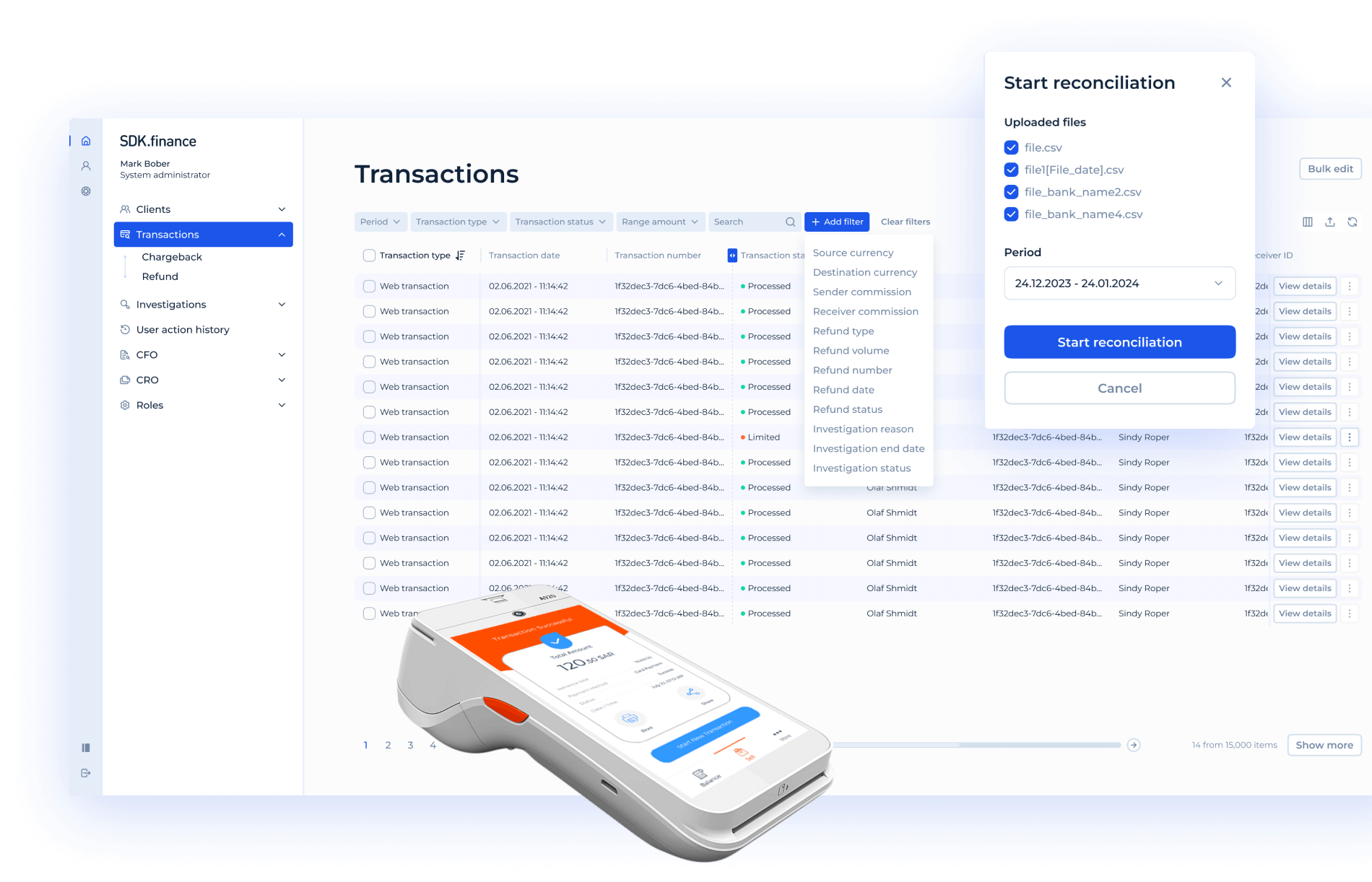

Online and in-store payment acceptance (cards, wallets, bank transfers)

-

Card acquiring integrations (MPGS, CyberSource, etc.)

-

Automatic settlement and payout processing

-

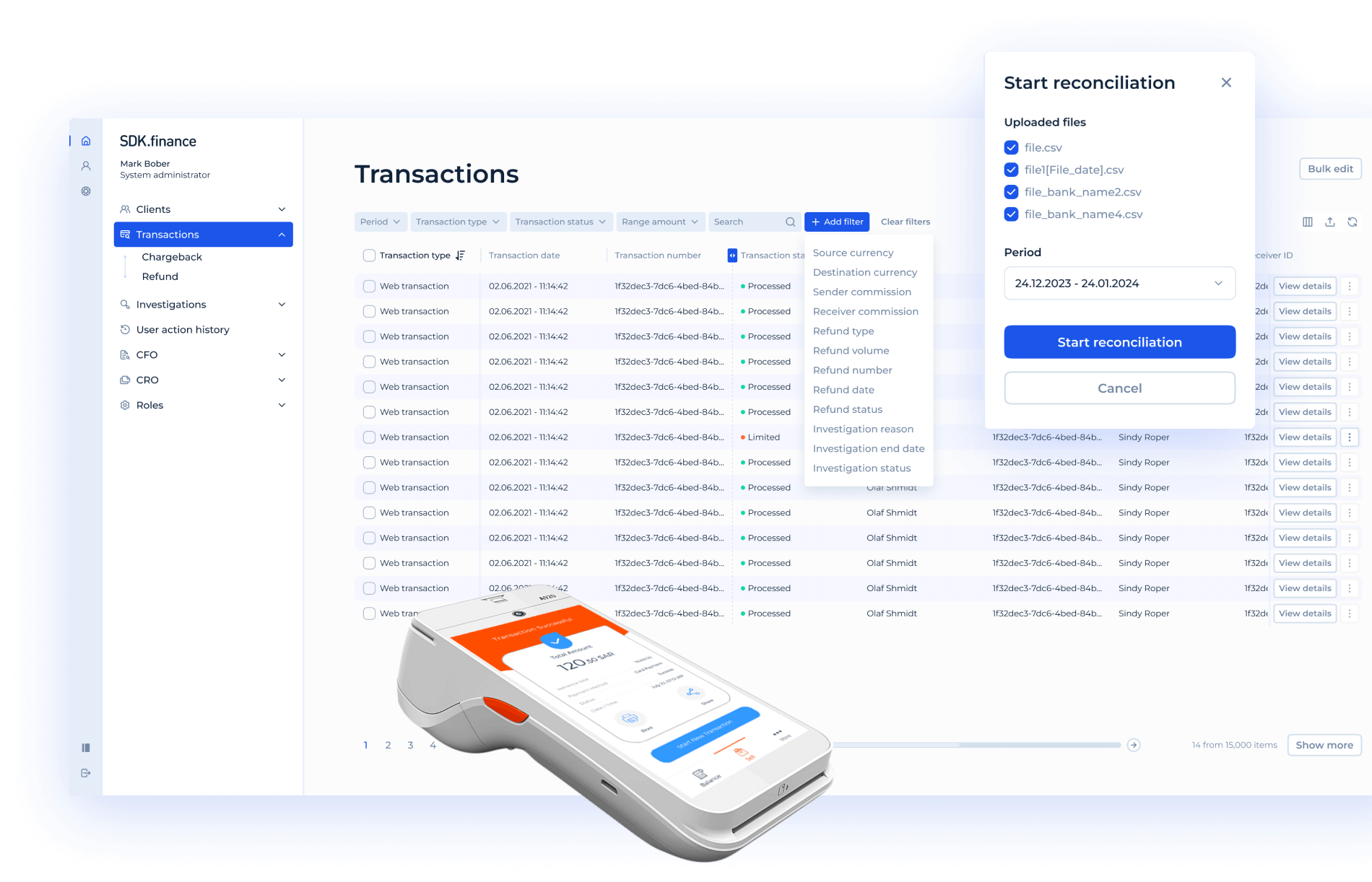

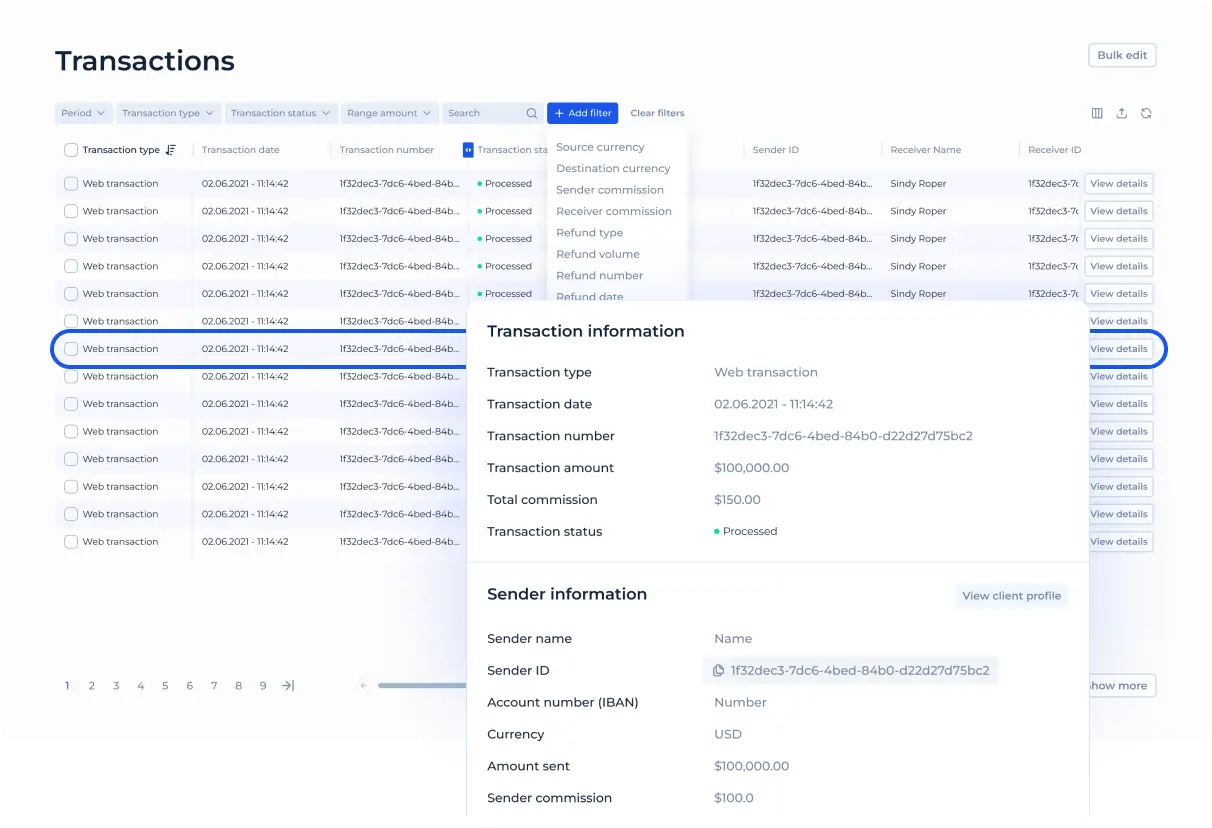

Reconciliation and exception handling dashboard

-

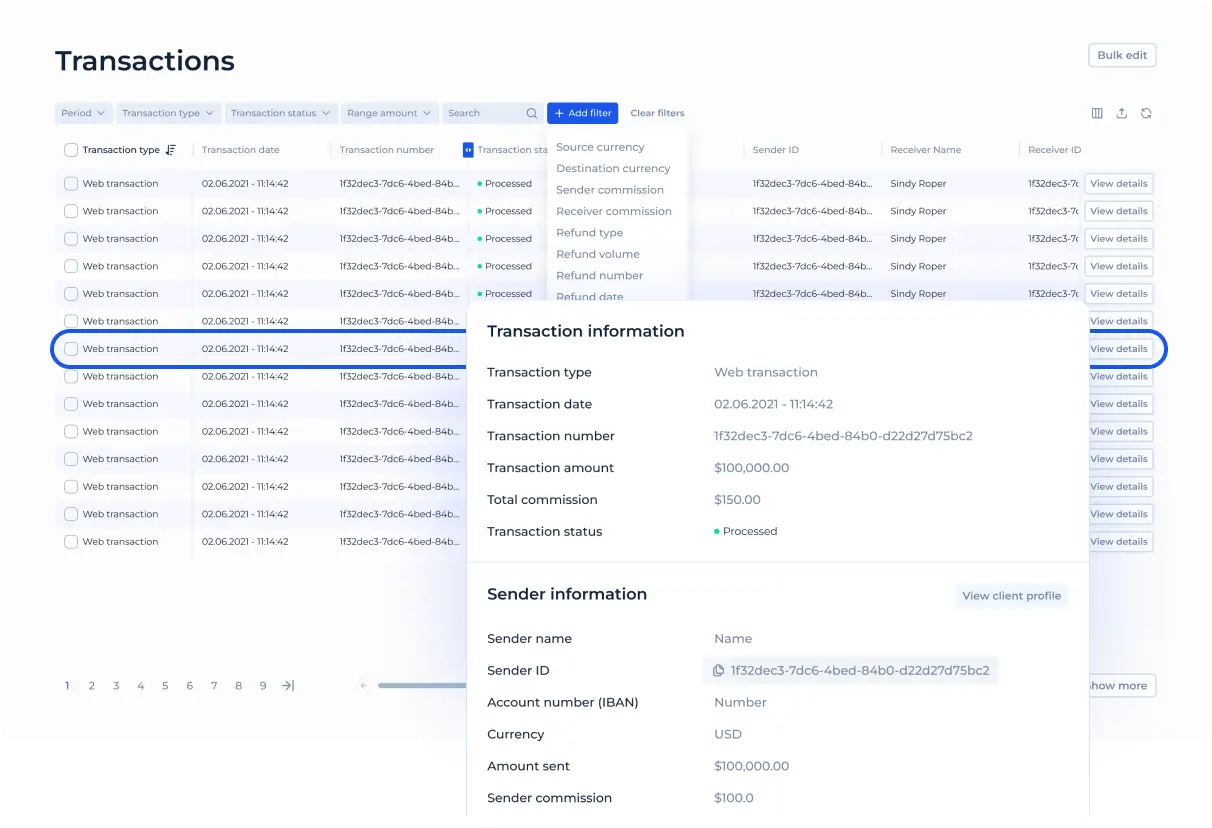

Real-time ledger for accurate transaction tracking

Compliance, Control, and Integration

-

PCI DSS Level 1 certified backend

-

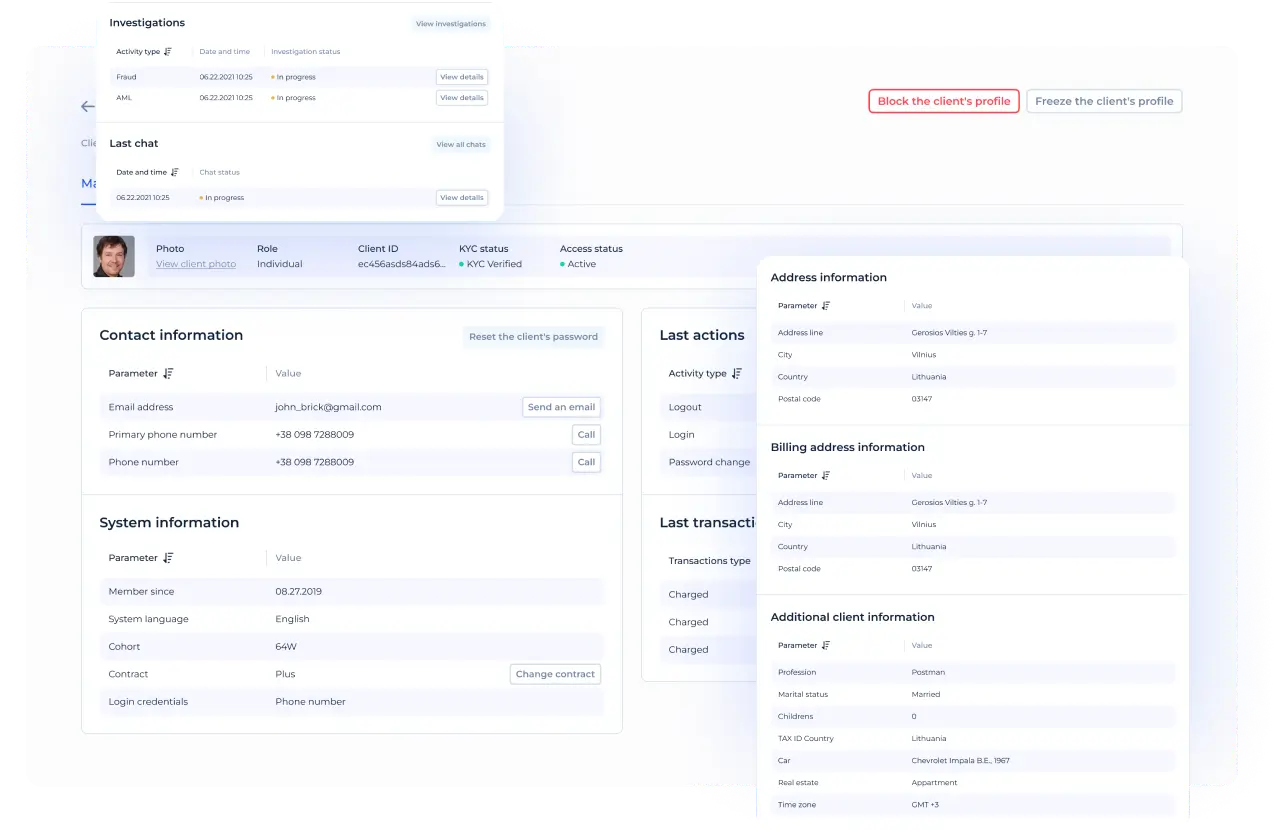

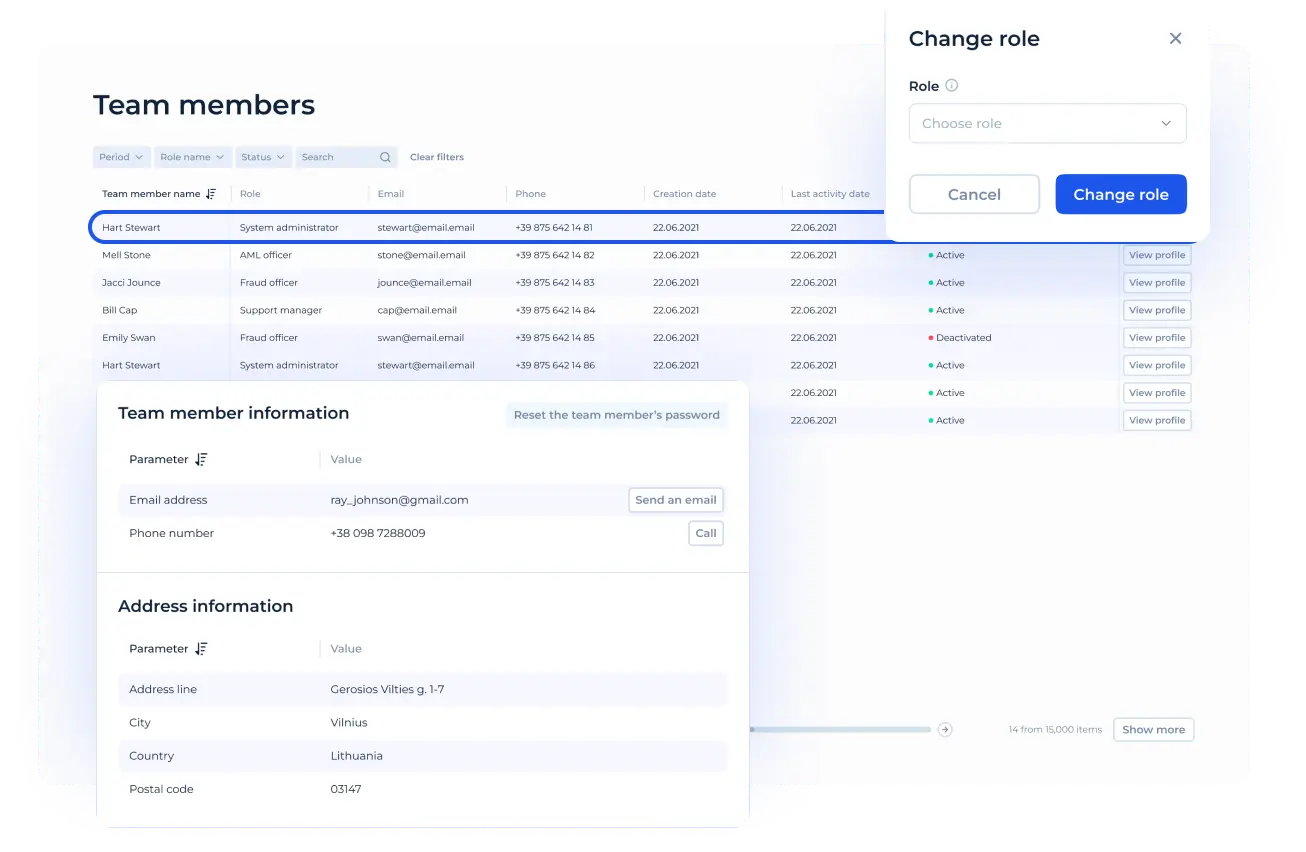

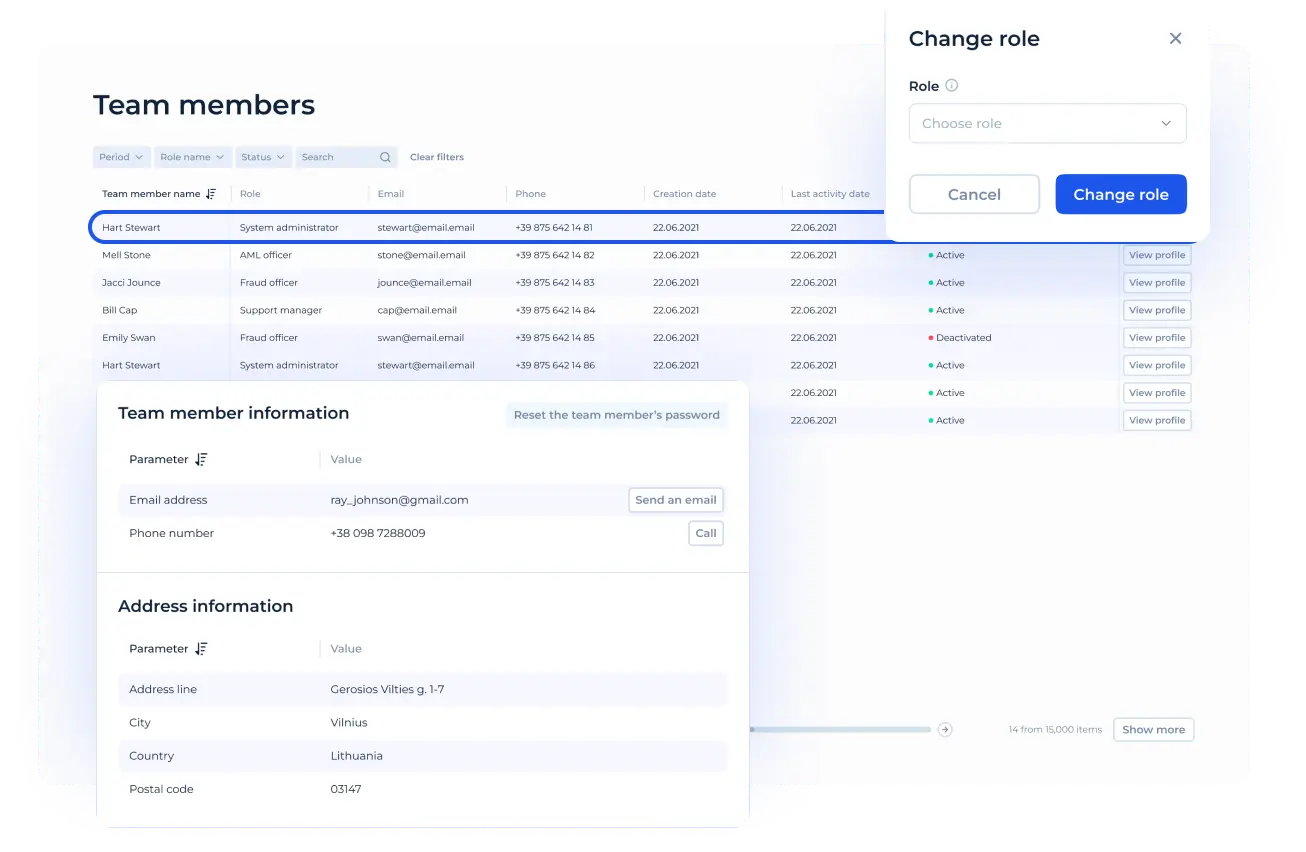

Role-based access for admin, accounting, AML officers

-

REST API ecosystem (470+ endpoints) and webhooks

-

Sandbox for testing integrations

-

On-premise or cloud deployment with optional source code license

What You Can Do with SDK.finance PSP Software

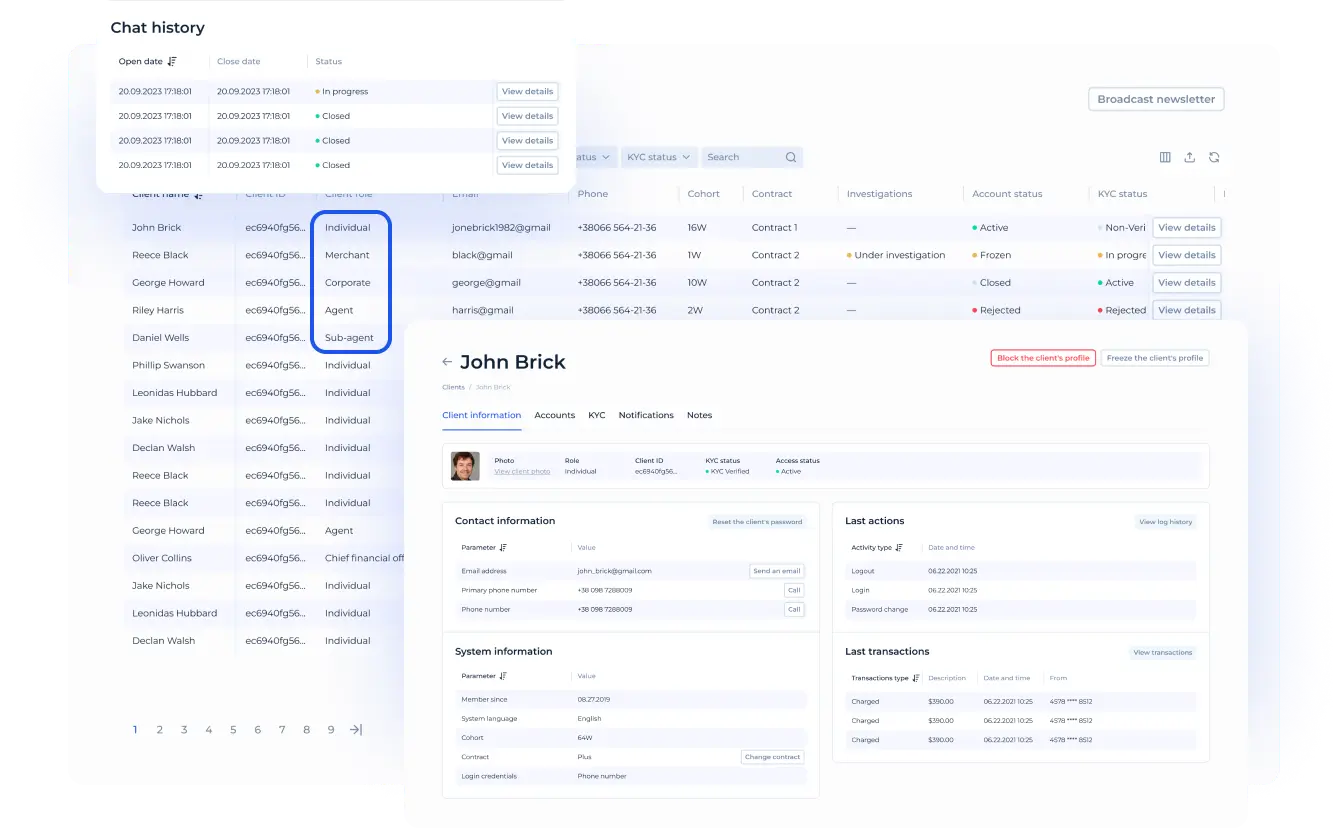

Onboard merchants

Verify and activate them with KYC/KYB flows

Accept Payments

From cards, wallets, or bank transfers via integrated APIs.

Process and route transactions

Through your configured acquirers or payment rails

Settle automatically

Apply commissions and fees per merchant agreement.

Monitor operations

Through an advanced back-office dashboard.

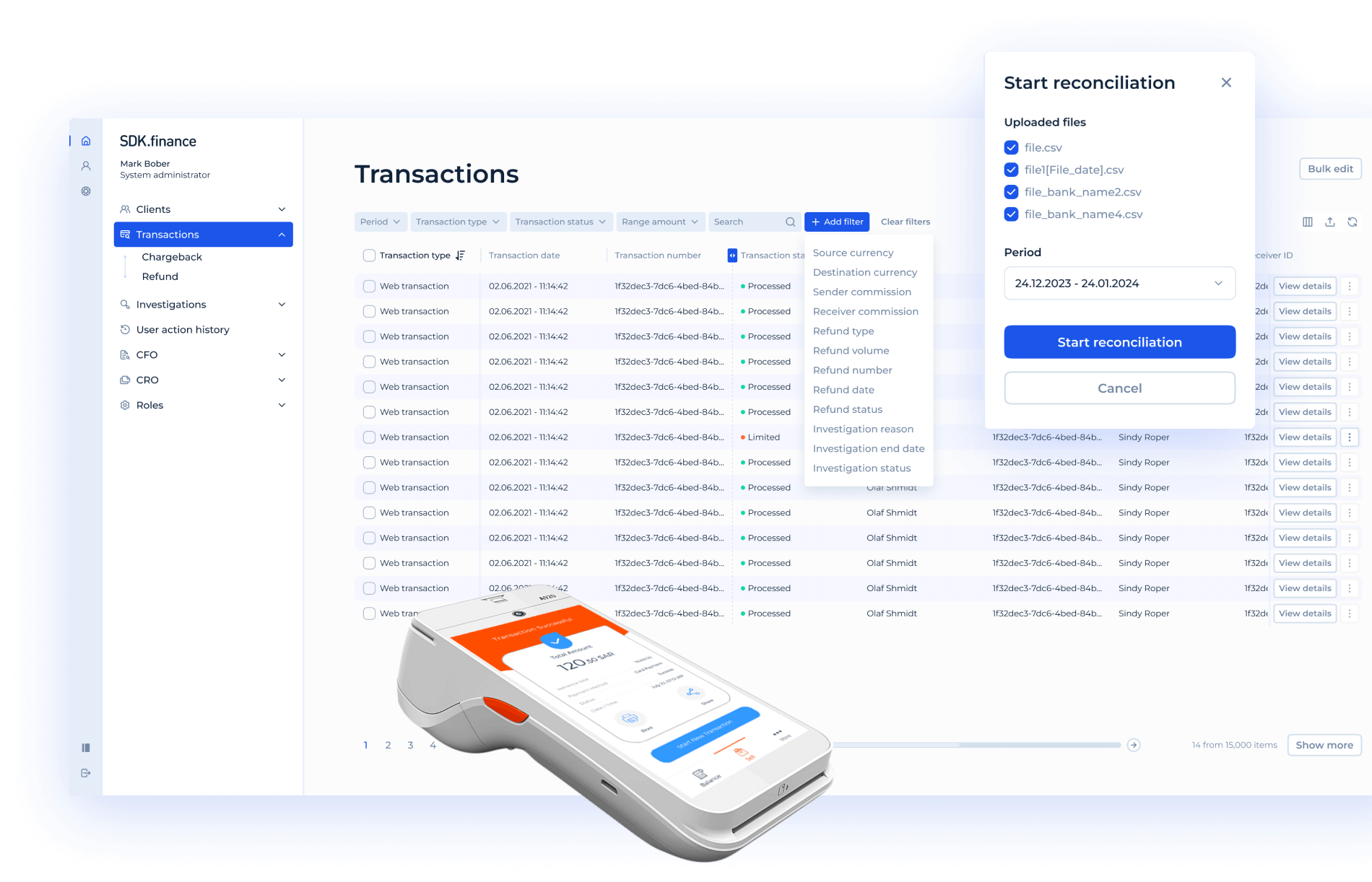

Merchant Portal Powered by SDK.finance

Explore this demo video to discover transactions and balance dashboard, stores management, money withdrawal process and other top features

Who uses SDK.finance PSP software

EMIs

Telecom

Why Companies Choose SDK.finance PSP Software

Own the technology

Get a source code licence for full control over your PSP infrastructure - no vendor lock-in, no dependency on third-party updates.

Accelerated time-to-market

Our pre-built PSP software replaces 18–24 months of internal engineering work. Focus on growth, not infrastructure.

Stay compliant

SDK.finance is PCI DSS Level 1 and ISO 27001:2022 certified, helping you meet key security and regulatory requirements from day one.

Scale globally

From local PSPs to international acquirers — handle thousands of merchants and millions of transactions daily with proven scalability.

Deployment models

Source Code License

AvailableA one-time purchase that provides full ownership of the platform’s codebase. This option is ideal for enterprises and financial institutions that require maximum control, unlimited customisation, and independence from the vendor. With the source code license, you can host the solution on-premise or in your preferred cloud infrastructure.

SaaS

AvailableA subscription-based model designed for startups and growing fintechs that need a quick launch with minimal upfront costs. The SaaS option gives you access to the full white-label PSP software environment, pre-built mobile and web apps, and ongoing updates managed by SDK.finance.

Ready to build your own PSP?

Speed up your go-live with SDK.finance white-label PSP software – the reliable core behind successful payment businesses

White-label Payment Service Provider (PSP) solution FAQ

White-label PSP software is a ready-made payment platform that allows companies to operate as Payment Service Providers under their own brand. With SDK.finance, you get a complete backend for merchant onboarding, payment processing, settlement, and reconciliation – without building everything from scratch.

Choosing white-label Payment Service Provider (PSP) software lets you launch your payment platform faster while keeping full control over your technology and compliance. Instead of spending years developing from scratch, you start with a proven, PCI DSS-certified core that already includes merchant onboarding, payment processing, settlement, and reconciliation. With SDK.finance, you can customise every component, scale globally, and stay audit-ready from day one – all without vendor lock-in.

Unlike typical SaaS vendors, SDK.finance offers both cloud and source code license models. You can own the software, customise it fully, and operate it under your brand – with enterprise-grade performance and compliance built in.