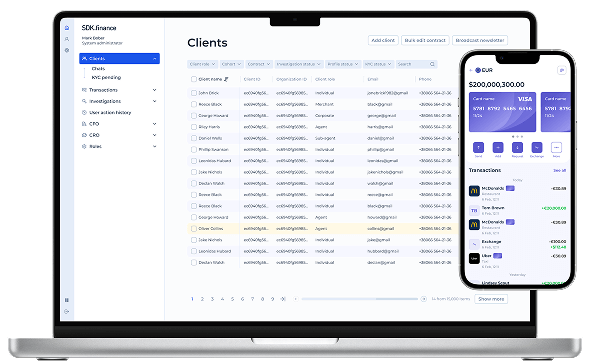

Enterprise-grade FinTech source code license

Build your financial products on a PCI DSS-certified, scalable Platform with full source code ownership. Customise features, integrate with existing systems, and innovate freely – without vendor lock-in.

What you get with the SDK.finance source code license

Faster time-to-market

Launch your financial product in a fraction of the time it takes to build from scratch. Our pre-built core features give you a head start while allowing full customization to meet your specific needs.

Infrastructure of your choice

Benefit from the freedom of hosting the infrastructure wherever you choose, whether on-premise to comply with local regulations or via cloud providers (AWS, Azure, Oracle, GCP, Huawei, IBM Cloud)

Full Platform control

Tailor the Platform to fit your unique business needs without limitations independently from the vendor. Modify existing functionalities, add new ones, and reshape your FinTech solution as your market demands change.

Significant cost savings

Save on development costs and resources and avoid building from scratch. Use our robust foundation and focus on customizations and unique value propositions.

Enhanced security, scalability & performance

With SDK.finance’s source code, you get a ready-made tool built for top-tier security, compliance, and scalability. Plus, you have full control to customize and adjust as your business grows or regulations change.

Robust integration toolset

Leverage our built-in integrations and modular framework, enabling seamless connections with banks, payment gateways, AML/KYC/KYB systems, and card issuing providers of your choice.

Continuous updates

Maintain the ability to customize and scale your solution while benefiting from our regular updates, patches and enhancements.

Why do enterprises choose SDK.finance?

Initial investment

Time to market

Customization

Maintenance & updates

New integrations

Access to expertise

Long-term cost efficiency

Low

Fast

Limited

Limited

Limited

Limited

Varies

Moderate

Fast

Full

Regular

Self-managed

Comprehensive support

High

High

Long

Full

Self-managed

Self-managed

Internal only

Varies

Strategic licensing solutions tailored

to your business goals

We offer licensing options designed to match your preferences,

business model and growth trajectory.

Annual

- Predictable annual expenses

- Lower initial capital expenditure

- Best for enterprises seeking to conserve capital

Lifetime

- Single one-time investment

- No recurring fees, reducing OPEX

- Ideal for companies focused on long-term value

Warranty, updates & expert guidance:

included with both license options

Extended code warranty

Our dedicated support team is ready to resolve any bugs or issues and provide tailored solutions for your unique environment.

Regular updates

Get continuous updates and expert guidance to fully leverage the Platform's potential.

Comprehensive documentation

Thorough documentation to support your team in managing every aspect of the platform with ease.

Knowledge transfer & support for your team

Hands-on training led by our experts with 10+ years of FinTech expertise equips your team to customize the Platform independently.

Code confidence guarantee:

a risk-free license acquisition process

Requirements analysis

Reach out and we’ll map our Platform’s functionality to your specific needs.

Commercial offer

Receive a tailored proposal, negotiate the details, and sign the contract.

Code audit

Evaluate the code and plan your product implementation on the Platform with our experts.

Decision point

Proceed only if the solution meets all your criteria, no strings attached.

Code transfer

Receive the full source code in your private GitLab repository and start development.

Customization and engineering support

Develop at your own pace with the professional engineering support from our experts.

Request a quote

SDK.finance Source Code License FAQs

- You purchase the digital wallet source code license and get the freedom of modifications as you see fit.

- Your team can customize the ready-made ewallet software so that it meets all regulatory, security and compliance standards.

- You start off having an essential part of your product at hand – a robust wallet engine designed to be easily extended via integrations, virtually without limits.

Yes, we offer video demos of the backoffice for your team and mobile app for your clients. Both available there and then, no waiting.

If you need more details or have any questions, do reach out to us and we’ll be in touch with you shortly.

SDK.finance architecture allows integrating any 3rd-party tools for each stage of the customer journey.

See all the pre-developed integrations.

For your custom integration requirements, our 470+ RESTful API set makes it easy to build integrations with third-party providers of your choice.

For details on the technologies used for our FinTech white label platform, visit our technology page.

A FinTech source code is a set of pre-built software components designed to facilitate the development of financial technology applications. These applications can range from online banking systems and mobile banking apps to digital payment platforms. By providing a robust foundation, FinTech source codes enable developers to create secure, scalable, and user-friendly financial applications without starting from scratch. This allows for greater focus on customization and innovation, ensuring that the final product meets the specific needs of the financial institution or application.

A FinTech source code typically includes a range of features that are essential for building comprehensive financial applications. These features include:

- Account Management System: Allows users to manage their accounts, view transaction history, and perform fund transfers with ease.

- Seamless Integration: Enables integration with third-party solutions such as payment gateways, credit scoring services, and more, ensuring a smooth and efficient operation.

- Mobile Banking: Provides a mobile-friendly interface, allowing users to access their accounts and perform transactions on-the-go using their mobile devices.

- Security: Incorporates robust security measures, including encryption and two-factor authentication, to protect user data and prevent fraud.

- Customization: Offers developers the flexibility to tailor the source code to meet the specific needs of their financial institution or application, ensuring a personalized user experience.