Traditional banks rely on massive core banking systems to handle everything from accounts to transactions. Coreless banking is a new approach that breaks away from this monolithic system, providing a more agile and adaptable solution for the development of new features and functionalities.

In our article, we explore what coreless banking is, its benefits and drawbacks, and find out the difference between core and coreless banking.

What is coreless banking?

Coreless banking is a modern banking model that operates without a traditional physical branch network or a central physical location. It focuses on providing services primarily through online platforms, mobile apps, and other digital channels instead of brick-and-mortar branches.

This banking model separates the core banking functions, such as account management and transaction processing, from the front-end channels like mobile apps and online banking. Banks utilize a modern, cloud-based core banking system that allows them to be more agile and adaptable in developing new features and functionalities.

Here’s the gist of coreless banking:

- Modular design: Instead of one giant system, coreless banking uses separate, smaller services for each function.expand_more This makes it more agile and easier to update.

- APIs: These services communicate with each other and external apps through APIs (application programming interfaces). This allows for easier integration of new features and FinTech products.

- Cloud-based: Coreless banking often runs on the cloud, which means it’s scalable and accessible from anywhere.

Overall, coreless banking aims to make banks more efficient and innovative, allowing them to offer a wider range of digital services to customers.

Benefits of coreless banking

Revolutionizing banking is a potential outcome of coreless banking. The key factor that makes it possible is speed. Implementing a banking core is a lengthy process, making it time-consuming to change anything.

For instance, if a bank operates on a legacy core banking platform and needs to change, it requires a change request and a substantial budget. However, with the coreless approach, banks can replace specific modules and make changes as needed, reducing risk and increasing the time to market.

Coreless banking offers several advantages for both banks and their customers. Here are some of the key benefits:

Faster innovation

The modular design and API-based structure of coreless banking allow banks to integrate new features and functionalities easily.

Reduced costs

Coreless banking often eliminates the need for expensive maintenance of legacy systems. Additionally, the cloud-based nature can further reduce infrastructure costs.

Enhanced scalability

Unlike monolithic systems, coreless banking can easily scale up or down based on demand, ensuring smooth operation during peak periods.

Improved customer experience

Coreless banking facilitates the development of user-friendly mobile apps and online platforms. This can lead to faster processing times, more intuitive interfaces, and a more satisfying overall experience for customers.

While coreless banking offers various advantages, its implementation can present complex challenges that necessitate a sufficient level of standardization to mitigate any potential risks of failure.

Challenges for coreless banking

Challenge: Security concerns as coreless banking systems depend heavily on cloud-based infrastructure.

Solution: Robust security measures are essential, including encryption, access controls, and continuous monitoring for vulnerabilities.

Challenge: Inadequate API security measures could leave these interfaces vulnerable to attacks by malicious actors.

Solution: Implementing strong authentication protocols, authorization controls, and regular penetration testing are crucial to mitigate these risks.

Challenge: Regulatory considerations as coreless banking involve data sharing between multiple entities.

Solution: Companies need to ensure strict adherence to data privacy regulations like GDPR and CCPA to maintain compliance.

Challenge: Consumer data protection

Solution: Existing data privacy frameworks may need adaptation to address potential risks associated with coreless models.

Core banking vs coreless banking: what is better?

Determining whether core banking or coreless banking is “better” depends on various factors, including individual preferences, the specific needs of customers, and the strategic goals of financial institutions.

The key difference between core banking and coreless banking lies in their system architecture and approach to innovation.

Core banking:

- Monolithic system: Relies on a single, large software suite for all banking functions. This makes it complex and slow to update.

- Limited agility: Adding new features or functionalities is difficult and time-consuming due to the interconnected nature of the system.

- Less scalable: Expanding the system to accommodate growth can be expensive and challenging.

Coreless banking:

- Modular design: Utilizes separate, smaller services for each banking function (accounts, transactions, etc., providing flexibility and easier updates.

- Highly agile: New features and functionalities can be integrated quickly through APIs.

- Highly scalable: The system can easily scale up or down based on demand by adding or removing modules.

In simpler terms, core banking is like having one giant machine for all your banking needs. Updating or expanding it is a complex task. Coreless banking, on the other hand, is like having a set of specialized tools for each function. This makes it easier to modify, adapt, and improve the system.

Coreless banking vs BaaS: what is the difference?

While core banking and coreless banking focus on internal operations, Banking as a Service (BaaS) shifts the focus toward innovation by offering pre-built banking functionalities

Banking as a Service (BaaS) and coreless banking are two separate concepts in the financial industry, with their unique characteristics and implications.

Coreless banking focuses on modernizing a bank’s core systems to improve efficiency and facilitate faster innovation.

On the other hand, BaaS offers pre-built banking functionalities for FinTech companies to incorporate into their apps, allowing them to create innovative financial products and services.

| Feature | BaaS | Coreless banking |

| Focus | Building new financial products & services | Revamping internal banking systems |

| Approach | Provides pre-built functionalities for integration by third parties | Modernizes core banking infrastructure for efficiency and innovation |

| Target audience | FinTech companies, non-banking institutions | Traditional banks |

| Result | Improved in-house banking operations and new features for the bank’s customers | Innovative financial products and services offered by non-traditional players |

As we explore the differences between coreless banking and Banking as a Service, it’s crucial to understand how these concepts shape the financial landscape.

Looking ahead, the future of coreless banking holds promises of increased efficiency and agility within traditional banking institutions.

The future of coreless banking

Coreless banking has the potential to be a game-changer for the financial services industry. By overcoming the existing challenges and leveraging its inherent advantages, it can pave the way for:

- Hyper-personalized financial experiences: Coreless banking’s flexibility allows banks to tailor products and services to individual customer needs in real time. Imagine receiving loan offers based on your spending habits or automated savings plans that adapt to your financial goals.

- Deeper integration with FinTech: The open and collaborative nature of coreless banking fosters seamless integration with innovative FinTech solutions. This could lead to a wider range of financial products and services being readily available to customers through a single platform.

- Empowering new players: The lower barrier to entry for coreless banking could empower new players, like challenger banks and non-traditional financial institutions, to disrupt the market. This increased competition can ultimately benefit consumers by driving innovation and offering more competitive rates and fees.

Trends in coreless banking technology

- Advanced AI and machine learning: Leveraging AI for fraud detection, personalized recommendations, and automated financial management can further enhance security and customer experience.

- Focus on open banking: Open APIs are likely to become even more standardized, allowing for even greater interconnectivity between financial institutions and third-party providers.

- Enhanced security measures: As coreless banking evolves, robust security solutions like blockchain technology and biometrics could become more widely adopted to address security concerns.

Therefore, coreless banking presents a future filled with possibilities. By embracing this innovative approach, financial institutions can create a more efficient, agile, and customer-centric landscape that empowers individuals to better manage their finances and unlocks a new era of financial services.

SDK.finance coreless banking solution

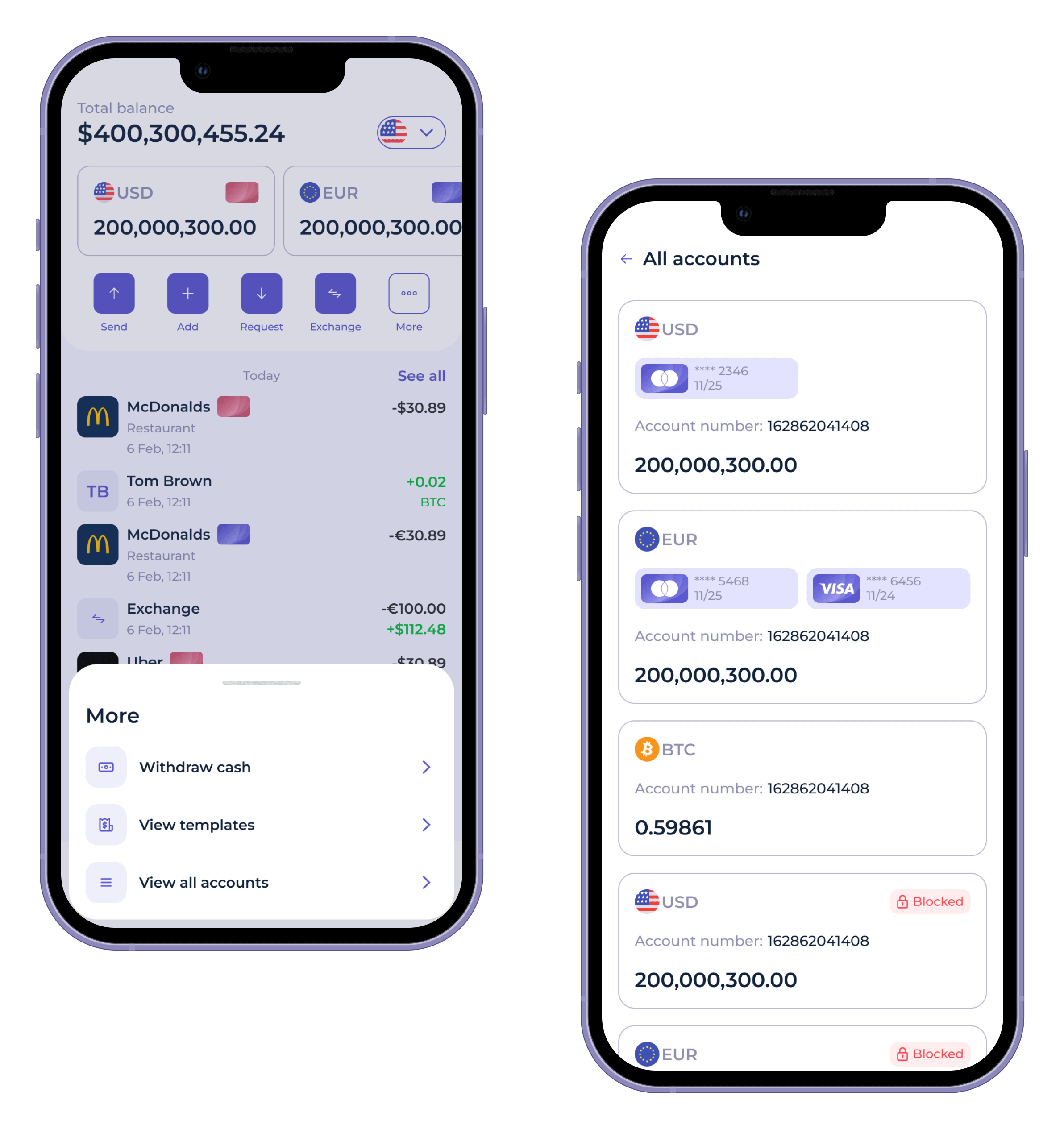

SDK.finance FinTech Platform is a scalable solution for launching digital payment products like neobanks, digital wallets, payment acceptance systems, and money transfer platforms. Instead of building everything from scratch, you can leverage SDK.finance’s pre-built software with 400+ API endpoints to jumpstart your coreless banking offerings.

SDK.finance offers various modules catering to specific financial services such as payments, transfers, remittances, and more.

With SDK.finance, companies can swiftly launch digital banking or payment solutions without building core financial functionalities from scratch, accelerating their time to revenue.

Our FinTech Platform comes with pre-integrated vendors for essential features such as payment acceptance, card issuance, and KYC compliance, streamlining the integration process for your financial operations.

So, the SDK.finance Platform acts as a coreless banking solution, providing businesses with the tools to build financial apps and services, while expediting development and reducing costs.

References:

The article is based on insights from Pavlo Sidelov, the founder of SDK.finance.