Before diving into a comparison of Avaloq and FIS, it’s worth exploring a broader set of options in today’s evolving core banking landscape. If you’re seeking a wider perspective on available solutions, start with our Top Core Banking Software List.

As financial institutions modernise their infrastructure, many find themselves comparing Avaloq and FIS – two longstanding players in the core banking technology market. But for many mid-size banks, fintech startups, and non-financial enterprises expanding into embedded finance, the question isn’t just Avaloq vs FIS, but whether there are better-fit alternatives tailored to faster deployment, ownership, and cost-efficiency.

In this article, we’ll explore the strengths and limitations of Avaloq and FIS – and introduce SDK.finance as a flexible, API-first alternative built for today’s digital finance demands.

Avaloq: Core Banking for Private and Retail Banking

Avaloq’s core banking platform used by LGT, Deutsche Bank, and Barclays, among many others, offers optimized efficiency and future-proofed software. With more than 70 modules and digital solutions, the highly modular platform can be seamlessly integrated and scaled to best match the needs of a client.

Avaloq’s core banking platform used by LGT, Deutsche Bank, and Barclays, among many others, offers optimized efficiency and future-proofed software. With more than 70 modules and digital solutions, the highly modular platform can be seamlessly integrated and scaled to best match the needs of a client.

Avaloq is widely used in private banking and wealth management, known for its deep functionality and Swiss pedigree in compliance and data security. Its platform offers core banking, digital banking, and wealth solutions. The platform excels at reducing redundancies and streamlining back-office operations, so staff can focus on high-value tasks while clients receive superior digital service.

Strengths:

-

Strong focus on wealth and private banking

-

Integrated core and digital banking suite

-

Backed by NEC, providing enterprise-grade infrastructure

Limitations:

-

Costly implementation and long project cycles

-

Customisation often tied to Avaloq’s proprietary ecosystem

-

Primarily suitable for larger banks with complex requirements

FIS: Legacy Strength Meets Financial Services Scale

FIS (Fidelity National Information Services) serves a broad market, with solutions spanning core banking, card processing, payments, and risk management. It is best known for scale and resilience across financial verticals.

FIS helps banking institutions of all sizes to implement a fully integrated core banking system or complement legacy infrastructure with critical components. The cloud-native banking platform was designed with API-first functionality that allows banks to lower costs, reduce IT burden, manage regulatory demands, and easily launch new products.

FIS offers modern design, personalized products and services, and low fees to attract and bring customers in. With the FIS core, banks can meet rising consumer expectations and become more agile while staying on top of regulatory changes.

Strengths:

-

Comprehensive product suite (core, cards, lending, fraud)

-

Proven track record in high-volume environments

-

Global presence and support infrastructure

Limitations:

-

Legacy system complexity makes integration and flexibility harder

-

Difficult for fast-moving fintechs or smaller banks to adapt quickly

-

Tends to suit institutions with multi-year digital transformation budgets

SDK.finance: Modern Alternative with Full Ownership and Flexibility

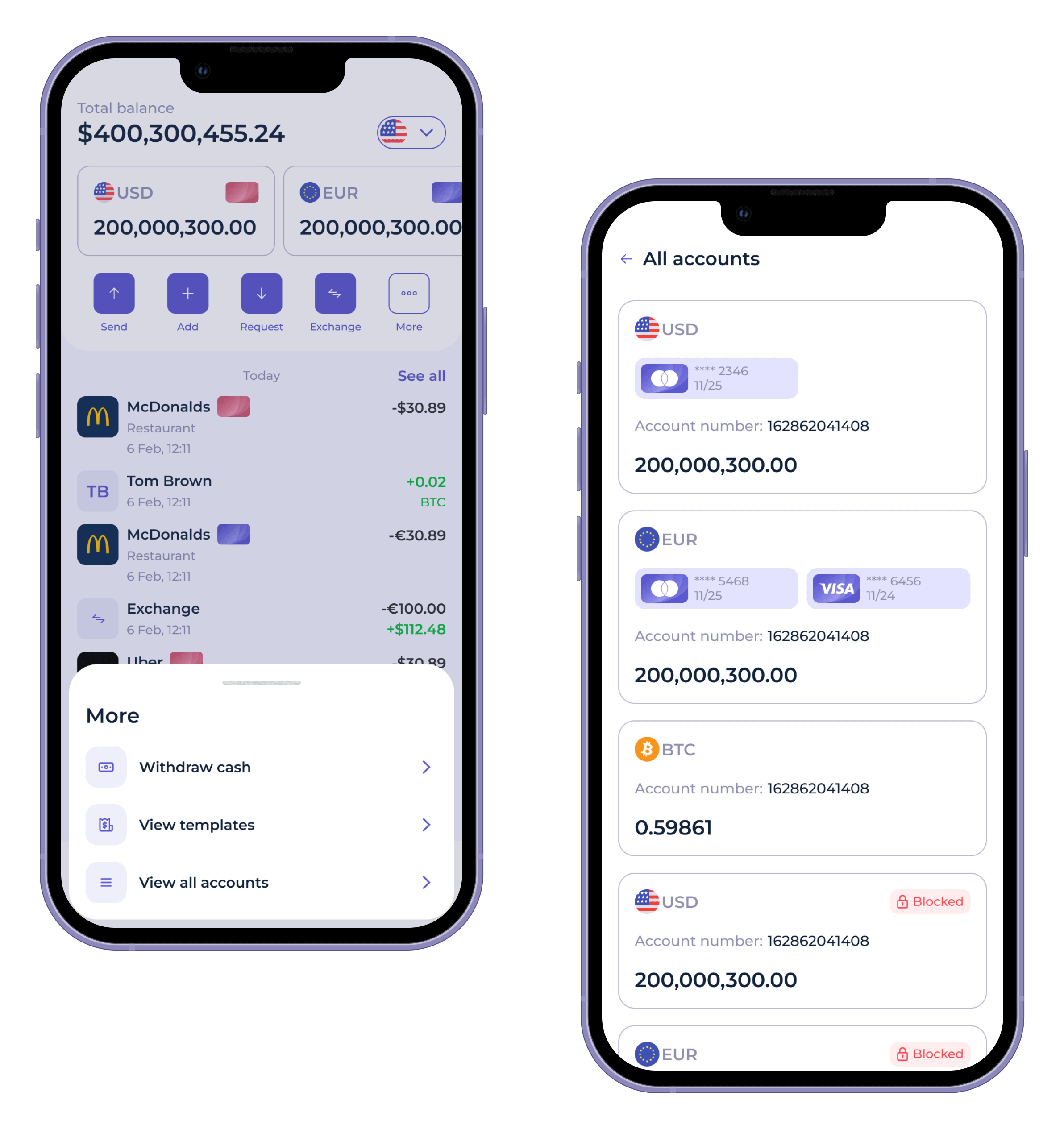

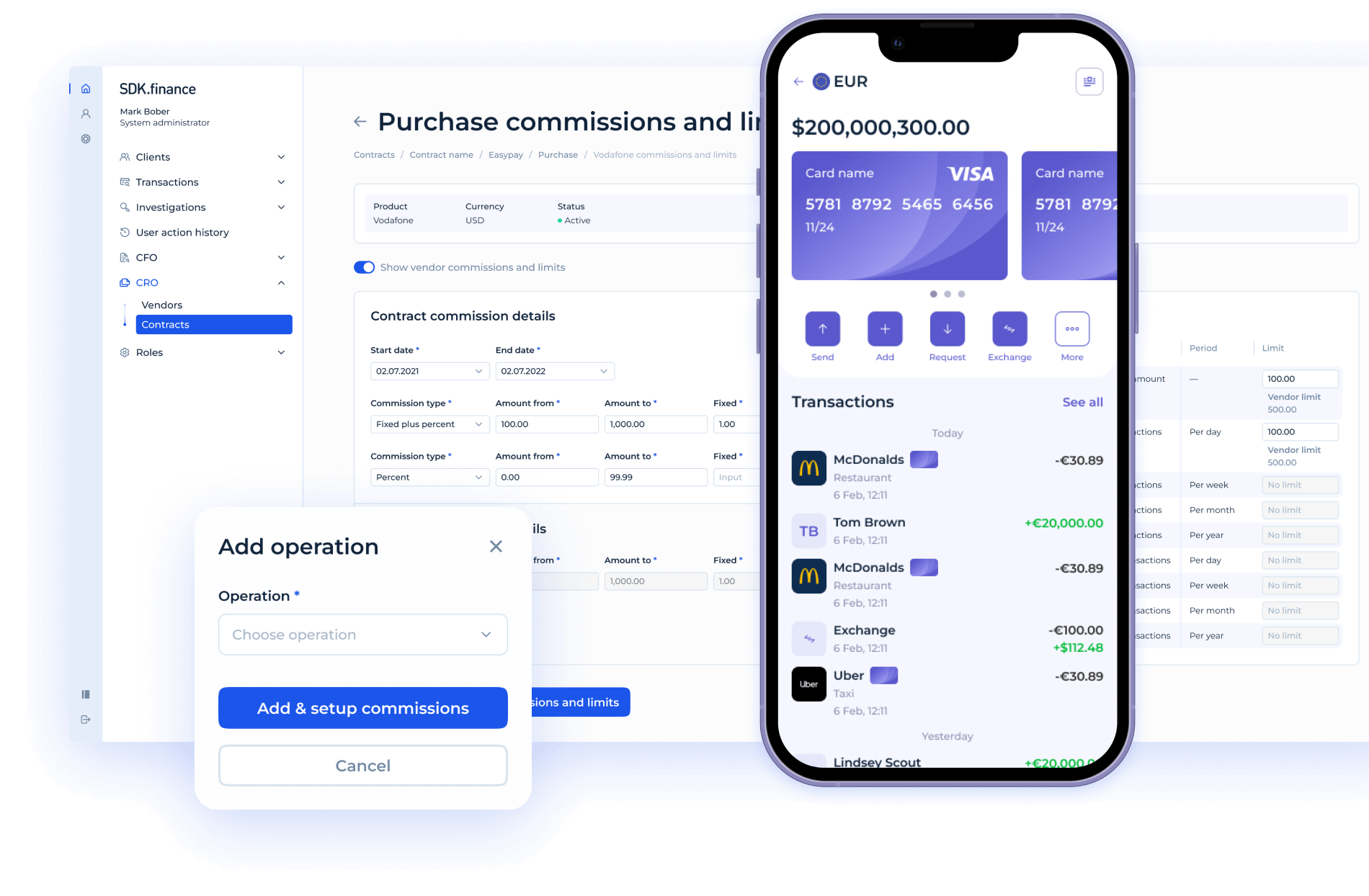

Image source: SDK.finance core banking frontend interfaces

Why SDK.finance Is Worth Considering?

SDK.finance offers a white-label FinTech Platform designed for institutions seeking agility without compromising performance. Built on a modular, API-first architecture, it enables fast launches of banking and payment solutions—ranging from digital wallets and neobanks to merchant payment platforms.

Key Differentiators:

-

Source Code License available for complete product ownership and modification—ideal for teams looking to build proprietary systems without vendor lock-in.

-

PaaS Subscription Model for faster time-to-market with reduced upfront costs.

-

Scalable performance: handles 2,700+ TPS and up to 233 million daily transactions.

-

Ledger-based architecture for multi-asset support: fiat, crypto, loyalty, or custom-defined units.

-

Built-in support for KYC/AML, multi-currency wallets, real-time transactions, role-based permissions, and merchant services.

-

PCI DSS Level 1 compliant; includes over 470+ RESTful APIs for easy third-party integration.

Ideal for:

-

FinTechs launching new products

-

Enterprises embedding finance into existing ecosystems

-

Banks modernising legacy systems in a phased manner

-

Super apps integrating digital payments, ride-hailing, delivery, etc.

Feature Comparison Table

| Feature / Vendor | SDK.finance | Avaloq | FIS |

|---|---|---|---|

| Customisation level | High (source code or PaaS) | Medium (within ecosystem) | Low to medium |

| Deployment options | Cloud/Source code with full access | On-prem / Cloud | On-prem / Cloud |

| Speed to market | 3–6 months | 12–24 months typical | 12+ months |

| Target customers | FinTechs, banks, non-banks | Private & retail banks | Large banks, FIs |

| Licensing model | PaaS or one-time source code purchase | Subscription | Subscription |

| Pre-integrated vendors | Multiple PSPs, KYC, card issuers, crypto | Limited | Extensive but locked-in |

| Transaction throughput | High | High | High |

| Real-time processing | ✓ Yes | ✓ Yes | ✓ Yes |

| Multi-asset support | ✓ Fiat, crypto, loyalty, custom assets | Limited | Moderate |

| Other selling products | Core banking, digital wallets, neobank, crypto-to-fiat apps, merchant payment processing, super apps, embedded finance, transaction processing | Wealth management, core banking | Core banking, card issuing, fraud prevention, lending |

When to Choose SDK.finance Instead

You should consider SDK.finance over Avaloq or FIS if:

-

You’re looking for faster deployment with flexible ownership options.

-

You need to launch a wallet, neobank, or embedded finance product quickly and cost-efficiently.

-

Your team wants to own the codebase and avoid long-term vendor lock-in.

-

You serve emerging markets or super app use cases that require adaptability, not rigid legacy platforms.

-

You need full back-office capabilities, real-time reporting, and compliance tools out of the box.Final Thoughts

While Avaloq and FIS remain robust choices for large, traditional banks with extensive requirements and longer project timelines, they may not be the best fit for every organisation.

SDK.finance offers a strong alternative for those seeking faster speed to market, lower TCO, greater control over their stack, and a flexible path to innovation in digital finance.