Crypto providers are essential for building modern wallets, banking, and on-ramp solutions. Crypto products have moved far beyond simple trading apps. Today, companies launch crypto wallets, crypto banking products, embedded on-ramps, and multi-asset financial services that combine fiat and digital assets in a single experience. Supporting multiple currencies – including both cryptocurrencies and fiat currencies like USD, EUR, and GBP – is essential to provide flexibility for users and businesses, enable instant conversion, and reduce exposure to volatility.

In emerging markets, where traditional banking infrastructure may be lacking, crypto and stablecoin solutions can offer instant settlement and increased financial inclusion. Blockchain payments are increasingly used for stablecoin checkout processes, though challenges remain around user experience and features like refunds and subscriptions.

What many decision-makers underestimate is that these products are rarely built as a single system. Instead, they are assembled from specialised infrastructure providers, each responsible for a very specific part of the stack. Each block is usually provided by a different specialist vendor. Using different providers can help diversify custodial services, reduce operational and counterparty risks, and enhance compliance strategies. Custody providers secure private keys. Exchanges and liquidity providers handle pricing and execution. On-ramp and off-ramp providers connect crypto to traditional payment rails. Blockchain infrastructure providers ensure reliable access to public networks.

Platforms such as SDK.finance sit above these components. They provide the ledger, accounting logic, transaction orchestration, and operational controls that turn disconnected crypto technologies into a regulated, manageable financial product. With one platform, organizations can integrate compliance, multi-currency and fiat currency support, and operational workflows to streamline the management of complex financial products.

This guide provides a comprehensive overview of crypto providers and their roles in building wallets, banking, and on-ramp solutions. It is designed for founders, product leaders, and executives seeking to understand the infrastructure landscape and make informed decisions. Understanding these providers is crucial for launching secure, compliant, and scalable crypto products.

Everything you need to launch crypto wallets, payments, and custody

Learn moreKey Terms and Concepts Explained First

What is crypto wallet infrastructure?

Crypto wallet infrastructure is the backend system that manages balances, transactions, custody integration, and blockchain connectivity.

What is crypto banking software?

Crypto banking software refers to platforms that combine crypto asset management with banking-style ledgers, accounts, compliance workflows, and fiat integration.

Before looking at providers, it is important to align on terminology. Many misunderstandings in crypto projects come from mixing up these concepts:

| Term | Definition |

|---|---|

| Tokens | Digital assets issued on blockchain networks. Tokens can represent money (like stablecoins), access to services, or other digital value. Most crypto platforms support many different tokens across multiple blockchains. |

| Ledger | The internal accounting system of a crypto product. It records who owns what, tracks balances and transactions, and is used for reporting and compliance. The ledger exists inside the platform, not on the blockchain. |

| Custody | The secure holding and control of crypto assets through private keys. Whoever controls the private keys controls the assets, which is why professional custody providers are used instead of managing keys internally. |

| Liquidity | The ability to buy or sell crypto at a stable price and in sufficient volume. Liquidity is required for swaps, conversions, and user transactions and is usually provided by exchanges or brokers. |

| On-ramp / Off-ramp | Services that allow users to move money between traditional finance and crypto. On-ramps convert fiat money into crypto, while off-ramps convert crypto back into fiat. |

| Crypto payments |

Digital currency transactions enabled by payment gateways, allowing businesses to accept cryptocurrencies. Features include support for multiple coins, settlement options, international coverage, and enhanced security for integrating crypto payments into existing systems. |

| Blockchain infrastructure |

The technical connection to blockchain networks. It allows the platform to check balances and send transactions, similar to how internet infrastructure connects applications to online services. |

Why Crypto Products Depend on External Infrastructure Providers

Blockchains are not designed to run financial products. They do not manage user permissions, account balances, refunds, chargebacks, or regulatory reporting. They only move assets between addresses.

Because of this, crypto products are split into two worlds:

- Off-chain systems, where accounting, compliance, and user management live.

- On-chain systems, where settlement and asset transfers happen.

External infrastructure providers bridge these two worlds. They reduce operational risk, speed up delivery, and allow teams to focus on product logic instead of low-level cryptography.

Relying on specialized providers solves three critical problems:

- Security & Liability: Storing private keys requires military-grade hardware and procedures (HSMs, MPC). Outsourcing this shifts the burden of key management to firms with SOC 2 Type 2 certifications and insurance policies.

- Regulatory Coverage: Many providers hold trust charters or money transmitter licenses, offering a regulatory umbrella for activities like custody and fiat conversion. It is important to verify the specific legal entity that holds these licenses, as compliance with regulatory requirements depends on the legal entity’s structure and jurisdiction.

- Speed to Market: Integrating a unified API for 50+ blockchains is faster than running and maintaining nodes for each individual protocol.

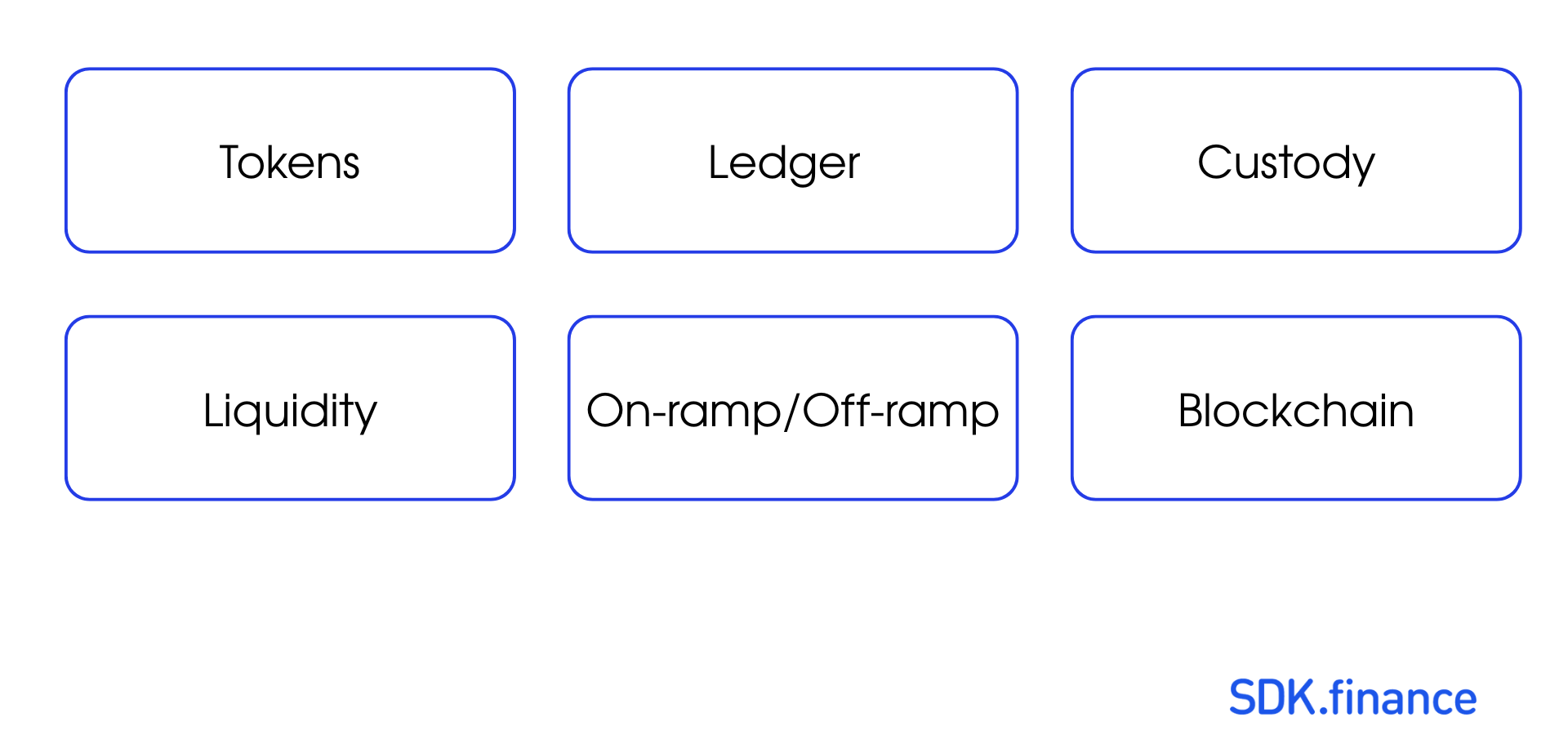

Typical crypto components in modern FinTech products

Most production-grade crypto products include the following building blocks:

- Ledger and product logic, which tracks balances and business rules.

- Custody infrastructure, which secures private keys and signs transactions.

- Liquidity and pricing, which enables conversion between assets.

- On-ramp and off-ramp services, which connect crypto to fiat money.

- Blockchain connectivity, which submits and monitors on-chain transactions.

Each block is usually provided by a different specialist vendor.

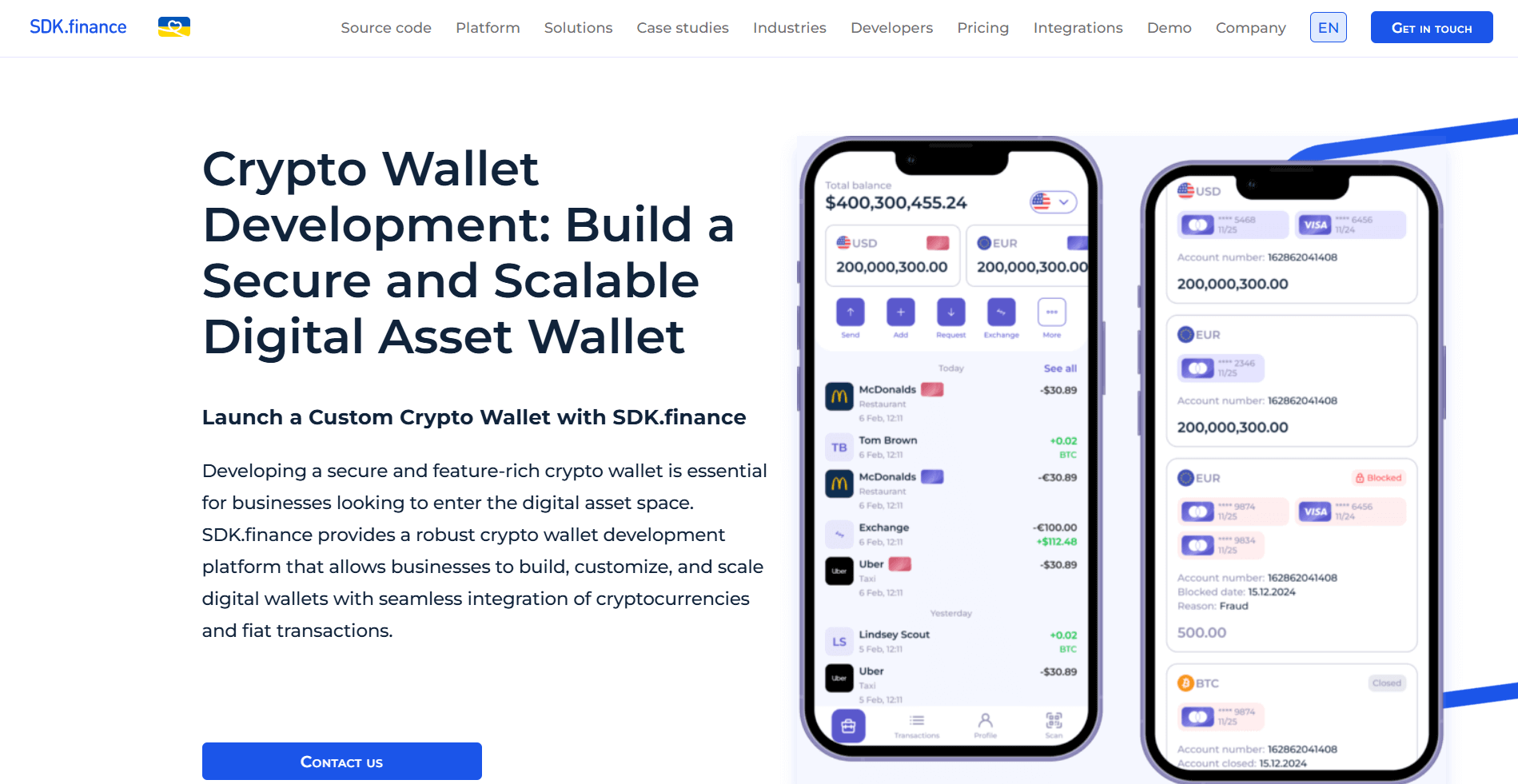

SDK.finance crypto wallet infrastructure for FinTech and banking platforms

SDK.finance provides the core banking and ledger layer for crypto-enabled products. It acts as the system of record that tracks user balances, manages internal transactions, and handles accounting and operational workflows.

The Platform does not hold crypto assets or execute trades itself. Instead, it connects to specialised providers:

- Custody providers such as Fireblocks or BitGo for blockchain transactions.

- Liquidity providers such as Kraken for pricing and execution.

- On-ramp and off-ramp providers for fiat deposits and withdrawals.

This approach allows companies to launch a white-label crypto wallet or crypto banking product quickly, without building core infrastructure from scratch. SDK.finance is available as a SaaS solution for fast deployment or under a source code license for full control and customisation.

Its modular architecture makes it possible to change providers over time as volumes grow or regulatory needs evolve, without rebuilding the core system.

Everything you need to launch crypto wallets, payments, and custody

Learn moreRegulatory Framework: Navigating Compliance in Crypto Infrastructure

Navigating the regulatory landscape is one of the most significant challenges for institutions operating in the digital asset space. Crypto infrastructure must comply with a patchwork of laws and regulatory requirements that vary across jurisdictions and evolve rapidly. In the United States, for example, companies dealing with crypto assets must adhere to anti-money laundering (AML) and know-your-customer (KYC) regulations, register with agencies like FinCEN, and ensure compliance with securities laws enforced by the SEC.

For institutional clients, working with providers that have obtained the necessary regulatory approvals and licenses is essential to mitigate risks and ensure the lawful transfer of assets and money. By partnering with regulated companies, institutions can confidently operate across multiple jurisdictions, knowing their providers have the legal entity structure and licenses required to support compliant operations. This approach not only protects clients and assets but also streamlines the process of adapting to new regulatory developments as the crypto industry matures.

Risk Management: Addressing Threats and Vulnerabilities in Crypto Solutions

Effective risk management is at the core of any successful crypto operation. Institutions must proactively identify and address threats to their digital assets, from cyberattacks to operational failures.

Beyond technical security, institutions should adopt comprehensive risk management strategies such as diversification of assets, regular audits, and robust incident response plans to further mitigate risks. By leveraging the expertise and reliability of experienced providers, institutions can ensure the integrity of their operations and the safety of their assets. This partnership-driven approach allows organizations to focus on their core business while relying on proven providers to manage the evolving risks inherent in the digital asset space.

Crypto Custody Providers

Custody is the foundation of any crypto service. In a traditional bank, custody is a vault; in crypto, it is the secure management of private keys. If you lose the keys, you lose the assets.

Some crypto providers also offer staking services for institutional clients, adding value and security by enabling clients to earn rewards while assets are securely held. Many financial institutions require specialized custody solutions and trustee authority to meet compliance and operational needs.

Enterprise custody is different from a personal hardware wallet. It relies on Multi-Party Computation (MPC) or Multi-Signature (Multi-Sig) technology to ensure that no single person or server can move funds unilaterally.

What custody providers actually do

A custody provider:

- generates private keys securely;

- stores keys using cryptographic protection;

- signs blockchain transactions;

- enforces approval rules and security policies.

Custody providers do not track user balances and do not decide who owns what. They execute transactions on behalf of a system that already made those decisions in its ledger.

Fireblocks – Scalable MPC Wallet Infrastructure

Fireblocks has become a standard for fintechs and banks that need speed and scalability. Unlike cold storage (which is slow), Fireblocks uses MPC technology to split private keys into shares, allowing for secure, instant transactions without the keys ever being fully exposed.

What MPC means in practice

Instead of storing a private key in one place, MPC splits it into cryptographic shares distributed across different systems. No single component can sign a transaction alone.

What Fireblocks is used for

- operating hot and warm wallets;

- defining transaction approval rules;

- signing and broadcasting transactions;

- connecting securely to exchanges and DeFi protocols.

Why companies choose Fireblocks

- strong security model without cold-storage delays;

- automation-friendly APIs;

- clear separation between custody and business logic.

Fireblocks is commonly used by fintechs, banks, and crypto platforms that need high transaction volumes with institutional-grade controls.

BitGo – Regulated Custody and Multi-Signature Security

BitGo is widely regarded as the “gold standard” for institutional custody, particularly for assets that need to remain in cold storage. BitGo operates as a regulated Trust Company, which is a critical differentiator for banks requiring a qualified custodian.

How BitGo works

Transactions require multiple independent keys to approve. Typically, one key is controlled by the client, another by BitGo, and sometimes a third for recovery.

What BitGo is used for

- long-term asset storage;

- insured custody setups;

- cold and warm wallet strategies;

- regulatory-aligned custody models.

Why companies choose BitGo

- clear legal custody framework;

- insurance coverage;

- conservative operational approach.

BitGo is often selected by asset managers and regulated crypto businesses where governance and legal clarity matter more than transaction speed.

Coinbase Custody – Institutional Asset Storage

Leveraging the infrastructure of the largest US exchange, Coinbase Custody is a New York State-regulated trust company. It is heavily utilized by ETF issuers and large institutions due to its track record of zero loss incidents over 12+ years.

Seamlessly connects with Coinbase Prime for trading, making it ideal for products that need to trade large blocks of assets while keeping them secure.

Metaco – Custody Technology for Banks

Metaco (acquired by Ripple) differs from the above; it is a technology provider, not a custodian. It provides the software (Harmonize) that allows a bank to build its own custody operations on-premises or in a private cloud. This is typically chosen by Tier 1 banks (like Citi or BNP Paribas) that demand total control over their infrastructure.

How Metaco is used

- deployed inside a bank’s own infrastructure;

- integrated with existing core banking systems;

- operated fully by the institution.

Crypto Liquidity Providers

Liquidity providers in crypto supply market access and pricing that allow wallets and banking platforms to convert assets at stable prices.

If your wallet allows users to swap Bitcoin for USDC, or your bank allows users to buy Ethereum with Euros, you need a liquidity provider. You cannot simply “hold” liquidity; you must source it from the market. Leading crypto providers offer deep liquidity pools across various crypto assets, enabling large trades to be executed efficiently and securely.

When choosing crypto providers for liquidity, it is crucial to understand the costs involved, including transparency in pricing models to avoid unexpected expenses. Always check for hidden fees in transaction, deposit, and withdrawal charges, as undisclosed costs can significantly impact your operational efficiency and overall profitability.

What liquidity providers do

Liquidity providers:

- quote prices;

- execute buy and sell orders;

- provide market depth.

They do not manage user accounts or custody. They simply provide access to markets.

Kraken – Exchange and Liquidity Access

Kraken is one of the most established global exchanges. While many think of Kraken as a retail exchange, it is a vital infrastructure partner for B2B products. For a wallet or crypto bank, Kraken provides the deep order books necessary to execute trades without “slippage” (moving the price against yourself).

Integration typically involves connecting to Kraken’s API to fetch real-time price feeds for your users and executing “back-to-back” trades. When your user buys 1 BTC on your app, your system simultaneously buys 1 BTC on Kraken to offset the risk. Its regulatory standing in North America and Europe makes it a safe counterparty for fintechs.

How Kraken is used in products

- price discovery;

- spot trade execution;

- crypto-fiat liquidity.

Why Kraken is often selected

- long operating history;

- strong API stability;

- presence in regulated markets.

Kraken is commonly integrated as a liquidity source rather than as a consumer-facing trading UI.

Binance

Binance offers some of the deepest global liquidity.

It is often used purely as a liquidity venue for conversions and treasury operations rather than as a compliance anchor.

Bitstamp

Bitstamp is known for conservative operations and European market focus.

It is commonly used in products targeting regulated EU markets.

Crypto Payment Providers

If your product involves e-commerce checkout or B2B cross-border transfers, you need infrastructure to parse blockchain data and confirm payments. Crypto providers enable businesses to accept payments and receive payments in cryptocurrencies, allowing them to cater to the preferences of their customers and expand their reach with flexible payment options. Enterprises require advanced, scalable payment infrastructure with multi-jurisdiction licensing, high transaction volume support, and dedicated support to meet their international operational needs.

Circle – Stablecoin (USDC) Infrastructure

Circle is the issuer of USDC and provides a suite of APIs that bridge traditional banking rails with blockchain rails.

- Function: Enables businesses to accept card payments and settle in USDC, or send payouts in USDC to global wallets.

- Integration: Their infrastructure is essential for “on-chain” fintechs that want to build dollar-denominated products without holding volatile assets.

BitPay – Crypto Payment Gateway

BitPay is a veteran processor focused on merchant acceptance. It is custodial, meaning it processes the payment and settles with the merchant in fiat or crypto.

- Key Feature: Locks in the exchange rate at the moment of purchase, eliminating volatility risk for the merchant.

- Efficiency: Supports the Lightning Network for low-cost Bitcoin transactions.

Coinbase Commerce – On-Chain Payments

Coinbase Commerce offers a non-custodial approach (by default), where payments go directly to a merchant’s wallet. It simplifies the complex UX of accepting crypto by generating payment links and detecting payments across multiple blockchains automatically.

Fiat On-Ramp and Off-Ramp Providers

Crypto on-ramp providers enable users to convert fiat money into cryptocurrency using cards or bank transfers.

The “ramp” is the choke point of the crypto economy. It is the infrastructure that converts Fiat (USD, EUR) into Crypto (BTC, ETH) and vice versa.

Crypto providers must obtain payment processing licenses to operate legally and ensure compliance with financial regulations. In addition, regional licensing is crucial for validating that a crypto payment gateway or service adheres to local regulations and operates legally within specific jurisdictions.

What on-ramps and off-ramps do

These providers:

- process fiat payments;

- perform user checks;

- convert fiat to crypto or vice versa;

- deliver funds to wallets or bank accounts.

They act as payment intermediaries between banking systems and crypto markets.

For a wallet developer, building your own ramp requires establishing banking relationships, acquiring local payment processing licenses, and managing massive fraud risk. Instead, most wallets integrate third-party widget providers.

Which providers offer crypto on-ramp solutions?

- MoonPay / Ramp / Transak: These providers offer a widget or API that you embed into your wallet. The user completes KYC directly with the provider, pays via credit card or bank transfer, and the provider settles crypto into the user’s wallet.

- Stripe: Recently re-entered the space to offer on-ramp services, leveraging their massive reach in traditional payments to offer high-acceptance conversions.

From a product perspective, these are pure UX integrations. You are handing off the customer to the provider to handle the regulatory burden of the money transmission.

Blockchain Access Infrastructure

(The Node Layer)

To read a user’s balance or broadcast a transaction, your system must talk to a blockchain node. Running your own nodes (geth, bitcoin core) is maintenance-heavy and prone to downtime.

Consequently, nearly all commercial crypto products utilize Node Providers such as Alchemy, Infura, or QuickNode. These act as the “ISP” for the blockchain, providing reliable APIs (RPC endpoints) that ensure your wallet always displays the correct balance and your transactions don’t get stuck in the mempool.

How These Categories Work Together in Real Crypto Banking Products

To visualize how this comes together, consider a typical “Neo-bank with Crypto” product flow. You are not choosing one provider; you are orchestrating several:

- The User Actions: A user logs into your app (built on SDK.finance) and clicks “Buy $100 Bitcoin.”

- The Ramp: The user’s fiat balance is debited. If using an external ramp (like MoonPay), the fiat processing happens there. If using an internal ledger, your system initiates the trade.

- The Trade: Your backend requests a price from a Liquidity Provider (Kraken or Zero Hash). You lock the price and execute the buy.

- The Settlement: The Liquidity Provider delivers the Bitcoin. You do not store this on your laptop; it settles into your institutional vault provided by a Custodian (Fireblocks or BitGo).

- The Record: SDK.finance records that User A now owns 0.00x BTC. The physical BTC is commingled in the Fireblocks vault, but the SDK ledger tracks the individual ownership.

Everything you need to launch crypto wallets, payments, and custody

Learn moreSummary Table: Crypto Infrastructure Providers by Function

| Provider group | Examples of providers | What this group does | Typical responsibility in a crypto product |

|---|---|---|---|

| Core banking and ledger platform | SDK.finance | Acts as the system of record for balances, transactions, fees, and accounting | Tracks user ownership, applies business rules, manages workflows, and orchestrates integrations with external crypto services |

| Crypto custody providers | Fireblocks, BitGo, Coinbase Custody, Metaco | Securely generate, store, and use private keys | Execute blockchain transactions, enforce approval rules, protect assets using MPC or multi-signature models |

| Liquidity providers and exchanges | Kraken, Binance, Bitstamp | Provide market prices and execute buy and sell orders | Enable crypto-to-crypto and crypto-to-fiat conversions, manage exposure during user trades |

| Crypto payment and stablecoin infrastructure | Circle, BitPay, Coinbase Commerce | Enable crypto-based payments and stablecoin settlement | Support merchant payments, stablecoin payouts, and dollar-denominated crypto flows |

| Fiat on-ramp and off-ramp providers | MoonPay, Ramp Network, Transak, Stripe | Convert fiat money to crypto and back | Handle card and bank payments, user checks, and fiat settlement |

| Blockchain infrastructure (node providers) | Alchemy, Infura, QuickNode | Provide reliable access to blockchain networks | Read balances, broadcast transactions, and monitor confirmations via APIs |

Key Insights: How to Read This Provider Landscape

- Crypto products are built as layered systems, not single platforms.

Custody, liquidity, fiat conversion, and blockchain access are handled by specialised providers, while the core ledger and product logic remain separate. - The ledger is the strategic control point.

Ownership, balances, accounting, and compliance must live in a dedicated core system, while external providers only execute specific functions. - Modular infrastructure reduces risk and future lock-in.

Separating the core platform from custody, exchanges, and on-ramps allows providers to be changed as volumes, regulations, or geographies evolve. - Ready-to-go core platforms accelerate time to market.

Using a white-label core like SDK.finance enables companies to launch crypto wallets or crypto banking products without building critical infrastructure from scratch.

Real-World Example: Crypto-to-Fiat Wallet in Production

A practical illustration of how this infrastructure model works can be seen in the Nebeus crypto-to-fiat platform.

In the case study Nebeus x SDK.finance, Nebeus built a regulated financial product that combines crypto wallets, fiat accounts, and seamless conversion between digital assets and traditional currencies. The platform uses a modular architecture where custody, liquidity, and blockchain access are handled by specialised providers, while SDK.finance operates as the core ledger and orchestration layer.

This setup allowed Nebeus to launch and scale a crypto-enabled financial service without building core banking and accounting infrastructure from scratch, while retaining full control over balances, compliance workflows, and transaction logic.

Read the full case study here.

Evaluation Criteria: How to Choose the Right Crypto Infrastructure Providers

Selecting the right crypto infrastructure provider is a strategic decision that impacts security, compliance, and long-term scalability. Institutions should evaluate providers based on several key criteria:

- Track Record and Security: Assess the provider’s history in the digital asset space, including their security protocols, incident history, and reputation for reliability.

- Asset Coverage: Ensure the provider supports a broad range of digital assets and offers services such as crypto custody, staking services, and access to a robust trading platform.

- Seamless Integration: Look for providers that offer APIs and tools for easy integration with your existing systems, enabling efficient operations and a unified user experience.

- Regulatory Compliance: Verify that the provider holds the necessary licenses and regulatory approvals for your target markets, and that they maintain transparent, auditable reporting.

- Service Offerings: Consider the breadth of services available, from custody and trading to reporting and compliance support, to ensure the provider can meet your evolving needs.

Final Thoughts: Modular Infrastructure Wins

The era of “reinventing the wheel” in crypto is over. For a Head of Product, the goal is to assemble the best-in-class stack, not to build a custody solution from scratch.

By leveraging specialized providers – Fireblocks for security, Kraken for liquidity, Circle for payments -you reduce your regulatory scope and technical debt. This allows your team to focus on what matters: the user experience and the core value proposition of your financial product.

Infrastructure providers solve narrow but critical problems. A platform like SDK.finance turns those solutions into a manageable financial product.

This separation of responsibilities is what allows modern crypto wallets, crypto banking apps, and embedded crypto services to scale without rebuilding the core every time the market changes.

Everything you need to launch crypto wallets, payments, and custody

Learn more