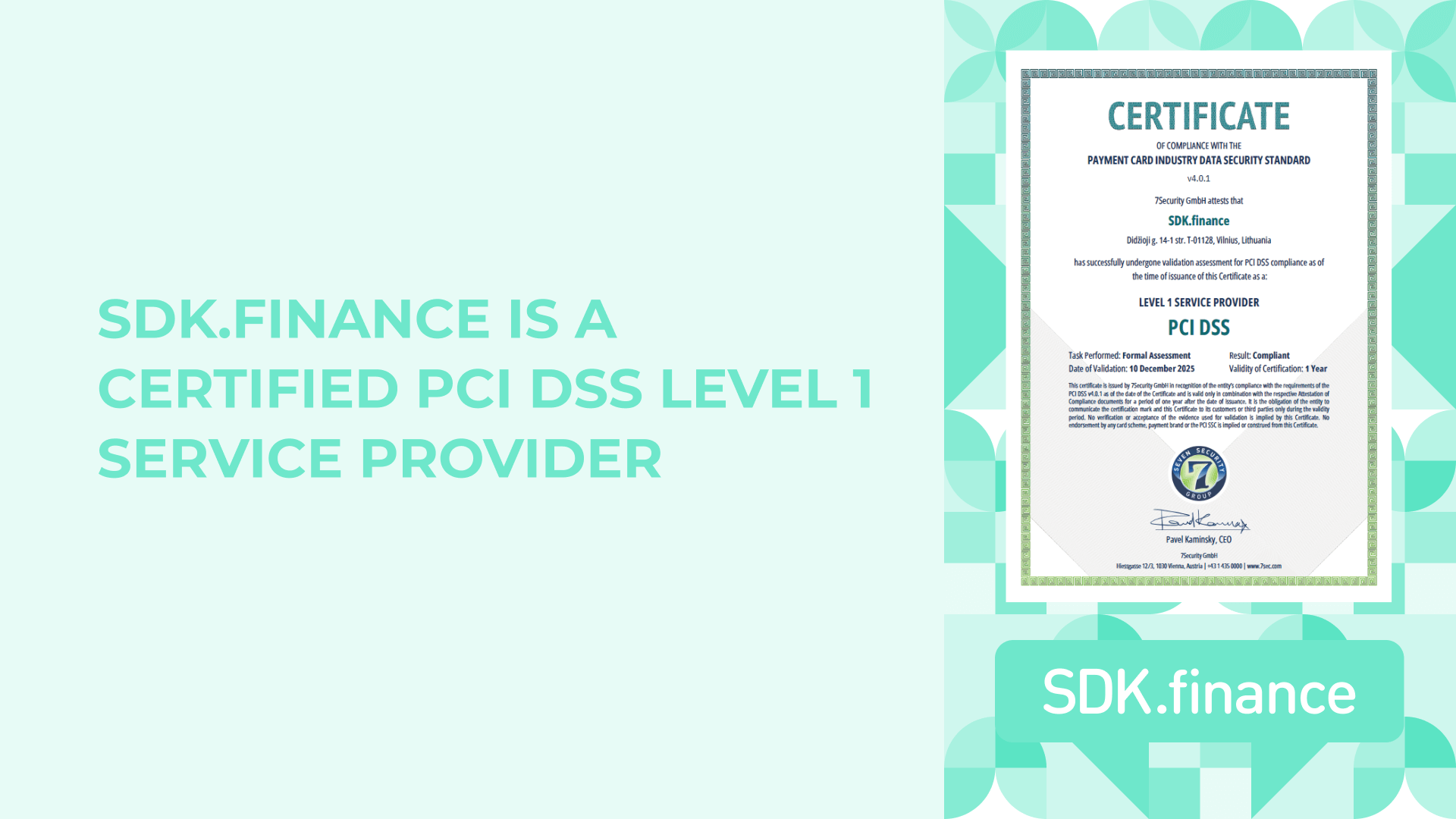

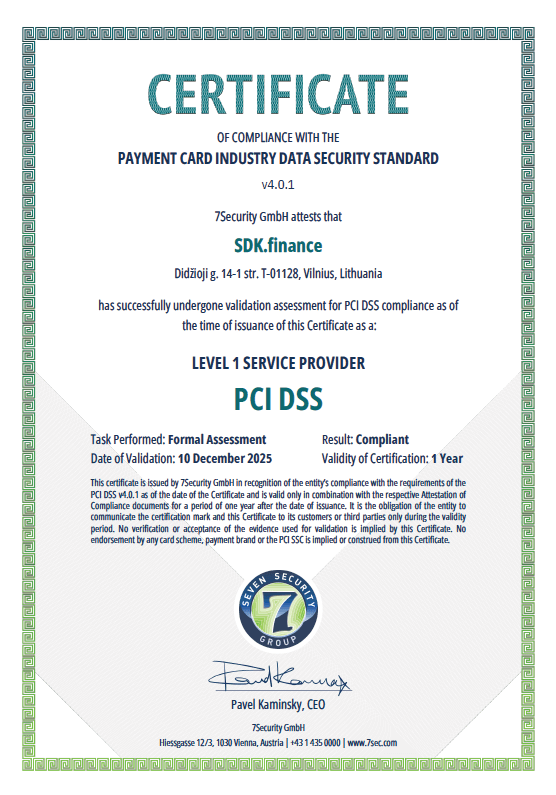

Big news – we’re pleased to share that SDK.finance has successfully completed its annual PCI DSS reassessment and is PCI DSS Level 1 certified under PCI DSS version 4.0.1, the latest version of the standard.

This confirmation follows an independent audit and validates that our security controls, software development practices, and governance processes continue to meet the highest requirements of the Payment Card Industry Data Security Standard. As PCI DSS certification is valid for one year only, this result confirms that compliance at SDK.finance is not a one-time milestone, but an ongoing operational commitment.

SDK.finance PCI DSS Certificate

What PCI DSS Level 1 compliance means for our customers

PCI DSS Level 1 is the highest level of certification within the standard and applies to service providers whose systems or processes can impact the security of payment environments.

SDK.finance does not store, process, or transmit cardholder data. That responsibility remains with the banks, PSPs, and FinTech companies operating payment flows. However, our Platform and software development practices form part of our customers’ PCI DSS scope.

According to the official Attestation of Compliance:

-

SDK.finance provides software development services assessed under PCI DSS v4.0.1.

-

The assessment focused on requirements related to secure software development and information security governance.

-

Independent auditors confirmed that all applicable requirements are either in place or not applicable.

In practice, this means our customers build on a Platform designed and maintained according to PCI DSS-aligned security principles, reducing compliance risks during audits and regulatory reviews.

Why PCI DSS Certification Is Renewed Every Year

PCI DSS is designed as a living security standard that evolves alongside the payment industry. New attack vectors, architectural patterns, and operational risks emerge continuously, which is why PCI DSS certification is valid for one year only.

Annual reassessment ensures that:

-

Security controls remain effective as systems and codebases evolve.

-

New features, integrations, and infrastructure changes are reviewed under current requirements.

-

Development and governance processes reflect real operational practices, not historical assumptions.

-

Compliance is validated against the latest version of the standard, not legacy interpretations.

For financial institutions and FinTech companies, this provides assurance that a technology partner maintains security discipline over time, not just at the point of initial certification.

Scope of the PCI DSS v4.0.1 Assessment

The PCI DSS assessment was conducted between 1 October and 2 December 2025 and resulted in a full compliant status.

The scope of the assessment included:

-

Secure software development lifecycle.

-

Vulnerability and patch management.

-

Change management processes.

-

Information security governance.

-

Security training and background screening.

-

Internal audits and incident response procedures.

The assessment was performed by 7Security GmbH, an independent Qualified Security Assessor, providing external validation of SDK.finance security practices.

Why This Matters for Regulated Payment and Banking Products

For companies building payment systems, digital wallets, or banking applications, PCI DSS compliance is not limited to infrastructure and operations. Software design decisions have a direct impact on audit scope, risk exposure, and long-term compliance costs.

By using a PCI DSS Level 1 certified Platform, customers benefit from:

-

A clearer separation of PCI DSS responsibilities.

-

Reduced risk of inherited compliance gaps.

-

Faster onboarding with acquiring banks and payment partners.

-

Greater confidence during due diligence and enterprise procurement.

Annual certification ensures these benefits remain valid as products scale and evolve.

A word from our CTO

“PCI DSS is not about passing an audit once. It’s about proving, year after year, that security is embedded into how software is built and governed. Renewing our PCI DSS Level 1 certification confirms that this approach remains part of SDK.finance’s engineering culture as the Platform grows.”

Pavlo Sidelov, Co-Founder & CTO at SDK.finance

Secure software, built for the future of FinTech

Security is not a feature added at the end of development. It is a foundation that must be validated continuously. With PCI DSS Level 1 certification under version 4.0.1, SDK.finance continues to provide a secure and reliable foundation for payment and banking products operating in regulated environments.

If you are looking for PCI DSS Level 1 certified software for your payment or banking product, contact us and we will explain how SDK.finance can support your requirements, architecture, and compliance goals.