Digital banking has moved far beyond putting traditional services into a mobile app. In 2026, the real discussion is about infrastructure. What sits underneath the app. What processes transactions. What controls risk. What allows you to launch new products without rewriting half the system.

The global digital banking platform market is projected to reach around $43.98 billion in 2026, growing at close to 20% annually. That growth tells a clear story. Banks are no longer experimenting with digital layers. They are rethinking their core technology.

Over three quarters of financial institutions are already integrating SaaS or modular banking platforms into their architecture. Not because it is fashionable, but because legacy systems struggle to support real-time fraud checks, automated compliance, embedded finance models, or multi-product ecosystems. Manual processes and tightly coupled cores simply do not scale in today’s environment.

For retail banks, EMIs, PSPs, and fintech founders, the challenge is practical. How do you move fast without creating technical debt? How do you stay flexible without losing control of your infrastructure?

In this comparison, we look at the leading digital banking software providers in 2026. We focus on what actually matters: architecture, scalability, deployment models, and the ability to support long-term product evolution, not just a quick launch.

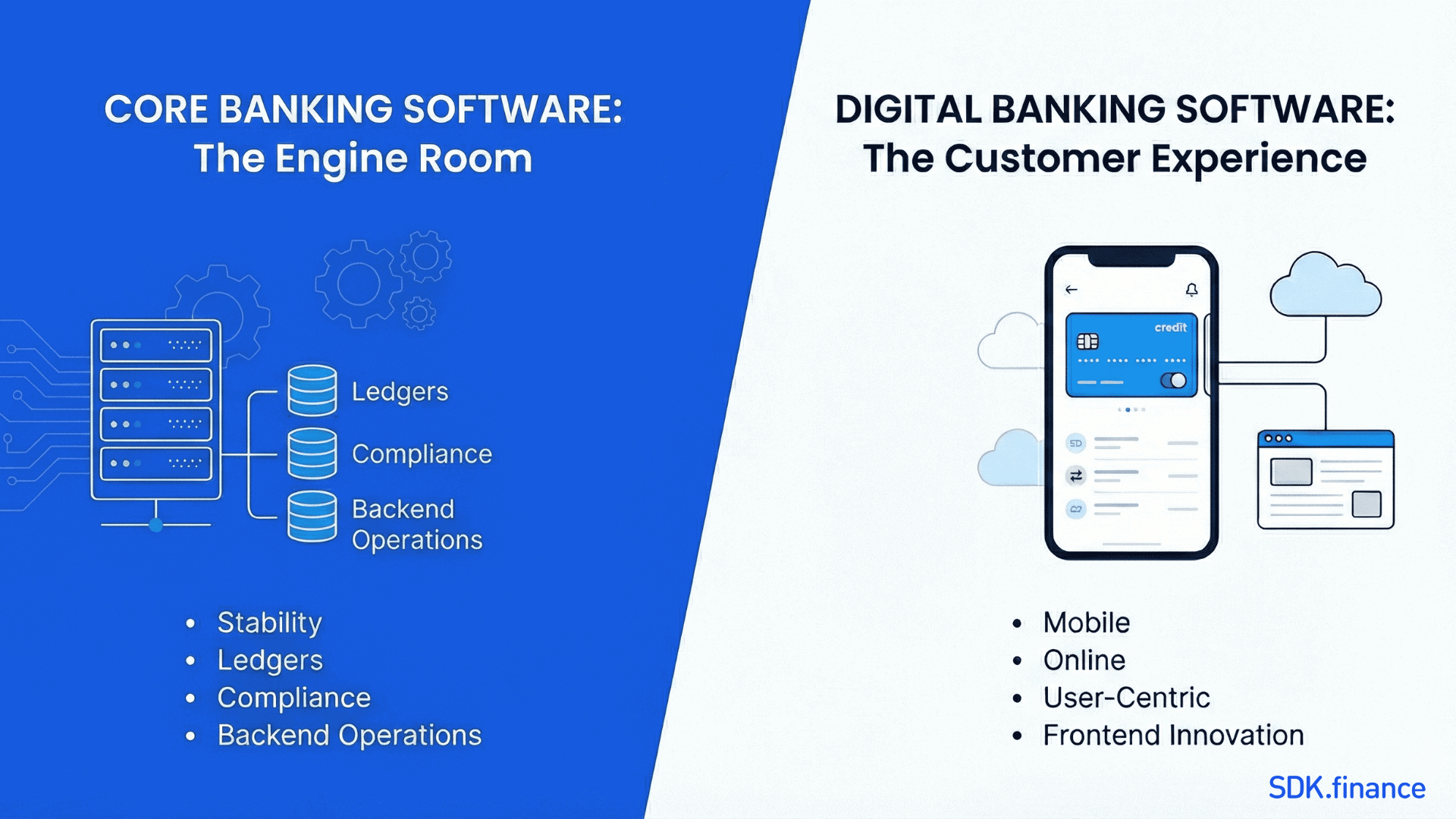

What Is Digital Banking Software

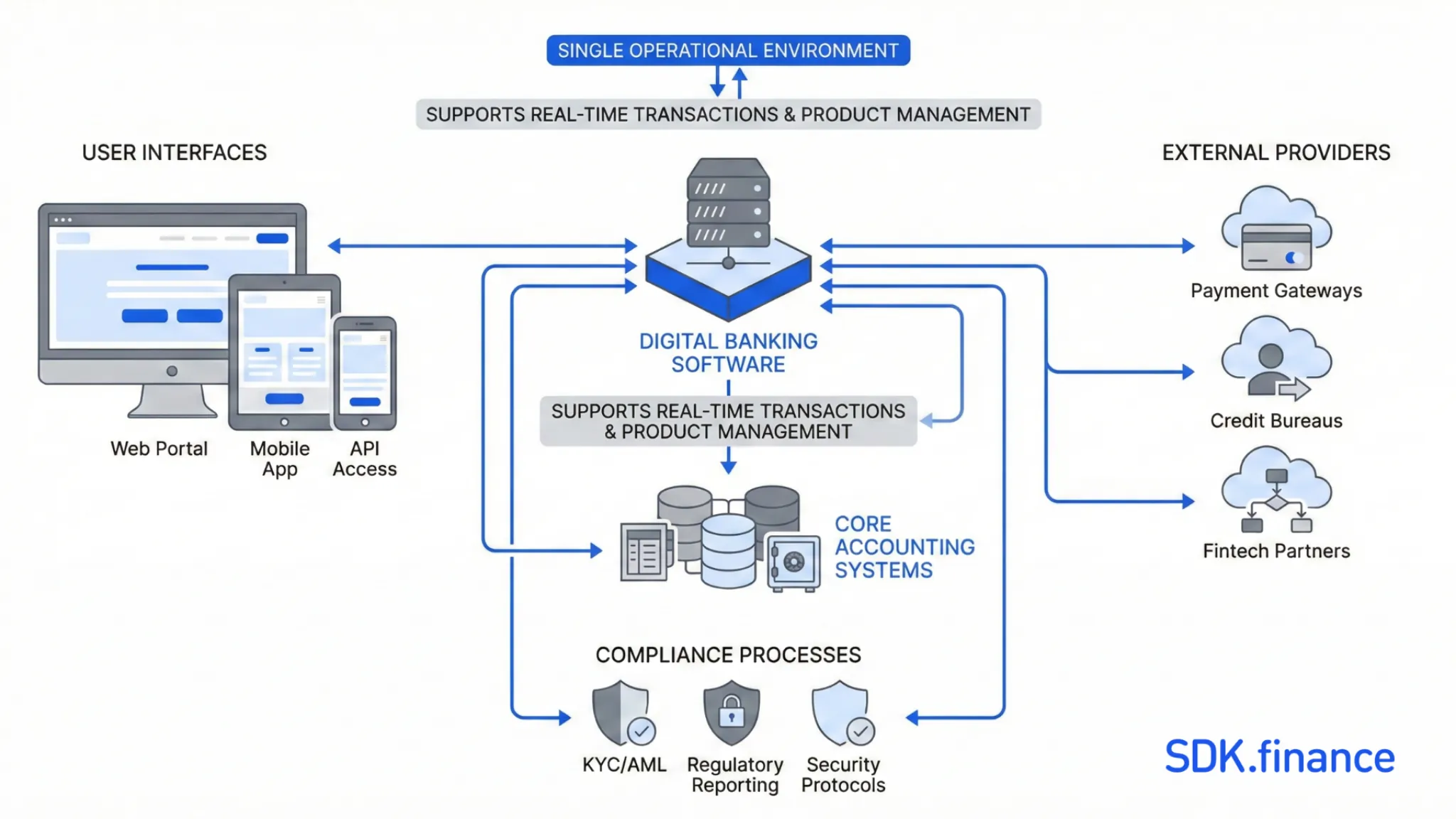

Digital banking software is the backend technology layer that enables banks and fintech companies to deliver financial services through digital channels. It connects user interfaces, core accounting systems, compliance processes, and external providers into a single operational environment that supports real-time transactions and product management.

It is important to distinguish this from the front-end mobile applications or the legacy core banking systems that manage the final ledger of record. Legacy systems often limit digital transformation due to their inflexibility, high maintenance costs, and inability to support rapid innovation.

Modern digital banking software is specifically designed to overcome these limitations by providing a flexible, modular, and scalable foundation for new financial products and services.

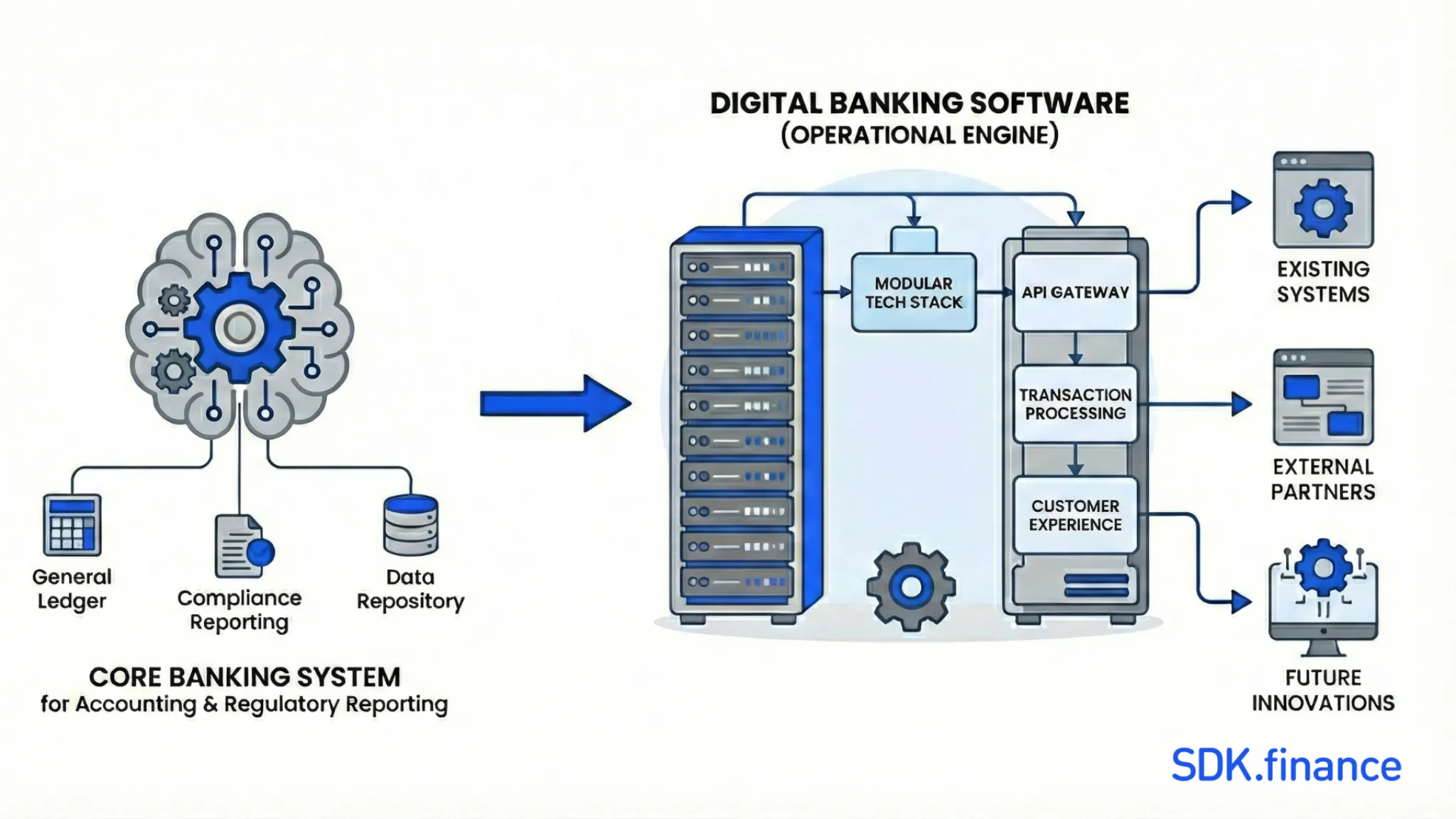

While a core banking system acts as the “brain” for accounting and regulatory reporting, digital banking software serves as the operational engine. Built on a modern, modular tech stack, it enables flexibility and scalability to support evolving business needs and seamless integration with existing systems. It handles:

- User Management: Identity verification, KYC/AML workflows, and profile security.

- Service Orchestration: Coordinating complex actions across multiple APIs, such as card issuing, international transfers, and currency exchange, with easy integration to third-party services, accounting systems, and fintech solutions.

- Product Definition: The ability to configure and launch specific financial products (e.g., savings pockets, multi-currency wallets) without altering the underlying ledger.

How We Evaluated Digital Banking Software Providers

To provide an objective ranking, we evaluated each provider based on seven critical performance and operational metrics:

- Functional Coverage: The breadth of native features, including account management, payment processing, and onboarding modules, as well as the ability to support new features to keep up with evolving market demands.

- Architecture and Modularity: The use of microservices or independent modules that allow for selective deployment and scaling.

- API-First Design: The quality and quantity of documented APIs (REST or GraphQL) available for third-party integrations.

- Deployment Models: Availability of flexible hosting options, including SaaS, private cloud, and source code licensing.

- Scalability: The platform’s proven ability to handle high transaction volumes and concurrent users.

- Target Customers: Alignment with specific institutional needs, from small fintechs to Tier-1 global banks, ensuring that offerings can be tailored to the unique business needs of different organizations.

- Geographic Flexibility: Multi-currency support and compliance readiness for different regulatory jurisdictions (UK, EU, MENA, etc.).

Top Digital Banking Software Providers in 2026

1. SDK.finance

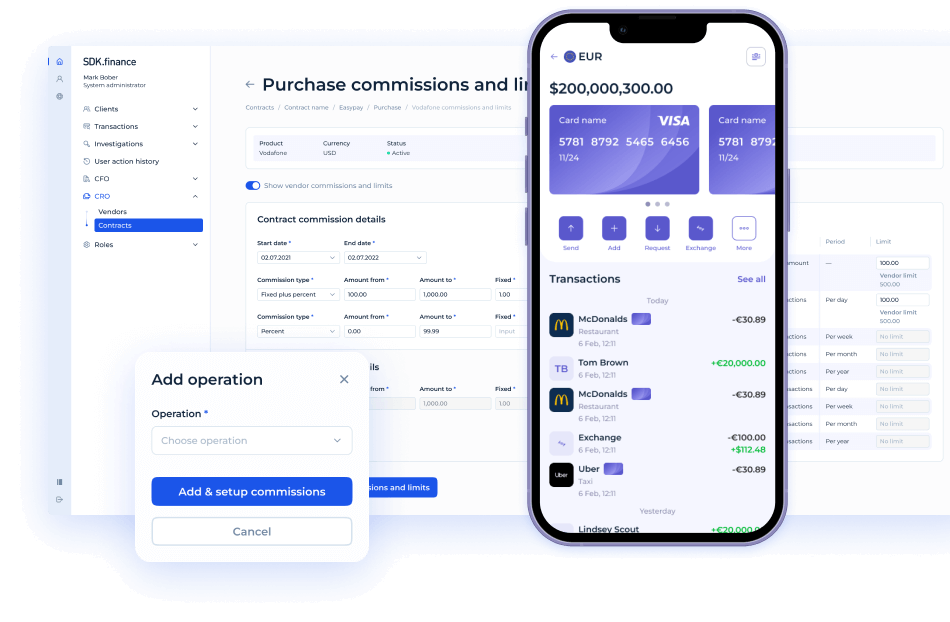

SDK.finance is a leading digital banking software provider with over 15 years of deep-seated expertise in fintech infrastructure. Internationally recognised as a regular finalist of the prestigious PayTech Awards and Banking Tech Awards, the company has established a robust global footprint, serving clients across the United States, Europe, North America, MENA, and Africa.

The platform offers an expert-grade balance between rapid market entry and long-term architectural autonomy. In 2026, SDK.finance is distinguished by its flexible delivery models, offering both a cloud subscription for agile scaling and a source code license for institutions that require total ownership of their intellectual property.

This digital banking software is engineered for high-performance environments, capable of handling 2,700+ transactions per second. It is fully PCI DSS and ISO certified, ensuring rigorous adherence to global security standards. With an expansive library of 570+ REST APIs, it provides the connectivity required to thrive in a modern, open-banking ecosystem. To further accelerate launch timelines, SDK.finance includes professional white-label mobile and web applications, featuring an intuitive interface that enables end users to easily manage accounts, payments, and permissions across multiple currencies and markets. This allows clients to deliver a premium user experience from day one, while also ensuring seamless experiences across digital channels through real-time control and smooth customer interactions.

- Key Strengths: Source code ownership to eliminate vendor lock-in, native crypto-fiat capabilities, 570+ documented APIs for deep customisation, and configuration and deployment with less effort compared to traditional solutions.

- Product Capabilities: Powering Neobanks, Digital Wallets, Payment Gateways, Currency Exchanges (Fiat & Crypto), Crypto Banking, and Remittance services.

- Best suited for: EMIs, PSPs, and banks seeking secure, scalable, and independent infrastructure.

- Considerations: Institutions opting for the source code license should maintain a technical team to manage and evolve their proprietary version.

SDK.finance also provides ready-to-use white-label mobile and web applications, allowing institutions to launch faster while maintaining control over accounts, payments, user permissions, and multi-currency operations. The mobile application supports multiple languages, including English, French, Spanish, and Arabic. Additional languages can be added based on project requirements, making it suitable for international deployments and region-specific rollouts.

To better understand how the end-user experience works in practice, you can explore the mobile application demo below, which showcases account management, multi-currency wallets, payments, and back-office interaction in a real operational environment:

2. Mambu

Mambu is a cloud-native, SaaS-only platform known for its “composable banking” approach. It allows banks to build their stack by picking and choosing various third-party services. Mambu supports both retail and business customers through its flexible modules, enabling financial institutions to serve a wide range of client needs. Its Digital One platform offers a comprehensive, modular solution for modern banking needs.

- Strengths: Rapid deployment, pure SaaS model with zero maintenance overhead, and a large marketplace of pre-integrated partners.

- Best suited for: Challenger banks and established retail banks launching “greenfield” digital brands, as well as other businesses seeking to innovate in financial services.

- Limitations: No option for on-premise deployment or source code access; subscription costs can scale significantly with user growth.

3. Temenos (Temenos Banking Cloud)

A dominant force in global banking, Temenos has successfully transitioned its legacy expertise into a modern, cloud-based offering serving over 3,000 clients globally. Temenos delivers comprehensive digital solutions for global banks, supporting online banking, mobile platforms, and enhanced operational efficiency.

- Strengths: Massive functional depth, global regulatory coverage, robust digital payments capabilities, and a proven track record with 41 of the world’s top 50 banks.

- Best suited for: Large incumbent banks undergoing enterprise-wide digital transformation.

- Limitations: Implementation cycles can be longer and more complex compared to leaner fintech-native platforms.

4. Thought Machine

Thought Machine’s core product, Vault Core, is built on a “smart contracts” logic, allowing banks to create any financial product from scratch without traditional ledger constraints. The platform also enables banks to launch new services quickly, helping them expand their digital offerings and adapt to evolving customer needs.

- Strengths: Extremely flexible product engine, high-performance ledger, modern, cloud-native engineering, and helps banks streamline operations through automation and flexible product configuration.

- Best suited for: Tier-1 banks and high-growth fintechs needing unique, non-standard financial products.

- Limitations: The high degree of flexibility requires significant configuration effort to define products.

5. Finastra

Finastra provides a broad suite of financial software, with its FusionFabric.cloud platform focusing on open collaboration and ecosystem integration.

- Strengths: Extensive experience in corporate and retail banking; strong focus on open banking and API connectivity; robust support for small business banking solutions, including tailored account management and deposit tools for small business clients.

- Best suited for: Universal banks that require a blend of retail, commercial, and treasury capabilities.

- Limitations: Navigating their vast product portfolio can be complex for smaller, agile fintech startups.

6. Velmie

Velmie offers a modular digital banking platform with a focus on high-performance architecture and specialized modules like crypto-banking and micro-investing. Velmie also provides a streamlined account opening process for new accounts, enabling fast, digital onboarding with automation and multi-channel support to enhance customer experience and operational efficiency.

- Strengths: Hybrid architecture that blends traditional fintech with native crypto-fiat capabilities.

- Best suited for: Fintech startups and mid-market financial institutions in emerging markets.

- Limitations: Smaller global footprint compared to major incumbents like Temenos or Finastra.

7. nCino

While often associated with loan origination, nCino’s Cloud Banking Platform has expanded into a comprehensive digital experience layer built on Salesforce.

- Strengths: Exceptional CRM integration, streamlined commercial lending workflows, and efficient onboarding processes that make it easier to acquire new customers through quick online sign-up and user-friendly systems.

- Best suited for: Community and regional banks focusing on improving the banker and customer experience.

- Limitations: Less focus on the transactional ledger compared to other infrastructure-heavy providers.

8. Swan

Swan is a European Banking-as-a-Service (BaaS) provider that allows companies to embed banking features, including Mastercard card issuing, via a simple API. Swan empowers financial institutions to offer embedded finance solutions, enabling them to expand their digital banking services with greater flexibility and speed.

- Strengths: Includes the regulatory licence (EMI); incredibly fast to go live (days rather than months).

- Best suited for: Non-financial companies (SaaS, marketplaces) looking to offer embedded finance.

- Limitations: Limited customisation of the underlying banking logic; restricted primarily to the European market.

Comparative Overview of Top Digital Banking Software Providers 2026

| Provider | Year Founded | HQ | Deployment Models | Architecture Focus | Best Suited For | Source Code Access |

|---|---|---|---|---|---|---|

| SDK.finance | 2013 | London, UK | SaaS + Source Code Licence | Modular ledger-based platform | EMIs, PSPs, banks seeking infrastructure control | Yes |

| Mambu | 2011 | Berlin, Germany | SaaS only | Composable SaaS core | Challenger banks, digital brands | No |

| Temenos | 1993 | Geneva, Switzerland | SaaS + Private Cloud | Enterprise core banking suite | Tier-1 and global incumbent banks | No |

| Thought Machine | 2014 | London, UK | SaaS + Cloud-native | Smart-contract based core | Tier-1 banks, complex product structures | No |

| Finastra | 2017 | London, UK | SaaS + Hybrid | Broad banking ecosystem | Universal banks (retail + corporate) | No |

| Velmie | 2016 | London, UK | SaaS + Hybrid | Modular fintech architecture | Fintech startups, emerging markets | No |

| nCino | 2012 | Wilmington, USA | SaaS (Salesforce-based) | CRM-centric digital layer | Regional and community banks | No |

| Swan | 2019 | Paris, France | BaaS (SaaS + EMI licence) | Embedded finance platform | SaaS companies, marketplaces | No |

Customer Engagement in Digital Banking

In digital banking, engagement is not a campaign or a separate feature. It is the everyday experience customers have when they open the app, check a balance, or move money. If that experience feels clear and useful, engagement happens naturally. If it feels confusing or generic, customers slowly disengage.

Modern digital banking systems give institutions more control over how that experience is built. They make it possible to adjust what customers see and how they interact with financial services.

In practice, engagement is shaped by several core elements:

- clear financial insights

Spending breakdowns, transaction categorisation, and simple summaries that help customers understand where their money goes. - context-based suggestions

Relevant offers or tools based on actual behaviour, not generic promotions sent to everyone. - consistent service environment

Payments, cards, transfers, and additional services accessible within the same interface, without switching platforms. - responsive communication

Notifications and updates that are timely and useful, not intrusive.

Data plays a role, but only when it is used thoughtfully. Understanding how a customer typically manages their account allows the bank to adjust communication and product visibility. Someone making frequent international payments may care about FX transparency. A customer receiving regular income may be more interested in budgeting or savings tools.

Mobile apps remain the primary touchpoint in this model. They act as daily financial dashboards where customers can monitor activity, control limits, review transactions, and manage products in real time.

Engagement in digital banking is built gradually. It comes from usability, relevance, and consistency rather than aggressive marketing. When customers feel that the system supports their financial routine instead of complicating it, retention becomes a natural result.

Cash Flow Management Features

Effective cash flow management is a cornerstone of financial health for both businesses and individuals, and digital banking platforms are designed to make this process seamless and efficient. Modern digital banking systems offer a range of cash flow management features, including real-time account monitoring, automated payment processing, and predictive analytics. These tools provide customers with instant access to up-to-date financial information, enabling them to track cash flow, identify trends, and make informed decisions.

Integration with other digital services, such as accounting software and payment processing systems, further streamlines financial management by consolidating data and automating routine tasks. This seamless integration not only saves time but also reduces the risk of errors, ensuring that customers have a clear and accurate view of their financial position at all times.

By leveraging these advanced cash flow management features, customers can optimize their financial management, improve liquidity, and ensure timely payments, all from within a single digital banking platform.

Cash Flow Management Features

Cash flow is what keeps both businesses and individuals stable. It is not only about how much money you have, but about timing. When funds come in. When they go out. Whether there is enough available at the right moment.

Digital banking platforms make this easier to manage because they give users constant visibility. Instead of waiting for statements or exporting spreadsheets, customers can see account balances and transactions in real time. That alone changes how financial decisions are made.

Most modern systems include features such as:

- real-time balance tracking

Immediate updates after transactions, so there is no uncertainty about available funds. - automated payment handling

Scheduled transfers, recurring payments, and reminders that reduce manual work. - cash flow overview tools

Visual breakdowns of incoming and outgoing payments that help spot patterns over time. - forecasting and alerts

Early signals if balances are expected to drop below a defined level.

Integration also plays an important role. When digital banking software connects with accounting systems or payment processors, financial data does not need to be entered twice. Transactions sync automatically, reports stay aligned, and routine reconciliation becomes simpler.

For businesses, this means better control over liquidity and fewer surprises at month-end. For individuals, it means clearer budgeting and fewer missed payments.

In practical terms, strong cash flow tools reduce uncertainty. They replace guesswork with real-time information and allow financial planning to happen inside the banking environment rather than across multiple disconnected systems.

Digital Banking Software vs Core Banking Platforms

Modern 2026 architectures distinguish between the user-facing orchestration layer and the underlying ledger. Unlike traditional banking, which relies on legacy systems and manual processes, modern digital banking software providers leverage advanced technologies such as AI, automation, and cloud computing to deliver more efficient, secure, and user-friendly banking experiences.

Typical Customers for Digital Banking Software

Different organisations utilise these platforms to achieve distinct business outcomes:

- Retail Banks: To launch digital-only sub-brands or replace legacy middle-ware.

- Challenger Banks: To build a full-stack offering quickly while maintaining the ability to iterate on features.

- EMIs and PSPs: To expand from payment processing to offering full account and card services.

- Fintech Startups: To focus resources on unique front-end features rather than rebuilding standard ledger logic.

- Non-Financial Enterprises: To integrate “embedded finance” into their apps, increasing customer retention.

How to Choose a Digital Banking Software Provider

Choosing a digital banking software provider is a long-term decision. Once implemented, replacing the system is costly and slow. That is why evaluation should go beyond a feature checklist.

Start with architecture. Mobile, web, and backoffice components should operate as a unified system. If they are loosely connected, operational friction and customer experience gaps usually follow.

Build vs Buy

Building internally offers full control, but it requires time, strong engineering capacity, and long stabilisation cycles. Buying an existing platform significantly reduces time to market.

Many institutions combine both approaches. They adopt a ready-made foundation for ledger logic and transaction processing, then build their unique value at the product layer. The key question is where your real competitive advantage lies.

SaaS vs Source Code

SaaS reduces infrastructure and maintenance overhead. It suits organisations focused on speed and predictable costs.

Source code models attract institutions that need deeper control due to security, regulatory, or strategic reasons. With code access, internal teams can modify logic without depending entirely on the vendor’s roadmap.

The choice often reflects how much control the organisation wants to retain long term.

Integration and Exit Flexibility

Digital banking software must integrate easily with KYC providers, card processors, payment networks, and accounting systems. Clear APIs and structured data access simplify this.

It is also important to consider exit flexibility. Transparent data export and well-documented APIs reduce the risk of long-term dependency.

Ultimately, the right provider is not the most complex one, but the one that aligns with your operating model and allows steady evolution without constant reengineering.

Final Thoughts

In 2026, the digital banking software market is defined by modularity and ownership. The transition away from monolithic systems is nearly complete, and the focus has shifted to how easily a platform can integrate into a wider ecosystem of AI-driven tools and digital assets.

When selecting a provider, look beyond the feature list. Prioritise an architecture that offers the flexibility to pivot as regulatory demands evolve. Ownership of the technology stack – whether through deep API control or source code licensing – remains the strongest safeguard for long-term scalability and innovation.