The financial services market is in the middle of a structural shift. Established banks are facing competition from agile FinTech players, and non-financial brands are adding payments and accounts into their customer journeys. At the centre of this change sits a practical enabler: the white-label mobile banking app.

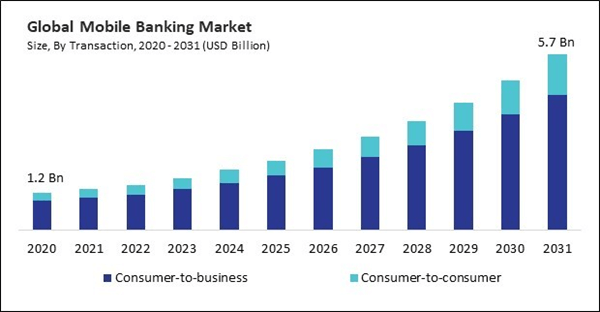

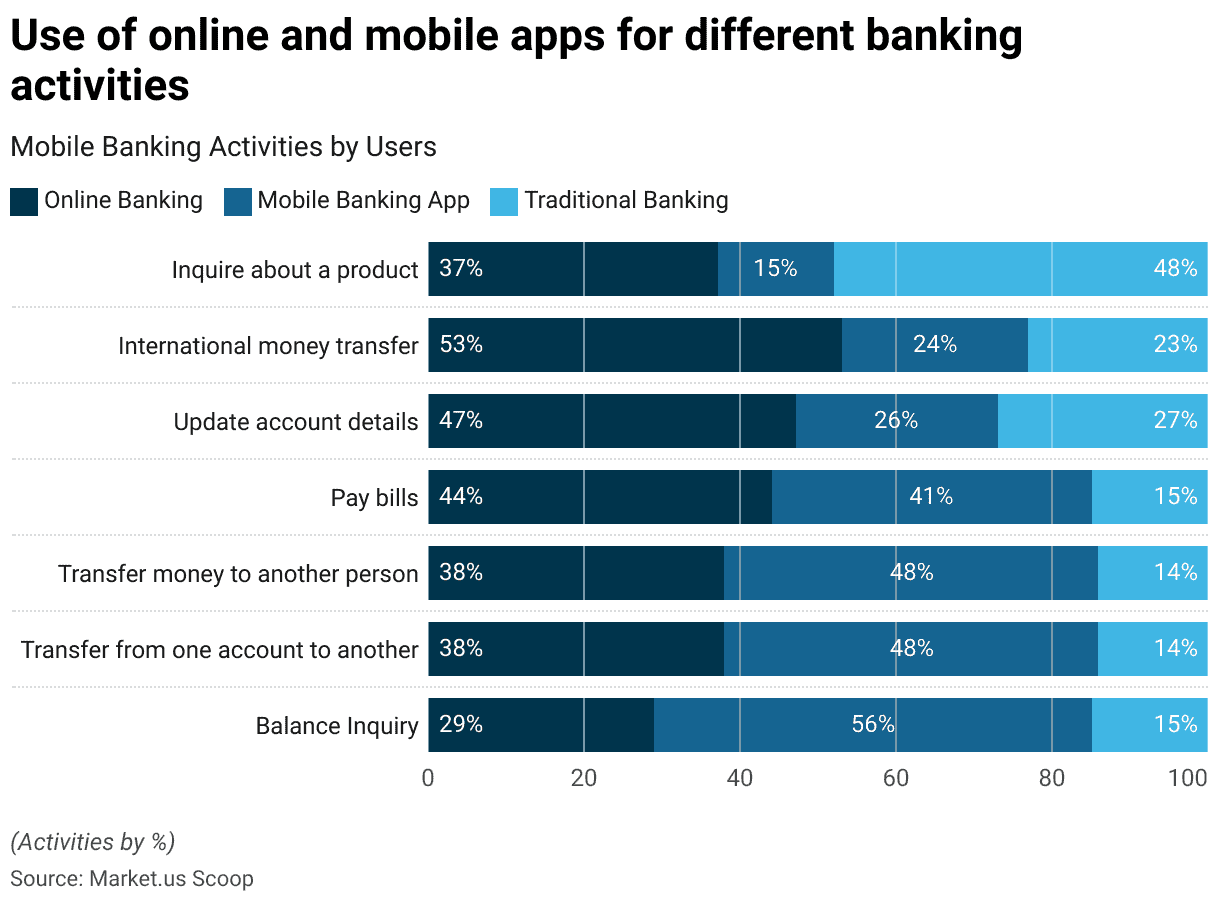

As of 2025, more than 2.5 billion people use mobile banking regularly, with projections of 3.6 billion by 2026. For banks, FinTech startups and consumer brands, the question is no longer whether to offer mobile banking. The task is to deliver it quickly, within budget, and with the quality users expect.

White-label mobile banking solutions meet that brief. They are fully-built applications that can be branded, configured and launched far faster than a bespoke build. They make enterprise-grade capability accessible and let teams focus on customer value rather than plumbing.

This guide explains how a white-label mobile banking app works, the technical components, deployment options, core features and the business case.

What Is a White-Label Mobile Banking App?

A white-label mobile banking app is a ready-made banking application built by a technology provider. Banks, fintech companies, or other businesses can then take this app, put their own logo and design on it, choose the features they need, and connect it to their own systems.

Think of it like buying a newly built house. The foundation, wiring, and plumbing are already done – you just choose the paint colours, furniture, and decorations to make it feel like your own.

The White-Label Banking Model Explained

-

Technology provision. A banking software provider produces a secure, compliant mobile platform with the modules required for accounts, payments, cards and operations.

-

API access. Institutions integrate through documented APIs, connecting legacy systems and third-party services.

-

Customisation. Teams brand the app, adapt customer journeys, select features and set policies to fit their market and strategy.

-

Rapid deployment. Instead of a 12 to 18 month programme, a white-label mobile banking app can go live in weeks, depending on integrations and scope.

Why White-Label Mobile Banking Is Gaining Momentum

-

Digital-first expectations. People expect banking to feel like their best everyday apps. That means instant access, simple flows and availability across devices.

-

Lower barriers to entry. White-label reduces the technical lift for telecoms, retailers, marketplaces and other non-banks that want to add financial services.

-

Time and cost pressure. Custom builds often run into seven figures and extended timelines. White-label alternatives compress both.

-

Regulatory complexity. Banking involves strict controls. Credible providers bake these into the platform so teams can focus on operations and service.

-

Focus on strengths. Banks can keep attention on risk, product and customers while relying on a partner for the heavy software engineering.

How White-Label Mobile Banking Apps Work: Architecture and Components

Based on more than 15 years of SDK.finance’s experience in developing banking and payment products for financial institutions across Europe, MENA, and beyond, the architecture of a modern white-label mobile banking app is built to balance flexibility, reliability, and security.

This type of solution isn’t just a mobile interface – it’s a full technology ecosystem that supports real-time transactions, user management, compliance, and integrations with external financial systems.

Below is the structure and main components that, from SDK.finance’s experience, ensure stable performance and scalability for digital banks and FinTechs:

The Technology Stack

1) Frontend: the user-facing application

Native iOS and Android apps with:

-

Native mobile apps optimised for both iOS and Android

-

Clean, intuitive design for a smooth user experience

-

Full branding flexibility (logo, colours, typography)

-

Accessibility and multilingual support

2) Backend: the core processing engine

The backend executes financial logic and provides reliability at scale:

-

Core ledger and accounts. Balance management, postings and reconciliation

-

Payments and transfers. Execution of domestic and international rails

-

Data layer. Secure storage of customer data and history with auditability

-

Business rules. Limits, fees, compliance checks and workflow orchestration

-

Security. Encryption, key management, authentication and authorisation

3) Admin panel: management and operations

A role-based back office for day-to-day control:

-

Customer and account management

-

Transaction monitoring, reporting and disputes

-

Product configuration, limits and fees

-

Analytics, dashboards and operational KPIs

-

Compliance views and exportable reports

-

Case tools for customer support

4) APIs and integrations

Integration is a core capability:

-

Payment acceptance and cards. Gateways and issuers

-

KYC, KYB and AML. Identity verification and screening

-

Banking rails. SEPA, SWIFT and local schemes

-

Value-add services. FX, lending, investments and rewards

-

Open banking. PSD2-aligned APIs where applicable

-

Digital assets. Optional crypto features for compliant markets

Deployment Models

-

SaaS. Hosted by the vendor. Best for speed, predictable costs and vendor-managed updates.

-

On-premises. Deployed to the institution’s infrastructure. Preferred by organisations with strict data residency, extended customisation needs or specific operational controls.

Core Features of a White-Label Mobile Banking App

Account and card management

-

Multi-currency accounts

-

Instant virtual cards and physical card lifecycle

-

Card controls including freeze, limits and channel settings

-

Real-time balances, statements and export options

Payments and transfers

-

P2P by contact details

-

Scheduled and recurring bill pay

-

International transfers on SWIFT, SEPA or domestic rails

-

QR and contactless payments where supported

-

Built-in FX and transparent conversion

-

Templates for frequently used recipients

-

Automatic and manual categorisation for personal finance

Security features

-

Two-factor and biometric authentication

-

TLS-secured traffic and modern cryptography

-

Device binding and secure session management

-

Real-time fraud signals and velocity rules

-

Alerts for thresholds, new devices and sensitive operations

Regulatory compliance

-

KYC. Document capture, biometric checks and liveness tests

-

KYB. Company verification, directors and UBOs

-

AML. Screening, transaction monitoring and case management

-

PSD2 and SCA. Strong authentication for European operations

-

GDPR and privacy. Data minimisation, rights handling and retention

-

Audit trail. Full traceability of actions across systems

Additional capabilities

-

Remote onboarding flows with fallback for manual review

-

In-app support via chat or tickets

-

Budgeting, insights and savings goals

-

Corporate accounts with roles and approvals

-

Secure document exchange for statements and compliance

Business Benefits: Why Financial Institutions Choose White-Label

Adopting a white-label mobile banking app gives financial institutions a faster, safer, and more cost-effective path to market. Instead of spending a year or more developing custom software, organisations can launch in just a few weeks or months, quickly reacting to market shifts or regulatory changes. The financial advantage is equally clear: while bespoke development often costs between 500,000 and 2 million USD, white-label solutions typically range from 50,000 to 250,000 USD – including licensing and implementation. The long-term savings continue through smaller internal teams, vendor-managed updates, and predictable subscription models.

Scalability and flexibility come built in. Institutions can start with a pilot and expand to millions of users without rebuilding infrastructure, adding features, providers, or localisation for new currencies and markets as needed. This approach also lets businesses focus resources on what truly drives growth – customer acquisition, engagement, product innovation, and compliance excellence — instead of maintaining complex software.

White-label platforms like SDK.finance also deliver enterprise-grade technology at a fraction of the cost, backed by continuous R&D, advanced analytics, and specialist security expertise. With production-tested components, proven performance, and compliance already integrated, institutions significantly reduce technical and regulatory risks while gaining the agility to scale and innovate with confidence.

Introducing the SDK.finance White-Label Mobile Banking App

The SDK.finance mobile banking application is the result of years of engineering, compliance expertise, and product evolution within real financial environments. It’s not a prototype or concept, it’s a production-ready mobile app built on a robust, ledger-based core that has already powered live banking and payment systems worldwide.

In this video, you’ll see how SDK.finance combines its 15+ years of FinTech experience to deliver a complete white-label mobile banking solution for iOS and Android:

The SDK.finance white-label mobile banking app offers all the essential tools for secure, compliant, and user-friendly digital banking – fully branded and multilingual:

Onboarding and KYC Verification

Quick and compliant customer onboarding:

-

Create new accounts in minutes.

-

Complete KYC verification with document upload.

-

Track and update verification status anytime.

Account and Card Management

All key account and card operations in one place:

-

Open and manage multi-currency and crypto-to-fiat accounts.

-

Set spending limits, issue new cards, and download statements.

-

Instantly block or unblock accounts when needed.

Transactions and Payments

Simple and transparent money movement:

-

Send funds to cards, accounts, or IBANs.

-

Generate QR codes for quick payments.

-

Schedule recurring or template-based transfers.

-

Categorise transactions and contact support directly from the payment view.

User Profile and Customer Support

Personal and accessible account management:

-

Edit profile details and reset passwords.

-

Configure OTP, alerts, and notifications.

-

Use the live chat to reach support and share documents.

-

Switch between English, Spanish, French, Portuguese, Arabic, or add more languages for local markets.

Built with compliance, security, and scalability at its core, the SDK.finance mobile app delivers a complete, multilingual digital banking experience ready for your brand.

Conclusion: White-Label Mobile Banking As Strategy

Digital banking is now the standard. Competitive pressure is intensifying, and complexity is not easing. In this context, white-label mobile banking apps are not just a cost play. They are a delivery strategy.

The advantages are clear.

-

Speed. Launch in weeks and capture opportunities while they are open

-

Economics. Reduce development costs by 70 to 90 percent while retaining enterprise-grade capability

-

Focus. Spend more on customers and product, less on plumbing

-

Risk. Build on proven technology with compliance and security already in place

-

Scale. Start focussed and grow coverage, features and markets over time

-

Innovation. Benefit from ongoing platform improvements and an open integration fabric

For established banks modernising their footprint, for startups that need to validate and scale, and for enterprises adding finance to their ecosystem, a white-label mobile banking app offers a pragmatic route to market.

With billions of mobile banking users by 2026, the timing is immediate. The decision is which partner to choose and how fast to move.