SDK.finance SaaS Digital Banking Platform

Launch your neobank in weeks using a ready-made white-label SaaS FinTech Platform with pre-built web UI and iOS/Android mobile apps. No need to build from scratch.

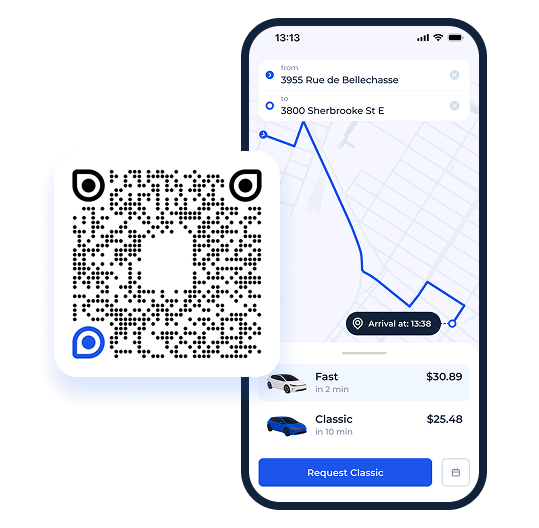

Get in touchExplore the SDK.finance mobile app

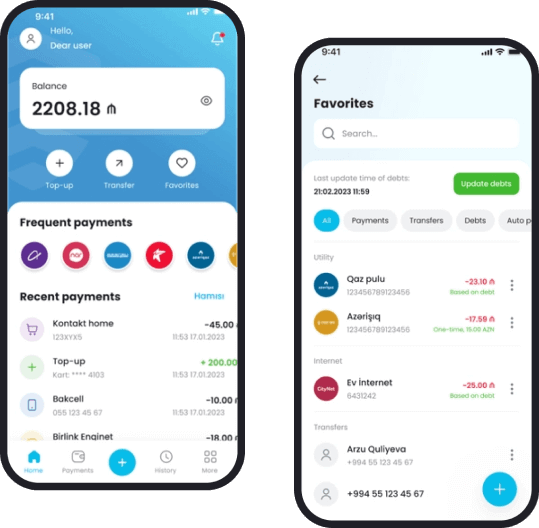

Accelerate the launch of your mobile payment or digital wallet app with white-label solution

Launch your neobank

in weeks

Database

You get a dedicated environment for secure hosting – your data, your control.

Updates

We take care of technical improvements, maintenance, and feature rollouts – so you don’t have to.

Support

Real human help from our team – experienced, responsive, and ready to solve real issues.

Integrations

Use our pre-integrated vendors or bring your own – our team will connect them for you.

New features

Need something specific? Tell us. We’re ready to build it into your solution.

Multilingual interfaces

English, Spanish, French, and Arabic interfaces come ready to use. Need more? We can add any language you require.

What’s included in SDK.finance SaaS?

Back-end in APIs

Full platform functionality through 470+ endpoints

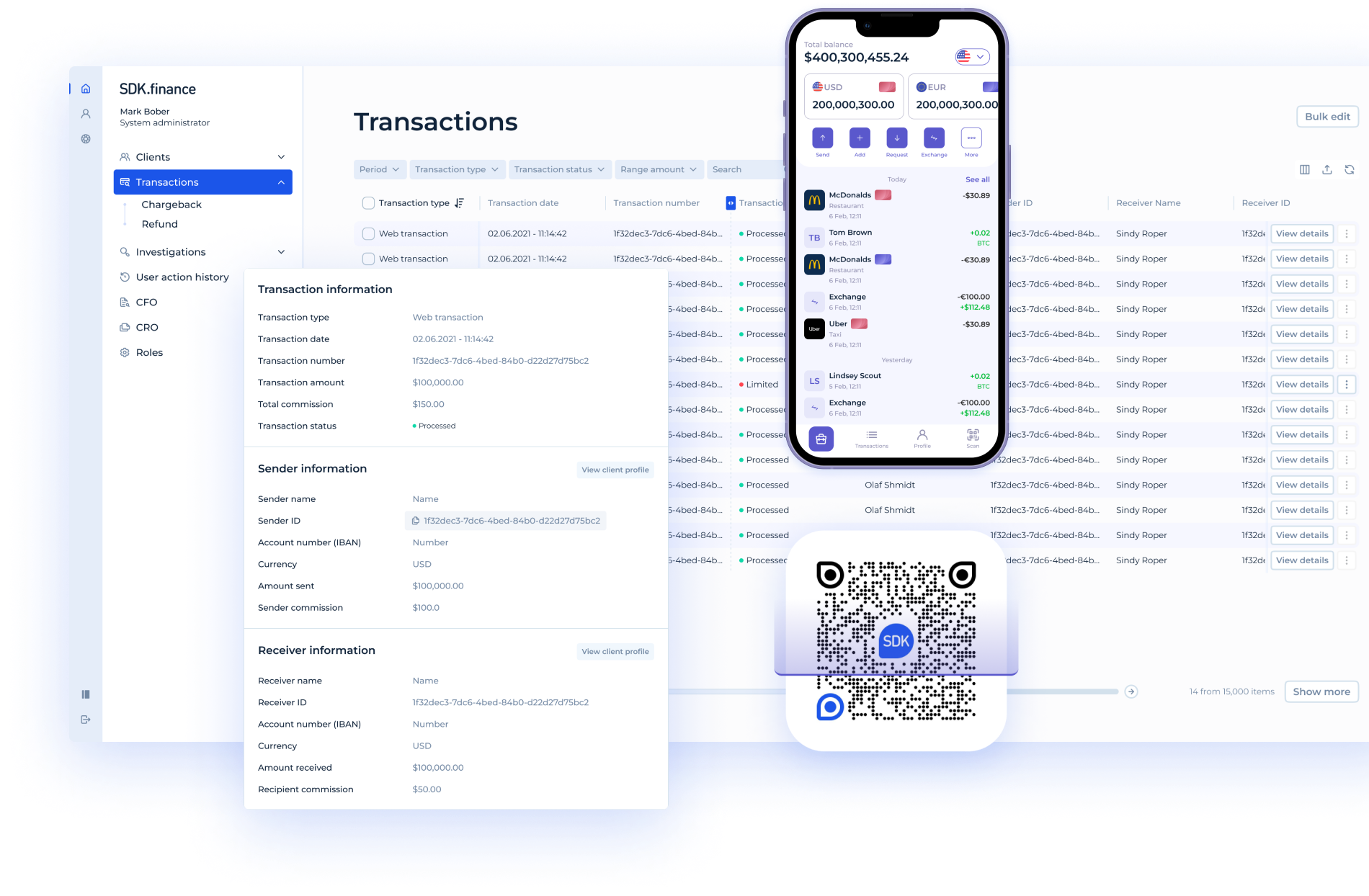

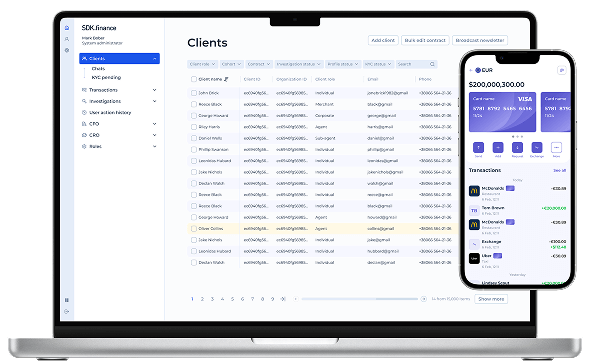

Admin panel

Web-based back-office UI for your team

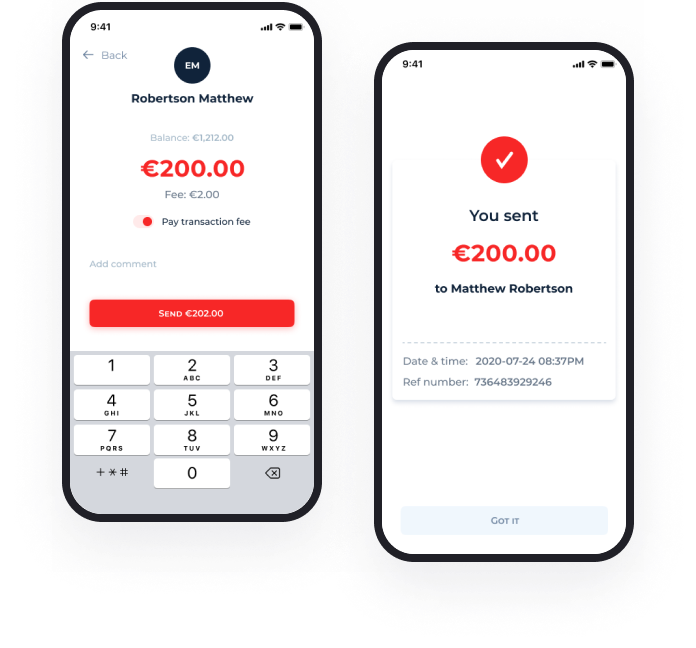

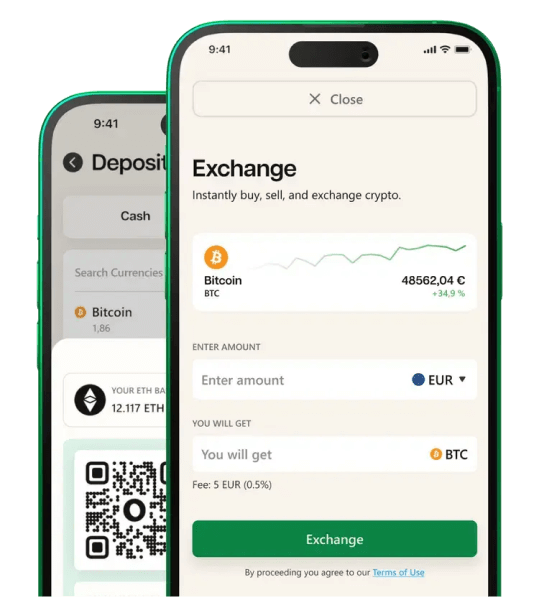

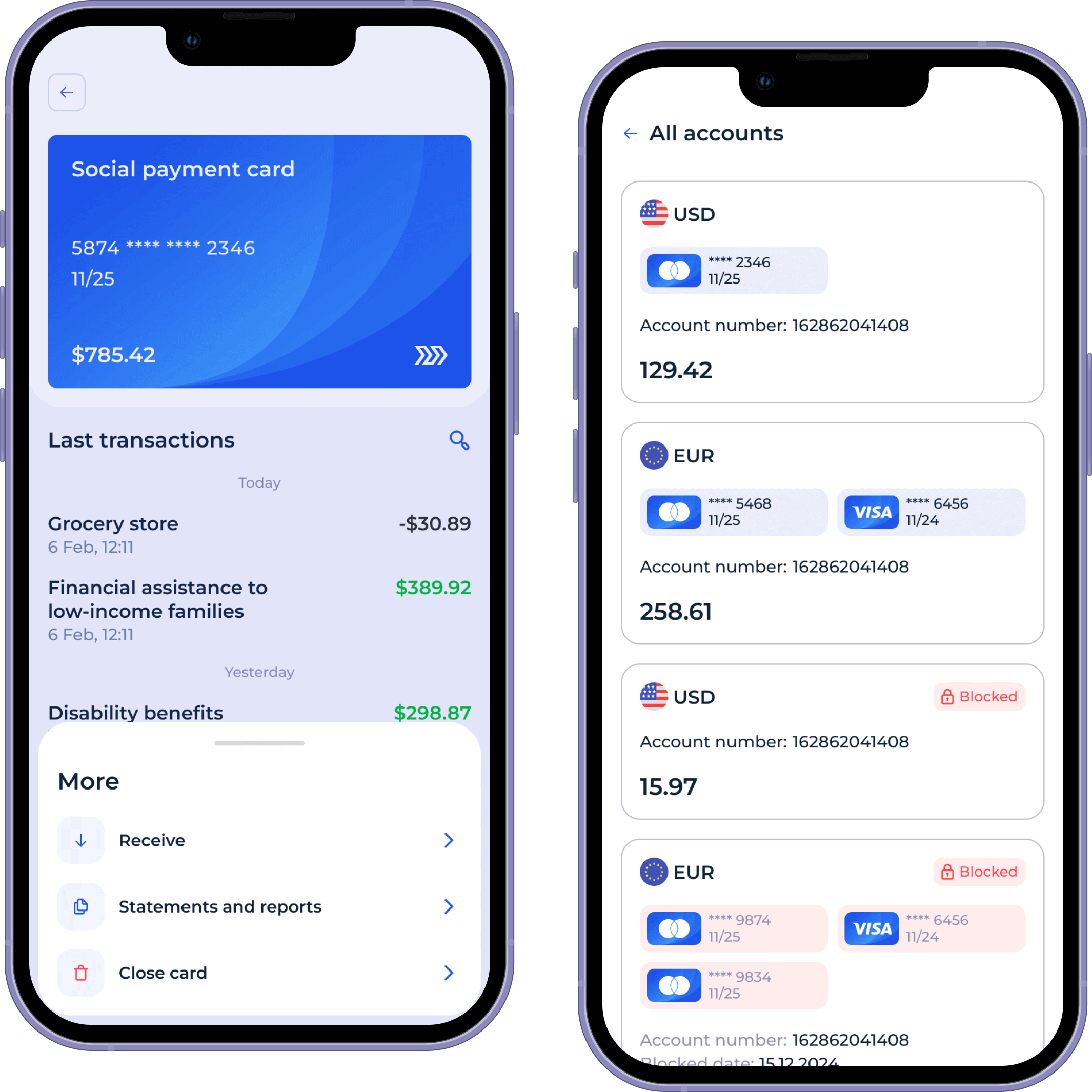

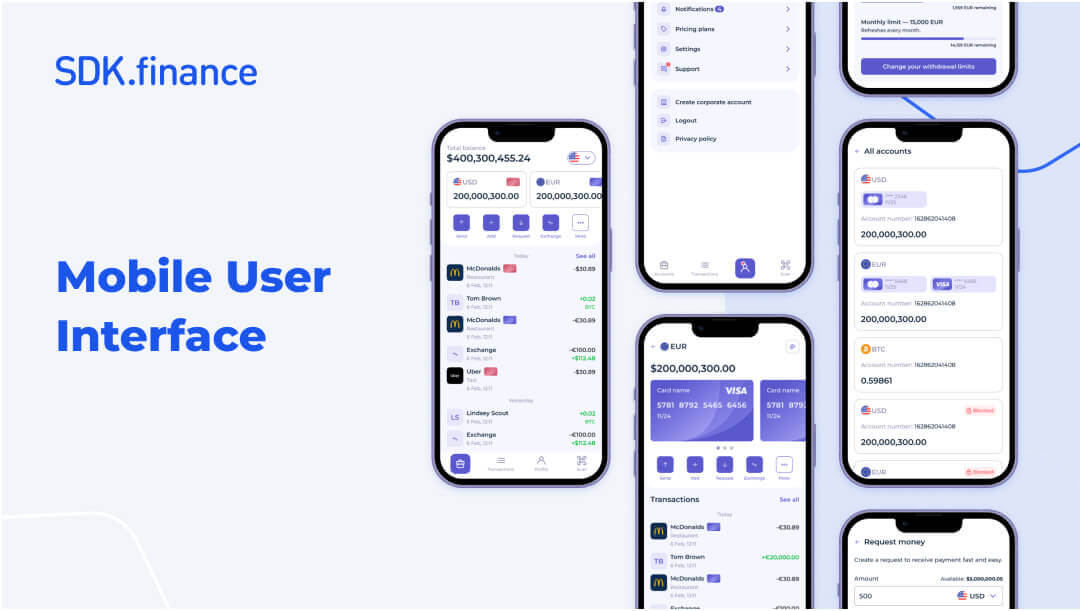

Client apps

iOS, Android, and web apps for individuals and businesses

Merchant portal

A dedicated interface for your business clients with checkout page

Save time with pre-built interfaces

Web, iOS, and Android apps included, no need to start from scratch

Watch demo

One price. All features.

Monthly payment

Check Pricing

What our customers say

Nebeus sought a Platform with ready-made solutions to save on development time and SDK.finance stood out for its competitive pricing, 24/7 support, responsive professional team, and flexibility for customization. The implementation process was smooth since we built our solution from scratch after partnering. Overall, we saved lots of time and money so I would recommend SDK.finance to those seeking a swift and affordable start.

Get started today

Connect with our team to explore how SDK.finance SaaS banking software can support your roadmap

SDK.finance SaaS Cloud Banking Software FAQs

SaaS in banking refers to Software-as-a-Service solutions that provide ready-made digital banking infrastructure over the cloud. Instead of building core systems from scratch, financial institutions or fintech companies can subscribe to a SaaS platform that includes the backend, APIs, compliance tools, and user interfaces needed to run digital banking services.

SDK.finance SaaS is a ready-to-use cloud-based platform designed to help companies launch digital banking, wallet, or payment products without building core infrastructure from scratch. It includes a powerful back-end with 470+ APIs, 60+ modules, pre-built mobile and web apps, and an admin dashboard—delivered as a subscription. Ideal for teams looking to launch a digital banking solution in weeks with the flexibility to scale.

A digital banking SaaS platform helps you launch faster and at lower cost by providing ready-made infrastructure, pre-built web and mobile apps, and built-in compliance features. It supports easy integrations, scales with your growth, and reduces the need for in-house development.

Yes, we offer video demos of the back-office for your team and mobile iOS/Android app for your clients. Both available there and then, no waiting.

If you need more details or have any questions, do reach out to us and we’ll be in touch with you shortly.

SDK.finance architecture allows integrating any 3rd-party tools for each stage of the customer journey.

See all the pre-developed integrations.

For your custom integration requirements, our 470+ RESTful API set makes it easy to build integrations with third-party providers of your choice.

Our solution isn’t geographically limited as it’s fully customizable thanks to the white label format. So if you have concerns about using our white-label digital bank for the US, Middle East, MENA, LATAM, or other regions, you don’t have to. By hosting your application on clouds like AWS, your hybrid cloud solution bank can store sensitive information on your private server—according to data handling and management regulations.

SDK.finance SaaS is available on a monthly subscription basis, making it easier to start without a heavy upfront investment. Pricing depends on the deployment stage – development or production – and the volume of transactions.

To see detailed pricing plans, visit our Pricing Page.