Dubai is moving fast toward a cash-light future. The emirate has launched an ambitious Dubai Cashless Strategy, targeting 90% digital transactions by 2026. Officials estimate this could add more than AED 8 billion ($2.17 billion) annually to the economy – a clear sign that governments view digital finance as an engine of growth, not just convenience.

By 2024, 97% of Dubai’s government services were already digital, creating a strong base for expansion. The next step is to extend this digital efficiency across retail, utilities, mobility, and private sector payments. The initiative aligns with the Dubai Economic Agenda (D33) and the leadership’s vision of positioning the city as a global capital of the digital economy.

The global shift towards cashless economies

Dubai’s cashless ambitions are part of a worldwide trend:

-

85% of POS transactions were cashless in 2024.

-

By 2027, this could rise to 89% globally.

-

The value of digital transactions is set to reach $20 trillion in 2025.

-

4.8 billion people (nearly 60% of the world’s population) will use mobile wallets by 2025.

Countries like Sweden have nearly eliminated cash (only 10% of payments remain), while even traditionally cash-heavy markets like Japan now report over 42% cashless adoption.

Against this backdrop, Dubai’s goal positions it as a regional leader in cashless adoption, with one of the fastest timelines in the world.

Inside Dubai’s cashless strategy

Key objectives

-

90% of all transactions digital by 2026.

-

Expand AI-driven and contactless payments.

-

Strengthen public-private partnerships, including fintechs and crypto companies.

-

Upgrade digital infrastructure and cybersecurity.

-

Ensure economic and financial inclusion for all.

Role of crypto

A distinctive feature is the acceptance of stablecoins for government fees. By enabling this, Dubai is acknowledging the rising role of digital assets in the future of finance. Under a recent agreement, residents will be able to use Crypto.com’s digital wallet to pay certain government fees in crypto, with the funds automatically converted to AED and transferred to government accounts.

This shows Dubai’s willingness to integrate digital assets while keeping a clear regulatory framework.

Notably, the fintech sector is seen as a crucial enabler of the cashless strategy. Dubai’s government openly acknowledges that fintech innovation will underpin the next steps in its digital payments evolution. By fostering a supportive environment – for instance, simplifying licensing procedures for payment and crypto companies – authorities are encouraging both local startups and global players to contribute solutions.

This approach has already attracted major names: Dubai has granted licences to companies like Ripple, Binance, and others, with industry leaders praising the UAE’s relatively accessible regulatory process for fintech and crypto compared to some Western countries.

Focus on trust and user experience

At the heart of Dubai’s plan is a focus on trust and user experience. The government recognises that people will fully embrace cashless living only if digital payments are:

- easy

- universally accepted

- secure.

As Dubai’s Digital authority puts it, cashless payments need to be “integral to daily life”, supported by an ecosystem that offers ease and security for all stakeholders.

This means a shopper should be confident that every merchant – from a supermarket to a street vendor – can accept a quick digital payment. It also means robust fraud prevention and consumer protection measures are in place so that users trust the digital systems. By actively involving the private sector (banks, fintech firms, payment providers), Dubai aims to foster innovation while setting standards to keep transactions safe and reliable.

Implications for financial infrastructure

The 2026 deadline is a wake-up call for banks and fintechs. Handling a predominantly cashless economy means that core banking systems, payment processing networks, and digital channels must be robust, scalable, and always available.

A cashless economy requires:

-

Scalable infrastructure – payment engines capable of handling high transaction volumes in real time.

-

Interoperability – open APIs and partnerships to enable seamless connections across banks and fintech apps.

-

Cybersecurity and resilience – fraud detection powered by AI, biometric security, and disaster recovery systems.

-

Merchant readiness – POS terminals, QR codes, and mobile links must be available everywhere, including small businesses and taxis.

We can expect further development of open banking and API-driven services so that even non-bank fintech apps or super apps can plug into the payments ecosystem securely.

In practice, a consumer might use a fintech app linked to their bank account to pay a merchant who uses a different banking provider’s system – all in seconds, with the funds moving seamlessly on the backend. Achieving this means banks must embrace open APIs and partnerships.

Indeed, Dubai’s implementation roadmap highlights expanding digital infrastructure and partnering with fintech companies as a first order of business. Financial institutions that collaborate, by integrating fintech solutions or offering their own APIs, will be better positioned to serve customers in this new landscape than those that try to go it alone.

Regulatory and compliance considerations

Moving towards a highly digitised financial system also brings regulatory and compliance challenges to the forefront. Key priorities include:

-

KYC/AML compliance – biometric onboarding, automated transaction monitoring, and integration with government ID systems.

-

Data protection – stricter requirements for handling sensitive customer information.

-

Competition and innovation – encouraging fintech and crypto firms while ensuring interoperability.

-

Consumer protection – clear liability rules, dispute resolution, and ensuring inclusion of less tech-savvy users.

The UAE has committed to building an advanced regulatory framework that balances innovation with security and public trust. This balance is crucial. On one hand, regulators need to permit new fintech models (like mobile payment apps, P2P payment platforms, or crypto services) to operate and innovate.

On the other hand, they must set rules to ensure these services are safe and reliable. We can expect updated regulations or guidance around digital payment services, perhaps new licensing categories for fintech providers, and standards for things like e-wallet security, data protection, and consumer rights in digital transactions.

The mention of an advanced framework suggests that authorities are drawing on global best practices and possibly anticipating future technologies (for instance, regulating digital assets and blockchain-based payments, given the crypto element of the strategy).

Changing consumer expectations

Today’s customers, whether individuals or businesses, increasingly expect financial services to be digital, instant, and frictionless. In a world where almost everything can be done with a smartphone tap or click, waiting in line to withdraw cash or dealing with exact change feels increasingly antiquated. The cashless strategy will further elevate these expectations, as people come to assume that every transaction – no matter how small – can be completed digitally in seconds.

As Dubai accelerates its transition, consumer behaviour will shift further:

-

Universal acceptance – customers expect to pay digitally anywhere, anytime.

-

Convenience – instant, mobile-first transactions become the norm.

-

Security with ease – biometric logins, real-time alerts, and purchase protection.

-

Personalisation – spending insights, budgeting tools, and multi-channel payments.

Consumers will reward institutions that offer secure, simple, and inclusive services. Those that fail to adapt risk losing relevance.

Modernising with white-label digital banking platforms

To achieve the ambitious goals of Dubai’s cashless strategy (and similar initiatives elsewhere), many banks and fintech companies are realising they don’t have to reinvent the wheel. Instead of building every digital solution from scratch – a process that could take years – institutions can accelerate their modernization by leveraging white-label digital banking platforms.

What is white-label digital banking platform?

White-label digital banking platforms are ready-made, highly customizable software solutions that provide the core functionality needed for digital payments, banking, and even cryptocurrency services, which a bank or fintech can brand and adapt as their own.

The idea is straightforward: use a proven technology foundation to jump-start your digital offerings, and focus your energy on tailoring the product to your customers and ensuring compliance, rather than coding the basics from zero.

Instead of starting from scratch, organisations can:

-

Launch wallet-based services rapidly

-

Integrate seamlessly with digital payment channels

-

Replace legacy infrastructure with modular, API-first systems

-

Support cashless-first strategies from day one

In practice, this approach enables banks and fintechs to align with government-led initiatives like Dubai’s Cashless 2026 Strategy while staying compliant, scalable, and competitive.

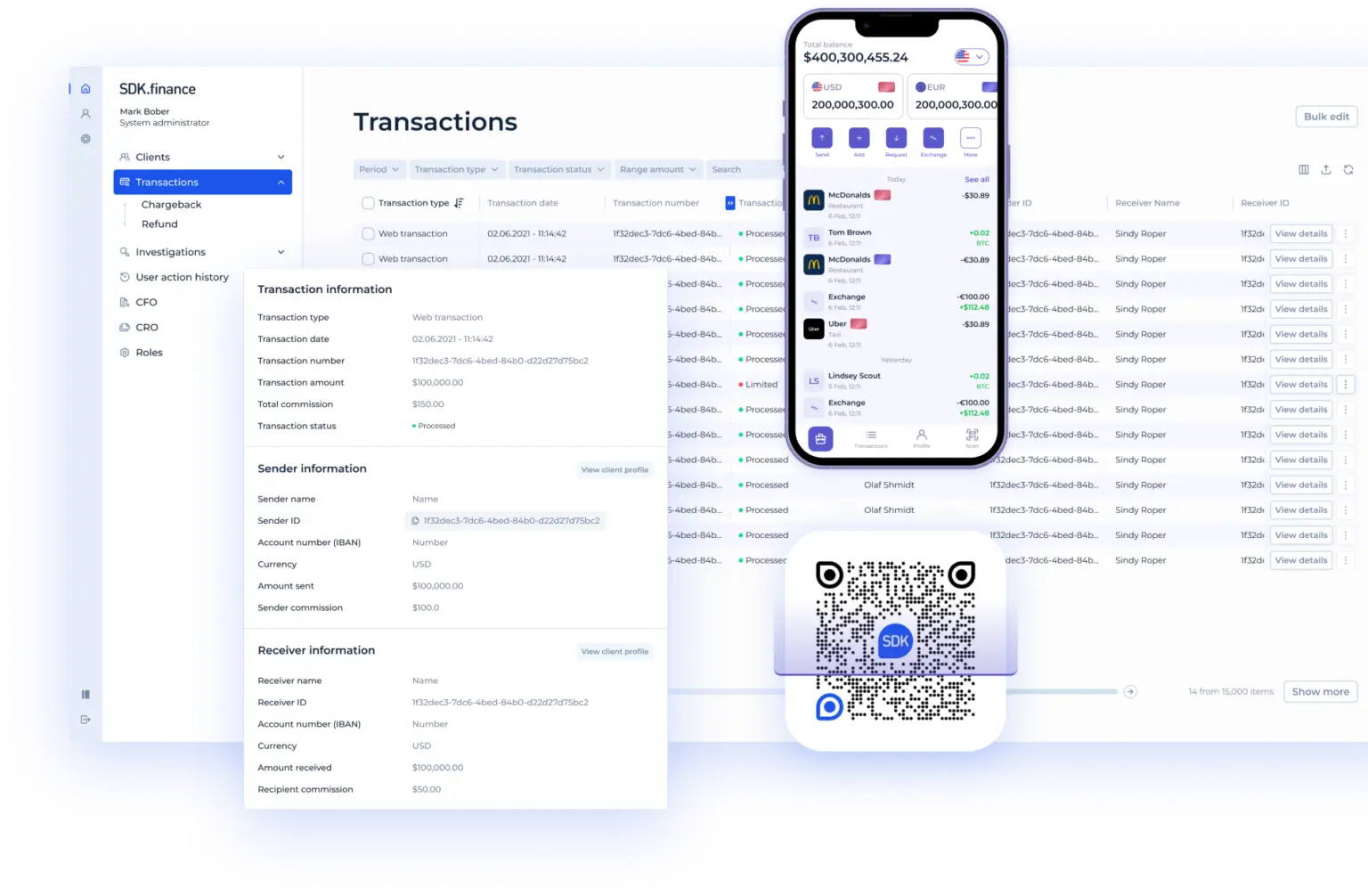

SDK.finance: powering the cashless future in MENA and beyond

At SDK.finance, we’re fully aligned with Dubai’s vision. As a core fintech platform provider, we help financial institutions modernise and thrive in the shift to digital-first economies.

Our platform enables:

-

Rapid launch of wallet-based products for individuals and businesses

-

Integration with multiple digital payment channels, including cards, QR, and crypto

-

Migration away from legacy systems, replacing them with modular, API-driven infrastructure

-

Immediate readiness for cashless-first strategies, supporting compliance and scalability from day one

- Built-in Arabic language support for mobile and web applications, ensuring accessibility for customers across the MENA region.

Alex Malyshev, CEO of SDK.finance, leading digital banking software provider, comments:

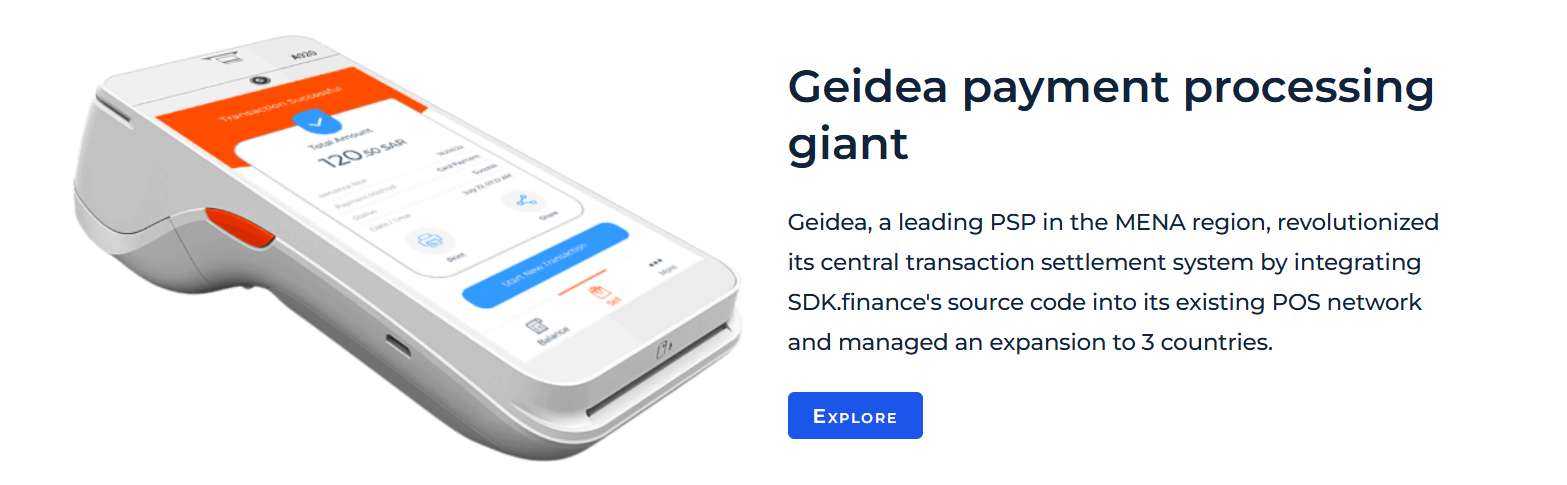

“Dubai’s commitment to a cashless economy is more than a regional milestone; it’s a global signal of how financial ecosystems are evolving. For licensed financial institutions and payment providers, the challenge isn’t just about going digital but doing so with secure, scalable, and client-centric systems from day one. At SDK.finance, we’ve already helped leading MENA players like Geidea modernise their transaction infrastructure and handle millions of daily payments. This experience proves that with the right foundation, the transition to cashless can be both rapid and sustainable.”

Case study: Geidea (Saudi Arabia)

Geidea, one of the largest payment providers in Saudi Arabia, used SDK.finance to transform its transaction accounting and scale operations.

Key results achieved:

-

Expanded partnerships with multiple banks

-

Processing capacity scaled to over 4 million daily transactions

-

Automated reconciliation, reducing manual effort and errors

-

Strengthened ability to capture the growing e-commerce market

This example shows how SDK.finance empowers financial institutions in MENA to meet the demands of cashless strategies with speed, security, and scalability.

Dubai isn’t just going cashless. It’s redefining the future of money. SDK.finance is here to power that future.

Let’s build it – digitally, securely, globally.