Europe has become one of the most dynamic regions for FinTech innovation, supported by a strong regulatory framework, widespread adoption of digital banking, and a highly competitive startup ecosystem. From London and Berlin to Vilnius and Warsaw, the continent is home to a growing number of FinTech software development companies helping banks, financial institutions, and non-banking enterprises modernise their technology.

These companies specialise in building the backbone of today’s financial services, offering solutions that cover everything from core banking systems and digital wallets to payment processing and compliance tools. In this article, we explore leading players such as SDK.finance, Ciklum, SoftServe, Django Stars, Andersen, EPAM, Luxoft, GlobalLogic, Intellectsoft, Future Processing, ScienceSoft, and JCommerce to provide a clear picture of the strongest FinTech software development partners in Europe.

For businesses exploring digital transformation or launching new financial products, understanding the leading FinTech software development companies in Europe provides a valuable benchmark when choosing the right partner.

How to start a FinTech business?

Entrepreneurs, startups, and businesses working to create a FinTech solution need a highly dedicated team, strong vision, and modern tech components. As in-house FinTech product development involves considerable risk and very narrow windows of opportunity, many partner with FinTech software development companies to benefit from their industry expertise.

There are many ways to start a FinTech company – see our article on How to Start a Neobank for more information.

SDK.finance carefully vetted, researched, and analyzed reputable resources to create this shortlist of the finest and largest FinTech software development companies with a strong presence in Europe, even if their headquarters are elsewhere. Clutch, Top Developers, Good Firms, IT Firms, Crunchbase, and the companies’ websites are just some of many sources used to compile this top 10.

Top 10 FinTech Software Development Companies in Europe 2026

SDK.finance

Headquarters: Vilnius, Lithuania / London, UK

Founded in: 2013

Specialization: FinTech, Payments, Banking, Data Science

Minimum project size: Information available on request

Website: sdk.finance

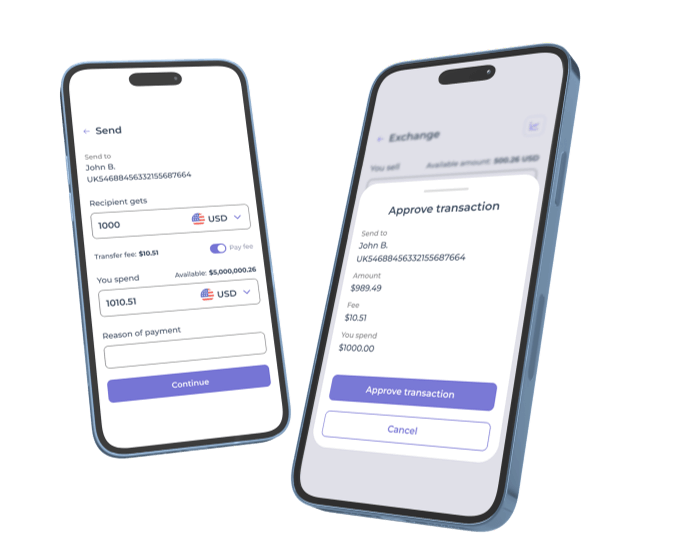

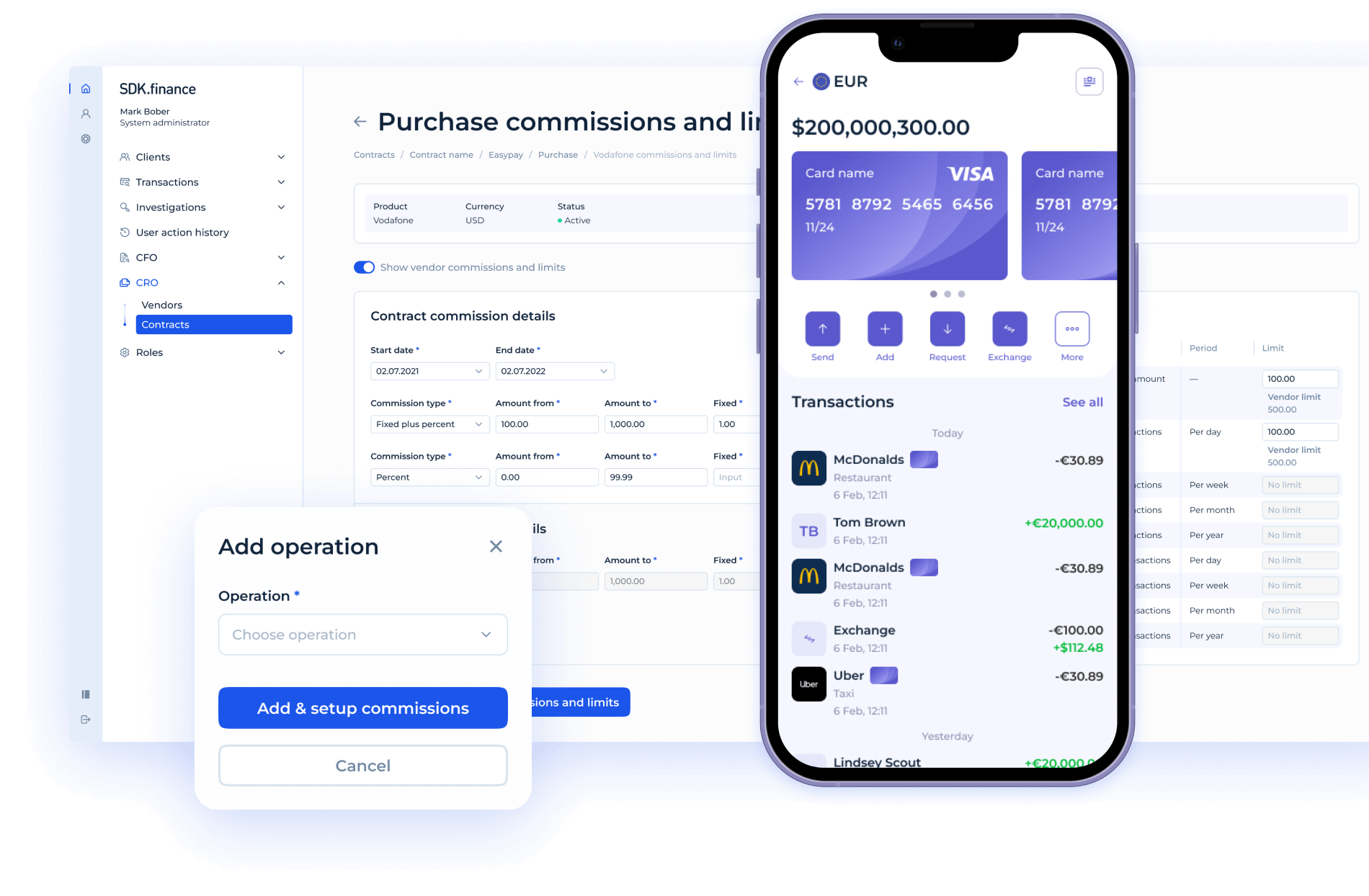

With more than 15 years of proven experience in the FinTech industry, SDK.finance has built a reputation as a trusted technology partner for banks, financial institutions, and enterprises worldwide. The company has been recognised at the PayTech Awards and Banking Tech Awards for its contribution to modern financial technology, reflecting its strong standing in the market. SDK.finance delivers a highly secure, mobile-ready Platform designed to serve as the foundation for any banking or payment product, supported by PCI DSS Level 1 and ISO 27001:2022 certifications that validate its commitment to security, data protection, and operational reliability.

From payment systems and neobanks to money remittance services, e-wallets, and omnichannel payment acceptance, SDK.finance enables organisations to accelerate development and bring reliable financial solutions to market faster.

Image source: SDK.finance neobank solution interfaces

With SDK.finance you can choose the most suitable development mode according to your product strategy.

- Dedicated development team with more than 10 years of experience to bring your digital bank to life faster

- Self-service development with a pre-developed Platform by SDK.finance to support your technical team. The Platform is available as a cloud-based software and Source Code modes.

Both modes allow you to accelerate the development of your banking software and focus on the customer and product experience.

Innowise

Headquarters: Warsaw, Poland

Founded in: 2007

Specialization: FinTech, Healthcare, Pharma, eCommerce, Manufacturing, Logistics, etc.

Minimum project size: On request

Website: innowise.com

Innowise is a fintech software development company that designs and develops high-performance financial ecosystems backed by enterprise-grade architecture, advanced security, and precision engineering for mission-critical financial operations.

With compliance embedded from day one, Innowise develops fintech platforms aligned with PSD2, PCI DSS, GDPR, CCPA, ISO 27001, and SOC 2 Type II requirements, ensuring audit readiness, regulatory compliance, and data protection throughout the entire development lifecycle.

Backed by 150+ fintech experts, the company has successfully delivered 100+ projects for clients in more than 30 countries, serving startups and global enterprises alike.

Ciklum

Headquarters: London, UK

Founded in: 2002

Specialization: FinTech, Healthcare, E-commerce/Retail, Entertainment

Minimum project size: $25 000

Website: www.ciklum.com

With development centers and offices all over Europe and the world, Ciklum builds tailored digital solutions that leverage emerging technologies for Fortune 500 and fast-growing companies. Just Eat, Flixbus, Metro Markets, EFG International, Zurich Insurance, and Lottoland are just some of many clients that have entrusted Ciklum with software development.

Ciklum leverages its nearly two decades of expertise to deliver solutions with proven market value and enhance digitally immature products. The companies’ specialists diligently guide clients through data-driven principles and offer a unique perspective with strong digital consulting aligned to business goals.

ZoolaTech

Headquarters: Miami, FL, USA

Founded in: 2017

Specialization: Custom Software Development, Retail/E-commerce, FinTech, Healthcare, AI/ML, Cloud & DevOps

Minimum project size: ~$100,000+

Website: www.zoolatech.com

ZoolaTech is a global software engineering company specializing in building secure, scalable fintech products for both startups and enterprise-level financial institutions. With development hubs across Europe and Latin America, the company delivers high-performance engineering teams and end-to-end product development services.

ZoolaTech’s fintech expertise spans digital banking platforms, payment solutions, data analytics, cloud-native architectures, and legacy system modernization. Their teams focus on long-term product stability, compliance-ready design, and seamless user experiences. With a strong emphasis on senior-level talent and flexible engagement models including dedicated teams, team augmentation, and managed delivery. ZoolaTech helps fintech companies scale efficiently while maintaining enterprise-grade quality and security.

SoftServe

Headquarters: Austin, USA

Founded in: 1993

Specialization: FinTech, Energy, Healthcare, Retail, Media and Entertainment

Minimum project size: $50 000

Website: www.softserveinc.com

For almost three decades, SoftServe has been transforming, accelerating, and optimizing how companies do business. As a digital authority on cutting-edge technology, the company implements end-to-end solutions that deliver innovation without compromising quality or speed. SoftServe relies on an empathetic, people-centered foundation of both seasoned experts and team members who are just starting their career in fintech to generate compelling new ideas, develop, and implement transformational products and services from concept to release.

SoftServe strives to empower its clients to identify their unique advantages, accelerate solution development, and improve competitiveness in today’s digital economy. The company’s key clients include Panasonic, Henry Schein Practice Solutions, BMC Software, Avery Products, Allscripts, Zilliant, Cloudera, MEDHOST, SolarWinds, and many others.

Django Stars

Headquarters: Ukraine

Founded in: 1993

Specialization: FinTech, Logistics, Travel, Proptech

Minimum project size: Unknown

Website: www.djangostars.com

Django Stars is a FinTech software development partner with 16 years in digital finance. They design and deliver secure, compliant finance products: from payments and lending to regtech and wealthtech, turning complex financial logic into clean, user-centric apps. The team handles end-to-end FinTech development across mobile, web, cloud, desktop, and custom hardware, and can scale teams or advise startups and enterprises.

In its portfolio of successful cases, Django Stars includes collaborations with companies such as MoneyPark, PADI Travel, and Scoperty.

Andersen

Headquarters: New York, USA

Headquarters: New York, USA

Founded in: 2007

Specialization: Financial services, Medical, Information technology, Logistics, eCommerce

Minimum project size: $50 000

Website: www.andersenlab.com

Banks across the world rely on Andersen’s expertise in core banking software solutions. Among them are BNP Paribas, Paysera, ING, G Bank, GeneralFinancing etc. With over 170 successfully delivered custom banking solutions for over 16 years, Andersen has earned a great reputation in the EU and USA markets.

With Andersen’s solutions, customers can improve the business efficiency of their banking institution to benefit from better workflows, custom relations, resource planning, and data-driven decision-making. Andersen has a rich advisory board of 30+ experts in this field and 250+ specialists in their team which allow them to deliver high-end software solutions in the banking sector, from regular software development to integration and digitalization of the whole banking systems.

Through the incorporation of the innovative Tech-Stack with modern technologies such as AI and ML, Andersen guarantees their clients that their software is always up-to-date. Furthermore, constant updates and 24/7 support allow banks to benefit from the latest trends and minimize their risks of failure. With a 90% rate of returning customers, Andersen is a reliable partner for developing core banking software and other digital banking solutions.

EPAM

Headquarters: Newton, USA

Founded in:1993

Specialization: FinTech, Tourism, Media and Entertainment, Life Sciences, Healthcare

Minimum project size: $10 000

Website: www.epam.com

Since its founding in 1993, EPAM has leveraged its rich software engineering expertise for global product development, digital engineering, and cutting-edge digital product design. EPAM’s software engineering strength, innovative strategic planning, and professional IT consulting services have been recognized by industry leaders and independent research institutes.

With roots in Belarus, EPAM helps 275+ Forbes Global 2000 customers in 35+ countries transform business and software development challenges into profitable business opportunities. Innovative design, next-generation solutions, and unique engineering culture make EPAM a trusted FinTech software development company.

Luxoft

Headquarters: Zug, Switzerland

Founded in: 2000

Specialization: FinTech, Telecom, Energy, Automotive, Travel & Aviation

Minimum project size: $5 000

Website: www.luxoft.com

Luxoft’s deep domain expertise cements its status as a top-quality FinTech software development company for high-end business solutions. The company consistently brings together technology, talent, innovation, and the highest quality standards to build long-lasting partnerships with industry giants, such as Boeing, IBM, Deutsche Bank, UBS, Harman, Avaya, Alstom, Sabre, Ford, Hotwire, that is why Luxoft is considered one of the top software companies in Europe.

Luxoft attracts seasoned business and technology specialists who fulfill the most demanding client needs with high-quality, innovative technology solutions. The company’s proprietary processes and methodologies, technology skills, and industry knowledge enable business transformation, enhance customer experiences, and boost operational efficiency.

GlobalLogic

Headquarters: San Jose, USA

Founded in: 2000

Specialization: FinTech, Automotive, Communications, Consumer & Retail, Healthcare

Minimum project size: $25 000

Website: www.globallogic.com

GlobalLogic is a full-lifecycle FinTech product development company that leverages chip-to-cloud software engineering expertise to build and deliver next-generation digital products and services. GlobalLogic expertly integrates design, complex engineering, and agile delivery capabilities with a solid European presence across offices and development centers to produce superior business outcomes for global brands.

The company pays special attention to helping clients answer the question of what they want to build with top-tier brand strategists, ideation experts, and UX designers. The design-led approach enables complete digital transformations for the most critical and strategic products that drive GlobalLogic’s customers’ revenues.

Intellectsoft

Headquarters: Miami, USA

Founded in: 2007

Specialization: FinTech, Construction, Healthcare, Insurance, Logistics & Automotive

Minimum project size: $50 000

Website: www.intellectsoft.net

Intellectsoft’s software development FinTech services help businesses of any scale leverage cloud technologies such as digital wallets, secure trading, payment processing, cross-border transactions, and lending. Intellectsoft relies on cutting-edge technologies to accelerate adoption of new solutions and untangle complex challenges that emerge during digital transitions.

Intellectsoft handles full lifecycle development and management of custom software, starting with ideation and concept to delivery and ongoing support. The company’s structure and IS360 framework allow it to maintain a tailored approach to each client and enable successful digital transformations while fostering deep engineering expertise.

Future Processing

Headquarters: Gliwice, Poland

Founded in: 2000

Specialization: FinTech, Data Science, Machine Learning

Minimum project size: $25 000

Website: www.future-processing.com

In just over 20 years, Future Processing went from 2 people to 800, 200 clients, and 600+ projects. Software development FinTech services are upheld by the company’s mission to leverage technology and ask the right questions to deliver the highest quality solutions on time. Future Processing is one of the most reliable software development companies in Europe, that provides consulting.

With a deep pool of talented software engineers, Future Processing can manage software development projects from the initial requirements gathering and analysis to final maintenance and support. The company stays at the forefront of innovative technologies to help their clients make the most out of digital with Machine Learning, Cloud, or Data Science solutions.

ScienceSoft

Headquarters: McKinney, USA

Founded in: 1989

Specialization: FinTech, Banking, Healthcare, Manufacturing, Retail, Telecommunications

Minimum project size: $5 000

Website: www.scnsoft.com

ScienceSoft is an established FinTech software development company that has vast expertise in developing a wide range of solutions for banks and financial institutions, from internet banking and CRMs to data analytics and lending software. 700+ specialists cater to big corporations and startups alike as the company’s solutions can be platform-based or customized.

IBM, eBay, Robert Half, Viber, PerkinElmer, Ford Motor Company, and other prominent companies have formed reliable partnerships with ScienceSoft, and it does everything to live up to its clients’ expectations. No matter how great the uncertainty, the company excels at both detailed and strictly controlled project plans.

JCommerce

Headquarters: Katowice, Poland

Founded in: 2005

Specialization: FinTech, HealthTech, Retail, Telecom, Industry 4.0, IT Consulting

Minimum project size: $10 000

Website: www.jcommerce.eu

JCommerce has been building scalable digital solutions to empower clients with a competitive edge. The company has helped its clients implement and develop Enterprise-class applications and systems, payment systems, and business automation solutions for clients in the financial services industry such as ING Bank Śląski, ERGO, Backbase, and Squared Financial Services.

JCommerce is invested in commitment, collaboration, and transparency as a way of achieving true and trusting partnerships. The company’s 300 skilled specialists leverage the best practices for project and team delivery in nearshore and offshore models to innovate and deliver value with full-cycle product development. JCommerce is one of the trusted software companies in Europe thanks to its scalability and transparency.

Choosing the Right FinTech software development company

Choosing the right financial software development company is no easy task. The difference between an average match and a great one can make or break even the best FinTech product. Dedicating time to explore, research, and talk with different companies will pay for itself in no time at all.

The team at SDK.finance has worked tirelessly to make innovative FinTech products as accessible as possible. With 15+ years of expertise at the heart of the platform, SDK.finance has everything you need to launch your banking or payment product. Contact us to see how our solutions would work for your organization.