The rapid rise of neobanks has transformed how individuals and businesses interact with financial services. In response, a growing number of financial institutions, fintech startups, and even non-financial brands are turning to white-label digital banking platforms to enter the market faster and more efficiently.

According to researches, the neobank market is projected to reach $3.4 trillion by 2032, with a CAGR of nearly 49%. Meanwhile, over 50% of traditional banks are accelerating digital transformation to remain competitive. In this environment, white-label banking platforms are playing a crucial role in lowering technical, regulatory, and financial barriers to entry.

Top white-label digital banking platforms in 2026

SDK.finance

Headquarters: Vilnius, Lithuania

Headquarters: Vilnius, Lithuania

Best For: Fintechs and enterprises that want complete product control, own their infrastructure, and build highly customised banking experiences.

Time to Launch: 2–3 months (MVP)

Core Strength: Source code licence + PCI DSS certified + scalable ledger

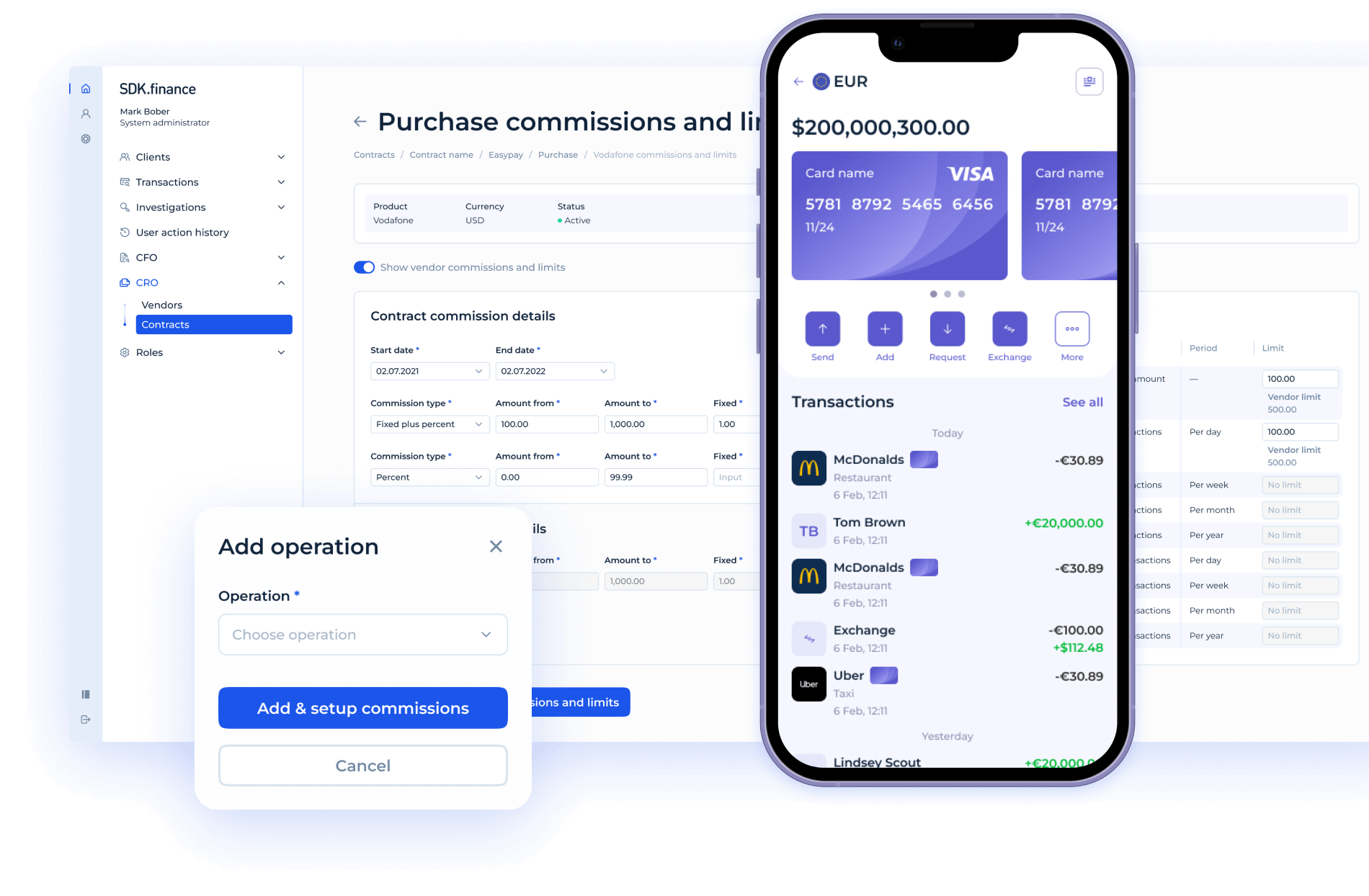

Among the top white-label providers in 2025, SDK.finance offers one of the most complete and flexible platforms on the market. With over 15 years in fintech software development, SDK.finance supports a wide range of use cases from launching digital banks to enabling embedded finance for telecoms and marketplaces.

Built for customisation and control

SDK.finance offers two deployment models: a source code license for full control, or a cloud-based SaaS subscription. This flexibility is rare in a market dominated by SaaS-only vendors.

What sets SDK.finance apart:

-

Source code license – Full ownership and customisation without vendor lock-in

-

Pre-built interfaces – Ready-made frontends for customers, admins, and merchants

-

Mobile apps & merchant portal – Included out of the box (iOS and Android)

-

PCI DSS level 1 compliant – Enterprise-grade security built in

-

Fast time to market – Launch an MVP like “Neopunk” in as little as 3 months

-

High-performance infrastructure – 2,700+ transactions per second baseline, horizontally scalable

With live projects across Europe, Asia, and MENA, SDK.finance has become the go-to platform for teams that need to balance speed, compliance, and long-term flexibility.

In 2024, SDK.finance was recognized as a finalist for the Pay Tech Awards in the Best Digital Solution Provider category for payment technology, highlighting its contribution to advancing payment infrastructure. The company has also participated in cutting-edge innovation programs, including a central bank digital currency project led by Barclays.

Check out the SDK.finance mobile app UI, designed to help you create secure and feature-rich financial experiences in record time:

Crassula

Headquarters: Riga, Latvia

Headquarters: Riga, Latvia

Best For: Fintech startups and small financial institutions in the EU looking for a fast, SaaS-based launch.

Time to Launch: 2–6 weeks

Core Strength: Fast onboarding and integration with EU banks

Crassula offers a no-code platform for launching white-label digital banks with IBANs, SEPA, SWIFT payments, FX, and crypto wallets. It’s ideal for teams focused on quick go-live and low operating overhead, though backend control is limited.

Velmie

Headquarters: New York, USA

Headquarters: New York, USA

Best For: Regional banks, digital wallet operators, or startups wanting a modular, API-first solution.

Time to Launch: 2–3 months

Core Strength: Hybrid deployment model + KYC/AML integrations

Velmie provides a flexible core banking platform with strong APIs and a microservices-based backend. It supports features like mobile wallets, multi-currency accounts, FX, lending, and crypto rails. Available as SaaS or on-premise.

Akurateco

Headquarters: Amsterdam, Netherlands

Best For: PSPs, acquirers, and merchant aggregators needing smart routing and fraud prevention.

Time to Launch: 1–4 weeks

Core Strength: Payment orchestration layer + fraud monitoring

Akurateco offers white-label access to over 200 payment connectors through a single interface. While it doesn’t offer full neobank capabilities, it excels in payment processing, reconciliation, and merchant onboarding.

Swan

Headquarters: Paris, France

Headquarters: Paris, France

Best For: EU platforms embedding banking via API under Swan’s licence

Time to Launch: 1–2 months

Core Strength: Regulated BaaS with built-in compliance

Swan is a Banking-as-a-Service provider that offers SEPA payments, IBANs, card issuing, and account creation. Businesses can launch financial services without becoming regulated entities themselves. However, they operate under Swan’s licence and framework.

Mambu

Headquarters: Berlin, Germany

Headquarters: Berlin, Germany

Best For: Mid-to-large financial institutions needing composable SaaS core banking

Time to Launch: 4–9 months

Core Strength: Cloud-native, composable architecture

Mambu serves more than 200 financial institutions globally. It supports deposits, lending, FX, and core banking services through its modular architecture. Requires extensive integration support and third-party developers.

Finastra

Headquarters: London, UK

Headquarters: London, UK

Best For: Tier-1 banks and large institutions modernising legacy systems

Time to Launch: 9–18 months

Core Strength: Deep functional coverage + regulatory alignment

Finastra’s Fusion platform covers retail, corporate, treasury, and risk functions. It is widely used in large-scale digital transformation projects. Customisation is extensive but deployment is time- and resource-intensive.

Temenos

Headquarters: Geneva, Switzerland

Headquarters: Geneva, Switzerland

Best For: Established banks needing cross-border, multi-regional digital banking

Time to Launch: 12+ months

Core Strength: Rich functionality + global coverage

Temenos offers a comprehensive suite of banking modules with cloud and on-premise options. It supports complex regulatory environments and high transaction volumes, though it requires significant project planning and investment.

White‑label digital banking providers: comparative overview

Here’s a refined vendor comparison, now including timeline to launch and representative use cases:

| Provider | Focus | Time to Launch | Control Level | Ideal For |

|---|---|---|---|---|

| SDK.finance | Source-code licensed neobank platform | 2–3 months | Source code

SaaS |

Fintechs, banks, and enterprises need agility + flexibility |

| Crassula | Modular SaaS for wallets, FX, issuance | 2–6 weeks | SaaS only | Fast-lean fintechs in the EU |

| Velmie | API-first for wallets & neobanks | 2–3 months | Configurable SaaS | Regional digital challengers |

| Akurateco | Payment orchestration & fraud | 1–4 weeks | SaaS (payments only) | PSPs needing gateway/routing |

| Swan | EU‑licensed BaaS (API banking) | 1–2 months | API/BaaS | Platforms embedding IBAN & cards |

| Mambu | Composable SaaS core banking | 4–9 months | SaaS (no code access) | Banks upgrading digital core |

| Finastra | Full-suite enterprise banking | 9–18 months | Closed enterprise core | Tier-1 banks with complex needs |

| Temenos | Modular global core banking | 12+ months | Closed enterprise core | Large incumbents with long-term scope |

Benefits of using white‑label neobank platforms

White-label platforms offer significant advantages over building a digital banking stack from scratch. These benefits apply to both startups and established financial institutions looking to modernise operations.

1. Faster time to market

Launching a new bank typically takes 12–24 months with a traditional build. White-label solutions reduce this to 2–6 months, sometimes even less. Pre-integrated components like KYC, payments, card issuing, and user portals allow teams to focus on branding, go-to-market, and compliance – not core infrastructure.

2. Lower development costs

Custom-built banking cores require millions in development and compliance spend. In contrast, white-label banking solutions reduce upfront investment dramatically. Depending on complexity and licensing, total launch costs can range from $50,000 to $300,000 – a fraction of traditional budgets.

3. Regulatory and security readiness

Most white-label platforms come with essential regulatory and security features out of the box:

-

KYC/AML modules

-

PCI DSS or ISO/IEC 27001 certification

-

GDPR and PSD2 compliance

-

Transaction monitoring

-

Role-based permissions and audit trails

This speeds up the licensing process and reduces compliance risks.

4. Focus on product and differentiation

By abstracting away infrastructure and compliance complexity, teams can focus on:

-

User experience (UX/UI)

-

Customer acquisition strategy

-

Differentiated financial features (e.g., niche lending, gamified savings, loyalty)

-

Data insights and personalisation

This accelerates innovation and shortens the feedback loop from customer to product iteration.

5. Customisation and branding flexibility

Unlike rigid SaaS products, white-label banking platforms offer flexibility in how much you can modify. Some platforms (like SDK.finance) provide source code access, enabling total product control. Others allow extensive API-level customisation within hosted environments.

This enables:

-

Full rebranding

-

Custom business logic

-

Localisation for different markets

-

Support for new currencies and assets (fiat or crypto)

6. Scalability for growth

Many platforms are built with scalability in mind:

-

Multi-currency and multi-asset support

-

Microservices or modular architecture

-

Event-driven processing for large transaction volumes

This ensures your system can scale with growth—across geographies, customer segments, and product verticals.

7. Fewer operational and compliance risks

Launching a neobank carries operational risk: technical instability, data leaks, compliance failures, vendor outages. White-label platforms have battle-tested infrastructure, SLAs, and vendor support—greatly reducing the risks that typically slow down early-stage fintechs.

Why SDK.finance leads?

White-label platforms dominate the fintech landscape for their combination of speed, cost-efficiency, and compliance. But when you need full control, enterprise-grade security, and rapid deployment, SDK.finance remains an unmatched option in 2025.

By offering source‑code licensing, pre-built UIs, PCI DSS compliance, and a 3-month MVP launch, SDK.finance bridges the gap between flexibility and time-to-market. Other vendors offer speed or breadth, but few provide all three: control, security, performance.

If your project involves launching or scaling a digital bank, embedded finance solution, or wallet service, explore how SDK.finance can help you move fast while keeping control. Reach out today to request a demo or discuss your options.