Core Banking Introduction: Why the Difference Still Causes Confusion

For many technology leaders in banking and financial services, the distinction between core banking software and digital banking software remains less clear than it should be. This is not due to a lack of experience or technical capability. Rather, it reflects how these systems have evolved, how vendors position them, and how transformation initiatives are typically organised inside large financial institutions.

Core banking solutions were introduced to solve operational and regulatory problems at scale. Digital banking software emerged later, driven by distribution, customer interaction, and the need to expose financial capabilities beyond traditional channels. Over time, these layers began to overlap in terminology but not in responsibility.

From a CTO or CIO perspective, the real risk lies in treating these systems as substitutes instead of complementary layers. When digital requirements are pushed into the core, delivery slows and risk increases. When core responsibilities are pushed into digital layers, financial integrity and regulatory clarity are compromised.

This article approaches the topic from an architectural and governance standpoint. It clarifies what each system is structurally responsible for, where boundaries should exist, and how mature organisations design banking stacks that can evolve without constant re-platforming.

What Is Core Banking Software?

Definition and role in traditional banking infrastructure

Core banking software represents the operational backbone of a regulated financial institution. Its purpose is not to enable innovation directly, but to guarantee financial correctness, consistency, and regulatory compliance across the organisation.

Historically, core banking systems were designed to support geographically distributed bank branches. The core ensured that balances, postings, and product rules remained consistent regardless of transaction origin. This requirement shaped core architectures around determinism, strict data integrity, and controlled change.

Even in modern deployments, this design philosophy remains valid. Core banking platforms are optimised for stability under regulatory scrutiny, not for rapid functional iteration.

Core banking as the system of record

From an architectural standpoint, a core banking system is the system of record for financial data. It owns the authoritative ledger, integrates with general ledger systems to update financial records, applies product logic such as interest and fees, and produces legally binding reports. In addition to accounts and banking transactions, the core banking system also processes other financial records within the banking infrastructure.

For technology leaders, coreless banking has important implications:

- The core defines financial truth, not downstream systems.

- Any inconsistency is resolved in favour of the ledger.

- Change management must prioritise auditability and reversibility.

This is why core platforms are typically governed by conservative release cycles and strict controls.

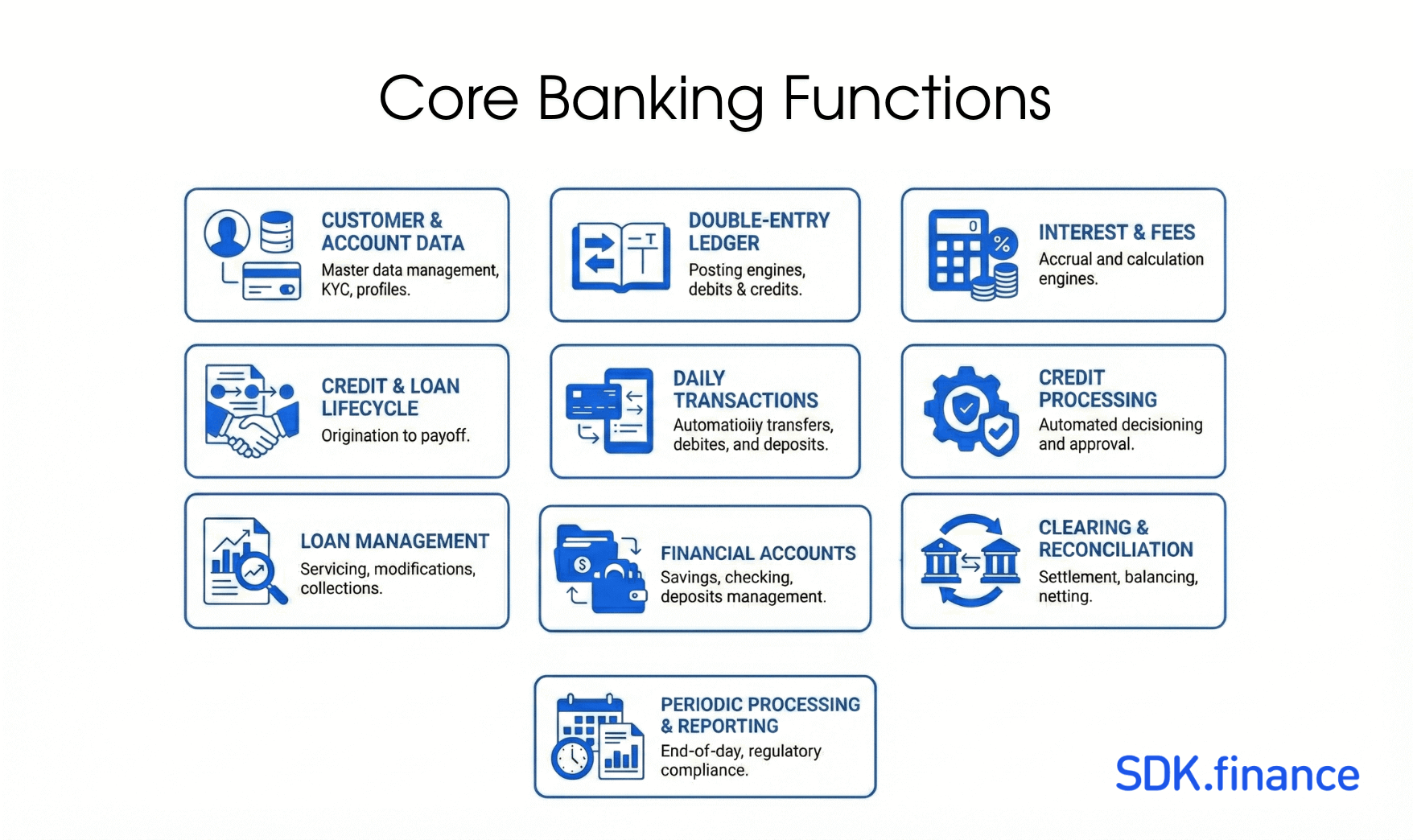

Typical functions handled by core banking systems

In practice, core banking system includes handling core banking operations and banking services:

- Customer data and account master data.

- Double-entry ledger and posting engines.

- Interest accrual and fee calculation.

- Credit and loan lifecycle management.

- Daily banking transactions processing.

- Credit processing capabilities.

- Loan management as an essential function.

- Management of financial accounts.

- Clearing, settlement, and reconciliation.

- Periodic processing and regulatory reporting.

These components are deeply interconnected. Modifying one area often requires coordinated changes elsewhere, which directly affects delivery velocity.

What Is Digital Banking Software?

Definition and scope of digital banking platforms

Digital banking software operates above the core and does not replace it. Its role is to expose financial services through digital channels in a controlled, scalable way.

Architecturally, digital banking platforms function as orchestration layers. They coordinate user interactions, business workflows, and integrations with multiple back end systems, including core banking platforms and third-party providers.

Digital banking as the customer and business interaction layer

For end users, digital banking software, including mobile banking, defines the perceived bank. For internal teams, it becomes the primary operational interface for onboarding, payment services, and support.

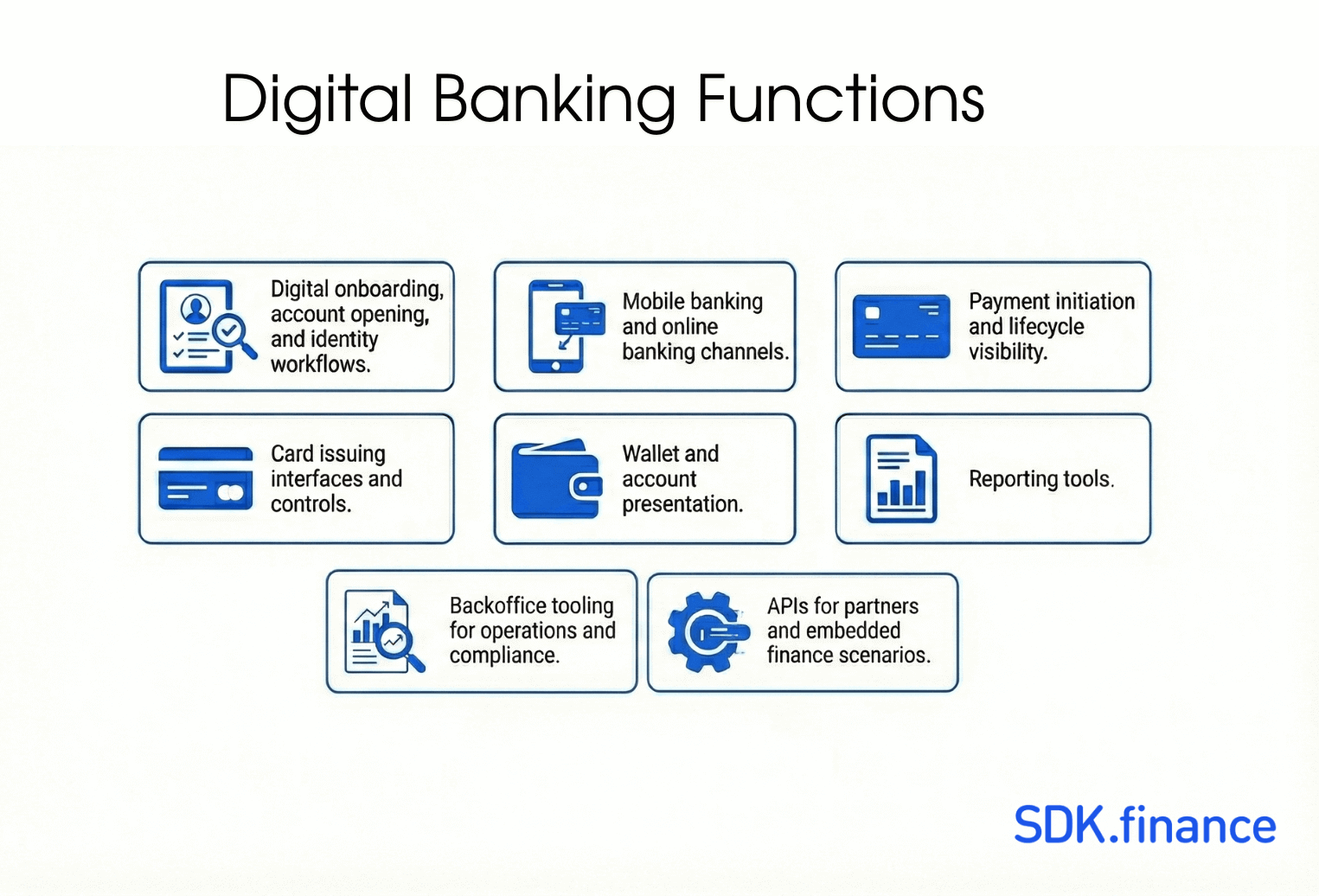

Typical digital banking services include:

- Digital onboarding, account opening, and identity workflows.

- Mobile banking and online banking channels.

- Payment initiation and lifecycle visibility.

- Card issuing interfaces and controls.

- Wallet and account presentation.

- Reporting tools.

- Backoffice tooling for operations and compliance.

- APIs for partners and embedded finance scenarios.

Digital banking systems are increasingly designed as next generation solutions that support digital transformation and digital adoption, optimise onboarding, and expand the services offered, helping financial institutions reduce operating costs while delivering a seamless banking experience aligned with evolving customer expectations.

Unlike core systems, digital platforms are built to evolve continuously as a new system layer that adapts to changing business models and channels, enabling organisations to stay competitive and maintain a sustainable competitive advantage over time.

Typical functions handled by digital banking software

From a systems perspective, digital banking platforms usually implement:

- User and account management.

- Two factor authentication.

- Workflow and state orchestration in core banking software.

- Channel-specific presentation logic.

- Notification and communication layers.

- Transaction views and analytics.

- Support and case-management tooling.

- Integration routing and abstraction.

These functions sit intentionally outside the core ledger.

Core Banking vs Digital Banking: Architectural Differences

Monolithic core systems vs modular digital platforms

Most core banking systems, including modern ones, operate under tightly governed architectures. Even when modular, their components are strongly coupled through financial logic and regulatory dependencies.

Digital banking platforms are modular by necessity. Onboarding, payments UX, card management, and notifications can be deployed independently. This architectural separation directly supports faster delivery and lower operational risk.

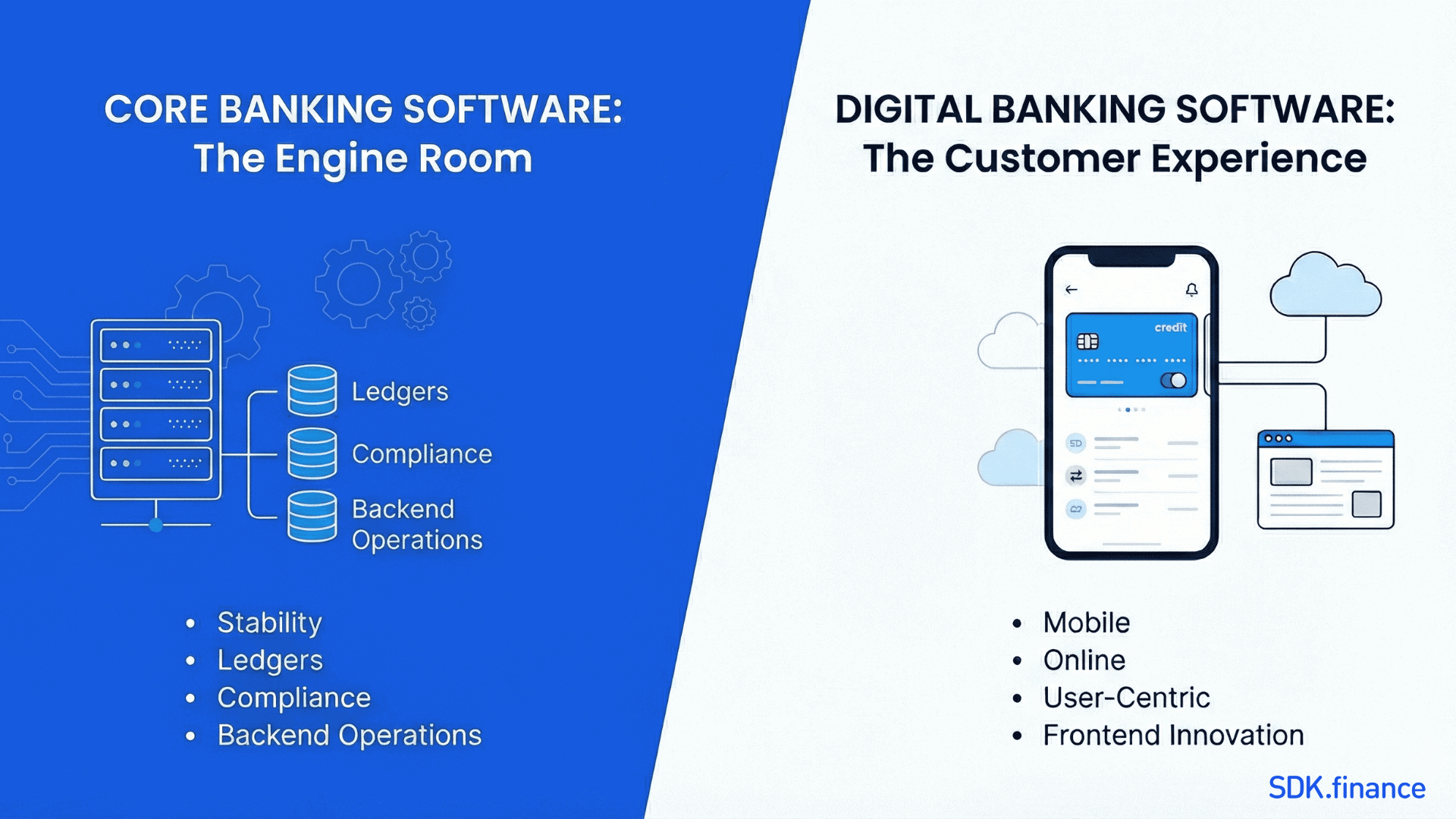

Ledger-centric vs experience-centric architecture

Core banking architecture is ledger-centric. All processes exist to maintain accounting correctness.

Digital banking architecture is experience-centric. Transactions are part of broader workflows that include validation, confirmation, exception handling, and communication.

Real-time processing expectations

Digital channels demand immediate feedback. Digital platforms handle this through asynchronous orchestration and event-driven updates, while shielding users from batch or synchronous core processing. With the growing demand for instant payments, modern core banking systems are increasingly integrating instant payment capabilities to deliver real-time transaction speed and enhanced customer experiences.

Data Ownership and Processing Models

Core banking systems store financial data in structures optimised for integrity, auditability, and reconciliation.

Digital banking platforms maintain derived data models for workflow state, transaction views, and analytics. These datasets are not authoritative. They exist to support interaction, monitoring, and reporting.

In advanced architectures, digital platforms may operate sub-ledgers for multi-wallet or closed-loop scenarios. These remain synchronised with the core ledger and are governed accordingly.

APIs and Integration Capabilities

Legacy core platforms often expose limited APIs or rely on batch integrations. This constrains digital delivery and increases dependency on middleware.

Digital banking software is API-first. It consumes APIs from core systems and external providers, while exposing stable interfaces to channels and partners. In practice, it becomes the integration backbone of the platform.

Most enterprise banking use cases involve multiple systems. Digital banking software coordinates these interactions and enforces consistency across them.

Product Development Speed and Flexibility

From an enterprise governance perspective, core banking systems intentionally limit change velocity. Even minor adjustments require formal change management, testing, reconciliation, and approval from risk and compliance stakeholders, which slows delivery and increases operational effort within the back end system.

Digital banking platforms decouple product innovation from ledger stability. New functionality is introduced through workflow changes, orchestration logic, or interface updates rather than core modifications, allowing teams to iterate faster without disrupting critical processes or the underlying back end system. This approach aligns well with cloud solutions, where scalability and controlled change are essential.

Modern platforms emphasise configuration over custom development. This approach improves operational efficiency by reducing manual intervention, lowering dependency on release cycles, simplifying day-to-day system management, and enabling more effective use of cloud solutions, which in turn decreases long-term maintenance overhead.

Compliance, Security, and Operational Control

Core banking platforms are responsible for financial compliance. They enforce accounting logic, maintain immutable transaction histories, and generate regulatory reports that form the foundation for enterprise risk management.

Digital banking software addresses operational compliance. It orchestrates KYC and KYB workflows, routes AML alerts, records user actions, and manages documentation flows. By coordinating specialised providers rather than replacing them, digital platforms help mitigate risk while supporting continuous innovation at the operational layer.

From a security standpoint, digital platforms typically implement authentication, authorisation, role-based access control, and channel-level security policies. They also provide real-time operational visibility through dashboards and alerts, strengthening oversight without increasing dependency on core system changes.

Customer Experience and Channel Strategy

Core banking systems are not designed for direct customer interaction. Exposing them directly limits flexibility and slows iteration, making it difficult to respond to changing customer preferences.

Digital banking software enables a channel-agnostic strategy. The same services can be delivered via mobile apps, web portals, internal backoffice tools, or partner APIs, supporting consistent experiences while enabling streamlined operations across channels.

Role-based access and configurable interfaces allow a single platform to serve retail, SME, enterprise, and partner use cases without duplicating logic, ensuring adaptability to customer preferences without increasing operational complexity.

Artificial Intelligence and Automation Capabilities

Core banking systems were not originally designed with AI-driven workflows in mind. Integrating analytics, automation, or machine learning often requires external tools, complex data pipelines, and changes at the core level, which slows down adoption and increases costs.

Digital banking platforms are better positioned to leverage AI as a layer on top of transactional data. Built-in APIs, real-time event streams, and modular architectures make it easier to apply AI for onboarding automation, transaction monitoring, customer insights, and operational optimisation.

For most organisations, deploying artificial intelligence on top of a digital banking platform delivers faster results than retrofitting intelligence into a legacy core, while keeping critical systems stable and under control.

Cost Structure and Total Cost of Ownership

Core banking platforms typically involve high upfront investment, long deployment timelines, and expensive upgrades. Vendor involvement is often required for changes.

Digital banking platforms usually offer more flexible cost structures. Faster deployment, internal configurability, and reduced dependency on core changes improve ROI.

For most enterprises, licensing and customising proven platforms is more economical than building from scratch.

Core Banking vs Digital Banking: Comparison Table

| Area | Core Banking Software | Digital Banking Software |

|---|---|---|

| What it is for | Keeps financial records correct and compliant | Lets users access and use financial services digitally |

| Role in system | System of record | Digital interaction layer |

| Owns account balances | Yes | No |

| Handles ledger and postings | Yes | No |

| Interest and loan logic | Yes | No |

| Regulatory reporting | Yes | No |

| KYC and AML workflows | No | Yes |

| Speed of change | Slow and controlled | Fast and flexible |

| Impact on time to market | High | Low |

| User-facing | No | Yes |

| Mobile and web apps | No | Yes |

| API-first design | Usually no | Yes |

| Product experimentation | Poor fit | Good fit |

| Best for banks holding deposits | Yes | Not alone |

| Best for neobanks and EMIs | Only if licensed | Yes |

| Best for PSPs and MSBs | Usually not needed | Yes |

| Best for embedded finance | No | Yes |

| Typical owner | CIO, Finance, Risk | CTO, Product, Digital teams |

When Core Banking Software Is Still Required

Any organisation holding customer funds or operating on its balance sheet requires a core banking platform. Products involving interest, amortisation, or long-term credit exposure depend on core logic.

High-volume transaction environments also benefit from mature core performance characteristics.

When Digital Banking Software Is the Better Starting Point

Digital-first institutions, including neobanks, EMIs, and PSPs, typically prioritise digital banking platforms to accelerate launch and iteration.

Enterprises entering financial services through embedded finance rely on digital banking software to avoid unnecessary infrastructure complexity.

In legacy environments, introducing a digital layer is often the first modernisation step.

Core Banking and Digital Banking Working Together

Decoupling customer channels from the core reduces risk and increases architectural flexibility. The digital layer absorbs change, while the core remains stable.

Digital banking software often functions as intelligent middleware, coordinating providers and enforcing workflows without embedding financial logic in channels.

This separation supports phased core modernisation rather than disruptive migrations.

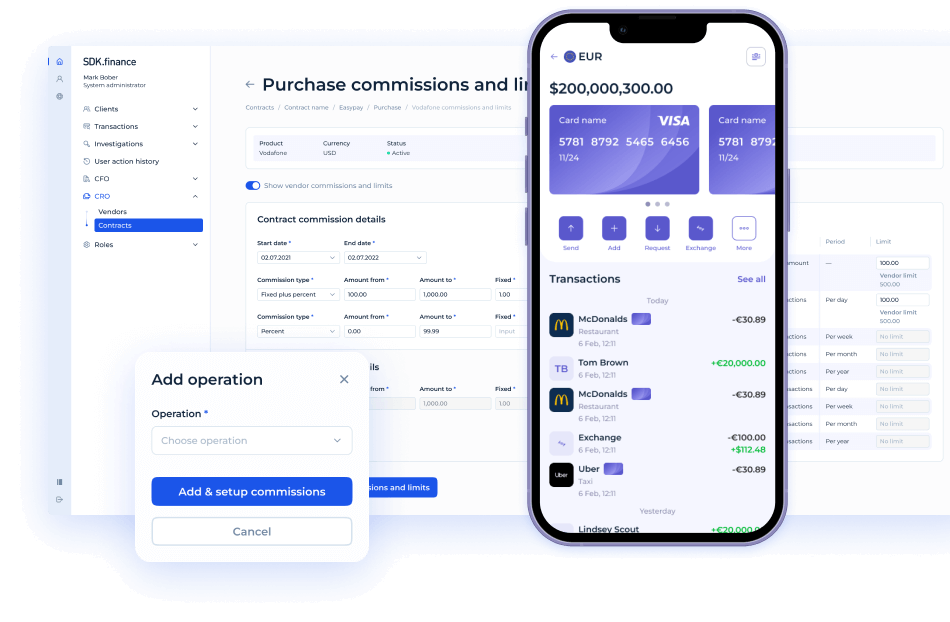

How SDK.finance Approaches Digital Banking Software

SDK.finance is designed as a white-label digital banking software layer built around a real-time ledger and positioned between core banking systems, payment infrastructure, and customer-facing channels.

Conclusion: Choosing the Right Foundation for Your Banking Product

Core banking software and digital banking software solve different problems at different layers of the architecture. One guarantees financial integrity. The other enables adaptability and speed.

For enterprise technology leaders, the key is not choosing one over the other, but defining clear boundaries and governance models. When these layers are aligned correctly, organisations gain the ability to evolve products without destabilising the financial core.

If you are evaluating how a digital banking layer should sit alongside your core systems, SDK.finance can help you design and implement that separation in practice. Explore how the Platform is used in real banking architectures or discuss your specific setup with the SDK.finance team.