The financial industry is undergoing a structural shift. What started as a niche market for early adopters has moved into the mainstream, reshaping how consumers interact with money. In just a few years, digital assets have become part of everyday financial behaviour: investing, cross-border payments, saving, payroll, merchant settlements, and even loyalty systems increasingly involve crypto or tokenised value. On-ramps and off-ramps are crucial for onboarding new users into the crypto space, making it easier for individuals and businesses to participate in this rapidly evolving environment.

This rising adoption has created a new expectation from users. People want the ability to move funds between fiat and crypto the same way they move money between bank accounts: quickly, securely, and without navigating multiple platforms. As a result, crypto on ramp and crypto off ramp flows are no longer optional. They are becoming core components of the fintech stack.

Yet, while demand has surged, implementing fiat–crypto conversion inside a financial product remains one of the most complex challenges for product and engineering teams. Regulatory constraints, inconsistent banking access, fragmented payment rails, liquidity sourcing, fraud risks, and settlement complexity mean that building these capabilities in-house is far from straightforward. On/off ramps are essential for bridging the gap between traditional finance and digital assets, enabling seamless integration and improved user experience.

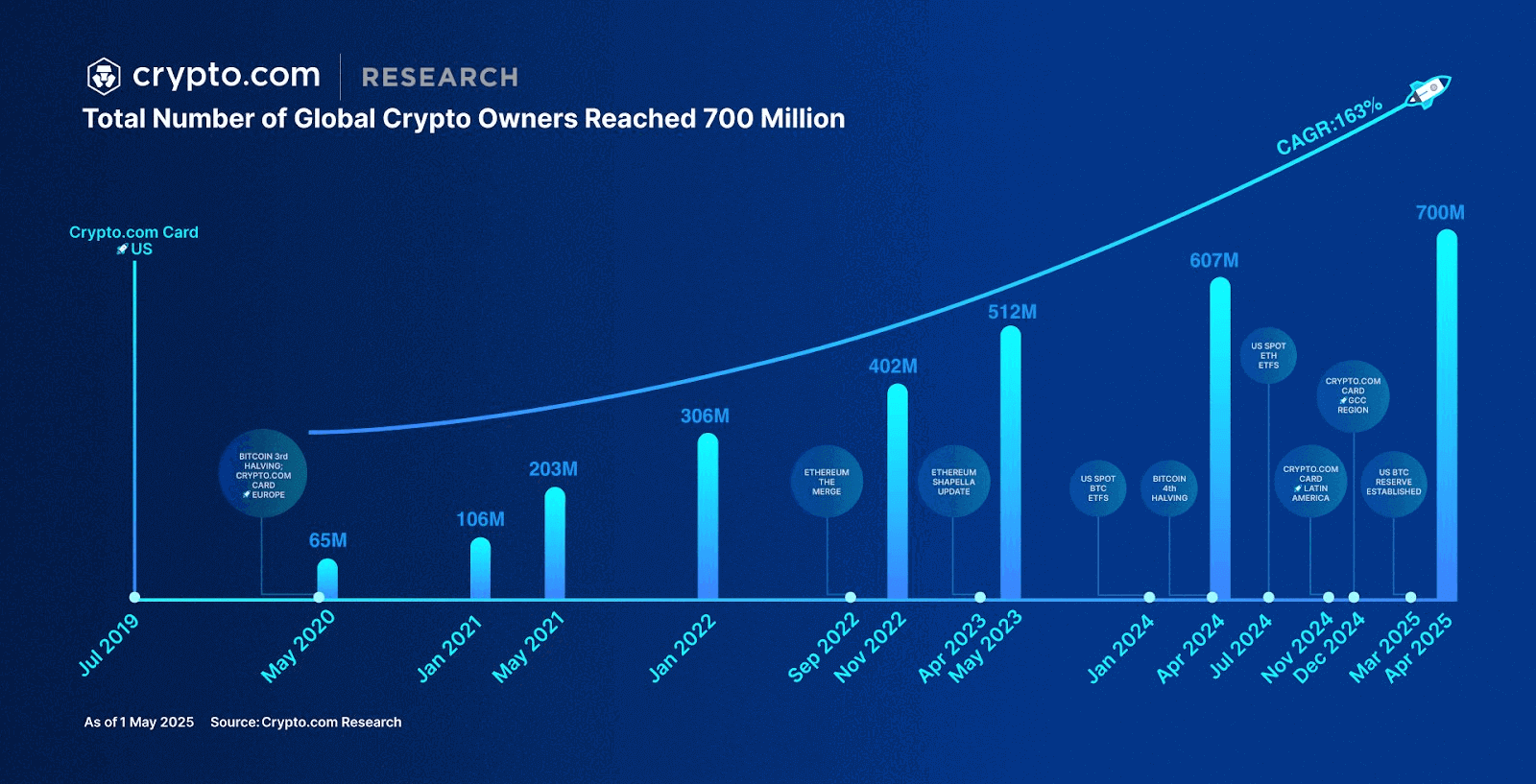

Before examining these challenges, it’s useful to understand just how widespread crypto usage has become. These developments are key drivers for mass adoption, as they make it easier for both individuals and businesses to access and use digital assets in daily transactions.

Everything you need to launch crypto wallets, payments, and custody

Learn moreGlobal Crypto Adoption in 2025: Key Statistics

- 580 million people worldwide now own crypto (Triple-A, January 2025), up from 562 million in 2024 and 420 million in 2023.

- 34% year-over-year growth in global crypto ownership, despite market volatility.

- 55% of new crypto users buy digital assets through mobile banking apps and fintech platforms rather than exchanges (Chainalysis & The Block Research, 2024–2025). High approval rates for payment methods are critical for seamless onboarding and ensuring more completed purchases.

- 38% of potential users cite difficulties buying crypto with fiat as their main barrier to entry (Gemini Global Survey). Offering a preferred payment method can help lower these barriers and make the onramp process more user-friendly.

- 41% of existing users say fast and reliable crypto-to-fiat withdrawals are their biggest unmet need (PYMNTS.com & Deloitte).

- Usage of stablecoins grew by 45% in 2024, with adoption accelerating into 2025 as they become a preferred medium for cross-border settlements (Visa & Circle). The increasing volume of crypto transactions highlights the importance of efficient processing and secure payment flows.

- 74% of institutional investors plan to increase digital asset exposure in 2025 (Fidelity Digital Assets).

- The global crypto market cap exceeded $2.6 trillion in March 2025 (CoinMarketCap).

These numbers reflect a clear market reality: crypto is no longer a standalone industry. It is becoming part of the broader digital finance ecosystem, and users expect fiat connectivity to be embedded wherever they manage their financial lives.

What Is On-Ramp Crypto?

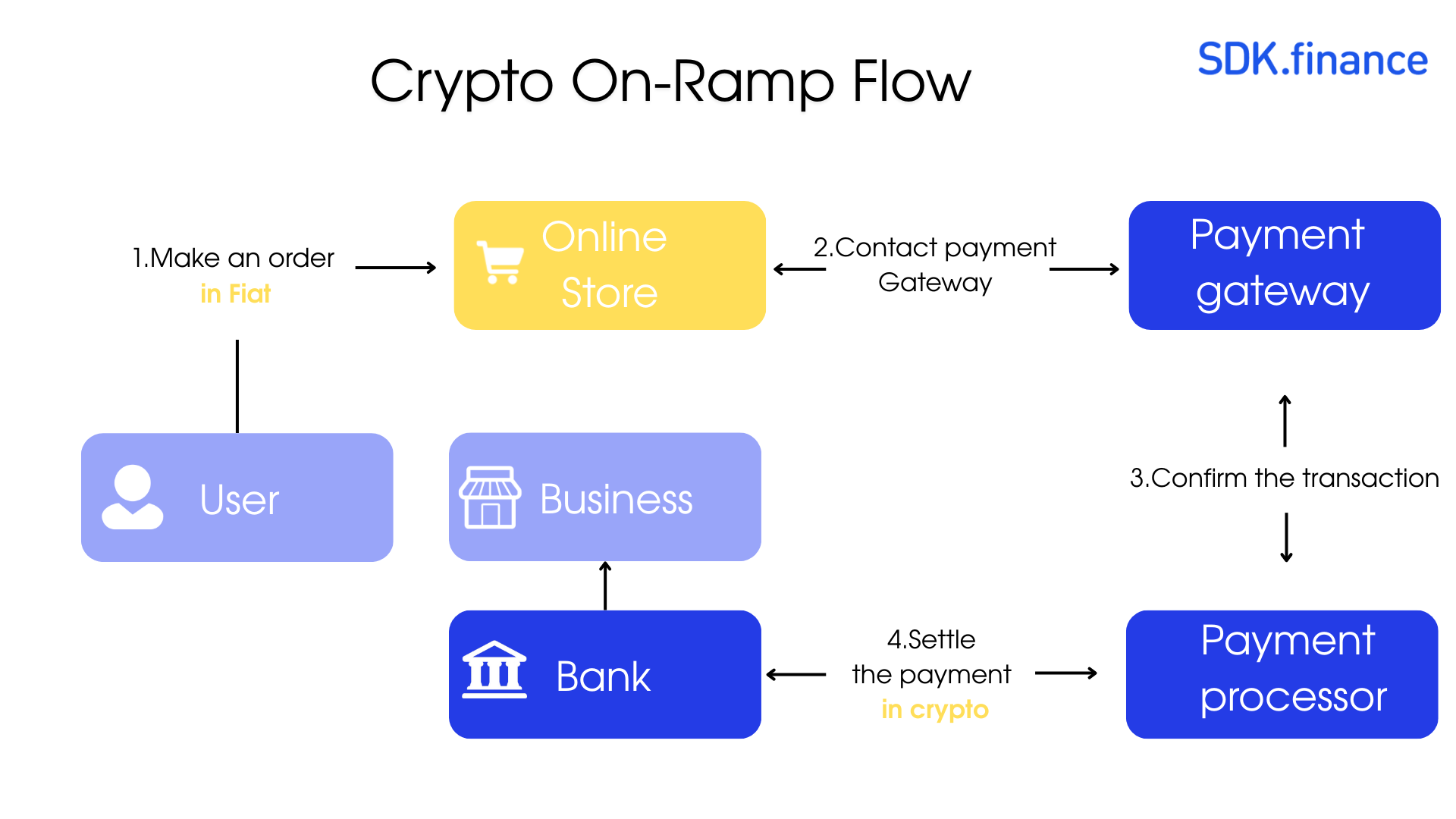

A crypto onramp is a mechanism that enables users to convert traditional currencies and fiat money, such as USD, EUR, or JPY, into digital assets, streamlining access to cryptocurrencies.

This process allows users to exchange fiat money for cryptocurrencies, serving as the entry point into the crypto ecosystem. In practical terms, this is the moment when a user pays with a bank card, approves a bank transfer, or uses a local payment method to buy crypto.

Onramps enable secure crypto transactions by integrating robust security features, such as secure APIs, regulatory compliance, and fraud protection, ensuring safe and reliable movement of funds between traditional financial systems and digital assets.

The essential characteristics of a good onramp include:

- a familiar payment experience (cards, open banking, instant bank transfers);

- transparent pricing and rate locking;

- fast confirmation and wallet delivery;

- reliable KYC/AML verification;

- compliance with regional regulations;

- high approval rates for payment methods, ensuring more successful and efficient transactions.

Onramps also give users full control over their assets once purchased, allowing direct management and custody of their cryptocurrencies.

Users judge the quality of the flow based on a single expectation: “I pay with fiat, and I immediately see crypto in my balance.”

Behind that simple expectation, however, lies a sequence of tightly coordinated processes involving payment processors, identity checks, liquidity providers, settlement partners, and backend ledger logic.

What Is a Crypto Off-Ramp?

A crypto off ramp is the reverse of an on-ramp: it converts digital assets back into fiat and transfers the fiat to the user’s bank account, debit card, or other payout method.

An off ramp solution allows users to sell crypto and receive fiat, making it easy to exit their crypto positions. This step is essential for creating trust. Even experienced crypto users often say that the ability to cash out quickly is one of the most important elements of a product.

The off-ramp experience needs to feel like any other withdrawal:

- clear timeline,

- predictable fees,

- safe delivery of funds,

- transparent tracking of status,

- payout to debit card.

In reality, crypto-to-fiat conversions require more operational precision than most fiat-only payouts. The platform must liquidate crypto at the correct rate, track the exact amount, apply compliance checks, and coordinate with banking partners for payout execution. Off-ramps also enable spending of fiat after conversion, such as using a debit card for everyday purchases.

Any issue during this flow – delays, unclear crypto liquidation, missing payout confirmations – breaks user trust immediately.

Everything you need to launch crypto wallets, payments, and custody

Learn moreWhy On/Off Ramps Have Become a Must-Have Feature

For most users, their first touchpoint with crypto is not an exchange anymore. It is a fintech application they already trust: a mobile wallet, a challenger bank, a brokerage platform, or a payment app. These services increasingly act as the front door into the crypto world. Modern on/off ramps now support a wide range of supported cryptocurrencies, not just Bitcoin or Ethereum, giving users access to a diverse selection of digital assets.

This shift is not accidental. It stems from three behavioural trends. Integration with existing fintech apps is crucial, as seamless onboarding and compatibility with various platforms enhance user experience and operational efficiency.

Centralized exchanges and decentralized exchanges both offer on-ramp and off-ramp services, but with different user experiences. Centralized exchanges typically provide easier onboarding and custody, while decentralized exchanges enable peer-to-peer trading and greater control over assets.

Trust is paramount. Users want to know their funds are safe and that they can transact easily. The ability to sell crypto directly within these platforms further increases user confidence and convenience.

After purchasing, users can transfer their assets to their crypto wallets for safekeeping or further use.

1. Users want convenience, not fragmentation

People are tired of creating multiple accounts across several specialised platforms. They expect to buy, store, convert, and withdraw assets in one place.

Users also expect a wide range of popular payment options, including Google Pay, Apple Pay, credit or debit card, and other payment cards, to make transactions as seamless as possible. Reducing KYC friction is crucial for a smooth onboarding experience.

2. Everyday use cases require fiat compatibility

Remittances, merchant payments, trading, savings, investment diversification – all of these involve traditional money, but also increasingly include everyday purchases and spending with digital currencies. A standalone crypto-only environment cannot fully support these needs, as seamless on/off ramps are essential to connect digital assets to real world financial activities.

3. Trust is defined by fiat liquidity

Users may hold digital assets, but their financial life is still denominated in fiat. A product that allows users to exit crypto easily is perceived as reliable. Users want to convert traditional fiat currencies and government issued money quickly and transparently, making the process seamless. Clear and transparent transaction fees are also crucial for building trust, as users need to understand the costs associated with moving between digital assets and fiat. A product that traps value is not.

Together, these trends explain why on ramp crypto and off ramp crypto capabilities have become foundational components of modern financial products.

Why Implementing On/Off Ramps Is So Challenging

Building fiat–crypto conversion is not like adding a simple payment method. The complexity comes from how many components must work together, including seamless integration with traditional finance systems and payment cards, and how sensitive each step is to operational failure.

Below are the most common challenges.

Regulation varies across regions

KYC, KYB, AML, transaction monitoring, licensing requirements, reporting obligations – they differ by jurisdiction and often change quickly. For crypto-related operations, it is crucial to link digital asset activities to real world identities to ensure regulatory compliance and traceability. A product operating across markets needs adaptable, compliant flows.

Banking relationships are unstable

Many traditional banks still restrict or ban crypto-related businesses from accessing fiat rails. Products often need multiple partners across regions, each with different rules.

Card acquiring for crypto is specialised

Not all processors support crypto purchases. Those that do typically impose higher fraud controls, stricter risk scoring, and additional documentation requirements.

Liquidity sourcing must be accurate

The system needs fair pricing, rate locking, and real-time conversion. Any mismatch leads to user complaints or financial risk for the company.

Fraud risk is higher than in traditional e-commerce

Stolen cards, chargebacks, synthetic identities – on-ramps experience elevated fraud attempts, and controls must be robust.

Reconciliation is more complex

Two ledgers must always match:

one for fiat and one for crypto.

Discrepancies cause operational headaches and regulatory issues.

Localisation multiplies complexity

Launching in 10 markets may require 10 sets of banking rails, 10 compliance flows, and 10 variations of payout methods.

These are the reasons why mature, stable crypto on off ramp functionality is rare – and why many companies rely on specialised infrastructure or ready-made platforms instead of building their own from scratch.

Everything you need to launch crypto wallets, payments, and custody

Learn moreSecurity and Transparency in On/Off Ramps

In the rapidly evolving crypto ecosystem, security and transparency have become non-negotiable pillars for any platform offering fiat to crypto and crypto to fiat services. As users increasingly expect to exchange fiat currency for digital assets – and vice versa – with the same confidence they have in the traditional financial system, robust security and clear, transparent processes are essential for building trust and driving mainstream adoption.

How On-Ramps Work Behind the Scenes

Even though users experience a simple “buy crypto” button, the actual flow is a complex chain of events. Seamless integration with payment processors and liquidity providers is essential to ensure smooth onboarding and connectivity between platforms. The system must also handle crypto transactions securely and efficiently, supporting regulatory requirements and traceability throughout the process.

1. User initiates purchase

They select an amount and choose a payment method, ensuring they can use their preferred payment method for maximum convenience.

2. Identity verification

Regulators require KYC before fiat–crypto conversion. This step integrates providers such as Sumsub, ComplyAdvantage, Veriff, or Onfido. Minimizing KYC friction is essential to improve user experience and streamline onboarding.

3. Payment processing

The system connects to a card acquirer or open banking provider. A card payment or bank transfer is initiated. Supported payment methods include Google Pay, Apple Pay, credit, debit card, , and other payment methods.

4. Rate locking

The user receives a crypto quote. After the transaction is confirmed, the system buys the exact amount of cryptocurrency through its liquidity provider or exchange.

5. Account crediting

The purchased crypto is assigned to the user’s wallet, and the ledger updates fiat and crypto balances. After purchase, users gain full control over their crypto assets, allowing them to manage and access their holdings independently.

6. Settlement and reconciliation

On the backend, banking partners settle the fiat, and the crypto purchase is fully reconciled.

The system must ensure that every movement of value is recorded correctly, especially when multiple payment processors and liquidity sources are involved.

How Off-Ramps Work Behind the Scenes

A fiat off ramp crypto flow requires the same level of precision, if not more. A robust off ramp solution enables users to sell crypto and receive fiat efficiently, ensuring a seamless transition from digital assets to traditional currency. Throughout this process, it is crucial to maintain transparency regarding transaction fees, as these can vary and significantly impact the user experience.

1. The user requests a withdrawal

They specify the fiat amount they want to receive.

2. Crypto liquidation

The platform calculates how much crypto must be sold, executes the process to sell crypto, and obtains fiat funds.

3. Compliance checks

AML rules often require enhanced monitoring for crypto-to-fiat flows. This includes linking cryptocurrency transactions to real world identities to ensure regulatory compliance and traceability.

4. Payout routing

Depending on the region, payouts may be delivered through bank transfers, instant card payouts, debit card, or local payment methods.

5. Settlement

Banks and payment processors settle the transaction, and the user sees the funds in their account.

A reliable off-ramp depends on stable banking connections, proper fund segregation, and accurate ledger updates – the elements that make the entire process transparent and auditable.

Where On/Off Ramps Fit Into Today’s FinTech Landscape

The importance of on-ramp/off-ramp functionality varies across industries, but the reliance on these flows is expanding rapidly. As the crypto space continues to evolve, on/off ramps are becoming essential infrastructure, enabling seamless movement between fiat and digital currencies for a wide range of use cases.

In summary, these ramps not only support conversion between digital currencies and fiat, but also facilitate everyday spending by allowing users to easily use their crypto holdings for purchases.

Digital wallets and neobanks

Customers expect to buy, sell, hold, and cash out crypto inside the apps they already use for fiat payments. After purchasing crypto, users often want the option to transfer their assets to crypto wallets for safekeeping or to facilitate further transactions.

Crypto exchanges and brokerages

For exchanges, on/off ramps are the foundation of the product. Both centralized exchanges and decentralized exchanges rely on these flows to enable users to move between fiat and crypto. User acquisition depends heavily on these flows.

Cross-border remittances

Stablecoins significantly reduce costs and settlement times, but users still need local fiat entry and exit points. This involves converting traditional currencies and government issued money, such as USD or EUR, into stablecoins or crypto for cross-border transfers.

Merchant services

Businesses may accept crypto from customers but settle in fiat through off-ramp flows. This enables everyday purchases with crypto, allowing customers to use digital assets for routine transactions while merchants receive settlements in their preferred currency.

Web3 onboarding

NFT marketplaces, gaming economies, and DeFi apps increasingly rely on embedded on-ramps so that users can pay with their local currency. Seamless integration with Web3 platforms is essential to ensure a smooth onboarding process, enabling compatibility with various services and enhancing the overall user experience.

Investment apps and brokerages

Traditional investment tools are gradually adding crypto exposure, requiring clean fiat–crypto conversion flows.

In short, on/off ramps are becoming a universal requirement wherever fiat and crypto intersect.

Why the Future of Finance Requires Reliable On/Off Ramps

As global adoption accelerates, the financial system is moving toward multi-rail operations. Fiat, stablecoins, CBDCs, tokenised assets, and traditional card networks will coexist. Users will expect to switch between them without complexity.

Reliable on/off ramps between fiat and crypto are essential for achieving financial freedom in this evolving financial system, enabling individuals to control and transfer their wealth with ease.

Several long-term trends reinforce this direction:

- Regulated stablecoins are becoming mainstream

With MiCA in Europe and other regulatory initiatives globally, stablecoins are entering formal financial frameworks.

- FinTech apps are becoming multi-asset platforms

The same interface may support euros, dollars, stablecoins, reward points, and tokenised assets side by side.

- Corporate demand is rising

Businesses use on-chain assets for treasury operations, global payroll, and supplier payments.

- User expectations are increasing

Faster payments, transparent fees, and unified experiences are no longer “nice to have.”

In this context, on ramp off ramp crypto capabilities will play a similar role to card payment processing today: a core infrastructure layer powering a wide range of financial services.

Everything you need to launch crypto wallets, payments, and custody

Learn moreSDK.finance: A Reliable Technology Partner for On/Off-Ramp Capabilities

SDK.finance provides the technological foundation for companies that want to build or enhance crypto-enabled financial products without investing years into backend development. The platform supports a wide range of crypto use cases, from simple buy/sell modules inside existing payment products to full-scale exchanges or even launching a crypto bank from scratch.

With built-in crypto on-ramp and off-ramp functionality, a multi-asset ledger, and an API-first architecture, SDK.finance enables teams to integrate fiat–crypto conversion flows in a matter of months rather than years. It also serves as a strong base for businesses looking for reliable crypto on-ramp solutions, offering the flexibility to connect KYC providers, payment processors, and liquidity partners quickly. For companies seeking to launch or extend secure and scalable crypto on-ramp solutions, SDK.finance provides a solid and adaptable infrastructure.

Key advantages include:

-

Built-in on/off-ramp support, enabling straightforward fiat–crypto and crypto–fiat conversions.

-

Multi-asset ledger architecture capable of handling fiat, crypto, stablecoins, and custom digital assets.

-

API-first backend that simplifies integration with KYC providers, payment processors, liquidity partners, and banking rails.

-

Compliance readiness, including PCI DSS Level 1 and ISO 27001:2022 certifications.

-

Flexible delivery models (SaaS or source code) to match operational and regulatory needs.

-

Fast time-to-market, allowing companies to launch crypto products significantly sooner and with reduced engineering effort.

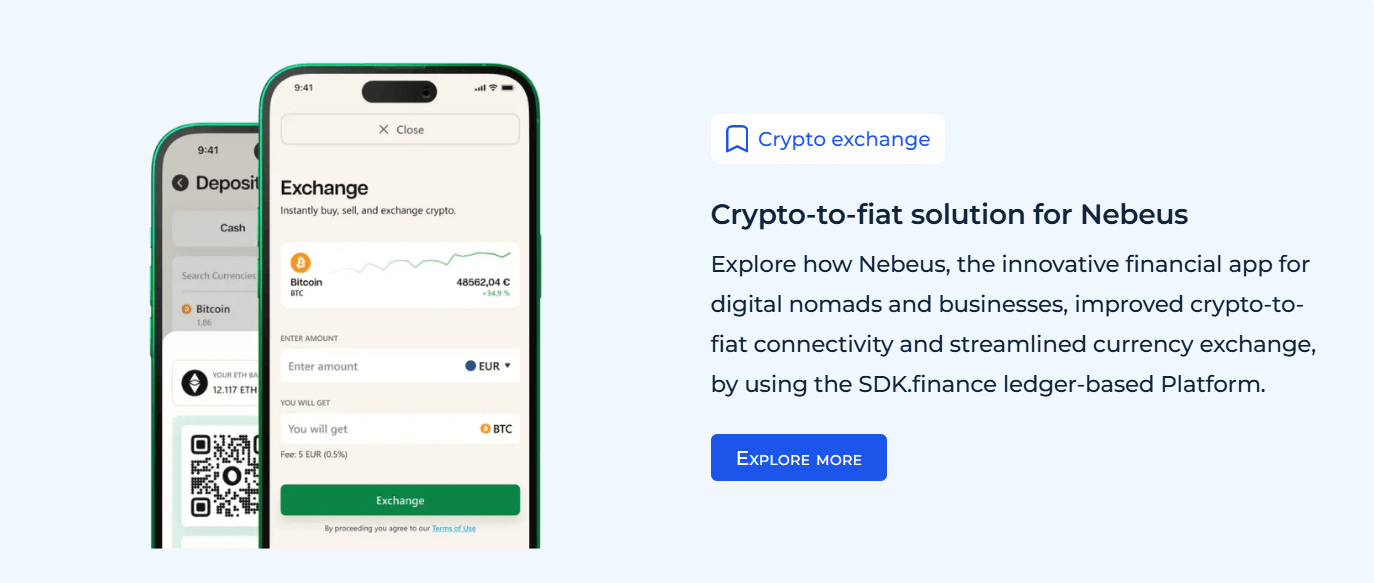

A strong example is Nebeus, a crypto finance company that used SDK.finance to build an ecosystem combining multi-currency accounts with crypto asset management. Their journey shows how the platform supports complex crypto–fiat interactions, speeds up delivery, and maintains operational stability even under high transaction volumes.

Ready to add on/off-ramp capabilities to your product?

Explore how SDK.finance can support your crypto roadmap.