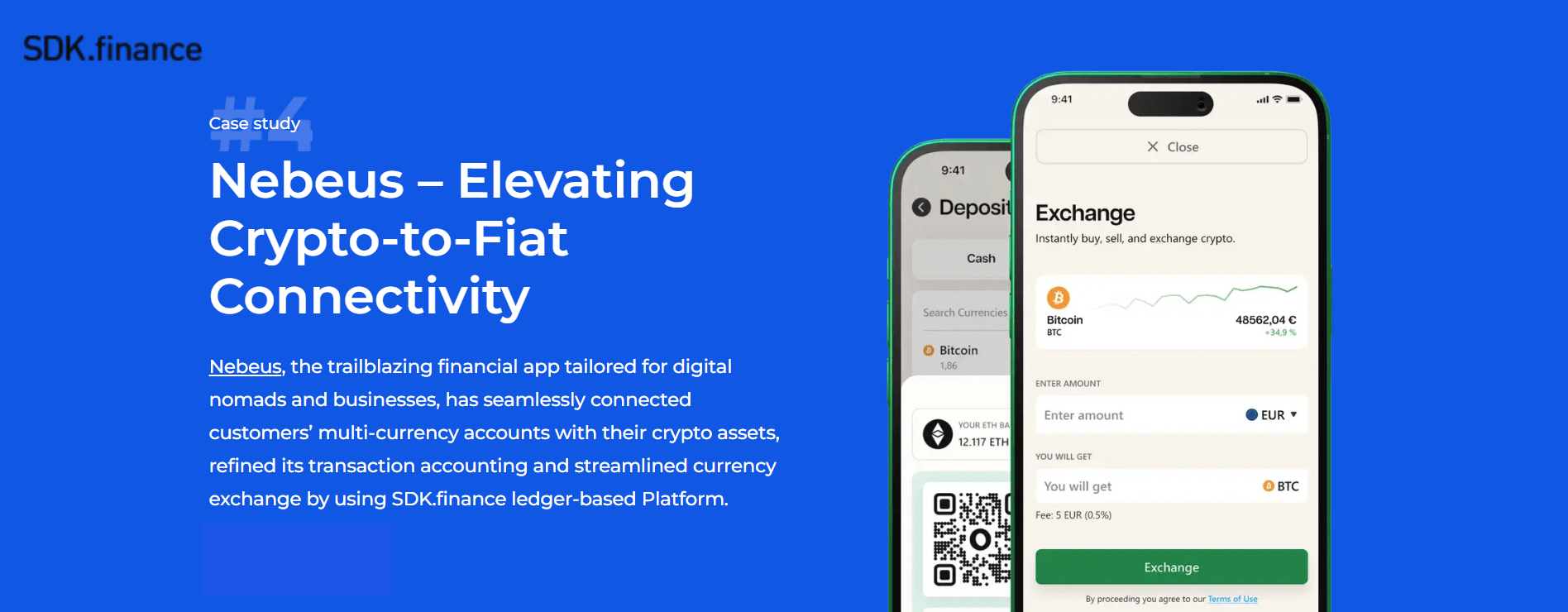

Discover how SDK.finance’s ledger-based white-label FinTech Platform enabled Nebeus, a regulated crypto finance company, to cut development time, reduce costs, and bring secure crypto-to-fiat services to digital nomads and businesses worldwide.

The Challenge: Connecting Two Financial Worlds

The rise of digital assets created a demand for everyday usability. For Nebeus, a Barcelona-based crypto finance company, the vision was clear – make it possible for users to manage and spend crypto as easily as traditional money.

The difficulty lay in building a bridge between two fundamentally different systems: blockchain-driven digital currencies and regulated fiat infrastructure. And it had to be done fast.

Who Is Nebeus?

Founded in 2014, Nebeus started as a peer-to-peer crypto lending service and grew into a full-scale financial ecosystem.

In 2022, Nebeus reached a key milestone by being officially recognised by the Bank of Spain as a Virtual Asset Service Provider (VASP) and Cryptocurrency Custodian. This achievement signalled that the company could innovate while staying compliant – no small feat in a tightly regulated environment.

Today, Nebeus is an all-in-one app that effortlessly merges multi-currency payments, virtual IBANs, cryptocurrency services, and globally-issued cards, empowering users and businesses around the globe to navigate their dynamic work lifestyles.

The Problem: Complex Infrastructure, Limited Time

To realise their vision, the Nebeus team needed a financial core capable of:

-

Linking crypto wallets with fiat accounts

-

Enabling real-time conversions between digital and traditional currencies

-

Handling thousands of transactions with precise accounting

-

Meeting regulatory and reporting standards

Building such infrastructure from scratch would have taken years of development and substantial investment. With competitors moving quickly, time was the one thing Nebeus didn’t have.

The Solution: SDK.finance’s Ledger-Based Platform

Instead of starting from zero, Nebeus chose to partner with SDK.finance, adopting its ledger-based fintech core to accelerate development and ensure reliability.

Why SDK.finance Was the Right Fit

-

Proven Ledger Technology

SDK.finance’s platform is built on a robust ledger-based transaction engine that supports both fiat and digital assets with full auditability. This foundation ensured that Nebeus could manage complex multi-asset operations securely while maintaining compliance across jurisdictions. -

15+ Years of FinTech Experience

With over 15 years in the FinTech industry, SDK.finance has supported clients across Europe, MENA, Africa, and North America, helping payment providers, banks, and startups bring their ideas to market faster. This depth of experience gave Nebeus confidence in the platform’s technical maturity and adaptability to different regulatory and business contexts. -

Flexible Delivery Models: SaaS or Source Code

SDK.finance offers two deployment options – SaaS for rapid, cost-effective launch and Source Code License for full ownership and control. Nebeus chose the SaaS model, which allowed them to start quickly without the burden of heavy infrastructure costs or long implementation cycles, while retaining the option to scale and customise in the future. -

Speed and Cost Efficiency

By leveraging SDK.finance’s ready-made modules and 470+ APIs, Nebeus reduced development time by more than fivefold and saved substantial costs compared to custom development. The platform’s out-of-the-box functionality meant their team could focus on product innovation rather than backend engineering. -

Customisable Framework

Although the system comes pre-built, its modular architecture and open APIs enabled Nebeus to tailor features to fit their specific crypto-fiat business model, creating a product that feels entirely their own while relying on proven technology underneath. - Enterprise-Grade Security and Compliance

SDK.finance’s platform is certified as a PCI DSS Level 1 Service Provider and compliant with ISO 27001:2022 information security standards. These certifications ensure that all transactions and sensitive customer data are protected according to international best practices – a crucial factor for a regulated company like Nebeus, recognised by the Bank of Spain as a Virtual Asset Service Provider.

By combining proven infrastructure, global experience, and a flexible SaaS delivery model, SDK.finance empowered Nebeus to bring a complex crypto-fiat platform to market faster, more affordably, and with the confidence of enterprise-grade technology behind it.

Everything you need to launch crypto wallets, payments, and custody

Learn moreA Founder’s Perspective

Sergey Romanovskiy, Founder, CEO & CTO of Nebeus:

“Nebeus needed a platform with ready-made solutions to save development time. SDK.finance stood out for its competitive pricing, 24/7 support, responsive team, and flexibility. The implementation was smooth, and we saved both time and money. I’d recommend SDK.finance to anyone seeking a quick and affordable start.”

This isn’t just endorsement – it’s insight from someone who compared multiple platforms and chose what worked in practice.

Implementation in Action

Once integrated, SDK.finance’s core improved Nebeus’s operations across several critical areas:

-

Instant Currency Exchange: Users could switch between crypto and fiat effortlessly.

-

Simplified Account Operations: Deposits, withdrawals, and transfers became faster and more transparent.

-

Real-Time Tracking: Both customers and administrators gained visibility into transactions and balances.

-

Automated Reconciliation: The platform maintained accurate, multi-currency ledgers, reducing manual errors and ensuring compliance.

Results: A Faster, Smarter, Compliant Platform

The collaboration delivered measurable outcomes:

-

5x faster time-to-market compared to developing an in-house core.

-

Significant cost reduction through SDK.finance’s ready infrastructure.

-

Regulatory confidence backed by reliable reporting and data integrity.

-

Operational scalability, enabling new services and partner integrations.

In short, Nebeus gained a compliant, future-ready system without sacrificing speed or innovation.

What Other Fintechs Can Learn

The Nebeus story highlights lessons that apply to many fintech founders:

-

Focus on what makes you unique. Let a proven platform handle the heavy lifting of financial infrastructure.

-

Compliance is easier with structure. Ledger-based systems simplify audit trails and reporting.

-

Speed is strategy. Launching earlier builds market presence before competitors catch up.

-

Reliable partners matter. Around-the-clock vendor support keeps operations running smoothly.

The Bigger Picture: Redefining Crypto-Fiat Integration

Nebeus’s success points to a broader industry trend. As cryptocurrencies mature, the line between digital and traditional finance continues to blur. Platforms like SDK.finance enable this transition – helping FinTechs innovate responsibly within regulatory frameworks.

Expect to see more regulated crypto companies emerging, more SaaS-powered FinTech launches, and more consumers expecting one unified experience – where “money” simply works, regardless of form.

Final Thoughts

By partnering with SDK.finance, Nebeus transformed a complex challenge into a practical, scalable solution.

The result: a fully operational, compliant crypto-fiat platform delivered in months instead of years.

For FinTechs seeking to bridge innovation and regulation, this case shows what’s achievable when solid infrastructure meets visionary execution.

Explore the SDK.finance Platform to see how our ledger-based foundation can help you build faster, smarter, and more securely.

Everything you need to launch crypto wallets, payments, and custody

Learn more