Over the past few years, FinTech has evolved from a promising niche into one of the most competitive technology sectors. From mobile banking and cross-border transfers to embedded finance, demand for new digital financial products keeps growing. But while ideas multiply, execution has become the real bottleneck.

Most FinTech founders enter the industry with a clear vision of how to improve money movement or customer experience. Before starting development, it is crucial to conduct market research to analyze customer needs and market conditions, ensuring the solution addresses real opportunities and stands out in the fintech sector. The trouble starts when they try to build everything from scratch. Developing a financial platform that’s secure, compliant, and scalable has turned into a marathon of technical and regulatory obstacles.

The gap between ambition and delivery is now the main reason so many projects never reach the market.

Introduction to FinTech: The Landscape Today

The financial technology landscape is experiencing unprecedented growth, fueled by rapid advancements in emerging technologies such as artificial intelligence, blockchain, and cloud computing. Financial institutions are increasingly turning to custom fintech software development to keep pace with evolving customer expectations and regulatory demands. By leveraging fintech software development services, these organizations can streamline financial processes, enhance operational efficiency, and deliver innovative financial services that set them apart in a crowded market.

Custom fintech software empowers businesses to reimagine everything from banking and payments to lending, investment, and insurance. This ability to leverage technology for tailored solutions is transforming the way financial services are delivered, making them more accessible, efficient, and secure. As a result, the fintech software market is on a steep upward trajectory, with global projections estimating it will reach $1.13 trillion by 2032. In this dynamic environment, staying ahead means not just adopting new technologies, but also rethinking how software development is approached to maximize agility and impact.

What Really Hides Behind a “Simple” FinTech App

What looks like a neat payment screen to a user is, in fact, a layered system of financial logic and regulation.

Even the most basic FinTech development project must cover:

- Core transaction processing with real-time balances, multi-currency support, robust payment processing, and a focus on seamless transactions to ensure a smooth user experience.

- Regulatory workflows for AML, KYC, and audit tracking that satisfy multiple jurisdictions.

- Security mechanisms following PCI DSS standards, encryption, multi-factor authentication, and advanced fraud detection to protect sensitive financial data.

- Integrations with banks, payment gateways, and verification providers – including integration with bank accounts and financial accounts for data aggregation and personal finance management, each using different APIs and data models.

- Operational layers for reconciliation, settlements, and reporting.

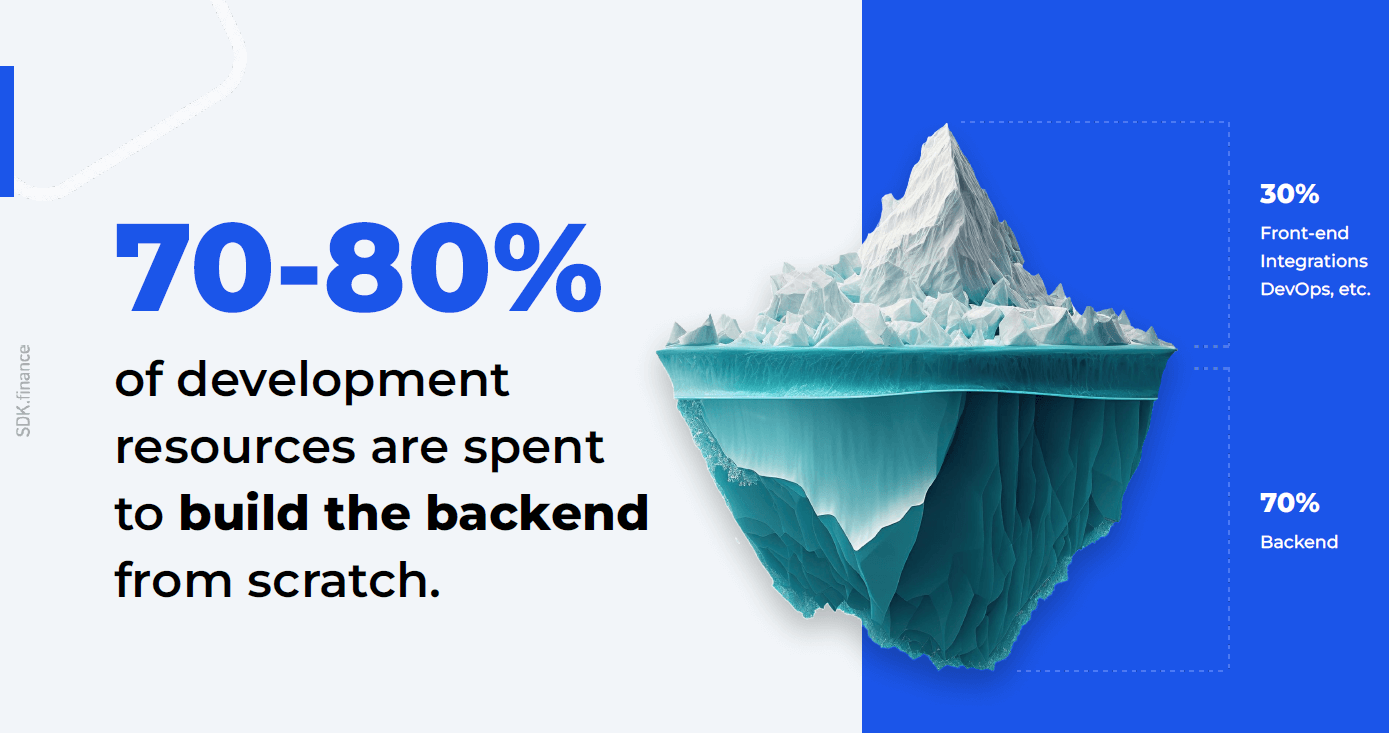

In most projects, 70-80 % of engineering time goes into this hidden structure rather than visible features. As a result, teams spend months perfecting code that customers never see – infrastructure that’s essential but adds no real competitive edge.

Time and Cost: The Two Limits That Define Success

Time-to-market is the single most critical factor for fintech success. Every month spent in software development is a month competitors are acquiring customers, gathering feedback, and iterating their product. Yet building a compliant, secure FinTech backend typically requires:

- Launching a compliant FinTech product from scratch isn’t a six-month exercise.

- A realistic path to MVP takes at least a year, and full functionality often two or more.

- It usually involves assembling a skilled development team of 15-25 highly specialised developers, DevOps, and compliance experts.

- Before a single user transaction happens, founders face months of payroll, audits, and cloud bills.

- The structured development process for fintech software includes requirements gathering, design, development, testing, and deployment, all of which must be carefully planned and executed.

- Then, once the system goes live, ongoing maintenance and regulatory updates keep consuming resources that could have gone to growth.

- In practice, every extra quarter in development means another competitor enters the market earlier, wins customers, and gains data advantage.

That’s why, according to several industry studies, around 70 % of FinTech startups never pass the three-year mark – they burn through funding long before seeing meaningful traction. The challenges of managing a fintech project, including the complexity of a fintech software project, often contribute to these failures.

As Alex Malyshev, CEO of SDK.finance, observes:

“Many FinTech startups don’t fail because of weak ideas, but because of how they build. They invest years perfecting infrastructure instead of validating their product in the real market. The companies that succeed launch on a solid, compliant core and adapt through real customer insight – not through endless internal development cycles”

Regulation: The Moving Goalpost

Unlike other tech fields, FinTech operates under constant regulatory pressure. Rules change faster than many teams can update their code.

To operate legally, companies must handle:

- Continuous AML and transaction monitoring.

- KYC and KYB checks, document validation, and sanctions screening.

- PCI DSS certification and annual reassessment.

- GDPR compliance and local data-residency requirements.

- Licensing obligations that differ for each region and product type.

Regulatory technology (RegTech) solutions can automate many compliance tasks such as auditing, reporting, and risk management, helping fintech companies stay up to date with evolving regulations. Data analytics also plays a crucial role in monitoring transactions and ensuring ongoing compliance by providing real-time insights and supporting data-driven decision-making.

Every new directive adds another layer of code, testing, and legal review. What begins as a technology build quickly becomes an ongoing compliance operation. For early-stage companies without dedicated risk teams, this alone can derail the timeline.

When Regulatory Compliance Eats Innovation

Once a FinTech team enters the compliance cycle, creative bandwidth shrinks.

Engineers who should be improving user flows or building analytics are busy updating reporting logic or responding to audits.

The result is predictable: products reach the market late, look similar to competitors’, and rarely offer the unique customer experience they promised.

FinTech success today depends less on coding everything internally and more on directing talent toward the parts that differentiate – design, usability, and customer trust.

Leveraging valuable insights from analytics can further inform enhancements to user experience and product features, helping teams focus on what truly sets their fintech software development apart.

Software Architecture: The Unseen Engine of FinTech

Behind every successful fintech software solution lies a robust software architecture that serves as its unseen engine. The architecture determines how well the software can scale, how securely it handles financial transactions, and how efficiently it integrates with existing financial systems and third-party services. Expert fintech software developers carefully select programming languages, frameworks, and databases to create solutions that are not only high-performing but also compliant with complex regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

When financial institutions consider fintech software development outsourcing, the importance of a well-structured software architecture becomes even more pronounced. It ensures that the resulting fintech software can seamlessly enable users to conduct financial transactions, access financial data, and interact with various financial services without friction. Moreover, a strong architectural foundation is essential for data protection, supporting secure integrations, and future-proofing the solution against evolving compliance requirements. Ultimately, the right software architecture is what transforms innovative ideas into reliable, scalable, and compliant fintech software solutions.

The Case for a Different Foundation

The old “build versus buy” debate in FinTech development is mostly settled.

The real question is how to use limited engineering capacity wisely.

Forward-looking companies treat infrastructure as a shared foundation – something stable, certified, and maintained by experts – while they focus on innovation at the product layer.

For EMIs (Electronic Money Institutions) and PSPs (Payment Service Provider), this approach has become essential. They can’t afford to rebuild ledger systems, KYC engines, or payment gateways every time regulations shift.

Adopting ready-made white-label software for EMI or software for PSP doesn’t mean losing control; it means reclaiming time and budget that would otherwise vanish in compliance and maintenance work.

Partnering with a reputable software development company or development company allows access to custom fintech solutions and fintech development services, ensuring tailored, secure, and scalable products that meet specific business needs.

The difference between success and failure often comes down to a single strategic decision: choosing the right technological foundation from day one.

Strategic Infrastructure for Financial Institutions as a Real Advantage

Modern FinTech leaders increasingly recognise a clear truth: competitive strength doesn’t come from rebuilding banking technology from scratch – it comes from how effectively you deliver value to your customers.

That’s why more teams are turning to white-label FinTech infrastructure – a proven foundation that takes care of the complex, regulated backend, allowing them to concentrate on innovation where it matters most.

White-label infrastructure also streamlines financial operations, improving efficiency, security, and the overall customer experience:

- Faster market entry

Instead of spending a year developing and testing your own core, you can go live in weeks using a white-label system that’s already built, certified, and production-ready. It means you start testing your business model and acquiring users while competitors are still in development.

- Better use of capital

With infrastructure costs already solved, your funding can go toward marketing, partnerships, and product enhancement rather than backend construction. Every euro invested works directly toward growth instead of technical debt.

- Real focus on product

Your engineers can stop coding payment rails and compliance modules, and start building the user experience, features, and integrations that define your brand’s personality and competitive edge.

- Room to grow

A well-architected white-label core gives you space to scale confidently. You canThese scalable solutions support business growth by allowing you to onboard new users, add partners, or enter new markets knowing the system underneath is capable of handling millions of transactions securely and efficiently. Handling such high volumes also means ensuring secure transactions and robust protection of sensitive data, so your customers’ information and financial exchanges remain safe and compliant.

SDK.finance and the Shift Toward Smarter Development

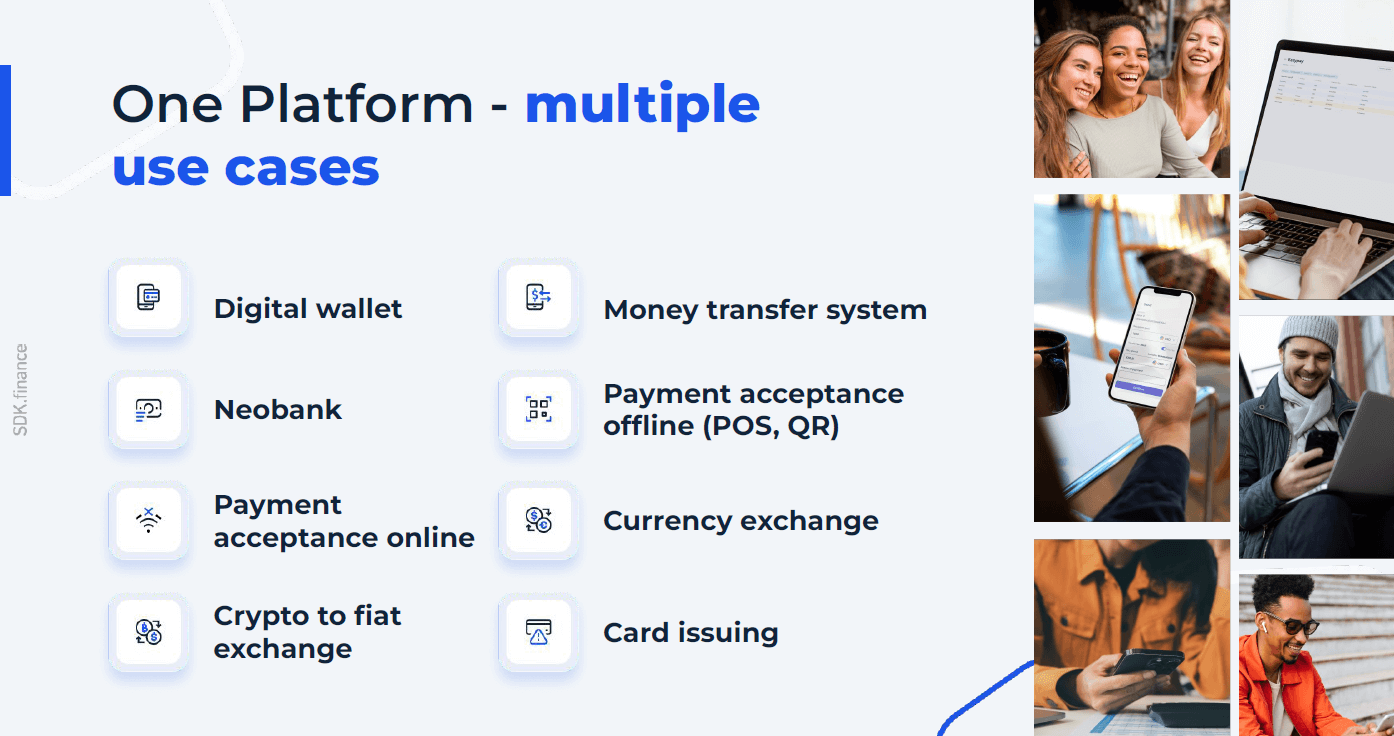

SDK.finance provides exactly this kind of white-label foundation. It’s a complete FinTech core designed for companies that want to move fast without compromising control.

The platform provides a complete core for financial products – accounts, wallets, transfers, card issuing, AML/KYC, and reconciliation – accessible through more than 470 REST APIs and 60 functional modules.

Alongside the backend, SDK.finance offers ready-made mobile payment app and web interfaces for both end users and administrators, reducing front-end development time and ensuring a seamless experience from day one.

The system supports multiple languages, enabling instant localisation for different markets without additional development effort.

With more than 15 years of FinTech expertise and successful implementations in Europe, the Middle East, Africa, and North America, SDK.finance has helped banks, EMIs, PSPs, and FinTech companies bring new financial products to life.

Teams can start building immediately on top of a PCI DSS Level 1, ISO 27001:2022-compliant foundation that already supports thousands of transactions per second.

Two Deployment Options to Fit Your Strategy

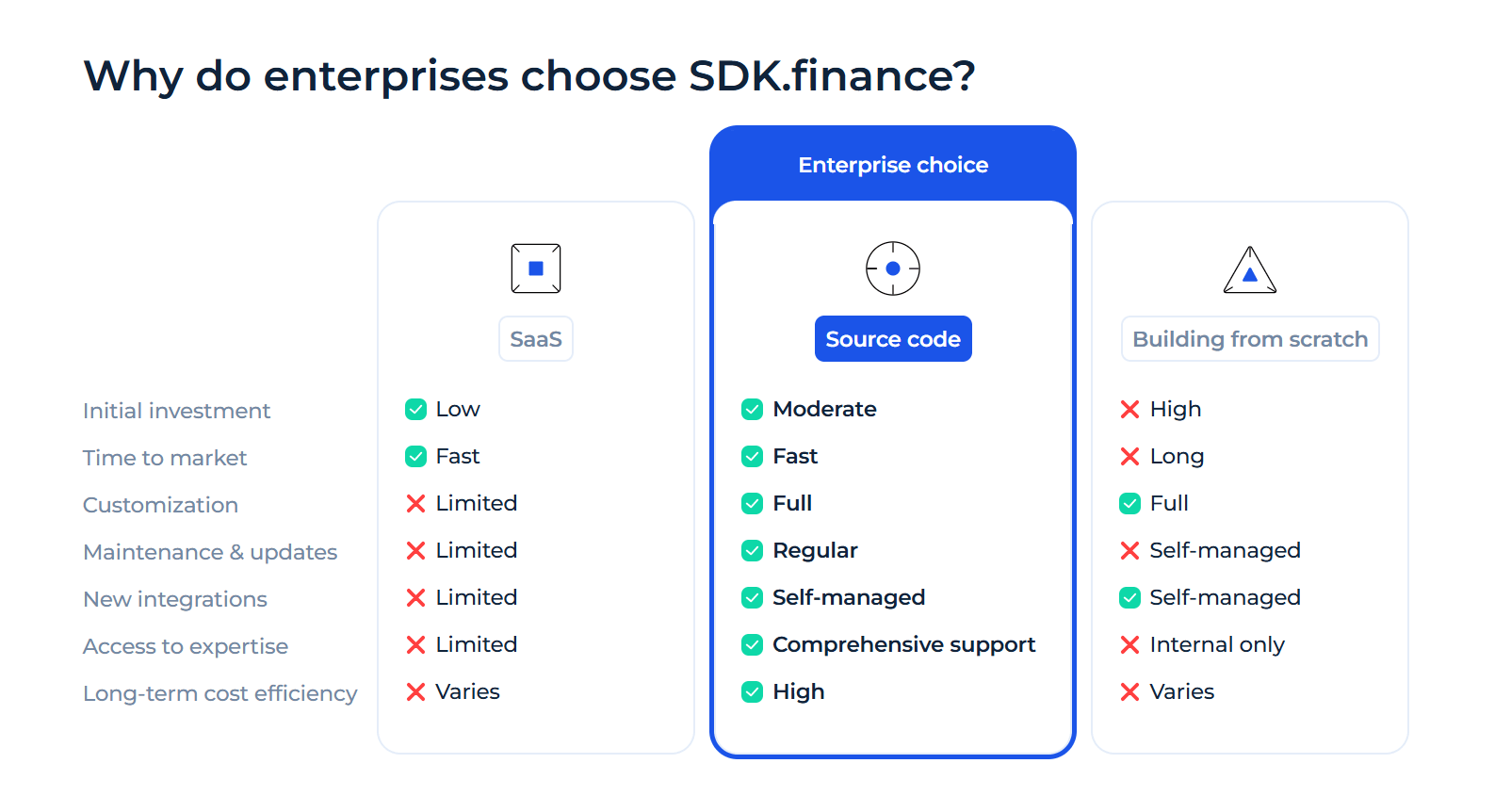

SDK.finance offers two ways to run the platform, depending on your priorities – quick launch or full control.

1. SaaS model – for speed.

Perfect for startups and lean fintech teams that need to launch fast without heavy investment.

You pay a subscription, and SDK.finance manages the hosting, updates, and security.

Pre-built modules and integrations mean your product can go live in weeks while you focus on growth, not maintenance.

2. Source code license – for control.

Best for enterprises, EMIs, and PSPs that need independence and flexibility.

You own the full codebase, customise it to your standards, and host it on any infrastructure – cloud or on-premises.

Data stays entirely under your control, ensuring compliance and long-term stability.

Both options use the same secure, high-performance SDK.finance core.

You simply choose whether speed or ownership fits your goals better.

In both cases, SDK.finance takes care of the heavy technical lifting so product teams can focus on the market, not the middleware.

Industry Recognition

SDK.finance’s technology and innovation continue to earn recognition from leading industry organisations around the world. In 2025, the company was named a finalist in both the Banking Tech Awards and the PayTech Awards, highlighting its growing influence in financial technology. This follows earlier distinctions such as White Label FinTech of the Year at the Go Global Awards 2022 and second place in the Barclays CBDC Hackathon 2022, which acknowledged SDK.finance’s contribution to the future of digital payments and banking infrastructure.

Competing Where It Counts

The FinTech leaders of the next decade won’t be the ones who wrote the most backend code. They’ll be the ones who deliver secure, intuitive, and context-aware experiences. That’s where customers decide whom to trust.

By removing the need to rebuild the core stack, SDK.finance allows teams to channel their energy into design, analytics, and partnerships – the areas that create real differentiation in digital finance. Leveraging a robust fintech solution and advanced financial software empowers teams to focus on innovation and deliver unique value to their customers.

You don’t have to start from scratch to innovate. You need a technology base that lets you:

-

Launch quickly – reach the market in weeks, not years.

-

Use capital effectively – invest in growth instead of backend rebuilding.

-

Stay compliant – rely on pre-built frameworks that meet global standards.

-

Scale confidently – process growing transaction volumes without redesigning architecture.

-

Focus on what matters – deliver features that truly attract and retain customers.

Ready to Build Faster?

Building from scratch once looked like the bold choice. Today, it’s often the slowest and most expensive route to market.

Regulatory demands, security standards, and customer expectations make full in-house development unsustainable for most teams.

Using a proven, configurable FinTech foundation such as SDK.finance shortens delivery cycles, reduces compliance risk, and enables innovation where it matters – the customer experience.

Build faster. Scale safely. Focus on innovation, not infrastructure.

Explore SDK.finance Platform.