These days, nobody’s really surprised when you pay with your phone or send money instantly. Digital wallets have quietly taken the spot that used to belong to the leather one in your back pocket. What began as a quick way to store card details has turned into a vital part of the financial world. Banks, FinTechs, online stores, and even telecoms use them to keep money moving smoothly.

Let’s break down what a digital wallet really is, how it works behind the curtain, what types you’ll find out there, and why so many businesses depend on this tech now.

What Is a Digital Wallet?

A digital wallet (or e-wallet) is a software application or online service that securely stores a user’s payment information, identification details, and transaction history, allowing them to make electronic payments without using physical cash or cards.

Digital wallets can store:

-

Credit and debit card information

-

Bank account data

-

Loyalty points and coupons

-

Tickets or identification

-

Cryptocurrency private keys

In essence, a digital wallet replaces the traditional wallet with an encrypted digital interface that lets users send, receive, and manage money through connected devices – usually a smartphone.

When you make a payment, the wallet checks who you are, talks to the bank or network, and finishes the transaction in real time. It’s basically your regular wallet but faster, safer, and way more connected to the rest of your digital life.

How Digital Wallet Works?

To the user, paying with an e-wallet feels simple. Behind the scenes, though, there’s a lot going on – systems talking to each other, verifying identities, following regulations, and keeping everything secure.

The Backend and APIs

Every digital wallet runs on a backend system that manages all the accounts, balances, and transactions. It connects to other systems through something called APIs (basically a bridge that lets different apps talk to each other).

These APIs handle things like:

- Creating new users and checking their info

- Managing money and transactions

- Letting you top up or withdraw funds

- Linking to banks or payment processors

Most wallets are built with an API-first mindset, meaning everything the app can do – payments, transfers, balances – can also be done through these APIs. This makes it easy to plug wallets into other services like banking apps, online stores, or even mobile operators.

Behind the curtain, it’s all modular. One part handles AML checks, another manages currency exchange, another sends you notifications. These parts talk to each other instantly using systems like Kafka or RabbitMQ, so when something happens (say, you send money), the whole system reacts immediately.

That’s how they keep things lightning fast even when thousands of transactions are flying through at once.

Security and Compliance

Security isn’t an add-on here; it’s absolutely essential. These wallets deal with sensitive data and actual money, so they need several layers of protection.

You’ll usually find:

- Encryption: Everything’s scrambled using TLS, and card numbers or keys are stored in encrypted or tokenized form.

- Authentication: Users confirm payments with PINs, passwords, or biometrics. Some even tie your account to your device for extra safety.

- Hardware protection: Phones often use secure elements or trusted environments to keep cryptographic keys safe.

- Regulation: Systems that deal with card data must meet PCI DSS standards and include KYC (Know Your Customer) and AML (Anti-Money Laundering) checks.

Many backends also use Hardware Security Modules (HSMs) to handle encryption keys and go through regular security testing to stay ahead of potential threats.

All these steps make sure that your wallet isn’t just convenient – it’s genuinely secure.

Real-Time and Scalable Operations

Here’s the thing: people expect digital wallets to work instantly. If you send money or buy something, your balance should update right away – no lag, no waiting.

To make that happen, the best systems rely on:

- Super-optimized databases and caching

- Asynchronous, event-based processing

- Horizontal scaling (basically, adding more machines when demand spikes)

The result? Wallets that can process thousands of transactions every second while keeping everything smooth and real-time. Even fees and currency conversions happen in a blink.

The Main Types of Digital Wallets

Not all digital wallets are created equal. Here’s how they usually break down:

1. Closed-Loop Wallets

Used within one company’s ecosystem – like the Starbucks app. You load money, spend it at their stores, and earn rewards. Simple, but you can’t use it elsewhere.

2. Semi-Closed Wallets

These work across a network of merchants that have partnered with the provider. You can shop or pay bills but usually can’t withdraw cash. Paytm started this way. It’s a middle ground between flexibility and control.

3. Open Wallets

The most flexible type. They connect to banks and card networks, so you can buy anywhere, transfer funds, or withdraw from ATMs. PayPal’s a great example. But because they operate at a broader financial level, they follow stricter regulations.

4. Cryptocurrency Wallets

These don’t hold the actual coins but the private and public keys that let you access them. You can choose custodial (the provider manages your keys) or non-custodial (you keep control). Many FinTech apps now blend crypto and fiat wallets so users can see all their assets in one place.

5. Mobile Money Wallets

Huge in places like Kenya, with services like M-Pesa. They’re tied to mobile numbers and let users send and receive money even without a bank account or internet access.

| Type of Digital Wallet | Description | Examples |

|---|---|---|

| Closed-Loop Wallet | Operates within a single company’s ecosystem. Funds can only be used with the issuing brand or merchant. | Starbucks App, Walmart Pay |

| Semi-Closed Wallet | Works across a network of approved merchants and partners but doesn’t allow cash withdrawal outside that network. | Paytm (early version), Amazon Pay |

| Open Wallet | Interoperable with banks and card networks. Enables users to pay, transfer, and withdraw money anywhere. | PayPal, Google Pay, Apple Pay |

| Cryptocurrency Wallet | Manages cryptographic keys and allows users to store, send, and receive digital assets such as Bitcoin or Ethereum. | MetaMask, Coinbase Wallet |

| Mobile Money Wallet | Telecom-based wallet that lets users store, send, and withdraw funds using a mobile number or USSD code. | M-Pesa, MTN Mobile Money |

Where You’ll Find Digital Wallets in Action

Banking & FinTech:

Banks use them as the face of digital banking – for transfers, onboarding, and managing accounts.

Retail & eCommerce:

Shops love them for fast payments and loyalty programs. Apple Pay or Alipay make checkout frictionless.

Crypto:

If you dabble in crypto, your wallet is your lifeline. Some apps like Nebeus merge fiat and crypto, giving users one sleek interface for all their assets.

Super Apps:

Think Grab or WeChat – one app where you can ride, eat, shop, and pay all with one balance.

Telecom & Financial Inclusion:

In emerging markets, mobile wallets help people without bank accounts access digital money safely.

Benefits of Digital Wallets

For consumers, digital wallets mean:

- Instant, cash-free payments

- Secure and convenient transactions

- Access to multiple currencies

- Smooth online and offline use

For businesses, they bring:

- Lower costs from handling less cash

- Better engagement via loyalty programs

- Real-time insights into customer behavior

- New income from fees and partnerships

Basically, digital wallets sit right at the crossroads of innovation, convenience, and inclusion – redefining how money moves around the world.

Building a Digital Wallet: Skills That Matter

Creating a digital wallet is not a straightforward coding project. It’s an undertaking that blends technology, finance, and compliance — each with its own depth. To build a wallet that works reliably at scale, a team needs a rare mix of engineering know-how and an understanding of how money moves through regulated systems.

Key areas of competence usually include:

-

Frontend and mobile engineering to design an intuitive user interface.

-

Backend development and payment routing for ledger management and fund flows.

-

Cybersecurity to protect data and prevent fraud.

-

API design and integration for banks, processors, and external partners.

-

User experience design focused on simplicity and trust.

Equally important is the regulatory side. A wallet that stores customer data or handles real funds must meet strict standards that go beyond ordinary software compliance. Among them are:

-

PCI DSS, ensuring cardholder data protection.

-

GDPR, governing the handling of personal information in Europe.

-

PSD3 and similar frameworks setting payment service rules.

-

KYC and AML controls to prevent identity misuse and financial crime.

Meeting these requirements from day one can easily consume months of work and legal review. This is why many FinTechs prefer to start from a pre-compliant technical foundation rather than reinvent the same logic internally.

Launching a Wallet Without Starting from Scratch

Developing a digital wallet system entirely in-house can become a long and costly exercise. Teams often spend years building backend logic, setting up integrations, and aligning with compliance demands – only to reach the market too late.

A smarter route is to use a pre-built FinTech core that already handles the heavy lifting: account management, transactions, AML/KYC, and reporting. By doing so, businesses typically shorten their development timeline by up to five times and save a significant share of their budget compared to full custom builds.

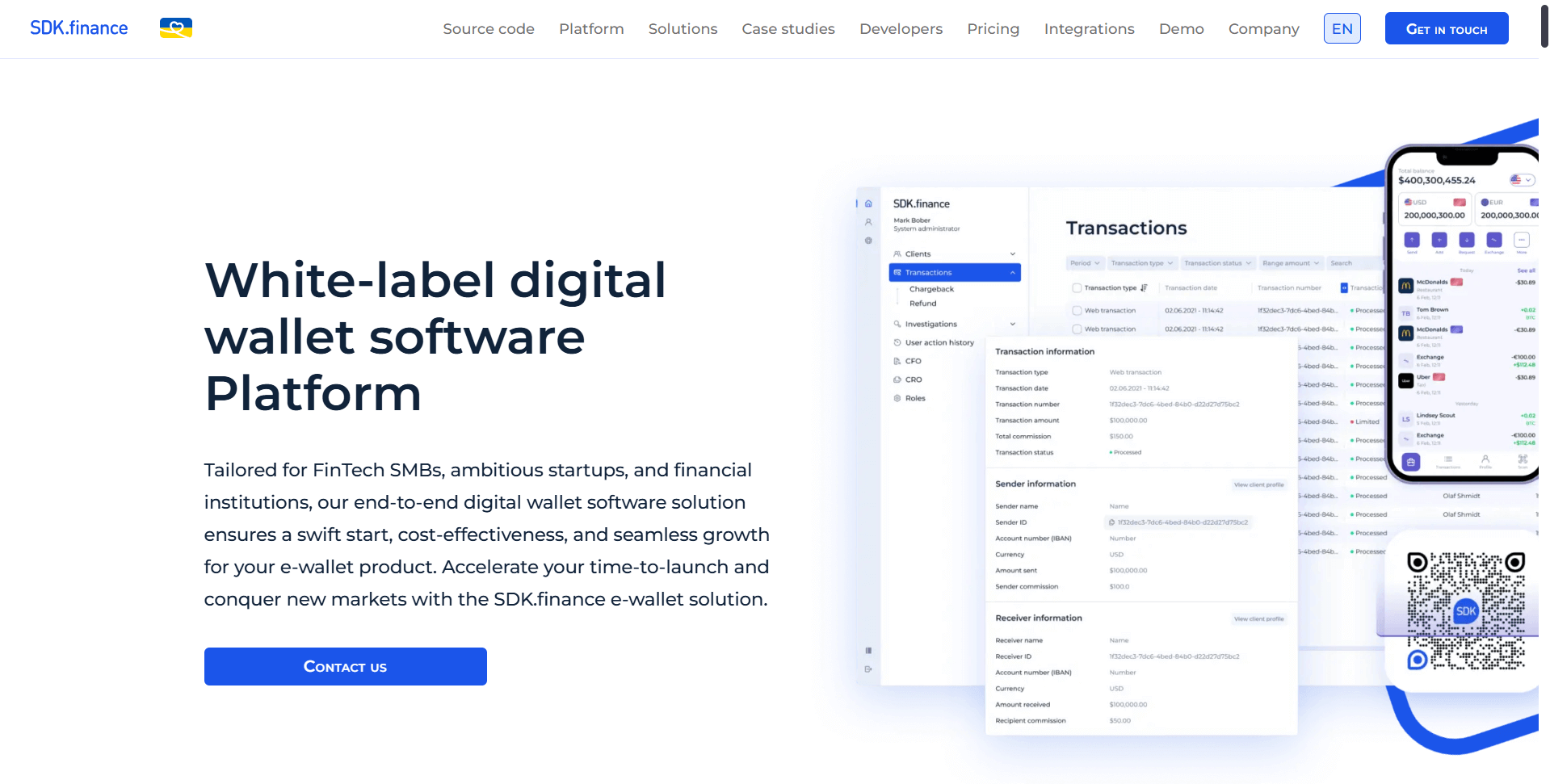

SDK.finance: The Foundation for Digital Wallet Development

This is where SDK.finance proves valuable. With more than 15 years in FinTech software development, the company offers a ledger-based, modular white-label digital wallet platform that speeds up the delivery of wallet, neobank, or payment products.

With the SDK.finance digital wallet solution, businesses can give their customers access to a full range of financial services, including the ability to:

-

Create and manage multi-currency accounts for fiat, crypto, or loyalty balances.

-

Top up wallets via bank transfer, card, or external payment gateways.

-

Send and receive funds instantly between users or to external accounts.

-

Make online and in-store payments, including QR and NFC-based transactions.

-

Issue and manage payment cards, both physical and virtual.

-

Process merchant payments with settlement and reconciliation tools.

-

Exchange currencies in real time using integrated FX rate management.

-

Pay bills and invoices directly from the wallet balance.

-

Monitor transactions and spending through detailed histories and analytics.

-

Verify customers with built-in KYC and AML modules.

-

Apply fees and commissions dynamically without code changes.

-

Operate securely, backed by PCI DSS Level 1 certification and encryption standards.

This functionality forms a complete foundation for any company planning to launch an e-wallet, payment app, or embedded finance service – ready to configure, integrate, and scale.

Companies from MPAY, which shifted from physical kiosks to digital payments, to a North African super app that unites taxi services, delivery, and in-app payments, have already launched their ecosystems on SDK.finance technology.

For organisations planning to introduce their own e-wallet, using SDK.finance means starting with a system that’s already proven, compliant, and cost-efficient – saving valuable time and capital while keeping full control over future product development.

Digital wallets aren’t just convenient – they’ve become the invisible infrastructure behind how we pay, store, and send money. With real-time processing, top-tier security, and flexible APIs, they connect banks, consumers, and businesses seamlessly.

If you’re building a new wallet platform, partnering with a proven system like SDK.finance isn’t just a shortcut – it’s the smartest way to launch fast while staying compliant and scalable for the long run.

Explore how SDK.finance can help you launch your digital wallet faster, securely and at a fraction of the usual cost. Get started here.