Looking for the right core banking platform? Start by reviewing the Top Core Banking Software List, where we compare leading providers, including Finacle, Finastra, and SDK.finance.

Choosing the right core banking software is a strategic decision that can define how well a financial institution adapts to change, serves its customers, and brings new products to market. Finacle and Finastra are two of the most recognised names in this space. In this article, we break down what each platform offers and present SDK.finance as a flexible alternative for those looking for greater control and modularity.

Overview of the Providers

Finacle by Infosys

Finacle is a cloud-native, modular core banking platform designed to support digital transformation across retail, corporate, and universal banking. It serves over 1 billion end customers globally and is known for its open API stack, embedded insights, and real-time capabilities.

Finacle is a cloud-native, modular core banking platform designed to support digital transformation across retail, corporate, and universal banking. It serves over 1 billion end customers globally and is known for its open API stack, embedded insights, and real-time capabilities.

Finacle key focus areas:

-

Cloud deployment with microservices-based architecture

-

Strong presence in emerging and developed markets

-

Designed for large-scale digital banking transformation

Finastra

Finastra provides a broad portfolio of financial software products, including core banking, lending, payments, and treasury solutions. With customers in over 130 countries and partnerships with 90 of the top 100 global banks, Finastra focuses on open innovation and ecosystem collaboration.

Finastra provides a broad portfolio of financial software products, including core banking, lending, payments, and treasury solutions. With customers in over 130 countries and partnerships with 90 of the top 100 global banks, Finastra focuses on open innovation and ecosystem collaboration.

Key focus areas:

-

FusionFabric.cloud open developer platform

-

Broad functional coverage (retail, corporate, treasury, lending)

-

Strength in large, multinational banking environments

Choosing the right core banking software is a strategic decision that can define how well a financial institution adapts to change, serve its customers, and bring new products to market. Finacle and Finastra are two of the most recognised names in this space. But for businesses looking to shorten time-to-market, maintain full control over their codebase, and reduce vendor lock-in, SDK.finance offers a flexible, modular alternative.

Why SDK.finance?

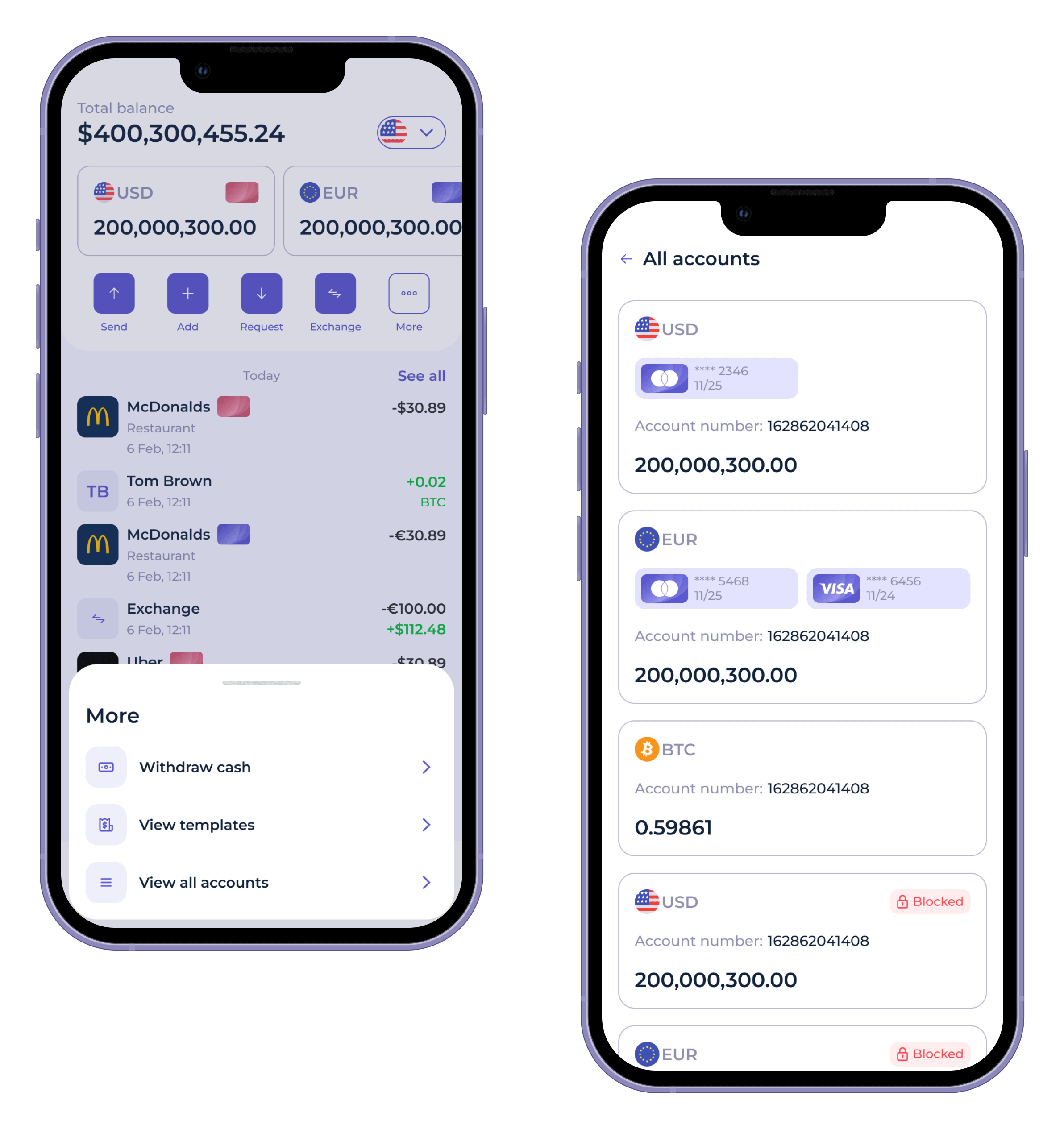

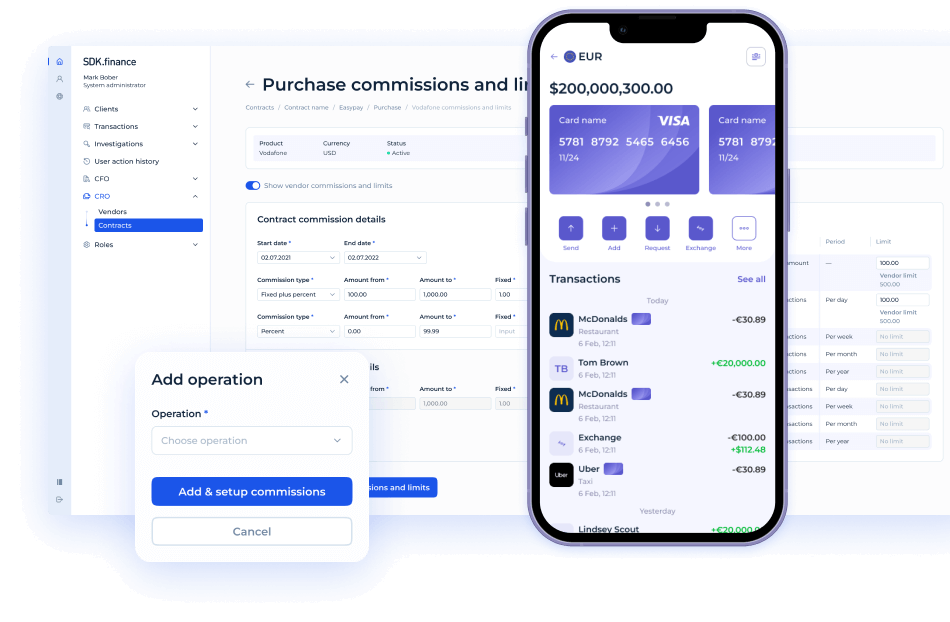

Image source: SDK.finance back office interfaces

SDK.finance is a European core banking and payment software provider that combines the reliability of a ledger-based backend with the agility of a modular architecture. It’s designed for financial institutions, payment providers, and enterprise companies building neobanks, digital wallets, or super apps. The Platform is available both as a source code licence and a cloud-based subscription, enabling full control or fast deployment depending on the business needs.

Key Benefits of SDK.finance:

-

Fast time to market: Launch financial products in weeks, not years, using a pre-built backend and mobile app.

-

Complete technology stack: Backend, frontend, mobile app, and over 470 RESTful APIs for integration.

-

Modular architecture: 60+ independent modules for tailored implementation and faster feature updates.

-

Source code access: Full ownership and control over the codebase, customise without vendor lock-in.

-

Scalable performance: Supports 2,700+ transactions per second, built for high-growth environments.

-

Multi-asset support: Handle fiat, crypto, loyalty points, and other custom assets in one system.

-

Compliance-ready: PCI DSS Level 1 certified, with pre-integrated KYC/AML and data separation model.

-

Flexible deployment: On-premise or any major cloud (AWS, Azure, Google Cloud, Oracle, etc.).

-

Dual delivery model: Choose between perpetual licence or PaaS depending on budget and needs.

-

Extensive back-office tools: Role-based admin panel for transaction monitoring, compliance, and reporting.

-

Industry-proven: Used by payment providers, crypto platforms, and super apps across multiple markets.

Whether you’re launching a wallet, modernising a bank, or building a multi-service platform, SDK.finance offers the foundational infrastructure to accelerate your product development, without compromising on flexibility or control.

Now, let’s see how SDK.finance compares to Finacle and Finastra.

Core Banking Platforms Comparison Table

| Feature/Capability | SDK.finance | Finacle by Infosys | Finastra |

|---|---|---|---|

| Founded | 2013 | 1999 | 2017 (via Misys + D+H merger) |

| Headquarters | Vilnius, Lithuania | Bangalore, India | London, UK |

| Customer Profile | FinTechs, banks, EMIs, non-financial enterprises | Retail, corporate, and universal banks | Global banks and credit unions |

| Deployment Models | On-premise, private/public cloud, hybrid | Cloud, on-premise, hybrid | Cloud-first, hybrid |

| Modular Architecture | Yes (60+ modules) | Yes (microservices) | Yes |

| API Access | 470+ RESTful APIs | 100+ APIs | 1800+ APIs |

| Time to Market | Several months | Several months | Months to a year |

| Core Strengths | Rapid launch, code ownership, flexibility | Real-time engine, strong global footprint | Broad product suite, developer ecosystem |

| Open Banking Support | Yes | Yes | Yes |

| License Type | Source code licence or PaaS | SaaS/Subscription | SaaS/Subscription |

| Use Case Fit | Digital wallets, PSPs, crypto-fiat apps, super apps, embedded finance | Core transformation for banks | Lending, treasury, corporate banking |

| Integration Capability | High (Kafka-based, modular design) | High | High (FusionFabric.cloud) |

| Security & Compliance | PCI DSS Level 1, KYC/AML-ready, PSD2-ready | ISO, PSD2-ready | ISO, PSD2, cross-border compliance support |

Final Thoughts

While Finacle and Finastra are robust platforms trusted by global institutions, SDK.finance offers a strong alternative for organisations seeking:

-

Faster product development cycles

-

Full control through source code access

-

Scalable architecture that adapts to varied use cases

To explore how SDK.finance compares with other top core banking platforms, visit the full Top Core Banking Software List.