The ability to process transactions at scale is a litmus test for modern payment infrastructure. For banks, FinTechs, and e-wallet providers, transaction throughput, measured in transactions per second (TPS), is the metric that defines resilience and readiness for growth. But while “high-volume” is a popular term, in practice, only a handful of systems in the world operate at the extreme end of the scale.

In this article, we at SDK.finance, a leading digital banking software provider, explore:

- What “high-volume transactions” actually mean

- Which types of businesses genuinely require such capabilities,

- When aiming for ultra-high TPS can become unnecessary overspending.

- We also explain why the priority for most institutions isn’t hitting ultra-high TPS today, but building a scalable architecture that grows in line with their business.

High-volume transactions meaning

High-volume transactions in payments refer to financial services that process extremely high transaction volumes (on the order of tens of thousands of transactions per second without downtime). In industry practice, this generally means platforms capable of sustaining 10,000+ TPS, with 20,000 TPS recognised as a key benchmark that only global card networks, super-app wallets, and large-scale national payment infrastructures typically achieve.

This isn’t an abstract engineering challenge. It’s a daily reality for the world’s largest networks. Knowing who truly operates at this scale helps banks, PSPs, and fintechs set realistic technology goals.

Real-world benchmarks

Below, we outline some notable examples of payment, banking, and FinTech businesses that either handle around ultra-high TPS in real-world operation or have peaked at even higher rates, especially during events. We focus on actual current load and publicly reported cases, particularly in the digital bank, e-wallet, and neobank segments:

- Card Networks: Visa & Mastercard

- Super-Apps: Alipay & WeChat Pay

- Alipay, the world’s largest digital wallet, peaked at an astonishing 544,000 TPS during China’s Singles’ Day in 2019, reflecting the extreme demands of global-scale events.

- WeChat Pay saw a burst of 409,000 TPS during Lunar New Year digital “red envelope” campaigns, ensuring seamless payments for hundreds of millions simultaneously.

- National Instant Payment Systems: India’s UPI

UPI, India’s real-time payments platform, averages 7,500 TPS but is architected for peak loads above 10,000 TPS, processing 20 billion transactions monthly as of mid-2025.

Should every platform target ultra-high TPS?

For most digital banks and payments startups, ultra-high TPS is unnecessary, and striving for it creates avoidable cost and complexity. Instead, the focus should be on right-sizing capacity, leveraging modern, elastic platforms, and ensuring readiness for growth. PCI DSS and, more importantly, ISO 27001:2022 certification are foundational for secure scaling.

Even the world’s best-known fintechs and neobanks operate far below the 20,000 TPS threshold.

-

PayPal averages around 475 TPS, with peaks reaching only a few thousand during global e-commerce surges (e.g.Black Friday).

-

Nubank, the largest neobank by customer count (88 million customers as of 2023), upgraded its systems to handle about 3,000 TPS per client, but this still falls well short of card network volumes.

-

Other digital-only banks such as Revolut, Chime, and N26 typically measure in the hundreds of TPS, concentrating more on customer experience and product innovation than on extreme throughput.

For these players, the challenge isn’t achieving 20k TPS today, but ensuring their platforms are scalable, able to expand capacity in step with business growth rather than overspending on infrastructure from day one.

Comparative TPS levels: from networks to neobanks

| Platform | User base | Average TPS | Peak/Event TPS |

|---|---|---|---|

| Visa | 4 billion | ~8,500 | >65,000 |

| Mastercard | 3.4 billion | ~4,600 | ~20,000 |

| Alipay | 900M+ | Thousands | 544,000 |

| WeChat Pay | 900M+ | Thousands | 409,000 |

| UPI (India) | 500M+ | ~7,500 | >10,000 |

| PayPal | 430M+ | ~475 | Few thousand |

| Neobanks (avg.) | Tens of millions | 100–3,000 | Below 10,000 |

Visa and Mastercard are engineered for near-zero downtime at global scale. Alipay and WeChat Pay demonstrate record-breaking bursts during consumer events. UPI shows how national infrastructure can approach sustained high-volume loads. By contrast, PayPal and neobanks remain well below the 20k TPS threshold.

Peak vs. sustained TPS

-

Peak TPS: Alipay’s Singles’ Day surge to 544k TPS and WeChat Pay’s 409k TPS burst show what happens during short, high-pressure events.

-

Sustained TPS: Visa averages ~8,500 TPS day after day. UPI sustains ~7,500 TPS across billions of monthly transactions.

The distinction between average TPS and peak TPS is critical. While average loads may sit in the thousands, shopping festivals or national salary days can trigger surges multiple times higher. Infrastructure must be built with this headroom.

The cost of overbuilding

Chasing 20k TPS capacity from day one is often wasteful. It demands infrastructure, compliance, and redundancy investments far beyond most institutions’ actual needs.

For startups and mid-sized players, the smarter path is:

-

Right-size capacity for current demand.

-

Build on a scalable foundation to expand seamlessly as growth accelerates.

-

Prioritise resilience and compliance (PCI DSS, ISO 27001:2022) as prerequisites for sustainable scaling.

SDK.finance perspective: scaling smart

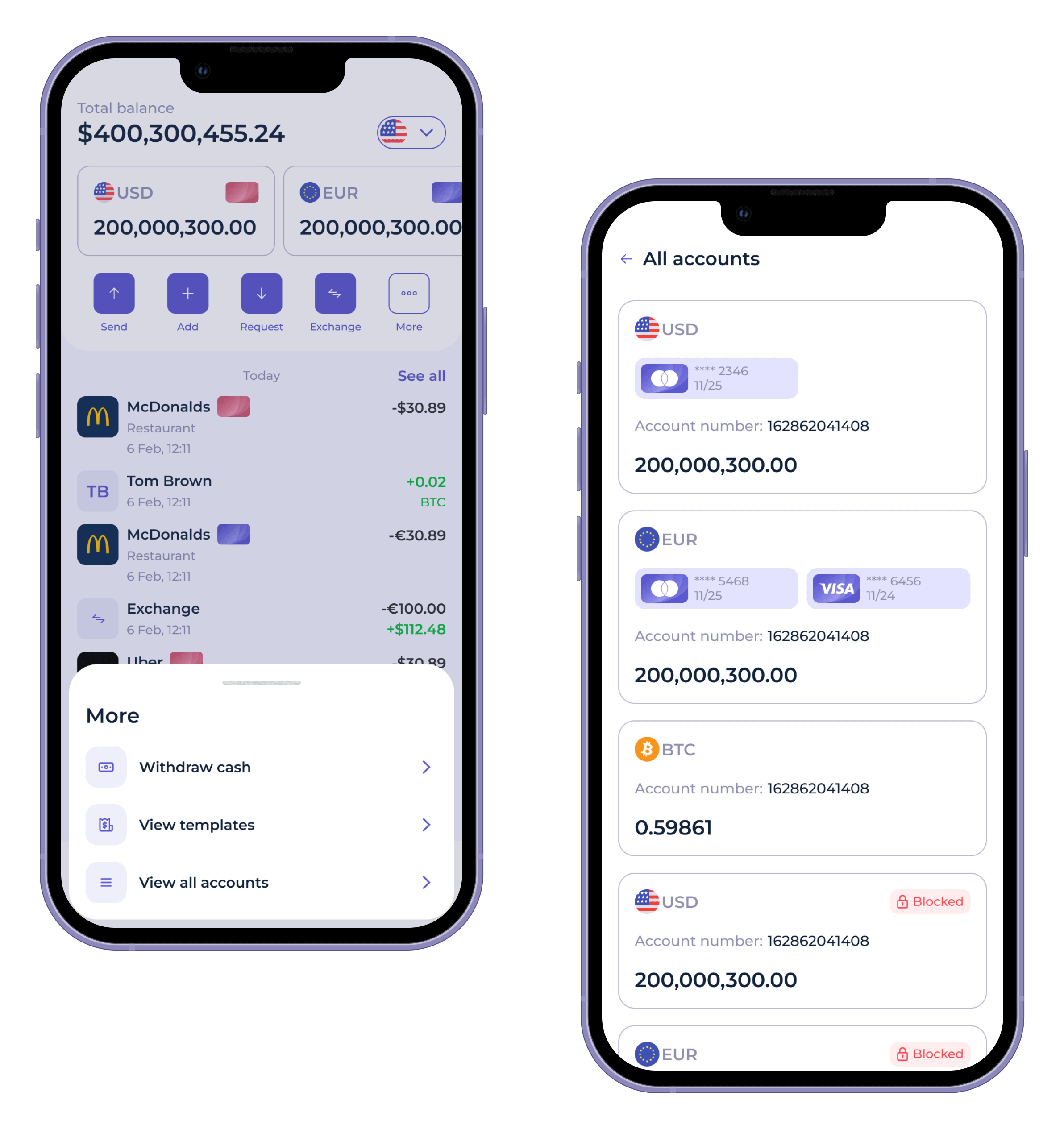

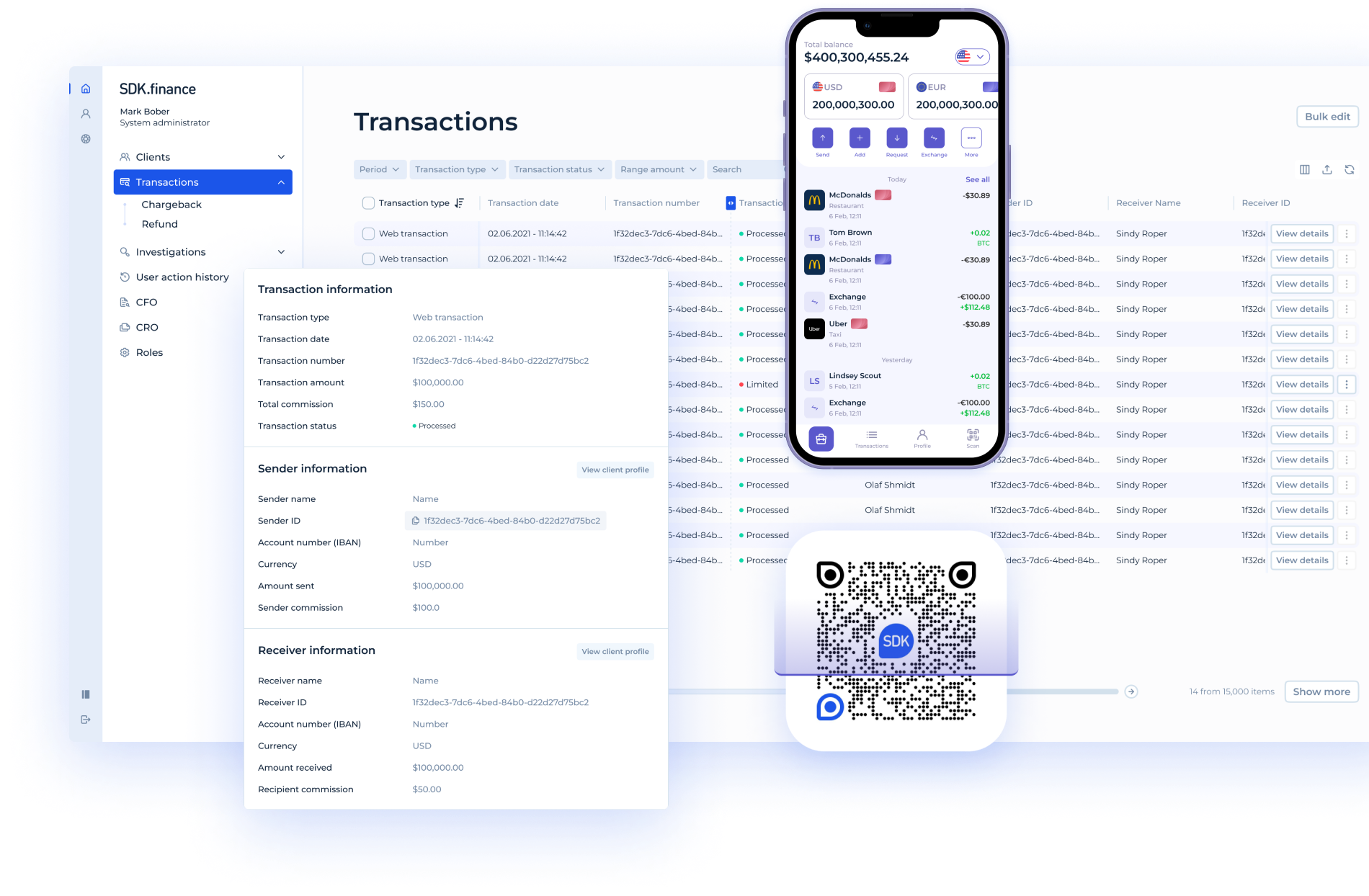

SDK.finance is engineered for financial institutions aiming to deliver high reliability and real-time performance, with ISO 27001:2022 and PCI DSS certifications for best-in-class security and resilience.

This means partners get the elasticity to support thousands of TPS today, and the confidence to grow towards genuine “high-volume” territory without re-platforming when payments ambitions soar.

Recommendation: Platforms should align architecture and vendor choice with actualm and realistically projected, TPS needs. For most, selecting a future-ready, certified, and elastic solution like SDK.finance ensures both cost efficiency and the capability to scale when market opportunities demand it.

SDK.finance delivers a ledger-based, modular platform designed to scale with business growth. Instead of forcing institutions to overbuild, it offers:

-

Scalability-first architecture: expand from thousands to tens of thousands TPS as infrastructure is added.

-

470+ APIs and 60+ modules: covering digital wallets, payment processing, reconciliation, compliance, and more.

-

Enterprise-grade security: PCI DSS Level 1 and ISO 27001:2022 certified.

-

Deployment flexibility: on-premises or across any major cloud provider.

-

Proven performance: trusted by PSPs, super apps, and fintechs processing millions of transactions daily across multiple regions.

Key takeaway

Only a handful of ecosystems – Visa, Mastercard, Alipay, WeChat Pay, UPI – operate at 20,000+ TPS today. For most financial institutions, the real challenge isn’t hitting that number now, it’s building a platform that can scale toward it without re-architecture.

With SDK.finance, institutions get a future-ready payments foundation: secure, modular, and built for scale. Launch with the capacity you need today, and grow confidently as transaction volumes rise.