The neobanking market is expected to grow to $394 billion in value by 2026, at a CAGR of 46.5% in the coming years, driven by underserved market segments such as non-bank customers, SMEs, freelancers, startups, and credit entrants. The largely undisturbed retail banking business, which has enjoyed excessive profits and left many customers dissatisfied and unserved, is now threatened by neobanks.

Revolut, Fidor, Simple, N26, and Monzo are some of the well-known neobanks, the alternatives to which incumbent banks are trying to develop. For instance, Goldman Sachs has launched Marcus, and RBS has launched its standalone version called Bó to compete with the “newcomers”.

What creates the demand for digital banks?

Digital banks offer unparalleled convenience and transparency to their users: via their smartphones, customers can open an account whenever and wherever they want. In addition, low and transparent fees allow customers to reap the benefits of financial services.

The established banking system, on the other hand, relies on physical branches to open accounts, carry out transfers and handle customer queries, which is very restrictive for some customer groups.

Those who live in rural areas or work long hours need to make special arrangements to travel to a branch during business hours just to open an account.

Moreover, traditional banks cover their high overheads by passing on the costs to consumers in the form of high and unexpected fees. So, digital banks are a lot more accessible and cheaper to use than brick-and-mortar ones. Now, let us look at Revolut, one of the most prominent representatives of the digital banking industry and its evolution.

What is Revolut?

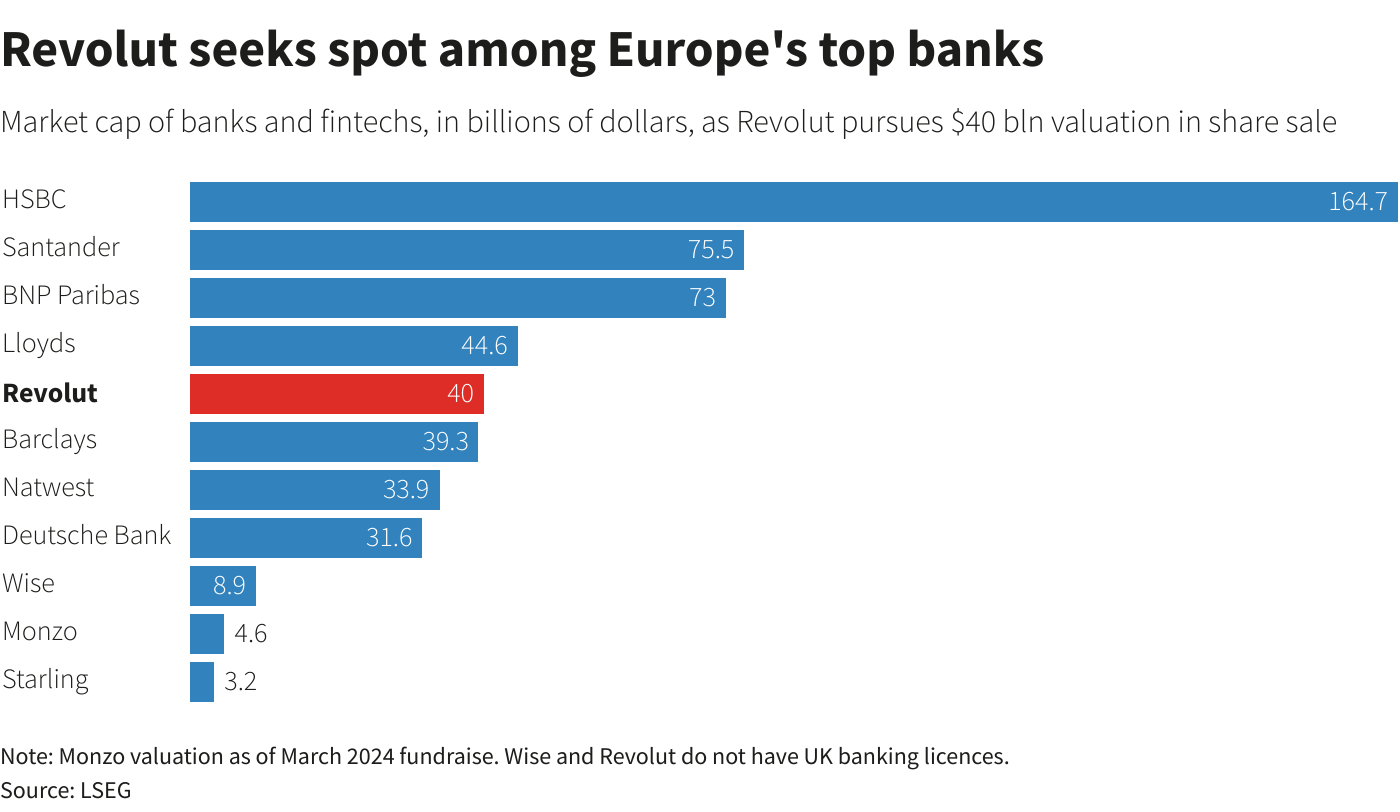

Revolut Ltd is one of the UK’s most highly regarded and well-known digital banks, launched in 2015 by Nikolay Storonsky. Revolut is regulated by the Financial Conduct Authority (FCA) as an e-money institution, ensuring that customer funds are safeguarded. Revolut does not hold a UK banking licence but has obtained a full banking licence from the European Central Bank, and its subsidiary is licensed and regulated by the Bank of Lithuania within the European Union. Revolut aims to achieve a valuation exceeding $40 billion through an upcoming share sale in 2024. This valuation would establish Revolut Ltd as Europe’s leading digital bank.

Revolut users and revenue stats

26 million – number of retail Revolut customers (as of December 2023)

400 million – number of transactions a month in 2023

5,9 thousands – people working for Revolut

+60% – total number of users growth in 2023

$1.1 billion – revenue in 2023 (45% increase compared to 2022)

38 – countries

$15.5 billion – was entrusted to Revolut in customer deposits – (70% increase compared to 2022)

Source: Revolut annual report 2023

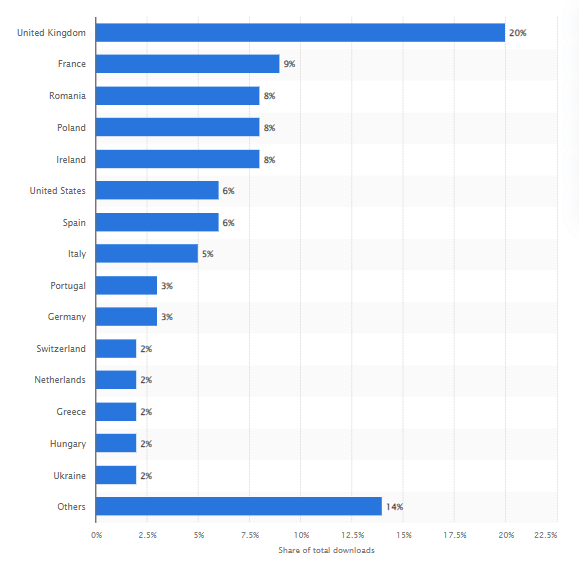

Market share of Revolut banking app downloads worldwide (as of February 2023)

Image source: Statista

This fintech startup has attracted millions of customers by allowing its customers to do almost anything online that most traditional banks do offline.

Many people wonder what has made Revolut Ltd so successful and search for a “recipe” on how to build a white-label digital bank that could make a real alternative to this giant.

Why is Revolut such a popular platform?

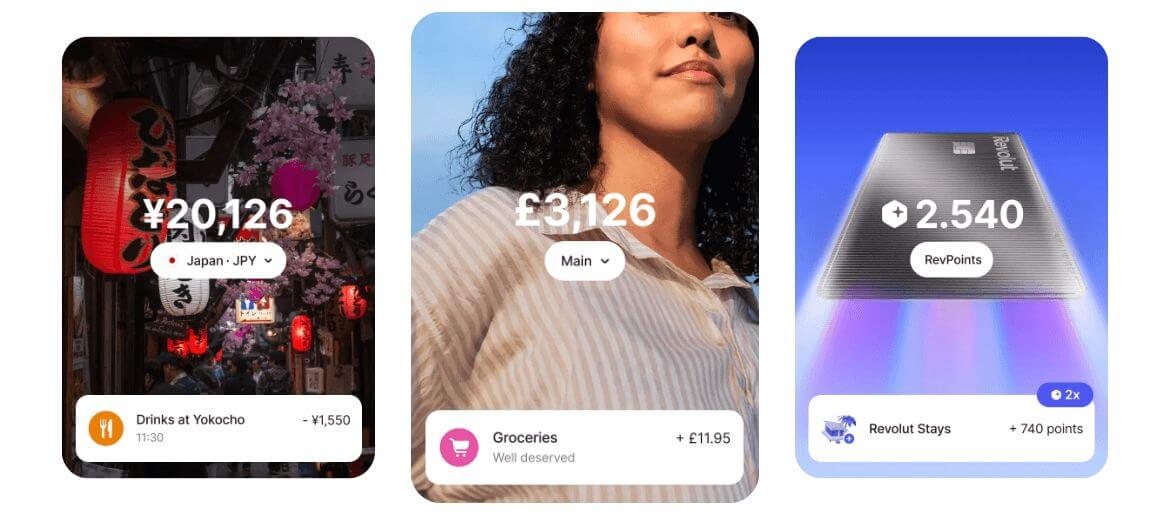

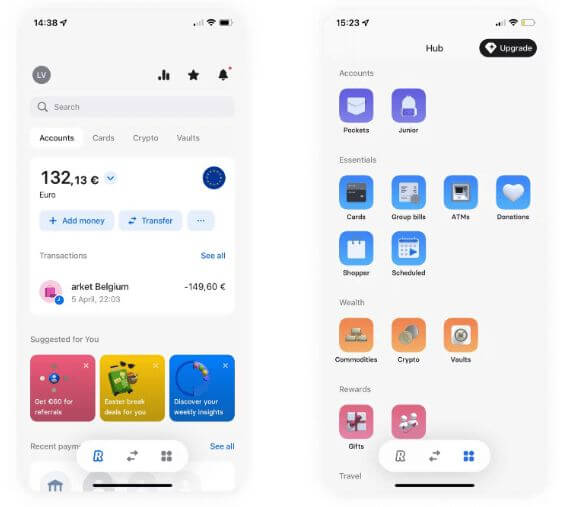

Revolut’s banking features make managing your money incredibly easy. Although the term “user-friendly” is used far too often today, in this case, it perfectly sums up the Revolut experience. Simple everyday use examples show why Revolut is much better than a traditional bank.

Source: Reuters Graphics

Truly user-friendly

Image source: Revolut official website

User-friendly experience is top priority for this neobank. Compared to the long queues and never-ending red tape at traditional banks, opening an account with Revolut is a breeze. And it’s not just one basic account – you can set up more accounts in 30 currencies with just a few taps and at no cost.

Multi-currency

You can spend the money in any of your currencies via a card you receive in the post, making it much easier to travel and spend abroad. Revolut allows users to spend in multiple currencies without incurring additional transaction fees.

Let us say you are in Prague and have a few Czech crowns in your secondary account, but not enough to buy another cup of coffee. Revolut automatically converts your primary currency to make up the difference when you pay with your card.

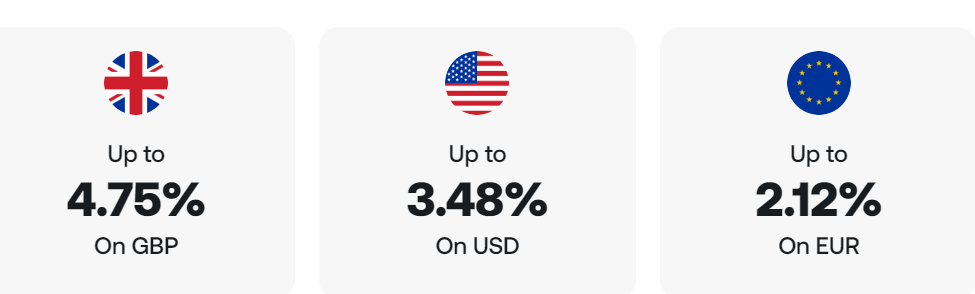

Deposits

$15.5 billion was entrusted to Revolut in customer deposits in 2023 (that’s up by 70% compared to 2022). Revolut enables users to open an account in seconds and watch their money grow, compound, and increase. Savings interest rate is variable, and returns may vary depending on the user’s plan and currency.

Image source: Revolut official website

Personal loans

Revolut customers can apply for loans ranging from €1,000 to €35,000, with interest rates starting at 5.99%. Revolut offers loans as part of its banking services, with competitive interest rates and flexible repayment options. User can apply for a loan or a credit card via Revolut app in few easy steps.

Lower foreign transaction fees

But that’s not the kicker. Unlike traditional banks, Revolut Bank does not charge you exorbitant foreign currency fees or exchange your money at a terrible rate that’s set once a day.

Instead, you get a constantly updated interbank exchange rate with no fees, so you save money on every transaction. Revolut estimates that customers save an average of £46 when traveling abroad.

The same applies to international bank transfers. Apart from the interbank exchange rate, Revolut does not charge any fees for money transfers or currency exchange. This is what makes this digital bank very popular not only with frequent travelers and ex-pats but also with people having family abroad.

No more card-related fuss

Revolut Bank has solved the usually complicated problem of lost cards. Instead of calling your bank’s hotline and spending time on hold, you can change your pin code or block your debit card in the Revolut app with just a few taps. Revolut also offers fee-free debit card spending overseas and provides additional debit cards with various benefits and perks.

There you can adjust your spending limits and quickly switch between magnetic stripe, NFC, and ATM transactions for added security.

Image source: Revolut official website

Freedom of transactions

If you have canceled or blocked your “traditional” bank card and are waiting for a new one, you will not be able to spend your money at the brick-and-mortar banks. Revolut banking app lets you can create a virtual debit card and be able to carry out online transactions. Users can communicate with the support team through the in-app chat for various queries, assistance, and issue resolutions. You can even create one-time-use virtual cards with details that change after each purchase for an extra layer of security.

Spending visualization

As soon as you make a purchase, you’ll automatically receive an instant payment notification from your app, which will also display the amount you have spent that day to help you keep track of your spending. Each purchase is then categorized, saved, and used to project your monthly spending.

You can always access the fantastic spending analytics to see how much money you have spent by retailer, category, or country. Revolut Bank also lets you set up “vaults” that round up your purchases and deposit the difference into a special savings account. You can even set up an accelerator that multiplies your chance to help you reach your savings goal faster.

These features make managing your bank account incredibly easy. Whether you’re using a personal account or one of Revolut’s business accounts, the neobank’s diverse features, low cost, and customizability originate from a single system – their core banking system.

Revolut Business Model: How does Revolut make money?

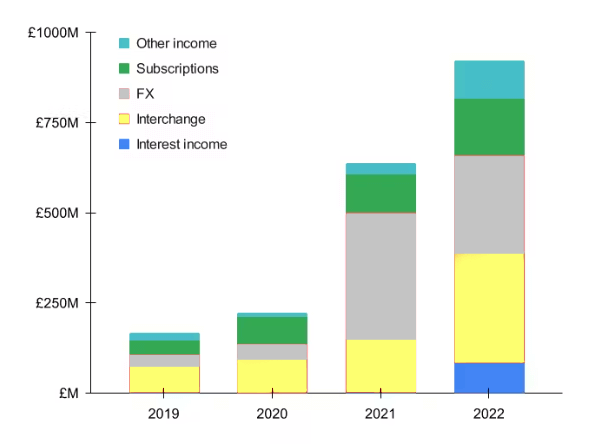

Image source:BusinessofApps

Taken the favourable conditions for the customers and low fees, many people are left wondering – how does Revolut earn money? Or, more generally, how do digital banks make money? Let’s take a closer look at Revolut’s business model.

Revolut offers a comprehensive range of payment services for personal and business customers, including overseas payments, savings, and investment products.

According to Revolut’s official data, there are a few main sources of this digital bank income:

Image source: Sacra

Revolut Plus, Revolut Premium, Revolut Metal, and Revolut Ultra paid subscriptions provide unlimited foreign exchange, higher ATM withdrawal limits, and benefits like travel insurance and airport lounge access, with prices ranging from £3.99 to £45 per month.

There’s one more thing, however. Every time a customer makes a card purchase, the card scheme (Visa or Mastercard) returns a portion of the fees to Revolut. It is an incredibly small percentage fee, but it adds up when millions of purchases are made.

As B2B users companies can create accounts that offer multi-user access, expense management, and API integration, with plans starting at £25 per month.

Benefits of Revolut vs. traditional banks

Unlike traditional banks, Revolut offers its customers full control over their banking experience. They are free to set their security preferences, such as whether or not to enable NFC or magnetic stripe payments. Customers can also use the features that established banks simply don’t offer, from buying cryptocurrencies and gold to investing in the NYSE. Unlike high street banks, which charge around €3 per transaction for ATM usage in Spain, Revolut offers more cost-effective solutions.

The reason traditional banks can’t implement new features is because of their technology infrastructure. Closed legacy systems require a lot of time and resources to upgrade, and some banks struggle to integrate even the most basic functions like currency exchange.

Digital banks, on the other hand, rely on a much more flexible and robust API-first architecture to introduce new functionality in a fraction of the time.

These factors make Revolut attractive not only to the previously underserved customers but also to those who’ve accounts with traditional banks. If you can open a free bank account in the time it takes to download a new app, trying out a neobank is as easy as can be.

Must haves needed to build a digital bank like Revolut

Revolut, like Rome, wasn’t built in a day. We at SDK.finance know all too well that building a digital bank is a complicated process (based on our 15-year experience in creating banking software).

Revolut Ltd provides a range of services and is regulated by various authorities, ensuring compliance and security for its users. So, what are the key components that are mandatory for building an app similar to Revolut?

Core banking system

An essential part of any digital bank is its core banking platform. It is an engine behind accounts, balances, transactions, the storage of customer data, receipts, and other reporting tools.

A decent core banking software relies on a composable architecture that’s connected via APIs and allows distribution channels, products, and customer data to be decoupled.

This particularly agile architecture allows for carrying out quick changes while providing a continuous digital customer experience.

Once the banking core is ready, customer onboarding, payment processing, card issuing, and KYC services are integrated into the platform. Developing a core banking platform from scratch is a complicated and time-consuming process that can overwhelm teams and delay product launches.

For this reason, very few banks use their own platforms. N26, Tandem, O2 Banking and other Revolut competitors have outsourced their core banking platforms from the fintech software vendors. The new cloud-based platforms with pre-integrated key features help assemble best-in-class products and launch them much faster and with less capital expenditure.

Dedicated team

It cannot be overstated how important it is to have the right team to develop a digital bank like Revolut. A team should be made up of people genuinely interested in implementing your vision through to the end. Their success is based on shared responsibility, trust in each other and a lack of doubt about their purpose and goals.

Here is an an example of what a small digital bank team can look like:

Vision & growth hacking

Vision shared within the team, helps everyone understand what they are working towards and encourages the work with passion. Growth hacking consists in selecting a single hypothesis at a time and testing it to see if it works out or not. Then you need to document and analyze the results before moving on to the next iteration. The approach is particularly attractive to startup founders because it focuses on rapid growth. Although some results may turn out to be complete failures, other experiments may produce a successful strategy for exponential growth.

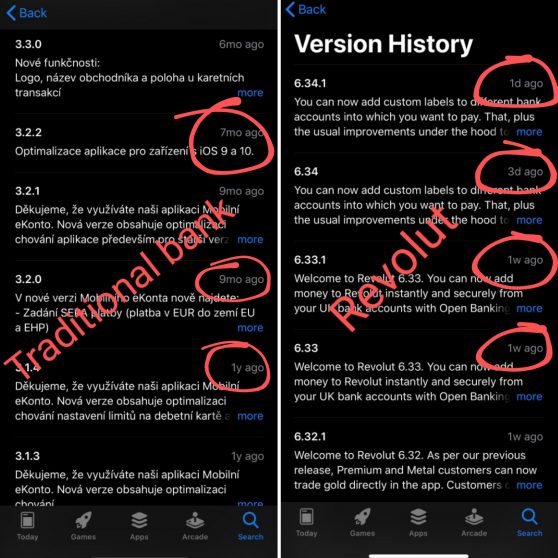

Quick features delivery

For a startup with limited resources to succeed in a new market, it needs to innovate much faster to outperform the competition. Launching new versions is crucial to provide customers with a superior UX, and that is exactly what Revolut has done.

Updates frequency: Revolut vs. traditional banks

Compared to a traditional banking app that has a couple of updates a year, Revolut releases a new version a few times a week. Its constant iterations and fixes allow it to continuously please its growing customer base and stay ahead of the competition.

The problem in traditional banking is that the journey from an idea to a rolled-out feature takes months or even years. On the other hand, neobanks can implement this in weeks thanks to different business processes and product development lifecycle and core banking software, of course.

Image source: Revolut

Since any bank is based on a core bank system, it is often the main barrier for the implementation of the new WOW features that customers love.

Digital banking software to create a Revolut-like bank

Among the next-generation fintechs competing in the banking services market, SDK.finance has been particularly successful at leveraging modern tools to help companies launch their neobanks quickly and easily on their retail banking platform.

Watch the SDK.finance mobile app UI of our Platform, designed to help you create secure and feature-rich financial solution in record time: