People often mix up “payment gateway” and “payment processor,” but they actually handle very different parts of a transaction. If you think of payments like a relay race, the gateway starts the run while the processor finishes it.

Merchant services refer to the broader suite of financial solutions that enable businesses to accept payments both online and in-store, including payment gateways and processors.

In this piece, experts from leading digital payment software provider SDK.finance will break down these concepts, explaining how the two fit into both online (card-not-present) and POS (card-present) acquiring. We’ll cover what each does, how they interact with banks and card networks, how they help businesses accept payments, how they make money, and what kind of risks and licences are involved. There’s even a comparison table at the end if you’re the type who likes to see it all laid out neatly.

Introduction to Payment Systems

A payment system is the backbone of modern commerce, connecting buyers and sellers through a network of financial institutions, technology platforms, and payment processors.

At the core of every payment system are two essential components: payment gateways and payment processors. Understanding the difference between a payment gateway and a payment processor is crucial for any business looking to accept credit card payments and manage online transactions efficiently. While the debate of payment gateway vs payment processor is common, the reality is that both are necessary for a seamless payment experience.

Payment gateways are responsible for collecting and securely transmitting payment data from customers, while payment processors handle the actual processing of credit card payments behind the scenes. By working together, gateways and payment processors ensure that online transactions are fast, secure, and reliable, allowing businesses to accept credit cards and other payment methods with confidence.

Definitions and Roles

A payment gateway is basically the digital front door of a transaction. It’s the bit of tech that securely captures a customer’s card info - think of that checkout form you fill out when buying something online - and passes it along for processing. The payment gateway collects the customer's credit card information, encrypts it, and forwards it for processing.

It encrypts the card data, runs some basic fraud checks (and sometimes 3-D Secure), and sends the authorisation request off to whoever’s handling the heavy lifting. Once the result comes back-approved or declined-the gateway shows the transaction approval or decline to the customer and the merchant. Its main job? Keep things secure, fast, and fraud-resistant.

To simplify: the gateway is the front end you see; the processor is the back-end machine that moves the money.

Online Acquiring (Card-Not-Present)

When you buy something online or in an app, both parts-the gateway and the processor-are usually involved. These are card not present transactions, meaning the physical card is not used, and payment is made remotely, such as in eCommerce or phone orders.

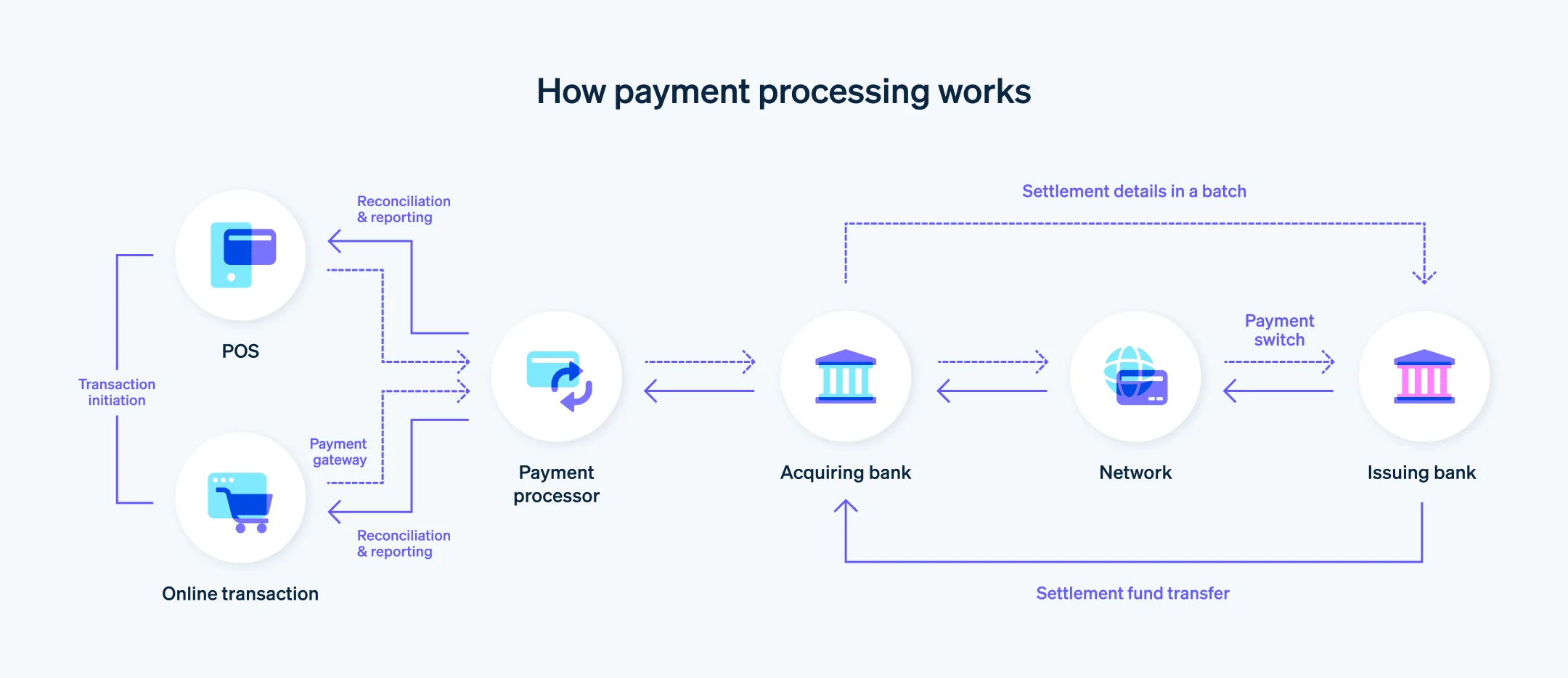

Here’s the flow in plain English:

- You (the customer) type your card details on the checkout page.

-

The gatewayonline payment gateway is responsible for securely transmitting payment information and credit card data. It encrypts that info, does fraud checks or 3-D Secure if needed, and forwards an authorisation request to the processor.

- The processor then sends it through the card network to your bank (the issuer). The bankayment processor sends the authorization request through the card network to the customer’s card issuing bank, which approves or declines ithe transaction and sends the response back.

- The payment gateway tellnotifies the merchant (and you) what happeof the transaction approval or declined. If it‘’s approved, your bank reserves the amount.

- Later, the processor kicks off clearing and settlement-interacts with the customer’s bank to settle the funds—money leaves your account, flows through the card network, reaches the acquirer, and finally lands in the merchant‘’s bank account. The gateway‘’s done its part by then.

POS Acquiring (Card-Present)

For in person transactions at a physical store, businesses rely on a point of sale system (POS system) to accept card transactions. The POS system includes both hardware and software designed to process payments at the point of sale. The POS terminal – whether it‘’s a card readerpayment terminal, credit card reader, credit card machines, a self-checkout, or a smartphone with a tap-to-pay app – takes over the role of the gateway.

Here’s the gist:

- The terminal reads your card (magstripe, chip, or NFC).

- It sends the authorisation request straight to the processor or acquirer.

- The processor does its routing magic, gets the decision back, and sends it to the terminal.

- You get a receipt, and everyone’s happy.

Clearing and settlement happen later, just like in online payments. In most POS setups, you don’t need a separate gateway, since the terminal already does that job. Large chains might still use a “gateway-like” system to connect multiple acquirers for reliability or cost optimization.

Responsibilities and Interactions

The gateway connects merchants and customers. It handles the checkout UI, encryption, tokenisation, and some fraud prevention. It doesn’t touch the actual funds – it just passes secure data to one or more processors.

The processor connects to the banking world. It communicates with card networks and issuers, manages clearing and settlement, and keeps up with strict compliance and reporting rules. The processor settles funds into the merchant’s acquiring bank, which holds the merchant account and receives funds from approved transactions.

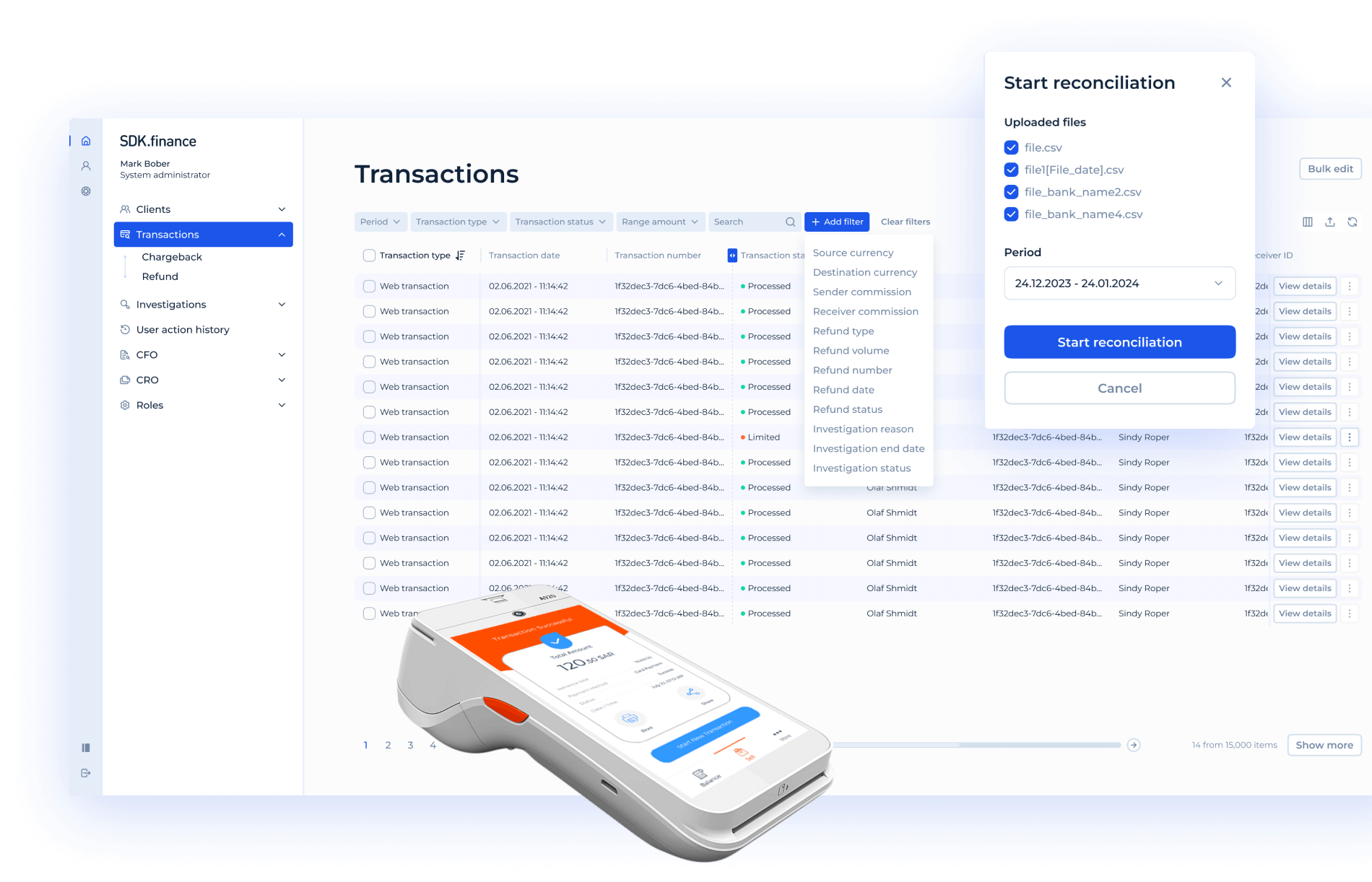

Pro insight from SDK.finance: In practice, a payment gateway and a payment processor can exist within a single solution only if a provider owns the entire payment infrastructure. However, in many cases, these functions are handled by different vendors – one focusing on secure data transmission, the other on authorisation and settlement. Processors and payment gateways work together as part of comprehensive payment processing services to facilitate seamless credit card transactions.

Merchant account providers often offer both merchant accounts and integrated payment gateways to streamline payment processing for businesses. Integrated payment gateways are embedded directly into the merchant’s e commerce platform, allowing customers to complete transactions without being redirected to an external site. Alternatively, third party payment gateways can be used with a merchant’s e commerce platform to provide flexible and scalable payment options.

Having a merchant account is essential for businesses to receive funds from card transactions, as it acts as the bank account where funds are held before being transferred to the business’s main account. Merchant accounts are typically set up with a merchant service provider or merchant account provider, who may also offer payment gateway technology as part of their service package.

Business Models and Licensing

How they make money:

- Gateways typically charge a fixed fee per transaction or a monthly subscription. Extras like advanced fraud tools or reporting dashboards can cost more. They don’t earn from interchange or network fees.

- Processors/Acquirers earn from the merchant discount rate (MDR), which is a small percentage of each transaction. That covers interchange (what goes to the issuing bank), card scheme fees, and the processor’s own margin. When choosing a provider, businesses should compare options to find the best payment processor for their needs.

They might also charge for chargeback handling, merchant onboarding, or terminal rentals.s, or additional costs such as chargeback fees.

Licensing and Regulation:

- Gateways are mostly tech companies. They don’t need a banking license unless they actually hold or move funds. Still, they must comply with PCI DSS and data protection laws. If a gateway starts acting as a payment facilitator (boarding merchants and managing settlements), it usually falls under regulated PSP or EMI rules.

- Processors are financial institutions, plain and simple. They’re either licensed acquirers themselves or work under one. They have to meet regulatory requirements like AML/CTF checks, PCI DSS, capital adequacy, and operational resilience standards.

Some payment providers are also registered as a Money Services Business (MSB) to comply with financial regulations and demonstrate legitimacy.

Risks and Liabilities

Gateways deal mainly with technical and reputational risks—system downtime, data breaches, or weak fraud filters. While they’re not financially responsible for chargebacks, a security failure can seriously damage trust and lead to penalties or lost clients. Some gateways now offer enhanced fraud protection, providing specialized tools and measures to reduce the risk of fraudulent transactions.

Processors, meanwhile, carry the real financial risk. They handle merchant funds, so they face chargeback exposure, scheme fines, compliance audits, and settlement or liquidity challenges. They’re also the ones on the hook for ensuring funds move correctly and legally.

Security and Reliability

When it comes to payment processing, security and reliability are non-negotiable. Payment gateways play a vital role in securely transmitting sensitive payment data – such as credit card numbers and expiration dates- from the customer to the payment processor. This is achieved through advanced encryption, tokenization, and strict adherence to industry standards like PCI DSS.

On the other side, payment processors are responsible for ensuring that each transaction is processed accurately and efficiently, minimizing the risk of errors or fraudulent activity. Both payment gateways and payment processors must implement robust security protocols to protect customer data and prevent unauthorized access. By choosing reputable gateways and payment processors, businesses can safeguard their customers’ information and provide a trustworthy payment experience, reducing the risk of data breaches and ensuring the integrity of every credit card transaction.

Fees and Pricing

Understanding the fees and pricing structures of payment gateways and payment processors is essential for any business looking to optimize its payment processing costs. Payment gateways and payment processors may charge a variety of fees, including flat transaction fees, percentage-based fees, monthly or annual subscription fees, and additional charges for premium services like recurring billing or advanced fraud protection.

The total cost can vary depending on the provider, transaction volume, and the types of payments accepted. It’s important for businesses to carefully compare the pricing models of different gateways and payment processors to ensure they are getting the best value for their needs. By evaluating the full range of fees associated with payment processing, businesses can make informed decisions, manage their expenses, and choose the right combination of payment gateway and payment processor to support their growth.

Examples

- Payment Gateways: Authorize.Net, CyberSource, Braintree, Stripe (gateway layer), Adyen (gateway module), Uniteller, Payture, CloudPayments.

- Processors/Acquirers: Fiserv, Worldpay, Global Payments, Adyen (as acquirer), Stripe (processing layer), major bank acquirers like Barclays, plus PayPal and Square as PSPs.

What is the difference between payment gateway and payment processor?

The main difference in the payment processor vs payment gateway comparison lies in what stage of the transaction they handle and how they interact with other parties in the payment flow. Many businesses require both a payment processor and a payment gateway to ensure seamless online and in-person transactions.

The processor and payment gateway work together: the payment gateway securely captures and encrypts payment data, while the payment processor routes and settles the transaction between banks.

Payment gateway: the front door of the transaction

A payment gateway acts as the digital interface that securely transmits payment data from the customer to the processor. Payment gateway software is the technology that enables secure encryption and transmission of payment information between the customer, merchant, and payment processor. Payment gateway services include features such as encryption, fraud screening, and integration with payment processors, ensuring safe and efficient online transactions. It’s typically used for online transactions (card-not-present) or POS terminals that need to encrypt and send payment data.

Payment processor: the middleman that moves the money

A payment processor is the engine that communicates with card networks (Visa, Mastercard, etc.) and banks to authorise and settle transactions. The payment processor acts as an intermediary between the merchant, card networks, and banks, ensuring smooth communication and transaction flow.

It is responsible for the movement of funds between the customer’s issuing bank and the merchant’s acquiring bank. The payment processor sends transaction data and payment information to the relevant financial institutions, making sure all parties can process transactions efficiently.

Side-by-Side Snapshot

| Parameter | Payment Gateway | Payment Processor |

|---|---|---|

| Role | Collects card data securely and forwards it for authorisation; returns result to merchant. | Routes authorisations via card networks, handles clearing and settlement to the merchant. |

| Key Functions | Checkout UI, encryption, tokenisation, 3-D Secure, basic fraud screening. | Network connectivity, authorisation routing, clearing, settlement, reporting, compliance. |

| Online Acquiring | Always needed to capture card data securely. | Always needed to execute the transaction flow. |

| POS Acquiring | Usually built into the terminal; sometimes used for routing across multiple acquirers. | Mandatory for all POS transactions. |

| Counterparties | Merchant and customer. | Acquirer, card networks, and issuers. |

| Licensing | Tech provider; PCI DSS required. Not regulated unless handling funds. | Financially regulated; must hold acquiring licenses and comply with AML/CTF rules. |

| Liability | Responsible for secure data handling; not liable for fund movement. | Bears chargeback and settlement risk. |

| Revenue Model | Fixed or monthly fees, add-ons for fraud tools and reporting. | Percentage-based MDR plus extra fees. |

| Examples | Authorize.Net, Braintree, Stripe, Adyen (gateway). | Fiserv, Worldpay, Adyen (acquiring), Stripe (processing), PayPal. |

Conclusion

In short, payment gateways and processors work hand in hand. The gateway is about capturing data securely and making the checkout experience smooth; the processor takes care of the actual money movement, authorisation, and settlement.

For online payments, you’ll almost always need both. At a physical point of sale, the terminal often does the gateway’s job, but you still need the processor to move the funds.

From a business perspective, the gateway is a tech service focused on security and reliability, while the processor is a regulated financial service focused on compliance and fund movement. Knowing where one ends and the other begins helps merchants pick the right setup-whether that’s a standalone gateway and acquirer or an all-in-one PSP-and helps banks and fintechs design their own solutions smartly.