The past decade has reshaped digital payments. Businesses now operate across multiple regions, accept dozens of payment methods, and connect to acquiring banks, processors, and payment service providers (PSPs) simultaneously. While global expansion has opened new revenue opportunities, it has also introduced significant operational and technical complexity.

In this context, two key concepts often surface in strategic discussions: payment orchestration and PSP software. Both are important components of a modern payment stack – a flexible, cloud-based infrastructure that integrates multiple payment methods and processors, providing centralized control and optimization of payment processes.

Teams evaluating how to build a PSP often ask the same question: Do we rely on a single PSP software, adopt a payment orchestration layer, or combine both?

This article provides a detailed, technical, and business-focused comparison of payment orchestration vs PSP software, designed for FinTech startups and enterprise IT teams that aim to deliver robust payment capabilities. The analysis draws on industry best practices, architectural patterns, and payments experience relevant to Europe, the UK, the US, and MENA.

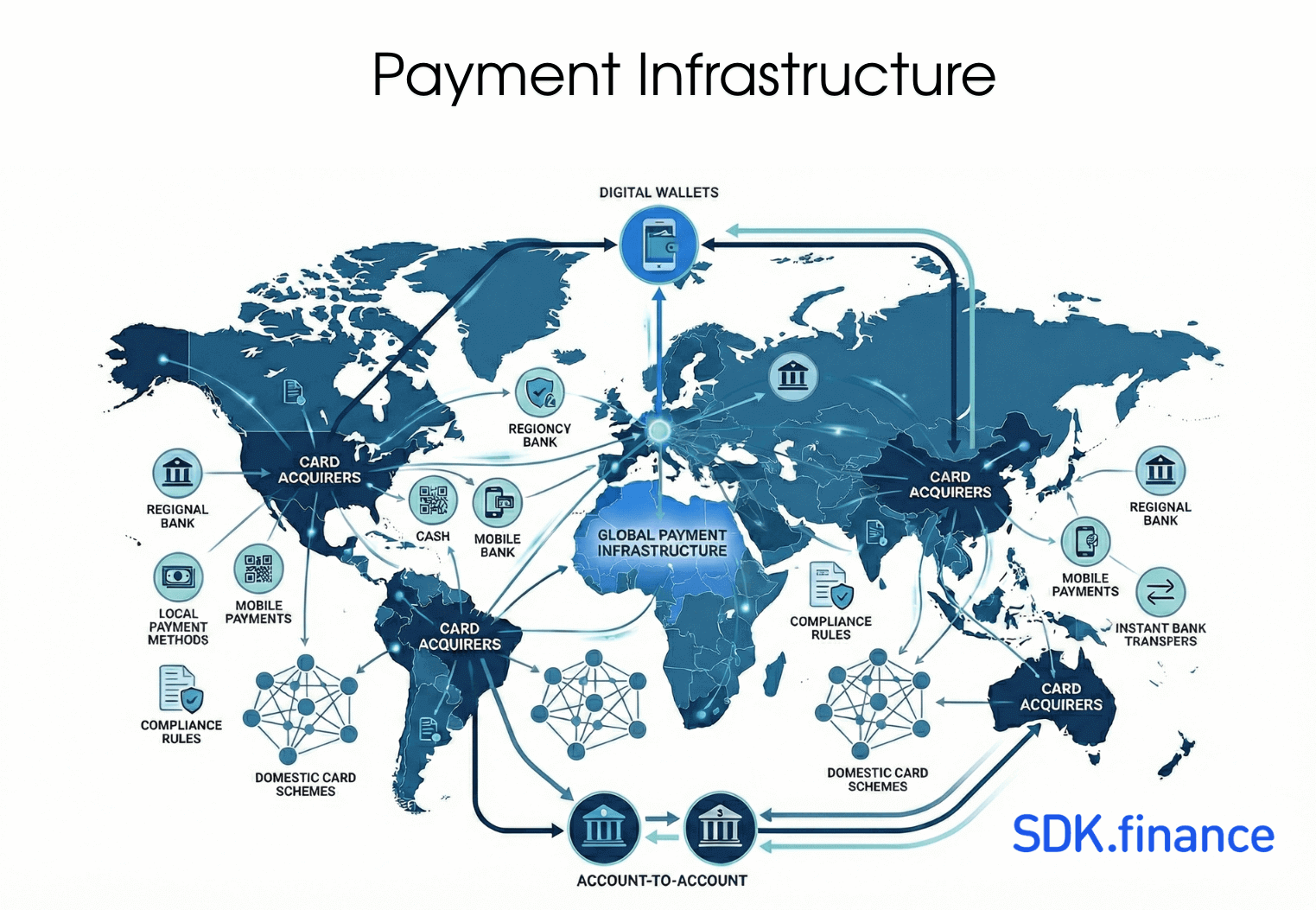

Understanding the Role of Payment Infrastructure

Digital commerce has outgrown the single-processor era. Today’s payment landscape is fragmented:

- Dozens of card acquirers with regional dominance

- Thousands of local payment methods

- Multiple domestic card schemes

- Country-specific compliance rules

- A growing list of digital wallets and account-to-account options

Modern payment systems consolidate and manage these diverse elements through centralized platforms, streamlining integration and enabling businesses to orchestrate multiple providers and methods efficiently.

Merchants and fintech platforms must balance customer expectations with operational efficiency. At the same time, they must navigate settlement, reconciliation, regulatory obligations, and risk management.

In this environment, businesses must operate within a complex payment ecosystem, integrating various technologies, providers, and compliance requirements to optimize efficiency and deliver a seamless customer experience.

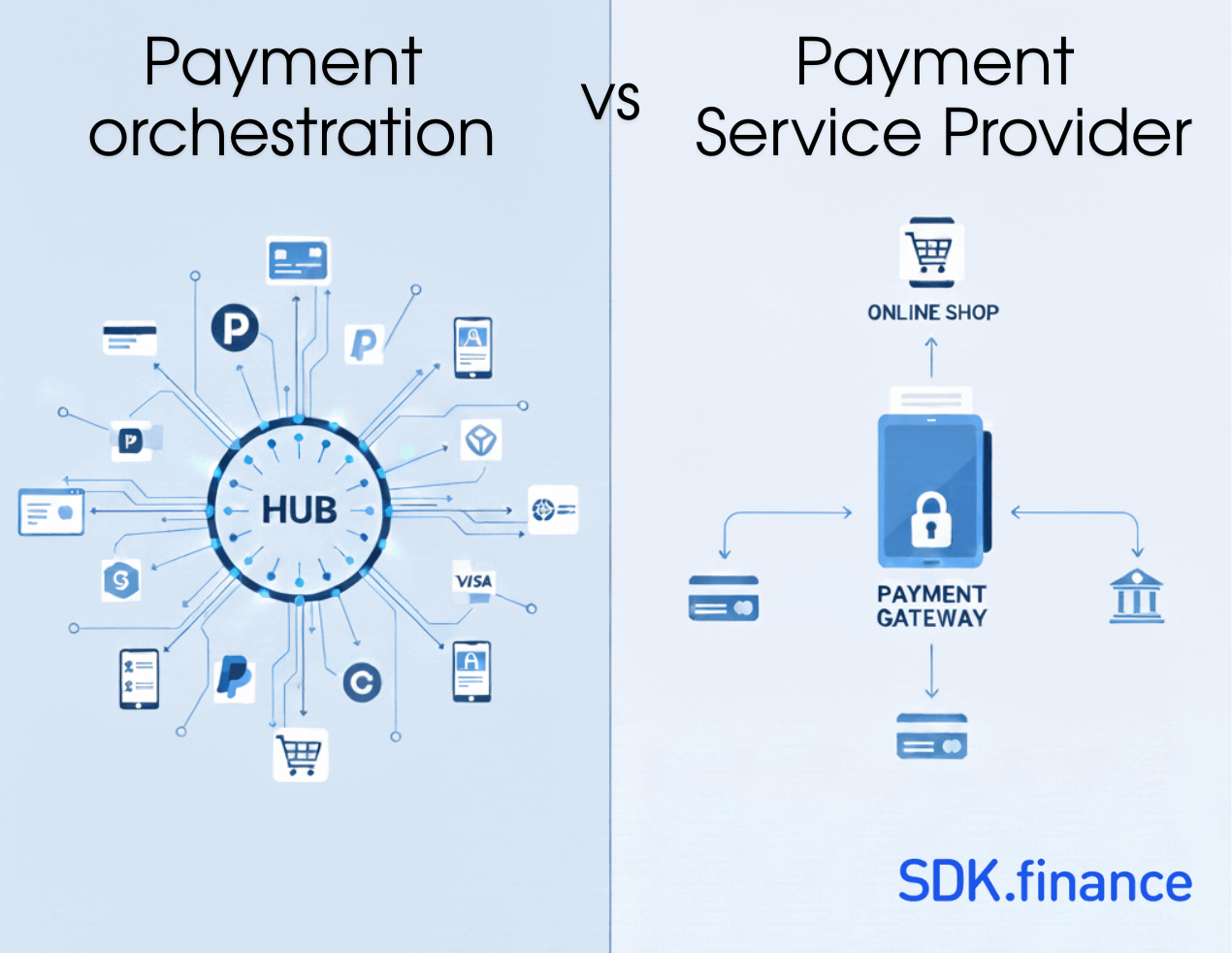

This complexity has given rise to two major approaches:

- The PSP model — a single payment service provider that bundles payment acceptance, processing, merchant onboarding, settlement, and risk controls.

- The orchestration model — a middleware layer that routes each transaction through the most suitable provider based on rules, performance, cost, geography, or availability.

Both approaches are valid, but they solve different problems. Understanding the distinction is essential before choosing a payment strategy.

What Is a Payment Service Provider (PSP)?

A Payment Service Provider is a regulated entity enabling merchants to accept electronic payments. PSPs connect directly to acquiring banks, card networks, and local payment schemes, consolidating various payment services such as payment gateways, processors, and settlement into a single platform.

They take responsibility for the core components of payment processing, including authorisation, clearing, settlement, merchant onboarding, fraud checks, and PCI DSS compliance.

Most PSPs provide a unified stack that covers key payment functions, such as:

- Payment gateway and API endpoints

- Integration with card networks and local acquirers

- Merchant onboarding (KYC/KYB)

- Transaction processing

- Refunds and chargebacks

- Tokenisation and 3-D Secure flows

- Settlement and reconciliation

- Merchant payout schedules

- Reporting dashboards

Their role extends beyond technical processing. PSPs often act as merchant acquirers or payment facilitators, aggregating multiple businesses under their licence. This means they take on meaningful regulatory obligations.

Why companies adopt PSP software

Organisations choose PSP solutions because they provide:

- A fast path to accepting payments

- A simplified regulatory model (PSP handles PCI, AML, KYC)

- A ready-made, integrated payments infrastructure

- High stability and predictable operations

- A fixed set of payment methods supported by the provider’s network

For many, a PSP is the default starting point when launching payments in a focused market. A single API and a single contractual relationship reduce maintenance workload and allow the business to scale locally without major complexity.

However, this convenience introduces limitations. If the PSP has gaps in regional coverage, supported payment methods, or local acquiring performance, the business may eventually outgrow the PSP model and require additional providers.

What Is a Payment Orchestration Platform?

A Payment Orchestration Platform is not a regulated payment processor. It is a technology layer placed between the merchant’s checkout and multiple payment providers. Its goal is to optimise the routing, performance, redundancy, and flexibility of payment flows. Payment orchestration work involves integrating various payment providers into a centralized platform that manages transaction routing, processing, reconciliation, and data analysis.

Rather than processing payments itself, the orchestrator:

- Connects to several PSPs, gateways, and acquiring banks, managing multiple processors and multiple payment integrations within a single platform

- Normalises APIs into a single integration

- Applies routing logic for each transaction, with transaction routing and payment routing as key features

- Provides failover when one processor declines or experiences downtime

- Centralises analytics and unified reporting across providers, optimizing routing payments and route transactions for efficiency and reliability

- Manages tokenisation and vaulting (in advanced systems), protecting sensitive data and implementing advanced fraud detection and fraud prevention mechanisms

- Supports multiple payment methods that a single PSP might not cover

The orchestration layer is essentially a control tower for payments. It determines the best possible route for each transaction based on rules such as:

- Geographic location

- Card type and issuer

- Processor performance metrics

- Transaction value

- Currency

- Cost structures

- Merchant or user-specific logic

- Local payment method availability

A payment orchestrator manages these processes, optimizing payment flows, routing payments, and ensuring secure handling of sensitive data through robust fraud prevention and detection measures.

Why companies adopt payment orchestration

Businesses adopt orchestration because it provides:

- Greater approval rates through smart routing

- Risk reduction via multi-provider redundancy

- Localised payment experiences per region, dynamically presenting the most relevant payment methods and multiple payment options based on customer preferences

- Flexibility to add new providers without rewriting code

- Independence from vendor lock-in

- Centralised reporting across diverse providers

- Better control over the payment journey

- Competitive advantage by offering superior payment solutions and enhancing customer experience

Orchestration is particularly valuable for organisations operating across Europe, the UK, the US, and MENA — regions with highly fragmented payment ecosystems.

By leveraging orchestration, businesses can rapidly integrate alternative payment methods to meet evolving market demands and ensure they always offer the most relevant payment methods for their customers.

PSP vs Orchestration: A Functional Comparison

Below is a detailed comparison across the dimensions that matter most to fintech teams and IT decision-makers.

Role in the payment flow

PSP software:Operates as the primary payment processor. When a payment request is initiated by the merchant, the PSP software securely handles the payment information and routes it to the acquiring bank, which then communicates with the issuing bank to verify and authorize the transaction. It handles authorisation, clearing, settlement, and risk checks. It holds regulatory responsibility for merchants.

Orchestration:Does not process payments. Instead, it optimises how existing PSPs and acquirers are used.

Integration model

PSP software:A single API covers all processing functions. Simple to integrate initially, but expands in complexity when adding multiple PSPs.

Payment orchestration:One integration exposes many PSPs. Each provider must still be configured, but the merchant’s application integrates only once. The orchestration model simplifies the integration and management of multiple providers and multiple payment processors through a single integration, streamlining operations and improving payment routing flexibility.

Technical architecture

PSP:

Monolithic or modular, but centralised around the provider’s platform. Merchant traffic flows through one pipeline.

Orchestrator:

Middleware layer operating a hub-and-spoke model. Merchant traffic flows through the orchestrator, then out to the optimal provider.

Customisation and control

PSP:Limited flexibility. Merchant experiences and flows depend on the provider’s capabilities.

Payment orchestration:Allows granular control over routing, flows, local methods, and experiment-driven optimisation. Orchestration platforms also deliver advanced payment management capabilities, enabling merchants to coordinate and optimize payment flows across multiple providers.

Scalability and geographic reach

PSP:Scales within the boundaries of that PSP’s coverage.

Payment orchestration:Scales horizontally with any number of PSPs, regional acquirers, and emerging payment methods. Orchestration platforms simplify the integration of local payment providers and local payment processors, enabling rapid adoption of new payment methods as businesses expand globally.

Compliance

PSP:Holds PCI DSS compliance. Performs KYC/KYB and AML monitoring on merchants. Takes regulatory responsibility.

Payment orchestration:Provides PCI-compliant vaulting, but does not replace PSP regulatory obligations. Merchants may need to onboard with multiple PSPs. Orchestration platforms also offer unified reporting, consolidating analytics and transaction data across multiple payment providers to streamline compliance, reconciliation, and audit processes.

Vendor dependency

PSP: One vendor to manage — simple but introduces lock-in and single-point-of-failure risks.

Payment orchestration: Distributes dependency across providers but introduces reliance on the orchestrator platform itself.

Integration Complexity: A Deep Dive

The difference between the two models becomes even clearer when examining the underlying technical architecture. Orchestration platforms consolidate multiple payment integrations into a single, manageable interface, allowing businesses to efficiently handle various payment methods such as online payments, POS, and subscription billing within one unified system.

PSP integration

Integrating a PSP is relatively straightforward:

- One API

- One onboarding process

- One set of callbacks

- A fixed set of features

This makes it ideal for launches or for companies operating in a specific region. However, the architecture becomes restrictive when the business grows into new markets or needs specialised payment methods.

Vendor lock-in is a real risk. If the PSP experiences downtime, or if performance drops in certain regions, the merchant has limited ability to react quickly.

Payment orchestration integration

Integrating an orchestrator requires more architectural planning upfront but simplifies long-term scaling:

- A single integration to the orchestration API

- Multiple PSPs and acquirers behind the scenes

- The ability to activate or switch PSPs without code changes

- Centralised token vault

- Unified handling of callbacks

Orchestration platforms help manage high transaction volume efficiently by optimizing payment routing and balancing loads across multiple providers, which can lead to better processing rates and cost savings.

For businesses that already use multiple PSPs, migrating them under one orchestration layer requires careful QA work, because each PSP’s data structures and callback formats differ. But once done, payment operations become substantially easier to scale.

Business Functionality: Customisation, Flexibility, and Control

The differences extend far beyond technical architecture. Orchestration platforms not only offer deep customization and control, but also manage the entire payment lifecycle—from checkout and transaction authorization to fraud prevention, tokenization, and reconciliation—within a unified system. This comprehensive approach streamlines operations and enhances both efficiency and security for businesses.

User experience and checkout flows

PSPs typically define the structure of the checkout and available methods, especially when using SDKs or hosted payment pages.

Orchestration enables:

- Complete control over checkout UI

- Region-specific payment experiences

- Dynamic presentation of available payment methods

- A/B testing of providers

Offering a wide range of payment options through orchestration helps meet customer expectations, reduces friction at checkout, and directly improves conversion rates and success rates by minimizing failed transactions and cart abandonment.

This is important when local expectations differ – for example:

- iDEAL in the Netherlands

- Bancontact in Belgium

- Mada in Saudi Arabia

- Wallets across the UAE

- Direct debit through SEPA

- Open banking options in the UK

A single PSP’s list of supported methods may limit adoption in new markets.

Adding or switching multiple payment providers

With a PSP-only approach:

- Adds complexity

- Requires new integrations

- Introduces new operational overhead

- May require changes in the merchant’s checkout

With orchestration:

- New provider = configuration change

- Switching routes = updating rules

- No need to rewrite application code

- A/B test new acquirers before committing

- Simplifies the management of multiple providers, reducing operational complexity and enabling rapid adaptation to market changes

This agility is a major driver behind the growth of orchestration.

Regulatory Differences: Compliance, Licensing, and Risk

PSP responsibilities

PSPs carry significant regulatory obligations:

- KYC/KYB checks during merchant onboarding

- AML monitoring

- Sanctions screening

- PCI DSS certification

- Reporting obligations

- Chargeback handling

This makes PSPs attractive for startups or SMEs, as the PSP absorbs much of the compliance work.

Orchestration responsibilities

Orchestration platforms:

- Are not regulated as payment institutions

- Do not perform merchant KYC/KYB

- Do not handle settlement

- Do not hold merchant funds

Merchants must maintain relationships with multiple PSPs unless the orchestrator also offers Payments-as-a-Service with embedded licencing options.

In regions such as MENA, where local regulators impose strict licensing and settlement rules, orchestration is valuable because it connects merchants to local PSPs that meet regulatory requirements, rather than relying on global PSPs with limited regional coverage.

Performance, Availability, Fraud Prevention, and Operational Resilience

Failover and redundancy

With a single PSP, downtime means one thing: failed payments.

Orchestration introduces failover:

- If PSP A declines, route to PSP B

- If PSP A is experiencing latency, shift traffic

- If local acquiring is required, route based on BIN

By rerouting failed payments to alternative providers, smart payment orchestration helps reduce declined transactions, increasing authorization rates and improving the overall checkout experience. This reduces failure rates and improves conversion.

Authorisation optimisation

Many merchants adopt orchestration because different acquirers perform differently across regions, card types, and issuers. Smart routing can result in significantly better approval rates. By dynamically routing transactions to the optimal provider, orchestration platforms increase authorization rates and transaction success rates, while also helping to optimize costs by selecting the most cost-effective payment providers.

Cost optimisation

Orchestration can reduce operational costs by leveraging intelligent transaction routing and negotiation to lower payment processing fees, resulting in lower costs and improved financial performance for businesses. Specifically, orchestration can help by:

- Selecting the cheapest provider for specific transaction types

- Avoiding cross-border fees through local acquiring

- Minimising chargeback exposure using stricter fraud routes

- Balancing volume across providers to meet pricing tiers

Use Cases: When to Choose PSP or Orchestration

When a single PSP is sufficient

- Startups testing their business model

- SMEs operating in one country

- Early-stage fintechs that want minimal compliance workload

- Businesses with predictable volume and simple needs

When orchestration is the better choice

- Companies scaling across Europe, UK, US, and MENA

- Merchants offering high-volume online commerce

- Marketplaces requiring redundancy and multi-provider control

- Enterprise merchants that require advanced control, efficiency, and scalability in managing multiple payment providers and routes

- Businesses that need local payment methods across many markets

- Platforms offering embedded payments

When a hybrid model is ideal

Most mature businesses use a hybrid approach:

- Keep one primary PSP

- Add an orchestration layer for optimisation

- Slowly expand into multiple regional providers

- Build redundancy and local compliance over time

This is especially common for global brands, subscription businesses, and enterprise platforms.

Summary Table: PSP vs Orchestration

Below is a concise comparison across essential capabilities.

| Dimension | PSP Software | Payment Orchestration |

|---|---|---|

| Primary role | Processing & settlement | Routing & optimisation |

| Compliance | PSP handles PCI, KYC, AML | Depends on PSPs |

| Architecture | One processing pipeline | Middleware with many providers |

| Flexibility | Limited | Very high |

| Redundancy | None | Multi-provider failover |

| Scalability | Bound to PSP coverage | Global expansion through connectors |

| Checkout control | Limited | Highly customisable |

| Adding methods | PSP-dependent | Easy to plug in new PSPs |

| Vendor lock-in | High | Low |

| Ideal for | SMEs, simple payments | Global & complex operations |

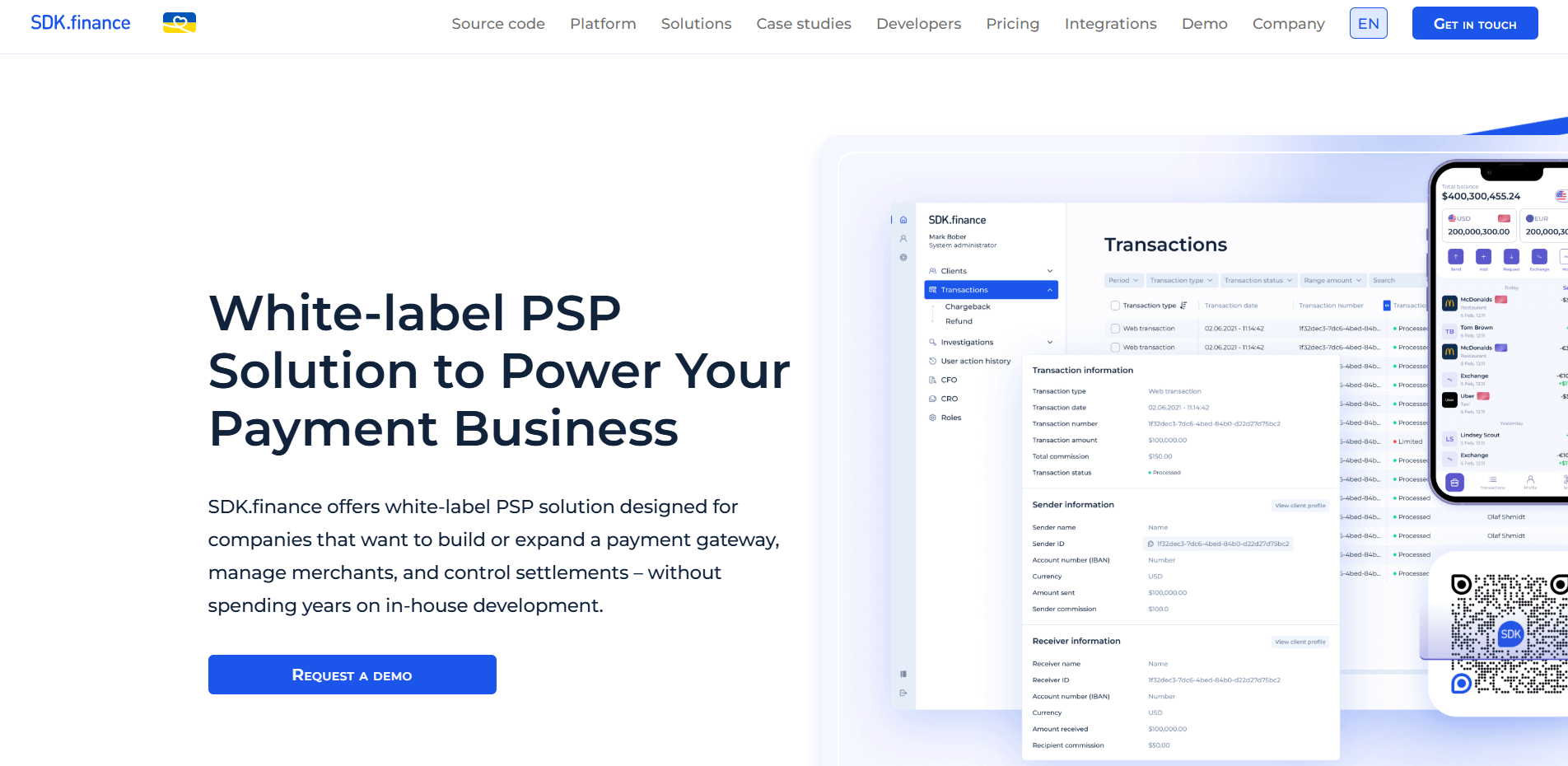

SDK.finance: a technology foundation for becoming a Payment Service Provider

For teams aiming to enter the payments market as PSPs rather than relying solely on orchestration, SDK.finance provides a robust white-label PSP system that functions as the technological engine for payment acceptance, merchant onboarding, transaction processing, and settlement.

The SDK.finance Platform is built on a ledger-first architecture and includes over 60 functional modules and 470+ APIs for integration and customisation, offering strong performance, flexibility, and full control for PSPs .

Key capabilities for PSPs

- Multi-currency merchant accounts

- Merchant onboarding and KYC workflows

- Refunds, chargebacks, and dispute tracking

- Real-time ledger for all transactions

- Support for online and offline payment acceptance

- Advanced fee configuration

- Transaction monitoring and AML tools

- Comprehensive back-office for operations and finance

- PCI DSS Level 1 architecture

The system processes over 2,700 transactions per second and supports deployments in public cloud, private cloud, or on-premise environments .

SaaS or full source-code ownership

SDK.finance offers two delivery models:

- SaaS model for rapid deployment with minimal upfront cost

- Source code licence for full ownership, customisation, and independence from the vendor

Ideal for companies launching PSP services

The platform is designed for:

- PSPs entering new markets

- FinTechs providing embedded payment capabilities

- Marketplaces building internal payment infrastructure

- Enterprises creating merchant service divisions

- Payment companies modernising their legacy back-ends

Explore the full PSP solution.

Final Thoughts

Choosing between PSP software and payment orchestration is not simply a technical decision. It depends on your business model, regional presence, compliance strategy, and ambitions.

- A PSP-centric model is straightforward for early-stage and localised operations.

- Payment orchestration becomes essential as the business expands into new markets or needs advanced optimisation, redundancy, and control.

- A hybrid approach is common among sophisticated merchants and fintech platforms, combining the strengths of both.

Understanding the strengths and limitations of each approach allows fintech leaders to build a payment architecture aligned with long-term goals. As competition intensifies and customer expectations rise, the ability to control, optimise, and scale payment processes becomes a strategic advantage rather than an operational requirement.