We’re looking at global digital payment volumes pushing past the $15 trillion mark in 2026. Because of this massive shift, the hidden tech moving that money around has never mattered more. Simply put, a payment processing system acts as the digital engine that checks, routes, and finalizes financial exchanges between buyers and sellers.

If you’re scaling a business right now, having a merchant payment processing system that won’t crash under pressure isn’t a luxury – it’s the basic foundation for getting paid, building trust, and keeping the lights on.

What Is a Payment Processing System?

A payment processing system is the core software infrastructure that makes moving money between a buyer and a seller safe and possible. It takes care of routing transaction data, getting authorization, clearing the funds, and finally settling them across different banks so merchants actually get paid without errors.

When we look past that basic payment processing definition, the real scope of these platforms is huge. They handle complicated payment routing, figure out multi-currency conversions on the fly, and talk to dozens of different banking APIs. They are the actual plumbing of modern commerce – turning a click on a checkout button into real cash in a merchant’s bank account.

How payment processing differs from transaction processing systems

Let’s clear up a common mix-up. While transaction processing systems (TPS) handle broad business events like logging a support ticket or updating your warehouse inventory, payment processing infrastructure does one very specific job: moving money securely across financial rails. Think of payment systems as highly specialized financial engines, while TPS is an umbrella term for everyday enterprise data exchanges.

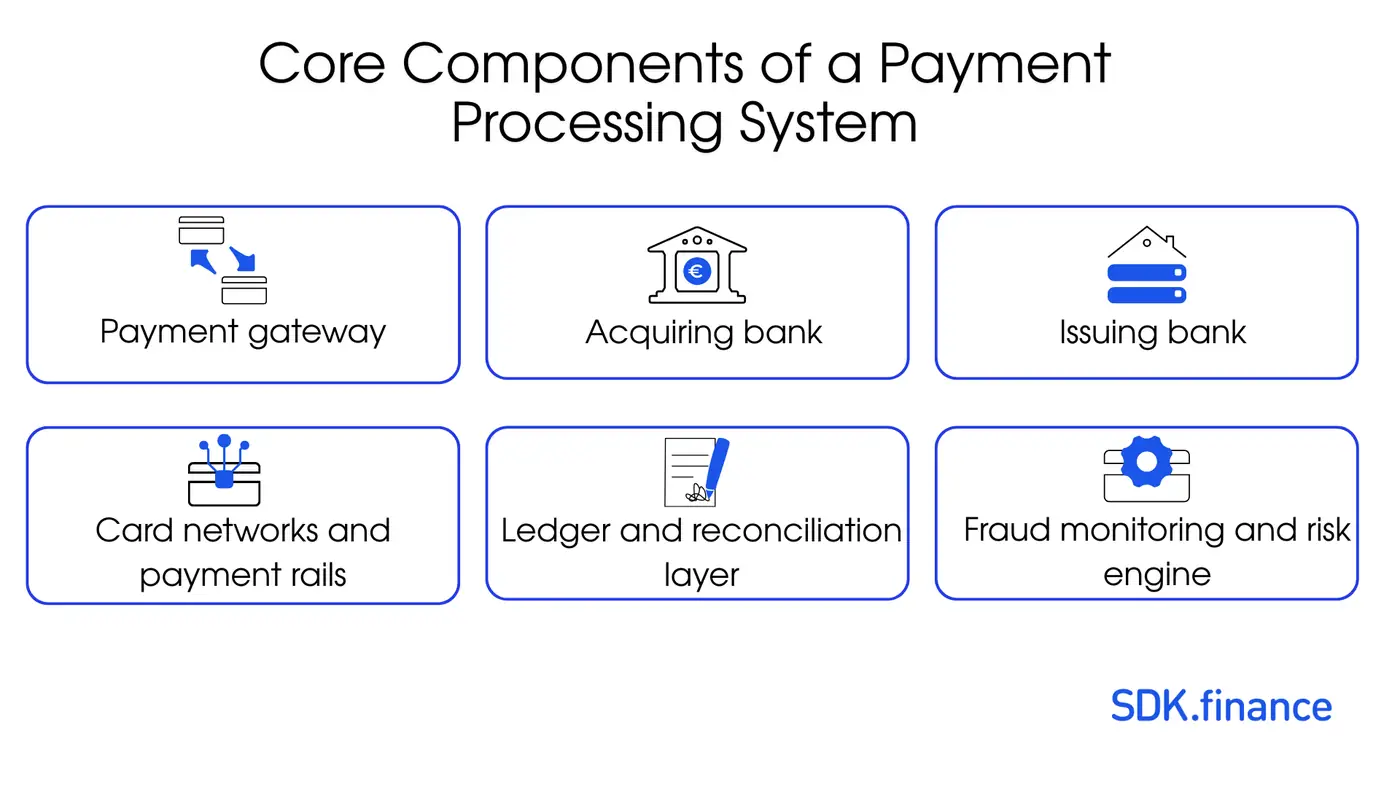

Core Components of a Payment Processing System

Building a reliable payment processing architecture means stitching together several different players. All of them have to communicate perfectly in a matter of milliseconds.

Payment gateway

The payment gateway role is basically your digital cash register. It securely captures the customer’s card details, locks them down with encryption, and passes that data to the processor. It’s the security checkpoint between the person buying and your financial backend.

Acquiring bank

The acquiring bank function (often called the merchant bank) is to collect the money for the business. In the payment processing architecture, the acquirer looks at the transaction data, asks the customer’s bank for permission, and eventually drops the settled funds into the merchant’s account.

Issuing bank

The issuing bank in payment processing stands in for the customer. This is the bank that gave the shopper their credit or debit card. They hold the funds and have the final say on approving or declining the charge based on the account balance and status.

Card networks and payment rails

The card payment network (think Visa, Mastercard, or local domestic networks) is the highway connecting the acquiring and issuing banks. They set the speed limits—meaning the rules for data sharing, interchange fees, and clearing.

Ledger and reconciliation layer

You need a rock-solid payment reconciliation system to track every single cent. The ledger logs the status of every transaction, pairing up the initiated payments with the actual settled cash so you don’t end up with missing funds or double-spending nightmares.

Fraud monitoring and risk engine

A good payment fraud detection setup analyzes transactions as they happen. By checking things like IP addresses, typing speed, or weird buying patterns, the risk engine blocks shady activity before it even asks the bank for authorization.

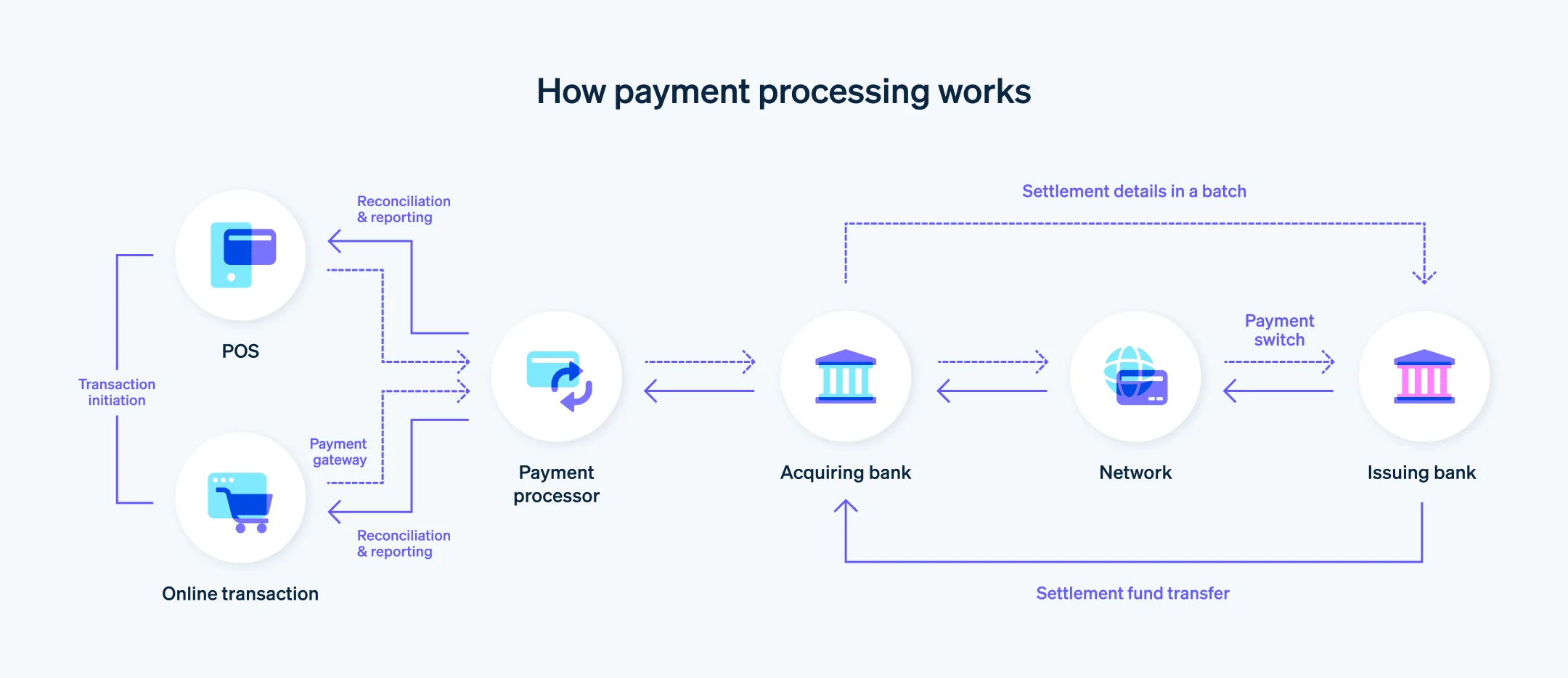

How Payment Processing Systems Work

The payment processing workflow is a massive relay race that happens in the blink of an eye. Here is the typical card payment processing flow, from the moment of checkout to the final payout:

-

Payment initiation: The shopper types their card details into a checkout page or taps their phone at a physical terminal.

-

Authorisation request: The gateway encrypts the sensitive data and hands it to the payment processor. The processor routes it to the acquiring bank, which then shoots it through the card network to the issuing bank.

-

Risk and compliance checks: In real-time, the issuing bank and fraud engines verify the CVV, check if the funds are actually there, and scan for red flags.

-

Approval or decline: The issuing bank bounces an “approved” or “declined” message back down the chain—through the network, acquirer, processor, and gateway. The merchant sees this result instantly.

-

Clearing: Usually at the end of the day, the processor gathers up all the approved authorizations into a batch file and sends it to the network to figure out who owes what.

-

Settlement: The actual money moves from the issuing banks to the acquiring bank. Depending on the rails, this usually takes 1 to 3 business days.

-

Ledger recording: Finally, the payment reconciliation system marks the settlement as complete, updates the merchant’s balance, and wraps up the whole how payment processing works cycle.

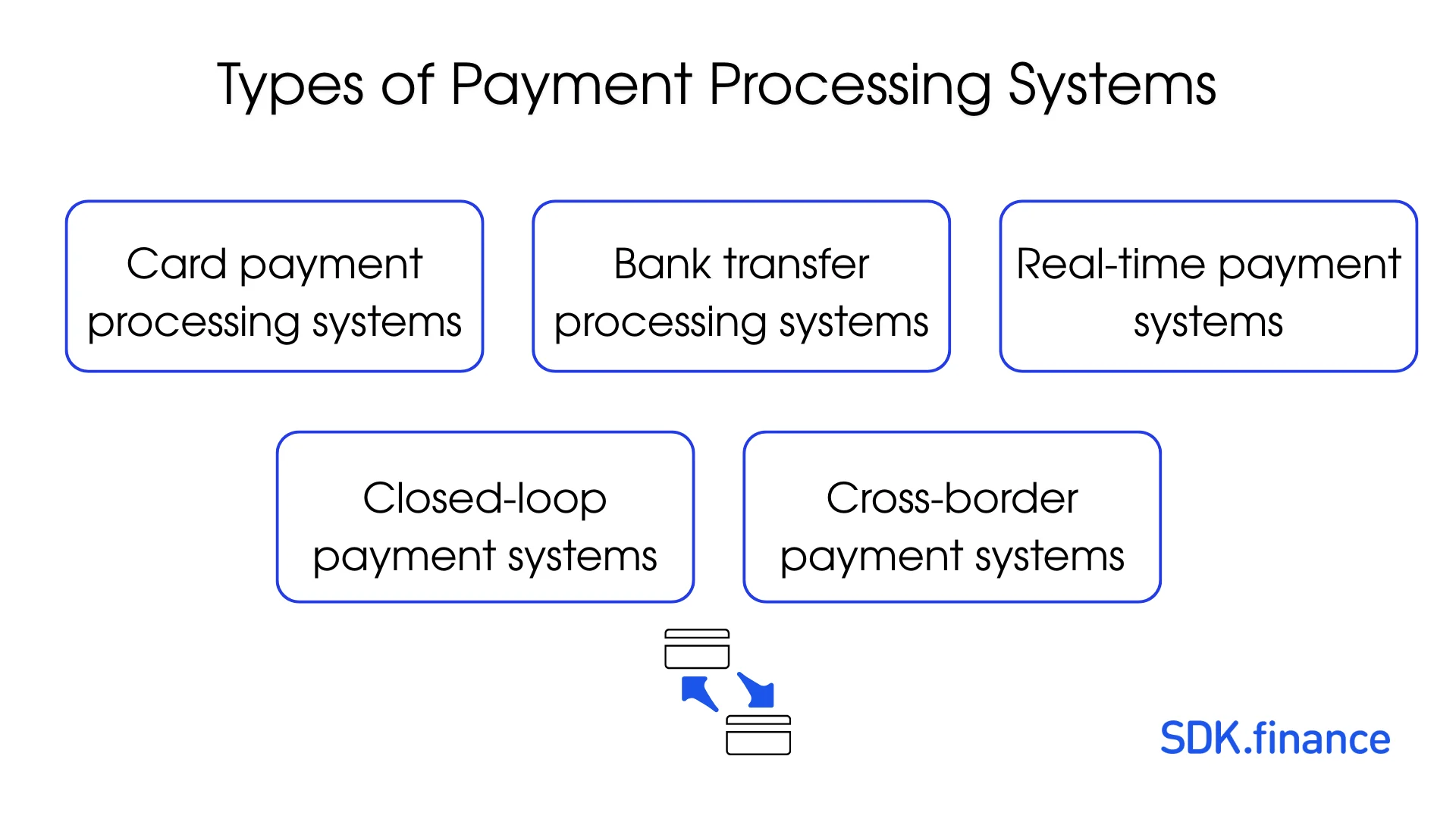

Types of Payment Processing Systems

Not all businesses move money the same way. The rails you choose dictate the type of system you need.

Card payment processing systems

Built specifically for credit and debit networks, these handle the messy world of interchange fees, chargeback disputes, and the strict PCI DSS rules set by major card brands.

Bank transfer processing systems

These handle account-to-account (A2A) moves, like ACH in the States or SEPA in Europe. They are much cheaper to run, making them perfect for B2B invoices or massive volume transfers.

Real-time payment systems

Real-time payment processing (like FedNow or PIX) is changing the game by settling funds instantly, 24/7. Merchants get their cash in seconds, skipping the old multi-day waiting game entirely.

Closed-loop payment systems

These are self-contained ecosystems where the issuer and acquirer are the exact same company. Think Starbucks cards, university meal plans, or transit passes.

Cross-border payment systems

Designed for global commerce, these systems tackle currency conversions on the fly, FX rate logic, and complex international routing. If you’re expanding globally, figuring out your international payment infrastructure is absolutely critical to avoid getting crushed by FX fees and compliance headaches across borders.

Payment Processing System vs Payment Gateway

People mix these up constantly. But understanding the payment processor vs payment gateway difference is key to mapping out your merchant payment infrastructure.

| Feature | Payment Gateway | Payment Processing System |

| Primary Function | Captures, locks down, and forwards payment data. | Does the heavy lifting: routes data, talks to banks, and moves the money. |

| Analogy | The digital card reader at the front door. | The financial plumbing hidden inside the walls. |

| Settlement | Never touches the actual funds. | Drives the clearing and payment settlement process. |

| Focus | Front-end security and customer checkout experience. | Bank routing logic, compliance, and backend reconciliation. |

Note: Even though a lot of modern tech providers sell these as a bundled package, knowing the difference matters when you’re architecting your backend.

Business Use Cases

Who actually needs to build or buy this kind of heavy-duty software? Let’s look at the primary business models.

Payment Service Providers (PSPs)

PSPs sit in the middle, aggregating accounts for thousands of merchants. A solid PSP payment processing setup needs massive throughput and automated onboarding so they don’t drown in manual merchant approvals.

Electronic Money Institutions (EMIs)

EMIs need payment processing software to manage e-wallet balances, peer-to-peer transfers, and card issuing. Deep ledger integration is a must to keep user balances perfectly synced.

Retail banks

Both legacy and neo-banks run processing engines to offer merchant acquiring to their business clients, turning transaction fees into a major revenue stream.

Marketplaces and super apps

If you’re running the next Uber or Airbnb, your merchant payment infrastructure has to manage split payments – routing a single customer charge to the platform, a driver, and maybe a tax authority all at once.

Crypto-to-fiat platforms

Crypto exchanges and on/off-ramps use processing engines to connect old-school fiat networks (like ACH or SEPA) to Web3 ecosystems. This requires incredibly tight KYC/AML checks and instant ledger updates.

Key Technical Requirements in 2026

If you’re outlining a scalable payment processing software architecture today, the standards are much higher than they were five years ago. Tech teams need to prioritize:

-

API-first architecture: You have to be able to plug into mobile apps, external gateways, and third-party KYC tools without breaking the core system.

-

Real-time processing capability: Relying only on batch files isn’t going to cut it anymore. Systems need to handle instant rails like FedNow or SEPA Instant natively.

-

PCI DSS compliance: Absolute non-negotiable. You need strict tokenization and encryption to keep cardholder data safe at rest and in motion.

-

High transaction throughput: A truly scalable payment processing system won’t choke during Black Friday or other massive traffic spikes.

-

Modular infrastructure: The freedom to rip out a gateway or swap banking partners without having to rewrite your entire engine from scratch.

-

Integration flexibility: Having pre-built hooks for various payment protocols and local networks.

Challenges in Building a Payment Processing System

Running your own payment engine is notoriously difficult. The biggest hurdles usually include:

-

Regulatory complexity: Trying to keep up with PSD2 in Europe, local licensing rules, and shifting AML laws is a massive operational headache.

-

Settlement and reconciliation: Trying to match millions of rows of transaction data across different time zones and bank cut-off times. If your ledger is off, your business is in trouble.

-

Fraud risk management: You have to block the bad guys without accidentally declining legitimate customers (false positives), which kills conversion rates.

-

Scalability under peak load: Preventing your servers from melting down when payment volumes 10x overnight.

-

Multi-currency support: Dealing with live FX rates and keeping funds balanced across multiple correspondent bank accounts globally.

Build vs Buy: Developing a Payment Processing System

When mapping out your product roadmap, deciding whether to build a payment processing system from the ground up or buy something pre-made is the heaviest choice you’ll make.

Building from scratch gives you 100% control, but it also drains millions of dollars, takes years of engineering, and forces you through brutal compliance audits before you can even run a single test transaction.

On the flip side, licensing a solid payment processing software solution gets you to market radically faster. You get a battle-tested core ledger and backend right out of the box, allowing your internal developers to focus on what actually drives growth: user experience and customer acquisition.

How SDK.finance Supports Payment Processing Infrastructure

For businesses that need to build or modernise a payment processing system, infrastructure design becomes a key challenge. As an example of scalable backend technology, SDK.finance offers a pre-built payment processing core designed specifically for high-volume financial environments.

The platform’s technical capabilities include:

-

Ledger-based architecture: Maintains a single source of truth for all transactional states and account balances.

-

Real-time transaction engine: Designed to process and route data instantly.

-

2,700+ transactions per second: Built to sustain high throughput during peak load periods.

-

570+ RESTful APIs: Facilitates seamless API-first integration with external gateways, third-party providers, and banking rails.

-

Modular service layers: Allows for the independent scaling and updating of specific payment components.

-

PCI DSS Level 1 compliance: Meets the highest security standards for tokenizing and handling sensitive payment data.

-

Deployment flexibility: Available for deployment on-premise or via the cloud to satisfy strict data residency requirements.

SDK.finance provides the technological foundation for PSPs, EMIs, banks, and enterprises building merchant payment infrastructure.

Future-Proofing Your Payment Infrastructure

At the end of the day, moving money safely is what keeps a business alive. These systems aren’t just IT expenses. They are the engines driving your revenue. Whether you’re an EMI crossing borders or a marketplace handling complex vendor payouts, your payment architecture dictates your growth speed.

Get it wrong, and you deal with dropped transactions and compliance nightmares. Get it right, and you have an invisible backend that scales effortlessly. Building a merchant payment infrastructure from scratch is a massive drain on resources. By leveraging a robust, pre-built core like SDK.finance, you skip years of backend development. You get to focus your engineering power on building a great product and getting more users.

If your team is evaluating architecture options or looking to modernize an existing backend, explore how the SDK.finance core platform can accelerate your time-to-market.