The Myth of Instant Cross-Border Money Transfers

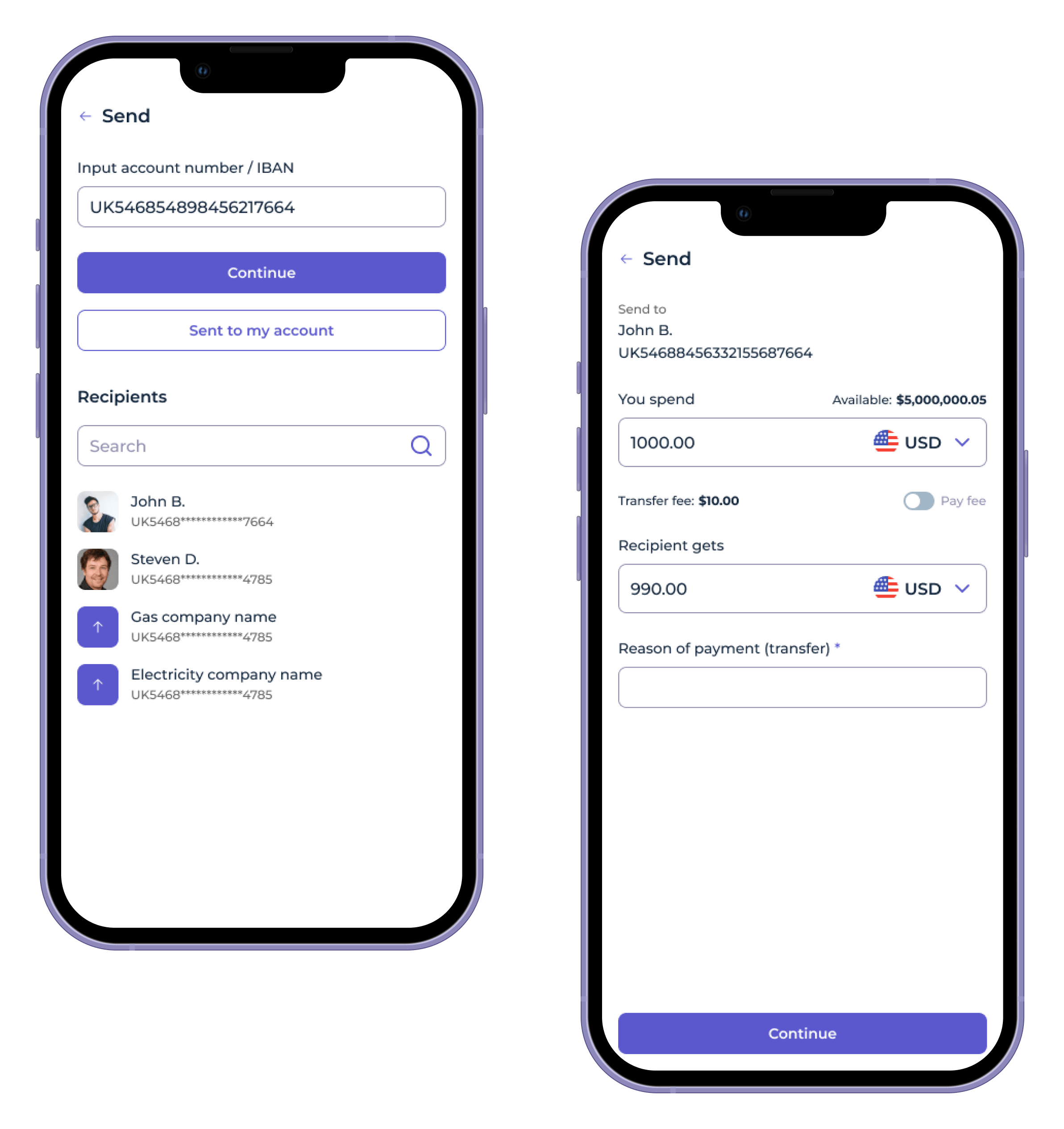

In FinTech, cross-border money transfers look deceptively simple. To the end user, it’s just a few taps and seconds before money lands in another country. Users now have access to various ways to send money, including bank transfers, debit or credit cards, and direct debit, each offering different speeds and costs. These options enable users to send money abroad quickly and efficiently, making international transfers more accessible than ever.

SDK.finance, with over 15 years of experience building payment and banking systems across Europe, MENA, Africa, and the Americas, has seen this complexity firsthand. In the money transfer industry, millions of transactions are processed globally every day, reflecting the vast scale and trust in these services. While modern technology can accelerate product development, liquidity, regulatory capital, and compliance remain the true bottlenecks. In this business, software can be licensed or built-but liquidity must be funded.

How cross-border money transfers actually work around the world?

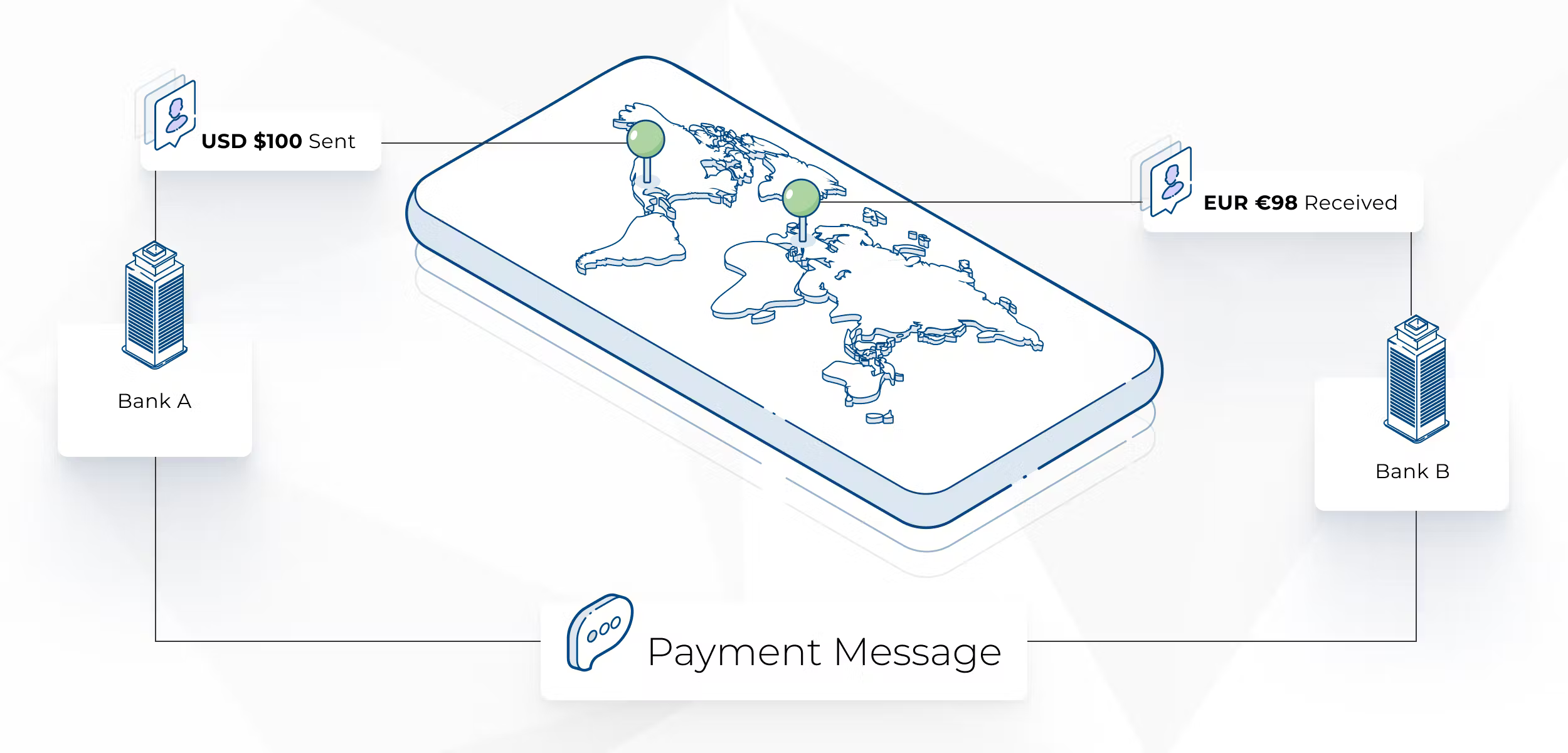

When a customer sends funds abroad, whether through bank transfers or other ways to send money, the money doesn’t actually travel across borders in real time. Instead, money transfer operators rely on a network of local accounts, partner banks, and correspondent institutions that replicate the movement of funds. Bank accounts play a crucial role in facilitating different transaction options and services, enabling both peer-to-peer payments and business transfers.

The typical process looks like this:

- A user selects the destination country and sends money from Country A.

- The sender provides the receiver’s details and the operator debits the user’s balance, instructing its partner in Country B to pay the recipient immediately – from a pre-funded local account. It is important to provide accurate recipient’s bank details, such as the bank name, account number, and any required codes, to ensure the transfer is successful.

- Settlement between the two partners happens later – sometimes hours, sometimes days – through banking networks like SWIFT or other intermediaries. This can involve a wire transfer between the banks to complete the process.

The transfer of funds may involve several steps and institutions to ensure secure delivery to the recipient.

Customers can send abroad using various ways to send money, such as bank transfers, depending on the destination country and available receive methods. When customers send money internationally, they should consider factors like costs, transfer times, and the available payment and receive options to choose the most efficient method.

This model creates the illusion of instant payments. The recipient gets the money fast because it’s already there. But for the FinTech company, it means maintaining liquidity reserves in multiple currencies and jurisdictions. The more corridors and countries supported, the more capital is locked up in idle accounts.

The Liquidity Burden: Pre-Funding and Trapped Capital

Pre-funding is at the heart of the liquidity challenge. Each corridor requires a separate float to guarantee immediate payouts.

Industry data estimates that over $4 trillion globally is trapped in pre-funded accounts to support cross-border flows-capital sitting idle, earning almost nothing.

For a scaling FinTech, this quickly becomes a constraint on growth. Every new market means another local treasury to fund. A business processing $50 million monthly with a conservative 10% liquidity buffer ties up $5 million per corridor. Assuming an 8% cost of capital, that’s $400,000 per year in opportunity cost-per market.

Multiply that across several currencies, and the financial drag becomes evident. The faster you grow, the more working capital you must immobilise. Unlike SaaS, this model doesn’t scale with users-it scales with cash.

Multi-Currency Float and FX Risk

Operating across currencies magnifies the problem. Maintaining balances in USD, EUR, GBP, NGN, or PHP exposes you to FX volatility. If one of those currencies depreciates overnight, your float instantly loses value.

Larger institutions hedge this risk through derivatives-forward contracts or currency swaps – but smaller FinTechs rarely have access to these tools. Many simply overfund accounts to absorb potential losses, which ties up even more capital.

Even where exchange rates are stable, FX spreads, intermediary fees, and conversion costs quietly erode profit margins. Understanding the exchange rate and the impact of currency exchange is crucial when sending money internationally, as unfavorable rates can significantly reduce the amount received by the recipient.

For example, if you send USD and the recipient receives EUR, the exchange rate and currency exchange fees will directly affect the final amount delivered. It is essential to carefully compare exchange rates and transaction fees from different providers before making a transfer, as this difference between gross and net revenue is often the difference between viability and bankruptcy for many money transfer startups.

Are International Money Transfers Ever Truly Instant?

Only a handful of country pairs offer real-time settlement between banking systems. For most corridors, “instant” means instant disbursement, not settlement. Settlement can take several business days, depending on the corridor and method.

Funds to the recipient are advanced from a pre-funded pool while the sending side settles later. Transfer speed varies and is typically longer for cross-border transactions. Until the actual settlement completes, the provider bears the liquidity exposure and counterparty risk.

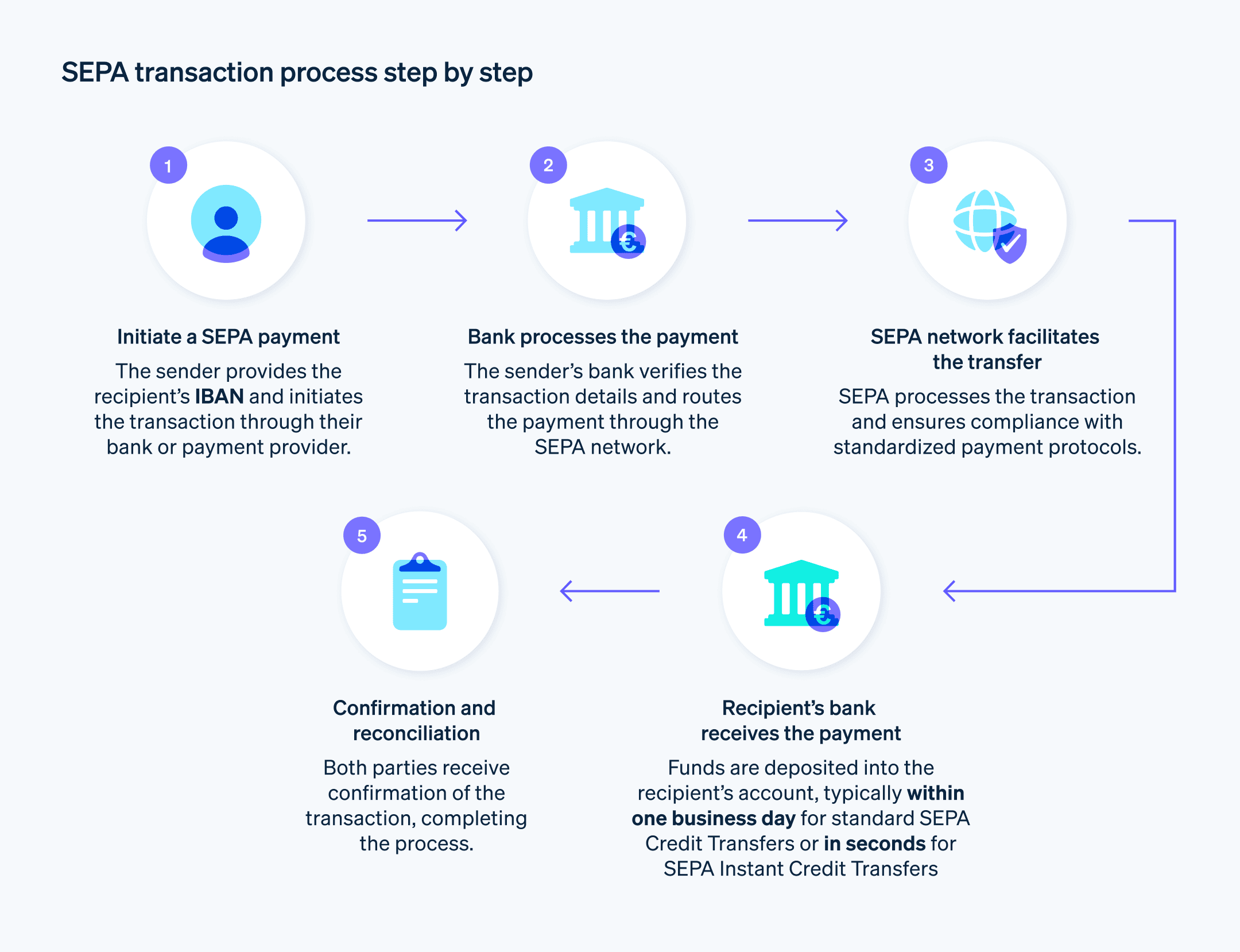

Technologies like ISO 20022 messaging, regional instant payment schemes (like SEPA Instant or the UK’s Faster Payments), and emerging on-demand liquidity models using stablecoins or tokenised cash are shortening this gap. But as of 2025, true cross-border instant payments remain the exception, not the norm.

Image source: Stripe

Regulation: The Price of Trust

While liquidity determines speed, compliance determines survival. In cross-border finance, regulatory oversight is non-negotiable.

To operate legally, payment providers must obtain licences such as:

- Electronic Money Institution (EMI) or Payment Institution (PI) in the EU, which require minimum initial capital of €350,000.

- Money Transmitter Licences (MTL) in the U.S., where each state often demands surety bonds and local reserves.

On top of these, regulators require strict safeguarding of customer funds, meaning client money must be held in ring-fenced accounts-untouchable for operational use. These measures are specifically designed to protect clients and serve their best interests, ensuring that the businesses can reliably serve the customers they are intended to support.

That’s not the end of it. Each regulator also expects robust KYC (Know Your Customer) and AML (Anti-Money Laundering) frameworks. Failing to maintain them can be ruinously expensive.

In July 2025, Wise (formerly TransferWise) was fined £4.2 million by the UK’s Financial Conduct Authority for AML control failures linked to inadequate monitoring and delayed reporting of suspicious activity.

The fine may seem manageable for an established unicorn, but for a smaller operator, such penalties-or even temporary licence suspension-could be fatal. It highlights that compliance isn’t just paperwork; it’s a structural cost of doing business.

Robust AML processes require investment in:

- Transaction monitoring systems

- Ongoing sanctions screening

- Suspicious activity reporting

- Periodic audits and regulatory communication.

In practice, that means hiring compliance officers, integrating KYC/AML vendors, and maintaining continuous reporting-all of which consume both time and liquidity.

Banking Relationships and Collateral Requirements

Building a payout network also means forming partnerships with local banks (correspondent bank) or payment aggregators. For companies operating in the money transfer business, it is essential to establish strong banking relationships and manage collateral requirements to remain competitive.

These partners rarely take risk lightly. Most require pre-deposited collateral or minimum account balances as a safeguard.

Each of these micro-balances fragments your liquidity further. Even if you aggregate transactions through a few global partners, those partners themselves maintain local accounts and pass on the cost of capital to you through fees or longer settlement cycles.

The end result: even when your customer sees a one-second transfer, you might have five days of liquidity exposure behind it.

Fee Structure and Pricing: The Hidden Costs of Moving Money

When considering money transfer services, many users focus on speed and convenience, but the true cost of sending money often lies beneath the surface. Money transfer operators and financial institutions employ a variety of fee structures that can significantly impact the final amount received by the recipient. These include transfer fees—either as a flat rate or a percentage of the transfer amount—alongside less obvious costs such as exchange rate margins and commission fees.

For example, a money transfer app might advertise low upfront fees, but apply a less favorable exchange rate, quietly increasing the total cost of international money transfers. Some services charge higher fees for faster transfer speeds or for sending money to less common destinations, while others may have different pricing tiers based on supported countries or the method of delivery (bank account, cash pickup, or mobile wallet).

Because these costs can add up quickly, it’s essential for users to research and compare the fee structures of different money transfer services before making a decision. Look beyond the headline transfer fee – consider the exchange rate offered, any additional service charges, and the overall value for your specific transfer needs. By understanding the full fee structure, users can avoid unexpected expenses and ensure their money goes further, whether they’re supporting family abroad or managing international business payments.

Security and Safety Measures: Protecting Funds in a High-Risk Industry

Security is a top priority in the money transfer industry, where the risk of money laundering and fraudulent activity is ever-present. To protect users’ funds and personal information, reputable money services businesses and money transfer operators implement advanced security protocols at every stage of the transfer process. These measures include robust encryption to safeguard data, two-factor authentication for account access, and continuous monitoring of transactions to detect and prevent suspicious activity.

Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is not just a legal requirement—it’s a critical defense against illicit transactions. Providers must verify the identity of users, monitor for unusual patterns, and report any suspicious financial transactions to authorities. This is especially important for peer-to-peer and mobile wallet services, where the speed and convenience of digital platforms can otherwise make them attractive targets for bad actors.

When choosing a money transfer service, users should prioritize providers that are transparent about their security practices and applicable fees. Look for clear information on how your money and data are protected, and ensure the service is licensed and regulated in the countries where it operates. By selecting a provider that takes security seriously, users can send money with confidence, knowing their funds are safeguarded throughout the transfer process.

Why Deep Pockets Still Win?

The cross-border payments business rewards those who can fund it. Western Union, MoneyGram, and other incumbents dominate not because of superior technology but because of deep liquidity networks and established correspondent relationships.

Modern entrants can reduce these barriers with:

- Smart routing (matching send and receive flows between corridors),

- Dynamic rebalancing (automatically moving float where demand spikes),

- Access to on-demand liquidity via stablecoins or credit facilities.

As technology and market trends evolve, new opportunities are expected to arise in the money transfer business, enabling both incumbents and new entrants to expand their reach and discover additional ways to connect with users.

But even then, the underlying requirement remains: money must exist somewhere first.

The Role of Money Transfer Technology: Liquidity Efficiency, Not Elimination

SDK.finance provides the infrastructure to make this financial machinery more efficient. Our ledger-based platform, used globally by EMIs, PSPs, and money transfer operators, offers:

- Real-time visibility into balances across corridors

- Automated fund rebalancing via APIs

- Multi-currency support with dynamic FX rate integration

- Pre-built KYC/AML and reporting modules for compliance alignment

- Back-office tools for reconciliation and audit trails.

Technology can’t remove liquidity requirements-but it can help you manage capital smarter, reduce idle float, and maintain control in a multi-currency environment.

Conclusion: The Hard Truth About Cross-Border FinTech

Cross-border money transfers remain one of the hardest corners of FinTech because they sit at the intersection of three worlds: technology, liquidity, and regulation.

Software can move data instantly, but money is slower. It pools in accounts, awaits settlement, and demands compliance oversight at every turn.

For founders, this means success depends on mastering both code and capital. You’ll need a technology backbone strong enough to handle real-time reporting and a financial strategy deep enough to sustain liquidity and compliance.

Modern money transfer platforms compete by offering low fees, transparent fees upfront, and a variety of payment methods – including credit card and debit card options. The chosen payment method can significantly influence the overall transfer fees and exchange rates, so users should carefully consider which payment method best suits their needs for cost efficiency. They emphasize fast delivery time and multiple receive methods such as digital wallet and app-based solutions. Users can track the total amount, transfer fee, and transaction fees before completing a transfer, ensuring transparency. Some platforms, like the Remitly app or a different app, provide a complete list of features and options for sending money to loved ones, including special offers for the first transfer and the ability to get paid quickly.

With , you can build the former confidently. So you can focus on managing the latter intelligently.

Ready to launch your cross-border payment business on solid financial and technological ground?