By 2026, Banking-as-a-Service feels far less experimental than it did a few years ago. For many companies, it has simply become the practical way to launch financial products. Instead of assembling a core banking system piece by piece, businesses plug into platforms that already support accounts, payments, cards, onboarding, and compliance through structured APIs.

The growth of the market reflects that shift. Current estimates place the global BaaS market at around USD 35–45 billion in 2026, with projections suggesting it could reach USD 75–90 billion by 2030–2031. Annual growth remains in the 16–18% range, which is strong but steady. It is driven less by hype and more by a structural change in how digital products are built. Financial services are increasingly embedded inside broader ecosystems rather than offered as standalone products.

What is different today is who is using BaaS. It is not only fintech startups looking for speed. Large retailers, telecom operators, software vendors, and online marketplaces are integrating financial features directly into their platforms. For them, BaaS reduces infrastructure risk. It allows teams to focus on customer experience and commercial models while relying on specialised providers for transaction processing and ledger logic.

The provider landscape has also become clearer. Some platforms operate entirely on a cloud subscription basis. Others combine SaaS access with deeper configuration options. A smaller group offers full source-code licensing for organisations that want more control over their infrastructure and long-term roadmap. In practice, choosing a BaaS partner now comes down to ownership, flexibility, compliance alignment, and scalability rather than feature lists alone.

In the sections below, we take a closer look at several established BaaS providers in 2026, including SDK.finance, Marqeta, Solarisbank, Galileo Financial Technologies, Treezor, and Intergiro. We review where they come from, how they structure their deployment models, and what differentiates them in a more mature embedded finance market.

What is banking as a service?

Banking as a Service (BaaS) is a model that allows non-bank companies to offer regulated financial services by connecting to licensed banking infrastructure through Application Programming Interfaces (APIs). Instead of becoming a bank themselves, businesses integrate banking capabilities such as accounts, payments, card issuing, lending, and compliance into their own products.

In practice, a BaaS provider supplies the underlying infrastructure, regulatory framework, and access to payment rails. The partner company focuses on customer experience, branding, and distribution, while the licensed institution remains responsible for holding funds and meeting regulatory requirements.

This model enables fintech startups, marketplaces, retailers, telecom operators, and software platforms to embed financial services directly into their ecosystems. As a result, financial functionality becomes a feature inside digital products rather than a standalone banking relationship.

Banking as a Service differs from traditional core banking software because it combines infrastructure, regulatory access, and API connectivity in a packaged offering. Depending on the provider, BaaS may operate through a fully licensed bank, an Electronic Money Institution, or a technology platform working with sponsor banks.

Watch the video to learn more about banking as a service:

Essentially, banking as a service providers act as a middleman between banks and businesses, allowing businesses to access banking services and infrastructure without having to build their own from scratch. This can include everything from payment processing and account management to compliance and regulatory support.

Evolution of Embedded Finance

The evolution of embedded finance has transformed the way businesses offer financial services to their customers. In the past, businesses had to rely on traditional banks to provide financial services, which often resulted in a cumbersome and time-consuming process. However, with the advent of Banking as a Service (BaaS), businesses can now integrate financial services directly into their products, providing a seamless and user-friendly experience for their customers.

The first generation of embedded finance, also known as “SaaS 1.0,” focused on providing tailored software services and generating monthly recurring revenue. This phase was characterized by the development of specialized software solutions that catered to specific business needs.

The second generation, “SaaS 2.0,” facilitated online payments for customers, enabling businesses to generate more revenue and compete in the market. This era saw the rise of e-commerce platforms and online payment gateways that simplified transactions.

The current generation, “SaaS 3.0,” has led to the rise of BaaS solutions, allowing businesses to offer additional embedded finance features, such as loans, accounts, and cards, beyond payments. This evolution has empowered businesses to create comprehensive financial ecosystems within their platforms, enhancing customer engagement and satisfaction.

By leveraging BaaS, companies can now provide a wide range of financial services without the need for a traditional banking license, making financial services more accessible and integrated than ever before.sd

Examples of BaaS providers and business partnership

The banking as a service model encompasses various industries, from technology companies to e-commerce, that provide banking services through a partnership with financial institutions. Below are some examples of partnerships and collaborations that involve banking as a service companies.

FinTech startups and traditional banks

In this case, a fintech startup partners with a traditional bank to offer a digital wallet service. For example, in partnership with Sutton Bank and Marqeta, Cash App provides its customers with a personalized debit card that enables both in-store transactions and hassle-free ATM cash withdrawals.

In addition, Lincoln Savings Bank enriches the Cash App experience by providing account and routing numbers, facilitating the effortless processing of incoming and outgoing ACH payments.

Source: Deloitte Digital

Transportation companies and brick-and-mortar banks

Uber and the State Bank of India have partnered to provide vehicle financing to drivers. Under this partnership, driver partners interested in working on the Uber platform can apply for a vehicle loan, which will be approved instantly through an integrated digital offering.

Source: Uber Money

E-commerce platforms and payment services

An e-commerce platform partners with banking as a service companies to provide a seamless payment experience. For example, an e-commerce giant like Shopify uses Stripe to optimally integrate SME bank accounts (held at Evolve) with its e-commerce platform. The main benefit is the creation of a comprehensive dashboard outside of the traditional banking system.

In addition, merchants using a credit account have faster access to funds generated by Stripe’s payment processing services. These embedded financial solutions not only strengthen customer engagement but also enrich their experience with additional financial offerings.

Source: Deloitte Digital

Collaboration between banking SaaS companies and traditional financial institutions is changing the landscape of modern banking services, as banking as a service companies bring a new level of agility and flexibility to the financial industry.

How do banking as a service companies work?

Banking as a Service providers (BaaS) enable non-banks, including fintech startups and technology companies, to offer banking services and financial services to their customers without having to build an entire banking system from scratch.

This is achieved by leveraging the established resources of traditional banks via APIs to provide a seamless and consistent user experience.

Here is a typical breakdown of the process:

- 1. Engagement. Fintech companies subscribe to the BaaS platform.

- 2. Solution development. Using APIs, these fintech companies develop innovative financial services solutions tailored to their target audience.

- 3. Collaboration. Established financial institutions serve as banking as a service providers and grant fintech companies access to their APIs to integrate their solutions.

Source: Amlegals

Essentially, banking as a service companies facilitate a mutually beneficial relationship between traditional banks and non-bank institutions by giving the latter the tools to seamlessly offer financial products while leveraging the former’s existing expertise and infrastructure.

Best banking as a service companies in 2026

Creating such a financial platform requires specialized skills and an experienced technical team. To help you choose a reliable partner to develop a BaaS platform or integrate your software with an existing solution, we have compiled a list of the top banking as a service companies.

SDK.finance

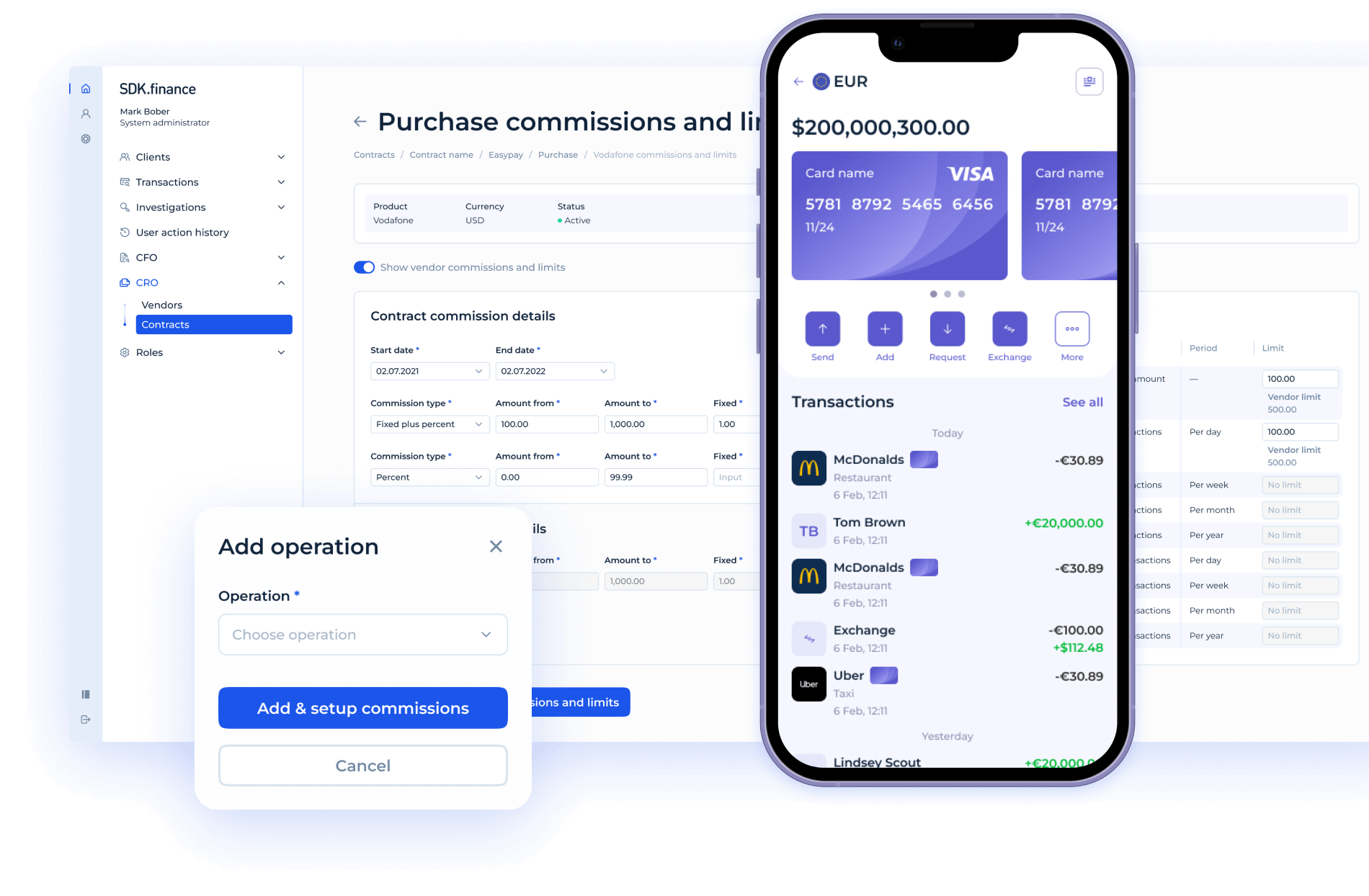

SDK.finance

SDK.finance provides a white-label FinTech Platform for the development of a wide range of banking products. The solution serves as a powerful foundation for building digital wallets, neobanks, money transfer services, currency exchange products, offline payment processing systems, payment gateways and other FinTech products – quickly and much more easily.

With SDK.finance you can choose the most suitable development mode according to your product strategy. We offer a scalable FinTech Platform for self-service development or a dedicated product development team for building your product on top of SDK.finance software.

The payment Platform available in two formats – a cloud-based solution for a quick and affordable start, and a source code version, available for purchase anytime, which gives you total independence from the vendor.

SDK.finance delivers a white-label digital banking platform designed for fintechs, EMIs, PSPs, banks, and enterprises. It comes with 60+ modules and 500+ APIs, plus pre-built mobile and web interfaces for internal teams and end customers. Multi-language support includes English, Arabic, Spanish, and French.

SDK.finance’s interfaces

The platform is certified under PCI DSS Level 1 and ISO 27001:2022, offering strong compliance and data security. Use cases include neobank launches, digital wallets, merchant acquiring, payroll solutions, and crypto-to-fiat services.

Top modules include (onboarding & KYC, accounts and multi-currency wallets, transfers and payments, card issuing, merchant services, transactions and ledger, AML/anti-fraud tools, currency exchange, accounting & finance, back-office UI).

Marqeta

Although Marqeta is primarily known for card issuance, the company is also active in the BaaS space. The company provides APIs for card issuance, payment processing, and digital wallets, enabling businesses to develop innovative payment solutions. Marqeta targets industries such as FinTech, eCommerce, and on-demand services, offering features such as instant approval, customizable payment management, transaction analytics, and comprehensive developer support.

Solarisbank

Solarisbank

Solarisbank is a Berlin-based banking as a service provider offering a range of financial services and APIs for companies operating in Europe. The company positions itself as a banking-licensed technology company that enables businesses to develop and offer financial products without having to obtain a banking license themselves.

Galileo

Galileo

Galileo is recognized as one of the top banking as a service providers, known for its powerful API platform, debit card issuance and other financial services. One of Galileo’s strengths is its flexibility. The platform is designed to support a wide range of financial services, allowing companies to tailor their offerings to their specific needs and audiences.

Treezor

Treezor

Treezor, a European banking as a service company, offers a wide range of financial services, including payment processing, electronic wallets, card issuance, and KYC compliance. The offering is particularly suitable for financial institutions, mobility services, neobanks, and employee benefit programs.

Intergiro

Intergiro provides a suite of payment APIs that help internet platforms increase revenue, reduce costs, and boost product engagement. Its no-code white-label platform allows businesses to quickly deploy customized banking solutions with banking features like accounts, cards, and payments, all supported by data-driven insights.

Stripe Treasury

Stripe, through Stripe Treasury, enables platforms to embed financial accounts, money movement, and card functionality directly into their products. Its global footprint and strong developer ecosystem make it relevant for SaaS platforms and marketplaces entering financial services.

Stripe, through Stripe Treasury, enables platforms to embed financial accounts, money movement, and card functionality directly into their products. Its global footprint and strong developer ecosystem make it relevant for SaaS platforms and marketplaces entering financial services.

ClearBank

ClearBank is a UK clearing bank providing BaaS infrastructure with direct access to UK payment schemes. It is commonly used by fintechs and financial institutions seeking regulated access to domestic payment rails.

ClearBank is a UK clearing bank providing BaaS infrastructure with direct access to UK payment schemes. It is commonly used by fintechs and financial institutions seeking regulated access to domestic payment rails.

Unit

Unit is a US-based API-first BaaS platform focused on helping software companies embed accounts, cards, and payments into their products through sponsor bank partnerships.

Airwallex

Airwallex offers global payments and financial infrastructure with strong coverage across Asia-Pacific, Europe, and North America.

It supports embedded finance use cases for cross-border businesses.

Zeta

Zeta provides modern banking technology and card processing infrastructure, working with banks and fintech companies across India, the Middle East, and other global markets.

Zeta provides modern banking technology and card processing infrastructure, working with banks and fintech companies across India, the Middle East, and other global markets.

Comparison of BaaS Providers in 2026

| Provider | Year Founded | HQ | Geographic Strength | Customer Profile | Licensing Type |

|---|---|---|---|---|---|

| SDK.finance | 2013 | London, UK | Europe, MENA, North America | Banks, fintechs, PSPs, enterprises building wallets and neobanks | Technology provider (partners with licensed banks) |

| Marqeta | 2010 | Oakland, USA | North America, global fintech | Fintechs, digital banks, marketplaces | Technology provider (partners with licensed banks) |

| Solarisbank | 2015 | Berlin, Germany | Europe | Fintechs and enterprises launching regulated EU financial products | Fully licensed German bank |

| Galileo Financial Technologies | 2000 | Salt Lake City, USA | North America | Neobanks, fintech apps, digital-first financial institutions | Technology provider (sponsor bank partnerships) |

| Treezor | 2016 | Paris, France | Europe | Marketplaces, fintech startups, embedded finance platforms | Electronic Money Institution (France) |

| Intergiro | 2014 | Stockholm, Sweden | Europe | SMEs, fintechs, digital businesses | Electronic Money Institution (Sweden) |

| Stripe (Treasury) | 2010 | San Francisco, USA | North America, global SaaS platforms | SaaS platforms, marketplaces, digital businesses | Technology provider (bank partnerships) |

| ClearBank | 2015 | London, UK | United Kingdom | Fintechs, financial institutions, payment firms | Fully licensed UK clearing bank |

| Unit | 2019 | New York, USA | North America | SaaS companies embedding financial features | Technology provider (sponsor bank model) |

| Airwallex | 2015 | Melbourne, Australia | APAC, Europe, North America | Cross-border businesses, platforms, fintechs | Regulated financial institution (multi-jurisdiction licences) |

| Zeta | 2015 | Bengaluru, India | India, MENA, global banking clients | Banks, card issuers, fintech companies | Technology provider |

Banking SaaS companies are known for their flexible platforms that enable organizations to launch new services with unprecedented speed. This agility not only accelerates time-to-market, but also increases competitiveness as companies can respond instantly to market trends and customer demands.

The result is a dynamic environment in which innovation thrives, enabling companies to seize opportunities as they arise and maintain a strong position in the rapidly evolving financial landscape.

Benefits of BaaS

Banking as a Service (BaaS) offers several compelling benefits to businesses, making it an attractive option for companies looking to enhance their financial offerings:

- Increased Customer Loyalty: By offering financial services directly within their products, businesses can increase customer loyalty and retention. Customers appreciate the convenience of accessing financial services without leaving the platform they are already using.

- Improved Customer Experience: BaaS enables businesses to provide a seamless and user-friendly experience for their customers, improving overall satisfaction. Integrated financial services reduce friction and enhance the user journey.

- New Revenue Streams: BaaS enables businesses to generate new revenue streams by offering financial services to their customers. This diversification can lead to increased profitability and business growth.

- Reduced Costs: BaaS can reduce costs for businesses by eliminating the need for traditional banking relationships and infrastructure. Companies can leverage the existing infrastructure of BaaS providers, saving on development and operational expenses.

- Increased Financial Inclusion: BaaS can increase financial inclusion by providing access to financial services for underserved populations. By integrating financial services into widely used platforms, BaaS helps bridge the gap for those who may not have access to traditional banking.

These benefits demonstrate how BaaS can transform the way businesses interact with their customers, offering enhanced financial services and driving customer loyalty.

Trends for banking as a service in 2026

According to a Finastra survey, the banking as a service sector is expected to reach a remarkable $7 trillion by 2030. Banking SaaS companies have seen a significant upsurge, including fintech startups and tech giants that are increasingly recognizing the potential to revolutionize the way financial services are delivered.

Open banking

Open banking is driving the evolution of BaaS by encouraging data sharing, driving innovation, and enabling collaboration. BaaS providers using Open-Banking are well-positioned to deliver more customer-centric and advanced financial services while navigating the changing regulatory landscape.

Digital-only banking

Today, there are a number of banks without physical branches that offer competitive financial products and enhanced user experiences. Therefore, by integrating digital-only banking practices into BaaS providers, companies can offer technologically advanced, user-friendly, and accessible financial services.

RegTech

RegTech, or regulatory technology, is an important trend in BaaS. As financial regulations become more complex and stringent, RegTech solutions are gaining importance in helping BaaS providers and their customers effectively address compliance challenges.

Platform banking

A growing number of banks are adopting a platform-based strategy and expanding their service offerings beyond traditional banking to include offerings such as insurance, investments, and utility bill payments.

Future of Financial Services

The future of financial services is poised to be shaped by the continued growth of Banking as a Service (BaaS) and embedded finance. As more businesses integrate financial services into their products, we can expect to see increased competition and innovation in the financial industry.

Some potential trends that may shape the future of financial services include:

- Increased Use of Artificial Intelligence and Machine Learning: AI and machine learning technologies will play a significant role in improving financial services and customer experience. These technologies can help in personalizing financial products, detecting fraud, and providing predictive analytics.

- Greater Emphasis on Financial Inclusion: There will be a stronger focus on financial inclusion and access to financial services for underserved populations. BaaS and embedded finance can help bridge the gap by providing accessible financial solutions to a broader audience.

- Increased Use of Blockchain and Distributed Ledger Technology: Blockchain and distributed ledger technology will enhance security and transparency in financial transactions. These technologies can streamline processes, reduce fraud, and improve trust in financial systems.

- Greater Focus on Customer-Centricity and User Experience: The financial services industry will place a greater emphasis on customer-centricity and user experience. Companies will strive to offer intuitive, user-friendly financial products that meet the evolving needs of their customers.

- Increased Regulation and Oversight: As BaaS and embedded finance continue to grow, there will be increased regulation and oversight to ensure consumer protection and financial stability. Regulatory frameworks will evolve to address the unique challenges and opportunities presented by these innovations.

The future of financial services is bright, with BaaS and embedded finance driving significant advancements. These trends will shape a more inclusive, secure, and customer-focused financial industry, offering enhanced services and experiences for all stakeholders.

Conclusion

In this era of transformative change, the synergy between traditional banks and BaaS providers is reshaping the financial landscape. The shared pursuit of digitization, platform strategies, open banking, and RegTech is fostering a new era of financial services, promising innovation, accessibility, and improved experiences for all stakeholders.

The fact that banking as a service providers continue to grow underlines the transformative potential of collaboration, technology, and innovation, forging a path toward a dynamic and inclusive financial future.