In recent years, new players have emerged in the money transfer industry, including fintech startups that offer digital money remittance services. These companies use technology to streamline the remittance process and make sending money online faster, cheaper, and more convenient for customers.

Finding the perfect remittance software solution for your financial business needs can be a difficult task. There are a number of remittances companies offering money transfer platforms that cater to the different needs and preferences of FinTech businesses.

In this article, we highlight the top remittance companies and provide insight into the money transfer market.

Remittance software development companies market overview

The remittance software development market has experienced significant growth in recent years, driven by the increasing demand for fast, secure, and cost-effective international money transfers.

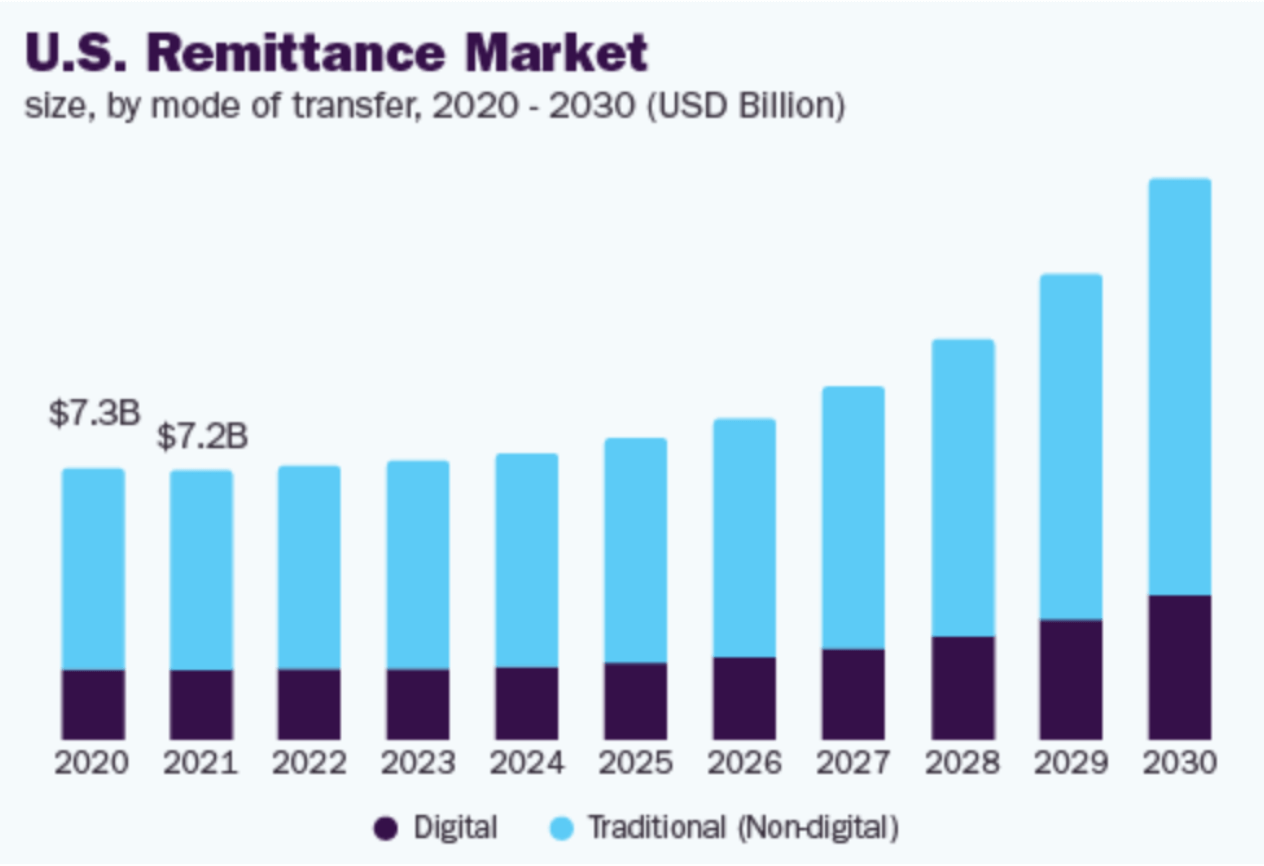

According to a report by Grand View Research, the global remittance software market size was valued at $6.1 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 17.2% from 2021 to 2028.

Remittance company market size

2020-2030 (USD Billion)

Source: Grand View Research

The remittance market remains a key part of the global financial system in 202, supporting cross-border income flows for millions of individuals and households worldwide.

Key market indicators for 2025 include:

-

Global remittance flows to low- and middle-income countries are projected to reach around USD 690 billion, underlining their role as a stable source of external financing.

-

Economic impact in developing countries remains significant, with remittances accounting for 5–10% of GDP in several emerging markets across Asia, Africa, and the Middle East.

-

Digital channels dominate remittances, as mobile money transfers, online wallets, and app-based platforms handle the majority of transactions.

-

Digital remittance volumes exceed USD 540 billion, driven by smartphone adoption, improved payment infrastructure, and lower operational costs compared to cash-based models.

-

Mobile-first remittance services continue to grow as users prioritise speed, transparency, and predictable fees for cross-border transfers.

Key market drivers

The remittance software development market is expected to continue to grow in the coming years, driven by factors such as:

- increasing globalization

- rising migrant populations

- the growing adoption of digital payments.

What is remittance software?

Remittance software is a type of technology used by financial institutions and money transfer companies to facilitate the international transfers. Remittance companies allow users to securely and efficiently send money internationally to recipients in other countries using various methods, such as bank transfers, mobile money, and cash pickup.

To explore the difference between money transfer and money remittance read this article on understanding the money transfer business.

What are the features of money transfer software?

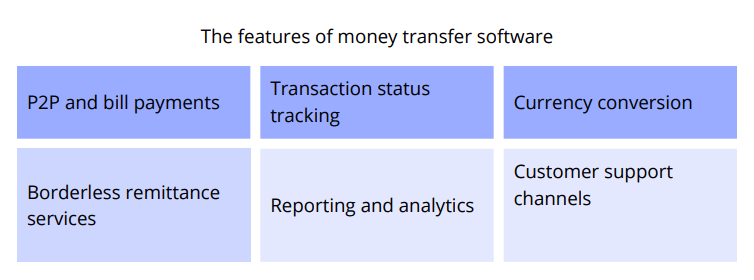

Remittance software often includes the following features:

-

P2P and bill payments

Money transfer software enables person-to-person (P2P) payments, allowing individuals to send money directly to friends, family members, or other individuals. Additionally, remittance companies often supports other useful features such as bill payments, enabling users to pay their utility bills, rent, or other invoices conveniently through the platform.

-

Borderless remittance services

This software facilitates seamless cross-border remittance services, enabling users to send and receive money internationally.

-

Currency conversion

Money transfer software incorporates currency conversion functionality, allowing users to send or receive money in different currencies. Digital remittance companies use this capability to ensure that recipients receive funds in their local currency, eliminating the need for them to worry about currency exchange.

-

Transaction status tracking

Remittance software provides users with the ability to track the status of their transactions in real-time. They can monitor the progress of their transfers, including transaction processing, fund disbursement, and delivery status. This transparency enhances trust and provides peace of mind to users.

-

Reporting and analytics

The system offers reporting and analytics features that provide valuable insights into transaction volumes, revenue trends, customer behavior, and other key performance indicators. These insights help businesses make data-driven decisions, optimize their operations, and identify growth opportunities.

-

Customer support channels

Money transfer software typically includes various customer support channels such as live chat, email support, or phone assistance. Prompt and reliable customer support ensures that users can seek assistance, resolve queries, and receive guidance whenever needed, enhancing their overall experience.

Remittance software plays a crucial role in facilitating international trade, supporting families and communities, and promoting economic growth in many countries.

By providing efficient, secure, and convenient remittance services, it enables individuals to send and receive money internationally, contributing to financial inclusion and empowerment.

Best remittance software providers 2026

There are many top remittance companies available, and selecting the top ones can depend on a variety of factors such as expertise, experience, and reputation. Here are some of the digital remittance companies based on their experience.

SDK.finance

SDK.finance

SDK.finance is a software vendor that specializes in payment software for building fintech solutions, including money transfer software, digital wallets, payment acceptance systems, neobanks and currency exchange services.

You can build your remittance app on a reliable FinTech platform designed by a team with 15+ years of experience in building payment products.

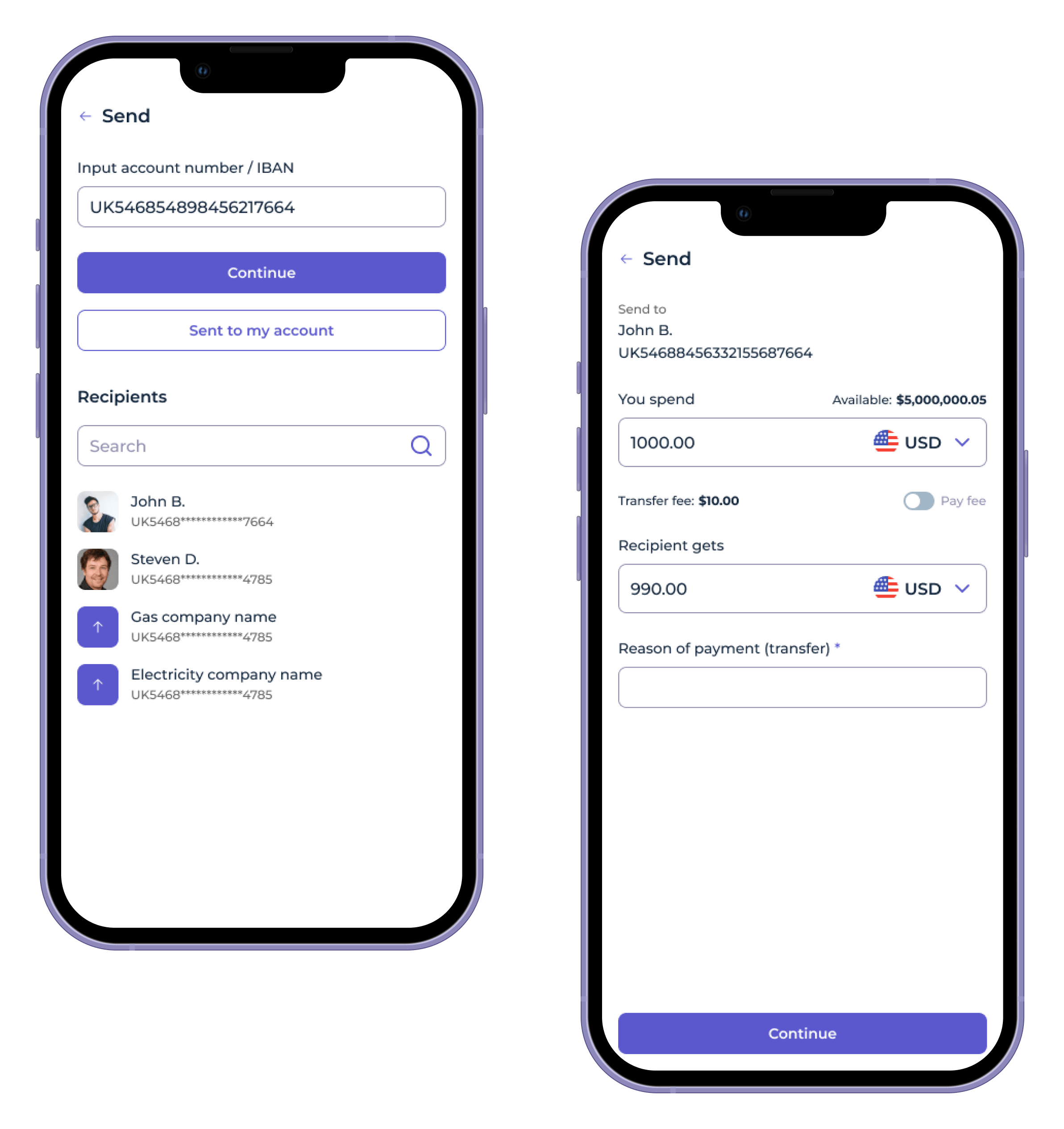

SDK.finance provides a money transfer software to develop a payment or remittance app to send money online.

The SDK.finance money transfer software comes with a range of features and functionalities that allow financial institutions to customize the platform to their specific needs. Some of the key features of the software include:

- Multi-currency support. The software can handle multiple currencies, making it easy for users to send and receive money in their preferred currency.

- Real-time payments. The platform supports real-time payments, which means that transactions are processed and settled instantly.

- P2P payments. It is possible to integrate with payment or service providers to enable transfers between cards, wallets and mobile.

- Bank and card payments. You can integrate with a banking network to offer bank account payments such as IBAN, SWIFT, or with card providers for card payment features.

- Customizable user interface. The software comes with a customizable user interface, which allows financial institutions to brand the platform and make it their own.

The SDK.finance money transfer software is a powerful and flexible solution for financial institutions looking to offer their customers a reliable and efficient way to send and receive money domestically or across borders.

Image source: SDK.finance platform interfaces

Respond to increased market demand for speedy money transfers with a progressive P2P transfer system, packed with the features your audience needs and values. Go to market in weeks, without breaking the budget:

- API-first architecture. 400+ REST APIs to integrate the software into your product and connect third-party services, including seamless bank transfers and mobile wallets integration.

- Affordable subscription model. Get the SDK.finance functionality available in the cloud, ready to use in no time and at a reasonable cost, with options for international money transfers.

- Source code license available. Get complete control over your banking solution by acquiring the source code license for maximum flexibility and no subscription fees.

FIS

FIS (Fidelity National Information Services) is a global software development company specializing in providing technology solutions and services to the financial industry. Headquartered in Jacksonville, Florida, FIS operates in more than 130 countries and serves a wide range of customers, including banks, financial institutions, corporations, governments and retailers.

FIS offers a full range of software products and services for various aspects of the financial industry, including banking and payments, asset management, risk and compliance, remittance companies, capital markets and insurance. The company’s software solutions are designed to streamline operations, increase efficiency, enhance the customer experience and drive innovation in the financial sector.

As a trusted money transfer company, the focus is on securely facilitating cross-border financial transactions for individuals and businesses worldwide.

One of FIS’ key strengths is its extensive expertise and ability to apply technology to solve complex challenges faced by financial institutions. The company invests heavily in research and development to stay at the forefront of technological advancements and provide cutting-edge solutions to its customers.

Paymentus

Paymentus

Paymentus is a leading remittance company focused on innovative technology and optimized payment processes.

As a one of the largest money transfer companies, Paymentus provides innovative solutions to businesses in a variety of industries, including finance, utilities, healthcare and government. The company’s main goal is to simplify and improve the payment process for both businesses and their customers.

The money transfer company enables its users to make money transfers seamless and convenient, revolutionizing the way people send and receive money across borders.

Paymentus offers a comprehensive suite of software solutions designed to streamline payment collection, facilitate secure transactions and improve overall financial operations. The software includes advanced features such as payment processing, invoicing, account management, reporting and analytics, and customer communication tools.

Sila

Sila

Sila is a software provider that offers a remittance platform that enables fast and secure money transfers between individuals and businesses. The system uses blockchain technology to ensure secure transactions and reduce the cost of cross-border money transfers.

The remittance company Sila offers packages to grow and scale that include all the essential building blocks for FinTech app developers. ACH enables payment processing and provides support for KYC/KYB, banking, compliance, fund storage and ledgering for money transfer organizations.

The platform includes digital wallets and payment APIs developed for various financial products, fintech, web3 and crypto projects.

You can connect Sila Wallet API ‘out-of-the-box’ or customize it to the specific requirements of the project, so that this money transfer company provides convenient access to financial services and enables efficient money transfers to various destinations.

Wrapping up

The remittance software market is expected to experience tremendous growth in the coming years due to globalization, increasing number of migrants, and the rise of digital payments. The money transfer industry offers a number of advantages for fintech companies and money transfer services.

With a large number of top money transfer companies, it can be difficult to find the right money transfer solution that fits your type of business. SDK.finance’s white-label money transfer software can help you get your remittance app up and running faster and more cost-effectively.