If you’re in the dynamic FinTech space with your business or innovation, you’ve probably asked yourself: “How much does it cost to build a banking app?”. It is difficult to determine the scope of a banking app, because the banking app’s design and functionality are crucial factors in the complex payment product development process.

However, with the SDK.finance’s 15+ years of expertise in FinTech software development, you can estimate the budget for banking product launch. In this article, we dive deep into the various facets of banking application development and the functions that come together to define the banking app development cost.

Banking app development market overview

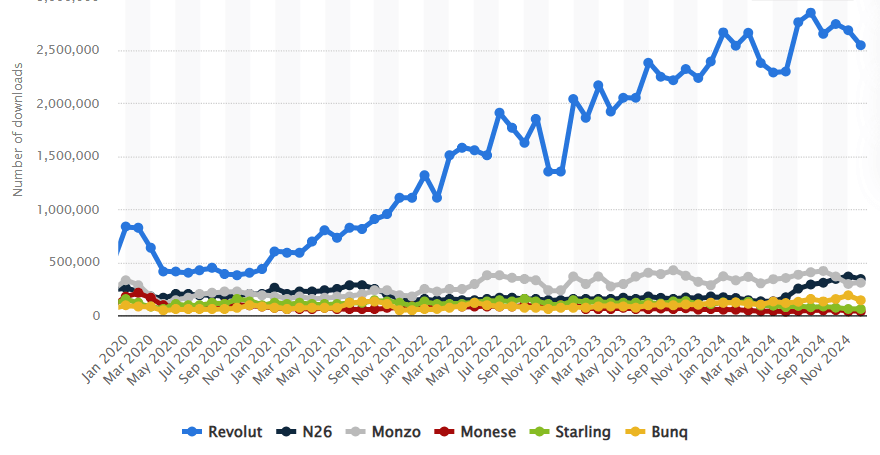

According to Statista, the use of neobanks has grown rapidly in recent years and represents a significant shift in the traditional banking landscape. This upward trend underscores consumers’ growing preference for digital, innovative banking solutions over traditional, brick-and-mortar institutions.

The main trend in FinTech development is the shift from traditional desktop banking and in-person branch visits to mobile banking. Mobile banking applications play a crucial role in modernizing financial services by providing users with convenience and accessibility. For banks, providing digital services is often more cost-effective than maintaining a network of physical branches. It also offers a wide range of features, such as mobile check deposits, bill payments, money transfers, investment tracking, and budgeting tools.

Banking app growth data

The main statistics of the mobile banking market

-

The increasing popularity and user adoption of mobile banking apps have significantly impacted the global mobile banking market, which is estimated to reach $1.36 billion by 2028.

-

57% of millennials and 64% of Gen Z have a financial account with a nontraditional institution, according to a PwC survey.

- According to Juniper Research, the total value of mobile money transactions in emerging markets will reach $2 trillion by 2027.

Number of European mobile-only bank app downloads in 2024

Source: Statista

Why is it important to understand the banking app development cost?

While the benefits of banking apps are obvious, there is a cost associated with their development. These costs can vary significantly depending on a variety of factors, including the complexity of the app, the platform it is targeting, security considerations, and the features offered.

Without a clear understanding of these cost factors, financial institutions and entrepreneurs risk embarking on an expensive and unpredictable app development journey.

Understanding the mobile banking app development cost is not just about budgeting.

It’s about making informed decisions, setting realistic expectations, and maximizing return on investment. Whether you are a financial institution looking to improve your digital presence or an entrepreneur looking to build the next breakthrough fintech app, understanding the financial aspects of the development process is critical to success.

Key factors affecting a banking app development cost

Developing a mobile banking app involves several key factors that contribute to the overall cost.

In the context of banking mobile app development, it is crucial to emphasize app accessibility and the preliminary steps, such as gathering requirements, conducting market analysis, creating a prototype, and progressing through the design, coding, and deployment phases. When financial companies understand these factors, they can plan and budget effectively, minimizing financial risks. Let’s take a look at some of the key factors that can affect the banking app development cost.

Banking App Type

The type of banking app being developed plays a significant role in determining the overall cost. There are primarily two types of banking apps: dedicated banking apps and aggregator apps.

- Dedicated banking apps are designed for a specific bank or financial institution, offering a wide range of services and features tailored to that institution’s customers. These apps typically include functionalities such as account management, transaction histories, bill payments, and customer support. Due to their comprehensive nature and the need for customization, dedicated banking apps are generally more expensive to develop, with costs ranging from $100,000 to $200,000 or more.

- On the other hand, aggregator apps collect data from multiple banks and financial institutions, providing users with a single platform to manage their finances. These apps offer features like balance checks, transaction histories, and money transfers across different accounts. Aggregator apps are generally less expensive to develop compared to dedicated banking apps, with costs ranging from $50,000 to $100,000. However, they require robust integration capabilities to ensure seamless data aggregation from various sources.

Choosing the right type of banking app depends on your business goals, target audience, and budget. While dedicated banking apps offer a more personalized experience, aggregator apps provide convenience by consolidating multiple accounts into one platform.

App complexity

The complexity of your banking app plays an important role in determining banking app development cost. Developing a basic banking app, which includes essential features such as user registration, account balance verification, transaction history, and money transfers, can vary significantly in price. However, additional features such as biometric authentication, push notifications, spending analytics, bill payments, and customer support chats can increase complexity and cost of mobile banking development.

We have considered the estimated time required to develop certain functions.

Time to create a mobile banking app (development only)

The development time for a mobile banking app depends on its complexity, ranging from 3 months to 18 months or more. The development process involves several stages, including research, design, development, testing, and deployment. Each stage requires careful planning and execution to ensure the app meets user expectations and industry standards:

- During the research phase, the development team gathers requirements, analyzes market trends, and defines the app’s features and functionalities. This stage can take a few weeks to a couple of months, depending on the project’s scope.

- The design phase involves creating wireframes, prototypes, and the user interface. A well-designed user interface enhances user engagement and satisfaction, which is crucial for the success of a mobile banking app. This phase typically takes 1 to 3 months.

- The development phase is where the actual coding happens. The time required for this phase depends on the app’s complexity and the experience of the development team. Basic banking apps with essential features like account management and transaction histories can be developed in 3 to 6 months. More complex apps with advanced features like biometric authentication, spending analytics, and real-time notifications can take 6 to 12 months or more.

- Testing is a critical phase to ensure the app is secure, functional, and user-friendly. This phase can take 1 to 3 months, depending on the app’s complexity and the number of features to be tested.

- Finally, the deployment phase involves publishing the app on app stores and making it available to users. This phase includes setting up servers, configuring databases, and ensuring compliance with app store guidelines. Deployment typically takes a few weeks.

| Feature | Development time |

| Authorization | 80 hours |

| KYC | 85 hours |

| User profile | 80 hours |

| Account activity | 152 hours |

| Transfers | 72 hours |

| Bill payments | 44 hours |

| Cards management | 58 hours |

| Security | 38 hours |

| ATM&bank locator | 60 hours |

| Setting | 30 hours |

| Support | 170 hours |

| Admin panel | 310 hours |

It’s important to note that more complex functions require more time, resulting in higher costs.

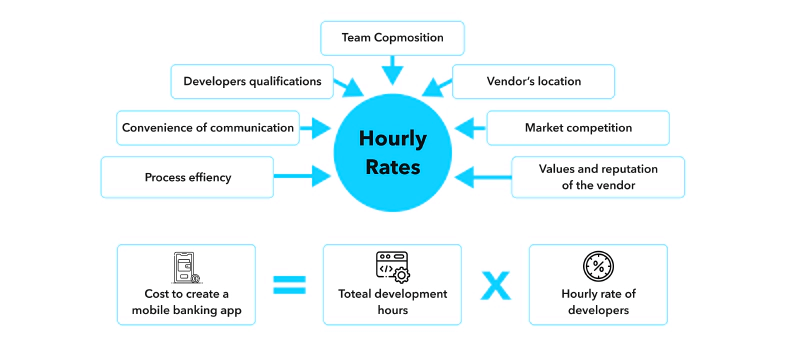

Here are the major determinants of hourly rates:

Team and expertise

Hiring skilled and experienced app developers is essential for a successful banking app. The cost of hiring app developers varies depending on factors such as location, experience level, and project complexity. It is important to strike a balance between cost and expertise to ensure a high-quality and cost-effective development process.

Costs can also vary depending on whether you choose to hire an in-house team or outsource development.

SDK.finance, for example, offers FinTech software development services that can significantly speed up the launch of a banking app. With 15 years of experience in payment product development, our team uses a pre-developed back-end Platform to save your time and resources.

Design and user experience

A well-designed and intuitive user interface created by experienced banking app developers increases user engagement and satisfaction, leading to higher adoption and usage.

However, designing a user-friendly and visually appealing mobile banking app requires skilled designers and additional development time, which can impact overall costs.

Key components for designing a mobile banking app

Source: Appinventiv

When considering the cost of UX and design, factors such as user research, wireframing, prototyping, and usability testing should be considered.

Investing in UX and design can set your banking app apart from the competition and contribute to its overall success. To develop an app that meets user expectations while staying within budget, it’s important to weigh the cost of design against the potential benefits.

Security and compliance

Security and compliance are top priorities when developing a banking app. Financial institutions must adhere to strict regulations and industry standards to protect user data and ensure secure transactions. Implementing robust security measures and compliance requirements adds complexity to the development process and increases overall costs.

To ensure the security of user data, banking apps typically include features such as secure logins, encryption, two-factor authentication, and transaction verification. In addition, compliance with regulations such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS) requires continuous monitoring and regular updates, which contributes to the mobile banking app development costs.

Technology stack

The technology stack you choose for your banking app can affect development costs. Different programming languages, frameworks, and tools have different costs and development times. Some technologies and frameworks allow for fast development, while others require more time and effort. Faster development can reduce labor costs.

Integration with third-party services

Most banking apps require integration with external systems such as payment gateways, credit bureaus, identity verification services, and other financial institutions. These integrations facilitate seamless transactions, improve security and compliance, and provide users with a comprehensive banking experience.

However, integrating third-party services can complicate the development process and increase overall costs. The cost of integration depends on factors such as the number of integrations, the complexity of APIs, and the need for customization.

Maintenance and updates

Developing a banking app is not a one-time expense. Ongoing maintenance and updates are necessary to keep the app secure, functional, and up to date with technology and user expectations. Maintenance costs typically include activities such as troubleshooting, performance tuning, server maintenance, and compatibility updates.

Regular updates are also important to introduce new features, improve usability, and address security vulnerabilities. The cost of maintenance and updates depends on factors such as the complexity of the application, the frequency of updates, and the need for ongoing support.

And now let’s try to estimate a rough cost of banking app development.

Estimated banking app development cost

How much does it cost to develop a banking app?

To put it simply -“there’s no one-size-fits-all answer”. Just as different buildings require unique architectural approaches depending on their intended use and complexity, the same is true for app development. The diversity of requirements and the complexity of the apps lead to different costs.

While it’s challenging to provide an exact cost without knowing the specific requirements of your banking app, we can provide a rough estimate for banking app development cost based on industry standards.

Primary features of a banking app

Banking app development involves integrating several key features that provide value, convenience, and security to users. Let’s take a closer look at some of the key features and discuss the average time and cost of developing a banking app for each feature.

| Feature | Description | Time | Cost |

| Authorization | Requires the integration of various security measures such as password protection, fingerprint recognition, or facial recognition ID. | 200 hours | $5000-$7500 |

| Notifications | Reminders to raise awareness of fraudulent activity or low balances can increase overall customer satisfaction. | 80 hours | $2000-$3000 |

| Access to сard details | Allow users to conveniently transact without having to manually enter their card details every time. | 150 hours | $4000-$6000 |

| Transactions and payments | Including options such as internal transfers, national/international payments, or automatic regular transfers. | 300-350 hours | $8000-$10,000 |

| Transaction history | Transaction history facilitates record keeping by providing details of past financial activity. | 80-100 hours | $2500-$3000 |

| Spending analytics | Identifies trends based on user spending habits to promote effective money management strategies to customers. | 120 hours | $4500-$5500 |

| In-app chat with customer support | Direct interaction with customer service representatives via an in-app chat system that allows users to easily resolve issues. | 130 -150 hours | $3750-$5250 |

| Splitting bills | By integrating this feature into your banking app, you provide a convenient way to share expenses with friends, family, or colleagues. | 160-220 hours | $8000-11000 |

| QR Code Scanning | This feature enables users to conveniently make payments by scanning the QR code displayed by merchants. | 140-200 hours | $7,000-$10,000 |

Keep in mind that these timings are only subjective estimates that take into account factors such as region-specific developer rates, technologies used, and other aspects that dramatically affect the overall price – so consider them only as rough guidelines!

Potential Additional Features of the Banking App

In addition to the core features, there are several potential additional features that can be included in a mobile banking app to enhance its functionality and user experience. Some of these features include:

- Advanced Security Features: Implementing biometric authentication (such as fingerprint or facial recognition) and encryption can significantly enhance the security of the app, protecting user data and transactions.

- Personalized Financial Management Tools: Offering budgeting tools, investment tracking, and personalized financial advice can help users manage their finances more effectively.

- Real-Time Transaction Alerts and Notifications: Providing real-time alerts for transactions, low balances, and suspicious activities can improve user engagement and security.

- Integration with Wearable Devices and Smart Home Systems: Allowing users to access their banking app through wearable devices like smartwatches or integrating with smart home systems can offer added convenience.

- Advanced Analytics and Reporting Tools: Offering detailed analytics and reports on spending habits, income, and expenses can help users make informed financial decisions.

- Integration with Social Media and Messaging Platforms: Enabling users to share transaction details, split bills, or send money through social media and messaging platforms can enhance the app’s usability and appeal.

While these additional features can increase the development cost, they can also provide a competitive edge and enhance the overall user experience. Investing in advanced features can lead to higher user satisfaction and retention, ultimately contributing to the app’s success.

Tech stack

Broadly classified into two major approaches:

- Native application development: employing technologies designed for specific platforms (iOS-Swift/Objective C & Android-Java/Kotlin). Although this escalates costs owing to separate apps per platform— it promises higher performance & better user experience.

- Cross-platform application development: cross-platform frameworks like React Native and Flutter can reduce development costs because you can write the code once and deploy it to multiple platforms.

Source: FDT

It is important to know that a wrong choice of tech stack can lead to inferior solutions that multiply future expenses through constant fixes – this underlines the importance of considering the long-term impact on banking application development costs when initializing your project.

Location and team

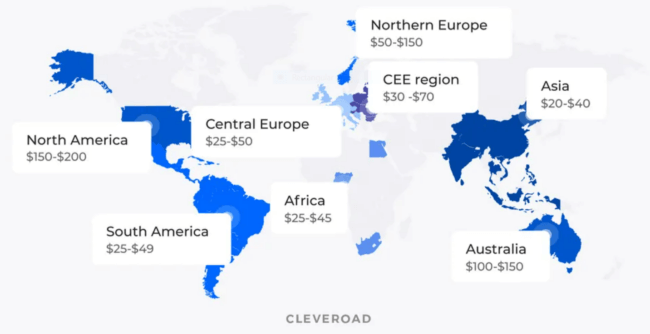

The average cost range involved in banking app development varies significantly depending on a number of factors. It’s worth noting that mobile banking app development is a sophisticated process and rightfully requires a larger financial investment compared to apps with less versatile features.

Typically, banking application development costs can range from $250,000 to over $1 million depending on an agency’s geographic location, experience level, required features, and underlying technology stack. However, this is only a rough estimate; actual prices can vary widely depending on specific requirements.

For instance, agencies in North America generally charge higher rates ($150-200/hr), amplifying your overall banking app development cost. As compared to Eastern European countries where software development services typically offer lower hourly rates ($50-100/hr).

Do keep in mind that these estimates are flexible and tip towards providing an inkling into budgeting for your project rather than exact figures.

Source: Cleveroad

How to reduce the banking app development cost?

It goes without saying that profitability is paramount in banking app development. In this digital age, developing a top-notch, feature-rich banking app doesn’t necessarily come with sky-high costs. Nevertheless, you can adopt certain strategies to manage your budget without compromising on quality.

Be methodical from the outset

Planning plays a critical role in managing the cost of developing banking applications. Careful planning helps anticipate and avoid unnecessary design changes in the middle of the process that can result in significant additional costs. Accurate estimation of costs prevents spending more than expected.

Prioritize core features only

Cost savings shouldn’t equate to sacrificing features important to user functionality. Prioritize core features such as transaction capabilities, balance inquiries or money transfers before adding luxury features such as chatbots or analytics. By implementing these unimportant elements later, you’ll improve financial efficiency during the early stages of mobile banking app development.

While there is no standard recipe for keeping expenses in check while optimizing performance, applying these strategies can make a huge impact on your ability to comprehensively control banking app development costs. Consciously managing all variables that directly impact overall costs promotes sustainable financial management in mobile banking app development.

Hire an experienced development team

While it may be tempting to cut corners when hiring developers, keep in mind that expertise plays an important role in determining long-term cost effectiveness. An experienced team minimizes errors throughout the development process, reducing spending on error corrections and revisions after the fact.

With SDK.finance FinTech software development services, you can speed up the development process and skip the most time-and resource consuming part of your product development and focus on UI/UX, the necessary integrations, and monetization.

Choose a reliable software vendor

Another important strategy for reducing banking app development costs is choosing a reliable software provider. By working with an experienced vendor, you can leverage their expertise, access cost-effective solutions, and ultimately ensure that your banking application development project stays within budget without compromising quality or security. For example, you can use a pre-developed SDK.finance payment software and cooperate with our development team to streamline the banking app development process.

Watch SDK.finance Platform demo video to explore how to maximize your revenue with our FinTech solution. This video showcases real-life scenarios demonstrating the power of the Vendor Management section for CROs within the SDK.finance backoffice:

Financial Licenses for Providing Banking Services

When building a banking app, obtaining the appropriate financial license is a critical step. This license ensures that your app operates within the legal framework of your target market and complies with local and international regulations. If you already have a financial license, you are only interested in the app development cost. However, if you are starting a mobile banking app from scratch, you should obtain a financial license. Obtaining the correct financial license is not only a legal necessity but also builds trust with your users and stakeholders. It’s important to work with legal and compliance experts to navigate the licensing process efficiently. While the initial costs and effort may seem significant, securing the right license will lay a solid foundation for your banking app’s long-term success.

Below, we’ll cover the types of licenses you might need, their costs, and the general requirements for obtaining them.

Types of Financial Licenses for Banking Services

The type of license you need depends on the services your banking app will offer. Common licenses include:

- Payment Institution (PI) License:

- Suitable for apps focused on payment processing, money transfers, and other non-deposit-taking activities.

- Commonly used in the European Union under the Payment Services Directive (PSD2).

- E-Money Institution (EMI) License:

- Required for apps handling electronic money issuance and storage, such as digital wallets or prepaid cards.

- Applicable in jurisdictions like the EU and the UK.

- Banking License:

- Necessary for apps offering full banking services, including deposit-taking, lending, and savings.

- Typically regulated by central banks in individual countries.

- Money Service Business (MSB) License:

- For apps operating in the US, focusing on money transmission, foreign exchange, or check cashing.

- Specialized Licenses:

- Includes licenses for cryptocurrency services, peer-to-peer lending, or crowdfunding platforms.

Costs of Financial Licenses

The cost of obtaining a financial license varies widely depending on the type of license and the jurisdiction. Here are approximate figures:

- Payment Institution License: EUR 5,000–EUR 50,000 in the EU, depending on the country.

- E-Money Institution License: EUR 20,000–EUR 150,000 in the EU.

- Banking License: USD 1–3 million in some countries, with additional capital reserve requirements.

- MSB License: USD 5,000–10,000 in the US, plus compliance program costs.

- Cryptocurrency Licenses: USD 10,000–50,000 depending on the specific service and jurisdiction.

When Banking App Owners Use a License from Another Bank

In certain cases, banking app owners may operate under a license provided by an established bank rather than obtaining their own. This approach is commonly referred to as Banking-as-a-Service (BaaS) or license-as-a-service. Here are some scenarios where this is applicable:

- Startups Testing the Market:

- Early-stage companies or startups may opt to use an existing bank’s license to minimize initial costs and compliance efforts while testing their app in the market.

- Faster Time to Market:

- Using a third-party license allows banking app owners to bypass the lengthy and complex licensing process, enabling quicker launches.

- Focus on Technology, Not Regulation:

- Some app owners prefer to focus on building and improving their app’s features and user experience, leaving regulatory compliance to the licensed bank.

- Cost Efficiency:

- For businesses with limited resources, using another bank’s license can be more cost-effective compared to fulfilling capital and regulatory requirements for their own license.

- Cross-Border Expansion:

- When entering new markets, banking app owners might use a local bank’s license to comply with region-specific regulations without establishing a new legal entity.

- Partnership Agreements:

- Collaborating with a licensed bank under a revenue-sharing or white-label model to leverage their regulatory status while building brand presence.

Costs and Requirements of Using Another Bank’s License

- Costs:

- Typically involve service fees or revenue-sharing agreements with the licensed bank. Costs vary depending on the level of service provided and the jurisdiction.

- Requirements:

- Compliance with the licensed bank’s operational standards.

- Integration with the bank’s infrastructure and adherence to its reporting requirements.

- Alignment with AML/KYC processes defined by the licensed bank.

Final thoughts

Developing a payment app involves several factors that affect the overall banking app development cost. Understanding these factors allows organizations to budget effectively and minimize financial risk. From assembling the right development team and prioritizing features to integrating third-party services, ensuring security and compliance, and investing in usability and design, each factor plays a critical role in the mobile banking app development cost.

Get a shortcut in software development – a ready FinTech software backend and an experienced financial software development team to save your time and resources.