The rise of mobile technology has changed the way we interact with financial services, leading to the rise of digital banking and the need for mobile banking applications. The banking industry is rapidly adapting to new technologies and evolving customer expectations, driving innovation in digital banking solutions.

In this article, we provide a comprehensive guide on how to start a banking app, considering SDK.finance software as a ready backend solution for banking and finance app development. Staying updated on market trends is crucial for developing competitive digital banking applications that meet the latest industry standards and customer demands.

Introduction to Digital Banking

Digital banking has fundamentally transformed the financial industry, offering individuals and businesses a faster, more convenient, and secure way to manage their money. With the widespread adoption of mobile banking apps, users can now access their accounts, pay bills, and conduct financial transactions from virtually anywhere, using just their mobile devices. This shift has prompted banks and financial institutions to prioritize mobile banking app development, investing in robust mobile banking software and innovative banking apps that cater to evolving customer expectations.

Developing a mobile banking application is not just about creating a digital version of traditional banking services. It requires a deep understanding of the banking sector, strict adherence to financial regulations, and a keen awareness of user behavior. Successful mobile banking software development combines technical expertise with insights into how users interact with digital banking platforms, ensuring that every feature – from account management to secure online payments – delivers a seamless and reliable experience. As digital banking continues to grow, the demand for advanced mobile banking solutions and agile app development processes will only increase, shaping the future of the financial industry.

With pre-built backend, and backoffice for system management.

Learn moreBenefits of Digital Banking

The adoption of digital banking brings a host of benefits for both users and financial institutions. One of the most significant advantages is convenience – mobile banking apps allow users to perform financial transactions, check account balances, and review transaction history with just a few taps, eliminating the need to visit physical bank branch locations. This not only saves time but also provides users with 24/7 access to their finances, empowering them to make informed decisions based on real-time financial data.

Digital banking also introduces new features that enhance the overall banking experience. From personalized financial advice and budgeting tools to investment management and instant notifications, mobile banking app development has enabled banks to offer a wide range of services tailored to individual needs. Additionally, digital banking reduces operational costs for banks and supports sustainability by minimizing the reliance on paper and physical infrastructure. As a result, both users and financial institutions benefit from a more efficient, cost-effective, and environmentally friendly approach to managing money.

Understanding the basics on how to build a banking app

For companies developing apps for banks, it is critical to understand how to make a banking app efficiently, as the FinTech industry demands a high level of security, reliability, and compliance with regulatory standards (regulatory compliance).

With pre-built backend, and backoffice for system management.

Learn moreIdentifying key features and functionalities

Before you begin banking app development, it is important to determine the mobile banking app features and functions you want the mobile banking apps to offer, as essential mobile banking features significantly enhance user experience. Below are some key features you should consider, before developing online banking application:

- Account access and management

Allow users to create accounts, view balances, and access transaction histories.

- Account statements

Enable users to view and download account statements in real time, ensuring transparency and secure access to sensitive financial data.

- Fund transfers

Allow users to transfer money between their accounts, send money to other users, and make external transfers.

- Bill payments

Enable users to pay bills directly through the app, schedule recurring payments, and view payment history.

- Transaction notifications

Send real-time push notifications for account activities, such as deposits, withdrawals, and purchases, to enhance user engagement and security.

- Budgeting and expense tracking

Offer budgeting tools and expense categorization to help users manage their finances more effectively.

- Security features

Implement strong security measures, such as two-factor authentication (2FA), biometric authentication (fingerprint or facial recognition), and app lock.

- Customer support

Offer in-app customer support with live chat, help center access, or the ability to contact customer service representatives.

- Financial insights

Offer personalized financial insights and tips to help users make informed decisions, using your banking services.

- P2P Payments

Facilitate peer-to-peer payments between users within the mobile banking apps.

- Integrations

Integrate other financial services, payment gateways, or third-party applications to extend functionality.

- Business banking apps

Provide specialized features for enterprises, such as multi-user access, advanced payment processing, bulk transactions, and industry-specific solutions to enhance financial management and user experience for businesses.

Features and functionality should be tailored to the target audience and comply with relevant financial regulations to ensure a secure and seamless banking experience for users. Features that enhance customer engagement, such as personalized dashboards and real-time interactions, are crucial for user retention and satisfaction.

Therefore, developing a mobile banking application is a complex process that requires planning a deep understanding of both financial systems and security measures.

Regulations

The development of banking and FinTech apps is subject to numerous regulations to ensure the safety, security, and fair treatment of consumers and to maintain the stability and integrity of the financial system. Implementing secure authentication is essential for meeting regulatory compliance requirements, building customer trust, and ensuring the safety of digital banking operations.

If you’re wondering how to start a banking app, consider that regulations for banking and financial technology applications vary significantly depending on the country of operation. Each country has its own set of laws, regulations, and guidelines governing the financial industry to create a digital-only banking application.

Banking and FinTech banking mobile app development are subject to a few regulations found below.

GDPR

GDPR

The General Data Protection Regulation was introduced by the European Union in 2016. It applies to all companies that provide services to EU citizens. Even if you are an American company providing services in Europe, the regulations apply to you. GDPR is specifically designed to protect sensitive user data and ensure privacy for banking app users.

PCI DSS

PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards established to protect credit card data and ensure cardholder privacy during all transaction processes. It applies to all organizations, stores or businesses that handle, process, store or transmit credit card data, regardless of their size or the number of transactions they perform.

Read our comprehensive guide to P2P payment app development to explore how to create a mobile payment app that stands out.

SEPA

SEPA

The Single Euro Payments Area (SEPA) is a payments integration initiative that enables seamless transactions in euros between European Union (EU) countries and some other European countries. SEPA enables the standardization and simplification of euro payments so that cross-border transactions within the SEPA area are comparable to domestic payments.

PSD2

PSD2

Payment Services Directive Two pieces of legislation apply to all payments made in the European Economic Area and are designed to force payment service providers to improve customer authentication procedures.

KYC

Know Your Customer is the process of verifying the identity of customers, that is necessary if you want create a digital-only banking application. The main objective of the guidelines is to prevent criminal elements from using banks for money laundering activities.

Choosing the right technology stack

The technology stack encompasses various tools, programming languages, frameworks, and libraries used for banking mobile app development. Explore step-by-step how to build a banking app that provides users with secure access to their accounts and a wide range of banking services.

After considering the differences between Android and iOS backend requirements, it’s important to note that native app development offers significant advantages for banking applications, such as enhanced security, better performance, and a more seamless user experience compared to cross-platform solutions.

With pre-built backend, and backoffice for system management.

Learn moreDeveloping the backend infrastructure

In the world of mobile banking software development, the backend is the backbone of any banking application, handling data storage, processing, and business logic. Ensuring seamless integration with existing banking systems is crucial for secure, regulatory-compliant, and efficient connections between various online banking platforms and core banking infrastructure. Choosing the right technology stack is a critical decision that directly impacts the scalability, security, and performance of the mobile banking application.

For instance, in the context of android banking app development, the choice of backend technologies differs significantly from development on the iOS platform. This variance arises from the different requirements and programming languages associated with each operating system: Android mainly uses Java or Kotlin, while iOS relies on Swift or Objective-C.

The backend infrastructure must also support complex financial operations, such as cash flow management and treasury activities, to meet the needs of businesses with extensive financial processes.

Benefits of using a ready backend solution to create a digital-only banking application

While building a backend from scratch can be time-consuming and resource-intensive, opting for a ready backend solution – offered as a comprehensive financial software platform – offers numerous advantages for developing future-ready banking apps.

First, it speeds up the mobile banking app development process and significantly reduces time to market. If you are confused about how to create a mobile banking app, the best option is to choose the FinTech software provider to save time and resources.

Secondly, ready solutions often come with pre-built features and functionality, so banking app developers do not have to reinvent the wheel and can focus on customizing the solution to meet specific requirements.

Financial companies that are looking at how to create a banking solution, must consider that a pre-developed software provides higher data protection options, using a security by design principles. Therefore, a proven back-end solution can offer enhanced security, reliability, and scalability because it has undergone extensive testing and improvements over time.

Overview of SDK.finance software as a backend solution

SDK.finance is a flexible FinTech software that serves as a powerful backend solution for banking app development. As a development company specializing in secure and scalable banking app solutions, SDK.finance provides expertise and end-to-end support for financial institutions seeking to launch compliant and innovative digital banking products. It offers a wide range of functionalities and tools designed to streamline the creation of modern, secure, and feature-rich financial technology applications.

With SDK.finance, developers can significantly accelerate the process of developing apps for banking applications, ensuring a robust foundation for building cutting-edge solutions that meet the evolving needs of today’s tech-savvy banking customers.

Key features and capabilities of SDK.finance

SDK.finance offers a wide range of key features and capabilities that make it a robust backend solution for banking app development. Below we present the main features:

- Customer onboarding

The banking platform supports remote account setup and enables integration with Know Your Customer (KYC) tools, simplifying the onboarding process for customers.

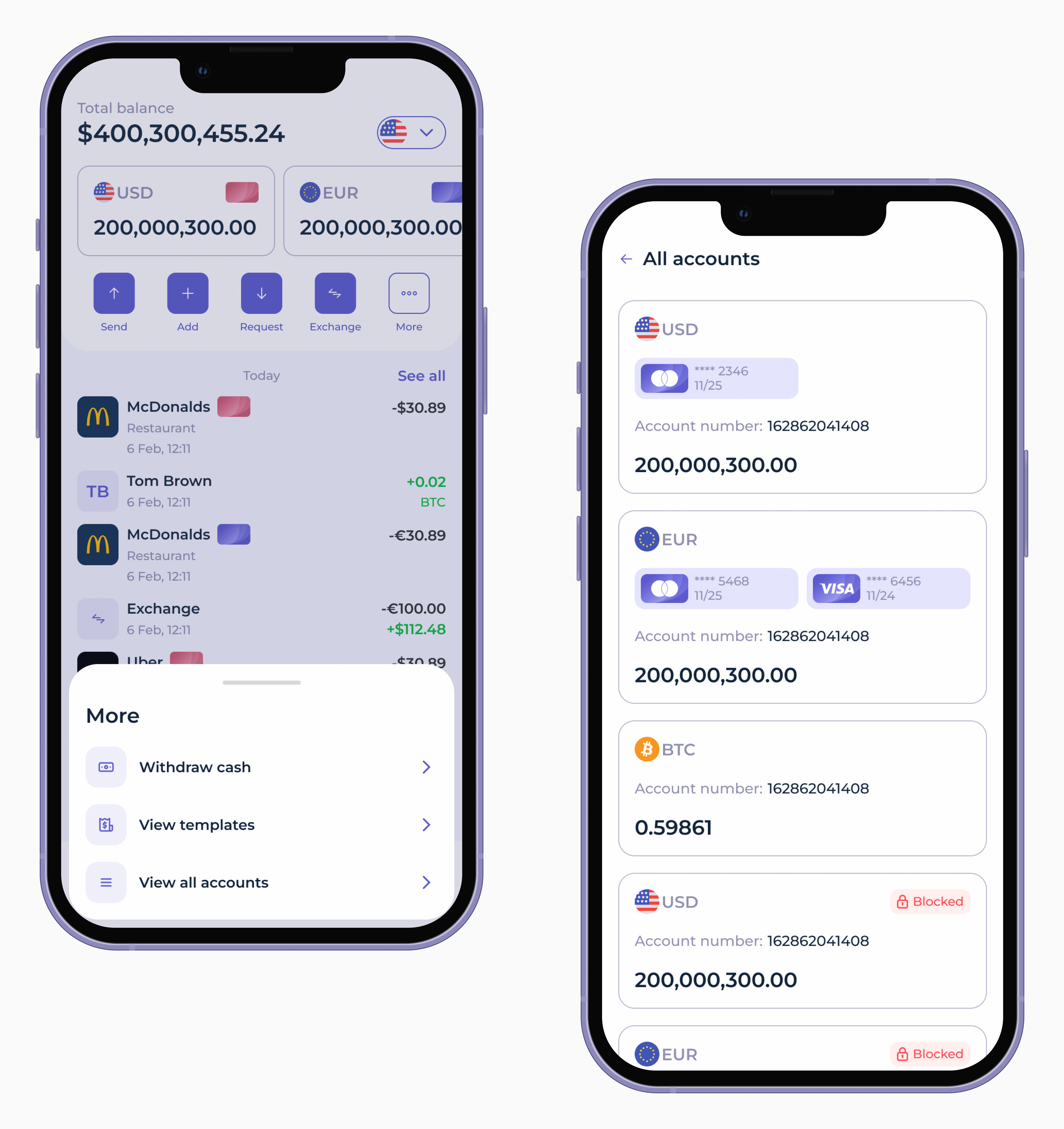

- Multi-currency accounts

The platform supports accounts in multiple currencies, allowing users to hold and manage funds in different currencies within a single account.

- Spending visualization

The SDK.finance system provides tools to categorize users’ expenses and display them in visually appealing charts. Users can also view transaction locations on a map.

- P2P money transfers

The mobile banking solution enables fast and secure peer-to-peer money transfers, allowing users to effortlessly send money to friends and family.

- Scalability and adaptability

The FinTech system is designed to scale and accommodate the growth and increasing transaction volumes of banking apps. It is also highly customizable, allowing developers to tailor the solution to their specific needs.

- Role and permissions management

The software makes it easy to manage team access to the backend by adjusting the permissions of preconfigured roles or creating new ones, increasing security and control, that is essential for mobile banking software development.

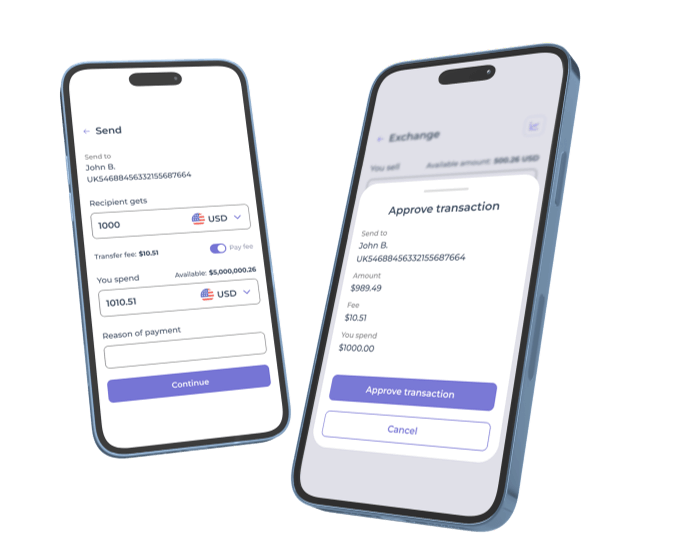

Watch the SDK.finance mobile app UI of our Platform, designed to empower you to create secure and feature-rich financial experiences in record time:

How does SDK.finance simplify the digital banking app development?

SDK.finance simplifies backend development by providing a ready-made infrastructure that covers essential finance functions. Developers can leverage the flexible APIs and customizable features to tailor the backend to specific business needs.

This significantly reduces development time and effort, allowing the team to focus on developing unique front-end experiences and other value-added features. The scalability and reliability of the solution ensures smooth performance even with high transaction volumes, providing businesses and their customers with a reliable and best-in-class financial technology solution.

Post-launch support is available to maintain, update, and continuously improve the app after deployment. User feedback is actively incorporated to guide future improvements and feature development, ensuring the banking app evolves to meet user needs and industry standards.

How how to build a banking app?

A user-friendly bank UI must be intuitive, easy to navigate, and visually appealing. Prioritizing customer experience is essential for successful banking app development, as it enhances user engagement, streamlines interactions, and fosters customer loyalty. They prioritize ease of use and make it easy for customers to access their accounts, manage their finances, and conduct transactions. Here are some examples of banks with user-friendly UIs for digital banking app development:

Revolut UI/UX design

Revolut UI banking apps have modern and visually appealing designs. It features a customizable dashboard that allows users to rearrange sections based on their preferences. The app offers instant spending notifications, budgeting tools, and real-time exchange rates for currency conversion.

Source: Revolut

Monzo UI/UX design

Monzo’s UI emphasizes transparency and ease of use in mobile banking app development. It categorizes transactions with colored icons, and the overview page shows spending trends at a glance. The search function and transaction descriptions make it easy for users to find specific transactions, and especially important for digital banking app development.

Source: Monzo

N26’s UI/UX design

Developing smartphone banking apps is a multi-faceted endeavor that requires attention to detail and a comprehensive understanding of financial technology. For example, N26’s UI is sleek and user-friendly in mobile banking development. It provides quick access to account balances, recent transactions and spending analysis. The “Spaces” function allows users to easily set aside money for specific purposes.

Integrations with third-party providers

Third-party integrations are essential to improve the functionality and convenience in mobile banking application development. Once the banking application is developed, third-party services must be integrated into the digital-only banking application.

Third-party solutions enrich your mobile banking application with external features without the need to build it from scratch. For example, you may need the following services:

- Payment gateways

- Local providers

- Push notification services

- Analytics and reports

For example, integrate with local service providers such as broadband providers, energy suppliers, telecom companies, and other popular services to enable bill payments directly from the banking app. This gives users a centralized platform to manage and pay their bills.

Integration with third-party services can be complex, especially for digital banking app development, as it requires working with external APIs and ensuring the app is properly configured to communicate with these services. However, experienced mobile banking software developers evaluate the available options and select the banking services that best meet the needs of the mobile banking application and its users. In addition, ensuring the security of the app and the confidentiality of data when communicating with third-party providers is crucial.

With pre-built backend, and backoffice for system management.

Learn morePersonal Financial Management Tools

Personal financial management tools have become a cornerstone of modern mobile banking apps, providing users with the resources they need to take control of their financial well-being. These tools are designed to help users track their spending, set budgets, and monitor progress toward their financial goals—all within the convenience of their preferred banking apps. By integrating personal financial management features, banks and financial institutions can offer a more comprehensive and engaging mobile banking experience, encouraging users to develop healthy financial habits and make smarter financial decisions.

Budgeting and Expense Tracking

Budgeting and expense tracking are essential components of personal financial management within mobile banking apps. These features allow users to categorize their income and expenses, visualize spending patterns, and identify opportunities to save. Advanced analytics and machine learning algorithms can further enhance these tools by providing personalized insights, such as spending trends, alerts for unusual activity, and tailored recommendations for optimizing budgets. By leveraging these capabilities, mobile banking apps empower users to stay on top of their finances and achieve greater financial stability.

Investment and Wealth Management

In addition to budgeting, mobile banking apps are increasingly offering investment and wealth management services as part of their personal financial management suite. Users can access a variety of investment products—such as stocks, bonds, and mutual funds—directly from their banking apps, track the performance of their portfolios, and receive personalized investment advice based on their financial goals and risk tolerance. Some apps also provide wealth management features like retirement planning and estate management, giving users a holistic view of their financial future. By integrating these advanced features, financial institutions can deliver a seamless and comprehensive financial management solution that meets the diverse needs of their customers.

Integrations with third-party providers

Third-party integrations are essential to improve the functionality and convenience in mobile banking application development. Once the banking application is developed, third-party services must be integrated into the digital-only banking application. Global banks, in particular, require robust integration capabilities to support international operations and meet the demands of multiple markets.

Third-party solutions enrich your mobile banking application with external features without the need to build it from scratch. For example, you may need the following services:

- Payment gateways

- Local providers

- Push notification services

- Analytics and reports

For example, integrate with local service providers such as broadband providers, energy suppliers, telecom companies, and other popular services to enable bill payments directly from the banking app. This gives users a centralized platform to manage and pay their bills.

Integration with third-party services can be complex, especially for digital banking app development, as it requires working with external APIs and ensuring the app is properly configured to communicate with these services. However, experienced mobile banking software developers evaluate the available options and select the banking services that best meet the needs of the mobile banking application and its users. In addition, ensuring the security of the app and the confidentiality of data when communicating with third-party providers is crucial. Bank representatives play a key role in monitoring third-party integrations for security and compliance, helping to prevent fraud and maintain customer trust.

With pre-built backend, and backoffice for system management.

Learn moreDeploying and launching the mobile banking application

The deployment and implementation of a banking application is a critical phase that requires careful planning and attention to detail, if you are going to create a digital-only banking application. During deployment, it is essential to ensure the protection of sensitive data, as robust data security measures are crucial for regulatory compliance and building user trust.

This process includes the following steps: final testing and quality assurance, infrastructure setup and hosting, regular updates and enhancements of banking apps. Additionally, implementing predictive analytics at this stage can enhance app functionality by enabling features such as assessing creditworthiness and offering personalized financial products. By carefully following these steps, financial institutions can deliver a secure, user-friendly, and feature-rich banking application that fosters user trust and loyalty.

How much does it cost to develop a banking app?

The banking app development cost can vary significantly, depending on a number of key cost factors. These include the complexity of the app, the features and functionality it offers, the platform it is being developed for (iOS, Android, or web), the location and experience of the development team, and the time required for development. Understanding these key cost factors early in the project is essential for effective budgeting and accurate estimation of expenses for mobile banking applications.

In general, developing full-featured banking apps from scratch can be a significant investment. The cost can range from tens of thousands to hundreds of thousands of dollars, and even higher for highly complex and customized solutions.

How long does it take to build a banking app?

The time required to build the banking apps can vary based on multiple factors, including the complexity of the app, the number of features, the development team’s expertise, and the development approach. However, you can speed up the development process by using mobile banking app development services.

Conclusion

The potential of digital-only banking applications is boundless, offering a transformative and efficient way for users to manage their finances. By using the capabilities of SDK.finance white-label banking software as a ready backend solution, you can significantly speed up the banking apps development process and enhance the app’s functionality.

With pre-built backend, and backoffice for system management.

Learn more