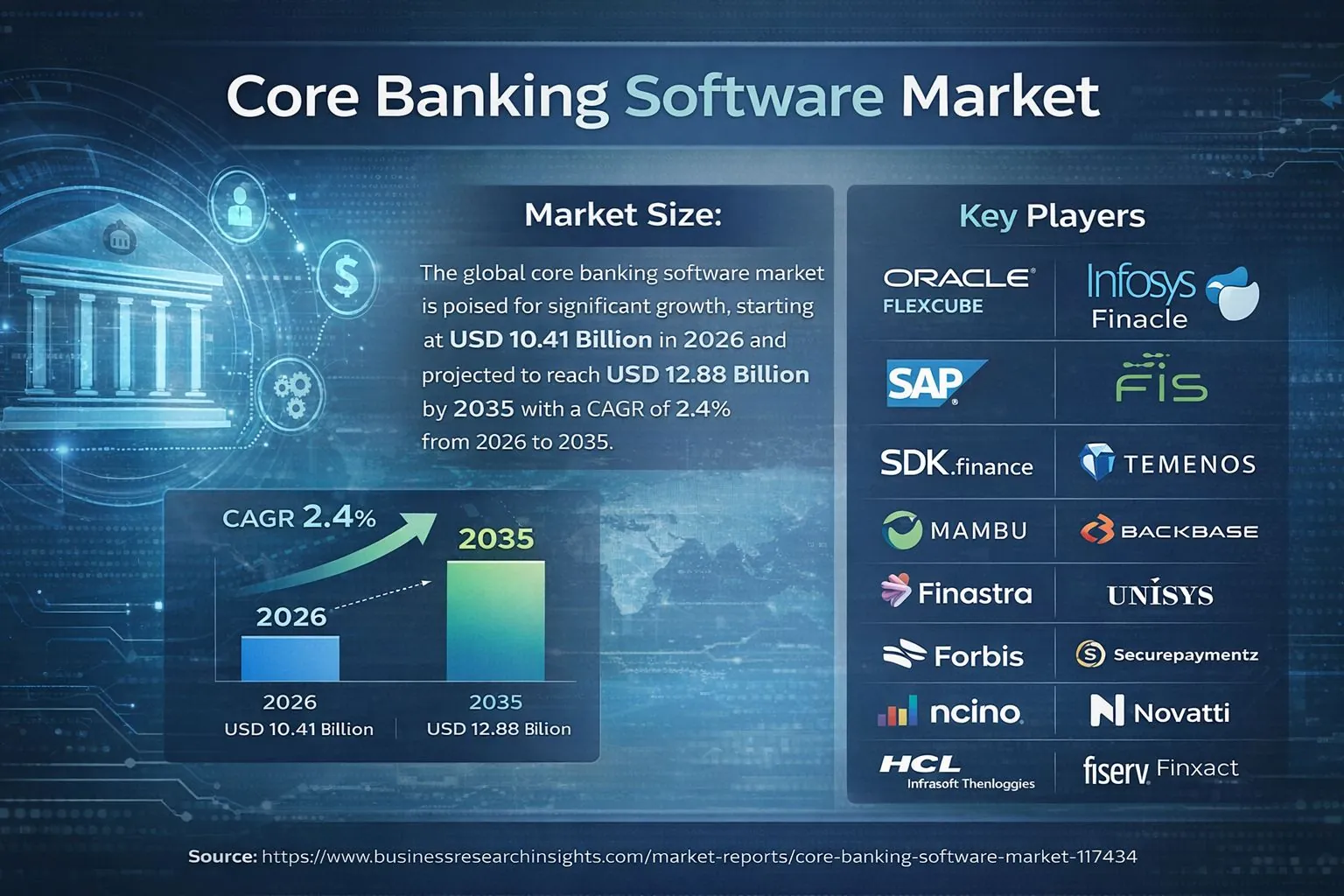

The banking landscape is undergoing a massive structural shift. According to the latest Business Research Insights report, “Core Banking Software Market 2026–2035: Trends, Growth and Key Vendors,” we are witnessing a transition from frantic experimentation to a phase of “steady-state transformation.”

The data tells a compelling story: the global market is projected to climb from USD 10.41 billion in 2026 to a staggering USD 12.88 billion by 2035. While the 2.4% CAGR indicates stability, the underlying technology stack is being completely rewritten.

What’s Really Happening Behind the Scenes?

The report highlights several critical friction points and catalysts currently defining the strategies of major financial institutions:

-

Cloud is the New Baseline: Cloud-based solutions now hold a 62% market share. Banks are finally moving past “on-premise” security fears in favor of the agility required to compete with BigTech.

-

The Legacy Anchor: Despite the rush to digitize, 42% of institutions are still struggling with “legacy gravity”—the difficulty of syncing modern, fast-moving front-ends with rigid, decades-old core systems.

-

AI Beyond the Hype: Roughly 58% of banks are now prioritizing AI-integrated cores, not just for chatbots, but for high-stakes automation in compliance and predictive risk analytics.

-

The Microservices Pivot: Nearly half of the market leaders (47%) have migrated to microservices-based architectures, allowing them to swap or update specific banking functions without risking a total system blackout.

Key Core Banking Players Driving Innovation

The competitive landscape is a mix of long-standing giants and agile newcomers. According to the research, the following companies are the primary drivers of innovation in the core banking space:

Oracle, Infosys, SAP SE, FIS, SDK.finance, Temenos Group, Mambu, Backbase, Finastra, Tata Consultancy Services, Unisys, Forbis, Securepaymentz, nCino, Novatti Group (ASX: NOV), Bricknode, HCL Technologies, Infrasoft Technologies Ltd, Fiserv, Jack Henry & Associates.

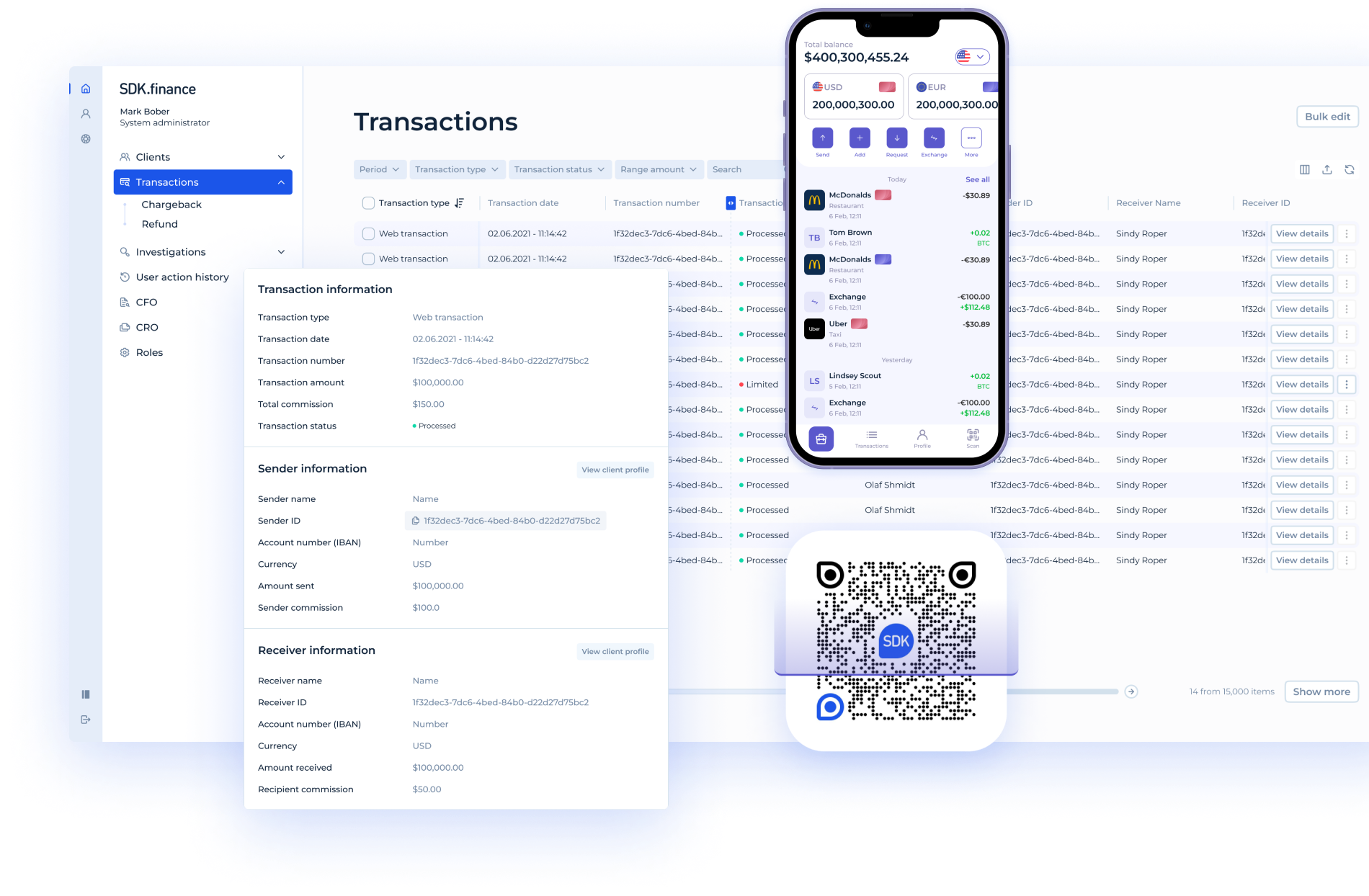

SDK.finance in the Global Vendor Spotlight: A Market Signal

One of the most notable takeaways from the Business Research Insights report is the recognition of SDK.finance as a key global vendor. Being positioned alongside industry veterans like Oracle, SAP, and Temenos is more than just a milestone – it reflects a market-wide shift toward modularity and source code control.

We recently explored what this means for the industry in our article on how SDK.finance was recognized as a top core banking provider in the 2026 market research.

Why is SDK.finance gaining traction against “traditional” giants?

-

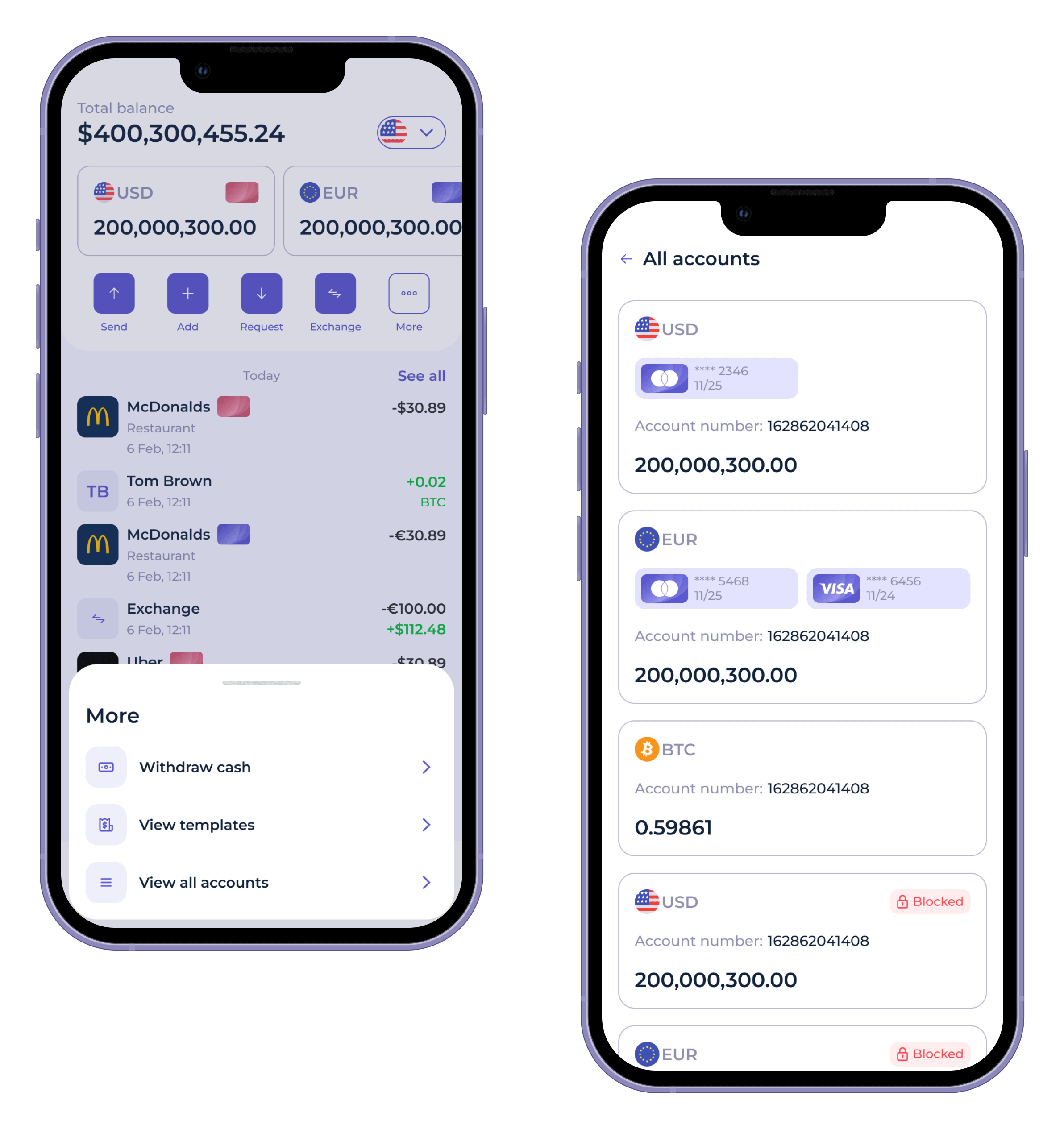

Breaking the Legacy Paradox: While 42% of the market feels “stuck,” SDK.finance’s API-first architecture allows banks to layer modern digital experiences on top of any existing base without a “rip-and-replace” nightmare.

-

Escaping Vendor Lock-in: With 55% of the market controlled by five major vendors, SDK.finance offers a strategic alternative: source code availability. This gives banks the freedom to own their tech roadmap rather than being at the mercy of a vendor’s update cycle.

-

Built for Massive Scale: Engineered to handle billions of transactions annually, the platform aligns perfectly with the report’s forecast for high-volume, cloud-native banking through 2035.

The Bottom Line

According to Business Research Insights, core banking is no longer a back-office necessity; it is a strategic growth engine. Banks that lean into cloud migration, AI-readiness, and modularity will secure the largest slice of the $12.88 billion market over the next decade.