Launching a payment service provider in 2026 requires far more than connecting to a card processor. PSP founders and payment service providers are expected to operate regulated, scalable payment infrastructures that support multiple acquirers, deliver full financial transparency, and adapt quickly to new markets and payment methods. As a result, white-label payment gateway software has become a foundational infrastructure choice and a core component of a modern payment platform, rather than a tactical integration.

White label payment solutions represent a broader category of turnkey, customizable payment processing options that allow businesses to rebrand and resell payment services under their own branding. A payment gateway works by securely processing transactions, routing payment data between customers, merchants, and banks, and returning transaction responses – all while enabling seamless integration and customization.

This article explains why white-label payment gateways matter today, how they enable offering online payment services under your own brand, outlines what defines an ideal provider in 2026, highlights the leading platforms on the market, and provides a practical framework for choosing the right solution. It is intended for PSP founders, payment professionals, and businesses evaluating payment infrastructure options.

Market Context and 2026 Statistics

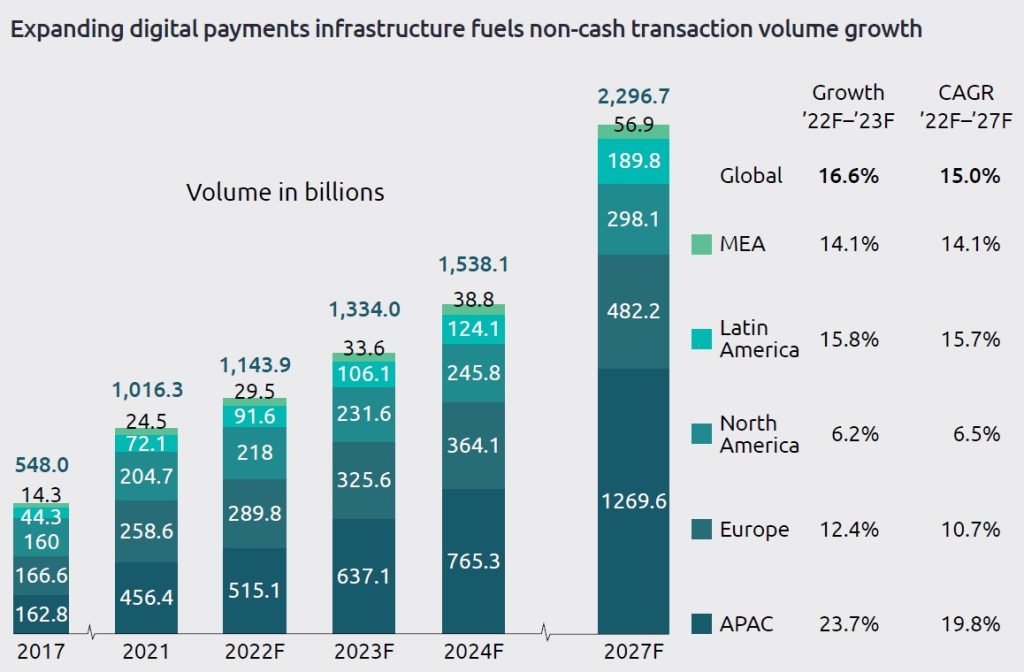

The relevance of white-label payment gateways is closely tied to how fast and how broadly digital payments continue to grow.

By the end of 2025, global non-cash payment volumes exceeded 1.6 trillion transactions, driven by e-commerce, marketplaces, subscription services, and embedded finance. Card payments remain dominant in value, while account-to-account payments and digital wallets continue to grow rapidly in volume, especially across Europe, Asia, and emerging markets.

Several structural trends define the PSP landscape as of 2026:

- Cross-border e-commerce continues to grow at double-digit rates year over year. Supporting multiple currencies and robust multi currency support is essential for international transactions, enabling businesses to tailor the payment experience and meet the needs of global customers.

- Regulators require stronger transaction traceability, auditability, and reporting.

- Merchants expect faster onboarding, near real-time settlement visibility, and a wide range of payment options to cater to diverse customer preferences.

- PSPs increasingly work with multiple acquiring banks to optimise transaction approval rates and costs.

These dynamics make it difficult for new PSPs to rely on closed or rigid payment stacks. White-label payment gateway providers address this gap by offering adaptable infrastructure that separates technology from licensing and acquiring relationships.

What Is a White-Label Payment Gateway?

A white-label payment gateway is backend payment software that allows a business to operate payment services under its own brand while retaining control over transaction logic, merchant relationships, and commercial terms.

A mature white-label gateway typically includes:

- Payment initiation and routing, supporting various payment methods for enhanced flexibility.

- Transaction lifecycle management from authorisation to settlement.

- Fee, commission, and interchange representation.

- Merchant onboarding and configuration tools.

- Merchant portal for transaction management and analytics.

- Reconciliation, reporting, and audit trails.

- APIs for integration with acquirers, banks, fraud tools, and KYC providers.

These platforms also enable management of payment flows and ensure secure handling of payment details and payment information throughout the transaction process.

The gateway provider supplies the technology. The PSP remains the regulated entity or partners with licensed institutions. Some businesses may also act as a payment facilitator, streamlining merchant onboarding and payment processing by aggregating merchants under their own master account. It is important to note that a payment gateway facilitates the secure transmission of payment information, while a payment processor handles the actual transaction processing – both are essential components of the payment ecosystem. This separation is critical for building an independent and scalable payment business.

What Types of Businesses Use White-Label Payment Gateways

White-label payment gateways are used by businesses that treat payments as a core capability, not a secondary feature. While use cases differ, the common goal is control over payment flows, branding, and long-term scalability without building infrastructure from scratch.

Payment Service Providers (PSPs) and Payment Facilitators

PSPs use white-label gateways to onboard merchants, connect multiple acquirers, manage transaction flows, and meet regulatory requirements under their own brand.

Fintech Companies and EMIs

Fintechs and EMIs embed white-label gateways into wallets, accounts, and card products to control payment logic, support multi-currency flows, and maintain audit-ready transaction records.

Marketplaces and Platform Businesses

Marketplaces rely on white-label gateways to handle split payments, commissions, payouts, and multi-seller setups while keeping the payment experience fully branded.

SaaS Companies Monetising Payments

SaaS providers use white-label gateways to support subscriptions, recurring billing, and usage-based pricing while retaining control over fees and margins.

Enterprises Building Internal Payment Capabilities

Enterprises adopt white-label gateways to centralise payments, reduce dependency on multiple processors, and support custom payment flows across regions.

Regional and Niche Payment Providers

Regional PSPs and niche providers use white-label gateways to launch faster, support local payment methods, and adapt quickly to regulatory or market changes.

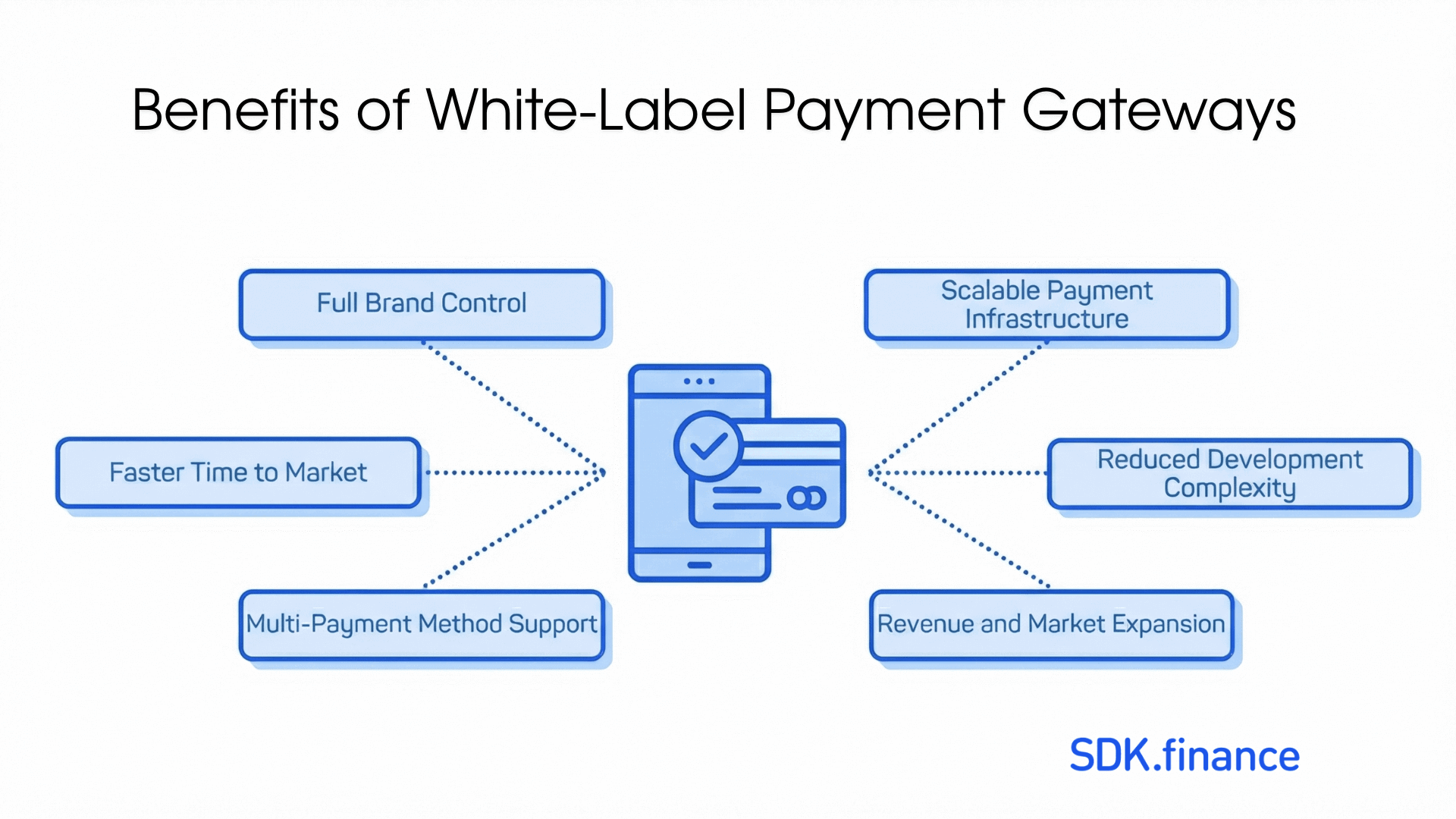

Benefits of White-Label Payment Gateways

White-label payment gateways deliver a host of advantages for businesses aiming to offer seamless, secure, and scalable payment services under their own brand. By leveraging a white-label payment solution, companies can maintain full control over the payment experience and reinforce their brand identity at every customer touchpoint, significantly enhancing the overall customer experience. This approach allows businesses to quickly adapt to evolving market demands without the burden of building and maintaining complex payment infrastructure from scratch.

A key benefit is the ability to support multiple payment methods-including credit cards, digital wallets, bank transfers, and alternative payments-enabling businesses to cater to diverse customer preferences and expand into new markets. This flexibility not only enhances the overall payment experience but also helps increase revenue streams by capturing a broader audience. With a white-label payment gateway, businesses can focus on their core competencies while offering a robust, secure, and fully branded payment process that drives customer loyalty, customer retention, and business growth. Ultimately, implementing a white-label payment gateway leads to better customer retention by fostering loyalty and satisfaction through a seamless and personalized payment experience.

What Defines an Ideal White-Label Payment Gateway Provider in 2026

In 2026, the strongest white-label payment gateway providers share several structural characteristics:

- They are infrastructure-first, not feature-first. The system is built around a transaction and accounting core where every payment event is recorded as a financial movement. Balances, settlements, and reports are derived from these records, ensuring consistency and auditability.

- They maintain a clear separation between software and regulation. The provider delivers PCI DSS-compliant software but does not act as the licensed PSP, process funds, or own merchant relationships. This gives clients flexibility across jurisdictions and licensing models. Robust security measures such as data encryption, tokenization, and access control are implemented to protect sensitive information and safeguard confidential payment and user data.

- True white-label capability is built into the platform. Branding, workflows, reporting, and operational logic can be configured so the payment service appears fully proprietary to merchants and end users. Providers should enable deep customization to address specific business requirements and business processes, allowing organizations to scale and adapt the solution as their operations evolve. This flexibility supports the optimization of billing, cash flow management, and strategic decision-making.

- Ideal providers support multiple deployment models, typically SaaS or PaaS for speed, and source code licensing for organisations that require full ownership, customisation, or on-premise deployment. For SaaS or PaaS models, minimizing technical maintenance for clients is essential to reduce operational overhead. PCI DSS Level 1 compliance is treated as a baseline requirement, not a differentiator.

In-House Development vs. White-Label Software

When considering how to manage payments, businesses often weigh the pros and cons of in-house development versus adopting a white-label payment solution. Building an in-house payment gateway is a significant investment, requiring extensive technical expertise, ongoing maintenance, and a dedicated team to ensure compliance and security. This process can be time-consuming and diverts resources away from core business activities, making it a challenging path for many organizations.

In contrast, white-label payment software offers a turnkey solution that can be rapidly deployed and easily integrated with existing systems. Providers like SDK.finance deliver advanced fraud prevention tools, support for multiple payment methods, and a secure, scalable platform -eliminating the need for businesses to develop these capabilities internally.

By leveraging white label merchant services, businesses can quickly enter the payment processing market, expand their service offerings, and generate new revenue streams without significant development or compliance costs. By choosing a white-label payment gateway, companies can avoid the complexities and costs of in-house development, reduce time to market, and rely on proven technology to process payments efficiently and securely. This allows businesses to focus on growth and innovation, while payment experts handle the intricacies of payment processing and fraud prevention.

Top White-Label Payment Gateway Providers in 2026

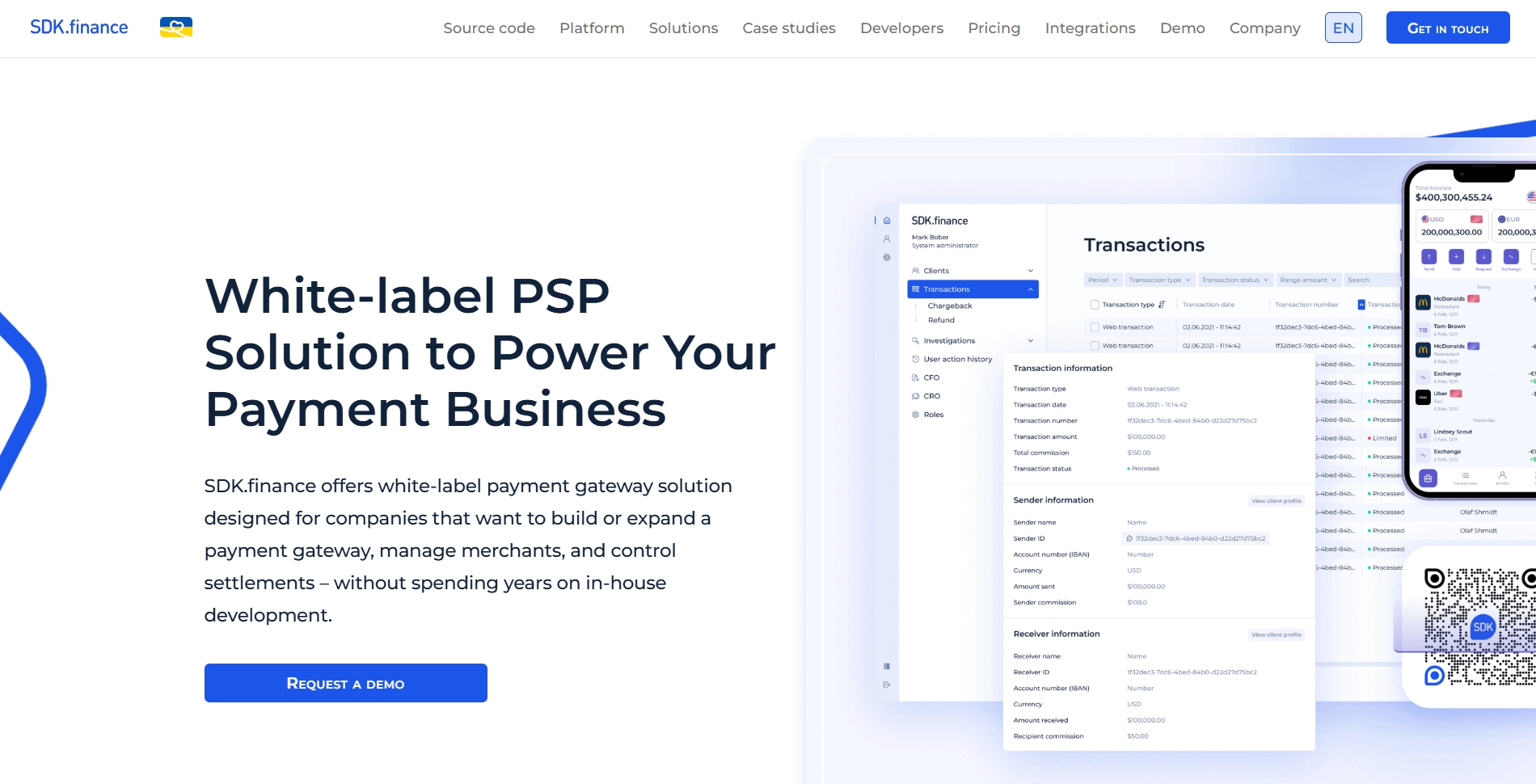

SDK.finance

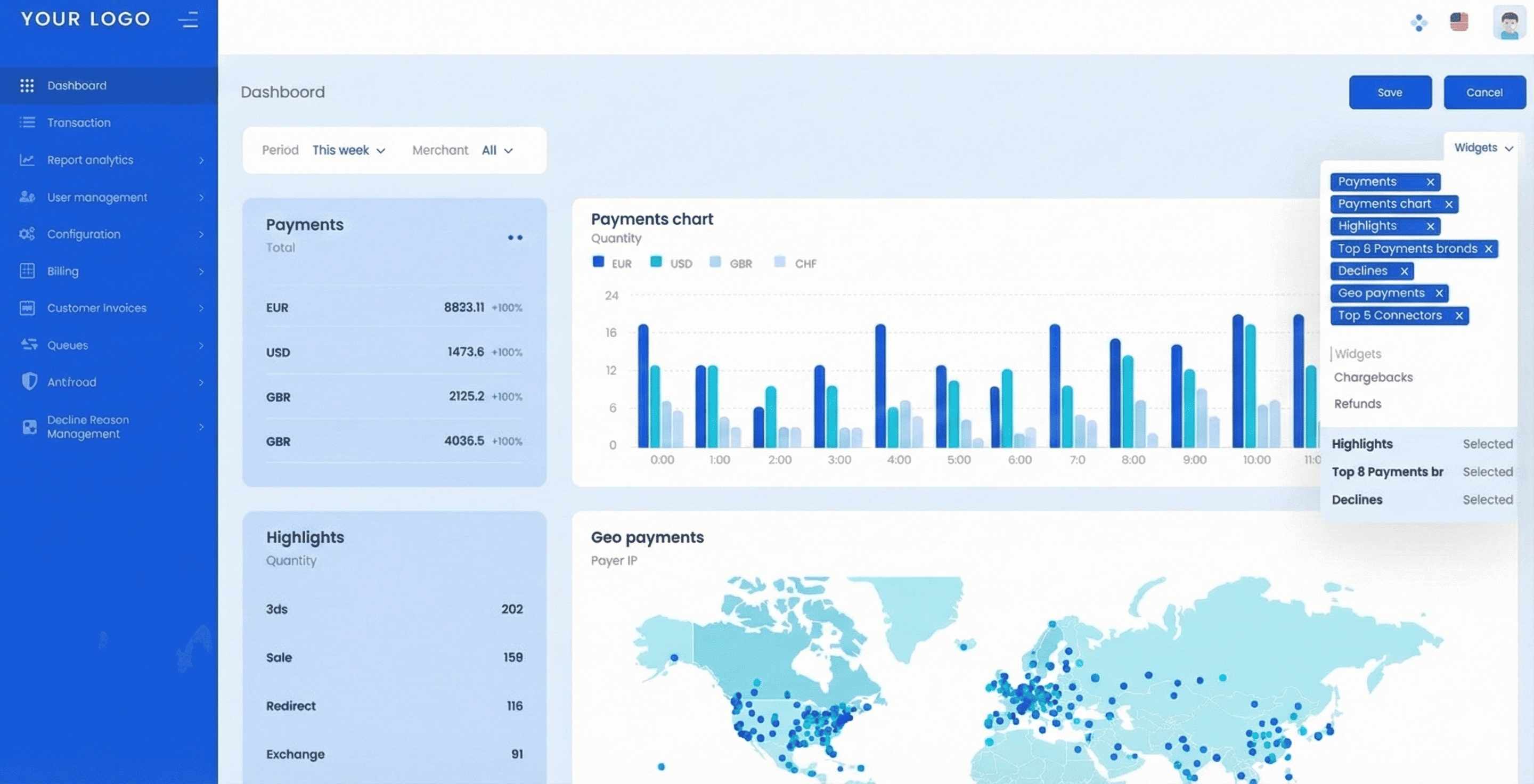

SDK.finance is designed for PSP founders who want to build a payment business with full control over infrastructure, economics, and future growth. Instead of offering a limited gateway layer, SDK.finance provides a white-label payment foundation that lets you define how payments work end to end. This is especially important if your roadmap includes multiple acquirers, cross-border expansion, or positioning payments as a core revenue stream rather than an auxiliary feature.

From a best-practice perspective, the platform covers the critical building blocks required to operate a serious payment service provider:

- flexible delivery models, including SaaS for faster launch and source code licence for full ownership and customisation.

- PCI DSS Level 1 compliance embedded as a baseline security standard, enhancing security for clients and ensuring safer payment processing.

- clear transaction traceability with full audit trails suitable for regulated environments.

- role-based backoffice access for finance, risk, and compliance teams.

- support for integrating your own acquiring banks, payment methods, and compliance partners.

What typically convinces PSP founders to engage is the long-term perspective. SDK.finance allows you to start with what you need today and scale without re-platforming as your volumes, regions, and regulatory complexity increase. You retain control over:

- transaction flows, fees, and settlement logic.

- reporting, reconciliation, and financial transparency.

- architectural decisions as your PSP evolves. This approach reduces dependency on third-party constraints, makes the business more attractive to partners and investors, and gives you confidence that the platform will support your PSP not only at launch, but years down the line.

To better understand how the merchant portal and payment workflows look in practice, a short product walkthrough video can be added here to demonstrate the end-to-end PSP and merchant experience:

Corefy

Corefy positions itself as a payment orchestration and white-label gateway layer that connects multiple PSPs, acquirers, payment processors, payment methods, and third-party services such as accounting software through a unified API.

It is commonly used by:

- PSPs that need flexibility in adding or switching payment providers,

- platforms operating across multiple regions,

- teams that prefer to assemble their own accounting or settlement stack.

Corefy’s strength lies in orchestration and routing, while ledger-level accounting is typically handled externally or via integrations.

Akurateco

Akurateco focuses on advanced payment routing and transaction orchestration. It ensures secure handling and routing of transaction information, optimizing approval rates by efficiently transmitting transaction data through financial networks for authorization.

It is often chosen by:

- PSPs operating high transaction volumes,

- businesses working with multiple acquirers and alternative payment methods,

- teams that already have dedicated financial accounting systems.

Decta

Decta combines payment gateway functionality with acquiring and card processing services, primarily within Europe. Financial institutions can leverage Decta’s bundled services to expand their payment offerings, strengthen their market position, and enhance customer loyalty by providing branded payment solutions.

This approach appeals to:

- card-centric PSPs targeting EU markets,

- businesses seeking a bundled gateway and acquiring setup,

- teams aiming to reduce initial integration complexity.

The trade-off is reduced flexibility when expanding beyond Decta’s acquiring footprint.

Adyen

Adyen delivers enterprise-grade payment infrastructure with global acquiring capabilities and direct connections to card schemes.

It is typically chosen by:

- large enterprises with significant transaction volumes,

- global merchants requiring unified commerce,

- organisations aligned with Adyen’s operational and commercial model.

Adyen is less commonly used as a foundation for early-stage PSPs building independent payment brands. Infrastructure costs can be a key consideration for businesses evaluating Adyen, as its enterprise-grade solution may involve higher expenses compared to white label payment gateway platforms that bundle infrastructure costs into transparent pricing models.

Comparison Table: Best White-Label Payment Gateway Providers 2026

| Key Factor | SDK.finance | Corefy | Akurateco | Decta | Adyen |

|---|---|---|---|---|---|

| Business Model Alignment | Built for PSPs, EMIs, and payment-led businesses. Supports sub-merchant models, multi-acquirer setups, and complex settlement logic. | Strong fit for PSPs and platforms focused on orchestration rather than a full PSP core. | Suited for high-volume PSPs and merchants prioritising routing and approval optimisation. | Best for EU-focused, card-centric PSPs seeking bundled acquiring. | Designed for large enterprises and global merchants rather than new PSPs. |

| Security & Compliance | PCI DSS Level 1. Strong audit trails, transaction traceability, and role-based access suitable for regulated environments. | PCI-compliant infrastructure. Compliance depth depends on surrounding systems. | PCI DSS compliant with advanced routing and fraud controls. | PCI DSS compliant with acquiring-grade security. | Enterprise-grade security and global compliance frameworks. |

| Customisation & Branding | Deep white-label control over flows, dashboards, reporting, and operational logic. Modular architecture. | Good branding and flow customisation at gateway level. Limited backoffice control. | Checkout and routing-level customisation. Limited financial backoffice flexibility. | Moderate branding and configuration flexibility. | Limited white-label flexibility within a platform-led model. |

| Supported Payment Methods | Cards, bank transfers, multi-currency processing. Additional methods integrated via partners. | Broad coverage through connected PSPs and payment providers. | Cards and alternative payment methods via integrations. | Primarily card payments. Limited alternative methods. | Wide global payment method coverage. |

| Integration Capabilities | API-first platform with extensive endpoints. Built for integration with acquirers, banks, KYC, and fraud providers. | Unified API layer for connecting multiple PSPs and acquirers. Strong orchestration tooling. | Mature routing engine, APIs, and provider connectors. | Standard APIs, tightly coupled with Decta acquiring services. | Direct scheme connections and enterprise-grade integrations. |

Key Factors to Consider When Choosing a White-Label Payment Gateway

When comparing providers, PSP founders typically evaluate:

1. Business model alignment

- support for e-commerce, SaaS, marketplaces, or payment facilitation,

- sub-merchant onboarding and transaction control where required, with some providers enabling onboarding and configuration in just a few clicks to streamline setup,

- readiness for volume and geographic expansion.

2. Security and compliance

- PCI DSS Level 1 compliance,

- built-in fraud controls and configurable risk rules,

- GDPR and regional regulatory support,

- assessment of whether a financial license is required for operating payment services in your target jurisdictions.

3. Customisation and branding

- control over checkout flows and dashboards,

- customizable dashboards for tailoring the user experience,

- configurable reporting and workflows,

- branded communication templates.

4. Supported payment methods

- card networks as a baseline,

- digital wallets, bank transfers, BNPL, and local methods,

- online transactions support for e-commerce and digital businesses,

- multi-currency processing and localisation.

5. Integration capabilities

- well-documented REST APIs and webhooks,

- sandbox environments and developer tools,

- pre-built integrations for common platforms,

- seamless integration with third-party services such as CRM systems, analytics platforms, and security tools.

6. Cost structure and transparency

- clear setup, subscription, and transaction pricing,

- transparent fee and commission reporting.

Final Thoughts

In 2026, white-label payment gateways define how a PSP operates, scales, and withstands regulatory and commercial pressure. The right platform supports transparency, flexibility, and long-term growth rather than just rapid market entry.

If you are evaluating white-label payment gateway software with the goal of building a sustainable payment business, SDK.finance offers an infrastructure approach aligned with modern PSP best practices.

To explore whether it fits your business model, start a conversation here.