White-label digital banking software to cut time-to-market

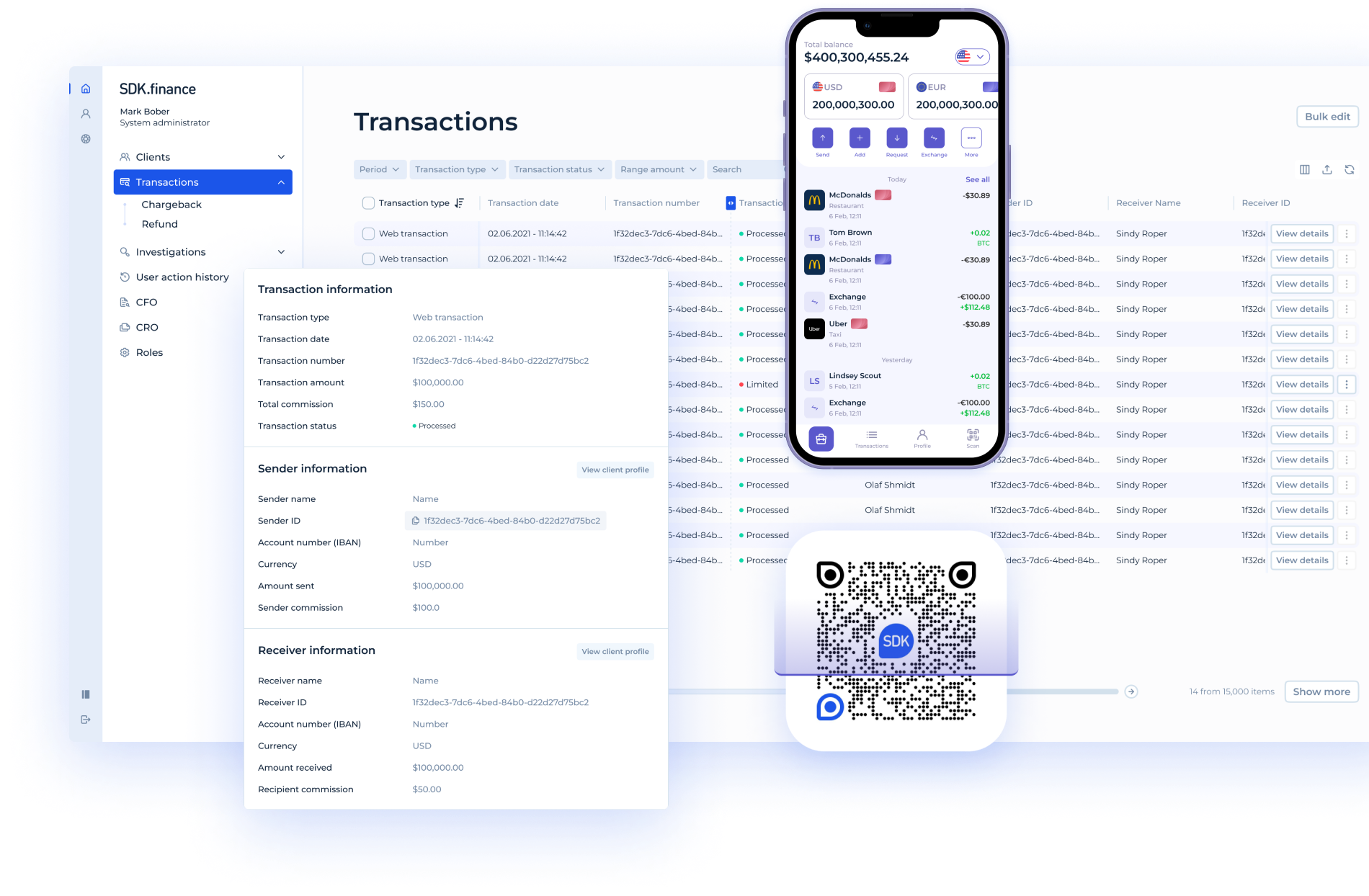

SDK.finance digital banking software provides everything you need to launch a digital bank: a robust core banking engine, pre-built mobile banking app and web interfaces, PCI DSS and ISO-certified infrastructure

Request a demoAll-in-one digital banking features for your product

From client onboarding and KYC to multi-currency accounts, transfers, card issuing, and compliance – SDK.finance provides a complete banking core with 470+ APIs for integration and future growth

Out-of-the-box functionality to accelerate your time-to-launch

For your clients

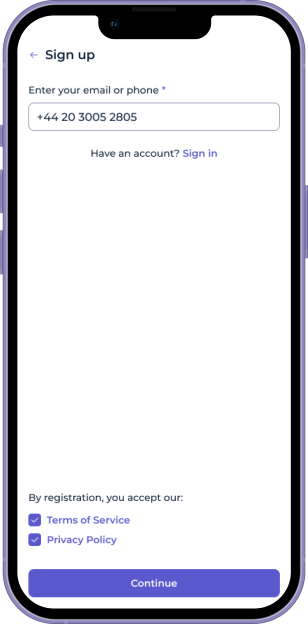

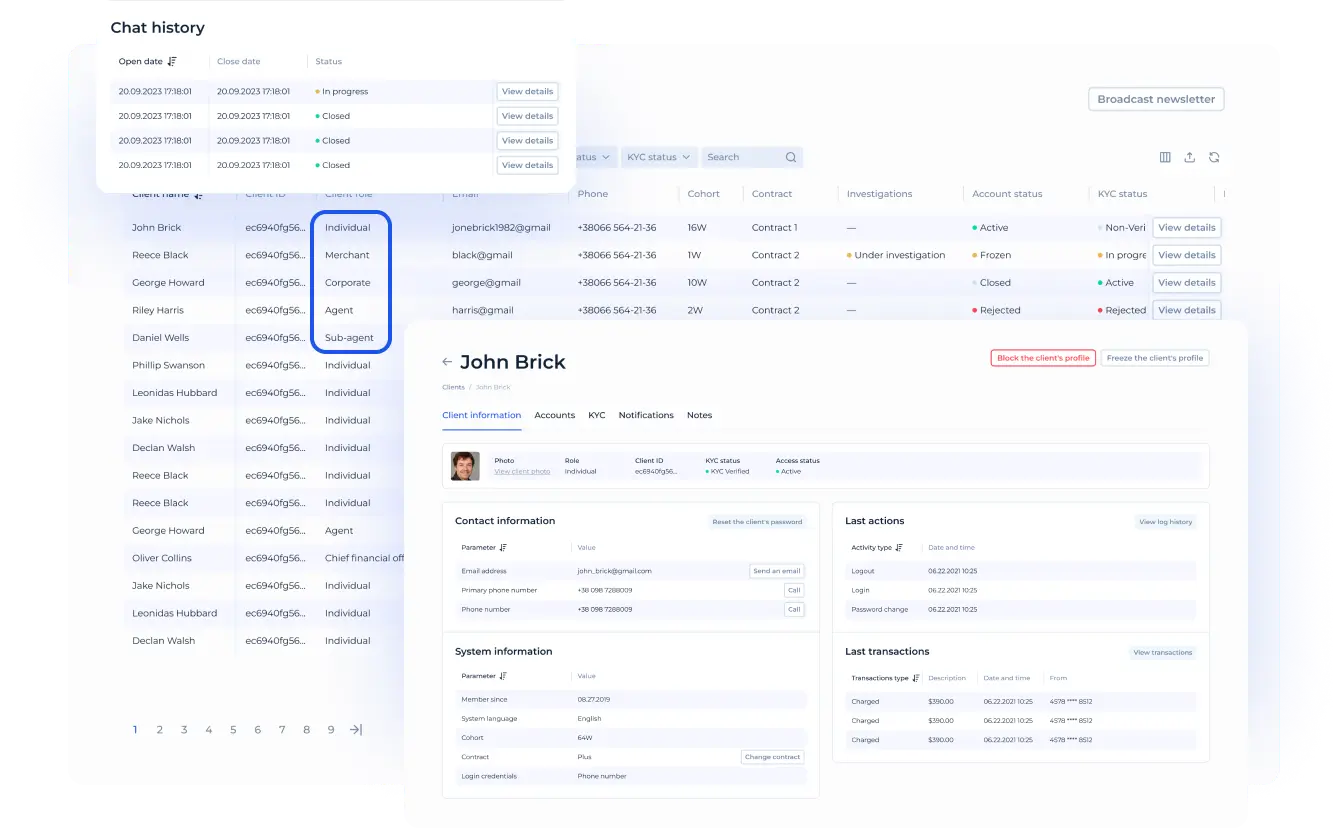

- Onboarding & 2FA (two-factor authentication)

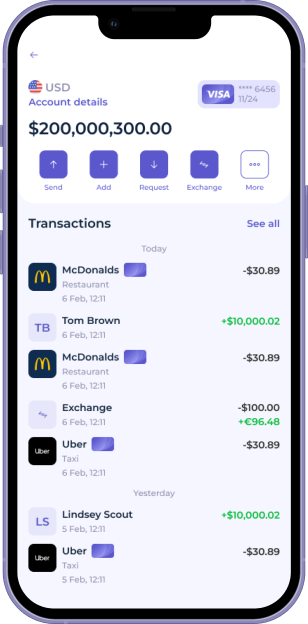

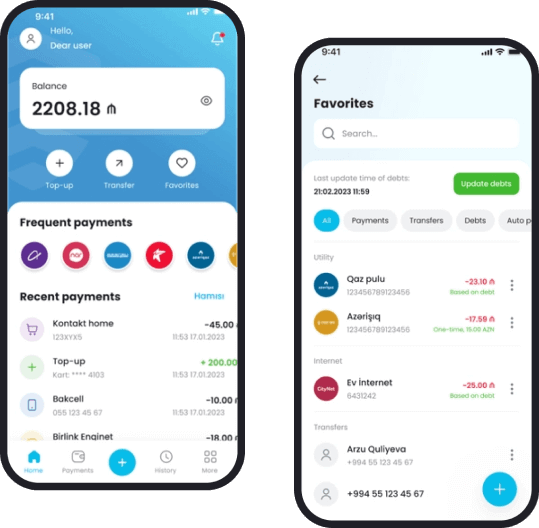

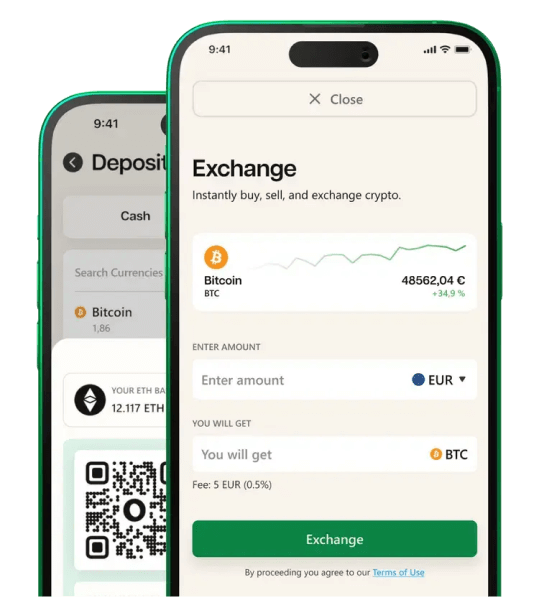

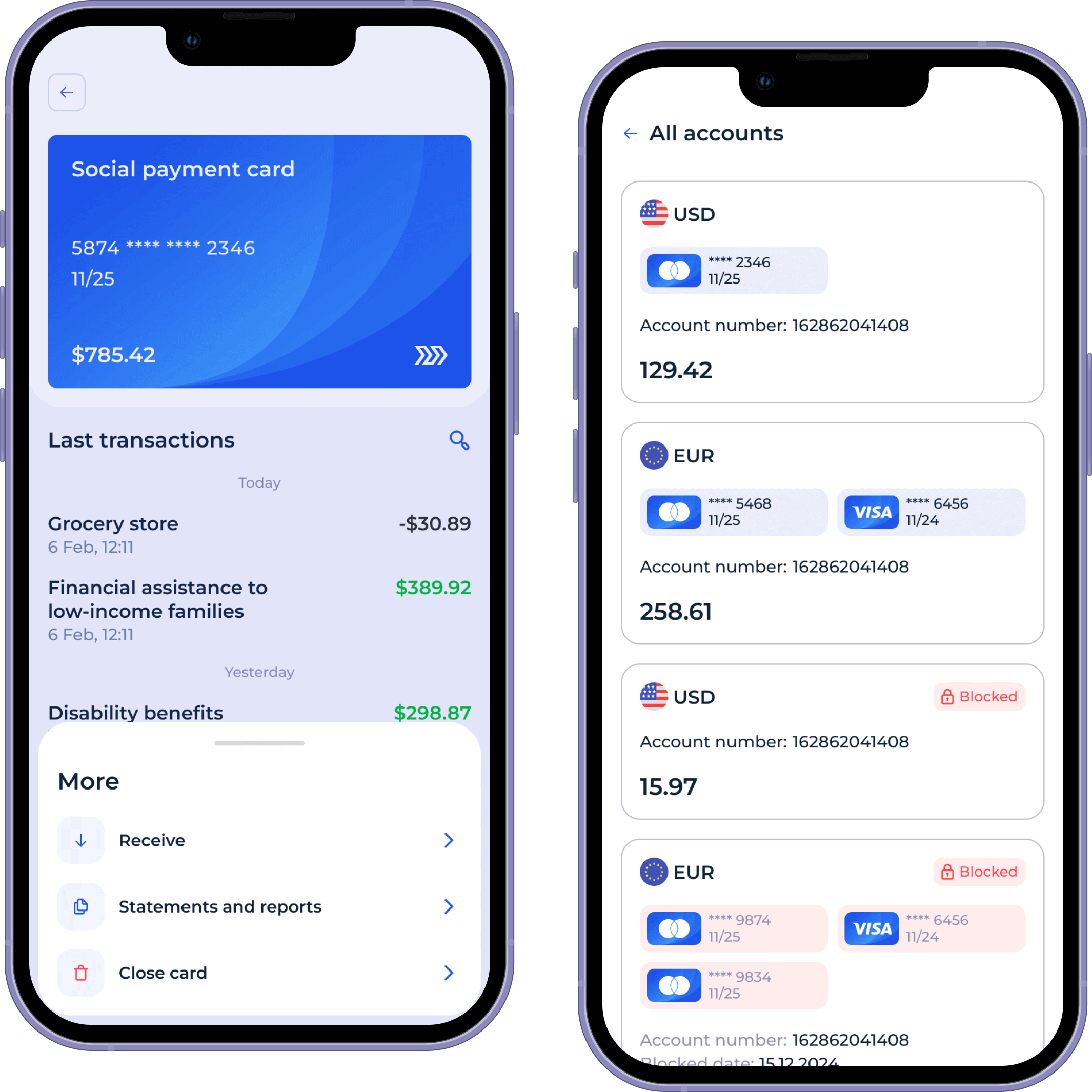

- Multi-currency accounts, crypto-to-fiat support

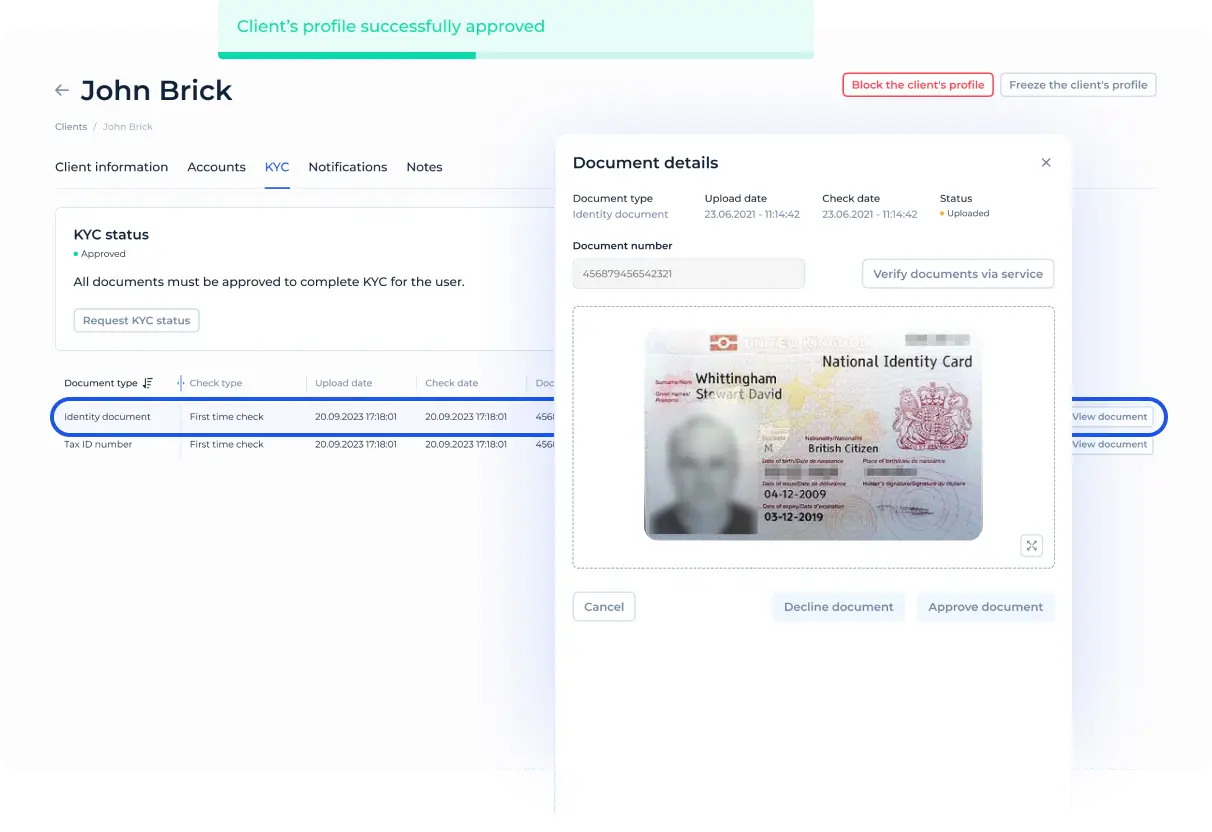

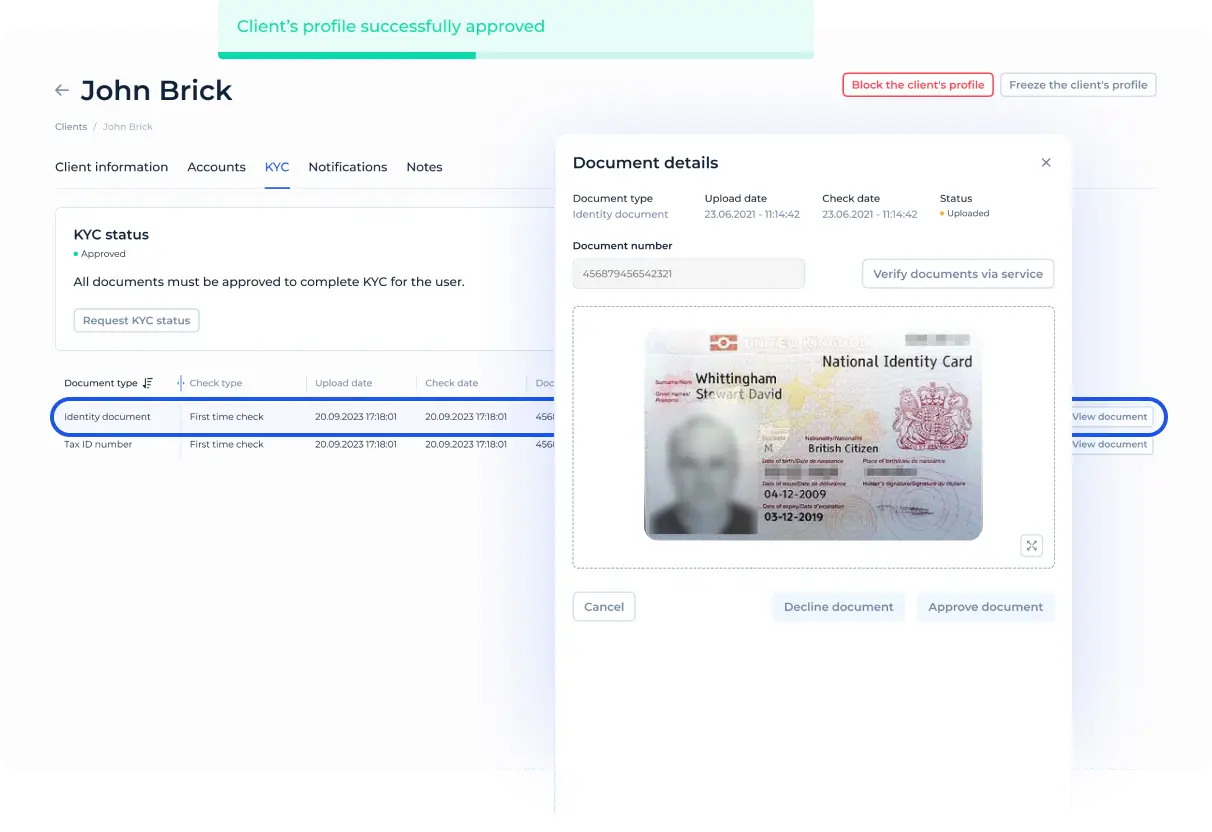

- Ongoing KYC/KYB with a trusted vendor

- Real-time currency exchange

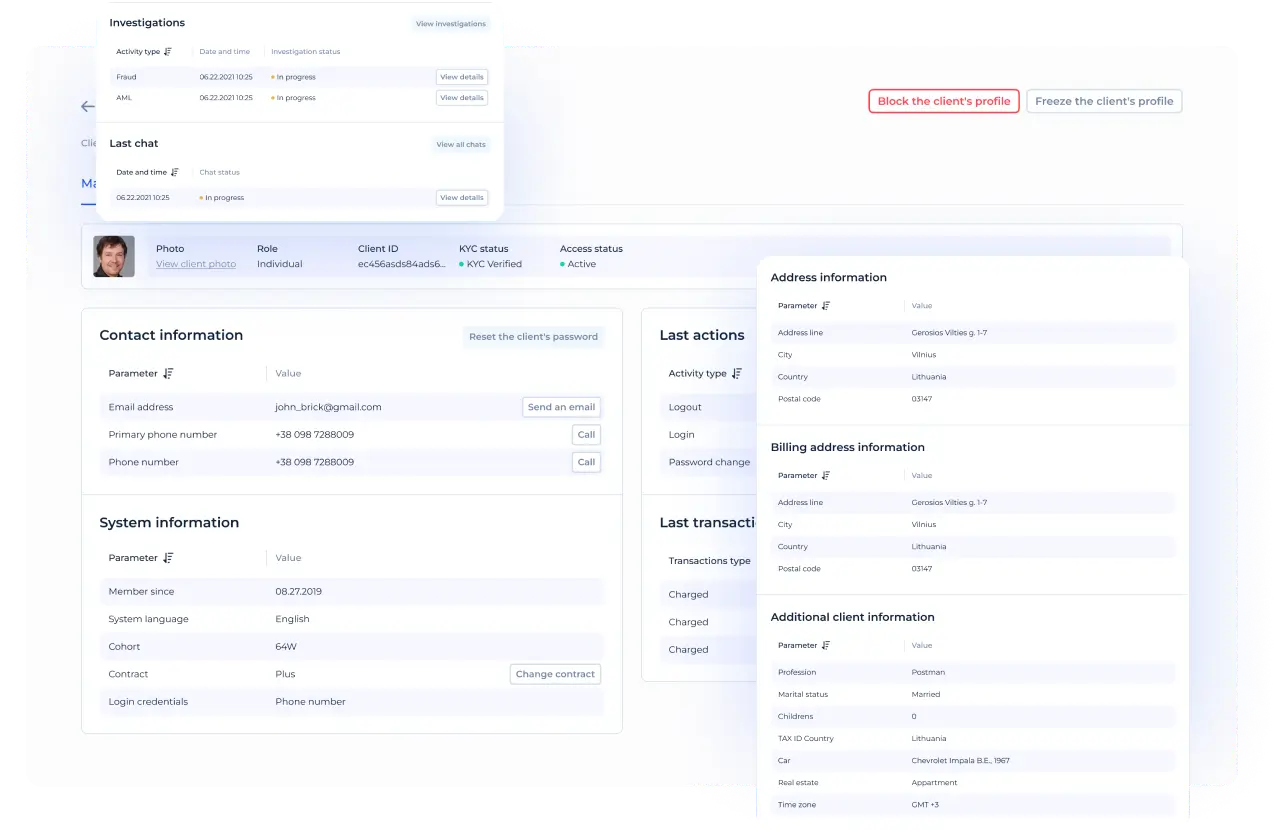

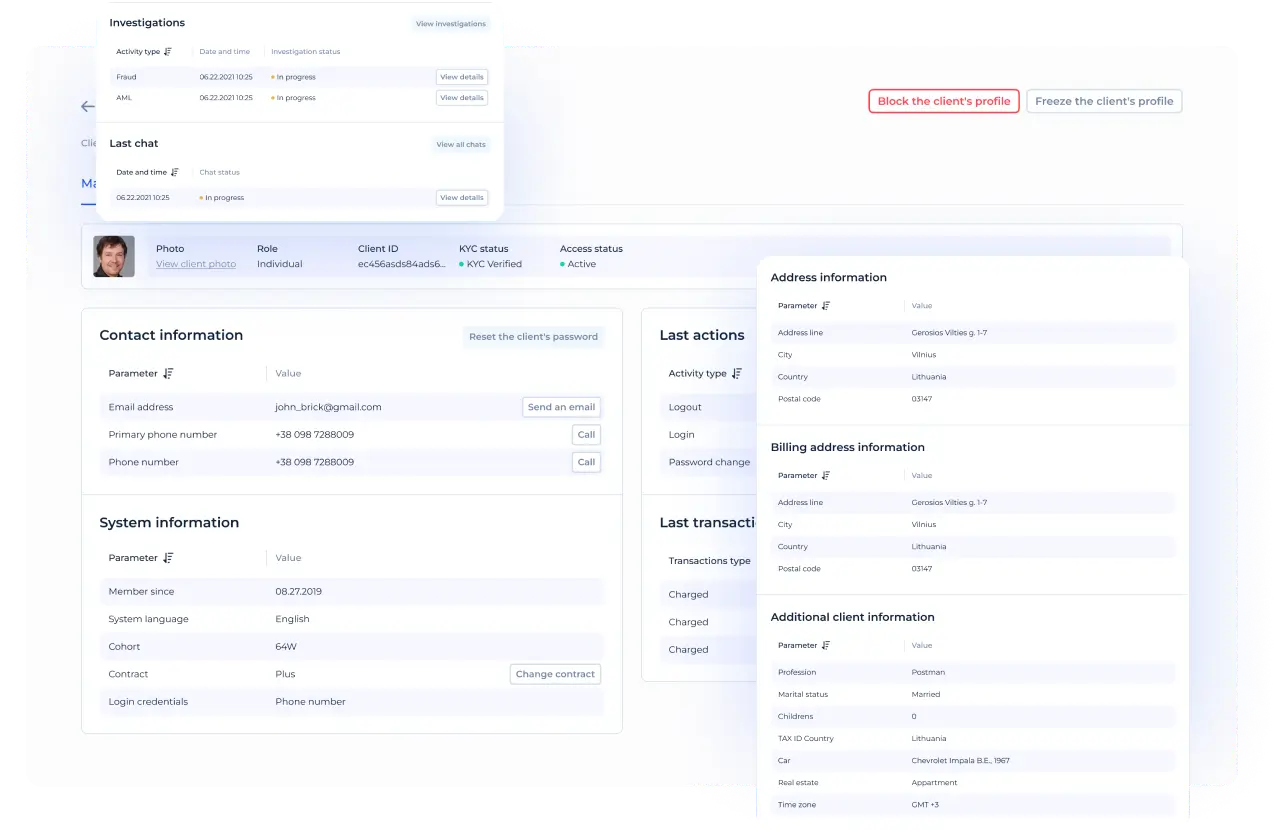

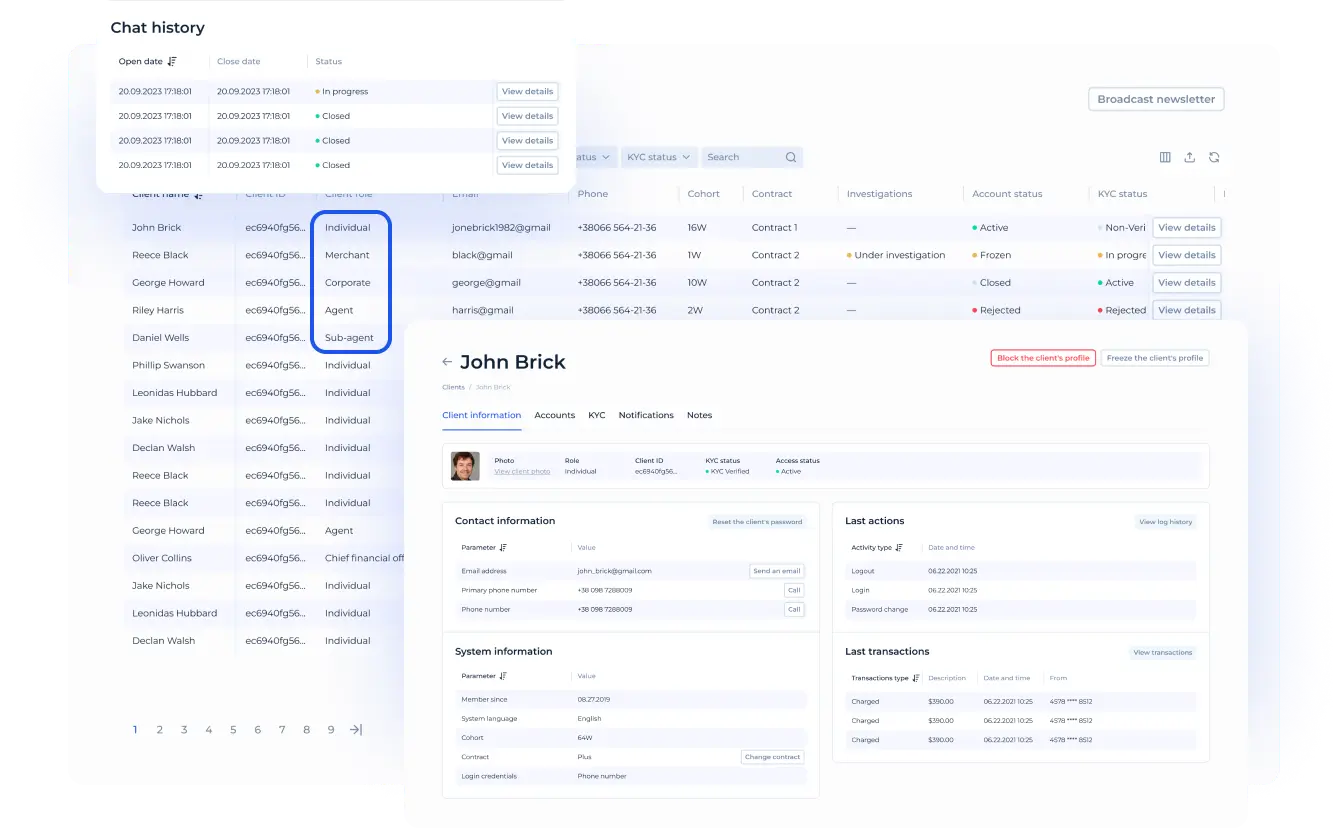

- Customer profile & settings

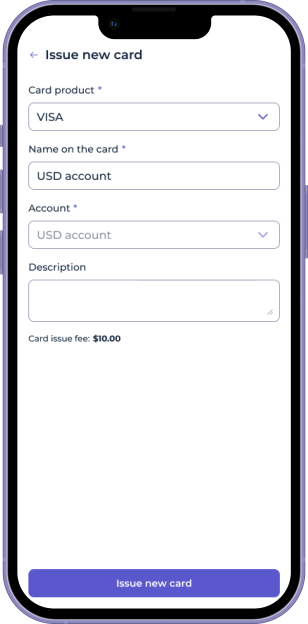

- Cards & IBAN linked to accounts

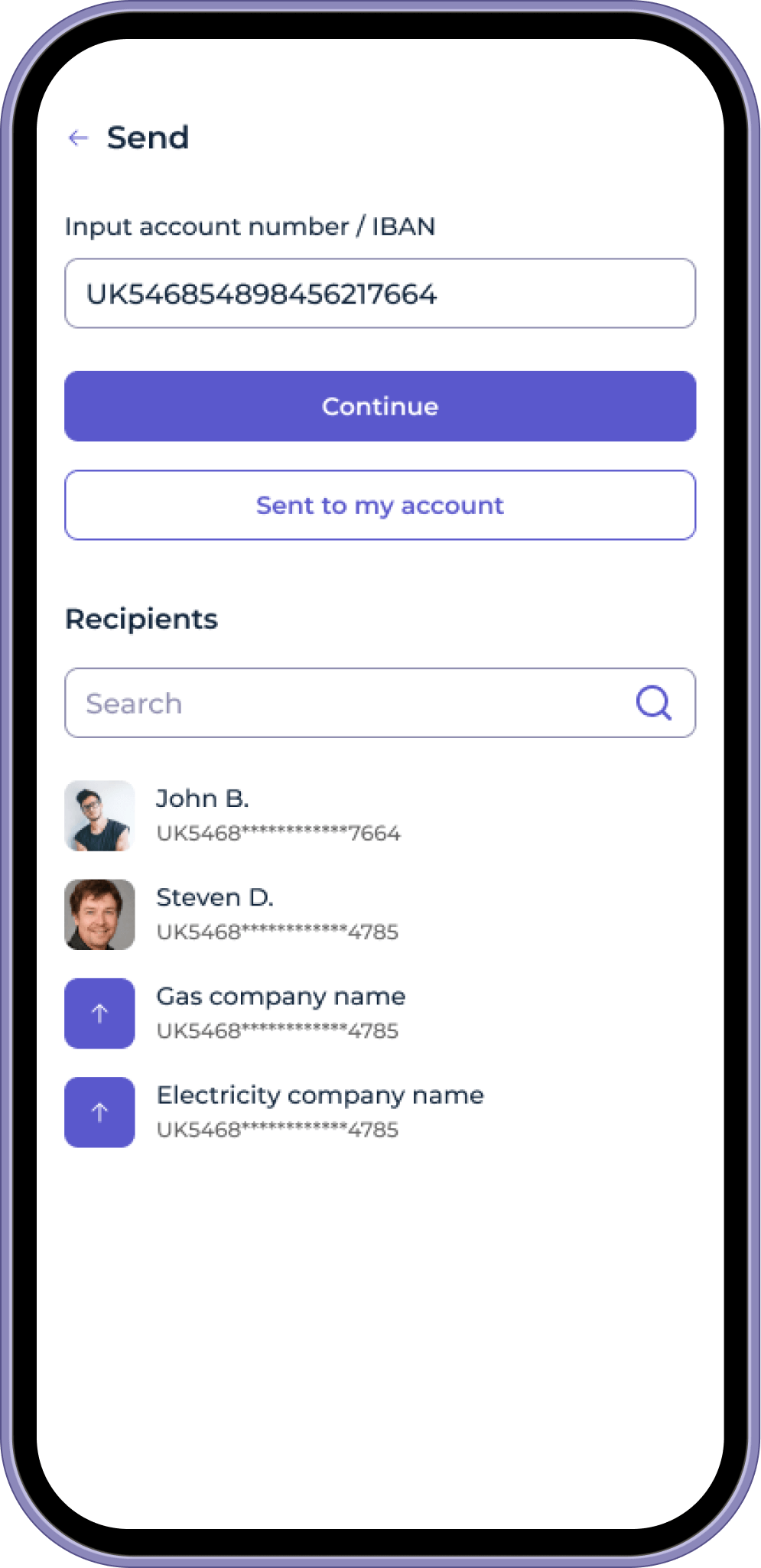

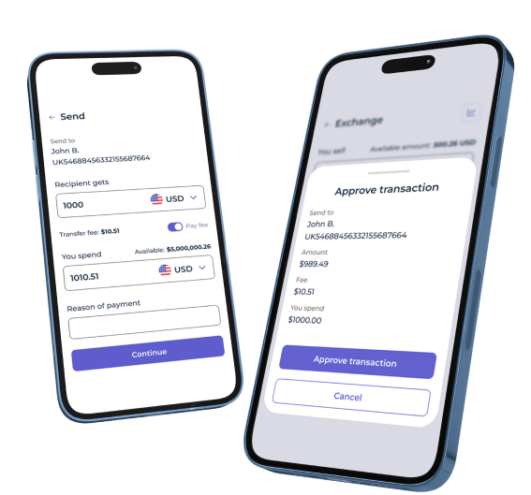

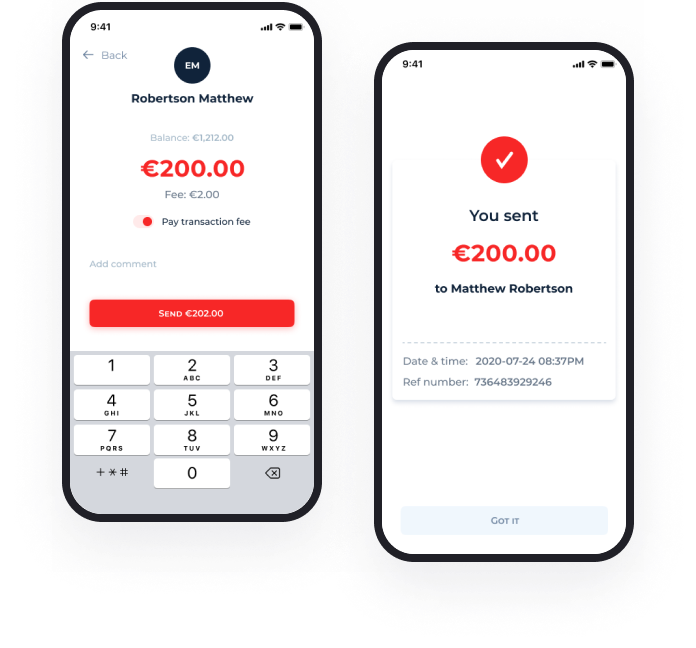

- Send, request, or exchange funds

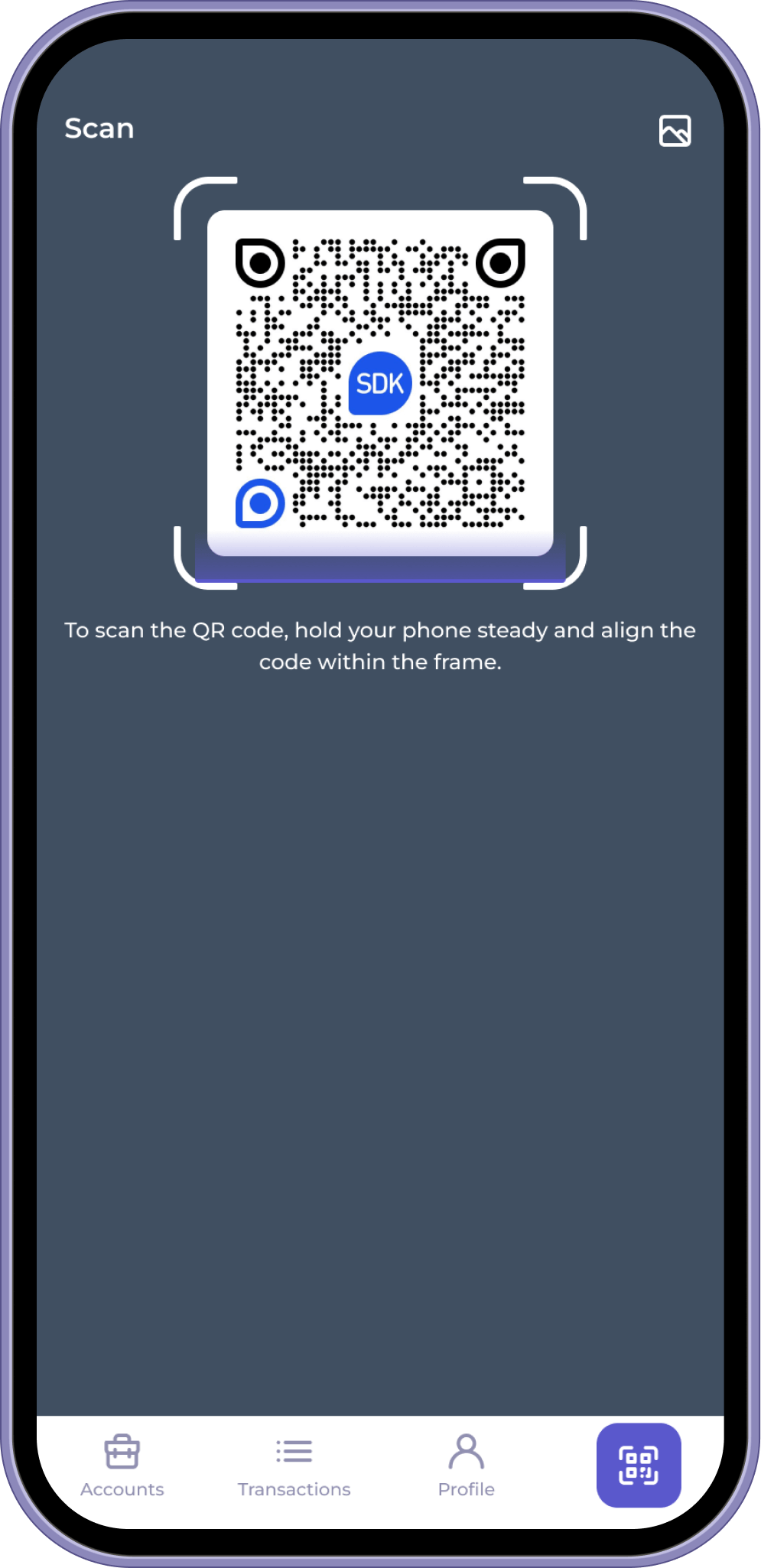

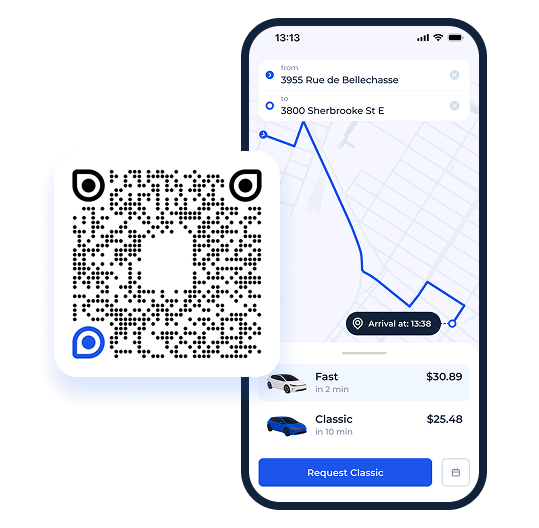

- Payment links & QR code payments

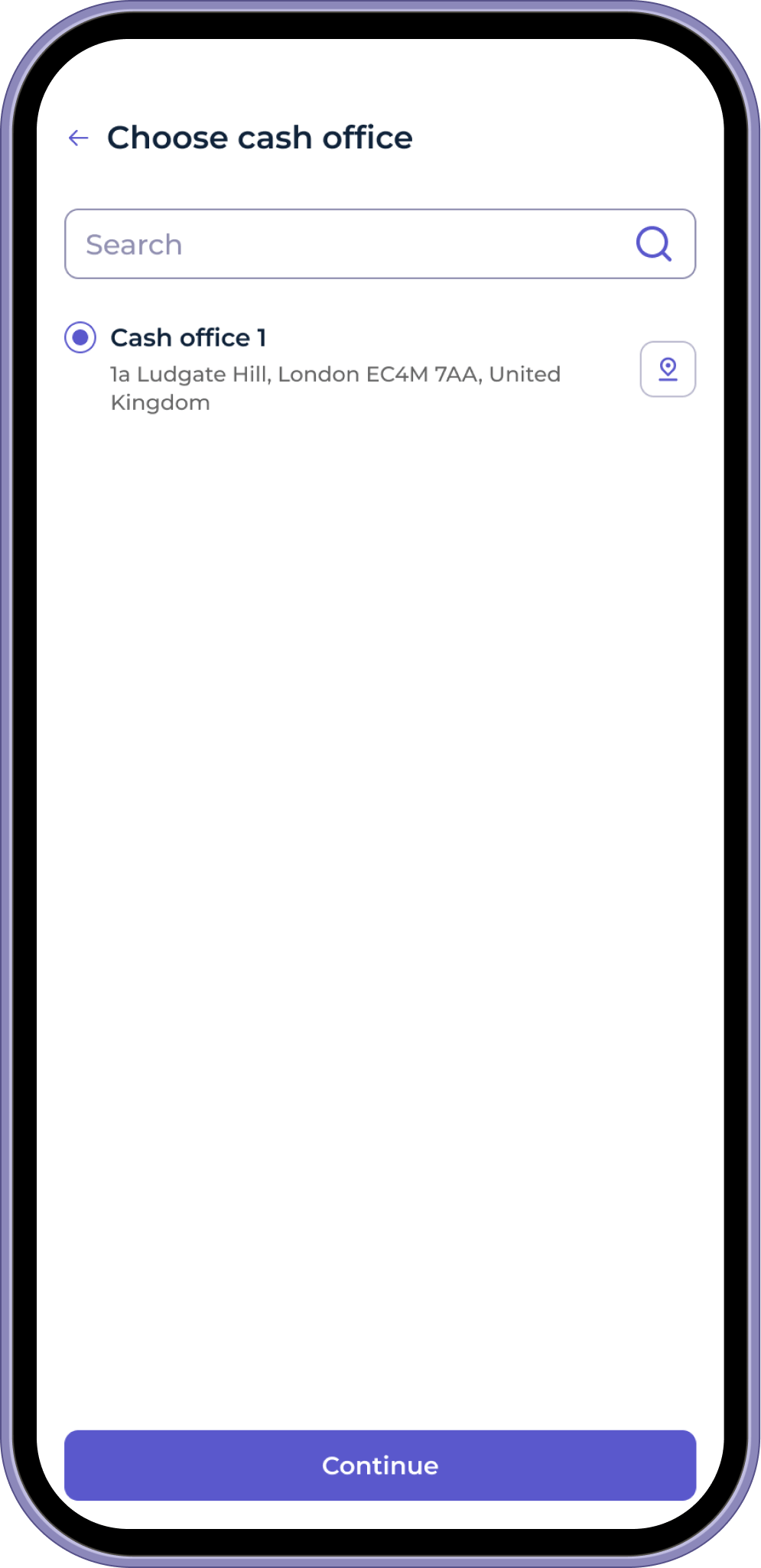

- Operations with cash for clients (Cash points)

- Customisable white-label mobile banking app available in English, Arabic, French, and Spanish

For merchants

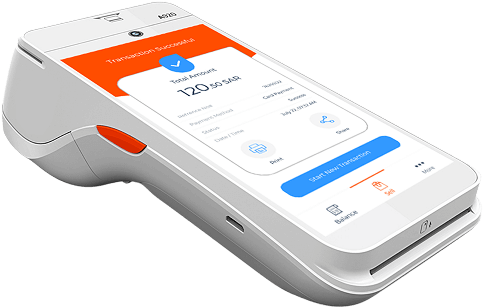

- Payment acceptance offline (POS, QR codes)

- Payment acceptance online (gateway)

- Checkout page experience

- Dispute resolution: refunds & chargebacks

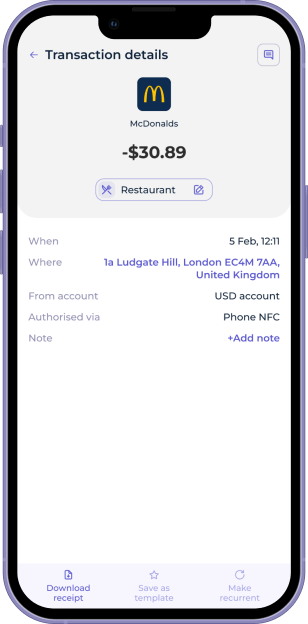

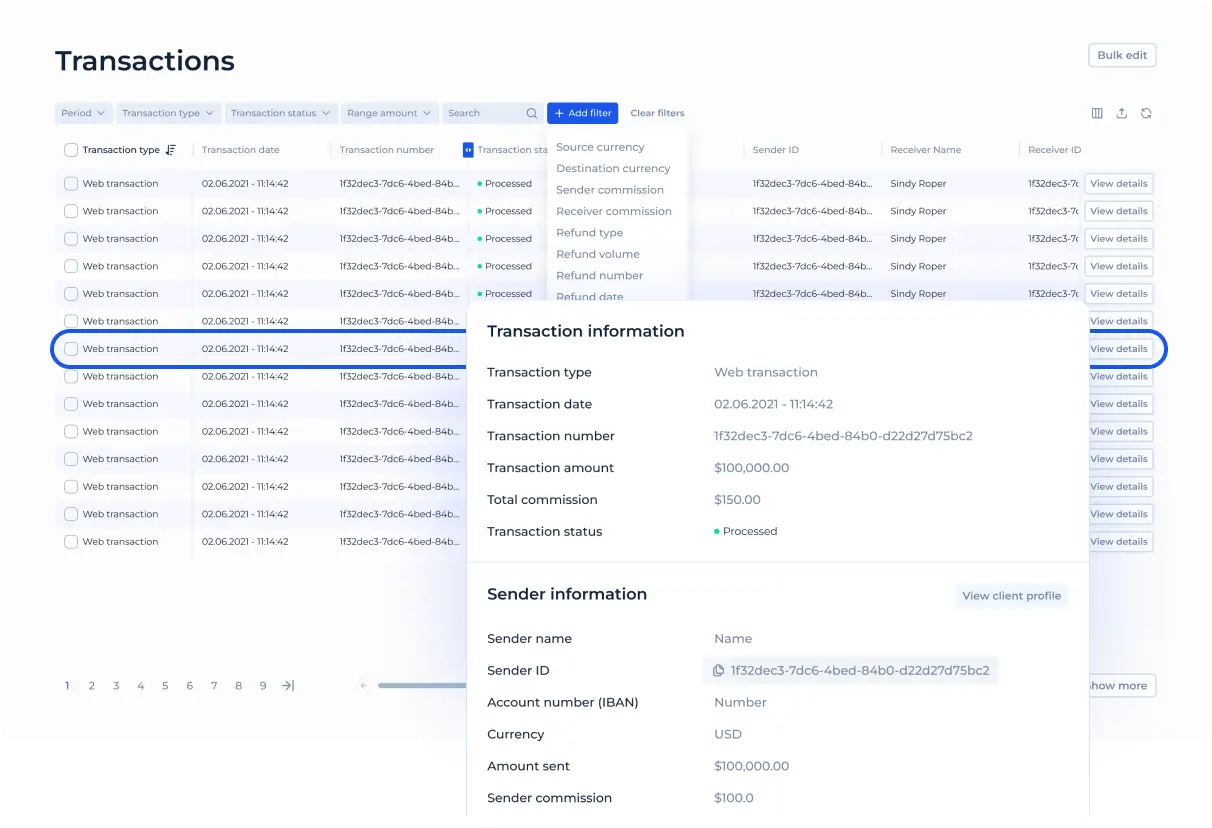

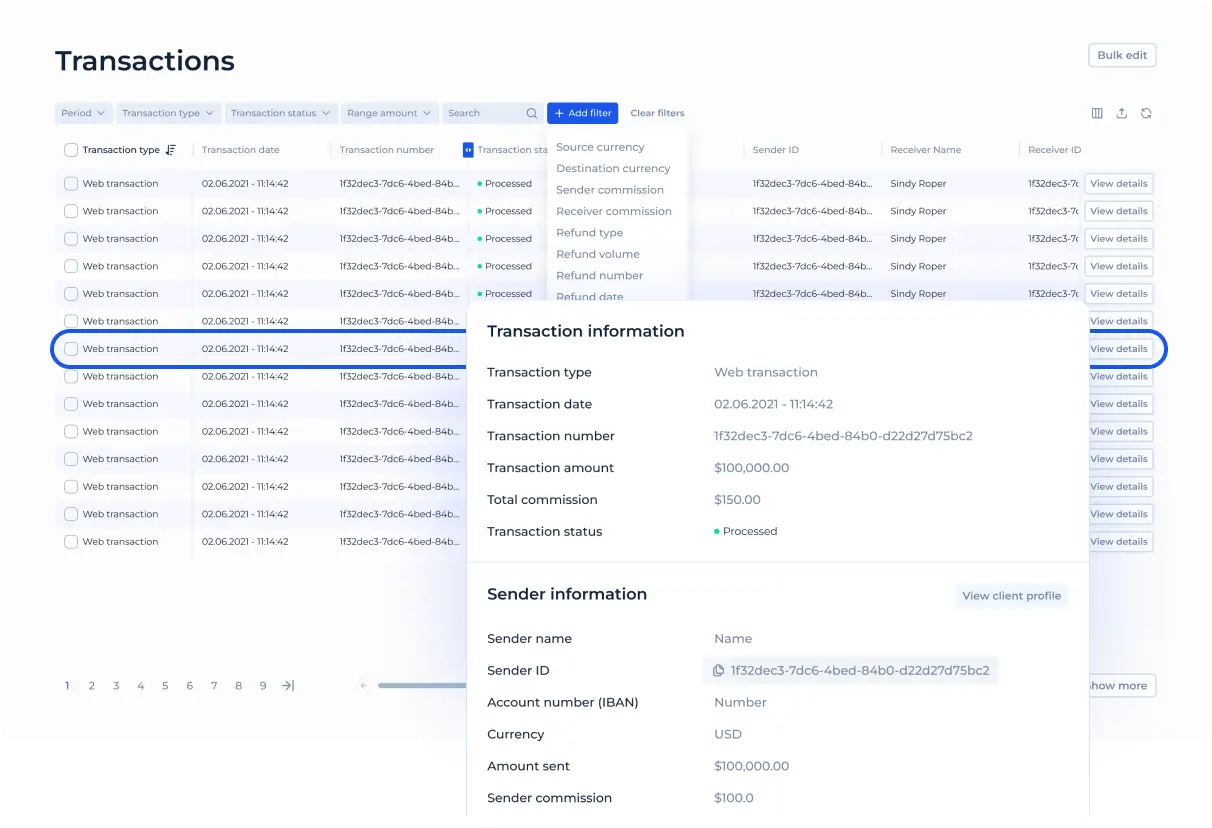

- Transaction monitoring and management

- Automated reconciliation and settlement

- Reports

System management

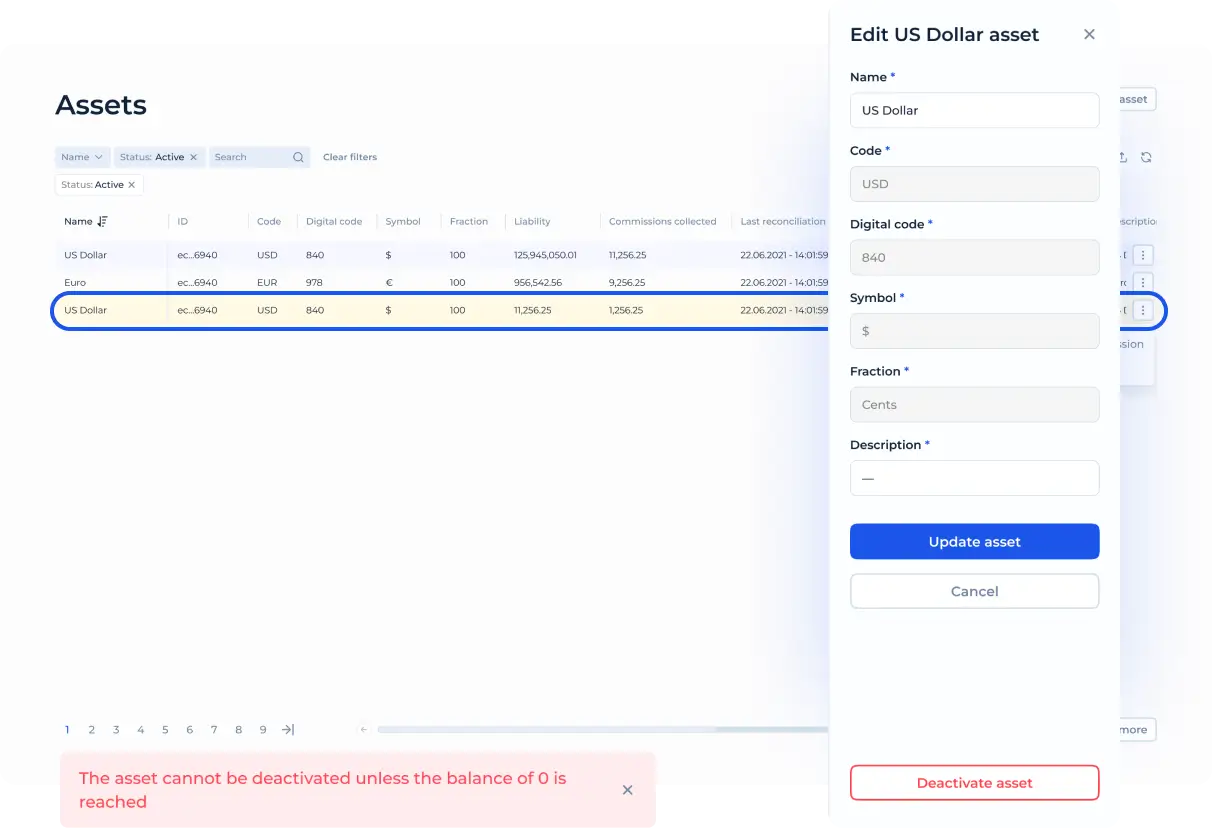

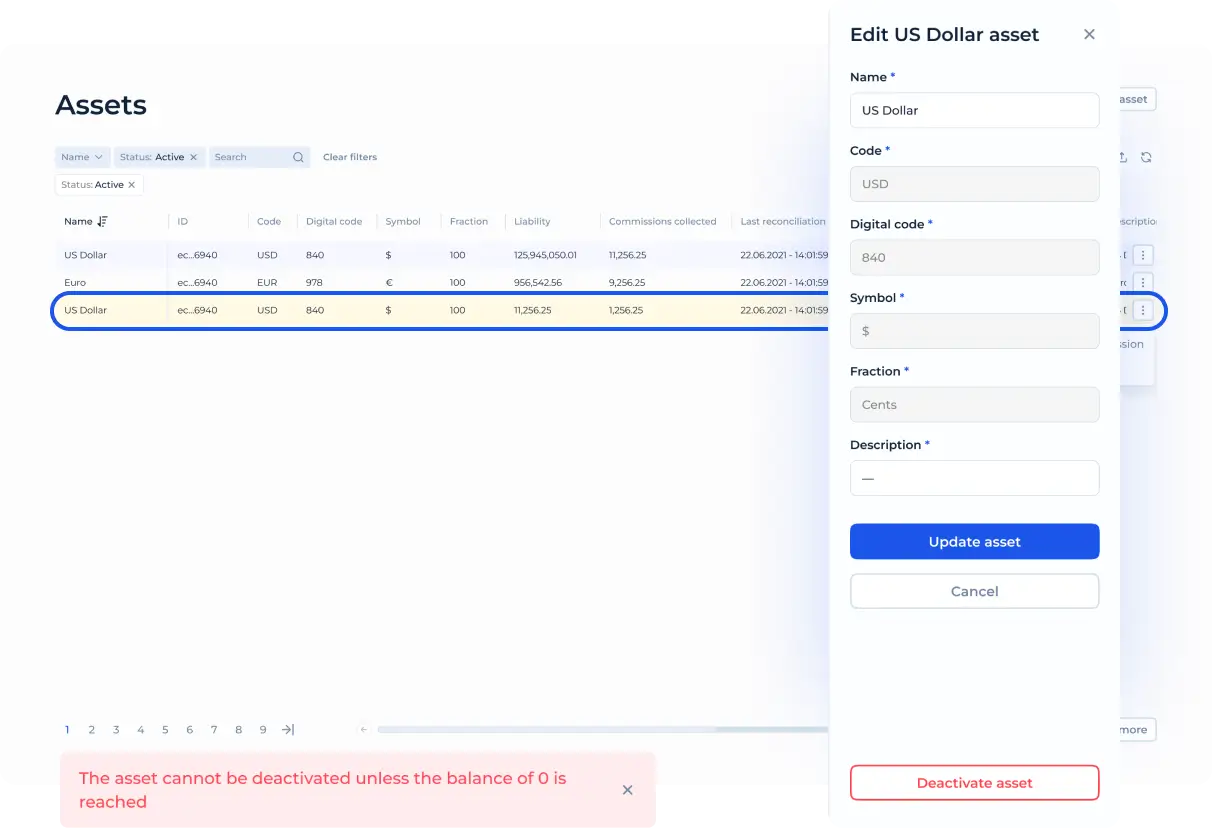

- Currency & assets creation engine

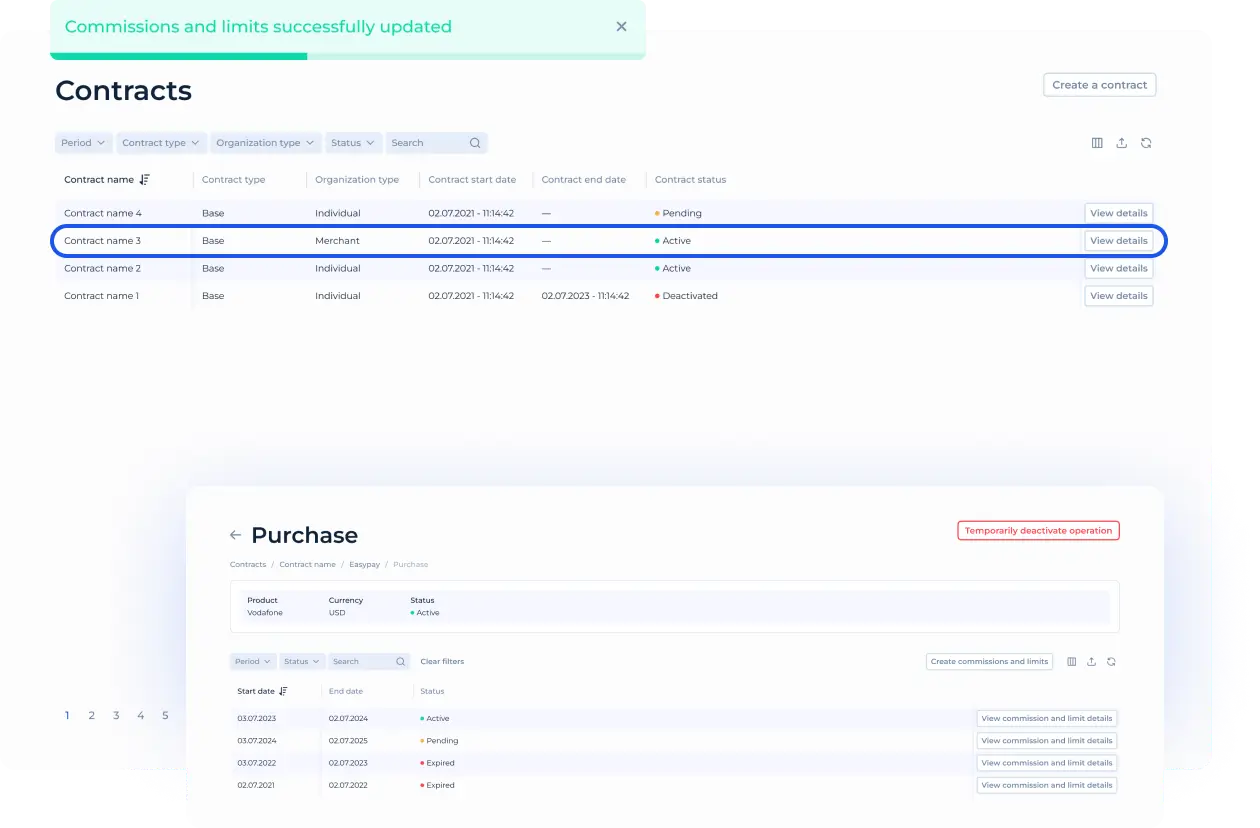

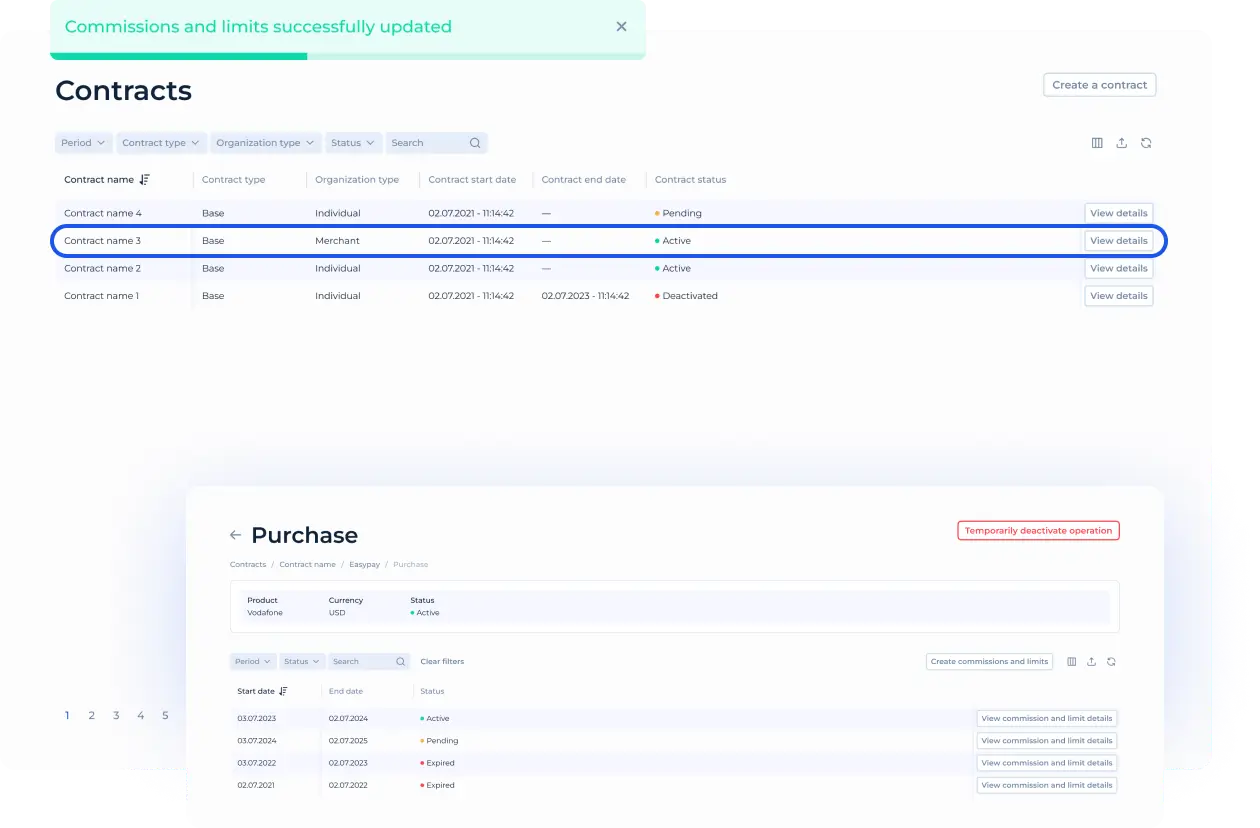

- Flexible fees & limits engine

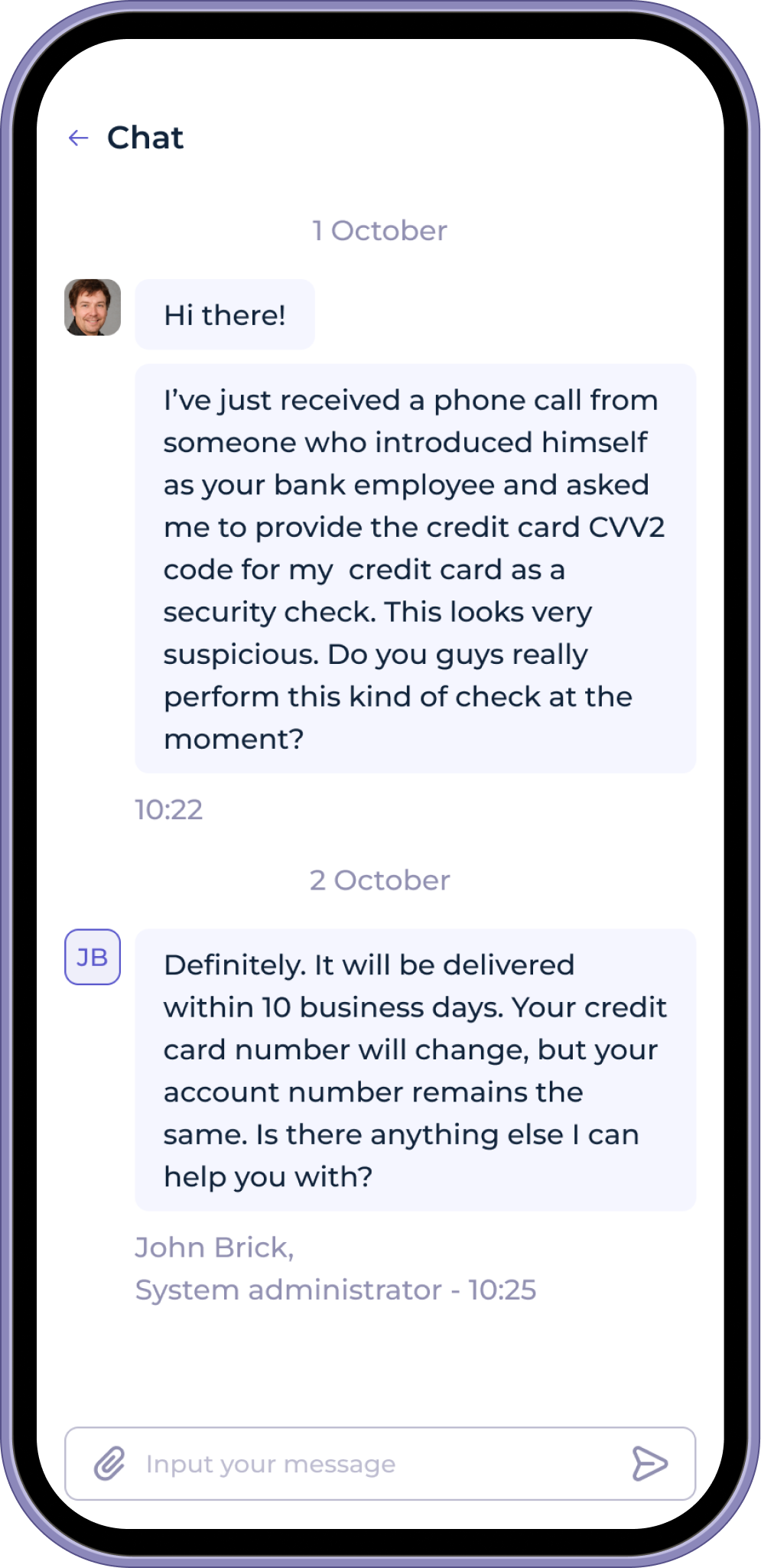

- In-system CRM & chat with clients

- Detailed transaction monitoring

- Flexible reporting

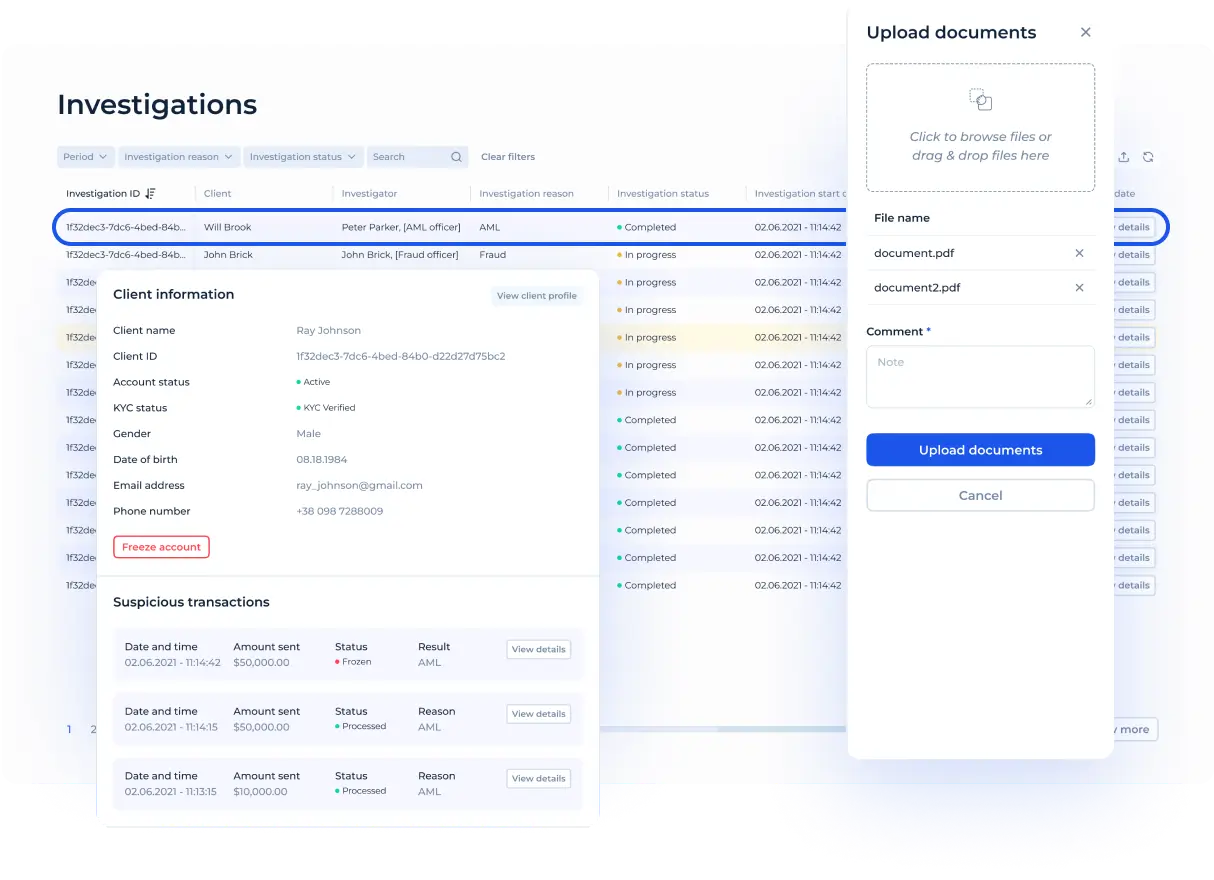

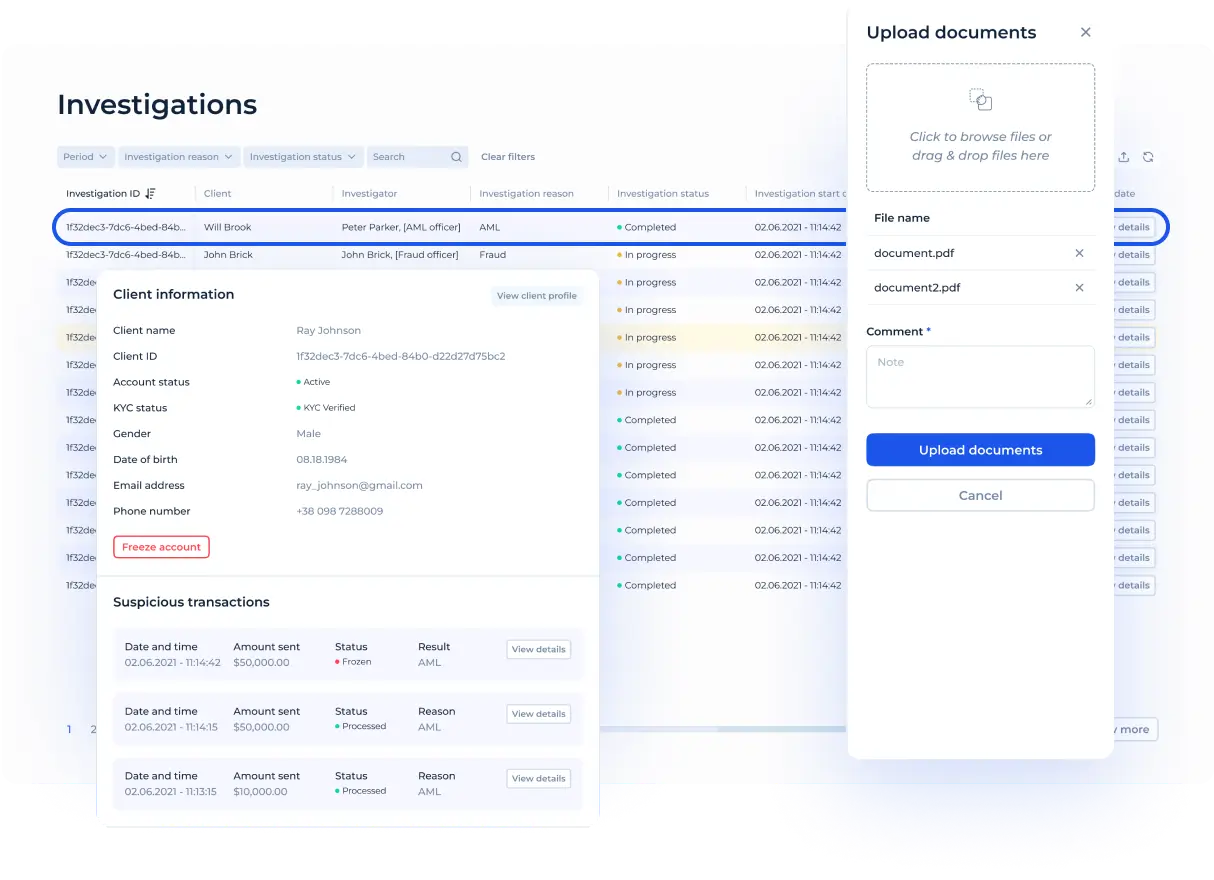

- AML/Anti-fraud officers’ workspace

- User action history

- Reconciliation & settlement section

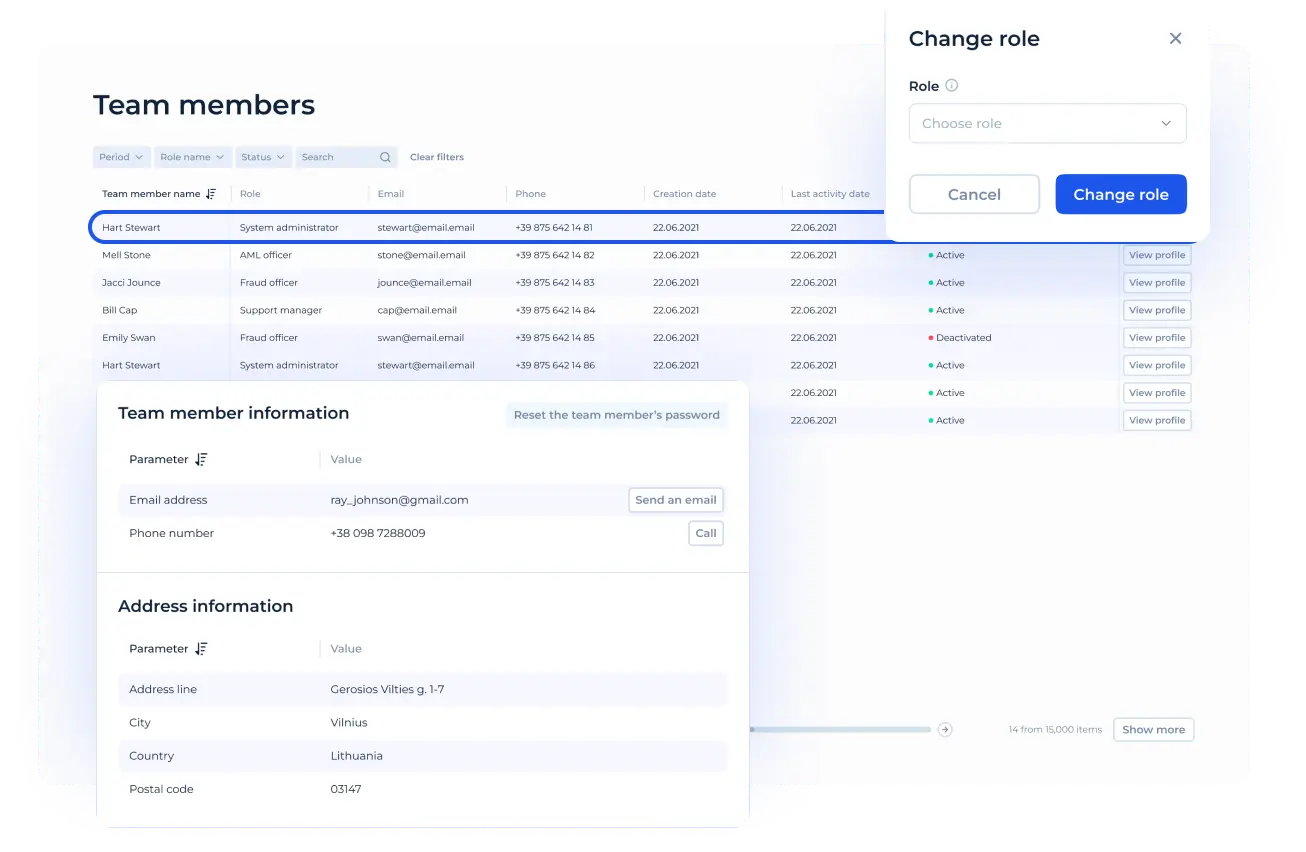

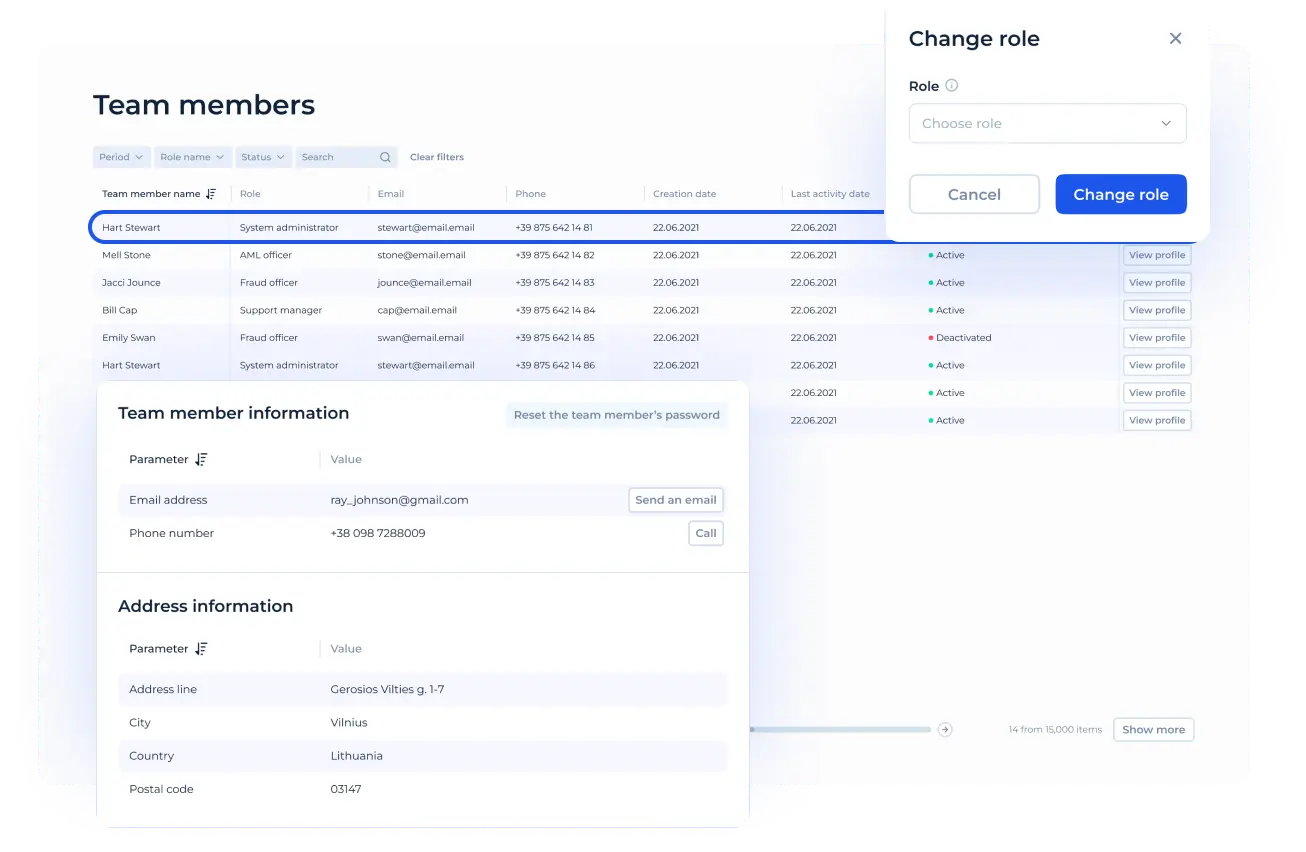

- Roles & permissions

Ready-to-go white label mobile banking app

Get a fully customisable iOS&Android mobile banking app equipped with essential features. The app is available in four languages – English, Spanish, French, and Arabic – allowing you to serve diverse client bases from day one.

Try it now (mobile app demo)Save time and resources

with our white-label digital banking Platform

Building a digital bank from scratch can take years and require extensive resources. With SDK.finance, you get speed, cost-effectiveness and unparalleled customizability.

Time to launch

Development costs

Customisability

Compliance readiness

1+ years

$$$$

High

Manual

A few weeks

$$

High

Built-in integrations

Deployment models

Source Code License

AvailableA one-time purchase that provides full ownership of the platform’s codebase. This option is ideal for enterprises and financial institutions that require maximum control, unlimited customisation, and independence from the vendor. With the source code license, you can host the solution on-premise or in your preferred cloud infrastructure.

View detailsSaaS

AvailableA subscription-based model designed for startups and growing fintechs that need a quick launch with minimal upfront costs. The SaaS option gives you access to the full white-label banking software environment, pre-built mobile and web apps, and ongoing updates managed by SDK.finance.

View detailsSource code license for

Enterprises

Full source code access

Complete freedom to modify and customize at your pace.

Warranty protection

Coverage for bug fixes and security updates

Comprehensive support

We empower your team with in-depth training, guidance, and ongoing support.

Meet your deadlines

Operate with your internal team to meet deadlines, bypassing vendor delays.

Minimized development risks

Avoid the bottlenecks of building from scratch

Consistent updates

Leverage regular Platform updates and enhancements for peak performance.

Get in touch to discuss your project with our experts

SDK.finance White-label Digital Bank Software? FAQs

A white-label banking is a ready-made banking software solution that allows a business to launch financial services under its own brand. Instead of building technology from scratch, you get a complete banking core, mobile and web apps, and compliance tools ready to use.

White-label banking software is a complex and technologically advanced product. It includes all the necessary core banking modules for accounts, payments, cards, AML/anti-fraud, and reconciliation. Alongside the banking core, it provides 470+ APIs for integration and ready-made mobile and web interfaces for end-users. This way, businesses receive not just a backend system, but a complete digital bank foundation that can be branded, customised, and expanded.

With white-label banking you save years of development and reduce costs. You can launch faster, rely on PCI DSS and ISO-certified security, and focus on growing your client base instead of building the core banking software.

Yes. SDK.finance provides a demo of its white-label banking software solutions so you can explore the full scope of the platform. Since it’s a complex and highly technological product, the demo showcases not only the core banking modules and 470+ APIs but also the ready-made mobile and web interfaces available for your clients. This way, you can see how the digital bank would look and operate both from the business side and for end-users.

SDK.finance white-label banking software comes with pre-built integrations for card issuing (Marqeta, Mastercard), payment gateways and processors (Stripe, PayPal, Paysafe, Corefy, CoinGate), open banking (Salt Edge), AML/KYC (Sumsub, ComplyAdvantage, OpenSanctions), and currency exchange (Currencycloud), along with tech services like Amazon S3 and SES. New integrations can be added either by our team on request or by your developers using the platform’s convenient API-first design.

SDK.finance white-label banking software is available in two models: SaaS for a fast and cost-efficient start, and a source code license for full ownership and unlimited customisation.

The cost of SDK.finance white-label banking software depends on the delivery model. SaaS pricing starts with a monthly subscription that fits startups and growing fintechs, while the source code license is a one-time investment designed for enterprises that need full ownership and customisation.

There are no location-related restrictions for using digital banking software from SDK.finance. The primary databases are under your team’s control in both SaaS and source code variants.

In the SaaS version, the SDK.finance hosts and maintains only the backend application on AWS or another cloud service provider. Consequently, you can comply with regulatory requirements related to sensitive data management and storage.

SDK.finance uses the cutting-edge technology stack. The software is developed on the Java 17 LTS. Our team performs security testing via JUnit, Arquillian, and OWASP security scanner. We review the code quality with SonarQube, UpSource, and FindBugs.

The implemented REST and gRPC API architecture helps to facilitate integration with third-party providers and services and assists in driving your banking or payment product innovation.