Mobile banking application with source code license to fast-track your banking app launch

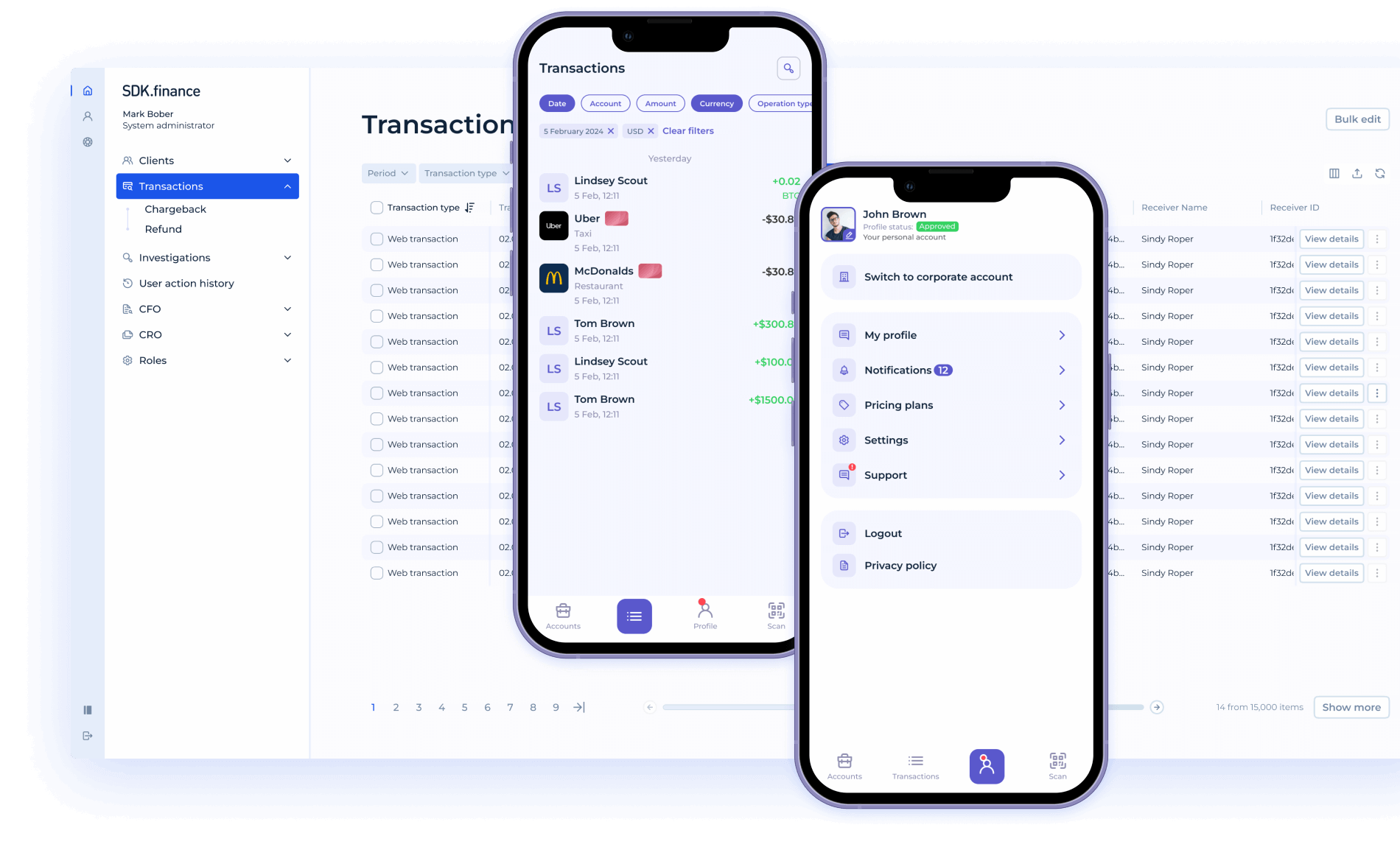

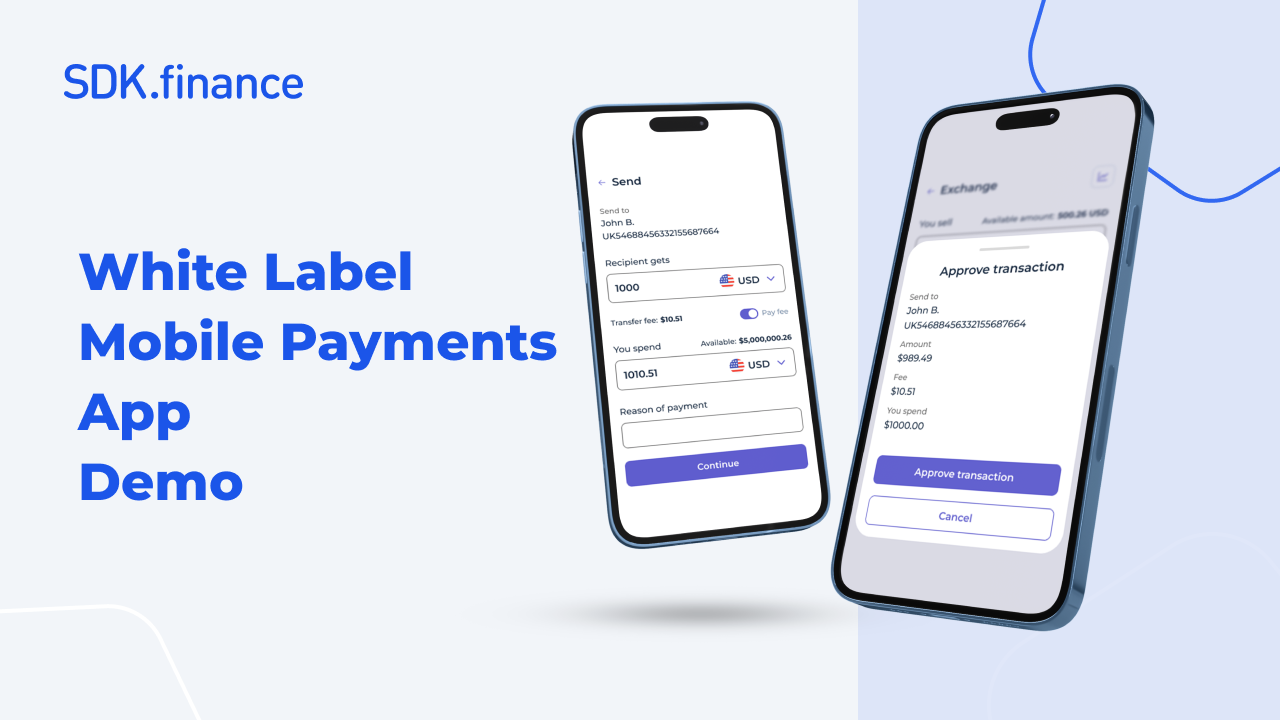

With SDK.finance banking app software source code you get a ready backend with a robust API layer – for faster launch and effective scaling of different types of mobile wallet apps. The Platform helps you cut down on the team resources and costs of developing a digital payment or mobile banking app.

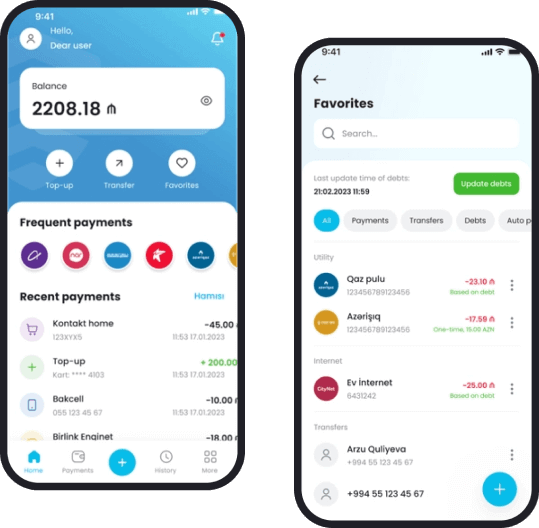

With mobile banking, users can manage their finances on-the-go, check their account balances, transfer funds, and pay bills from anywhere, at any time using a supported mobile device.

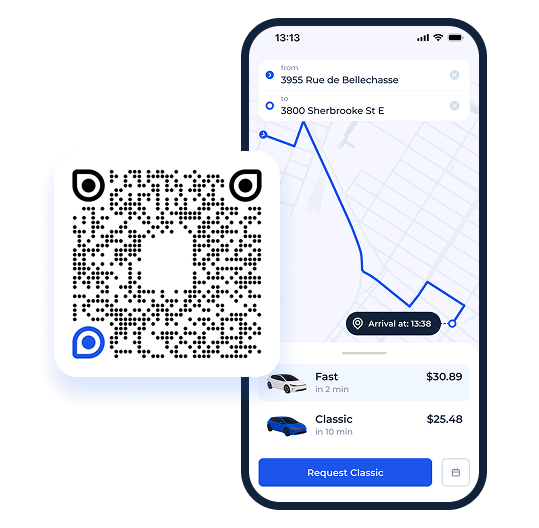

Contact usWatch our mobile banking application in action

Check out a demo video of the mobile banking application built on the SDK.finance Platform.

Delight your customers

with a feature-rich mobile banking app

Thanks to its unparalleled flexibility and advanced technology stack, SDK.finance white label banking software empowers you to build an advanced application to cater to your customers’ financial needs.

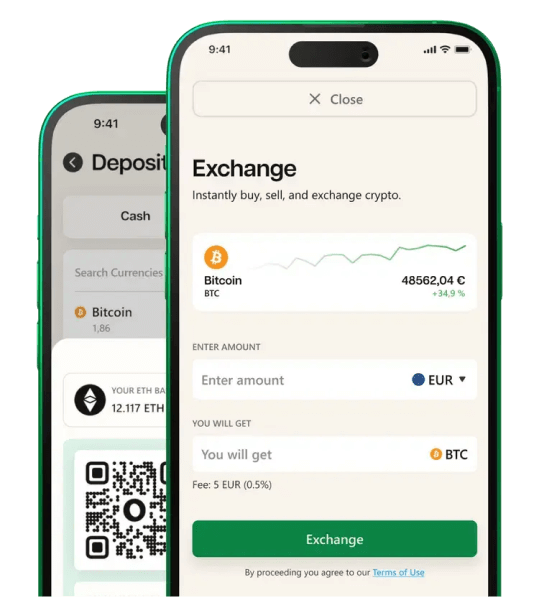

From fiat currencies and bonus points to coffee beans and litres, deal with almost any type of assets using our transactional engine as a foundation. Add as many different currencies or other asset types to the pre-built digital wallet system as you deem necessary, without any limits.

Through integration with a banking network, offer bank digital payments like IBAN and SWIFT to meet your users’ bank account, financial, and payment needs, as well as your business needs. Accommodate various customer segments and boost your turnover.

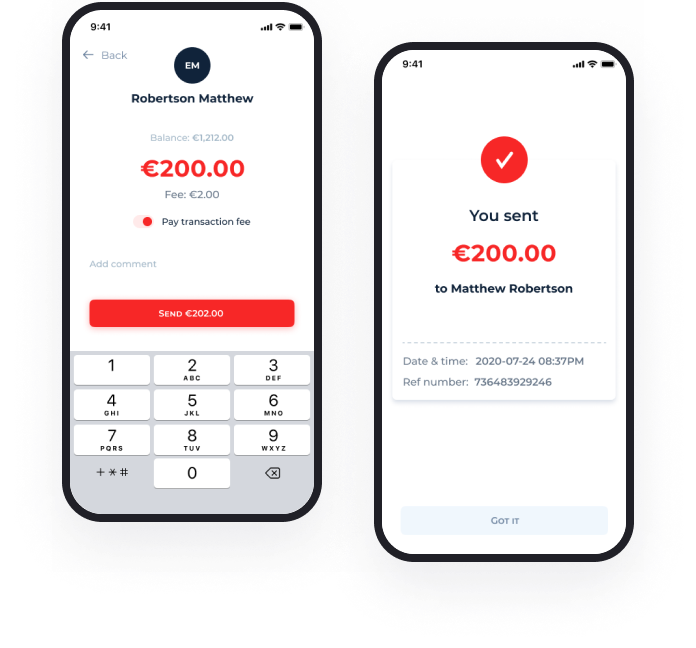

From internal P2P transfers to cross-border remittances, offer your wallet customers a hassle-free way to send money and receive it instantly. Integrate with payment and service providers to extend your transfer services range.

Let your users save time by paying their bills within their mobile wallet app – from utility bills to mobile top-up and broadband payments. Add support for any vendor you find necessary through API integration.

Empower your customers with seamless cross-border transactions by enabling instant currency exchange within their wallet app. Leverage our white-label digital payment solutions to deliver a frictionless user experience.

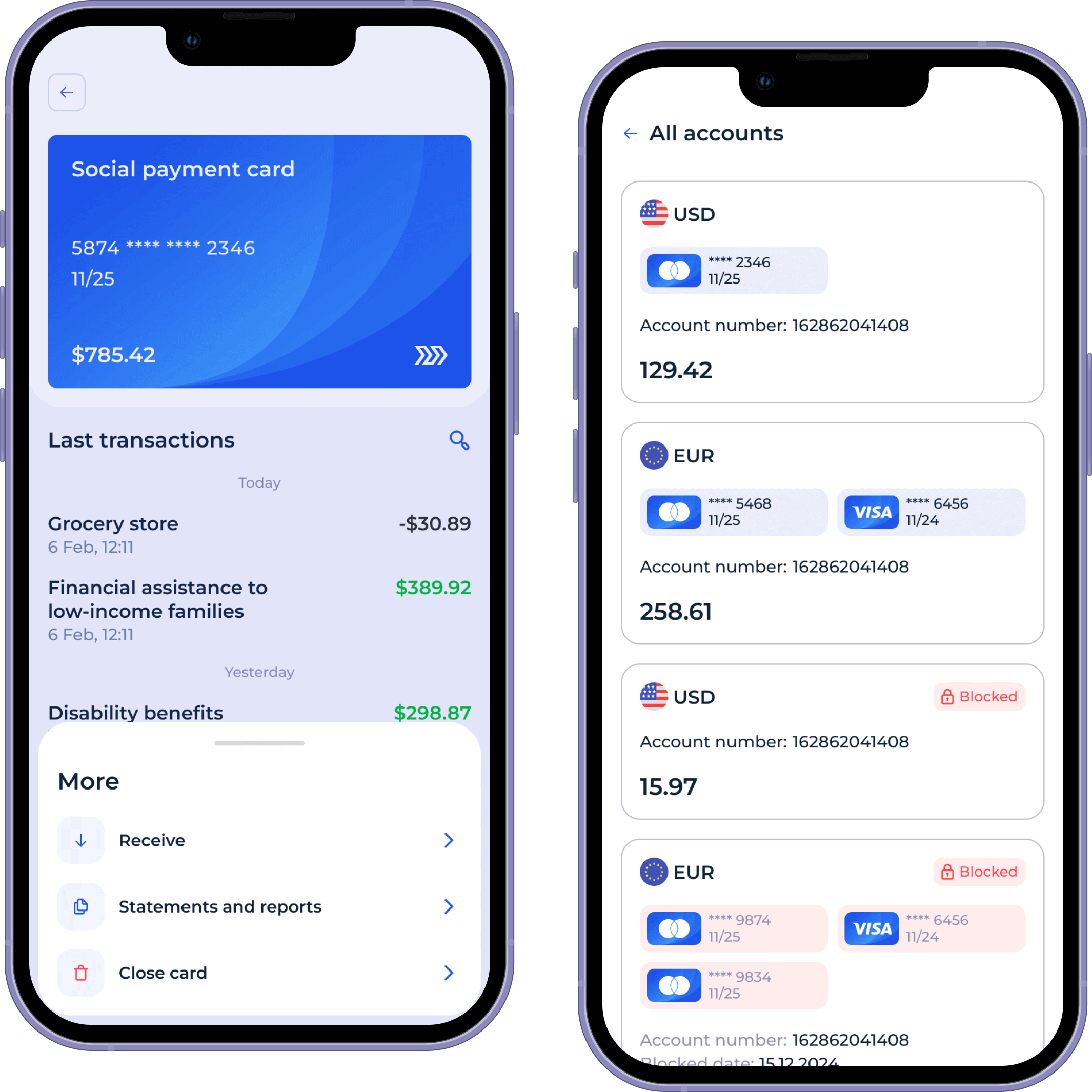

Provide seamless virtual and physical card issuing for managing debit cards hassle-free and your users’ convenience.

Improve your customers’ finances by helping them control their spending. Providing granular user friendly transaction history with exhaustive details and sophisticated filtering functionality offers better finance management opportunities for users.

Save time and resources

with our quick-launch app

Building a mobile banking solution from scratch can take years and require extensive resources. With SDK.finance, you get speed, cost-effectiveness and unparalleled customizability.

Time to launch

Development costs

Customisability

Compliance readiness

1+ years

$$$$

High

Manual

A few weeks

$$

High

Built-in integrations

Ready to speed up your mobile banking application launch?

Share your vision and see how SDK.finance aligns with your needs

Get in touchReady integrations with top providers

The SDK.finance digital banking Platform stands out with its seamless integration capabilities. It comes equipped with pre-integrated vendors for key functionalities such as payment acceptance, card issuance, and KYC/KYB compliance. This streamlined integration process ensures a hassle-free setup for your financial operations.

One mobile banking platform, multiple use cases

Catch the tide of the soaring popularity of mobile banking apps, align with your brand identity, open up new revenue streams, and expand into new markets to power up your business.

Mobile banking wallet

Engage and retain your bank customers plus obtain additional revenue by delivering a mobile banking application experience to your customers wherever they are.

Closed-loop wallet

Let your customers operate their assets and make transactions within your ecosystem by using a closed-loop wallet. Provide them with more value, help them spend more with you, and watch your revenue grow.

Telco wallet

Increase financial inclusion for the unbanked and level up the experience for your banked audience by providing mobile financial services with white-label virtual wallet software enriched with new features.

Mobile payment app

Build a fully-fledged payment app, leverage open banking to connect to thousands of financial institutions, and deliver an optimized user experience that enables users to manage finances, send, and receive money seamlessly.

Retail wallet

Deliver a seamless financial experience to your customers with a digital wallet built on the SDK.finance white-label Platform. Drive engagement and boost your revenue while enhancing the user experience.

Loyalty wallet

Develop a loyalty wallet system to enhance your loyalty programs and rewards initiatives. Enable prepaid, gift, or bonus card functionalities while ensuring real-time balance updates and accurate transaction tracking.

Online banking software to sustain your growth

With a workload capacity starting from 2,700 TPS* (transactions per second), SDK.finance can easily handle over 34 million daily transactions on a basic configuration, with enough room for optimization.

Learn more

Each financial project is unique. Let’s discuss yours

Related products

Neobank

AvailableGet your digital-only bank on the rails and turn the first several years of development into the first years of growing your customer base and revenue.

View product pageMoney transfer service

AvailableOffer your customers a fast, secure, and convenient way to send and receive money across borders and currencies.

View product pageSDK.finance mobile banking app FAQs

With SDK.finance banking app software, you get a ready banking app source code with a robust API layer, which allows for faster launch and effective scaling of different types of mobile wallet apps.

Yes, we offer demos of the backoffice for your team and mobile app for your clients.

If you need more details about our mobile banking application project or have any questions, do reach out to us and we’ll be in touch with you shortly.

There are no location-related restrictions for using the mobile banking app from SDK.finance. The primary databases are under your team’s control, while SDK.finance hosts and maintains the backend application on AWS or another cloud service provider. Consequently, you can comply with regulatory requirements related to sensitive data management and storage.

There are two versions of the mobile banking app available:

- The PaaS version is offered with a subscription-based pricing structure on the major cloud providers’ marketplaces like AWS or Azure. The main database is hosted on your own server, and you get the app deployed and maintained on the cloud by us.

- An on-premise version comes with the source code license, available for a one-time flat fee.

Of course. Learn more about the details of the source code purchase before making the decision about buying the mobile wallet Platform source code.

Feel free to contact us and discuss your project with one of our experts to see how our Platform aligns with your requirements.

Our mobile wallet Platform supports a wide range of payment methods, including credit and debit cards, bank transfers, and various digital payment services. Additionally, we are constantly updating our Platform to include new and emerging payment technologies to ensure a seamless and comprehensive payment experience for your users.