Enterprise FinTech Platform

A powerful, modular financial software with full source code access that helps enterprise businesses build, modernize or scale their financial services and payment solutions, all backed by a pre-developed backend and flexible, API-driven architecture.

All the features for a finance product, out of the box

Back-office capabilities

- Flexible KYC/KYB documents collection

- KYC/KYB verification:

- Automated via pre-integrated providers

- Manual

- Sanctions checks

Client features:

- Remote registration via email or phone number

- Secure identification documents uploading

- Two-factor authentication (2FA)

Back-office capabilities:

- Creating an unlimited number of currencies in the system

- Support for any digital assets

- Configuration options for currency or asset type

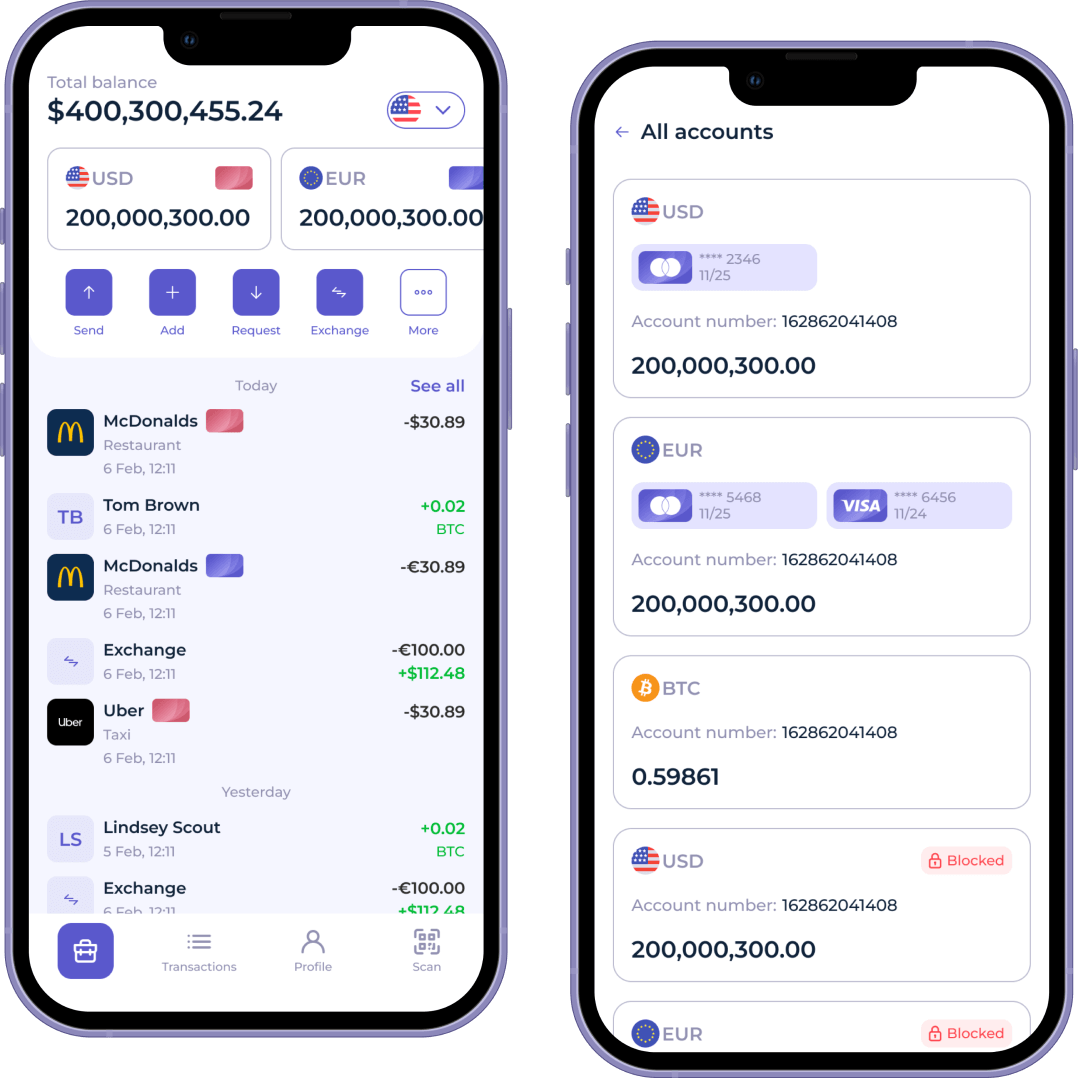

Client features:

- Accounts in any fiat currency

- Accounts for reward points, bonuses, crypto etc.

- Real-time balance in selected currency from all accounts

Back-office capabilities:

- Payment management: top-ups, withdrawals

- Bank, bill payments (via integration with providers)

- Currency exchange (internal/external)

- Configurable payment links

Client features:

- Account top ups & withdrawals

- In-system transfers

- Bank payments

- Bill payments

- Recurrent and scheduled payments

- Payment requests and QR-code payments

Back-office capabilities:

- Smart card issuance (prepaid, closed-loop cards)

- Branded debit card issuance through integrated providers (e.g., Marqeta)

Client features:

- Card payments (in store and online)

- Secure PIN management

- Card spending control

Backoffice capabilities:

- Management of cash-desk operations for any cashflow

- Cash-in/cash-out operations

- Support for physical and digital cash transactions

- Reconciliation of cash balances

Client features:

- In-person transactions at cashpoints

- Cash-in/out through integrated kiosks

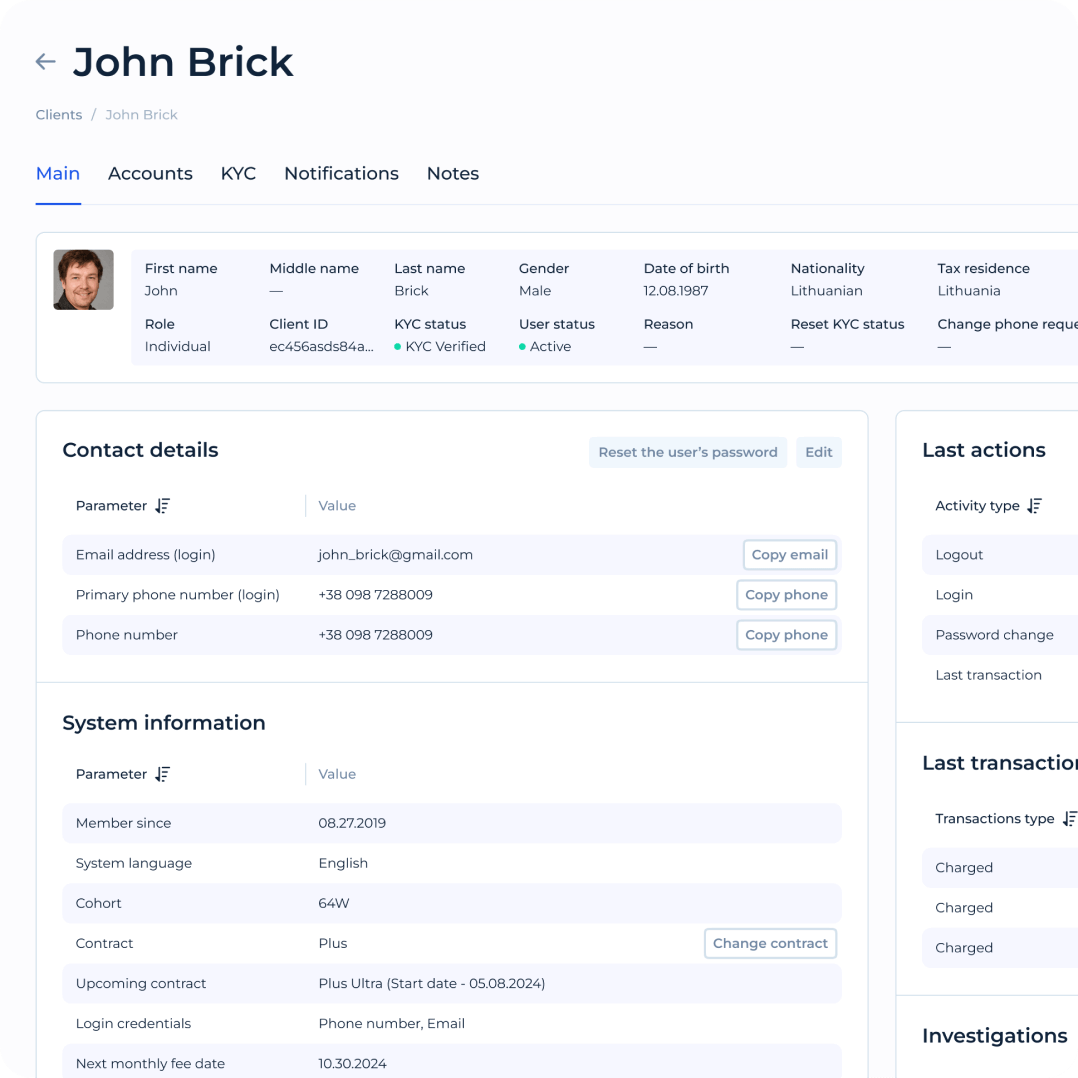

Internal system management

AML officer’s workspace

- AML officer’s workspace

- Monitoring transactions

- Manual AML investigation options

- Account freezing and transaction logging

- CRM for complete client information access

- Interaction history tracking

- In-app chat functionality

- Customer notes

- Detailed tracking of all system activities for clients and administrators

- Granular transaction fee configuration (%, flat, or hybrid)

- Transaction limits configuration (transactions number, period, amount)

- Vendor terms and fee structure management

- Scheduled reconciliation

- Discrepancy detection and resolution tools

- Automated commission calculations

- Rollback/rewind transactions

- Open banking support through SaltEdge integration

- Unified account balance viewing

- Seamless A2A payments and transfers

- POS payments acceptance

- Online payment acceptance (via integration with payment gateways)

- Customizable checkout page

- Dispute resolution management:

- Refunds

- Chargebacks

- Payouts and payment requests

Functionality available via pre-integrated vendors

Backoffice for your team + frontend for your clients

SDK.finance is built with progressive technologies and structured for seamless integration into enterprise environments.

Backend with API layer

More info on technologySophisticated system roles

Financial management

- CFO (Chief Financial Officer)

- Financial specialist

- Accountant

- Cashier

Compliance officers

- KYC/KYB Specialist

- AML Specialist

- Anti Fraud Specialist

Administrative control

- Administrator

- CEO

Revenue management

- CRO (Chief Revenue Officer)

- Revenue specialist

- Revenue analyst

Customer service

- Customer Success Specialist

Powerful ledger for accurate accounting

SDK.finance is based on a robust ledger engine ensuring that every transaction is accurately recorded, audited, and reconciled, offering a reliable foundation for financial management, compliance, and business insights.

Real-time transaction recording

Every financial transaction, from deposits to transfers, is logged instantly within the ledger.

Granular transaction details

Each transaction includes detailed metadata, providing visibility into fees, currency conversions, and other transaction specifics.

Atomic operations and reversals

The ledger treats each transaction as an atomic operation, preventing partial updates and enabling seamless reversals for error correction and compliance.

Multi-currency support

Supports accounts and transactions in multiple currencies, allowing payment businesses to operate globally.

Comprehensive reconciliation tools

Automated reconciliation and matching of transactions against bank statements or vendor reports.

Adjustable settlement cycles

Configure settlement frequencies (e.g., daily, weekly) to align with business needs, for an efficient cash flow management.

Why enterprises choose the SDK.finance FinTech Platform?

Source code license

Gain a competitive edge by obtaining our source code license. Fully customize and tailor your fintech solution to perfection, completely independently from SDK.finance as the vendor.

Accelerated time-to-market

With our pre-built software, you significantly reduce your time-to-market, getting your fintech product up and running faster, ahead of your competition.

High-performance transactional core

Our rock-solid and scalable engine ensures secure and high-performance transaction processing, providing you with the scalability needed to grow your business into an empire.

API-driven architecture

Our platform is built on modern APIs, making it easy to integrate with third-party providers and customize according to your unique requirements.

Ready to get started?

SDK.finance Enterprise FinTech Platform FAQs

The SDK.finance Platform is a backend software solution designed to serve as the foundation for building a wide range of financial products, including neobanks, digital wallets, money remittance services, payment processing systems, and more. It offers a modular architecture with 60+ functional modules and over 470 API endpoints, allowing businesses to configure and expand their systems based on specific use cases.

The SDK.finance Platform is designed to support a wide range of financial products by offering a flexible set of building blocks for payment and banking solutions. You can use it to build:

-

Digital wallets for individuals or businesses, including top-up, withdrawal, P2P transfers, and currency exchange features

-

Neobank apps with current accounts, transaction management, and KYC workflows

-

Payment processing systems for merchants, including online and offline payment acceptance

-

Money remittance platforms with domestic and international transfer capabilities

-

Merchant services with invoicing, refunds, payouts, and POS system integration

-

Card issuing infrastructure (via integration with third-party providers)

-

Closed-loop payment systems for marketplaces, gig platforms, or loyalty programmes

The modular approach makes it easy to tailor the Platform to specific business models and expand functionality as needs evolve.

The SDK.finance Platform is designed for banks, FinTech companies, PSPs, telecoms, retailers, and marketplaces aiming to launch or scale digital financial services. It’s also a fit for remittance providers, gig platforms, and system integrators needing a flexible backend to build products like neobanks, e-wallets, or payment systems with full control over infrastructure.

- You purchase the digital wallet source code license and get the freedom of modifications as you see fit.

- Your team can customize the ready-made ewallet software so that it meets all regulatory, security and compliance standards.

- You start off having an essential part of your product at hand – a robust wallet engine designed to be easily extended via integrations, virtually without limits.

Yes, we offer video demos of the backoffice for your team and mobile app for your clients. Both available there and then, no waiting.

If you need more details or have any questions, do reach out to us and we’ll be in touch with you shortly.

SDK.finance architecture allows integrating any 3rd-party tools for each stage of the customer journey.

See all the pre-developed integrations.

For your custom integration requirements, our 470+ RESTful API set makes it easy to build integrations with third-party providers of your choice.

For details on the technologies used for our FinTech white label platform, visit our technology page.

Yes, the SDK.finance Platform is built with integration in mind. It offers over 470 documented API endpoints and supports RESTful API architecture, making it straightforward to connect with existing systems such as CRMs, ERPs, payment gateways, KYC/AML providers, and core banking tools. You can also extend functionality via custom modules or third-party services.

Yes, SDK.finance supports both multi-currency and multi-asset account management out of the box. You can configure accounts to hold and operate with different currencies, and define custom asset types such as loyalty points, tokens, or other digital units. The Platform includes tools for currency conversion, exchange rate management, and transaction handling across assets.

The SDK.finance Platform can be deployed in two ways: as a cloud-based SaaS solution or as an on-premise system with a source code licence. For on-premise deployments, the Platform runs on a three-instance architecture (development, pre-production, and production), giving you full control over infrastructure, security, and customisation.

SDK.finance is designed to handle the scale, security, and flexibility required by enterprise-grade financial institutions. It supports high transaction volumes (up to 2,700 TPS), offers modular architecture with over 60 components, and includes 470+ API endpoints for seamless integration. With on-premise deployment and source code access, enterprises retain full control over infrastructure, compliance, and customisation.

Compliance functionality such as KYC, AML, and fraud prevention is available on the SDK.finance Platform through pre-integrated third-party providers. This approach allows businesses to choose the compliance solutions that best match their regulatory environment while significantly reducing integration time and effort.

Yes, with the source code licence, you gain full control over the SDK.finance Platform. This includes the ability to customise features, modify business logic, adapt the architecture to your infrastructure, and deploy the system in your own environment. It’s an ideal option for enterprises seeking long-term flexibility and ownership.

Yes, the SDK.finance Platform is fully customisable if you choose the source code licence. You can modify existing modules, develop new features, adjust workflows, and integrate additional services based on your specific business needs. This flexibility is especially valuable for enterprises building tailored financial solutions or operating in regulated environments.