Revolut, Fidor, Simple, N26, and Monzo are just some of the well-known digital banks that allow customers to open an account on their phone in minutes, whenever and wherever they want. Digital banks typically allow customers to open a checking account quickly and manage it entirely online, making it easy to review transactions and access banking features. In contrast, opening an account at a brick and mortar bank typically requires visiting a physical branch in person, where services like teller transactions, safe deposit boxes, and notarization are provided. But digital banking is not limited only to online banks. Over the past decade, banks that have created internal digital bank spin-offs optimized revenues and reduced operating costs by up to 70%.

But before we go any further, let us clarify the basics.

What is a digital bank?

What is digital banking?

Definition of Digital Banking

Digital banking refers to the transformation of traditional banking services into digital formats, allowing customers to manage their financial accounts, conduct transactions, and access various banking services through digital channels. This includes online banking, mobile banking, and mobile apps, which provide a seamless and convenient banking experience that can be accessed via a mobile device. By leveraging digital banking services, customers can enjoy a secure and personalized approach to managing their finances, with the ability to securely access their accounts at any time, without the need to visit a physical bank branch. This digitization of banking services ensures that customers have 24/7 access to their accounts and can perform a wide range of banking activities, including the ability to deposit money, from the comfort of their homes or on the go.

What are digital banking services exactly?

Most frequently, they include the following operations and activities (all the traditional banking services that are available 24/7 on mobile phones, computers, and compatible smart devices, without the need for a customer’s presence in the bank branch):

- Obtaining bank statements

- Online statements (view and download account activity electronically)

- Cash withdrawals

- Cash deposits (deposit cash at ATMs or partner locations)

- Transfer money

- Transferring funds (move money between accounts securely)

- Checking/savings account management

- Opening a digital bank account

- Debit cards (for ATM withdrawals and purchases)

- Loan management

- Bill payments

- Paying bills (manage and pay bills online)

- Cheques management

- Transaction records monitoring

- Overdraft fees (manage and monitor potential charges)

- Send money (quickly send funds to others via services like Zelle®)

- Receive money (receive funds instantly from others)

Some digital banking platforms may charge fees for certain accounts or specific transactions, so customers should review the fee schedule before using particular services.

Obviously, digital banking software makes all traditional services easier to access, understand and manage.

This approach allows us to test digital banking risk concepts before moving parts of the old legacy business to the new system. Notable examples include Goldman Sachs’ Marcus, RBS’ Bó, and State Bank of India’s YONO, which gained more than 26 million customers and reached profitability within 18 months.

Digital Banking Services

Digital banking services encompass both online and mobile banking, enabling customers to manage their bank accounts and perform transactions remotely. Online banking allows customers to access their accounts through a bank’s website, offering features such as account management, bill payment, fund transfers, and transaction history review.

On the other hand, mobile banking provides similar functionalities through a mobile app, making it even more convenient for customers to handle their banking needs using their smartphones or tablets. With mobile banking services, customers can deposit checks, pay bills, transfer funds, and monitor their bank accounts anytime, anywhere. The integration of online and mobile banking services ensures that customers have a comprehensive and flexible banking experience, tailored to their modern, fast-paced lifestyles. Some digital banking platforms also allow users to link accounts from other financial institutions, providing a consolidated view of their finances across multiple banks and services.

Digital banking statistics 2026

Digital Banking Market Growth

According to Statista, the digital banking sector will grow continuously over the next five years. In 2025, digital banks worldwide are projected to generate a net interest income of $1.61 trillion. This figure is expected to grow at a CAGR of 6.80% from 2025 to 2029, reaching $2.09 trillion by 2029. China is forecasted to lead in absolute terms, generating $528.8 billion in net interest income in 2025.

Source: Statista

Key digital banking statistic insights

- There are currently 1.75 billion digital banking accounts, collectively processing about $1.4 trillion annually, which translates to $2.7 million per minute.

- In the US, an average of 1,646 physical branches have closed each year since 2018, highlighting the move to digital-first banking.

- There are currently 1.75 billion digital banking accounts, collectively processing about $1.4 trillion annually, which translates to $2.7 million per minute.

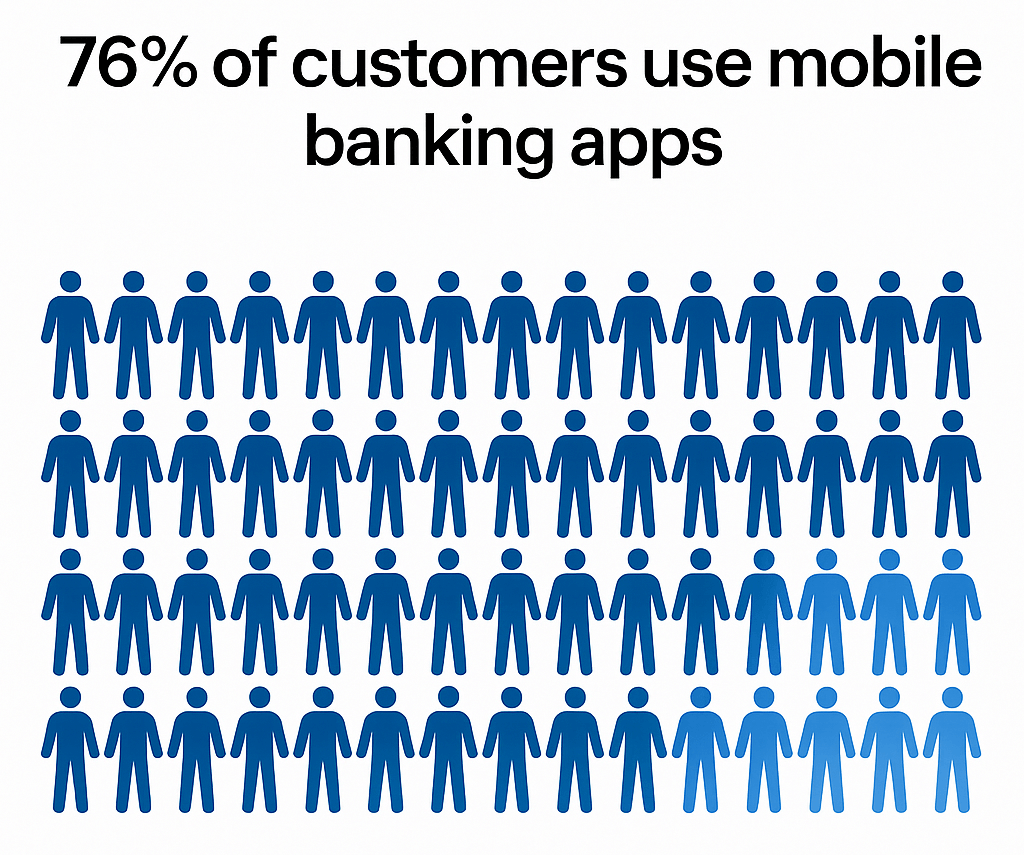

- Over 76% of American customers use mobile banking apps.

- Banks embracing digital transformation see 20%–40% reductions in operating costs, largely through automation, process optimisation, and reduced dependency on physical locations

Source: Pymnts

The growth of digital banking is primarily driven by the increasing adoption of digital technologies and changing customer preferences, who are increasingly inclined to use digital channels for their financial transactions. Modern digital banks are capitalizing on this trend, offering fast convenient mobile and online banking services according to consumers needs.

Key drivers of digital banking growth

-

Digital-first consumer behaviour: The rise of millennials and Gen Z, who prefer mobile and online channels, is a major driver of digital bank adoption.

-

Convenience and simplicity for users: Digital banks attract users by offering user-friendly platforms tailored to tech-savvy customers seeking frictionless financial services.

-

Lower operational costs for banks: Without physical branches, digital banks maintain a leaner cost structure, enabling them to offer more competitive fees and rates.

-

Efficient operations: Automation and streamlined digital processes lead to faster, more personalised services compared to legacy banks.

Digital banking trends

Digital banking is continuously evolving, driven by technological advancements, shifting customer preferences, and the widespread adoption of digital channels. Some of the key trends shaping the future of digital banking include:

- The rise of mobile banking: Mobile banking is gaining popularity, with an increasing number of customers using mobile apps to access their accounts and perform transactions. The convenience and accessibility of mobile banking apps make them a preferred choice for many.

- The growth of online banking: Online banking continues to expand, with more customers utilizing online platforms to manage their accounts and conduct financial transactions. The ease of use and comprehensive features of online banking contribute to its growing adoption.

- The emergence of digital-only banks: Digital-only banks, or neobanks, are becoming more prevalent. These financial institutions operate entirely online, offering a range of digital banking services without the need for physical branches, providing a streamlined and cost-effective banking experience.

- The increasing use of Artificial Intelligence: Artificial intelligence is being integrated into digital banking to offer personalized services, such as tailored financial advice and automated customer support. AI enhances the customer experience by providing relevant and timely assistance.

- The growth of digital payments: Digital payment methods, including mobile wallets and contactless payments, are becoming increasingly popular. Growing eWallet app development enabled customers to opt for convenient and secure payment options for their everyday transactions.

These trends are revolutionizing the way customers interact with their banks, offering a more convenient, secure, and personalized banking experience. As digital banking continues to evolve, financial institutions must adapt to these changes to meet the growing demands of their customers.

Digital banking vs. online banking: are they the same?

Although the two terms may seem interchangeable, there are actually fundamental differences between digital and online banking.

Online banking includes only some transactional functions of the underlying core banking system. Online banking is typically accessed via the Internet and provides basic banking functions such as account management and statement access. The capabilities of an online banking system are limited and cannot be quickly expanded to provide additional banking services to consumers. It is important to understand which financial institution is associated with online banks for deposit insurance.

Digital banking systems are much more flexible and allow banks to add and expand features much faster than traditional systems. Digital banking relies on high-level process automation, web-based services and APIs to provide banks and their customers with high levels of cost efficiency, security and flexibility. Modern banking solutions enable a fully digital customer journey, generating real-time data streams and accelerating key analytics. Despite the rise of digital banking, traditional financial institutions still hold a significant presence for many consumers, even as they undergo changes and experience branch closures.

There’s one more term frequently confused with online and digital banking – mobile banking. It can be defined as a service provided by an existing bank to its customers enabling them to perform transactions via their mobile devices, without the need to visit a bank branch.

So, out of the three notions, digital banking is a much broader one. It is safe to say that it is made up of a combination of online and mobile banking.

The benefits of digital banking for consumers

As more and more digital banks enter the market, it is important to understand how modern digital banking solutions enable them to offer better and cheaper services than traditional competitors. Here we highlight the most essential advantages of digital banking:

Cost savings

Traditional banks invest a lot of time and resources in checking and accounting. By eliminating redundant back-office processes, digital banking software significantly reduces operating costs. Digital banking systems remove a lot of work from banks by automating the processes associated with daily financial transactions. Digitization reduces the number of steps and people involved in transactions, reducing the risk of costly financial errors.

Improved usability

Integrated KYC and AML protocols enable digital banks and customers to open accounts within minutes from any internet-enabled device. ID Verification systems and risk assessments enable banks to serve customers quickly and easily, allowing people who are not bank customers to access financial services. A major advantage of personal banking is that it is available 24/7. This means that customers can carry out any transaction from anywhere and access a wide range of services.

Greater personalization

Digital banking software enables sophisticated personalization strategies powered by artificial intelligence (AI) and machine learning (ML). Banks can offer customers relevant financial options, interactive tools, and educational resources at the right time. Automated budgeting, spending analytics, savings reminders, and many other tools help inform and engage customers.

Wow-features

Digital banks already have many features that established banks simply cannot offer, such as buying cryptocurrencies and gold or investing in stock markets directly in the banking app. Mobile and online banking customers can instantly change their security settings, and transaction limits, and even specify whether or not they want to enable NFC or magnetic stripe payments.

Paying Bills and Managing Finances

Paying bills and managing your finances has never been easier thanks to the convenience of online and mobile banking services. With a mobile banking app, customers can pay bills directly from their checking or savings account, set up recurring payments for regular expenses, and access their account statements anytime. Enrolled users typically enjoy the ability to view their transaction history, making it simple to track where their money is going and avoid missing important payments.

Mobile banking services also allow customers to deposit money, send money, and receive money quickly and securely—often using services like Zelle for instant transfers. Budgeting tools built into online and mobile banking platforms help customers monitor their spending, set savings goals, and stay on top of their finances. By leveraging these digital banking services, customers can simplify their financial management, reduce the risk of late payments, and avoid unnecessary transaction fees. Whether you need to pay bills, transfer funds, or keep an eye on your account activity, online and mobile banking put powerful financial tools right at your fingertips.

Managing Your Cash Flow

Effectively managing your cash flow is essential for both individuals and businesses, and digital banking makes this process seamless. With online and mobile banking services, customers can easily monitor all account activity—including deposits, withdrawals, and other transactions—right from the accounts tab. This real-time access to account information empowers customers to make informed decisions about their finances and ensure they always have enough funds available.

Account alerts can be set up to notify customers of important account activities, such as low balances or large transactions, helping to prevent overdrafts and insufficient funds. In addition, online and mobile banking platforms offer budgeting tools and financial planning resources that make it easier to track spending, plan for future expenses, and manage multiple accounts. By utilizing these banking services, customers can maintain better control over their cash flow, avoid costly fees, and achieve greater financial stability.

Staying Organized

Staying organized is key to successful financial management, and digital banking provides all the tools you need to keep your finances in order. Through online and mobile banking services, customers can access detailed account statements, including online statements and mobile deposit records, to review their spending and monitor account activity. The mobile app makes it easy to deposit checks, send money, and receive money, so you can manage your finances wherever you are.

With features like bill pay, customers can schedule payments in advance, ensuring that bills are paid on time and helping to avoid late fees. The ability to view and download electronic statements means you can keep your records organized without the clutter of paper statements. By taking advantage of these online and mobile banking services, customers can stay on top of their finances, track payments, and maintain a clear overview of their money at all times.

Check this article to get more information about the advantages of digital banking.

The types of digital banks

While the terms “neobank” and “challenger bank” are familiar to nearly anyone today, telling one from the other may be difficult, so let’s dot all the i’s and explore the main types of digital banks.

Neobank

Neobank is a digital bank operating online, without any physical presence, which provides its customers remote access to its services via a mobile app. Many neobanks don’t hold a bank license and partner with an existing bank for bank-licensed operations (which means, their customers need to create an account at the partner bank). Often, the range of services offered by a neobank is narrower compared to the licensed banks.

Challenger bank

This term originated in the UK and refers to a recently launched bank that “challenges” traditional banking institutions. Being more user-friendly and cost-effective for an end-user, challenger banks focus on the audience segments that are underserved by the big financial institutions.

New bank

These are fully licensed neobanks that provide a full range of banking services and their only difference from the brick-and-mortar banks is the mode of operation – which is completely online. Examples of the new banks are Revolut, Monzo, N26, and Starling Bank.

Nonbank

Exactly as the name implies, these are non-banking institutions that provide financial services – for example, streamlined loans or mortgages, but they don’t simultaneously accept deposits or offer checking and savings accounts. Some of the nonbanks like Monese operate on EMI licenses.

What experts say about digital banking?

As the financial industry continues to evolve, leading industry experts are providing valuable insights into the transformative power of digital banking. Their perspectives help shape our understanding of current trends and future directions in this rapidly changing landscape.

The imperative for digital transformation

Banking technology experts consistently emphasize that digital transformation is no longer optional but essential for financial institutions to remain competitive. According to McKinsey research, banks that embrace digital transformation can optimize revenues and reduce operating costs by up to 70%, demonstrating the significant financial benefits of going digital.

Digital banking consultant Jim Marous, publisher of The Financial Brand, notes that “Financial institutions must view digital banking as more than just a delivery channel. It’s a complete transformation of how products are developed, how customers are served, and how the entire organization operates.”

SDK.finance’s perspective on digital banking’s future

Alex Malyshev, CEO of SDK.finance, offers a compelling vision for the future of digital banking:

“The future of banking isn’t just about digitizing existing processes. It’s about reimagining the entire customer journey through technology. At SDK.finance, we believe that digital banking must facilitate fully digital financial services for everyone, making them accessible to every citizen of the world. The most successful institutions will be those that combine technological innovation with a deep understanding of evolving customer needs.”

Alex Malyshev emphasizes that the core technology infrastructure is what ultimately determines a bank’s ability to innovate and adapt. “Traditional banks can’t implement new features because of their closed legacy systems, which require significant time and resources to upgrade. Digital banks, however, rely on flexible API-first architecture to introduce new functionality in a fraction of the time, allowing them to continually enhance the customer experience,” he explains.

The role of artificial intelligence and automation

Experts predict that AI will play an increasingly central role in digital banking. According to PwC research, AI is expected to reduce fraud by up to 50% by 2025, while also enabling more personalized financial services.

Dr. Louise Beaumont, co-chair of the Open Banking & Payments Working Group, suggests that “AI won’t just optimize existing banking processes. It will fundamentally change how financial services are conceived, delivered, and experienced by customers.”

The importance of security in digital banking

With increased digitalization comes heightened focus on security. Cybersecurity experts stress that digital banks must prioritize robust security measures to maintain customer trust and comply with regulatory requirements.

Digital banking consultant Chris Skinner, author of “Digital Bank,” notes that “Security isn’t just a technical challenge. It’s about creating a culture where security considerations are embedded in every aspect of product development and customer service.”

As digital banking continues to evolve, the insights from these industry experts provide valuable guidance for financial institutions navigating this complex landscape. By embracing technological innovation while maintaining a focus on customer needs and security, digital banks can position themselves for success in an increasingly competitive market.

Digital banking solution providers

According to McKinsey, more than 65% of banks surveyed are exploring the potential of next-generation core banking platforms. The digital banking experiences offered by challengers are forcing incumbent banks to re-examine legacy technology in their core business.

Source: Capgemini and Efma

This shift has led to a significant increase in mobile banking app development efforts across the industry. Financial institutions are recognizing that a robust, user-friendly mobile app is no longer just a nice-to-have feature, but a critical component of their digital strategy. By investing in mobile banking app development, banks can provide their customers with seamless, on-the-go access to a wide range of financial services, enhancing user experience and strengthening customer loyalty.

This is especially beneficial for specialized financial services, such as VA construction loan lenders, enabling them to offer tailored loan solutions with greater convenience and accessibility.

Security and Regulation in Digital Banking

Security and regulation are at the core of digital banking services, ensuring that customers can confidently manage their money online. To further safeguard customers, both digital only banks and traditional brick and mortar banks must comply with strict regulatory requirements. These include anti-money laundering (AML) and know-your-customer (KYC) laws, which are designed to prevent identity theft and other forms of financial crime. By adhering to these regulations, financial institutions help ensure that sensitive information remains protected and that unauthorized use of accounts is minimized.

Digital banking services also employ advanced security technologies, such as encryption and two-factor authentication, to protect every transaction and keep account information secure. Whether accessing banking services through mobile banking apps or online banking platforms, customers benefit from multiple layers of security that help prevent fraud and unauthorized access. As digital banks continue to innovate, maintaining robust security and regulatory compliance remains a top priority for the entire banking industry.

SDK.finance digital banking software

White-label software for digital banking helps banks modernize and benefit from lower costs, faster time to market, rapid scaling, and personalized offerings for consumers. Companies looking to launch a digital bank can get to market in a fraction of the time by partnering with SDK.finance, a white-label FinTech solution provider that helps businesses launch financial and payment products.

The Platform is designed to support a broad array of financial services, such as digital wallets, money transfer, card issuing, payment acceptance, and robust KYC and AML compliance features. This enables clients to seamlessly integrate and tailor functionalities to their specific requirements while upholding stringent security standards.

Our solution includes pre-built integrations with trusted partners and comprehensive back-office tools, which boost operational efficiency. These features simplify the management of clients, transactions, and finances, streamlining business operations.

View the demo video of the SDK.finance Platform:

Through its white-label core Platform and an expert team with 10+ years of FinTech experience, SDK.finance quickly and reliably transforms customers’ product visions into live masterpieces. Whether you’re envisioning the creation of a digital wallet, neobank, mobile banking app, payment processing system, payment acceptance solution, money remittance platform, or a currency/crypto exchange, our white-label solutions empower you to bring your ideas to market much faster than traditional from-scratch development.

Conclusion

Digital banking has fundamentally changed the way people interact with their banks, offering convenient ways to access a wide range of banking services anytime, anywhere. With the growth of online banks, mobile banking, and digital wallet solutions, customers can now pay bills, transfer money, deposit checks, and manage their financial products without ever visiting a physical branch. Traditional banks have also embraced this shift, providing online and mobile banking services to meet the evolving needs of their customers.

As the banking industry continues to evolve, digital banking empowers customers with more choices, better access, and a higher level of service than ever before.