When it comes to selecting a core banking platform, fintech companies and banks often evaluate providers like Mambu and Apex. Both are known for their cloud-native architectures and support for modern financial services. However, they differ significantly in flexibility, deployment models, and licensing terms. This article explores how they compare and where SDK.finance fits in as an alternative.

Mambu: A cloud-only SaaS platform

Founded: 2011 in Berlin, Germany

Founded: 2011 in Berlin, Germany

Business model: Subscription-based SaaS

Target audience: Neobanks, lenders, and fintechs seeking rapid go-to-market

Key limitations: No source code access, cloud-only delivery, limited customisation

Mambu has built a strong reputation by helping banks and fintechs quickly launch lending and deposit services. It is well-suited for institutions prioritising time-to-market over platform ownership. However, the SaaS-only model means users must accept certain vendor constraints:

-

No access to source code

-

Limited ability to make deep platform changes

-

Data hosted in the cloud (not suitable for some regulatory environments)

-

Subscription fees that grow with scale

Apex: Custom-focused with professional services

Founded: 1989

Founded: 1989

Business model: Licensing with heavy reliance on consulting services

Target audience: Financial institutions needing bespoke functionality

Key limitations: Slower implementation, higher total cost of ownership

Apex has a long track record in the financial software space. Unlike Mambu, Apex focuses on tailor-made solutions and offers custom development via professional services. This approach provides flexibility but often comes at the cost of longer implementation cycles and higher maintenance demands. In many cases, clients become dependent on Apex for future modifications or updates.

SDK.finance: A middle ground between control and efficiency

Founded: 2013 in Vilnius, Lithuania

Founded: 2013 in Vilnius, Lithuania

Business model: Source code licence or SaaS

Target audience: FinTechs, digital banks, financial institutions, marketplaces

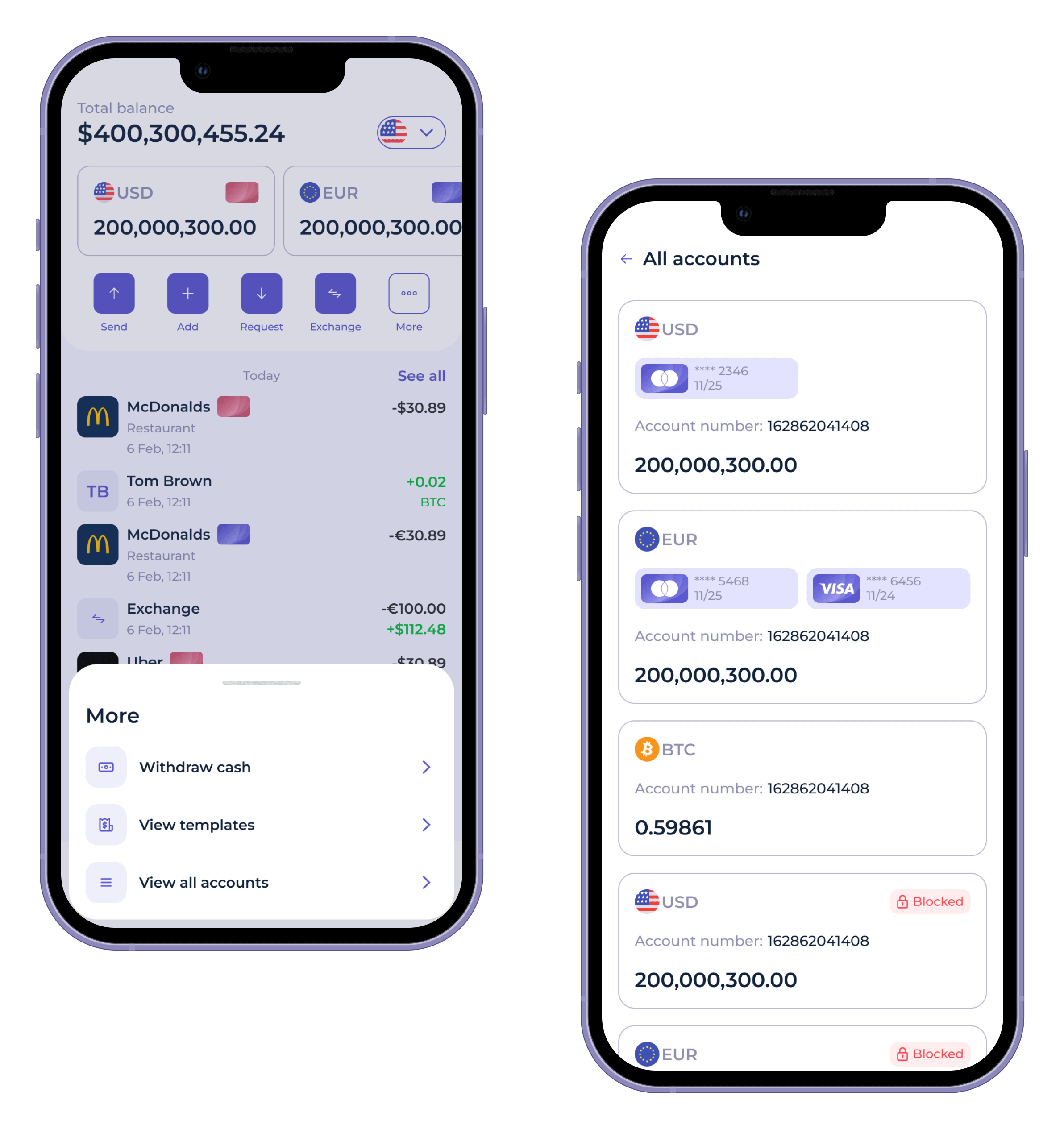

SDK.finance offers an alternative that balances customisability and speed. The Platform includes a full set of ready-made modules—accounts, wallets, transactions, AML tools, and more, which can be extended or adapted. Clients can choose to host the system in their own infrastructure and modify it as needed, which is especially relevant in regulated markets where data residency and compliance are critical.

Key strengths:

-

Source code license for full ownership and independence

-

Modular architecture with over 470 APIs

-

Available as SaaS or on-premise

-

Faster launch times than Apex, more control than Mambu

Products you can build on SDK.finance Platform:

-

Digital wallet solution – for personal, business, or marketplace payments

-

Payment acceptance system – for PSPs and merchant-facing businesses

-

Money remittance app – cross-border transfers and currency exchange

-

Neobank or challenger bank – full-stack digital banking setup

-

Payroll management system – digital wallet-based salary payments

- Super app core – combine financial features into one app

-

Card issuing infrastructure – integrate payment card lifecycle and payment services

Each product is powered by a unified backend, with APIs that streamline integration and accelerate development.

Key differences at a glance

| Feature | Mambu | Apex | SDK.finance |

|---|---|---|---|

| Deployment | Cloud only (SaaS) | On-premise / Custom builds | Cloud / On-premise |

| Source code access | No | No | Yes |

| Time to launch | Fast | Slow | Fast |

| Customisation flexibility | Limited | High (via Apex dev team) | High (in-house or partner) |

| Licensing model | Subscription only | Licence + services | Source code / SaaS |

| Ideal for | Speed-focused teams | Bespoke projects | Growth-stage fintechs, banks, enterprises |

When to choose SDK.finance over Mambu or Apex

SDK.finance may be the better choice if:

-

You need full control over your system and data

-

Your roadmap includes functionality outside standard SaaS templates

-

You want to reduce reliance on third-party developers

-

You operate in regions where hosting data locally is mandatory

-

You’re planning to scale and want to avoid rising subscription costs

Final thoughts

Choosing between Apex, Mambu, and SDK.finance depends on your priorities: speed, flexibility, ownership, and compliance. While Mambu is suitable for rapid deployment, and Apex serves institutions needing extensive customisation, SDK.finance offers the ability to launch fast while retaining full control through source code access.

If your fintech or banking business is looking for a core platform that evolves with you, SDK.finance is worth exploring.