Let’s delve into the complexities and explore the innovative solutions that are shaping the future of banking.

The rise of banking app development

Globally, the number of digital banking users is expected to reach 3.6 billion by 2024.

The increasing popularity of banking apps reflects the rapid digitization of financial services. This trend is driven by the growing demand for convenience and accessibility. Both banks and fintech startups are heavily investing in creating mobile applications that seamlessly integrate into users’ daily lives.

These apps offer a wide range of features, from simple account management and fund transfers to complex investment tools and personalized financial advice. As technology continues to advance, we can expect even more innovative and user-centric banking app experiences to emerge, further blurring the lines between traditional banking and the digital world.

Launch your neobank faster and cost-effectively with SDK.finance Platform

Get a pre-developed digital retail banking software to build your PayTech product on top

Learn moreThe global mobile banking market is expected to experience a compound annual growth rate (CAGR) of 12.2% from 2024 to 2030, fueled by the growing adoption of smartphones and consumer demand for convenient banking solutions. This robust growth trajectory underscores the immense potential for innovation and profitability in the field of banking app development.

The impact of mobile banking apps

Mobile banking apps have transformed the way individuals and businesses manage their finances. These digital platforms offer a range of benefits that cater to the needs of both consumers and enterprises.

Benefits for consumers

- 24/7 accessibility: Users can conveniently access their accounts, check balances, and initiate transfers anytime, anywhere.

- Enhanced security: Advanced features like biometric authentication, fraud alerts, and encryption protect sensitive financial information.

- Time-saving convenience: Streamlined transactions, bill payments, and money transfers save users valuable time.

- Personalized financial management: Tools for budgeting, saving goals, and expense tracking empower users to take control of their finances.

Benefits for businesses

- Cost efficiency: Mobile banking apps can reduce operational costs by automating processes and reducing reliance on physical branches.

- Improved customer experience: Enhanced accessibility and personalized services foster customer loyalty.

- Data-driven insights: Analyzing user behavior provides valuable data for informed business decisions.

- Competitive advantage: Offering a robust mobile banking app can differentiate a business from competitors.

- Expanded reach: Mobile apps allow businesses to reach a wider customer base.

By harnessing the power of mobile technology, banks and financial institutions can deliver exceptional value to their customers while driving business growth.

Different types of mobile banking apps

Mobile banking apps come in a variety of types, offering different features and services to cater to diverse user needs. However, 5 particular types have gained the most popularity among consumers.

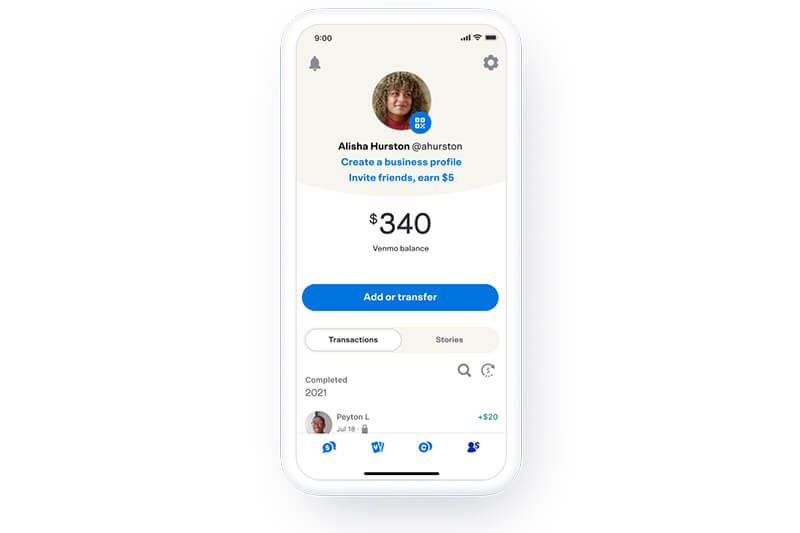

Digital mobile wallet apps

Digital mobile wallet apps streamline financial management by consolidating payment methods, prioritizing security through advanced features, and offering convenient payment options like contactless transactions and peer-to-peer transfers.

Key features:

- Securely stores payment information (credit/debit cards, prepaid cards).

- Enables contactless payments (tap-and-go technology).

- Facilitates online purchases without manual card entry.

- Allows peer-to-peer money transfers.

- Stores and manages loyalty cards and rewards.

Examples: Apple Pay, Google Wallet, Samsung Pay, PayPal, Venmo, Cash App

Source: Venmo

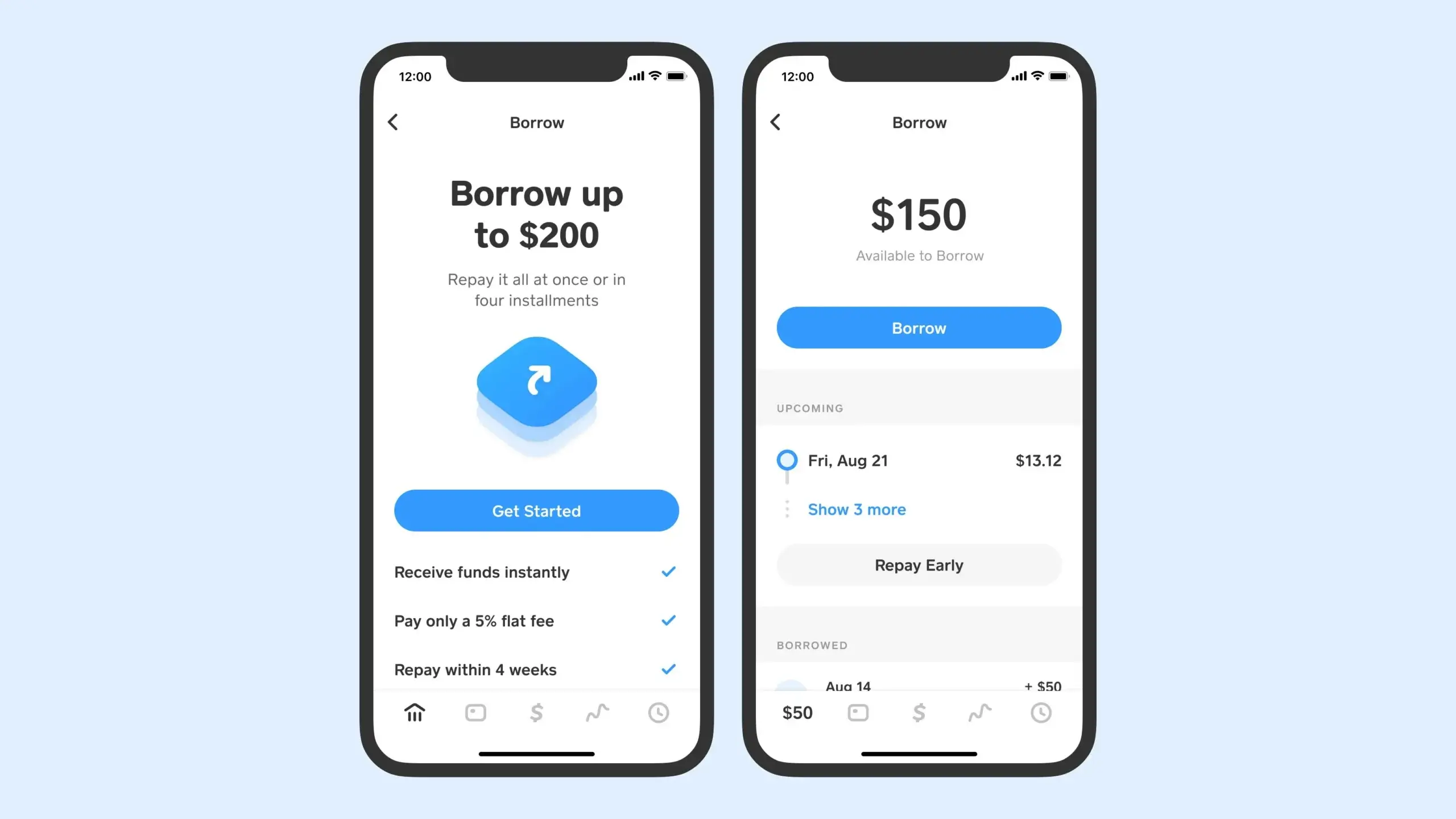

Business banking apps

Business owners can streamline operations with dedicated banking apps. These tools simplify account management, invoice creation, payroll processing, and expense tracking, saving time and boosting efficiency.

Business banking apps offer a range of tools to streamline financial management:

- Account management

- Invoice creation

- Payroll processing

- Expense tracking

- Payments and transfers

- Mobile deposits

- Loan management

Examples: Bank of America Business Online Banking, Xero, and Square.

Source: Square

Build a P2P payment or remittance app seamlessly with our solution

With SDK.finance software you can start money transfer app faster

More infoDigital-only banks

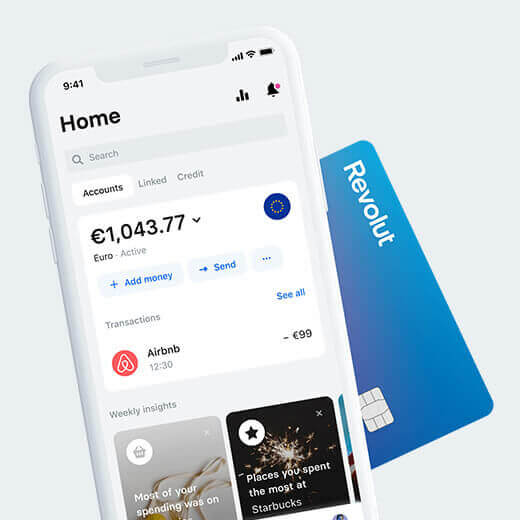

Digital-only banks, often called neobanks, are revolutionizing the financial industry. Operating exclusively online and through mobile apps, they bypass traditional brick-and-mortar branches, offering customers unparalleled convenience and flexibility.

Key features:

- Fee-transparent services

- Personalized financial products

- Financial wellness tools

- Seamless account opening

- Fast and efficient transactions

- Customer support through live chat or in-app messaging

- Integration with other financial services (investing, insurance)

Examples: Chime, N26, and Revolut.

Source: Revolut

Read the article on the banking super app revolution to explore the features that define next-gen finance products.

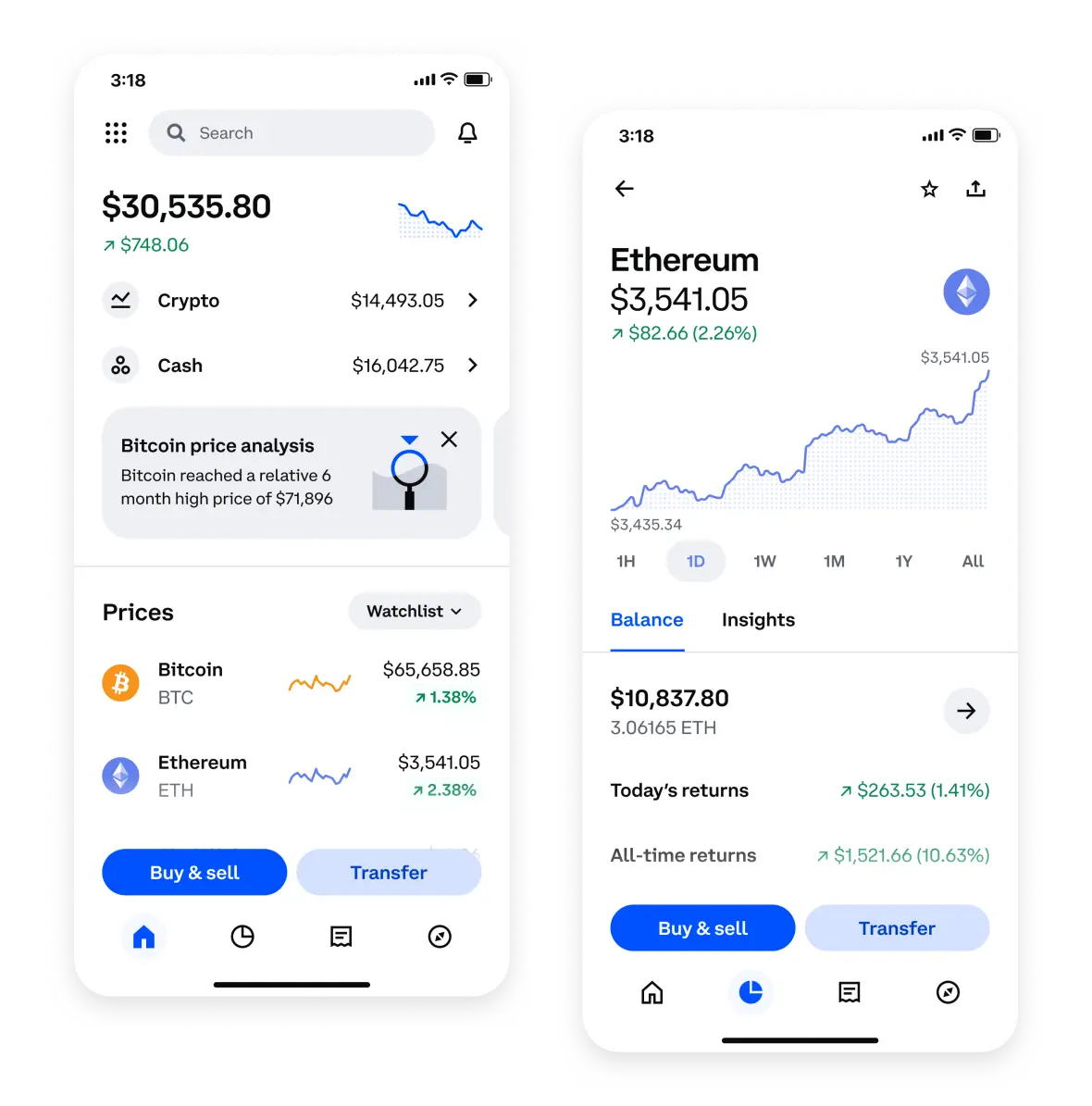

Cryptocurrency wallets

Cryptocurrency wallets are digital tools that securely store, send, and receive cryptocurrencies like Bitcoin. They hold the private keys necessary to access your digital assets on the blockchain.

Key features:

- Secure storage of private keys and cryptocurrencies

- Sending and receiving digital assets

- Transaction history tracking

- Multiple cryptocurrency support

- Backup and recovery options

- Integration with exchanges

- Additional features like DeFi interactions

Examples: Coinbase, Binance.

Source: Coinbase

Investment and wealth management apps

Investment and wealth management apps have transformed how individuals manage their finances. These platforms provide a range of tools to help users make informed investment decisions, track their portfolio performance, and achieve their financial goals.

Key features

- Portfolio management

- Investment research

- Automated investing

- Financial planning

- Tax optimization

- Advisor access

Examples: Robinhood, Personal Capital, Wealthfront

Source: Robinhood

With pre-built backend, and backoffice for system management.

Learn moreChallenges of banking and finance app development

Challenge 1: Ensuring robust security and data privacy

The financial industry is a prime target for cyberattacks, making security and data privacy paramount concerns in banking app development. For instance, the average cost of a data breach in the financial services industry was $5.35 million in 2022, according to IBM’s Cost of a Data Breach Report.

Solution: Implementing cutting-edge security measures:

- Multi-factor authentication: Implementing robust MFA mechanisms, such as biometrics, push notifications, and one-time passwords, significantly enhances account security.

- End-to-end encryption: Protecting sensitive data at rest and in transit through advanced encryption techniques like AES-256 is crucial.

- Threat intelligence: Staying ahead of cyber threats requires continuous monitoring of the threat landscape and proactive measures to mitigate risks.

- Security testing: Regular penetration testing, vulnerability assessments, and red teaming exercises help identify and address weaknesses in the app’s security posture.

- Incident response plan: A well-defined incident response plan ensures swift and effective handling of security breaches, minimizing damage.

Challenge 2: Navigating the regulatory landscape

The average cost of non-compliance has risen more than 45% in 10 years. The true cost of non-compliance for organizations due to a single non-compliance event is an average of $4 million in revenue.

As the FinTech industry is heavily regulated, with a complex web of laws, banking app development must adhere to these regulations to protect consumers and maintain trust.

Solution: Keep up with evolving financial regulations:

- Dedicated compliance team: Establishing a specialized team to monitor regulatory changes is essential for staying informed and proactive. Consider the key financial regulations like AML transaction monitoring, KYC, and other region-specific regulations to prevent legal penalties.

- Regulatory technology (RegTech): Leveraging RegTech solutions can streamline compliance processes and reduce operational risks.

- Industry partnerships: Collaborating with industry associations and regulatory bodies can provide valuable insights and support.

Challenge 3: Integration with legacy systems

A recent study by Gartner found that 80% of organizations struggle with legacy system integration, citing performance as a major concern. To improve performance and efficiency during legacy system integration, you can modernize your payment system, using the following solutions.

Solution: Modernize without disrupting operations

- Phased approach: Implementing a gradual modernization strategy minimizes disruption to core banking operations. For instance, Wells Fargo has successfully adopted a phased approach to replace its legacy core banking system, reducing operational risks and ensuring business continuity.

- Data migration: Carefully planning and executing data migration from legacy systems to new platforms is essential.

- API-led connectivity: Utilizing APIs to connect legacy systems with the new app can streamline integration and improve flexibility.

Get your digital wallet product launched months faster

Accelerate the development process with a ready-made SDK.finance Digital Wallet Software

More detailsChallenge 4: Meeting escalating user expectations

Customers today expect banking apps to be as intuitive and engaging as their favorite consumer apps. Delivering a seamless, personalized user experience is crucial for customer satisfaction and loyalty.

Solution: Deliver personalized experiences at scale

- Data-driven insights: Leveraging customer data to understand preferences and behaviors is essential for tailored experiences.

- Hyper-personalization: Going beyond basic personalization by considering factors like location, time of day, and social context to deliver highly relevant experiences.

- Omnichannel consistency: Ensuring a seamless user experience across different channels (mobile app, website, branches) to strengthen customer relationships. For instance, Chase ensures a seamless customer experience across branches, mobile app, and website by providing consistent account information, transaction history, and service options.

Focusing on design that revolves around the user and making use of new technologies, financial institutions can develop banking applications that please customers and encourage loyalty.

Challenge 5: Staying ahead of technological advancements

McKinsey report highlights, that banks that invest in digital transformation are more likely to achieve higher profitability and customer satisfaction. That`s why financial companies have to constantly adapt and embrace new innovations to stay competitive.

Solution: Implement a culture of continuous innovation

- Adopt a modular architecture: Design the app with a modular architecture that allows for easy updates and integration of new features. This flexibility enables quick adaptation to technological changes and customer demands. For instance, SDK.finance opts for a modular-based infrastructure with 60+ modules due to its superior alignment with their flexibility, scalability, and cost-efficiency goals, which are crucial for financial technology solutions.

- Leverage cloud technologies: Utilize cloud computing to enhance scalability, flexibility, and cost-efficiency. Cloud-based solutions can easily accommodate growing user demands and facilitate seamless updates. JPMorgan Chase has invested heavily in cloud technology to support its digital transformation initiatives and improve operational efficiency.

- Integrate emerging technologies: Proactively explore and integrate emerging technologies such as AI-driven chatbots, biometric authentication, and blockchain to enhance the app’s capabilities and offer innovative features.

- Monitor industry trends: Keep a close eye on industry trends and competitor activities. Staying informed about market developments helps identify opportunities for differentiation and innovation.

Challenge 6: Managing development costs and timelines

Solution: Balance in-house development with outsourcing

To maximize efficiency and innovation, fintech companies should find a balance between in-house development and outsourcing. This involves:

- Prioritization: Focusing on core functionalities and high-impact features can optimize resource allocation and reduce costs.

- Minimum viable product (MVP): Launching a basic version of the app quickly and iterating based on user feedback can streamline development.

- Outsourcing vs. in-house development: Evaluating the cost-benefit analysis of outsourcing specific development tasks can help control expenses.

Overcoming the challenges associated with developing banking apps requires a strategic, data-driven approach. By transforming these obstacles into opportunities, FinTech companies can stand out, improve customer satisfaction, and achieve sustainable growth.

Check this article to get more info on how to speed up FinTech software development.

Tech solutions for banking app development

To overcome these challenges, developers are leveraging cutting-edge technologies and methodologies:

- AI and Machine Learning: These technologies are being used to provide personalized banking experiences, detect fraud in real-time, and automate customer support through chatbots.

- Blockchain technology: By offering enhanced security and transparency, blockchain is being integrated into banking apps to streamline transactions and reduce fraud.

- Cloud computing: Leveraging cloud infrastructure allows banks to scale their operations efficiently, reduce costs, and improve app performance.

- Agile development: Adopting agile methodologies enables rapid iteration and adaptation to changing market needs, ensuring that banking apps remain relevant and competitive.

SDK.finance banking app solution

Developing a mobile banking app from scratch can be a time-consuming and resource-intensive endeavor. SDK.finance offers a powerful solution: a white-label digital retail banking software Platform that empowers you to launch your banking application quickly and efficiently.

Key functionality of SDK.finance Platform

The Platform comes with essential features out-of-the-box, eliminating the need for extensive development.

- Account management: Support accounts in any currency, enabling global transactions.

- Transaction processing: Facilitate smooth transfers, payments, and currency exchange.

- Card issuing: Integrate with Visa/Mastercard for seamless card issuance.

- KYC compliance: Streamline customer onboarding with built-in KYC tools.

- Security and fraud prevention: Ensure robust security measures for your neobank.

- Monetization tools: Set custom fees and contracts to maximize revenue.

Our ready-made FinTech solution allows you to:

Accelerate time-to-market: Speed up development, ensuring a robust and secure platform.

Leverage pre-built features: The platform provides a solid foundation for your banking app.

Customize your app: Tailor the app’s design to your brand and target audience.

Partner with an expert team: Avoid potential pitfalls and challenges.

SDK.finance is the shortcut to launch the scalable digital banking product. Focus on building your brand and customer experience, while our Platform takes care of the technical complexities.

Wrapping up

As the financial landscape continues to evolve, the importance of robust, secure, and innovative banking apps cannot be overstated. By overcoming development challenges and embracing new technologies, financial institutions can create powerful digital experiences that meet the demands of modern consumers and set the stage for the future of banking.